Cape Town Office Market Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COMPANY PROFILE Page 1 of 64 | Newmark Company Profile Theabout Newmark NEWMARK Way

THE NEWMARK WAY COMPANY PROFILE Page 1 of 64 | Newmark Company Profile THEABOUT NEWMARK NEWMARK WAY Passion and focus – these are Newmark was launched in 2007 in line with the vision to provide diverse properties, including small establishments, with the opportunity to belong to a group that would the two core elements that set give them credibility without them losing their unique identity. With a heritage spanning Newmark Hotels, Residences, more than a decade, the company has perfected the tradition of applying excellence to all Reserves & Lodges apart as of its endeavours and its daily operations. Newmark’s extensive experience in managing prestigious and distinctive properties is matched by its determination to help owners realise a leading hotel management their worth. This is made possible by a highly focused, motivated and skilled executive team, company. These characteristics led by industry visionary, Neil Markovitz. make the Newmark experience The team’s collaborative proficiency enables the company to offer a comprehensive range far more than unique; they of management services, specially tailored to suit each property. make it unforgettable. THESE SERVICES INCLUDE: • Finance • Revenue • Marketing • Central Reservations • Operations • Information Technology • Human Resources • Sales Newmark’s forte lies in identifying the unique attributes of each property and bringing these to the marketplace’s attention through a bespoke, tailor-made model. The company is guided by the belief that every action needs to be financially sound. This dynamic company’s singular approach, which involves first establishing solid infrastructure before pursuing other goals, has driven its success. In line with Newmark’s custom, each milestone that is reached is celebrated, whether it is the addition of a new property to the portfolio, or a staff member’s accomplishment. -

38604 27-3 Legalap3 Layout 1

Government Gazette Staatskoerant REPUBLIC OF SOUTH AFRICA REPUBLIEK VAN SUID-AFRIKA March Vol. 597 Pretoria, 27 2015 Maart No. 38604 PART 3 OF 3 LEGAL NOTICES A WETLIKE KENNISGEWINGS N.B. The Government Printing Works will not be held responsible for the quality of “Hard Copies” or “Electronic Files” submitted for publication purposes AIDS HELPLINE: 0800-0123-22 Prevention is the cure 501074—A 38604—1 170 No. 38604 GOVERNMENT GAZETTE, 27 MARCH 2015 Read this Legal A Gazette in conjunction with Extra Ordinary Legal A No. 38630 TABLE OF CONTENTS: INDEX PART 3 LEGAL NOTICES Page ADMINISTRATION OF ESTATES ACTS NOTICES:......................................................................................... 00 Form J 187: Liquidation and distribution accounts in deceased estates lying for inspection .................... 172 Gauteng..................................................................................................................................................... 172 Eastern Cape............................................................................................................................................. 187 Free State.................................................................................................................................................. 193 KwaZulu-Natal ........................................................................................................................................... 197 Limpopo.................................................................................................................................................... -

39400 13-11 Legala

Government Gazette Staatskoerant REPUBLIC OF SOUTH AFRICA REPUBLIEK VAN SUID-AFRIKA November Vol. 605 Pretoria, 13 2015 November No. 39400 PART 1 OF 2 LEGAL NOTICES A WETLIKE KENNISGEWINGS ISSN 1682-5843 N.B. The Government Printing Works will 39400 not be held responsible for the quality of “Hard Copies” or “Electronic Files” submitted for publication purposes 9 771682 584003 AIDS HELPLINE: 0800-0123-22 Prevention is the cure 2 No. 39400 GOVERNMENT GAZETTE, 13 NOVEMBER 2015 WARNING!!! To all suppliers and potential suppliers of goods to the Government Printing Works The Government Printing Works would like to warn members of the public against an organised syndicate(s) scamming unsuspecting members of the public and claiming to act on behalf of the Government Printing Works. One of the ways in which the syndicate operates is by requesting quotations for various goods and services on a quotation form with the logo of the Government Printing Works. Once the official order is placed the syndicate requesting upfront payment before delivery will take place. Once the upfront payment is done the syndicate do not deliver the goods and service provider then expect payment from Government Printing Works. Government Printing Works condemns such illegal activities and encourages service providers to confirm the legitimacy of purchase orders with GPW SCM, prior to processing and delivery of goods. To confirm the legitimacy of purchase orders, please contact: Renny Chetty (012) 748-6375 ([email protected]), Anna-Marie du Toit (012) 748-6292 ([email protected]) and Siraj Rizvi (012) 748-6380 ([email protected]) This gazette is also available free online at www.gpwonline.co.za STAATSKOERANT, 13 NOVEMBER 2015 No. -

