AAFMAA 2020” — a Strategic Vision in Focus

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1999 Annual Report

Army and Air Force Mutual Aid Association 121st Annual Report For the year ended 31 December 1999 1879 OVER 120 YEARS OF SERVICE 1999 Organized 13 January 1879 121st Annual Report For the year ended 31 December 1999 Army and Air Force Mutual Aid Association 102 Sheridan Avenue Fort Myer, Virginia 22211-1110 Branch office located in Pentagon Concourse (north end) Toll free: 1-800-336-4538 Local: 703-522-3060 (recorded messages after hours) FAX: 703-522-1336 E-mail: [email protected] Web site: www.aafmaa.com Office hours: 8:30 A.M.–4:30 P.M. EST Monday–Friday Night depository at both locations 1 2 3 ASSOCIATION DIRECTORS CHAIR General Robert W. Sennewald VICE CHAIR Lieutenant General Donald M. Babers BOARD OF DIRECTORS Term expires 2001: Lieutenant General Donald M. Babers Terms expire 2002: Lieutenant General Henry Doctor, Jr. Colonel Wayne T. Fujito Lieutenant General Bradley C. Hosmer Major General Susan L. Pamerleau* Captain Bradley J. Snyder, CLU Terms expire 2003: Major William D. Clark Major Joe R. Reeder Command Sergeant Major Jimmie W. Spencer Terms expire 2004: General Michael P.C. Carns Lieutenant General John A. Dubia Major General Michael J. Nardotti, Jr. Brigadier General L. Donne Olvey Chief Master Sergeant of the Air Force Sam E. Parish General Robert W. Sennewald CHAIRS EMERITI General Walter T. Kerwin, Jr. General Michael S. Davison DIRECTORS EMERITI General John R. Guthrie Brigadier General Elizabeth P. Hoisington ASSOCIATION OFFICERS President Captain Bradley J. Snyder, CLU Vice President for Services & Secretary Major Joseph J. Francis, CLU, ChFC Vice President for Finance & Treasurer Major Walter R. -

Read Newsletterarrow Icon

FALL 2016 AAFMAA Advantage AMERICAN ARMED FORCES MUTUAL AID ASSOCIATION NEWSLETTER The Launch of AAFMAA Mortgage Services LLC In May, AAFMAA launched our full-service mortgage Borrowers benefit from working with a mortgage lender lender, AAFMAA Mortgage Services LLC (AMS). AMS, that differentiates itself from other lenders. With AMS, a wholly-owned subsidiary of AAFMAA, offering a full homebuyers work with a group of professionals committed spectrum of mortgage products for home purchases and to knowing all the complexities of the mortgage industry, refinancing. Like its parent, AMS exclusively serves active as well as applicable local laws. duty, guard, reserve, retirees and honorably discharged The AMS team comes with decades of mortgage and veterans and their families. military experience. They truly understand the unique As part of our vision statement, “AAFMAA 2020,” we challenges and financial circumstances of military service. identified the need to add mortgage services to our offerings For example, many servicemembers may assume that VA to truly empower financial independence for the military loans always offer the most advantageous option for military community. Four years ahead of schedule, AAFMAA now homebuyers. However, the AMS team has the expertise to provides military families a trustworthy resource for building know when you will benefit more from a different type of home equity. Since a person’s home often represents loan. AMS always puts the military family first by offering their largest asset, AAFMAA established AMS operating mortgages that best suit the military member’s needs. under AAFMAA’s trusted standards and values, to help servicemembers make home ownership possible. -

Program Guide Sponsored By

AIR FORCE ASSOCIATION Program Guide sponsored by EXPANDING THE COMPETITIVE EDGE September 16-18, 2019 | National Harbor, MD | AFA.org Cover outer gatefold (in PDF only, this page intentionally left blank) AIR FORCE ASSOCIATION It takes collaboration and innovation to win in the multi-domain battlespace Program Guide sponsored by of the future. In the battlespace of tomorrow, success will depend on synchronized networks that rapidly EXPANDING integrate data sources and weapon systems across domains. Working together to outpace, disrupt and paralyze your adversary, multi-domain superiority is closer than you think. THE COMPETITIVE EDGE Learn more at lockheedmartin.com. September 16-18, 2019 | National Harbor, MD | AFA.org © 2019 Lockheed Martin Corporation Live: N/A Trim: W: 7.9375in H: 10.875in Job Number: FG18-23208_044b Bleed: H: .125in all sides Designer: Kevin Gray Publication: AFA Program Guide Gutter: None Communicator: Ryan Alford Visual: F-35C Resolution: 300 DPI Due Date: 7/22/19 Country: USA Density: 300 Color Space: CMYK Lethal. Survivable. Connected. The U.S. Air Force’s combat proven F-35A is the most lethal, survivable and connected fighter in the world. With stealth, advanced sensors, and networked data links, the F-35 can go where no fighter can go, see what no fighter can see and share unprecedented information with the joint, multi-domain fighting force. Supersonic speed. Fighter agility. Increased range. Extended mission persistence. Flexible weapons capacity. From the highest-end, sensitive missions to permissive battlespace. On the first day to the last. The F-35 gives the U.S. Air Force a decisive advantage, ensuring our men and women in uniform can execute their mission and return home safe every time, no matter the threat. -

