Retail Leasing Savills Research

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pn1701 2013 年第 28 期憲報第 6 號副刊 S. No. 6 to Gazette No. 28

2013 年第 28 期憲報第 6 號副刊 S. NO. 6 TO GAZETTE NO. 28/2013 PN1701 THE COMPANIES ORDINANCE THE COMPANIES ORDINANCE (CHAPTER 32) (CHAPTER 32) ——— ——— WAY BRIGHT INVESTMENT LIMITED SPECIAL AND ORDINARY 匯亮投資有限公司 RESOLUTIONS ——— OF SPECIAL RESOLUTION 巴富帆亭顧問有限公司 AND PATH FINDING CONSULTANT ORDINARY RESOLUTION COMPANY LIMITED ——— ——— Passed on the 8th day of July 2013 Passed on 3rd July, 2013 ——— ——— At an Extraordinary General Meeting of the By written resolutions signed by all the above-named company, duly convened and held shareholders of the Company on 3rd July, 2013, at 28/F., LHT Tower, 31 Queen’s Road Central, the following resolutions were duly passed as Hong Kong on the 8th day of July, 2013 the Special and Ordinary Resolutions:— following Resolutions were passed:— Special Resolution Special Resolution That the Company be wound up voluntarily and “That the Company be wound up voluntarily that Mr. Lau Chi Wai of 9th Floor, 10 Jubilee and that Messrs. CHI Chi Hung Kenneth and Street, Hong Kong be and is hereby appointed YEUNG Kwok Leung both of 28/F., LHT Liquidator of the Company for the purpose of Tower, 31 Queen’s Road Central, Hong Kong, such winding up and that he is hereby be and are appointed joint and several authorized to divide any part of the assets of liquidators for the purpose of such winding-up the Company as he shall think fit among the and that they be hereby authorised to divide any members of the Company in specie or in kind. part of the assets of the Company as they shall think fit among the members of the Company Ordinary Resolution in specie or in kind pursuant to the Articles of That pursuant to Section 255A(2) of the Association of the Company.” Companies Ordinance, audit of the Liquidator’s Statement of Accounts be not required. -

E WHARF (HOLDINGS) LIMITED ANNUAL REPORT 2014 in Building for Tomorrow, Wharf Has Achieved a Few “Firsts” in the Past Decades

Stock Code: 4 ANNUAL REPORT 2014 e Wharfe Limited (Holdings) THE WHARF (HOLDINGS) LIMITED ANNUAL REPORT 2014 www.wharfholdings.com In Building for Tomorrow, Wharf has achieved a few “firsts” in the past decades. That include the first all-weather mall in Hong Kong (Ocean Terminal), the first and only mall with retail sales exceeding 7% of Hong Kong retail sales (Harbour City), the first 17-storey vertical mall in Hong Kong (Times Square) and the first 40-storey industrial building in Hong Kong (CABLE TV Tower). Wharf has also been Building for Tomorrow in other sectors. That includes building and operating of the first cruise terminal in Hong Kong (Ocean Terminal), the first container terminal in Hong Kong (Modern Terminals), the first cross-harbour tunnel in Hong Kong (Hunghom Tunnel), the first electronic toll collection system in Hong Kong (Autopass), the first multi-channel Pay TV service in Hong Kong (CABLE TV), the first 24-hour news channel in Cantonese and the first 24-hour entertainment news channel in Cantonese in the world (i-CABLE News and i-CABLE Entertainment). Corporate Profile Backed by a long standing mission of “Building for Tomorrow” and a distinguished track record, the Group has produced consistent and quality growth over the years. Wharf is among the top local blue chip stocks that are most actively traded and widely held. Through years of value creation and new investment, the Group’s investment properties (“IP”) portfolio has grown to a book value of HK$302 billion as at the end of 2014. It represented 73% of the Group’s underlying core profit. -