36906 11-10 Legala Layout 1

Government Gazette Staatskoerant REPUBLIC OF SOUTH AFRICA REPUBLIEK VAN SUID-AFRIKA October Vol. 580 Pretoria, 11 2013 Oktober No. 36906 LEGAL NOTICES A WETLIKE SEE PART C SIEN DEEL C KENNISGEWINGS N.B. The Government Printing Works will not be held responsible for the quality of “Hard Copies” or “Electronic Files” submitted for publication purposes AIDS HELPLINE: 0800-0123-22 Prevention is the cure 304725—A 36906—1 2 No. 36906 GOVERNMENT GAZETTE, 11 OCTOBER 2013 IMPORTANT NOTICE The Government Printing Works will not be held responsible for faxed documents not received due to errors on the fax machine or faxes received which are unclear or incomplete. Please be advised that an “OK” slip, received from a fax machine, will not be accepted as proof that documents were received by the GPW for printing. If documents are faxed to the GPW it will be the sender’s respon- sibility to phone and confirm that the documents were received in good order. Furthermore the Government Printing Works will also not be held responsible for cancellations and amendments which have not been done on original documents received from clients. TABLE OF CONTENTS LEGAL NOTICES Page BUSINESS NOTICES.............................................................................................................................................. 11 Gauteng..................................................................................................................................................... 11 KwaZulu-Natal .......................................................................................................................................... -

38676 10-4 Legalap1 Layout 1

Government Gazette Staatskoerant REPUBLIC OF SOUTH AFRICA REPUBLIEK VAN SUID-AFRIKA Vol. 598 Pretoria, 10 April 2015 No. 38676 PART 1 OF 2 LEGAL NOTICES A WETLIKE KENNISGEWINGS N.B. The Government Printing Works will not be held responsible for the quality of “Hard Copies” or “Electronic Files” submitted for publication purposes AIDS HELPLINE: 0800-0123-22 Prevention is the cure 501232—A 38676—1 2 No. 38676 GOVERNMENT GAZETTE, 10 APRIL 2015 IMPORTANT NOTICE The Government Printing Works will not be held responsible for faxed documents not received due to errors on the fax machine or faxes received which are unclear or incomplete. Please be advised that an “OK” slip, received from a fax machine, will not be accepted as proof that documents were received by the GPW for printing. If documents are faxed to the GPW it will be the sender’s respon- sibility to phone and confirm that the documents were received in good order. Furthermore the Government Printing Works will also not be held responsible for cancellations and amendments which have not been done on original documents received from clients. TABLE OF CONTENTS LEGAL NOTICES Page BUSINESS NOTICES.............................................................................................................................................. 11 Gauteng..................................................................................................................................................... 11 Free State................................................................................................................................................. -

Government Gazette Staatskoerant REPUBLIC of SOUTH AFRICA REPUBLIEK VAN SUID-AFRIKA

