The Impact of Corporate Diversification on Firm Performance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Communication Management Category 1: Internal Communcation List of Winners Title Company Entrant's Name AGORA 2.0 Aboitiz Equity Ventures, Inc

Division 1: Communication Management Category 1: Internal Communcation List of Winners Title Company Entrant's Name AGORA 2.0 Aboitiz Equity Ventures, Inc. Lorenne Alejandrino-Anacta Keep It Simple, Sun Lifers: Gamifying A Simple Language Sun Life Financial Philippines Campaign Donante Aaron Peji Data Defenders: Data Privacy Lessons Made Fun and Sun Life Financial Philippines Engaging For Sun Life Employees Donante Aaron Peji PLDT Group Data Privacy Office Handle With Care Ramon R. Isberto Campaign PLDT Aboitiz Equity Ventures, Inc. (Pilmico Foods Super Conversations with SMA Corporation) Lorenne Alejandrino-Anacta Inside World: Engaging a new generation of Megaworld employees via a dynamic e-newsletter Megaworld Corporation Harold C. Geronimo Harnessing SYKES' Influence from Within to Inspire Beyond Reach Sykes Asia, Incorporated Miragel Jan Gabor ManilaMed's #FeelBetter Campaign Comm&Sense Inc. Aresti Tanglao Category 2: Employee Engagement Title Company Entrant's Name LOVE Grants Resorts World Manila Archie Nicasio a.Lab Aboitiz Equity Ventures, Inc. Lorenne V. Alejandrino CineNRW Maynilad Water Services, Inc Sherwin DC. Mendoza Central NRW Point System Maynilad Water Services, Inc Sherwin DC. Mendoza Leadership with a Heart Megaworld Foundation Dr. Francisco C. Canuto Dare 2B Fit ALLIANZ PNB LIFE INSURANCE, INC. ROSALYN MARTINEZ Category 3: Human Resources and Benefits Communication Title Company Entrant's Name Recruitment in the Social Media Era Manila Electric Company Gavin D. Barfield Category 5: Safety Communication Title Company Entrant's Name Championing cybersecurity awareness Bank of the Philippine Islands (BPI) Owen L. Cammayo Unang Hakbang Para Sa Kaligtasan: 2018 First Working MERALCO - Organizational Safety and Day Safety Campaign Resiliency Office Antonio Abuel Jr. -

Diversification Strategies of Large Business Groups in the Philippines

Philippine Management Review 2013, Vol. 20, 65‐82. Diversification Strategies of Large Business Groups in the Philippines Ben Paul B. Gutierrez and Rafael A. Rodriguez* University of the Philippines, College of Business Administration, Diliman, Quezon City 1101, Philippines This paper describes the diversification strategies of 11 major Philippine business groups. First, it reviews the benefits and drawbacks of related and unrelated diversification from the literature. Then, it describes the forms of diversification being pursued by some of the large Philippine business groups. The paper ends with possible explanations for the patterns of diversification observed in these Philippine business groups and identifies directions for future research. Keywords: related diversification, unrelated diversification, Philippine business groups 1 Introduction This paper will describe the recent diversification strategies of 11 business groups in the Philippines. There are various definitions of business groups but in this paper, these are clusters of legally distinct firms with a managerial relationship, usually by virtue of common ownership. The focus on business groups rather than on individual firms has to do with the way that business firms in the Philippines are organized and managed. Businesses that are controlled and managed by essentially the same set of principal owners are often organized as separate corporations, not as separate divisions within the same firm, as is often the case in American corporations like General Electric, Procter and Gamble, or General Motors (Echanis, 2009). Moreover, studies on emerging markets have pointed out that business groups often occupy dominant positions in the business landscape in markets like India, Korea, Indonesia, Thailand, and the Philippines (Khanna & Palepu, 1997; Khanna & Yafeh, 2007). -