Hong Kong Island Asking Rates / Oct 2017

Hong Kong Island LKF 29 (Onfem Tower) $46 Sunlight Tower $38 - $43 Lucky Building $34 - $38 Sunshine Plaza Full Lyndhurst Tower $45 Tai Tung Building $45 Asking Rates / Oct 2017 Man Yee Building $83 - $88 Tai Yau Building $40 - $45 New Henry House Full Tai Yip Building $32 - $34 New World Tower 1 & 2 $75 - $78 Tesbury Centre Full Nexxus Building $78 The Hennessy $33 Sheung Wan / Central West One / Two Exchange Square $165 The Phoenix $38 Three Exchange Square Full The Sun’s Group Centre $38 - $40 69 Jervois Street $30 - $32 One / Two IFC $170+ Times Media Centre $33 135 Bonham Strand Trade Centre $27 - $29 On Hing Building Full Trust Tower $26 - $28 181 Queens Road Central $50 - $55 Pacific House Full Tung Wai Commercial Building $30 235 Wing Lok Street Trade Centre Full Pacific Place One & Two $145 W Square $38 238 Des Voeux Road Central Full Parker House Full Wu Chung House Full 299 Queen’s Road Central $28.60 Prince’s Building $135 Yam Tze Commercial Building $25 - $28 Bangkok Bank Building $28 Printing House $70 - $73 Beautiful Group Tower $56 Prosperity Tower Full Causeway Bay BOC Group Life Assurance Building $40 Prosperous Building $40 - $46 Bonham Circus $45 - $55 Regent Centre Full 68 Yee Wo Street $45 Bonham Trade Centre $29 - $34 Ruttonjee Centre / Dina House $50 - $83 Bartlock Centre Full Central 88 $57 Shanghai Commercial Bank Tower Full Causeway Bay Plaza 1 & 2 $41 - $44 Centre Mark II $32 Silver Fortune Plaza Full China Taiping Tower 1 & 2 Full Chao’s Building $28 Somptueux Central $48 Chinachem Leighton Plaza Full China -

Hong Kong Guide Hong Kong Guide Hong Kong Guide

HONG KONG GUIDE HONG KONG GUIDE HONG KONG GUIDE Hong Kong is one of the most important finan- Essential Information Money 4 cial and business centers in the world. At the same time, administratively it belongs to the Communication 5 People's Republic of China. It is a busy me- tropolis, a maze of skyscrapers, narrow streets, Holidays 6 department stores and neon signs and a pop- ulation of more than 7 million, making it one Transportation 7 of the most densely populated areas in the world. On the other hand, more than 40% of Food 11 its area is protected as country parks and na- ture reserves where rough coasts, untouched Events During The Year 12 beaches and deep woods still exist. Things to do 13 Hong Kong is a bridge between east and west – it’s a city where cars drive on the left, where DOs and DO NOTs 14 British colonial cuisine is embedded in the very fabric of the city, and every sign is in English, Activities 19 too. But at the same time, the street life is distinctively Chinese, with its herbal tea shops, . snake soup restaurants, and stalls with dried Chinese medicines. You will encounter rem- nants of the “old Hong Kong” with its shabby Emergency Contacts diners and run-down residential districts situ- ated right next to glitzy clubs and huge depart- General emergency number: 999 ment stores. Police hotline: +852 2527 7177 Hong Kong is a fascinating place that will take Weather hotline (Hong Kong Observatory): hold of your heart at your first visit. -

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Islands Hong Kong Skycity Marriott Hotel 5482 Islands Hong Kong Skycity Marriott Hotel 5483 Yau Tsim Mong Block 2, The Long Beach 5484 Kwun Tong Dorsett Kwun Tong, Hong Kong 5486 Wan Chai Victoria Heights, 43A Stubbs Road 5487 Islands Tower 3, The Visionary 5488 Sha Tin Yue Chak House, Yue Tin Court 5492 Islands Hong Kong Skycity Marriott Hotel 5496 Tuen Mun King On House, Shan King Estate 5497 Tuen Mun King On House, Shan King Estate 5498 Kowloon City Sik Man House, Ho Man Tin Estate 5499 Wan Chai 168 Tung Lo Wan Road 5500 Sha Tin Block F, Garden Rivera 5501 Sai Kung Clear Water Bay Apartments 5502 Southern Red Hill Park 5503 Sai Kung Po Lam Estate, Po Tai House 5504 Sha Tin Block F, Garden Rivera 5505 Islands Ying Yat House, Yat Tung Estate 5506 Kwun Tong Block 17, Laguna City 5507 Crowne Plaza Hong Kong Kowloon East Sai Kung 5509 Hotel Eastern Tower 2, Pacific Palisades 5510 Kowloon City Billion Court 5511 Yau Tsim Mong Lee Man Building 5512 Central & Western Tai Fat Building 5513 Wan Chai Malibu Garden 5514 Sai Kung Alto Residences 5515 Wan Chai Chee On Building 5516 Sai Kung Block 2, Hillview Court 5517 Tsuen Wan Hoi Pa San Tsuen 5518 Central & Western Flourish Court 5520 1 Related Confirmed / District Building Name Probable Case(s) Wong Tai Sin Fu Tung House, Tung Tau Estate 5521 Yau Tsim Mong Tai Chuen Building, Cosmopolitan Estates 5523 Yau Tsim Mong Yan Hong Building 5524 Sha Tin Block 5, Royal Ascot 5525 Sha Tin Yiu Ping House, Yiu On Estate 5526 Sha Tin Block 5, Royal Ascot 5529 Wan Chai Block E, Beverly Hill 5530 Yau Tsim Mong Tower 1, The Harbourside 5531 Yuen Long Wah Choi House, Tin Wah Estate 5532 Yau Tsim Mong Lee Man Building 5533 Yau Tsim Mong Paradise Square 5534 Kowloon City Tower 3, K. -

