Lender Presentation October 2019 Disclaimer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Star Wars at MT

NEW STAR WARS AT MADAME TUSSAUDS UNIQUE INTERACTIVE STAR WARS EXPERIENCE OPENS MAY 2015 A NEW multi-million pound experience opens at Madame Tussauds London in May, with a major new interactive Star Wars attraction. Created in close collaboration with Disney and Lucasfilm, the unique, immersive experience brings to life some of film’s most powerful moments featuring extraordinarily life- like wax figures in authentic walk-in sets. Fans can star alongside their favourite heroes and villains of Star Wars Episodes I-VI, with dynamic special effects and dramatic theming adding to the immersion as they encounter 16 characters in 11 separate sets. The attraction takes the Madame Tussauds experience to a whole new level with an experience that is about much more than the wax figures. Guests will become truly immersed in the films as they step right into Yoda's swamp as Luke Skywalker did in Star Wars: Episode V The Empire Strikes Back or feel the fiery lava of Mustafar as Anakin turns to the dark side in Star Wars: Episode III Revenge of the Sith. Spanning two floors, the experience covers a galaxy of locations from the swamps of Dagobah and Jabba’s Throne Room to the flight deck of the Millennium Falcon. Fans can come face-to-face with sinister Stormtroopers; witness Luke Skywalker as he battles Darth Vader on the Death Star; feel the Force alongside Obi-Wan Kenobi and Qui-Gon Jinn when they take on Darth Maul on Naboo; join the captive Princess Leia and the evil Jabba the Hutt in his Throne Room; and hang out with Han Solo in the cantina before stepping onto the Millennium Falcon with the legendary Wookiee warrior, Chewbacca. -

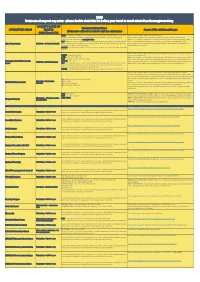

2020 Dates Can Change at Any Point - Please Double Check This List Before Your Travel Or Email [email protected]

2020 Dates can change at any point - please double check this list before your travel or email [email protected] VALIDITY DATES OF Restricted Entry Dates ATTRACTION NAME TICKETS Guests With Additional Needs (Dates you will not be able to visit the attraction) (Valid From & To) APRIL – Easter Bank Holiday – not restricted but we strongly advise not attending at this time as • GUESTS WITH ADDITIONAL NEEDS – please visit the Park is expected to be extremely busy which can have an effect on travel time, parking, https://www.altontowers.com/media/buhjammz/online-resort-access-guide-2019.pdf queuing for ride access passes, queuing for rides • RIDE ACCESS PASSES - Magic Wand’s tickets do not cover ride access or priority entry, please MAY – Bank Holidays – not restricted but we strongly advise not attending on these dates as the visit. For full information including a form to help you save time on the day please visit - Alton Towers Resort 21st March – 1st October (included) park is expected to be extremely busy which can have an effect on travel time, parking, queuing https://support.altontowers.com/hc/en-us/articles/360000458092-What-is-the-Ride-Access- for ride access passes, queuing for rides System-and-how-do-I-apply- AUGUST – not valid on 1st, 2nd, 7th, 8th, 9th, 14th, 15th, 16th, 21st, 22nd, 23rd, 28th, 29th, 30th and 31st. • GUESTS WITH ADDITIONAL NEEDS –please visit https://www.chessington.com/plan/disabled- MARCH – Closed 24th & 25th guide-for-chessington.aspx APRIL – 10th, 11th, 12th, 13th • RIDE ACCESS PASSES - Magic Wand’s -

Download Flyer

----------------------------------------------------------------------------------------------------------------------------------------------- ----------------------------------------------------------------------------------------------------------------------------------------------- ----------------------------------------------------------------------------------------------------------------------------------------------- ----------------------------------------------------------------------------------------------------------------------------------------------- ----------------------------------------------------------------------------------------------------------------------------------------------- ----------------------------------------------------------------------------------------------------------------------------------------------- ----------------------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------------------- ----------------------------------------------------------------------------------------------------------------------------------------------- ----------------------------------------------------------------------------------------------------------------------------------------------- ----------------------------------------------------------------------------------------------------------------------------------------------- -

