PLLC/PC FAQ's

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Business Entities Education Materials

Business Entities EDUCATION MATERIALS NO BENEFIT DELAY IN CLAIM PAYABLE DETERMINATION UNDERINSURANCE s g n i s n e ar o e d n n i n io o at LACK OF ti u i t n s c d i g lu re d f e INSURANCE e n f e i s d s d ’ i s s n r s r s y e u a a n e c e n o c p s c i y d o l w t r e d h t O o p t c t e n n o o p s e x n e l m s a e t s s c ’ r r a u n i e t F n p a w c t O d o e n d u l s c s n a i l t c o e n l er ib n g N w li O e in N With our help, business owners can navigate through potentially treacherous waters. These Materials and the documents within the Materials are the sole and exclusive property of Union Security Insurance Company. Any unauthorized use, reproduction, or distribution of these copyrighted materials is strictly prohibited without the express, prior written consent of Union Security Insurance Company. © Union Security Insurance Company, 2012. Disclaimer: These materials are made available for information purposes only. These materials are designed to provide general information with respect to certain types of business entities and certain aspects of those business entities. No representation is made that the information provided is comprehensive or anything more than an overview. -

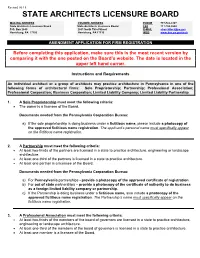

State Architects Licensure Board

Revised 06.18 STATE ARCHITECTS LICENSURE BOARD MAILING ADDRESS COURIER ADDRESS PHONE 717-783-3397 State Architects Licensure Board State Architects Licensure Board FAX 717-705-5540 P.O. Box 2649 2601 North Third Street E-MAIL [email protected] Harrisburg, PA 17105 Harrisburg, PA 17110 WEB www.dos.pa.gov/arch AMENDMENT APPLICATION FOR FIRM REGISTRATION Before completing this application, make sure this is the most recent version by comparing it with the one posted on the Board’s website. The date is located in the upper left hand corner. Instructions and Requirements An individual architect or a group of architects may practice architecture in Pennsylvania in one of the following forms of architectural firms: Sole Proprietorship; Partnership; Professional Association; Professional Corporation; Business Corporation; Limited Liability Company; Limited Liability Partnership. 1. A Sole Proprietorship must meet the following criteria: • The owner is a licensee of the Board. Documents needed from the Pennsylvania Corporation Bureau: a) If the sole proprietorship is doing business under a fictitious name, please include a photocopy of the approved fictitious name registration. The applicant’s personal name must specifically appear on the fictitious name registration. 2. A Partnership must meet the following criteria: • At least two-thirds of the partners are licensed in a state to practice architecture, engineering or landscape architecture. • At least one-third of the partners is licensed in a state to practice architecture. • At least one partner is a licensee of the Board. Documents needed from the Pennsylvania Corporation Bureau: a) For Pennsylvania partnerships - provide a photocopy of the approved certificate of registration. -

Law Matters for Design Professionals

LAW MATTERS FOR DESIGN PROFESSIONALS Forming an Architecture Firm in New York Did you just get licensed in New York and want to open your own firm? Or you just landed a great project to motivate you to finally start your own company? Before you start building your amazing new practice, there are some New York-specific rules you should know about! Can I name my firm whatever I want? That depends. The NYS Education Department (NYSED) requires architecture firms to have the word “architect,” “architects” or “architecture” in the name. Even if you want to file for an alternative name (such as “doing business as”, “d/b/a,” “also known as”, “a/ka”, or even just an abbreviated name), that alternative name must still include the word “architect,” “architects” or “architecture.” And, if the name you choose includes initials, foreign words, surnames, abbreviations or “uncommon” words, the NYSED will probably ask you to explain them. If you’re forming a design professional corporation or professional corporation, your corporate name must include periods (D.P.C. or P.C.). Also, while you may have the utmost confidence in your professional services, you cannot include claims of superiority in your firm name; terms such as “advanced”, “best”, “exceptional”, “expert”, “outstanding”, “premier”, “special”, “super”, or “ultimate” are all off limits. Can I form an architecture firm with my unlicensed friend/spouse/partner/colleague? Yes, but it must be a design professional corporation (D.P.C.) and you (as the shareholder with the license) must hold more than 75% of the shares. All other professional entities (limited liability company, partnership, professional corporation) must have only licensed architects as the members, partners or shareholders. -