2020 | AAFMAA Advantage

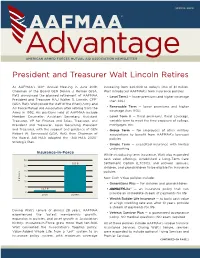

SPRING 2020 AAFMAA® Advantage AMERICAN ARMED FORCES MUTUAL AID ASSOCIATION NEWSLETTER President and Treasurer Walt Lincoln Retires At AAFMAA’s 140th Annual Meeting in June 2019, increasing from $20,000 to today’s limit of $1 million. Chairman of the Board GEN Dennis J. Reimer (USA, Walt introduced AAFMAA’s term insurance policies: Ret) announced the planned retirement of AAFMAA • Level Term I — lower premiums and higher coverage ® President and Treasurer MAJ Walter R. Lincoln, CFP than SGLI (USA, Ret). Walt joined the staff of the (then) Army and • Renewable Term — lower premiums and higher Air Force Mutual Aid Association after retiring from the coverage than VGLI Army in 1992. His positions held at AAFMAA include Member Counselor, Assistant Secretary, Assistant • Level Term II — fixed premiums, fixed coverage, Treasurer, VP for Finance and Sales, Treasurer, and variable term to meet the time exposure of college, President and Treasurer. Upon becoming President mortgages, etc. and Treasurer, with the support and guidance of GEN • Group Term — for employees of other military Robert W. Sennewald (USA, Ret), then Chairman of associations to benefit from AAFMAA’s low-cost the Board, AAFMAA adopted the “AAFMAA 2020” policies Strategic Plan. • Simple Term — expedited insurance with limited underwriting Insurance-in-Force While introducing term insurance, Walt also expanded 30 cash value offerings, established a Long-Term Care $25 B Settlement Option (LTCSO), and allowed spouses, 25 children, and grandchildren to be eligible for insurance 20 policies. 15 New Cash Value policies include: $ Billions 10 • Generations Plus — for children and grandchildren 5 $2.5 B • ANNUITYLife® — an insurance policy that can 0 2000 Current provide an immediate stream of payments for life • Wealth Builder Life Insurance — to build cash value at a high crediting rate and, after 10 years, provide a stream of payments for life During Walt’s tenure of almost 28 years, AAFMAA • Veteran Survivor Plan — a guaranteed acceptance experienced the fastest membership growth, policy. -

Solutions for YOUR Financial Future

Solutions for YOUR Financial Future 58106_Covers.indd 1 4/25/19 12:13 PM AAFMAA Board of Directors Executive Committee Finance Committee Membership Committee William M. Matz, Jr. John A. Dubia Dennis J. Reimer MG, USA, Retired LTG, USA, Retired GEN, USA, Retired Chairman, Finance Chairman, Membership Chairman of the Board* Committee Committee John A. Dubia Dennis D. Porter Janice M. Hamby LTG, USA, Retired COL, USA, Retired RADM, USN, Retired Chairman, Membership Vice Chairman, Finance Vice Chair, Membership Committee Committee Committee William M. Matz, Jr. MG, USA, Retired John T. Ridge Lewis E. Monroe, III Chairman, Finance CMSgt, USAF, Retired CMSgt, USAF, Retired Committee Mack C. Hill Walter R. Lincoln, CFP® Wilson A. (Bud) BG, USA, Retired Shatzer, Jr. MAJ, USA, Retired Chairman, Audit President and Treasurer* COL, USA, Retired Sub-Committee *Ex-officio member of all committees Senior Management Elisabeth J. Strines Jonathan D. George Col, USAF, Retired Brig Gen, USAF, Retired Walter R. Lincoln, CFP® President and Treasurer, AAFMAA Michael J. Meese, Ph.D., FLMI Executive Vice President and Secretary, AAFMAA Robin H. Boudiette, Jr. James M. Malley, CPA CW3, USA, Retired President, AAFMAA Mortgage OUR MISSION Services LLC Stephen C. Mannell, Jr., CTFA President, AAFMAA Wealth CONTACT US: Management & Trust LLC To be the www.aafmaa.com Carlos Perez, Jr., FLMI 1-800-522-5221 Chief Operating Officer and premier provider of Assistant Secretary, AAFMAA 102 Sheridan Ave Charles B. Betancourt, CCIM insurance, financial Fort Myer, VA 22211 Chief Operating Officer, AAFMAA Property LLC and survivor services 1850 Old Reston Ave Reston, VA 20190 Tiana Fallavollita Vice President Human Resources, to the American 639 Executive Place, Ste 200 AAFMAA Armed Forces Fayetteville, NC 28305 Kevin A. -

