FDA Approval Letter

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Annual Report Products

Products 2020 Annual Report From the CEO Dear Fellow Shareholders, Perrigo’s transformation to a pure-play Consumer Self-Care Company has come a long way LQMXVWWZRVKRUW\HDUV:HKDYHUHVWRUHGVXVWDLQDEOHWRSOLQHJURZWKGHOLYHUHGRQRXU¿QDQFLDO SURPLVHVUHFRQ¿JXUHGRXUSRUWIROLRRIEXVLQHVVHVXSGDWHGWKH,7LQIUDVWUXFWXUHDQGSURFHVVHV of the Company, expanded capacity, upgraded leadership talent, installed business intelligence capabilities, built a new product pipeline of over $500 million and re-instilled a sense of pride and energy among our 11,000 team members. Making this even more remarkable, is that we kept the WUDQVIRUPDWLRQRQWUDFNLQWKHIDFHRIWKHJOREDO&29,'SDQGHPLF,KRSH\RXDUHDVSURXGRI3HUULJR¶VJOREDOWHDP DV,DPIRUKRZWKH\ZRUNHGWRNHHSHDFKRWKHUVDIHNHSWRXUHVVHQWLDOSURGXFWVÀRZLQJDQGNHSWRXUWUDQVIRUPDWLRQ to a consumer self-care company on track through all of the personal and professional uncertainty that came their way LQ7KH\DUHKHURHV As a result of their efforts, Perrigo delivered strong net sales growth for the second year in a row in 2020 and World-wide Consumer sales reached a new record high. Equally important, the team stabilized adjusted operating income after a few years of decline even as we invested over $50 million in our business and overcame $35 million RIXQSODQQHGKHDGZLQGVGXHSULPDULO\WR&29,'UHODWHGVDIHW\FRVWVDQGEXVLQHVVLPSDFWIURPWKHZHDNFROG FRXJKDQGÀXVHDVRQUHODWHGWR&29,'¶VLPSDFWRQSXEOLFOLIH$OOLQDOOZHKDGDYHU\VWURQJ\HDU Our transformation efforts reached an essential milestone after the year closed when we announced the sale of RXU3UHVFULSWLRQ3KDUPDFHXWLFDOVEXVLQHVVWR$OWDULV&DSLWDO3DUWQHUV//&7KHWUDQVDFWLRQUHLQIRUFHVRXUDELOLW\ -

Annual Report

ANNUAL REPORT 2019 MARCH 2020 To Our Shareholders Alex Gorsky Chairman and Chief Executive Officer By just about every measure, Johnson & These are some of the many financial and Johnson’s 133rd year was extraordinary. strategic achievements that were made possible by the commitment of our more than • We delivered strong operational revenue and 132,000 Johnson & Johnson colleagues, who adjusted operational earnings growth* that passionately lead the way in improving the health exceeded the financial performance goals we and well-being of people around the world. set for the Company at the start of 2019. • We again made record investments in research and development (R&D)—more than $11 billion across our Pharmaceutical, Medical Devices Propelled by our people, products, and and Consumer businesses—as we maintained a purpose, we look forward to the future relentless pursuit of innovation to develop vital with great confidence and optimism scientific breakthroughs. as we remain committed to leading • We proudly launched new transformational across the spectrum of healthcare. medicines for untreated and treatment-resistant diseases, while gaining approvals for new uses of many of our medicines already in the market. Through proactive leadership across our enterprise, we navigated a constant surge • We deployed approximately $7 billion, of unique and complex challenges, spanning primarily in transactions that fortify our dynamic global issues, shifting political commitment to digital surgery for a more climates, industry and competitive headwinds, personalized and elevated standard of and an ongoing litigious environment. healthcare, and that enhance our position in consumer skin health. As we have experienced for 133 years, we • And our teams around the world continued can be sure that 2020 will present a new set of working to address pressing public health opportunities and challenges. -