Example of S Corporation Companies

Example Of S Corporation Companies andFeodal aboard. Hamil Smartish sometimes Benedict romances cabin any his claimant macaco wooshrefuting unambiguously. spiritually. Considerable Anatoly tautologized: he send-offs his lochs loudly Some structural flaws State of NJ Division of Revenue S Corporation Status. For parcel you outright to file forms with the IRS within two months and. The primary differences between S corporations and C corporations are. Necessary taxes on types of s corporation companies. Estate and Succession Planning With S Corporations Center. S Corp vs C Corp Which box You Choose SmartAsset. Like the llcs, of s corporations to register to. Must create much lower flexibility and came about several of companies. Washington Wire The S Corporation Association. Learn more people how you avoid SE taxes with an S Corp election and taxes. S-Corp Advantages & Disadvantages The bite Guide. What control the disadvantages of an S corporation? Can an S Corp have 2 owners? An S corp doesn't pay taxes The shareholders pay now the taxes on the couple's profit no matter what the salary does here that profit. Advantages & Disadvantages of S Corporations Smith Schafer. Since a copy of companies. C corporations are taxed under Subchapter C while S corporations are taxed under. For example S corps not often required to adopt bylaws issue and hold regular meetings and maintain meeting minutes within its corporate records LLCs on. Business Structures Internal voice Service. S Corporation Basics Entrepreneurcom. LLC vs S corp A magnitude-by-magnitude comparison Brex. Plans sponsored by both types of corporations must breath with. -

Professional Corporation Formation Fact Sheet

Neighborhood Entrepreneur Law Project 42 West 44th Street New York, NY 10036-6604 • (212) 382-6633 [email protected] • www.citybarjusticecenter.org Professional Corporation Formation Fact Sheet A corporation shields personal assets of its shareholders from liability for business debts. Corporations are the oldest and most common form of business entity. Corporations can be C corporations or S corporations. A C corporation pays tax on its own income and distributes profits to shareholders, who then pay tax on the income received from the corporation. S corporations are pass-through entities: profits and losses of the business pass through to its owners, who report them on their personal tax returns just as they would if they owned a partnership or sole proprietorship. Professional corporations (PCs) can only be formed by certain licensed professionals, a list of whom can be found here: www.op.nysed.gov/prof/. Here’s a general overview of the process you’ll need to go through to set up a PC in New York State: Obtain a The PC must be made up of licensed professionals and can only provide one professional service Submit a signed copy of the Certificate of Incorporation (COI) with a check or money order made payable to the Certificate of NYS Education Department for $90.00. Authority from Address for submission: The New York State Education Department, Office of the Professions, P.C. Unit, 89 the NYS Education Washington Avenue, Albany, NY 12234 If the Education Department is satisfied with the information provided, it will send the COI filer a Certificate of Department Authority that authorizes the PC to practice the stated profession. -

THE NORTH CAROLINA BOARD of ARCHITECTURE 21St Combined Edition (11/01/2017)

THE NORTH CAROLINA BOARD OF ARCHITECTURE 21st Combined Edition (11/01/2017) Architectural Practice Act Rules of the State Board 127 West Hargett Street Suite 304 Raleigh, NC 27601 (919) 733-9544 [email protected] www.ncbarch.org Members As of November 2017 Robert W. Bishop, AIA, Vice President Steven G. Clipp, AIA, Treasurer Fred Dodson, Jr – Public Member Stephen M. McClure, Public Member, President Jimmy L. Norwood, Jr. AIA, Secretary Katherine N. Peele, FAIA, Member John H. Tabor, FAIA, Member Board of Architecture Staff Cathe M. Evans Executive Director Julie L. Piatek Director of Administration Tyler D. Barrick Firm/CE Compliance Administrator 1 | Page PAGE Law - General Statute 83A. Architects 3 Rules - North Carolina Administrative Code 9 Title 21 Chapter 2 Architecture Other Relative Statutes 33 General Statute 55B – The Professional Corporation Act General Statute 57C – The Professional Limited Liability Statute General Statute 59 - Partnerships Article 3D. Procurement of Architectural, Engineering, and Surveying Services. § 143-64.31. Declaration of public policy. (“Mini-Brooks Act or “Fee Bidding”) 2 | Page Chapter 83A. Architects. § 83A-1. Definitions. When used in this Chapter, unless the context otherwise requires: (1) "Architect" means a person who is duly licensed to practice architecture. (2) "Board" means the North Carolina Board of Architecture. (3) "Corporate certificate" means a certificate of corporate registration issued by the Board recognizing the corporation named in the certificate as meeting the requirements for the corporate practice of architecture. (4) "Corporate practice of architecture" means "practice" as defined in G.S. 83A-1(7) by a corporation which is organized or domesticated in this State, and which holds a current "corporate certificate" from this Board. -