Congratulations to the USCGA Alumni Association on Its 125Th Anniversary

Congratulations to the USCGA Alumni Association on its 125th Anniversary LINE, L Maersk Line, Limited was awarded its fi rst government contract in SK IM R IT 1983 for the conversion and operation of fi ve Maritime Prepositioning E E A D Ships for the U.S. Navy’s Military Sealift Command. M 30 years later, we continue to provide quali service operating and managing U.S. government ships, and our U.S. fl ag fl eet of 30TH containerships, tankers, heavy lift and roll-on/roll-off vessels supports ANNIVERSARY the U.S. Military worldwide. E Our eff orts have been—and will be —guided by our values and ST. 983 1 commitment to the U.S. maritime industry, national securi , and environmental stewardship. Trust and integri will ensure that we are serving our customers 30 years from now. maersklinelimited.comFebruary 2014 1 In Every Issue THE BULLETIN Calendar of Coming Events ................4 Vol. 76, No. 1 February 2014 From the Superintendent ....................6 HJ064� . f\411 y, J.-!J 22 U. S. COAST GUARD ACAD'CMY 32 42 From the Editor ....................................8 Alu�ni Association Bulletin Your Letters .........................................10 Minding the Helm ..............................12 Development News ...........................14 Vol. II, No. 1 NEW LONDON, CONN. March, 1940 In Memoriam ......................................58 EDITORIAL COMMENT The Alumni Bulletin is just one year old and to celebrate its Class Notes ..........................................59 anniversary it is appearing in a new form. Although smaller in size, the new form contains about 20% more reading matter per page than . the old mimeographed sheet. This change greatly re duces the ever-increasing clerical work of the secretary and lends the dignity desired in a professional publication of this nature. -

3 Must-Do Maintenance Tips for Your AAFMAA Life Insurance Policy September Is Life Insurance Awareness Month

View as Webpage September 2019 Did You Know? 3 Must-Do Maintenance Tips for Your AAFMAA Life Insurance Policy September is Life Insurance Awareness Month Take this time to review your current coverage and ensure it provides adequate protection for your loved ones. Unsure of how much coverage your family needs? Find out using our Life Insurance Needs Calculator which uses your current assets and liabilities to help determine the appropriate amount of coverage for you. Just like when you buy a home, you’re planning for the long run A sound financial plan when you purchase an AAFMAA life insurance policy—10, 20, includes an emergency or 30 years or even for life. So, much like a home, you should fund to provide readily expect to perform some routine maintenance on your policy to accessible cash for make sure it performs the way you’d like down the road. Many urgent issues changes can occur during the life of your policy, so you should consider these three things on a periodic basis: Learn more about how to start an emergency fund Continue reading in our Learning Hub. and determine how much you should save here. AAFMAA Wealth Management & Trust Relationship Managers are What is a REAL ID? ready to help answer your questions about emergency funds or any other personal finance concerns. Get the conversation started today by requesting your complimentary portfolio review. Our experts can help you evaluate where your finances stand and identify opportunities for improvement. AAFMAA Mortgage Services LLC (AMS) Adds More States AMS is now licensed to provide mortgages to Members in Minnesota and Georgia. -

