As Filed with the Securities and Exchange Commission on May 5

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The 2018 Climate Accountability Scorecard Insufficient Progress from Major Fossil Fuel Companies

The 2018 Climate Accountability Scorecard Insufficient Progress from Major Fossil Fuel Companies HIGHLIGHTS Introduction Since the Union of Concerned Scientists In recent years, the fossil fuel industry has faced mounting shareholder, political, (UCS) issued its inaugural Climate and legal pressure to stop spreading climate disinformation and dramatically Accountability Scorecard in 2016, the fossil reduce emissions of heat-trapping gases. However, rather than make measurable fuel industry has faced mounting and serious changes to their businesses, the companies in our sample have taken shareholder, political, and legal pressure to small actions with minimal impact; continue to downplay or misrepresent climate stop spreading climate disinformation and science; and support climate-denying politicians, trade associations, and other dramatically reduce global warming industry groups that spread disinformation and oppose climate policies. In the fossil fuel–friendly context of the current US administration, civil society and emissions from its operations and the use of private sector actors have stepped up pressure on companies with large carbon its products. This follow-up study of eight footprints and poor track records on climate change with aggressive engagement major oil, gas, and coal companies (Arch and shareholder resolutions. States, counties, and municipalities have taken a Coal, BP, Chevron, ConocoPhillips, CONSOL strong stand by pledging to stay in the Paris climate agreement, passing sensible Energy, ExxonMobil, Peabody Energy, and climate legislation, committing to and achieving significant emissions reductions, Royal Dutch Shell) found that they are and holding the fossil fuel industry accountable for its role in climate change responding to these growing through investigations and litigation. In creating The Climate Accountability Scorecard, originally published in mainstream expectations. -

Peabody Energy Corporation Annual Report 2019

Peabody Energy Corporation Annual Report 2019 Form 10-K (NYSE:BTU) Published: February 27th, 2019 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 _____________________________________________ FORM 10-K þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2018 or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number 1-16463 ____________________________________________ PEABODY ENERGY CORPORATION (Exact name of registrant as specified in its charter) Delaware 13-4004153 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 701 Market Street, St. Louis, Missouri 63101 (Address of principal executive offices) (Zip Code) (314) 342-3400 Registrant’s telephone number, including area code Securities Registered Pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, par value $0.01 per share New York Stock Exchange Securities Registered Pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. -

WL Ross and Co., and the Anker Coal Disaster

Click here for Full Issue of EIR Volume 33, Number 4, January 27, 2006 subpoena both witnesses and documents, it now almost never does. It is instead interviewing witnesses behind closed doors, Interview: Mark Reutter making employer intimidation of miner witnesses more pos- sible. This lack of rigor by MHSA makes immediate Congres- sional hearings even more urgent. Sen. Robert Byrd (D- WLRoss and Co., and W.Va.) has attempted to schedule immediate hearings in a subcommittee of the Senate Appropriations Committee; whether these take place in the week of Jan. 23, or are put off, The Anker Coal Disaster is not clear at this writing. Sen. Jay Rockefeller (D-W.Va.) on Jan. 12, called for Mark Reutter is the author of Making Steel: Sparrows Point hearings in the Senate Health, Education, Labor, and Pensions and the Rise and Ruin of American Industrial Might (2004), Committee, signed by 11 other Senators of both parties, from which examines the bankruptcy proceedings of Bethlehem Kentucky, West Virginia, Pennsylvania, Indiana, and Ala- Steel and the company’s takeover by Wilbur L. Ross (see bama. Pressure is high on Committee Chairman Rick Enzi www.makingsteel.com for more), who controls the Sago coal (R-Wyo.) to schedule the hearings. In the Education and the mine. Reutter was interviewed by Paul Gallagher on Jan. 18. Workforce Committee on the House side, ranking Democrats George Miller (Calif.) and Major Owens (N.Y.) are pressing EIR: Twelve miners died and one was critically injured in a chairman John Boehner (R-Ohio) for hearings. Jan. 2 explosion at the Sago mine of Anker West Virginia If hearings are held soon and probe carefully this “Ross/ Coal, in Upshur County, West Virginia. -