Retail Leasing Savills Research

Hong Kong – April 2019 MARKET IN MINUTES Retail Leasing Savills Research Savills team Please contact us for further information RETAIL Nick Bradstreet Managing Director Head of Leasing +852 2842 4255 [email protected] Barrie Chan Deputy Senior Director +852 2842 4527 Retail market limps into 2019 [email protected] Despite a less than impressive January and February, some sectors continue to RESEARCH do well including cosmetics and pharmaceuticals. Simon Smith Senior Director • Retail sales over January and February recorded their fi rst • Experiential retail is catching on fast as the most Asia Pacifi c decline since February 2017, falling by 1.6%. creative brands off er customers a more rounded in-store +852 2842 4573 environment. [email protected] • The retail leasing market itself posted a subdued Kathy Lee performance and shopping mall rents rose modestly driven • Some retailers are beginning to understand the aging Director mostly by Harbour City, while street shop rents fl atlined. demographic better which is more segmented than Retail Consultancy previously as the “soon-to-be-old” (55-64 yrs) can be +852 2842 4591 • We expect 2019 to see stable rents in the absence of any distinguished from the “elderly” (65-79 yrs) by their [email protected] major stimulus which would be necessary for robust growth. interests, incomes and activity levels. Savills plc Savills is a leading global real estate service provider listed on • New road and rail infrastructure linking Hong Kong more the London Stock Exchange. The closely with the mainland has resulted in more visitors, company established in 1855, has “ Causes of disruption in the a rich heritage with unrivalled but both have so far underperformed passenger volume growth. -

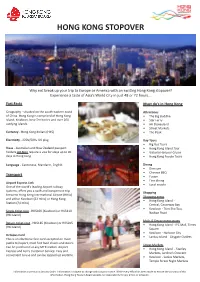

Hong Kong Stopover

HONG KONG STOPOVER Why not break up your trip to Europe or America with an exciting Hong Kong stopover? Experience a taste of Asia’s World City in just 48 or 72 hours... Fast Facts Must do’s in Hong Kong Geography - situated on the south-eastern coast Attractions of China. Hong Kong is comprised of Hong Kong • The Big Buddha Island, Kowloon, New Territories and over 260 • Star Ferry outlying islands. • HK Disneyland • Street Markets Currency - Hong Kong dollars (HK$) • The Peak Electricity - 220V/50Hz UK plug Day Tours • Big Bus Tours Visas - Australian and New Zealand passport • Hong Kong Island Tour holders DO NOT require a visa for stays up to 90 • Victoria Harbour Cruise days in Hong Kong • Hong Kong Foodie Tours Language - Cantonese, Mandarin, English Dining • Dim sum • Chinese BBQ Transport • Fusion • Fine dining Airport Express Link • Local snacks One of the world’s leading Airport railway systems, offers you a swift and inexpensive trip Shopping between Hong Kong International Airport (HKIA) Shopping areas and either Kowloon (22 mins) or Hong Kong • Hong Kong Island - Station (24 mins) Central, Causeway Bay • Kowloon - Tsim Sha Tsui, Single ticket cost - HK$100 (Kowloon) or HK$110 Nathan Road (HK Island) Malls & Department stores Return ticket cost - HK$185 (Kowloon) or HK$205 • Hong Kong Island - IFC Mall, Times (HK Island) Square • Kowloon - Harbour City Octopus Card • Lantau Island - Citygate Outlets This is an electronic fare card accepted on most public transport, most fast food chains and stores. Street Markets Can be purchased at any MTR station, Airport • Hong Kong Island - Stanley Express and Ferry Customer Service. -