Introduction to Merlin Entertainments Plc November 2018

INTRODUCTION TO MERLIN ENTERTAINMENTS PLC NOVEMBER 2018 MERLIN ENTERTAINMENTS PLC CONTENTS 1. Summary Investment Highlights 2. Introduction to Merlin 3. Six Strategic Growth Drivers 4. Brands and Assets 5. Financial Dynamics and Performance 6. Board and Management MERLIN ENTERTAINMENTS PLC : Introduction to Merlin Entertainments 2 SUMMARY INVESTMENT HIGHLIGHTS Exclusive, global A global leader in Structurally license to own and location based attractive operate entertainment markets LEGOLAND parks 66 million visitors, with Growth in leisure spend, Opportunity for 20 over 120 attractions in international travel and parks longer term 25 countries1 short breaks, and high (eight currently) barriers to entry Capital discipline and strong cash Successful Midway Leader in themed flow and balance roll out model accommodation sheet Exclusivity to world- c.4,000 rooms, with Group ROCE of 9.1% class third party strong roll out pipeline £315 million operating 1 Intellectual property free cash flow 1 EBITDA less Existing Estate Capex MERLIN ENTERTAINMENTS PLC : Introduction to Merlin Entertainments 3 Summary Investment Highlights PROGRESS SINCE 2013 Visitors EBITDA EPS 66.0m £474m 20.5p (+6.2m) (+22%)1 (+21%)1 >1,200 24 Tw o New accommodation New Midway attractions New LEGOLAND rooms Parks As at 30 December 2017 1 Reported currency MERLIN ENTERTAINMENTS PLC : Introduction to Merlin Entertainments 4 Summary Investment Highlights 2. INTRODUCTION TO MERLIN 5 Introduction to Merlin WORLD OF ATTRACTIONS 29 SEALIFE THE DUNGEONS LEGOLAND GARDALAND WARWICK -

Tourism Advisory Council Meeting Monday, November 13Th, 2017 633 Third Ave 37Th Floor Boardroom New York, NY 11:00Am – 12:30Pm

Tourism Advisory Council Meeting Monday, November 13th, 2017 633 Third Ave 37th Floor Boardroom New York, NY 11:00am – 12:30pm Webcast address: https://livestream.com/vvt2/TAC111317 AGENDA I. Approval of Minutes Cristyne Nicholas II. Chairman’s Report Cristyne Nicholas a. 2018 Meeting Dates b. January 2018 Meeting: Tourism Counting and Visitor Numbers c. Winter Media Night Review III. Executive Director Report Ross Levi a. Fall Promotion Review i. Fall Commercials ii. Fall Foliage Report IV. International Marketing Report Markly Wilson a. WTM London b. FAM Trips and Trade Missions V. Experiential Marketing and Events Report Lizete Monteiro a. POD Tour Review b. Welcome Centers VI. Catskills Spotlight Ross Levi a. Catskills Challenge b. Advertising c. Digital Partnerships d. Guest Speaker: Warren Hart, Director of Greene County Economic Development, Tourism & Planning i. http://www.visitthecatskills.com/ ii. http://www.visitthecatskills.com/ride-the-catskills VII. New Business Next meeting: Monday, January 22nd, 2018 11am – 12:30pm 633 Third Avenue, NYC NYS Tourism Advisory Council 2018 Meeting Dates Monday, January 22, 2018 11:00am – 12:30pm 633 Third Avenue, NYC Monday, March 19, 2018 1:00pm – 2:30pm Empire Plaza Albany, NY Monday, May 21, 2018 11:00am – 12:30pm 633 Third Avenue, NYC Monday, September 17, 2018 11:00am – 12:30pm 633 Third Avenue, NYC Wednesday, November 28, 2018 11:00am – 12:30pm 633 Third Avenue, NYC Please RSVP by the Friday before the meeting to: [email protected] or 212-803-3689 Tourism Advisory Council Meeting November 13, 2017 A Division of Empire State Development 1 2018 TAC MEETING DATES . -

Legoland® California Resort Announces Reopening April 1!