Read Newsletterarrow Icon

FALL 2020 AAFMAA® Advantage AMERICAN ARMED FORCES MUTUAL AID ASSOCIATION NEWSLETTER Security is Just a Click Away with AAFMAA The life of many Military Families can be hectic with loved ones’ access to crucial finances when they need PCS moves, deployments, and shifting responsibilities them the most. The AAFMAA Digital Vault provides you amongst the family. While this flux may become the and your family with the peace of mind of knowing your norm for many Military Families, there are some things documents are safe, organized and accessible any time. that should be predictable — like where you keep your The Digital Vault is a secure online portal available to you essential documents and how to access them. Birth by logging into the AAFMAA Member Center with your certificates, DD-214s, VA award letters, and more are unique credentials. From there, you can upload digital required documents for school registrations, passports, copies of your essential documents for secure storage ID cards, VA entitlements, life insurance claims, Social with access whenever you need them – globally, 24/7 Security benefits, and many other key events. online. What’s more, if you or your loved ones ever need At AAFMAA, we understand how crucial your essential assistance submitting a claim, the AAFMAA Member documents are to you and your family’s financial security. Benefits Team can securely access the documents One missing document could significantly delay your you’ve uploaded to help you receive the benefits you have earned. Visit today to access your Upload copies of your essential aafmaa.com/membercenter secure Digital Vault and upload your essential documents. -

2011 Annual Report

TAPE HERE Commitment TrustTrust Friendly Communication Tradition Respected Growth Service Premier Reliable Compassion Expansion Relationship Stability Focus Evolving Commitment Trust Friendly Communication Tradition Respected CommunicationTerm Insurance Growth Premier Reliable Expansion Relationship Friendly Stability I FocusWhole Evolving Life Commitment Trust Friendly Communication Tradition I RespectedANNUITY GrowthLife ServiceService Premier Reliable Compassion Expansion Relationship S Stability tability FocusFocus EvolvingEvolving CommitmentCommitment TrustTrust FriendlyFriendly CommunicationCommunicationAAFMAA TraditionTradition Respected Growth Tradition Respected Growth Service PremierANNUAL REPORTReliable Compassion FOLD HERE Relationship Stability Focus Army Communication and Air Force Evolving Commitment Trust Friendly Mutual Aid Association 102 Sheridan Avenue NO POSTAGE NECESSARY IF MAILED IN THE Relationship Tradition Respected Growth Service Premier Reliable Compassion Expansion UNITED STATES Fort Myer, VA 22211-1110 Focus Evolving INSURANCE Commitment SALES: 1-877-398-2263 Friendly Communication Stability Monday–Friday, 8:30 am–7:00 pm ET Trust Tradition MAIN OFFICE HOURS: Respected Growth ServiceMonday–Friday, Premier 8:30 am–4:30 pm ET Reliable Compassion Expansion Relationship Advice TOLL FREE: 1-800-522-5221 LOCAL: 703-707-4600 I ADDRESSEE Relationship Focus Evolving Commitment Friendly Communication Y Stability Trust FAX: 703-522-1336 B Survivor Services AID E-MAIL: [email protected] P E I WEB SITE: www.aafmaa.com LL -

Sqsssqqsppsqsqsrrqspqqsrqsrqp

Return Mail Processing PO Box 589 Claysburg, PA 16625-0589 March 5, 2021 G2784-L02-0000002 T00001 P001 *****AUTO**MIXED AADC 159 ALGPBPEJHMHLBOFOBK SAMPLE A. SAMPLE - L02 ADULT AMJIGMHDNPJKFDKNLK AKFIBNAMMODNOKCDIK APT ABC AFFCPGOBHJKCLEDPMK DDLLLLDLDDDLLLDLDL 123 ANY ST ANYTOWN, ST 12345-6789 sqsssqqsppsqsqsrrqspqqsrqsrqpspqqqrssqrrqrsssrqqsprqpqqpspssrrrqr [RE: Notice of Data Breach] Dear [Extra1 - Salutation] Sample: The American Armed Forces Mutual Aid Association (“AAFMAA”) is writing to notify you of a recent incident that may have impacted some of your information. Although at this time there is no indication that your information has been fraudulently misused in relation to this incident, we are providing you with information about the incident, our response to it, including offering you complimentary credit monitoring, and providing additional measures you can take to protect your information, should you feel it appropriate to do so. What Happened? On January 29, 2021, AAFMAA became aware of suspicious activity relating to its systems and immediately launched an investigation to determine the nature and scope of the activity. AAFMAA determined that an unauthorized actor gained access to certain AAFMAA systems between January 28, 2021 and January 31, 2021 and removed and/or viewed certain files from our network. AAFMAA undertook a comprehensive and time-intensive review of all files that were identified as impacted. This review was recently completed, and it was determined that certain information related to you may have been impacted. What Information Was Involved? Our investigation determined that the following types of your information may have been impacted by this incident: name, [Extra2 - data elements]. To date, AAFMAA has not received any reports of fraudulent misuse of any information impacted by this incident. -