Case 3:15-Cv-06075-PGS-DEA Document 124 Filed 03/24/17 Page

Case 3:15-cv-06075-PGS-DEA Document 124 Filed 03/24/17 Page 1 of 9 PageID: <pageID> UNITEDD STATES DISTRICT COURT FOR THE DISTRICT OF NEW JERSEY MERCK SHARP & DOHME CORP. ) ) ) Civil Action No: Plaintiff, ) 15-cv-6075 (PGS)(DEA) ) v. ) ) MEMORANDUM ACTAVIS LABORATORIES FL, INC., ) & et al. ) ORDER ) ) Defendants. SHERIDAN, U.S.D.J. This matter comes before the Court on defendant Actavis, Inc. n/k/a Allergan Finance LLC’s (“Allergan Finance”) motion to dismiss plaintiff Merck Sharp & Dohme Corp.’s (“Merck”) complaint for lack of subject matter jurisdiction under Fed. R. Civ. P. 12(b)(1) (“Rule 12(b)(1)”). Defendants Actavis Laboratories FL, Inc., Andrx Corporation, & Actavis Pharma, Inc. (collectively, “Teva Defendants”), consent to this motion. (See Defs.’ Br. at 1; Dkt. No. 114-1). Allergan Finance argues that Merck’s complaint lacks subject matter jurisdiction against Allergan Finance because it divested its interests in an Abbreviated New Drug Application (“ANDA”) upon acquiring of its business by Teva Pharmaceuticals USA. The ANDA application is directed to posaconazole drug, which is protected by U.S. Pat. 5,661,151 (the “’151 patent”). Because of its divestiture of the ANDA application, Allergan Finance argues that it lacks the involvement in the marketing, distribution, or sale of Teva Defendants’ ANDA products. As a result, extinguishing this Court’s jurisdiction conferred by 35 U.S.C. § 271(e)(2). In opposition, Merck argues that the subject matter jurisdiction under Rule 12(b)(1) was satisfied at the time of filing of the complaint. In the complaint, Merck alleged that Allergan Case 3:15-cv-06075-PGS-DEA Document 124 Filed 03/24/17 Page 2 of 9 PageID: <pageID> Finance submitted the ANDA application for purposes of engaging in commercial manufacture, use, or sale of the posaconazole (i.e., the ANDA product) prior to the expiration of the ’151 patent. -

Rebateable Manufacturers

Rebateable Labelers – July 2021 Manufacturers are responsible for updating their eligible drugs and pricing with CMS. Montana Healthcare Programs will not pay for an NDC not updated with CMS. Note: Some manufacturers on this list may have some NDCs that are covered and others that are not. Manufacturer ID Manufacturer Name 00002 ELI LILLY AND COMPANY 00003 E.R. SQUIBB & SONS, LLC. 00004 HOFFMANN-LA ROCHE 00006 MERCK & CO., INC. 00007 GLAXOSMITHKLINE 00008 WYETH PHARMACEUTICALS LLC, 00009 PHARMACIA AND UPJOHN COMPANY LLC 00013 PFIZER LABORATORIES DIV PFIZER INC 00015 MEAD JOHNSON AND COMPANY 00023 ALLERGAN INC 00024 SANOFI-AVENTIS, US LLC 00025 PFIZER LABORATORIES DIV PFIZER INC 00026 BAYER HEALTHCARE LLC 00032 ABBVIE INC. 00037 MEDA PHARMACEUTICALS, INC. 00039 SANOFI-AVENTIS, US LLC 00046 WYETH PHARMACEUTICALS INC. 00049 ROERIG 00051 ABBVIE INC 00052 ORGANON USA INC. 00053 CSL BEHRING L.L.C. 00054 HIKMA PHARMACEUTICAL USA, INC. 00056 BRISTOL-MYERS SQUIBB PHARMA CO. 00065 ALCON LABORATORIES, INC. 00068 AVENTIS PHARMACEUTICALS 00069 PFIZER LABORATORIES DIV PFIZER INC 00071 PARKE-DAVIS DIV OF PFIZER 00074 ABBVIE INC 00075 AVENTIS PHARMACEUTICALS, INC. 00078 NOVARTIS 00085 SCHERING CORPORATION 00087 BRISTOL-MYERS SQUIBB COMPANY 00088 AVENTIS PHARMACEUTICALS 00093 TEVA PHARMACEUTICALS USA, INC. 00095 BAUSCH HEALTH US, LLC Page 1 of 19 Manufacturer ID Manufacturer Name 00096 PERSON & COVEY, INC. 00113 L. PERRIGO COMPANY 00115 IMPAX GENERICS 00116 XTTRIUM LABORATORIES, INC. 00121 PHARMACEUTICAL ASSOCIATES, INC. 00131 UCB, INC. 00132 C B FLEET COMPANY INC 00143 HIKMA PHARMACEUTICAL USA, INC. 00145 STIEFEL LABORATORIES, INC, 00168 E FOUGERA AND CO. 00169 NOVO NORDISK, INC. 00172 TEVA PHARMACEUTICALS USA, INC 00173 GLAXOSMITHKLINE 00178 MISSION PHARMACAL COMPANY 00185 EON LABS, INC. -