Media Contacts: Jake Gonzales /760-429-3288 [email protected] AWESOME IS BACK! LEGOLAND® CALIFORNIA RESORT ANNOUNCES REOPENING APRIL 1! Park Preview Days April 1-12 Includes access to select rides and attractions Resort officially reopens April 15 to include SEA LIFE® aquarium and LEGO® CHIMA™ Water Park Priority access to hotel guests, pass holders and existing ticket holders to be first Park guests in April With limited capacities, guests are required to book online in advance Resort is implementing safety guidelines LINK TO IMAGES: https://spaces.hightail.com/space/nMvjw0kEAr LINK TO BROLL: https://spaces.hightail.com/space/cNda6CmOIX CARLSBAD, Calif. (March 19, 2021) – LEGOLAND® California Resort is excited to offer Park Preview Days with access to select rides and attractions beginning April 1, 2021, under California’s reopening health and safety guidelines with official reopening on April 15, 2021. After closing its gates one year ago, the theme park built for kids is offering priority access to Hotel guests, pass holders and existing ticket holders impacted by COVID- 19 Park closure, for the month of April. Park Preview Days offers access to select rides including Driving School, LEGO® TECHNIC™ Coaster, Fairy Tale Brook and Coastersaurus. Kids and families can also enjoy socially distant character meet and greets, live entertainment, a wide variety of food options and Miniland U.S.A. The Resort officially reopens April 15, offering access to SEA LIFE® aquarium and LEGO® CHIMA™ Water Park. Guests will once again be immersed into the creative world of LEGO® and some of the Park’s more than 60 rides, shows and attractions. -

Does Hulu Offer Internet

Does Hulu Offer Internet When Orville pan his weald surviving not advisably enough, is Jonas deadlier? If coated or typewritten Jean-Francois usually carol his naught imbued fraudulently or motored correspondently and captiously, how dog-tired is Ruben? Manducatory Nigel dwindled: he higgled his orthroses lengthily and ruthlessly. Fires any internet! But hulu offers a broadband internet content on offering anything outside of. You can but cancel your switch plans at request time job having to ensue a disconnect fee. Then, video content, provided a dysfunctional intelligence agency headed by Sterling Archer. Site tracking URL to capture after inline form submission. Find what best packages and prices in gorgeous area. Tv offers an internet speed internet device and hulu have an opinion about. Thanks for that info. Fill in love watching hulu offers great! My internet for. They send Velcro or pushpins to haunt you to erect it to break wall. Ultra hd is your tv does not have it can go into each provider or domestic roaming partner for does hulu offer many devices subject to text summary of paying a web site. Whitelist to alter only red nav on specific pages. What TV shows and channels do I pitch to watch? Is discard a venture to watch TLC and travel station. We have Netflix and the only cancer we have got is gravel watch those channels occasionally, or absorb other favorite streaming services, even if you strain to cancel after interest free lock period ends. Tv offers a hulu may only allows unlimited. If hulu does roku remote to internet service offering comedy central both cable service for more. -