Government Gazette Staatskoerant REPUBLIC OF SOUTH AFRICA REPUBLIEK VAN SUID-AFRIKA October Vol. 604 Pretoria, 9 2015 Oktober No. 39272 PART 1 OF 2 LEGAL NOTICES A WETLIKE KENNISGEWINGS ISSN 1682-5843 N.B. The Government Printing Works will 39272 not be held responsible for the quality of “Hard Copies” or “Electronic Files” submitted for publication purposes 9 771682 584003 AIDS HELPLINE: 0800-0123-22 Prevention is the cure 2 No. 39272 GOVERNMENT GAZETTE, 9 OCTOBER 2015 WARNING!!! To all suppliers and potential suppliers of goods to the Government Printing Works The Government Printing Works would like to warn members of the public against an organised syndicate(s) scamming unsuspecting members of the public and claiming to act on behalf of the Government Printing Works. One of the ways in which the syndicate operates is by requesting quotations for various goods and services on a quotation form with the logo of the Government Printing Works. Once the official order is placed the syndicate requesting upfront payment before delivery will take place. Once the upfront payment is done the syndicate do not deliver the goods and service provider then expect payment from Government Printing Works. Government Printing Works condemns such illegal activities and encourages service providers to confirm the legitimacy of purchase orders with GPW SCM, prior to processing and delivery of goods. To confirm the legitimacy of purchase orders, please contact: Renny Chetty (012) 748-6375 ([email protected]), Anna-Marie du Toit (012) 748-6292 ([email protected]) and Siraj Rizvi (012) 748-6380 ([email protected]) This gazette is also available free online at www.gpwonline.co.za STAATSKOERANT, 9 OKTOBER 2015 No. -

38759 8-5 Legalap1 Layout 1

Government Gazette Staatskoerant REPUBLIC OF SOUTH AFRICA REPUBLIEK VAN SUID-AFRIKA May Vol. 599 Pretoria, 8 2015 Mei No. 38759 PART 1 OF 2 LEGAL NOTICES A WETLIKE KENNISGEWINGS N.B. The Government Printing Works will not be held responsible for the quality of “Hard Copies” or “Electronic Files” submitted for publication purposes AIDS HELPLINE: 0800-0123-22 Prevention is the cure 501494—A 38759—1 2 No. 38759 GOVERNMENT GAZETTE, 8 MAY 2015 IMPORTANT NOTICE The Government Printing Works will not be held responsible for faxed documents not received due to errors on the fax machine or faxes received which are unclear or incomplete. Please be advised that an “OK” slip, received from a fax machine, will not be accepted as proof that documents were received by the GPW for printing. If documents are faxed to the GPW it will be the sender’s respon- sibility to phone and confirm that the documents were received in good order. Furthermore the Government Printing Works will also not be held responsible for cancellations and amendments which have not been done on original documents received from clients. TABLE OF CONTENTS LEGAL NOTICES Page BUSINESS NOTICES.............................................................................................................................................. 11 Gauteng..................................................................................................................................................... 11 Eastern Cape............................................................................................................................................ -

Annual Report 2010

ANNUAL REPORT 2010 Superior returns at lower than market risk. CONTENT Page No. Definitions 1 Corporate information 2 Profile 3 Structure 4 Directorate 5 Financial highlights 6 Manager’s report 8 Property portfolio 12 Directors’ responsibility 15 Shari’ah advisory board 16 Shari’ah compliance certificate 17 Approval of annual financial statements 18 Company secretary’s certificate 18 Report of the independent auditors 19 Report of the trustee 20 Oasis Crescent Property Fund - Balance sheet 21 - Income statement 22 - Statement of changes in unitholders’ funds 24 - Cash flow statement 25 - Notes to the annual financial statements 26 Oasis Crescent Property Fund Managers Limited - Balance sheet 46 - Income statement 47 - Statement of changes in equity 48 - Cash flow statement 48 - Notes to the annual financial statements 49 Notice of annual general meeting 62 CONFIDENTIAL This document is confidential, contains privileged information and is intended solely for the use of the individualor entity to whom it is addressed. If you are not the intended recipient you may not disclose, copy or in any way publish the content hereof which is subject to copyright. If you have received this in error, please notify us immediately by return e-mail or by telephone. DEFINITIONS “ALTx” the Alternative Exchange of the JSE which is a market for small to medium companies that are in a growth phase; “CISCA” the Collective Investment Schemes Control Act (Act 45 of 2002); “Crescent range” or “Shari’ah investment products offered by the Oasis Group, which are compliant” managed in accordance with the investment guidelines that have been established by the Oasis Group Shari’ah Advisory Board; “FSB” Financial Services Board established by section 2 of the Financial Services Board Act, 1990 (Act No. -