Corporate Governance Issues in Philippine-Listed Companies

Philippine Management Review 2019, Vol. 26, 1-16. Corporate Governance Issues in Philippine-Listed Companies Arthur S. Cayanan* University of the Philippines, Cesar E.A. Virata School of Business, Diliman, Quezon City 1101, Philippines This paper discusses corporate governance issues in Philippine-listed companies such as ownership structure, separation of Chairman and CEO positions, independent directors, related party transactions, among others, and how non-controlling stockholders are adversely affected by these issues. The paper also assesses the sufficiency of existing rules and regulations and the effectiveness of regulators in protecting minority interest. 1 Introduction Corporate Governance is defined as the system of stewardship and control to guide organizations in fulfilling their long-term economic, moral, legal and social obligations towards their stakeholders.1 On November 10, 2016, the Securities and Exchange Commission (SEC) approved the Code of Corporate Governance for Publicly-Listed Companies (CG Code for PLCs).2 The Code provides a list of the governance responsibilities of the board of directors (BOD), corporate disclosure policies, standards for the selection of external auditor, and duties to stockholders, among others. In this paper, emphasis will be on ownership structure, the positions of Chairman and Chief Executive Officer (CEO) being held by separate individuals, the independence of independent directors, some related party transactions, and how these issues affect the interest of non-controlling stockholders.3 2 Objectives This study has the following objectives: 1. To assess some corporate governance practices of the 30 Philippine Stock Exchange index (PSEi) PSEi-indexed stocks, e.g., ownership structure, different individuals holding the positions of the chairman of the BOD and CEO, related party transactions, and tender offers. -

2018 Annual Report

2018 ANNUAL REPORT Chairman’s Report Review of Operations Corporate Citizenship Corporate Governance Management’s Discussion and Analysis Consolidated Financial Statements Independent Auditor’s Report Consolidated Statements of Financial Position Consolidated Statements of Comprehensive Income Consolidated Statements of Changes in Equity Consolidated Statements of Cash Flow Notes to Consolidated Financial Statements Board of Directors Corporate Management Investor Relations SOLAIRE FACADE CHAIRMAN’S REPORT Ladies and gentlemen: and Sky Towers was 92.6 percent compared to 90.7 percent in the previous year. 2018 was a challenging year for the Philippine economy as it grappled with the inflation impact of the TRAIN law, higher oil prices and interest In 2018, our consolidated operating costs and expenses increased rates, and a weaker peso. However, despite all these challenges, the by only 8 percent to P27.096 billion, from P25.094 billion owing to economy showed its resilience, recording real GDP growth of 6.2 diligence in managing our expenses by rolling out cost-containment percent for the year. This marked the seventh straight year that the initiatives and programs. Philippine economy grew by at least 6 percent. Apart from consumer spending, which accounts for over 70 percent of GDP, gross fixed Bloomberry’s consolidated EBITDA increased by 21 percent to P14.895 capital formation sustained economic growth, particularly due to the billion, from P12.348 billion. Solaire’s EBITDA was P15.135 billion, government’s pursuit of its Build Build Build program. The country representing an increase of 20 percent. The Korea business reduced remained one of the fastest-growing economies in Asia, just next to its negative EBITDA to P240 million, from a negative P259 million in India, Vietnam and China, and ahead of Indonesia and Thailand. -

Megaworld Corporation 3

CR04055-2017 SECURITIES AND EXCHANGE COMMISSION SEC FORM ACGR ANNUAL CORPORATE GOVERNANCE REPORT 1. Report is Filed for the Year Dec 31, 2016 2. Exact Name of Registrant as Specified in its Charter MEGAWORLD CORPORATION 3. Address of principal office 28th Floor, The World Centre, 330 Sen. Gil Puyat Avenue, Makati City Postal Code 1227 4.SEC Identification Number 167423 5. Industry Classification Code(SEC Use Only) 6. BIR Tax Identification No. 000-477-103 7. Issuer's telephone number, including area code (632) 867-8826 to 40 8. Former name or former address, if changed from the last report N/A The Exchange does not warrant and holds no responsibility for the veracity of the facts and representations contained in all corporate disclosures, including financial reports. All data contained herein are prepared and submitted by the disclosing party to the Exchange, and are disseminated solely for purposes of information. Any questions on the data contained herein should be addressed directly to the Corporate Information Officer of the disclosing party. Megaworld Corporation MEG PSE Disclosure Form ACGR-1 - Annual Corporate Governance Report Reference: Revised Code of Corporate Governance of the Securities and Exchange Commission Description of the Disclosure In compliance with SEC Memorandum Circular No. 20 series of 2016, attached herewith is the Annual Corporate Governance Report (SEC Form-ACGR) of Megaworld Corporation for the year 2016. Filed on behalf by: Name Dohrie Edangalino Designation Head-Corporate Compliance Group MEGAWORLD CORPORATION ANNUAL CORPORATE GOVERNANCE REPORT (SEC FORM – ACGR) FOR YEAR 2016 SECURITIES AND EXCHANGE COMMISSION SEC FORM – ACGR ANNUAL CORPORATE GOVERNANCE REPORT 1. -