May 18, 2020 Peabody Energy 701 Market St. St. Louis, MO 63101

May 18, 2020 Peabody Energy 701 Market St. St. Louis, MO 63101-1826 To: Glenn Kellow, President and Chief Executive Officer Vic Svec, Senior Vice President, Global Investor and Corporate Relations Charlene Murdock, Director, US Communications We are writing to urge that you cease your association with, and end your funding of, the American Legislative Exchange Council (ALEC), which is leading an effort to lobby government officials—including President Trump—to ignore public health officials and discontinue mitigation measures before the COVID-19 outbreak is under control. ALEC’s work in this effort, which your company is funding through its support of ALEC, poses a serious threat to the health and safety of all us all. Recently, ALEC teamed up with a coalition of far-right lobbying groups to launch the “Save Our Country” campaign protesting the public health quarantine orders put in place to reduce the health risks of COVID-19. As The Washington Post recently reported, the ALEC-led coalition’s focus is on “pushing for the White House and GOP lawmakers to push back against health professionals who have urged more caution." Among health professionals, the consensus is clear on the risks of rolling back protective measures too early. As a prominent epidemiologist from Columbia University put it, “The math is unfortunately pretty simple. It’s not a matter of whether infections will increase but by how much.” Dr. Anthony Fauci, the leading infectious-disease expert at the National Institutes of Health, has warned that “unless we get the virus under control, the real recovery economically is not going to happen.” Prematurely moving to lift public-safety regulations poses a clear threat to public health. -

Ensuring a Robust COAL EXPORT MARKET

Coal Exports / Rich Nolan Ensuring A Robust COAL EXPORT MARKET By Rich Nolan, President and Chief Executive Officer, National Mining Association lthough it is seldom acknowl- contain the largest recoverable coal edged in the mainstream reserves on earth—optimally exploiting press, coal remains both the that opportunity will require expan- leading fuel for electricity sion and improvements in the nation’s generation worldwide and shipping and port infrastructure. The Aa key input in the steelmaking pro- potential payoff of such investment is cess. The International Energy Agency significant, as coal exports’ economic reports that coal accounts for almost 40 contributions extend well beyond the percent of electricity generation globally activities at the mine mouth and include and projects that its consumption will employment related to downstream increase for at least the next five years. transportation providers, service com- Global consumption patterns con- panies that prepare and load coal for tinue to shift, however, with Asia now export shipment, and other businesses far and away the region with the greatest that are supported by coal export activ- coal demand and growth prospects. ity. (Please visit NMA’s uscoalexports. While that opens up significant export org for detailed news and information opportunities for U.S. mines—which on U.S. coal exports.) 4 | COAL TRANSPORTER COAL TRANSPORTER | 5 Where is U.S. Coal Exported? Metallurgical Coal Market resulting from industrial slowdowns due to COVID-19. Metallurgical or “met” coal is used to produce coke, which is “Metallurgical coal mines in Appalachia have slowed produc- integral to steelmaking. The steel industry uses coal coke to tion based on reduced demand from global steel produc- smelt iron ore into iron to make steel. -

MSHA's Response to Corona Virus

Issue 2 ▪ 2020 2019 COAL Miner’s MeMORIAL THE MINING INDUSTRy’s RESPONSE TO COVID-19 MSHA’S RESPONSE TO CORONA VIRUS WORLD NEWS: UNLEASHING COAL IN INDIA Find Us on Facebook f coalenergyonline fhttps://www.facebook.com/coalenergyonline table of contents Features: 06 2019 Coal Miner’s Memorial 18 Safety First 2019 Novel Coronavirus 20 The American Mining Industry Responds to COVID-19 Health Crisis Departments: 2019 36 World News: Unleashing Coal in India Coal Miner’s Memorial 6 47 Member Spotlights In every issue: 03 Letter from your Publisher 04 Association Comparisons 25 In the Press 38 Association Members 48 Industry Events 50 Index to Advertisers 50 Upcoming Issue World News: INDIA 36 Published & Produced By: Martonick Publications, Inc. President: Contributing Writers: Maria Martonick Maria Martonick, Jenna Martonick PO Box 244322 Elenor Siebring, Kevin Harrigan Boynton Beach, FL 33424 Vice President: Julie Gates, Michelle Bloodworth Steve Martonick Rich Nolan, Jason Bohrer Toll Free Phone: (866) 387-0967 Jeremy J. Harrison, Shri Pralhad Joshi Toll Free Fax: (866) 458-6557 Managing Editor: A.J. Raleigh Graphic Designer: [email protected] Natalia Filatkina www.martonickpublications.com Research Coordinator: www.coalenergyonline.com Vivian Mofeed The opinions expressed by the authors of the articles contained in Coal Energy are those of the respective authors, and do not necessarily represent the opinion of the publisher. © Copyright 2020 ▌ Feature: COAL ENERGY ▌ 2013 ▪ 2 letter from THE PUBLISHER Dear readers, tions.com with any news that may be considered for publish in following issues. Welcome to Issue 2, 2020 of Coal Energy. Please visit our website, www.coalenergyonline. -

OUR ENVIRONMENTAL APPROACH North Antelope Rochelle Mine Our Environmental Approach Is Two‑Fold with a Focus on Responsible Coal Mining and Advanced Coal Use