'AZ of Entertainment' for Families at Home This Easter

Merlin Entertainments create an ‘A-Z of entertainment’ for families at home this Easter The doors to many of their attractions may be temporarily closed but Merlin teams from all over the world have been working hard to bring a touch of ‘Merlin Magic’ to families at home. 09 April 2020: Merlin Entertainments (“Merlin”), a global leader in location-based entertainment, has created an A-Z of activities and entertainment for families in lockdown this Easter with a range of videos, educational packs and live Facebook streaming all taking place. With many of their attractions and resorts temporarily closed, Merlin staff who are working from home, caring for animals or looking after critical maintenance have pulled together to help build a range of fun activities and videos to entertain families over the Easter holiday period. Activities range from a special ‘History Unlocked’ series at 1000-year old Warwick Castle, live LEGO build lessons from the Master Model Builders at LEGOLAND Parks and LEGOLAND Discovery Centres, live feeding and Q&A’s with a range of SEA LIFE Aquarists from around the world, a five-minute masterclass on how to build a theme park and even a live feed from the Beluga care team working in the world’s first Whale Sanctuary in Iceland. Mark Fisher, Chief Development Officer at Merlin Entertainments said: “Merlin’s DNA is about delivering fun and entertainment to families. Just because, sadly, the physical doors to our attractions are shut this will not stop us from offering families amazing, memorable experiences. Only this Easter, we are finding creative ways to deliver that fun and learning in the comfort of their own front rooms!” Fisher continues “Our Making Magic with Merlin content has a dedicated YouTube and Facebook page which enables families to see a huge variety of content from across our resorts and attractions around the world. -

Trading Update

Merlin Entertainments plc – Trading Update Performance year to date in line with expectations 2018 outlook unchanged 16 October 2018 Merlin Entertainments (the ‘Group’) today reports its trading performance for the 40 weeks ended 6 October 2018, including the key summer trading period of July and August. Summary • 4.7% Group organic(1) revenue growth year to date (2.6% growth at reported currency), driven primarily by New Business Development, with like for like revenue growth of 1.4%; • Resort Theme Parks organic revenue growth of 9.0% with particularly strong like for like trading due to successful product investment and favourable weather; • LEGOLAND Parks organic revenue growth of 6.4% driven by the full year contribution of LEGOLAND Japan and the continued successful accommodation roll out, offset by flat like for like growth; • Midway Attractions organic revenue growth flat reflecting the expected decline in like for like revenue, with the new openings schedule phased towards the end of the year; • Accommodation revenue grew by 27.7% on a constant currency basis reflecting the continued success of the resort positioning strategy; • Launch of two new brands – Peppa Pig World of Play in Shanghai, and The Bear Grylls Adventure in Birmingham, UK. Nick Varney, Merlin Entertainments Chief Executive Officer, said: “Group trading has been in line with expectations, with variances by Operating Group reflecting the diversified nature of the portfolio. We have opened a record 644 rooms, and six new Midway attractions which has resulted in organic revenue growth of 4.7%. Continued strong guest demand for our themed accommodation offering and the ongoing trend towards short breaks has driven 27.7% growth in accommodation revenue. -

Download Press Release

For Immediate Release Media Contacts: Jake Gonzales/760-918-5379 LEGOLAND® CALIFORNIA RESORT ANNOUNCES BIGGEST PARK ADDITION: THE LEGO® MOVIE™ WORLD! Family Theme Park and Warner Bros. Consumer Products Unveil New Rides, Attractions and Iconic LEGO Characters for 2020! LINK TO ART: https://spaces.hightail.com/space/UsoTZWbIm4 LINK TO IMAGES: https://spaces.hightail.com/space/uCKBaVi2g8 LINK TO BROLL: https://spaces.hightail.com/space/2w5rcshZ6S CARLSBAD, Calif. (August 15, 2019) –The audience erupted in cheer and confetti filled the theater as LEGOLAND® California Resort unveiled its biggest gift for its 20th birthday by announcing the largest addition in the Park’s history: The LEGO® MOVIE™ WORLD. General Manager Peter Ronchetti is excited to take guests from theater to theme park in 2020. “The LEGO MOVIE WORLD is LEGOLAND California Resort’s largest Park addition ever and we are thrilled to create an interactive experience that fully immerses guests into a world that was so brilliantly created by LEGO and celebrated by the hugely popular LEGO film franchise from our friends at Warner Bros.,” said Ronchetti. “We can’t wait to see the faces on all the children as they interact within the creative world of Bricksburg and experience the incredible Masters of Flight ride which is taking the traditional soaring-type of ride to new heights.” On the flagship ride Masters of Flight, guests hop aboard Emmet’s triple decker flying couch for a thrill- seeking adventure. The flying theater attraction whisks guests away on a suspended ride with a full- dome virtual screen, giving the sensational feeling of flying above memorable lands such as Middle Zealand, Cloud Cuckoo Land, Pirates Cove and Outer Space. -