BDO Moneytalks

It’s a conglo, conglo world By Roxanne S.C. Olanday ‘Tis the season of domestic corporate earnings results as investors eagerly await news of the 2015 full-year performance of firms, particularly the leading and best benchmark for the different sectors of the Philippines: the conglomerates. We can define a conglomerate as a corporation that is composed of various businesses that would at first glance appear MONEY TALKS unrelated. Typically, one company (also known as the parent company) in the group owns majority interest in the other companies or businesses (also known as subsidiaries) that operate independently. Though these subsidiaries conduct their respective businesses separately, their managers report to the management of the parent company. The bigger conglomerates are involved in diverse markets in order to spread or reduce business risk, but there are still others that choose to focus on a particular industry or sector. Generally, the benefits of conglomerates having a family-holding structure (parent and subsidiaries) are diversifying earnings and risks and reducing costs as the group share common resources. For one, better performing companies and industries can offset the negative effect of poorly performing ones on the consolidated earnings of the conglomerate. By being involved in different industries, conglomerates reduce their business risk usually found in operating in just one market. For another, costs are lessened through operational synergies and economies of scale; a holding-member company also has better access to capital funds that can support expansion plans. Conglomerates however, may expand so aggressively into new markets and/or segments that efficiency is compromised. -

C O V E R S H E

C O V E R S H E E T for AUDITED FINANCIAL STATEMENTS SEC Registration Number A 1 9 9 9 0 4 8 6 4 C O M P A N Y N A M E B L O O M B E R R Y R E S O R T S C O R P O R A T I O N A N D S U B S I D I A R I E S PRINCIPAL OFFICE ( No. / Street / Barangay / City / Town / Province ) T h e E x e c u t i v e O f f i c e s , S o l a i r e R e s o r t & C a s i n o , 1 A s e a n A v e n u e , E n t e r t a i n m e n t C i t y , T a m b o , P a r a ñ a q u e C i t y Form Type Department requiring the report Secondary License Type, If Applicable 1 7 - A C R M D N A C O M P A N Y I N F O R M A T I O N Company’s Email Address Company’s Telephone Number Mobile Number [email protected] 8888-8888 - No. of Stockholders Annual Meeting (Month / Day) Fiscal Year (Month / Day) 95 Every Third Thursday of April December 31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Number/s Mobile Number Gerard Angelo Emilio J. -

02-0221 List of Securities Eligible As Collateral

CN - No. 2021-0008 INDEX REVIEW TO : INVESTING PUBLIC AND ALL TRADING PARTICIPANTS DATE : February 8, 2021 SUBJECT : RESULTS OF THE REVIEW OF PSE INDICES The Philippine Stock Exchange is announcing the results of the regular review of the PSEi and sector indices covering trading activity for the period January to December 2020. The review of the composition of the indices was based on the revisions to the policy on managing the PSE Index Series. Attached is a list of the companies that will compose the PSEi and sector indices. All changes shall be effected on February 15, 2021, Monday. The list of index members and other index-related information can be accessed on a subscription basis through the Market Data Department at [email protected]. For your information and guidance. (Original Signed) RAMON S. MONZON President and CEO PSEi Company Stock Code 1 Ayala Corporation AC 2 Aboitiz Equity Ventures, Inc. AEV 3 Alliance Global Group, Inc. AGI 4 Ayala Land, Inc. ALI 5 Aboitiz Power Corporation AP 6 BDO Unibank, Inc. BDO 7 Bloomberry Resorts Corporation BLOOM 8 Bank of the Philippine Islands BPI 9 DMCI Holdings, Inc. DMC 10 Emperador Inc. EMP 11 First Gen Corporation FGEN 12 Globe Telecom, Inc. GLO 13 GT Capital Holdings, Inc. GTCAP 14 International Container Terminal Services, Inc. ICT 15 Jollibee Foods Corporation JFC 16 JG Summit Holdings, Inc. JGS 17 LT Group, Inc. LTG 18 Metropolitan Bank & Trust Company MBT 19 Megaworld Corporation MEG 20 Manila Electric Company MER 21 Metro Pacific Investments Corporation MPI 22 Puregold Price Club, Inc. -