Directors and Parties Involved in the Placing

DIRECTORS AND PARTIES INVOLVED IN THE PLACING DIRECTORS Name Residential address Nationality Executive Directors Mr. Tam Wing Ki (談永基) G/F, 99 Fourth Street Chinese (Chairman and chief executive Section L officer) Fairview Park New Territories Hong Kong Mr. Hsu Wing Sang (許永生) Flat 1218, 12/F, Shing Ka House Chinese Kwai Shing East Estate Kwai Chung New Territories Hong Kong Mr. Tao Hong Ming (陶康明) Flat A, 31/F, Block 12 Chinese Discovery Park Tsuen Wan New Territories Hong Kong Non-executive Director Mr. Chau Wai Hung, Andy Room 1905, Shek Cheung House Chinese (周煒雄) Shek Lei Estate Kwai Chung New Territories Hong Kong –56– DIRECTORS AND PARTIES INVOLVED IN THE PLACING Name Residential address Nationality Independent non-executive Directors Mr. Cheng Yuk Kin (鄭煜健) Flat 1809, Tower 2 Chinese Harbourview Horizon 12 Hung Lok Road Hung Hom Bay, Kowloon Hong Kong Mr. Fan Chun Wah, Andrew Room E, 22/F, Block 38 Chinese (范駿華) Laguna City 11 South Laguna Street Kwun Tong, Kowloon Hong Kong Ms. Reina Lim Yan Xin Flat 3011, Block R Singaporean (林延芯) Kornhill Quarry Bay Hong Kong See “Directors and Senior Management” for further details of our Directors and senior management. –57– DIRECTORS AND PARTIES INVOLVED IN THE PLACING PARTIES INVOLVED IN THE PLACING Sponsor Quam Capital Limited 18/F-19/F, China Building 29 Queen’s Road Central Hong Kong Joint Lead Managers Quam Securities Company Limited 18/F-19/F, China Building 29 Queen’s Road Central Hong Kong Pacific Foundation Securities Limited 11/F, New World Tower II 16-18 Queen’s Road Central Hong Kong Sole Bookrunner Pacific Foundation Securities Limited 11/F, New World Tower II 16-18 Queen’s Road Central Hong Kong Legal advisers to our Company As to Hong Kong law Tung & Co. -

Hong Kong Monthly

Research September 2012 Hong Kong Monthly REVIEW AND COMMENTARY ON HONG KONG'S PROPERTY MARKET Knight Frank 萊坊 Office Luxury brand expansion fuels office demand Residential New policies to have little immediate impact Retail Hysan Place boosts retail market in Causeway Bay1 September 2012 Hong Kong Monthly M arket in brief The following table and figures present a selection of key trends in Hong Kong’s economy and property markets. Table 1 Economic indicators and forecasts Economic Latest 2012 Period 2010 2011 indicator reading forecast GDP growth Q2 2012 +1.1%# +6.8% +5.0% +3.8% Inflation rate Jul 2012 +1.6% +2.4% +5.3% +3.4% Three months to Unemployment 3.2%# 4.4% 3.4% 3.4% Jul 2012 Prime lending rate Current 5.00–5.25% 5.0%* 5.0%* 5.0%* Source: EIU CountryData / Census & Statistics Department / Knight Frank # Provisional * HSBC prime lending rate Figure 1 Figure 2 Figure 3 Grade-A office prices and rents Luxury residential prices and rents Retail property prices and rents Jan 2007 = 100 Jan 2007 = 100 Jan 2007 = 100 230 190 300 210 170 250 190 150 170 200 150 130 130 110 150 110 90 90 100 70 70 50 50 50 2007 2008 2009 2010 2011 2012 2007 2008 2009 2010 2011 2012 2007 2008 2009 2010 2011 2012 Price index Rental index Price index Rental index Price index Rental index Source: Knight Frank Source: Knight Frank Source: Rating and Valuation Department / Knight Frank 2 2 Monthly review The local property market was robust last month. -

1193Rd Minutes

Minutes of 1193rd Meeting of the Town Planning Board held on 17.1.2019 Present Permanent Secretary for Development Chairperson (Planning and Lands) Ms Bernadette H.H. Linn Professor S.C. Wong Vice-chairperson Mr Lincoln L.H. Huang Mr Sunny L.K. Ho Dr F.C. Chan Mr David Y.T. Lui Dr Frankie W.C. Yeung Mr Peter K.T. Yuen Mr Philip S.L. Kan Dr Lawrence W.C. Poon Mr Wilson Y.W. Fung Dr C.H. Hau Mr Alex T.H. Lai Professor T.S. Liu Ms Sandy H.Y. Wong Mr Franklin Yu - 2 - Mr Daniel K.S. Lau Ms Lilian S.K. Law Mr K.W. Leung Professor John C.Y. Ng Chief Traffic Engineer (Hong Kong) Transport Department Mr Eddie S.K. Leung Chief Engineer (Works) Home Affairs Department Mr Martin W.C. Kwan Deputy Director of Environmental Protection (1) Environmental Protection Department Mr. Elvis W.K. Au Assistant Director (Regional 1) Lands Department Mr. Simon S.W. Wang Director of Planning Mr Raymond K.W. Lee Deputy Director of Planning/District Secretary Ms Jacinta K.C. Woo Absent with Apologies Mr H.W. Cheung Mr Ivan C.S. Fu Mr Stephen H.B. Yau Mr K.K. Cheung Mr Thomas O.S. Ho Dr Lawrence K.C. Li Mr Stephen L.H. Liu Miss Winnie W.M. Ng Mr Stanley T.S. Choi - 3 - Mr L.T. Kwok Dr Jeanne C.Y. Ng Professor Jonathan W.C. Wong Mr Ricky W.Y. Yu In Attendance Assistant Director of Planning/Board Ms Fiona S.Y. -