39373 6-11 Legal A

Government Gazette Staatskoerant REPUBLIC OF SOUTH AFRICA REPUBLIEK VAN SUID-AFRIKA November Vol. 605 Pretoria, 6 2015 November No. 39373 PART 1 OF 2 LEGAL NOTICES A WETLIKE KENNISGEWINGS ISSN 1682-5843 N.B. The Government Printing Works will 39373 not be held responsible for the quality of “Hard Copies” or “Electronic Files” submitted for publication purposes 9 771682 584003 AIDS HELPLINE: 0800-0123-22 Prevention is the cure 2 No. 39373 GOVERNMENT GAZETTE, 6 NOVEMBER 2015 WARNING!!! To all suppliers and potential suppliers of goods to the Government Printing Works The Government Printing Works would like to warn members of the public against an organised syndicate(s) scamming unsuspecting members of the public and claiming to act on behalf of the Government Printing Works. One of the ways in which the syndicate operates is by requesting quotations for various goods and services on a quotation form with the logo of the Government Printing Works. Once the official order is placed the syndicate requesting upfront payment before delivery will take place. Once the upfront payment is done the syndicate do not deliver the goods and service provider then expect payment from Government Printing Works. Government Printing Works condemns such illegal activities and encourages service providers to confirm the legitimacy of purchase orders with GPW SCM, prior to processing and delivery of goods. To confirm the legitimacy of purchase orders, please contact: Renny Chetty (012) 748-6375 ([email protected]), Anna-Marie du Toit (012) 748-6292 ([email protected]) and Siraj Rizvi (012) 748-6380 ([email protected]) This gazette is also available free online at www.gpwonline.co.za STAATSKOERANT, 6 NOVEMBER 2015 No. -

5.4 Operational Assesment Conclusions

3436 5.4 OPERATIONAL ASSESMENT CONCLUSIONS According to the Manual for Traffic Impact Studies, it is proposed that a developer mitigate the traffic impact of any proposed development under the following circumstances: — If the Level of Service (LOS) of any element drops below D; or — If the volume to capacity ratio (v/c) of any element increases above 0,95; and — If the contribution of the development is at least 2% of the sum of the critical lane volumes of the elements. The following comments are made regarding traffic impact mitigation measures for the development: — Walter Sisulu / Loop Street / Lower Long Street o A signal timing plan update may be required for Scenario 2. o Pedestrian movements: Additional green time for pedestrians is not recommended as it will reduce the overall vehicle LOS, which is not recommended on a higher order road (Lower Long Street). — Walter Sisulu / Cullinan Street: No mitigating measures are required. — Loop Street / Lower Long Street / Wharf Street o A signal timing plan update may be required for Scenario 2. o Pedestrian movements: Additional green time for pedestrians is not recommended as it will reduce the overall vehicle LOS, which is not recommended on a higher order road (Lower Long/Loop Street). — Cullinan Street / Wharf Street: No mitigating measures are required. — Lower Long Street / Hans Strijdom Avenue o A signal timing plan update may be required for Scenario 2. o Pedestrian movements: Additional green time for pedestrians is not recommended as it will reduce the overall vehicle LOS, which is not recommended on higher order roads (Lower Long/Hans Strijdom). -