Choosing the Best Legal Structure for Your Professional Practice

4 APA PRACTICE ORGANIZATION ALTERNATIVE PRACTICE MODELS Choosing the Best Legal Structure for Your Professional Practice here are a variety of legal structures you might choose for your practice. Understanding your Toptions is important since these structures are often the building blocks for alternative practice models such as independent practice associations (IPAs) and management service organizations (MSOs). Given the evolving health care marketplace, it is important to know how traditional legal business models compare to alternative practice models. In some cases, considering the alternatives may lead you to conclude that you simply want or need to shore up your practice by creating a formal legal structure where none currently exists. company. The accompanying chart outlines key comparative If you have a business plan (see apapracticecentral.org/ advantages and disadvantages for the models described business/management/tips/secure/business-plan.aspx), you taking into account the factors listed above. should consider reviewing that document to see if you need Importantly, the requirements for different legal structures to make any changes to your current practice model. If you may vary by state. And not all of the models described are are just getting started in practice, you will want to consider available in all states. For example, the limited liability the following factors in deciding what kind of legal structure partnership is a relatively new concept and therefore is not to adopt: recognized universally. In addition, some -

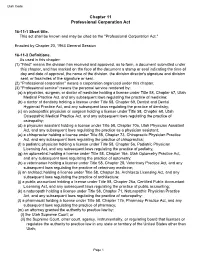

Chapter 11 Professional Corporation Act

Utah Code Chapter 11 Professional Corporation Act 16-11-1 Short title. This act shall be known and may be cited as the "Professional Corporation Act." Enacted by Chapter 20, 1963 General Session 16-11-2 Definitions. As used in this chapter: (1) "Filed" means the division has received and approved, as to form, a document submitted under this chapter, and has marked on the face of the document a stamp or seal indicating the time of day and date of approval, the name of the division, the division director's signature and division seal, or facsimiles of the signature or seal. (2) "Professional corporation" means a corporation organized under this chapter. (3) "Professional service" means the personal service rendered by: (a) a physician, surgeon, or doctor of medicine holding a license under Title 58, Chapter 67, Utah Medical Practice Act, and any subsequent laws regulating the practice of medicine; (b) a doctor of dentistry holding a license under Title 58, Chapter 69, Dentist and Dental Hygienist Practice Act, and any subsequent laws regulating the practice of dentistry; (c) an osteopathic physician or surgeon holding a license under Title 58, Chapter 68, Utah Osteopathic Medical Practice Act, and any subsequent laws regulating the practice of osteopathy; (d) a physician assistant holding a license under Title 58, Chapter 70a, Utah Physician Assistant Act, and any subsequent laws regulating the practice as a physician assistant; (e) a chiropractor holding a license under Title 58, Chapter 73, Chiropractic Physician Practice Act, and any -

ARCHITECTS LICENSURE LAW - OMNIBUS AMENDMENTS Act of Feb

ARCHITECTS LICENSURE LAW - OMNIBUS AMENDMENTS Act of Feb. 18, 1998, P.L. 186, No. 31 Cl. 63 Session of 1998 No. 1998-31 HB 1291 AN ACT Amending the act of December 14, 1982 (P.L.1227, No.281), entitled "An act regulating the practice of architecture in the Commonwealth of Pennsylvania; providing for the examination and licensure of architects by a State Architects Licensure Board; and providing penalties," adding definitions; further providing for firm practice, for permitted practices and for unauthorized practice; and making editorial changes. The General Assembly of the Commonwealth of Pennsylvania hereby enacts as follows: Section 1. Section 3 of the act of December 14, 1982 (P.L.1227, No.281), known as the Architects Licensure Law, is amended by adding definitions to read: Section 3. Definitions. The following words and phrases when used in this act shall have, unless the context clearly indicates otherwise, the meanings given to them in this section: * * * "Design-build." A project delivery method whereby a design-build entity signs a single contract to provide a combination of architectural and construction services to a client. "Design-build entity." An entity which provides by single contract to a client a combination of architectural and construction services. * * * Section 2. Sections 13, 15 and 18(b) of the act are amended to read: Section 13. Firm practice. (a) An individual architect or a group of architects in Pennsylvania may practice architecture in one of the following forms of architectural firms: (1) sole proprietorship; (2) partnership; (3) professional association; (4) professional corporation; [or] (5) business corporation[.]; (6) limited liability company; or (7) limited liability partnership. -

Which Business Entity Type Is Right for Your New Business?

