Report on Token Purchases During Block.One's Token Sale 22 July 2021 ______

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Peer Co-Movement in Crypto Markets

Peer Co-Movement in Crypto Markets G. Schwenkler and H. Zheng∗ February 4, 2021y Abstract We show that peer linkages induce significant price co-movement in crypto markets in excess of common risk factors and correlated demand shocks. When large abnormal return shocks hit one crypto, its peers experience unusually large abnormal returns of the opposite sign. These effects are primarily concentrated among smaller peers and revert after several weeks, resulting in predictable returns. We develop trading strategies that exploit this rever- sal, and show that they are profitable even after accounting for trading fees and frictions. We establish our results by identifying crypto peers through co-mentions in online news using novel natural language processing technologies. Keywords: Cryptocurrencies, peers, co-movement, competition, natural language pro- cessing. JEL codes: G12, G14, C82. ∗Schwenkler is at the Department of Finance, Santa Clara University Leavey School of Business. Zheng is at the Department of Finance, Boston University Questrom School of Business. Schwenkler is corresponding author. Email: [email protected], web: http://www.gustavo-schwenkler.com. yThis is a revision of a previous paper by the two authors called \Competition or Contagion: Evidence from Cryptocurrency Markets." We are grateful to Jawad Addoum (discussant), Daniele Bianchi (discussant), Will Cong, Tony Cookson, Sanjiv Das, Seoyoung Kim, Andreas Neuhierl, Farzad Saidi, and Antoinette Schoar, seminar participants at Boston University and the Society for Financial Econometrics, and the participants at the 2020 Finance in the Cloud III Virtual Conference, the 2020 MFA Annual Meeting, the 3rd UWA Blockchain, Cryptocurrency and FinTech Conference, and the 2020 INFORMS Annual Meeting for useful comments and suggestions. -

PWC and Elwood

2020 Crypto Hedge Fund Report Contents Introduction to Crypto Hedge Fund Report 3 Key Takeaways 4 Survey Data 5 Investment Data 6 Strategy Insights 6 Market Analysis 7 Assets Under Management (AuM) 8 Fund performance 9 Fees 10 Cryptocurrencies 11 Derivatives and Leverage 12 Non-Investment Data 13 Team Expertise 13 Custody and Counterparty Risk 15 Governance 16 Valuation and Fund Administration 16 Liquidity and Lock-ups 17 Legal and Regulatory 18 Tax 19 Survey Respondents 20 About PwC & Elwood 21 Introduction to Crypto Hedge Fund report In this report we provide an overview of the global crypto hedge fund landscape and offer insights into both quantitative elements (such as liquidity terms, trading of cryptocurrencies and performance) and qualitative aspects, such as best practice with respect to custody and governance. By sharing these insights with the broader crypto industry, our goal is to encourage the adoption of sound practices by market participants as the ecosystem matures. The data contained in this report comes from research that was conducted in Q1 2020 across the largest global crypto hedge funds by assets under management (AuM). This report specifically focuses on crypto hedge funds and excludes data from crypto index/tracking/passive funds and crypto venture capital funds. 3 | 2020 Crypto Hedge Fund Report Key Takeaways: Size of the Market and AuM: Performance and Fees: • We estimate that the total AuM of crypto hedge funds • The median crypto hedge fund returned +30% in 2019 (vs - globally increased to over US$2 billion in 2019 from US$1 46% in 2018). billion the previous year. -

Blockchain & Cryptocurrency Regulation

Blockchain & Cryptocurrency Regulation Third Edition Contributing Editor: Josias N. Dewey Global Legal Insights Blockchain & Cryptocurrency Regulation 2021, Third Edition Contributing Editor: Josias N. Dewey Published by Global Legal Group GLOBAL LEGAL INSIGHTS – BLOCKCHAIN & CRYPTOCURRENCY REGULATION 2021, THIRD EDITION Contributing Editor Josias N. Dewey, Holland & Knight LLP Head of Production Suzie Levy Senior Editor Sam Friend Sub Editor Megan Hylton Consulting Group Publisher Rory Smith Chief Media Officer Fraser Allan We are extremely grateful for all contributions to this edition. Special thanks are reserved for Josias N. Dewey of Holland & Knight LLP for all of his assistance. Published by Global Legal Group Ltd. 59 Tanner Street, London SE1 3PL, United Kingdom Tel: +44 207 367 0720 / URL: www.glgroup.co.uk Copyright © 2020 Global Legal Group Ltd. All rights reserved No photocopying ISBN 978-1-83918-077-4 ISSN 2631-2999 This publication is for general information purposes only. It does not purport to provide comprehensive full legal or other advice. Global Legal Group Ltd. and the contributors accept no responsibility for losses that may arise from reliance upon information contained in this publication. This publication is intended to give an indication of legal issues upon which you may need advice. Full legal advice should be taken from a qualified professional when dealing with specific situations. The information contained herein is accurate as of the date of publication. Printed and bound by TJ International, Trecerus Industrial Estate, Padstow, Cornwall, PL28 8RW October 2020 PREFACE nother year has passed and virtual currency and other blockchain-based digital assets continue to attract the attention of policymakers across the globe. -