Certificate of Filing of Amended Articles of Incorporation

REPUBLIC OF THE PHILIPPINES SECURITIES AND EXCHANGE COMMISSION SEC Building, EDSA, Greenhills City of Mandaluyong, Metro Manila COMPANY REG. NO. 167423 : : CERTIFICATE OF FILING OF AMENDED ARTICLES OF INCORPORATION KNOW ALL PERSONS BY THESE PRESENTS: This is to certify that the amended articles of incorporation of the : MEGAWORLD CORPORATION (Amending Article III thereof.) copy annexed, adopted on April14, 2014 by majority vote of the Board of Directors and on June 20, 2014 by the vote of the stockholders owning or representing at least two thirds of the outstanding capital stock, and certified under oath by the Corporate Secretary and a majority of the Board of Directors of the corporation was approved by the Commission on this date pursuant to the provision of Section 16 of the Corporation Code of the Philippines, Batas Pambansa Big. 68, approved on May 1, 1980, and copies thereof are filed with the Commission. Unless this corporation obtains or already has obtained the appropriate Secondary License from this Commission, this Certificate does not authorize it to undertake business activities requiring a Secondary License from this Commission such as, but not limited to acting as: broker or dealer in securities, government securities eligible dealer (GSED), investment adviser of an investment company, close-end or open-end investment company, investment house, transfer agent, commodity/financial futures exchange/broker/merchant, financing company and time shares/dub shares/membership certificates issuers or selling agents thereof. Neither does this Certificate constitute as permit to undertake activities for which other government agencies require a license or permit. · IN WITNESS WHEREOF, I have set my hand and caused the seal of this Commission to befff.ixed to this Certificate at Mandaluyong City, Metro Manila, Philippines, this I ,._,day of November, Twenty Fourteen. -

In the Philippines, We Have Several Blue Chip Companies That Are Being Traded in the Philippine Stock Market

In the Philippines, we have several blue chip companies that are being traded in the Philippine Stock Market. These blue chip companies were chosen based on GEMSS Growth Profitability Earnings Visibility Management Credibility Superior Products/Services Strong Balance Sheet Thirty blue-chip stocks listed on the Philippine Stock Exchange are included in the 210 most exciting stocks in the Asean Exchange, the newly launched common website of seven bourses in Southeast Asia. These 30 Philippine stocks mostly firms engaged in banking, real estate and utilities are part of the so-called Asean Stars, a selection of the largest and most dynamic Southeast Asian firms that are in the league of world leaders in their respective sectors. Blue Chips Class A Stocks All Stocks Preferred / By Sector Current Price Previous 52-Week High 52-Week Symbol Name PE (%) Close (%) Low AC Ayala Corporation 635 (-0.78%) 640 660 (3.94%) 485 35.568 Aboitiz Equity Ventures, AEV 54.8 (-0.27%) 54.95 61.6 (12.41%) 40 12.656 Inc. AGI Alliance Global Group, Inc. 28.45 (0.00%) 28.45 31.85 (11.95%) 20.25 21.014 ALI Ayala Land, Inc. 30.3 (-3.19%) 31.3 33.3 (9.90%) 23 46.119 AP Aboitiz Power Corporation 36 (-1.10%) 36.4 42.6 (18.33%) 30 10.843 BDO BDO Unibank, Inc. 88.9 (-2.52%) 91.2 93.5 (5.17%) 66.2 22.281 Bloomberry Resorts BLOOM 10.68 (0.00%) 10.68 12.52 (17.23%) 8.28 152.571 Corporation Bank of the Philippine 103.22 BPI 88.25 (-0.40%) 88.6 80.95 19.255 Islands (16.96%) DMC DMCI Holdings, Inc. -