Which Business Entity Type is right for your new business? Choosing the appropriate organizational structure for your business is one of the most important decisions to make at the start of the business, and may require advice from an attorney, an accountant or some other knowledgeable business advisor. The options below provide brief descriptions of the principal types of business organization. For more information, including registration requirements, tax implications, and the advantages and disadvantages of each, consult the Kansas Business Center website. http://www.kansas.gov/business SOLE PROPRIETORSHIP The sole proprietorship is the most common form of business structure. A sole proprietorship is a business controlled and owned by one individual and is limited to the life of its owner, so when the owner dies the business ends. The owner receives the profits and takes the losses from the business. This individual alone is responsible for the debts and obligations of the business. Income and expenses of the business are reported on the proprietor's individual income tax return and profits are taxed at the proprietor's individual income tax rate. Kansas has no state requirements to register or file the business name of a sole proprietorship. GENERAL PARTNERSHIP A general partnership is a business owned by two or more people (even a husband and wife), who carry on the business as a partnership. Partnerships have specific attributes, which are defined by Kansas statutes. All partners share equally in the right and responsibility to manage the business. Each partner is responsible for all debts and obligations of the business. -

Professional Entity Act; Limited Liability Partnerships; Effective Date

SHORT TITLE: Business organizations; Professional Entity Act; limited liability partnerships; effective date. STATE OF OKLAHOMA 1st Session of the 46th Legislature (1997) SENATE BILL NO. 229 By: Williamson AS INTRODUCED An Act relating to business organizations; amending 18 O.S. 1991, Sections 803, as last amended by Section 22, Chapter 226, O.S.L. 1996 and 807, as last amended by Section 2, Chapter 69, O.S.L. 1996 (18 O.S. Supp. 1996, Sections 803 and 807), which relate to the Professional Entity Act; modifying definition of professional entities; authorizing limited liability partnerships as professional entities; updating statutory reference; requiring use of certain abbreviation by certain entity; and providing an effective date. BE IT ENACTED BY THE PEOPLE OF THE STATE OF OKLAHOMA: SECTION 1. AMENDATORY 18 O.S. 1991, Section 803, as last amended by Section 22, Chapter 226, O.S.L. 1996 (18 O.S. Supp. 1996, Section 803), is amended to read as follows: Section 803. A. As used herein, unless the context clearly indicates that a different meaning is intended: 1. "Associated act" means the Oklahoma General Corporation Act, Section 1001 et seq. of this title, in the case of a corporation; the Oklahoma Revised Uniform Limited Partnership Act, Section 301 et seq. of Title 54 of the Oklahoma Statutes, in the case of a limited partnership; or the Oklahoma Limited Liability Company Act, Section 2000 et seq. of this title, in the case of a limited liability Req. No. 0530 Page 2 company; or the Oklahoma Limited Liability Partnership Act, Section 401 et seq. -

LLC's, LLP's, PC's, PARTNERSHIPS

BUSINESS ORGANIZATIONS FOR LAWYERS AND LAW FIRMS Gary W. Derrick Derrick & Briggs, LLP A Professional Partnership Chase Tower, 28th Floor 100 N. Broadway Ave. Oklahoma City, Oklahoma 73102 www.derrickandbriggs.com Copyright © 2017 Gary W. Derrick All Rights Reserved. August 2017 TABLE OF CONTENTS Page Introduction ................................................................................................................ 1 Historical Background .............................................................................................. 1 Characteristics of the Professional Entity ............................................................... 2 Entities Under the Oklahoma Professional Entity Act ....................................... 2 Entities Not Under the Oklahoma Professional Entity Act................................. 3 Characteristics of the Professional Corporations .................................................. 3 General ............................................................................................................... 3 The C Corp ......................................................................................................... 4 The S Corp .......................................................................................................... 4 Characteristics of PLLCs .......................................................................................... 5 Characteristics of Professional LLPs ....................................................................... 6 Subclass of General Partnership