NEO Market Report Summary

NEO Market Analysis NEO Market Report Summary NEO, frequently nicknamed within the cryptocurrency community as The One, Chinese Ethereum or Ethereum ‘‘killer’’, is a blockchain platform that implements digital assets, dApps and smart contracts, and tries to solve some scalability and regulatory issues of its competitors. With strong partnerships and support from the Asian cryptocurrency community, NEO is one of the most promising currencies in the crypto-assets space, with the ambitious goal of becoming the main “smart economy” of the world during the next few years. “A word to the wise. All cryptocurrencies, including NEO, are still largely considered to be in the experimental stage and as such should be treated as high risk assets. In any investment account, high risk assets should only represent a small portion of your overall portfolio. That said, we hope you enjoy this market analysis. Feel free to contact us with any questions or feedback.” eToro: @MatiGreenspan | Twitter: @MatiGreenspan | LinkedIn: MatiGreenspan NEO Market Analysis History Technical Description NEO was introduced in 2014 under the Ethereum changed the whole name Antshares by China-based company cryptocurrency sphere by introducing a new Onchain, a blockchain-specialized company layer when compared to Bitcoin by founded in 2014 by Da Hongfei and Erik developing a platform where smart Zhang. Two crowdsales in late 2015 contracts and other tokens and ICOs can be provided the founding for the project. On developed. On Ethereum, smart contracts these crowdsales, 17.5 million and 22.5 are written using special programming million NEO were sold for $550,000 and languages like Solidity. -

A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets

Journal of Risk and Financial Management Review A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets Nikolaos A. Kyriazis Department of Economics, University of Thessaly, 38333 Volos, Greece; [email protected] Abstract: This study is an integrated survey of GARCH methodologies applications on 67 empirical papers that focus on cryptocurrencies. More sophisticated GARCH models are found to better explain the fluctuations in the volatility of cryptocurrencies. The main characteristics and the optimal approaches for modeling returns and volatility of cryptocurrencies are under scrutiny. Moreover, emphasis is placed on interconnectedness and hedging and/or diversifying abilities, measurement of profit-making and risk, efficiency and herding behavior. This leads to fruitful results and sheds light on a broad spectrum of aspects. In-depth analysis is provided of the speculative character of digital currencies and the possibility of improvement of the risk–return trade-off in investors’ portfolios. Overall, it is found that the inclusion of Bitcoin in portfolios with conventional assets could significantly improve the risk–return trade-off of investors’ decisions. Results on whether Bitcoin resembles gold are split. The same is true about whether Bitcoins volatility presents larger reactions to positive or negative shocks. Cryptocurrency markets are found not to be efficient. This study provides a roadmap for researchers and investors as well as authorities. Keywords: decentralized cryptocurrency; Bitcoin; survey; volatility modelling Citation: Kyriazis, Nikolaos A. 2021. A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets. Journal of Risk and 1. Introduction Financial Management 14: 293. The continuing evolution of cryptocurrency markets and exchanges during the last few https://doi.org/10.3390/jrfm years has aroused sparkling interest amid academic researchers, monetary policymakers, 14070293 regulators, investors and the financial press. -