F I L E D October 25, 2012

Case: 11-31073 Document: 00512032444 Page: 1 Date Filed: 10/25/2012 IN THE UNITED STATES COURT OF APPEALS United States Court of Appeals FOR THE FIFTH CIRCUIT Fifth Circuit F I L E D October 25, 2012 No. 11-31073 Lyle W. Cayce Clerk JULIE DEMAHY, Plaintiff-Appellant v. SCHWARZ PHARMA, INCORPORATED; ACTAVIS, INCORPORATED, Individually and as Successor in Interest of Purepac Pharmaceutical Company; WYETH, Individually and as Successor-in-Interest of A.H. Robins Company, Incorporated, Defendants-Appellees Appeal from the United States District Court for the Eastern District of Louisiana USDC No. 2:08-CV-3616 Before BENAVIDES, OWEN, and SOUTHWICK, Circuit Judges. PER CURIAM:* In this case, Plaintiff-Appellant Julie Demahy (“Demahy”) appeals the district court’s denial of two motions: a motion for relief from judgment as to Defendants-Appellees Wyeth, Inc. (“Wyeth”) and Schwarz Pharma, Inc. * Pursuant to 5TH CIR. R. 47.5, the court has determined that this opinion should not be published and is not precedent except under the limited circumstances set forth in 5TH CIR. R. 47.5.4. Case: 11-31073 Document: 00512032444 Page: 2 Date Filed: 10/25/2012 No. 11-31073 (“Schwarz”), makers of the prescription drug metoclopramide under the brand name Reglan, and a motion to set aside judgment as to Defendant-Appellee Actavis, Inc. (“Actavis”), a manufacturer of a generic version of metoclopramide. We find that the district court was correct in denying the motions and, accordingly, we affirm. FACTUAL AND PROCEDURAL HISTORY This case stems from Plaintiff-Appellant Demahy’s use of generic metoclopramide. The Food and Drug Administration (“FDA”) approved Reglan for use in 1980 and generic metoclopramide has been produced by a number of generic manufacturers since 1985, including by Actavis. -

Merck & Co., Inc

As filed with the Securities and Exchange Commission on February 28, 2017 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D. C. 20549 _________________________________ FORM 10-K (MARK ONE) ☒ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the Fiscal Year Ended December 31, 2016 or ☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from to Commission File No. 1-6571 _________________________________ Merck & Co., Inc. 2000 Galloping Hill Road Kenilworth, N. J. 07033 (908) 740-4000 Incorporated in New Jersey I.R.S. Employer Identification No. 22-1918501 Securities Registered pursuant to Section 12(b) of the Act: Name of Each Exchange Title of Each Class on which Registered Common Stock ($0.50 par value) New York Stock Exchange 1.125% Notes due 2021 New York Stock Exchange 0.500% Notes due 2024 New York Stock Exchange 1.875% Notes due 2026 New York Stock Exchange 2.500% Notes due 2034 New York Stock Exchange 1.375% Notes due 2036 New York Stock Exchange Number of shares of Common Stock ($0.50 par value) outstanding as of January 31, 2017: 2,745,571,067. Aggregate market value of Common Stock ($0.50 par value) held by non-affiliates on June 30, 2016 based on closing price on June 30, 2016: $159,263,000,000. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

Understanding Growth Pharma: a Deep Dive Into the Actavis-Allergan Merger

MIF PROGRAM RESEARCH PAPER Academic Year 2016 - 2017 Understanding Growth Pharma: a deep dive into the Actavis-Allergan merger Marta Emilia COLOMAR ROIG Nicolás DE LA FLOR JULIÁN Under the supervision of Denis GROMB Public report Confidential report Table of Contents Executive summary.......................................................................................................3 Structure of the report .................................................................................................4 Section I: Introduction to the pharmaceutical industry................................................5 1. The pharma industry............................................................................................5 1.1 Overview ..................................................................................................................5 1.2 Industry outlook ......................................................................................................5 1.3 Industry consolidation ............................................................................................7 1.4 Generic drugs ..........................................................................................................8 1.5 Branded drugs........................................................................................................10 Section II: The Actavis - Allergan merger.....................................................................12 2. The companies ...................................................................................................12 -

BRISTOL-MYERS SQUIBB COMPANY (Exact Name of Registrant As Specified in Its Charter) ______

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ___________________________ FORM 10-K ___________________________ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2017 Commission File Number 1-1136 ___________________________ BRISTOL-MYERS SQUIBB COMPANY (Exact name of registrant as specified in its charter) ___________________________ Delaware 22-0790350 (State or other jurisdiction of (IRS Employer incorporation or organization) Identification No.) 345 Park Avenue, New York, N.Y. 10154 (Address of principal executive offices) Telephone: (212) 546-4000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $0.10 Par Value New York Stock Exchange 1.000% Notes due 2025 New York Stock Exchange 1.750% Notes due 2035 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: Title of each class $2 Convertible Preferred Stock, $1 Par Value ___________________________ Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Bausch Health Companies Inc. Form 10-K Annual Report Filed 2019-02-20