INTRODUCTION STRATEGY RESULTS Environmental Approach Social Approach Governance Approach OUR ENVIRONMENTAL APPROACH North Antelope Rochelle Mine Our environmental approach is two-fold with a focus on responsible coal mining and advanced coal use. Responsible Coal Mining Advanced Coal Use We begin with a deep appreciation Our commitment to the environment and understanding for the land and does not end with our operations. communities where we operate. Before Society has a growing need for energy any mining activity starts, we complete and a desire to reduce emissions, and comprehensive baseline studies of we believe both goals can be achieved — local ecosystems and land uses and not by moving away from coal — but by incorporate our findings into detailed embracing technology. mine plans aimed at reducing potential As outlined in our Statement on Climate impacts from our operations. Change, Peabody recognizes that climate As safe mining commences, we use change is occurring and that human industry leading practices to make the activity, including the use of fossil fuels, most efficient use of natural resources, contributes to greenhouse gas emissions. while minimizing our environmental We also recognize that coal is essential footprint. This includes a focus on to affordable, reliable energy and will reducing greenhouse gas intensity, continue to play a significant role in the conserving water, advancing recycling global energy mix for the foreseeable and waste management programs, future. Peabody views technology as and applying contemporaneous land vital to advancing global climate change reclamation to lessen surface disturbance. solutions, and the company supports advanced coal technologies to drive Our governing principles for all sites are continuous improvement toward the outlined in our Environmental Policy, ultimate goal of near-zero emissions which applies to employees, contractors, from coal. -

Hot Topics in Coal Company Bankruptcies

Hot Topics in Coal Company Bankruptcies David M. Hillman, Karen S. Park and Lucy F. Kweskin Table of Contents Hot Topics in Coal Company Bankruptcies Legacy Obligations: Union and Retiree Benefits and Obligations Under the Coal Act and Black Lung Act 2 Reclamation Obligations 9 Conclusion 12 Endnotes 13 About SRZ 17 The recent “fracking revolution” has allowed U.S. energy companies to tap into abundant supplies of shale gas.1 Previously thought inaccessible, this form of natural gas has been found throughout the United States in deep underground shale formations.2 The shale gas boom has created a spike in natural gas supplies, causing prices to decline to their lowest level since 1999,3 and this has been cause for concern for coal-based energy producers, as well as their suppliers, as declining natural gas prices have made competing gas-fired plants far more cost- effective alternatives to coal-burning plants.4 Indeed, coal-based electricity Resources LP (2009) and Consol- generation in the United States idated Energy (2007) provide has dipped from half to about only evidence of the rapidly deteriorating one-third since 2007, and profits market for U.S. coal companies. from the nation’s coal-fired power In addition, a 2013 Fitch Ratings plants selling electricity in the report identified several coal mining open market have plummeted from companies as “distressed” and $20 billion in 2008 to $4 billion “near distressed” given their bond in 2011.5 Consequently, plans for spreads over U.S. Treasuries. Fitch more than 150 new coal-fired Ratings -

1 United States District Court Eastern District Of

UNITED STATES DISTRICT COURT EASTERN DISTRICT OF MISSOURI EASTERN DIVISION FEDERAL TRADE COMMISSION, ) ) Plaintiff, ) ) v. ) Case No. 4:20-cv-00317-SEP ) PEABODY ENERGY CORPORATION ) ) and ) ) ARCH RESOURCES, INC., ) ) Defendants. ) INTRODUCTION Flipping a light switch is the culmination of a long and convoluted process. The electricity needed to turn on that light—indeed, the electricity needed for any purpose, be it residential, commercial, or industrial—is generated at power plants owned by investor- or publicly-owned utilities and cooperatives, independent power producers, or the government. Joint Stipulation of Uncontested Facts (“JSUF”) (Doc. [301-1]) ¶ 4. Each power plant consists of one or more electricity generating units (“EGUs”). Id. ¶ 5. Each EGU uses one of a wide range of generating technologies to transform the energy in a specific fuel—e.g., uranium, coal, oil, natural gas, sunshine, wind, water—into electricity. Id. ¶ 6. The typical user of electrical power is indifferent to the method used to generate that power; to most of us, a megawatt is a megawatt is a megawatt. Id. ¶ 8. But to energy companies, utilities, policymakers, regulators, and investors (to name just a few), the process by which certain fuels are selected—or not—for 1 use in electricity generation is a matter of momentous consequence. This case is about that process. One of the most important fuels for electricity generation is thermal coal. Though it has steadily ceded ground to natural gas and renewables over the past twenty years, coal still provides 20 percent of our nation’s electricity, and it is projected to remain an important fuel source for decades to come. -