Impossibility of Full Decentralization in Permissionless Blockchains

Impossibility of Full Decentralization in Permissionless Blockchains Yujin Kwon*, Jian Liuy, Minjeong Kim*, Dawn Songy, Yongdae Kim* *KAIST {dbwls8724,mjkim9394,yongdaek}@kaist.ac.kr yUC Berkeley [email protected],[email protected] ABSTRACT between achieving good decentralization in the consensus protocol Bitcoin uses the proof-of-work (PoW) mechanism where nodes earn and not relying on a TTP exists. rewards in return for the use of their computing resources. Although this incentive system has attracted many participants, power has, CCS CONCEPTS at the same time, been significantly biased towards a few nodes, • Security and privacy → Economics of security and privacy; called mining pools. In addition, poor decentralization appears not Distributed systems security; only in PoW-based coins but also in coins that adopt proof-of-stake (PoS) and delegated proof-of-stake (DPoS) mechanisms. KEYWORDS In this paper, we address the issue of centralization in the consen- Blockchain; Consensus Protocol; Decentralization sus protocol. To this end, we first define ¹m; ε; δº-decentralization as a state satisfying that 1) there are at least m participants running 1 INTRODUCTION a node, and 2) the ratio between the total resource power of nodes Traditional currencies have a centralized structure, and thus there run by the richest and the δ-th percentile participants is less than exist several problems such as a single point of failure and corrup- or equal to 1 + ε. Therefore, when m is sufficiently large, and ε and tion. For example, the global financial crisis in 2008 was aggravated δ are 0, ¹m; ε; δº-decentralization represents full decentralization, by the flawed policies of banks that eventually led to many bank which is an ideal state. -

Exploring the Interconnectedness of Cryptocurrencies Using Correlation Networks

Exploring the Interconnectedness of Cryptocurrencies using Correlation Networks Andrew Burnie UCL Computer Science Doctoral Student at The Alan Turing Institute [email protected] Conference Paper presented at The Cryptocurrency Research Conference 2018, 24 May 2018, Anglia Ruskin University Lord Ashcroft International Business School Centre for Financial Research, Cambridge, UK. Abstract Correlation networks were used to detect characteristics which, although fixed over time, have an important influence on the evolution of prices over time. Potentially important features were identified using the websites and whitepapers of cryptocurrencies with the largest userbases. These were assessed using two datasets to enhance robustness: one with fourteen cryptocurrencies beginning from 9 November 2017, and a subset with nine cryptocurrencies starting 9 September 2016, both ending 6 March 2018. Separately analysing the subset of cryptocurrencies raised the number of data points from 115 to 537, and improved robustness to changes in relationships over time. Excluding USD Tether, the results showed a positive association between different cryptocurrencies that was statistically significant. Robust, strong positive associations were observed for six cryptocurrencies where one was a fork of the other; Bitcoin / Bitcoin Cash was an exception. There was evidence for the existence of a group of cryptocurrencies particularly associated with Cardano, and a separate group correlated with Ethereum. The data was not consistent with a token’s functionality or creation mechanism being the dominant determinants of the evolution of prices over time but did suggest that factors other than speculation contributed to the price. Keywords: Correlation Networks; Interconnectedness; Contagion; Speculation 1 1. Introduction The year 2017 saw the start of a rapid diversification in cryptocurrencies. -

P2P Electricity Transaction Between Ders by Blockchain Technology

DEGREE PROJECT IN COMPUTER SCIENCE AND ENGINEERING, SECOND CYCLE, 30 CREDITS STOCKHOLM, SWEDEN 2018 P2P Electricity transaction between DERs by Blockchain Technology RUOGU LI KTH ROYAL INSTITUTE OF TECHNOLOGY SCHOOL OF ELECTRICAL ENGINEERING AND COMPUTER SCIENCE KTH Royal Institute of Technology School of Electrical Engineering and Computer Science Master’s Thesis in Computer Science and Computer Engineering P2P Electricity transaction between DERs by Blockchain Technology Author: Ruogu Liu Supervisors: Anne Håkansson Xue Wang Examiner: Prof.Mihhail Matskin, KTH, Sweden ii Abstract The popularity of blockchain technologies increases with a significant rise in the price of cryptocurrency in 2017, which drew much attention in the academia and industry to research and implement new application or new blockchain technology. Many new blockchains have emerged over the last year in a broad spectrum of sectors and use cases including IOT, Energy, Finance, Real estate, Entertainment, etc. Despite many exciting research and applications have been done, there are still many areas worth investigating, and implementation of the blockchain based distributed application are still facing much uncertainty and challenging since blockchain is still an emerging technology. Meanwhile, the energy sector is under a transition to be digitalized and more distributed. A global technology revolution has disrupted the conventional centralized power system with distributed resources and technologies, like photovoltaic units (PV), batteries, electric mobilities, etc. The citizens then have control of their generation and consumption profiles. The purpose of this master thesis is to explore existing blockchain technology, and smart contracts such as IOTA, NEO, Ethereum Tobalaba, which can be adapted in the energy sector. Within this thesis, blockchain and the smart contract is proposed as a way of building distributed applications for a p2p transaction use case in the energy asset management platform. -