Gary N. Aiken

GARY N. AIKEN [Personal address and phone number withheld] SUMMARY A leader and investment professional with substantial institutional expertise. Executives and Boards trust me to achieve objectives creatively, respectfully, and efficiently. BUSINESS EXPERIENCE AMERICAN ARMED FORCES MUTUAL AID ASSOCIATION (AAFMAA), Reston, VA 2001 –Present CHIEF ANALYST AND RISK MANAGEMENT OFFICER, AAFMAA Investment Management (2013 – Present) Direct strategic risk analysis for $26 billion mutual life insurance company. ● Advise Senior Management and Board of Directors on major investment, business, and strategic initiatives (mergers and acquisitions, new business plans, new products, and asset/liability planning). ● Conduct reviews of term and whole life insurance policy premium pricing and effects on cash flow, reserving, segment profitability, risk-based capital, and mutuality concerns. ● Responsible for capital adequacy measurement, cash flow analysis, and key metric sensitivity analyses. Explain results, present conclusions, and recommend courses of action. ● Contribute to analysis and management of investment portfolio assets totaling over $1.3 billion. PREVIOUS ROLES AT AAFMAA INCLUDE: Leading Member, Expansion Task Force ● Led successful effort to charter a North Carolina trust company as primary contact with the Commissioner of Banks staff. Created business plan, including all financial modeling and research of assumptions. ● Co-headed successful effort to start a mortgage banking division of AAFMAA: AAFMAA Mortgage Services LLC, roles included Board presentation, business plan and financial model development. ● Headed due diligence team on acquisition of $900 million National Bank, including transaction modeling/projections, analysis of $300 million distressed CRE portfolio, and negotiation of key deal points. Directed coordination with the Federal Reserve Board staff in Washington, DC. ● Evaluated potential Broker/Dealer acquisition valued at $25 million. -

2017 Annual Report

ANNUAL REPORT 2017 ® Solutions for Your Financial Future AAFMAA Board of Directors Executive Committee Finance Committee Membership Committee William M. Matz, Jr. John A. Dubia Dennis J. Reimer MG, USA, Retired LTG, USA, Retired GEN, USA, Retired Chairman, Finance Chairman, Membership Chairman of the Board* Committee Committee Joseph E. DeFrancisco Dennis D. Porter Janice M. Hamby LTG, USA, Retired COL, USA, Retired RADM, USN, Retired Vice Chairman of the Vice Chairman, Finance Vice Chair, Membership Board* Committee Committee John A. Dubia LTG, USA, Retired John T. Ridge George L. Horvath, III Chairman, Membership CMSgt, USAF, Retired CSM, USA, Retired Committee William M. Matz, Jr. Mack C. Hill MG, USA, Retired BG, USA, Retired Lewis E. Monroe, III Chairman, Finance Chairman, Audit CMSgt, USAF, Retired Committee Sub-Committee Walter R. Lincoln, CFP® William J. Lennox, Jr. MAJ, USA, Retired LTG, USA, Retired President and Treasurer* OUR MISSION *Ex-officio member of all committees To be the Wilson A. (Bud) Senior Management Shatzer, Jr. COL, USA, Retired Walter R. Lincoln, CFP® premier provider President and Treasurer, AAFMAA Tiana Fallavollita of insurance, Assistant to the President, AAFMAA Michael J. Meese, Ph.D., FLMI financial and Jonathan D. George Executive Vice President and Secretary, BG, USAF, Retired AAFMAA survivor services Carlos Perez, FLMI Chief Operating Officer and Assistant Secretary, AAFMAA to the American Kevin A. Kincaid Chief Marketing Officer, AAFMAA Armed Forces Robin H. Boudiette, Jr. Charlene Wilde CW3, USA, Retired Assistant Secretary, AAFMAA Community. Charles B. Betancourt, CCIM Chief Operating Officer, AAFMAA Property LLC Richard J. Convy, CPA, CFA CONTACT US: 102 Sheridan Ave 639 Executive Place, President, AAFMAA Wealth Fort Myer, VA 22211 Ste 200 Management & Trust LLC www.aafmaa.com Fayetteville, NC 28305 1850 Old Reston Ave James M.