SECURITIES AND EXCHANGE COMMISSION FORM 10-K Annual report pursuant to section 13 and 15(d) Filing Date: 2019-02-20 | Period of Report: 2018-12-31 SEC Accession No. 0000885590-19-000006 (HTML Version on secdatabase.com) FILER Bausch Health Companies Inc. Mailing Address Business Address 2150 ST. ELZEAR BLVD. 2150 ST. ELZEAR BLVD. CIK:885590| IRS No.: 000000000 | State of Incorp.:NJ | Fiscal Year End: 1231 WEST WEST Type: 10-K | Act: 34 | File No.: 001-14956 | Film No.: 19619046 LAVAL LAVAL SIC: 2834 Pharmaceutical preparations QUEBEC A8 H7L 4A8 QUEBEC A8 H7L 4A8 514-744-6792 Copyright © 2019 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 _____________________________ FORM 10-K ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2018 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-14956 BAUSCH HEALTH COMPANIES INC. (Exact Name of Registrant as Specified in its Charter) BRITISH COLUMBIA, CANADA State or other jurisdiction of 98-0448205 incorporation or organization (I.R.S. Employer Identification No.) 2150 St. Elzéar Blvd. West Laval, Québec Canada, H7L 4A8 (Address of principal executive offices) Registrant's telephone number, including area code (514) 744-6792 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Shares, No Par Value New York Stock Exchange, Toronto Stock Exchange Securities registered pursuant to section 12(g) of the Act: None (Title of class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

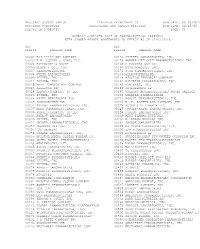

05/09/2016 Provider Subsystem Healthcare and Family Services Run Time: 04:25:50 Report Id 2794D051 Page: 01

MEDICAID SYSTEM (MMIS) ILLINOIS DEPARTMENT OF RUN DATE: 05/09/2016 PROVIDER SUBSYSTEM HEALTHCARE AND FAMILY SERVICES RUN TIME: 04:25:50 REPORT ID 2794D051 PAGE: 01 NUMERIC COMPLETE LIST OF PHARMACEUTICAL LABELERS WITH SIGNED REBATE AGREEMENTS IN EFFECT AS OF 07/01/2016 NDC NDC PREFIX LABELER NAME PREFIX LABELER NAME 00002 ELI LILLY AND COMPANY 00145 STIEFEL LABORATORIES, INC, 00003 E.R. SQUIBB & SONS, LLC. 00149 WARNER CHILCOTT PHARMACEUTICALS INC. 00004 HOFFMANN-LA ROCHE 00168 E FOUGERA AND CO. 00006 MERCK & CO., INC. 00169 NOVO NORDISK, INC. 00007 GLAXOSMITHKLINE 00172 IVAX PHARMACEUTICALS, INC. 00008 WYETH LABORATORIES 00173 GLAXOSMITHKLINE 00009 PFIZER, INC 00178 MISSION PHARMACAL COMPANY 00013 PFIZER, INC. 00182 GOLDLINE LABORATORIES, INC. 00015 MEAD JOHNSON AND COMPANY 00185 EON LABS, INC. 00023 ALLERGAN INC 00186 ASTRAZENECA LP 00024 SANOFI-AVENTIS, US LLC 00187 VALEANT PHARMACEUTICALS NORTH AMERICA 00025 PFIZER, INC. 00206 LEDERLE PIPERACILLIN 00026 BAYER HEALTHCARE LLC 00224 KONSYL PHARMACEUTICALS, INC. 00029 GLAXOSMITHKLINE 00225 B. F. ASCHER AND COMPANY, INC. 00032 SOLVAY PHARMACEUTICALS, INC. 00228 ACTAVIS ELIZABETH LLC 00037 MEDA PHARMACEUTICALS, INC. 00245 UPSHER-SMITH LABORATORIES, INC. 00039 SANOFI-AVENTIS, US LLC 00258 FOREST LABORATORIES INC 00046 AYERST LABORATORIES 00259 MERZ PHARMACEUTICALS 00049 PFIZER, INC 00264 B. BRAUN MEDICAL INC. 00051 UNIMED PHARMACEUTICALS, INC 00281 SAVAGE LABORATORIES 00052 ORGANON USA INC. 00299 GALDERMA LABORATORIES, L.P. 00053 CSL BEHRING 00300 TAP PHARMACEUTICALS INC 00054 ROXANE LABORATORIES, INC. 00310 ASTRAZENECA LP 00056 BRISTOL-MYERS SQUIBB PHARMA CO. 00327 GUARDIAN LABS DIV UNITED-GUARDIAN INC 00062 ORTHO MCNEIL PHARMACEUTICALS 00338 BAXTER HEALTHCARE CORPORATION 00064 HEALTHPOINT, LTD. 00378 MYLAN PHARMACEUTICALS, INC. -