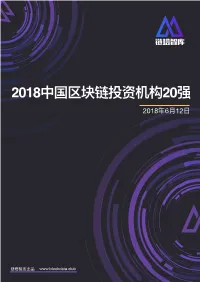

2018中国区块链投资机构20强 2018年6⽉12⽇

2018中国区块链投资机构20强 2018年6⽉12⽇ 链塔智库出品 www.blockdata.club 前⾔ 近年来,中国区块链⾏业的快速发展逐渐获得投资机构关注,中国区块链⾏业投资年增速已连续多年超 过100%。专注于区块链⾏业的投资机构正在⻜速成⻓,在区块链产业积极布局,构建⾃⼰的版图,⽽ 持开放态度的传统投资机构也在跑步⼊局。 链塔智库对活跃于区块链领域的120家投资机构及其所投项⽬进⾏分析,从区块链⾏业投资影响⼒、投 资标的数量、投资⾦额总量等⽅⾯选取了⼆⼗家表现最好的投资机构重点研究,形成结论如下: 从投资项⽬分类来看,这些投资机构普遍看好区块链平台类的公司。 从投资标的地域来看,这些投资机构更多的投资于海外项⽬。 从国内项⽬⻆度来看,北京地区项⽬占⽐最⾼。 从投资轮次来看,⼤部分投资发⽣在天使轮及A轮,反映⾏业仍处于早期阶段。 www.blockdata.club ⽬录 PART.1 2018中国区块链投资机构20强 榜单 PART.2 2018中国区块链投资机构20强 榜单分析 PART.3 影响⼒、投资数⽬、投资⾦额 细分榜单 PART.4 2018中国区块链投资机构版图 www.blockdata.club PART.1 2018中国区块链投资机构20强榜单 链塔智库基于链塔数据库数据,辅以整理超过120余家活跃于区块链领域的投资机构及所投项⽬,从 各家机构在投资影响⼒、投资项⽬数量、投资总额、回报情况、退出情况等维度进⾏评分(单项评价 最⾼10分),评选出2018中国区块链投资机构20强。 区块链投资机构评分维度模型 投资⾦额 重点项⽬影响⼒ 投资影响⼒ 背书能⼒ 媒体影响⼒ 退出情况 总投资数⽬ 投资数⽬ 所投项⽬已发Token数 回报情况 链塔智库研究绘制 www.blockdata.club www.blockdata.club 1 38.1% 21.1%95% 2018中国区块链 79.5% 投资机构 TOP 20 70.2% 名次 47.5% 机构名称 创始⼈ 总评价 影响⼒评分 数量评分 ⾦额评分 1 分布式资本 沈波 9.1 9 10 9 2 硬币资本 李笑来 9.0 10 9 8 3 连接资本 林嘉鹏 8.7 7 10 7 4 15.8% Dfund 赵东 8.1 7 6 9 5 54.1% IDG资本 熊晓鸽 7.7 9 4 9 6 泛城资本 陈伟星 7.5 9 5 6 7 真格基⾦ 徐⼩平 7.4 7 5 7 8 节点资本 杜均 7.1 6 10 7 9 丹华资本 张⾸晟 6.8 8 6 5 10 维京资本 张宇⽂ 6.5 8 5 5 11 了得资本 易理华 6.4 8 6 4 12 FBG Capital 周硕基 6.3 6 6 8 13 千⽅基⾦ 张银海 6.2 8 6 5 14 红杉资本中国 沈南鹏 6.1 10 4 5 15 创世资本 朱怀阳、孙泽宇 6.0 6 6 6 16 Pre Angel 王利杰 5.9 6 8 5 17 蛮⼦基⾦ 薛蛮⼦ 5.8 8 5 3 18 隆领资本 蔡⽂胜 5.5 7 5 3 19 ⼋维资本 傅哲⻜、阮宇博 5.2 6 5 5 20 BlockVC 徐英凯 5.1 6 5 4 数据来源:链塔数据库及公开信息整理 www.blockdata.club www.blockdata.club 2 PART.2 2018中国区块链投资机构20强榜单分析 2.1 区块链平台项目最受欢迎,占比44% 链塔智库根据收录的投资机构20强所投项⽬以及公开信息,对投资项⽬所属⾏业进⾏分类。 20强投资机构投资项⽬⾏业分布 其他 2% 社交 6% ⽣活 8% ⾦融 29% ⽂娱 11% 区块链平台 44% -