Our Growing WORLD

Our Growing WORLD Megaworld Corporation Annual Report 2011 1 Financial Highlights 2007 2008 2009 2010 2011 Table of Contents Consolidated Revenues 14.64 17.30 17.76 20.54 28.63 02 • Financial Highlights Real Estate Revenues 11.46 13.80 14.57 15.40 19.08 04 • Chairman’s Message EBITDA 4.39 5.75 6.43 7.65 11.62 06 • Our Growing World 20 • Projects Launched Net Income 3.03 3.79 4.07 5.09 8.16 28 • Results of Operations 30 • Financial Condition 32 • Corporate Governance 34 • Corporate Social Responsibility 36 • Board of Directors 39 • Key Officers 40 • Financial Statements 2 Our Growing World Megaworld Corporation Megaworld Corporation Megaworld 07 14.64 (in CONSOLIDATED Billion 08 17.30 Pesos) 09 17.76 REVENUES 10 20.54 11 28.63 07 11.46 (in EBITDA Billion 08 13.80 Pesos) 09 14.57 10 15.40 11 19.08 (in REAL 07 4.39 Billion ESTATE 08 5.75 Pesos) 09 6.43 REVENUES 10 7.65 11 11.62 (in NET 07 3.03 Billion INCOME 08 3.79 Pesos) Annual Report 2011 Annual Report 09 4.07 10 5.09 11 8.16 3 Chairman’s Message The year 2011 saw a modest expansion in the local economy as the country’s gross domestic product grew by 3.7%, compared to 7.6% growth in the previous year. The economy’s rather lethargic movement in 2011 was attributed to a relatively weak export sector as well as cautious government spending. Despite the country’s sluggishness in 2011, however, the resulting growth rate still fell within the government’s official projection of around 3.6% to 4% for the year. -

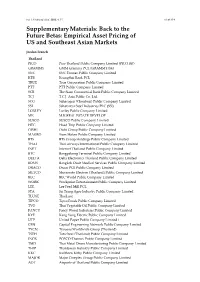

Empirical Asset Pricing of US and Southeast Asian Markets

Int. J. Financial Stud. 2016, 4, 15 S1 of S14 Supplementary Materials: Back to the Future Betas: Empirical Asset Pricing of US and Southeast Asian Markets Jordan French Thailand PICO Pico Thailand Public Company Limited (PICO.BK) GRAMMY GMM Grammy PCL (GRAMMY.BK) SNC SNC Former Public Company Limited KTB Krungthai Bank PCL TRUE True Corporation Public Company Limited PTT PTT Public Company Limited SCB The Siam Commercial Bank Public Company Limited TCJ T.C.J. Asia Public Co. Ltd. SCG Sahacogen (Chonburi) Public Company Limited SSI Sahaviriya Steel Industries PLC (SSI) LOXLEY Loxley Public Company Limited MK M.K.REAL ESTATE DEVELOP SUSCO SUSCO Public Company Limited HTC Haad Thip Public Company Limited OISHI Oishi Group Public Company Limited MAKRO Siam Makro Public Company Limited BTS BTS Group Holdings Public Company Limited THAI Thai Airways International Public Company Limited INET Internet Thailand Public Company Limited BTC Bangpakong Terminal Public Company Limited DELTA Delta Electronics Thailand Public Company Limited BDMS Bangkok Dusit Medical Services Public Company Limited DRACO Draco PCB Public Company Limited METCO Muramoto Electron (Thailand) Public Company Limited BEC BEC World Public Company Limited WORK Workpoint Entertainment Public Company Limited LEE Lee Feed Mill PCL STA Sri Trang Agro Industry Public Company Limited TLUXE ThaiLuxe TIPCO Tipco Foods Public Company Limited TVO Thai Vegetable Oil Public Company Limited FANCY Fancy Wood Industries Public Company Limited KYE Kang Yong Electric Public Company Limited UTP United Paper Public Company Limited i CEN Capital Engineering Network Public Company Limited TYCN Tycoons Worldwide Group (Thailand) TSTH Tata Steel (Thailand) Public Company Limited INOX POSCO-Thainox Public Company Limited TMD Thai Metal Drum Manufacturing Public Company Limited THIP Thantawan Industry Public Company Limited KKC Kulthorn Kirby Public Company Limited MAJOR Major Cineplex Group Public Company Limited AOT Airports of Thailand Public Company Limited Int.