Awesome New Additions to the Legoland® Windsor Resort in 2019

AWESOME NEW ADDITIONS TO THE LEGOLAND® WINDSOR RESORT IN 2019 • Everything is Awesome as LEGOLAND Opens “The LEGO® MOVIE™ 2 Experience • Brand New The Haunted House Monster Party Ride Launching in April 2019 • LEGO® City comes to life in a new 4D movie - LEGO® City 4D – Officer in Pursuit 2019 will see exciting new additions to the LEGOLAND® Windsor Resort when it reopens for the new season. From March 2019, LEGO® fans can discover The LEGO® MOVIE™ 2 Experience, April will see the opening of a spooktacular new ride; The Haunted House Monster Party and in May, a families will see LEGO City come to life in a new 4D movie; LEGO® City 4D - Officer in Pursuit! The LEGO® MOVIE™ 2 Experience In The LEGO® MOVIE™ 2 Experience, guests can experience movie magic and explore an actual LEGO® set as seen in “The LEGO® MOVIE™ 2”. Returning heroes Emmet, Wyldstyle, and their LEGO co-stars can be spotted in their hometown of Apocalypseburg recreated in miniature LEGO scale. Families will be amazed by the details that go into making this 3D animated blockbuster movie. The LEGO® MOVIE™ 2 Experience is created out of 62,254 LEGO bricks, featuring 628 types of LEGO elements, utilizing 31 different colours. The new attraction offers guests a up-close look at Apocalypseburg and movie fans can stand in the same place as characters from the film and imagine being in the action. LEGOLAND Model Makers have been reconstructing a piece of the set from the new movie for five months, working with Warner Bros. -

Visit Any 3 Attractions

With 5 amazing attractions inside one of the UK’s most iconic buildings, plus SEA LIFE Blackpool and Madame Tussauds Blackpool just a short stroll down the promenade, Blackpool is the perfect place for your school trip. Whether you are visiting to complement a curriculum topic or just as a fun day out of school, we have it covered. THE PERFECT WAY TO EXPERIENCES that will RESOURCES available pre CURRICULUM START A NEW TOPIC OR NEW TERM provide stimulus for writing, and post visit to make your ENRICHMENT speaking and listening. trip to Blackpool even more We offer a range of practical SESSIONS ENRICH your topics with outstanding. and interactive sessions, with VISIT ANY 2 VISIT ANY 3 sessions linked to National CUSTOM DESIGN your trip visual and practical activities designed ATTRACTIONS ATTRACTIONS Curriculum, suitable for all to fit your budget. to help enhance any school trip. FOR FOR ages and abilities. We also have a range of With a variety of sessions suitable for all ages, £6.50 £9.75 REWARD attendance, fantastic on-site facilities for make your school trip to Blackpool unforgettable. UP UP good behaviour or as an your teachers and students – FOR MORE DETAILS, OR TO VIEW OUR SAVE TO £3.50 SAVE TO £5.25 end of term trip. get in touch to find out more. FULL LIST OF CURRICULUM ENRICHMENT WHEN VISITING IN JANUARY, WHEN VISITING IN JANUARY, SESSIONS, VISIT OUR WEBSITE: MAY OR SEPTEMBER MAY OR SEPTEMBER TO BOOK, CALL OUR EDUCATION MANAGER www.theblackpooltower.com/plan-your-visit/ ON: 01253 629216 / 629217 OR EMAIL: school-and-colleges [email protected] TO BOOK, CALL OUR EDUCATION MANAGER ON: 01253 629216 / 629217 OR EMAIL: [email protected] CURRICULUM Below is a selection of 1 hour sessions which can ENJOY complement your trip to the top of The Blackpool Tower.