Blockchain Deployment Toolkit

Redesigning Trust: Blockchain Deployment Toolkit Supply Chain Focus April 2020 EXPERIENCE THE INTERACTIVE VERSION AT: wef.ch/blockchain-toolkit World Economic Forum 91-93 route de la Capite CH-1223 Cologny/Geneva Switzerland Tel.: +41 (0)22 869 1212 Fax: +41 (0)22 786 2744 Email: [email protected] www.weforum.org © 2020 World Economic Forum. This publication has been published by the World Economic Forum All rights reserved. No part of this as a contribution to a project, insight areas or interaction. The publication may be reproduced findings, interpretations and conclusions expressed herein area or transmitted in any form or by result of a collaborative process facilitated and endorsed by the any means, including World Economic Forum, but whose results do not necessarily photocopying and recording, or represent the views of the World Economic Forum, nor the entirety of by any information storage and its Members, Partners or other stakeholders. retrieval system. Preface The emergence of blockchain technology holds great promise for supply-chain organisations, perhaps as much as any new development in the industry’s infrastructure since it switched to standardised containers decades ago. The case for blockchain is stronger as the COVID-19 pandemic underscores the need for more resilient global supply chains, trusted data and an economic recovery enabled through trade digitization. At the same time, blockchain may engender a fair share of puzzlement and anxiety among supply-chain leaders unfamiliar with it as a new and unfamiliar digitisation tool. This toolkit is designed to help with the deployment journey, whether your organisation is seeking to gain increased efficiency, greater trust with counterparties, or other potential benefits offered by blockchain technology. -

Herding Behavior in Cryptocurrency Markets Universitat Autònoma De Barcelona Department of Applied Economics Obryan Poyser Calderón WORKING PAPER | November 2018

Herding behavior in cryptocurrency markets Universitat Autònoma de Barcelona Department of Applied Economics Obryan Poyser Calderón WORKING PAPER | November 2018 Abstract There are no solid arguments to sustain that digital currencies are the future of online payments or the disruptive technology that some of its former participants declared when used to face critiques. This paper aims to solve the cryptocurrency price determination puzzle from a behavioral finance perspective and trying to find the parallelism between the literature on biases present in financial markets that serve as a starting point to understand crypto-markets. Moreover, it is suggested that cryptocurrencies’ prices are driven by herding, hence this study test behavioral convergence under the assuption that prices “as-is” are the coordination mechanism. For this task, it has been proposed an empirical herding model based on Chang, Cheng, and Khorana (2000) methodlogy, and expandind the model both under asymmetric and symmetric conditions and the existence of different herding regimes by employing the Markov-Switching approach. keywords: Cryptocurrencies, Herding, Speculation, Markov Switching arXiv:1806.11348v2 [q-fin.ST] 30 Nov 2018 1 1 Introduction The digital economy have been increasing the exposure of state-of-art ideas, opportunities and changes in economics paradigms. By the same token, cryptocurrencies as well as Blockchain’s technology, and other potential applications are without a doubt a relevant concept that have emerged on the “new economy”. One could assure that most of the interest on cryptocurrencies was fueled by Bitcoin, the first successful implementation of a peer to peer network that could serve as a payment method. -

Blockchain Games: a Survey

Blockchain Games: A Survey Tian Min, Hanyi Wang, Yaoze Guo and Wei Cai School of Science and Engineering, The Chinese University of Hong Kong, Shenzhen, China Email: ftianmin, hanyiwang, [email protected], [email protected] Abstract—With the support of the blockchain systems, the the game operation. Asset Ownership: In traditional online cryptocurrency has changed the world of virtual assets. Digital games, the virtual properties, including credits, items, and games, especially those with massive multi-player scenarios, will avatars, belong to game operators since all data are stored be significantly impacted by this novel technology. However, there are insufficient academic studies on this topic. In this work, in the game operators’ server. In contrast, the blockchain we filled the blank by surveying the state-of-the-art blockchain game player owns their game assets, because all virtual assets games. We discuss the blockchain integration for games and will be bound to the players’ own address, which allows then categorize existing blockchain games from the aspects of the players to control and manage everything. The ownership their genres and technical platforms. Moreover, by analyzing enables the game assets to be independent of specific game the industrial trend with a statistical approach, we envision the future of blockchain games from technological and commercial operators, which allow the players to retain their digital perspectives. properties and in-game relationships, even after the game stops Index Terms—Blockchain, Game, Decentralization, Applica- its operation. Thanks to the ownership feature, virtual assets in tion, Software, Survey. the blockchain ecosystem have tremendous market liquidity.