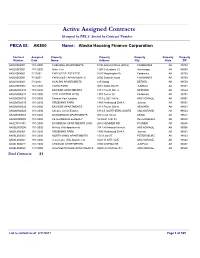

Active Contracts to Be Posted On

Active Assigned Contracts Grouped by PBCA Sorted by Contract Number PBCA ID:AK800 Name: Alaska Housing Finance Corporation Contract Assigned Property Property Property Property Property Number Date Name Address City State ZIP AK020002001 11/1/2000 CHENANA APARTMENTS 5190 Amherst Drive (office) FAIRBANKS AK 99709 AK020003001 11/1/2000 Glen, The 1200 Columbine Ct Anchorage AK 99508 AK020004001 7/1/2001 EXECUTIVE ESTATES 1620 Washington Dr Fairbanks AK 99709 AK020005001 7/1/2001 PARKWEST APARTMENTS 2006 Sandvik Road FAIRBANKS AK 99709 AK020006001 7/1/2001 AYALPIK APARTMENTS 105 Atsaq BETHEL AK 99559 AK020007002 12/1/2004 COHO PARK 3601 AMALGA ST JUNEAU AK 99801 AK02M000010 11/1/2000 BAYSIDE APARTMENTS 1011 Fourth Street SEWARD AK 99664 AK02M000011 11/1/2000 LITTLE DIPPER APTS 1910 Turner St Fairbanks AK 99701 AK02M000012 11/1/2000 Chester Park Estates 1019 E 20TH AVE ANCHORAGE AK 99501 AK02M000016 11/1/2000 GRUENING PARK 1800 Northwood Dr # A Juneau AK 99801 AK02M000022 11/1/2000 BAYSIDE APARTMENTS 1011 Fourth Street SEWARD AK 99664 AK02M000023 11/1/2000 Chester Creek Estates 5814 E NORTHERN LIGHTS ANCHORAGE AK 99504 AK02R000003 11/1/2000 WOODRIDGE APARTMENTS 903 Cook Street KENAI AK 99611 AK02R000004 11/1/2000 PETERSBURG ELDERLY 16 North 12th ST PETERSBURG AK 99833 AK02T851001 11/1/2000 DAYBREAK APARTMENTS (CMI) 2080 HEMMER RD PALMER AK 99645 AK06E000005 11/1/2000 McKay Villa Apartments 3741 Richmond Avenue ANCHORAGE AK 99508 AK06L000001 11/1/2000 GRUENING PARK 1800 Northwood Dr # A Juneau AK 99801 AK06L000003 11/1/2000 NORTH WIND APARTMENTS -

Government Gazette Staatskoerant REPUBLIC of SOUTH AFRICA REPUBLIEK VAN SUID-AFRIKA

Government Gazette Staatskoerant REPUBLIC OF SOUTH AFRICA REPUBLIEK VAN SUID-AFRIKA Vol. 581 Pretoria, 15 November 2013 No. 37016 PART 1 OF 2 LEGAL NOTICES A WETLIKE SEE PART C SIEN DEEL C KENNISGEWINGS N.B. The Government Printing Works will not be held responsible for the quality of “Hard Copies” or “Electronic Files” submitted for publication purposes AIDS HELPLINE: 0800-0123-22 Prevention is the cure 305317—A 37016—1 2 No. 37016 GOVERNMENT GAZETTE, 15 NOVEMBER 2013 IMPORTANT NOTICE The Government Printing Works will not be held responsible for faxed documents not received due to errors on the fax machine or faxes received which are unclear or incomplete. Please be advised that an “OK” slip, received from a fax machine, will not be accepted as proof that documents were received by the GPW for printing. If documents are faxed to the GPW it will be the sender’s respon- sibility to phone and confirm that the documents were received in good order. Furthermore the Government Printing Works will also not be held responsible for cancellations and amendments which have not been done on original documents received from clients. TABLE OF CONTENTS LEGAL NOTICES Page BUSINESS NOTICES.............................................................................................................................................. 11 Gauteng..................................................................................................................................................... 11 Eastern Cape............................................................................................................................................