BLBA BULLETIN NO. 16-01 Issue Date

US. DEPARTMENT' OF LABOR Office ofW~rs· Compensation Programs Division of Coal Mine Worl<ers' Compensation Washington, DC 20210 BLBA BULLETIN NO. 16-01 Issue Date: November 12, 2015 Expiration Date: Indefinite Subject: Patriot Coal Corporation Bankruptcy. Background: On May 12, 2015, Patriot Coal Corporation and its subsidiaries filed for bankruptcy protection under Chapter 11. On October 9, 2015, Patriot received approval from the Bankruptcy Court to complete the sale of all its coal-mining operations. Patriot sold those operations to Blackhawk Mining and ERP Compliant Fuel, LLC (an affiliate of the Virginia Conservation Legacy Fund). Neither Blackhawk nor ERP is liable for federal black lung liabilities, except for those miners who continue to work for these companies after the sale. Patriot was authorized to self-insure its federal black lung liabilities as well as the liabilities of its subsidiaries in the States of KY, WV, n.,, IN, MO and PA. Some of Patriot's liabilities, however, are covered by commercial insurance policies. The Division of Coal Mine Workers' Compensation (DCMWC) has been notified that Patriot will no longer administer, defend, or pay claims after October 31, 2015. Applicability: Appropriate DCMWC Personnel Purpose: To provide guidance for district office staff in adjudicating claims in which the miner's last coal mine employment of at least one year was with one of the 50 subsidiary companies that have been affected by the Patriot Coal Corporation bankruptcy. Action: 1. Ensure no interruption of benefits for claims currently in approved/accepted status. For claims in approved/accepted status, claims examiners (CEs) will immediately place these claims into the Federal Black Lung Disability Trust Fund (BLDTF) by completing a Form CM-1261. -

INSIDE JOB: Big Polluters' Lobbyists on the Inside at the UNFCCC

INSIDE JOB: Big Polluters’ lobbyists on the inside at the UNFCCC Introduction May 2017 represents an unprecedented opportunity In November 2016, the UNFCCC’s Paris Agreement came for government delegates to the United Nations into force, and as of April 2017, has been ratified by 143 Framework Convention on Climate Change (UNFCCC) to governments.15 It locked in a crucial commitment to keep meaningfully address climate change. At an upcoming global temperature warming to 1.5 degrees Celsius, meeting, delegates will take up the issue of conflicts and well below 2 degrees. This is a critical step, albeit of interest: whether organizations representing the long overdue, in the global initiative to mitigate climate interests of fossil fuel corporations should continue to change through a legally binding and enforceable treaty. have an outsized presence at the U.N. climate treaty negotiations. With the destructive effects of climate change growing more dire every day, much rides on However, unless a major obstacle is addressed, there the outcomes of this meeting. Will the UNFCCC be able is an alarmingly high chance that there will be as little to lead the way in moving the global community to progress made on the Paris Agreement as has been implement urgently needed solutions to climate change? made on the UNFCCC agreements that preceded it: Or will the fossil fuel industry continue to delay, water Kyoto, Copenhagen, and Cancún. To date, corporations down, and block such solutions—leading us all to the that have knowingly played a fundamental role in point of no return when it comes to climate change? creating the current climate crisis—and whose actions suggest they care more about their profits than our future—continue to interfere and secure a seat at the This report provides examples of trade and business climate policymaking table. -

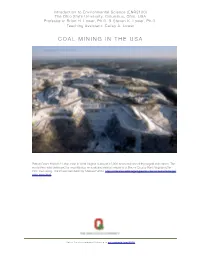

Coal Mining Assignment

Introduction to Environmental Science (ENR2100) The Ohio State University, Columbus, Ohio, USA Professors: Brian H. Lower, Ph.D. & Steven K. Lower, Ph.D. Teaching Assistant: Cailey A. Lower COAL MINING IN THE USA Patriot Coal’s Horbet-21 strip mine in West Virginia is almost 12,000 acres and one of the largest strip mines. The ecosystem was destroyed by mountaintop removal and nearby residents of Boone County West Virginia suffer from the mining. The image was taken by Melissa Farlow. http://science.nationalgeographic.com/science/enlarge/ strip-mine.html ! Intro Environmental Science • go.osu.edu/enr2100 Coal Mining in the USA Coal-fired power plants generate approximately 30% of the electricity in the United States. Each year about 900-million tons of coal is mined in the USA, or almost 6,000 pounds for each U.S. citi- zen. Most of this coal is mined from Wyoming, West Virginia, and Kentucky. The mining process can pollute freshwater resources and destroy natural ecosystems. One type of mining that is par- ticularly destructive is called mountaintop removal (MTR). This is the process of extracting coal seams from a mountain using explosives to remove the summit of the mountain. The excess rock and debris is discarded in the valleys because it is less expensive than removing it completely from the area. MTR predominantly appears in West Virginia, Kentucky and Tennessee. The explo- sives destroy the vegetation on the mountain and by filling the valleys with the debris, wildlife and valley streams are destroyed. Nearby people and organisms suffer from pollution in the air and water (e.g., heavy metals, acid mine drainage).