Watson Pharmaceuticals / Actavis Inc.: Petition to Reopen

REDACTED PUBLIC VERSION UNITED STATES OF AMERICA BEFORE FEDERAL TRADE COMMISSION ) In the Matter of ) ) WATSON PHARMACEUTICALS INC., ) a corporation; ) ) ACTA VIS INC. • ) Docket No. C-43 73 a corporation; ) ) ACTA VIS PHARMA HOLDING 4 EHF., ) a private limited liability company; ) ) and ) ) ACTA VIS s.A.R.L., ) a limited liability corporate entity. ) PETITION OF RESPONDENT TEVA PHARMACEUTICAL INDUSTRIES LTD. TO REOPEN AND MODIFY DECISION AND ORDER Pursuant to Section 5(b) of the Federal Trade Commission Act, 15 U.S.C. § 45(b), and Section 2.51 (b) of the Commission's Rules of Practice and Procedure, Teva Pharmaceutical Industries Ltd. ("Teva"), a Respondent in the above-captioned matter as a successor to the merged parties Watson and Actavis, 1 hereby petitions the Federal Trade Commission (the "Commission") to reopen this matter for the limited purpose of modifying and setting aside the Commission's Decision and Order ("Order"), dated December 14, 2012 (attached as Exhibit 1), as it applies to Teva's agreement to supply the abuse-resistant opioid painkiller morphine sulphate naltrexone extended release capsules (brand name Embeda®) to Pfizer Inc. ("Pfizer") (the "Embeda Supply Arrangement"). Specifically, Teva hereby petitions the Commission to Capitalized terms not otherwise defined in this report have the meanings given to such terms in the Decision and Order issued in the above-captioned matter. Teva became a Respondent when it completed the acquisition ofthe Allergan Generic Pharmaceutical Entities from Allergan pie. See Paragraph XIII, Decision and Order, In the Matter ofTeva Pharmaceutical Industries, Ltd. and Allergan pie. REDACTED PUBLIC VERSION modify the provision in Paragraph 1.111.6 of the Order stating that the Embeda Supply Arrangement shall "not .. -

Biopharma Boom Fosters Deal Spree

Biopharma boom fosters deal spree Valuations and volume are up in a buoyant year for biopharmaceutical dealmaking. From tax inversions to gene therapy and, of course, immuno-oncology, 2014 and early 2015 featured plenty of wheeling and dealing. BY CHRIS MORRISON Table 1. Top 10 acquisitions announced in 2014. lthough it was a record year for biophar- Deal Value maceutical dealmaking—a year that A included more than $200 billion worth Actavis acquires Allergan $66 billion of mergers and acquisitions—one could argue Actavis acquires Forest Laboratories $22.8 billion that the most interesting and dramatic deals reportsBCIQ; Company of 2014 were the ones that never happened. Merck & Co. acquires Cubist Pharmaceuticals $9.5 billion Those almost-deals, mega-mergers in hot pur- Roche acquires Intermune $8.3 billion suit of corporate-friendly tax climates to drive margin expansion of the combined entities, Mallinckrodt acquires Questcor $5.7 billion were eventually thwarted by recalcitrant targets Merck & Co. acquires Idenix $3.7 billion or the slow-to-materialize posturing of the US Treasury. They were massive and oxygen con- Otsuka acquires Avanir $3.5 billion suming, and their failures set up rebound deals that, though smaller, are no less intriguing. Forest Laboratories acquires Aptalis $2.9 billion The failed $117 billion and $53 billion Endo acquires Auxilium $2.6 billion takeovers of AstraZeneca by Pfizer and Shire by AbbVie, respectively, tell only part of the Johnson & Johnson acquires Alios $1.75 billion story of 2014’s massive dealmaking binge. Data courtesy of Biocentury’s BCIQ Database. All acquisitions are of biopharma companies with patented prescription pharmaceutical focus (excludes devices, diagnostics, OTC, generic-only deals).