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Wan Chai Block C, Fontana Garden 5868 Yau Tsim Mong Cam Key Mansion, 495 Shanghai Street 5869 Kowloon City Crystal Mansion 5870 Central & Western Best Western Plus Hotel Hong Kong 5871 Central & Western Tower 1, Kong Chian Tower 5872 Wan Chai 11 Broom Road 5873 Kwai Tsing Wah Shun Court 5874 Kowloon City Sunderland Estate 5875 Islands Headland Hotel 5877 Eastern Block A, Yen Lok Building 5879 Sha Tin Hin Kwai House, Hin Keng Estate 5880 Tai Po Po Sam Pai Village 5881 Sha Tin Mei Chi House, Mei Tin Estate 5882 Tsuen Wan Block 2, Waterside Plaza 5882 Sha Tin Jubilee Court, Jubilee Garden 5883 Kwun Tong Lee Ming House, Shun Lee Estate 5884 Southern Tower 9, Bel-Air On The Peak 5885 Central & Western Block 3, Garden Terrace 5886 Sai Kung Tower 5, The Mediterranean 5887 Sai Kung Tower 5, The Mediterranean 5888 Kowloon City Block 1, Kiu Wang Mansion 5889 Islands Heung Yat House, Yat Tung Estate 5890 Sha Tin Cypress House, Kwong Yuen Estate 5891 Kwai Tsing Block 6, Mayfair Gardens 5892 Eastern Tower 1, Harbour Glory 5893 Sai Kung Kap Pin Long 5894 Wan Chai Hawthorn Garden 5895 Tai Po Villa Castell 5896 Kwun Tong Ping Shun House, Ping Tin Estate 5897 Sai Kung Tak Fu House, Hau Tak Estate 5898 Kwai Tsing Ying Kwai House, Kwai Chung Estate 5899 1 Related Confirmed / -

When Is the Best Time to Go to Hong Kong?

Page 1 of 98 Chris’ Copyrights @ 2011 When Is The Best Time To Go To Hong Kong? Winter Season (December - March) is the most relaxing and comfortable time to go to Hong Kong but besides the weather, there's little else to do since the "Sale Season" occurs during Summer. There are some sales during Christmas & Chinese New Year but 90% of the clothes are for winter. Hong Kong can get very foggy during winter, as such, visit to the Peak is a hit-or-miss affair. A foggy bird's eye view of HK isn't really nice. Summer Season (May - October) is similar to Manila's weather, very hot but moving around in Hong Kong can get extra uncomfortable because of the high humidity which gives the "sticky" feeling. Hong Kong's rainy season also falls on their summer, July & August has the highest rainfall count and the typhoons also arrive in these months. The Sale / Shopping Festival is from the start of July to the start of September. If the sky is clear, the view from the Peak is great. Avoid going to Hong Kong when there are large-scale exhibitions or ongoing tournaments like the Hong Kong Sevens Rugby Tournament because hotel prices will be significantly higher. CUSTOMS & DUTY FREE ALLOWANCES & RESTRICTIONS • Currency - No restrictions • Tobacco - 19 cigarettes or 1 cigar or 25 grams of other manufactured tobacco • Liquor - 1 bottle of wine or spirits • Perfume - 60ml of perfume & 250 ml of eau de toilette • Cameras - No restrictions • Film - Reasonable for personal use • Gifts - Reasonable amount • Agricultural Items - Refer to consulate Note: • If arriving from Macau, duty-free imports for Macau residents are limited to half the above cigarette, cigar & tobacco allowance • Aircraft crew & passengers in direct transit via Hong Kong are limited to 20 cigarettes or 57 grams of pipe tobacco.