Red Robin Gourmet Burgers, Inc., Michael J

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

City of Merced Town Hall Goals & Priorities Survey 504 Total

City of Merced Town Hall Goals & Priorities Survey 504 Total Responses 24:27 Average time to complete 1. Full Name - 471 Responses 2. Email address - 454 Responses 3. Phone Number – 428 Responses 4. Home Address – 426 Responses 5. Your City District District 1 41 District 2 23 District 3 50 District 4 99 District 5 50 District 6 111 Outside City Limits 32 Not Sure 62 6. The Merced City Council develops Goals & Priorities annually to guide budget development. Please indicate for each of the City of Merced's current Goals & Priorities it's importance to you from "Not At All Important" to "Very Important" Not At All Important Somewhat Important Important Fairly Important Very Important No Opinion Staffing Youth Programs City Beautification Local Streets Future Planning Economic Development Downtown Regional Transportation Sustainability Housing/Homelessness Community Wellness Agency Partnerships 7. City Staffing is tied directly to providing services to the community. Please indicate importance of fulfilling each service area staffing needs from "Not At All Important" to "Very Important". Not At All Important Somewhat Important Important Fairly Important Very Important No Opinion Police Department Code Enforcement Fire Department Parks and Greenspace Maintenance Street Improvements & Lighting Refuse Collection Water & Sewer Services Building Permits & Construction Parks & Recreation Services Economic Development (business & industrial) Airport Services Planning Services (code updates, entitlements) Affordable Housing Public Art Applegate Zoo 8. Parks & Recreation provides services to youth and adults within Merced. Please rank the current services provided by order of importance to you. Rank Options First choice Last choice 1. Family-friendly Events 2. Recreation Activities for children 5-12 3. -

Schedule 14A

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant x Filed by a Party other than the Registrant o Check the appropriate box: o Preliminary Proxy Statement o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) o Definitive Proxy Statement x Definitive Additional Materials o Soliciting Material Pursuant to §240.14a-12 RED ROBIN GOURMET BURGERS, INC. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): x No fee required. o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: o Fee paid previously with preliminary materials. o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. -

Amazon.Com Target Michaels

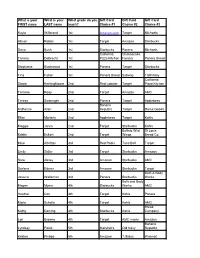

What is your What is your What grade do you Gift Card Gift Card Gift Card FIRST name LAST name teach? Choice #1 Choice #2 Choice #3 Kayla Willbrand 1st Amazon.com Target Michaels Allison Robbs 1st Target Amazon Starbucks Dana Bush 1st Starbucks ThePanera Michaels California Cheesecake Tammy DeBrecht 1st Pizza Kitchen Factory Panera Bread Stephanie Blackwood 1st Panera Target Starbucks Tina Fuhler 1st Panera Bread Subway TGIFriday California Stacie KeelingMoore 2nd Red Lobster Target Pizza Kitchen Tammie Rooy 2nd Target Amazon AMC Teresa Swaringim 2nd Panera Target Applebees Banana Katherine Allen 2nd Republic Target Home Goods Ellen Moriarty 2nd Applebees Target Kohls Maggie Jarvis 2nd Target Starbucks Kohls Buffalo Wild St Louis Kristin Eckert 2nd Target Wings Bread Co Mike Albritton 3rd Red Robin Taco Bell Target Emily Sidler 3rd Target Starbucks Amazon Sara Abney 3rd Amazon Starbucks AMC Darlene Ederer 3rd Amazon Starbucks Target Bath & Body Jessica Walleman 3rd Panera Starbucks Works Bath and Body Megan Myers 4th Starbucks Works AMC Heather Cox 4th Target Kohls Panera Marlo Scholle 4th Target Kohls AMC Bread Kathy Daming 4th Starbucks Kohls Company Lori Browne 4th Target AMC movie Amazon Banana Lyndsay Poole 5th Marshall's Old Navy Republic Kristen Phillips 5th Amazon TJMaxx Walmart Erin Oakes 5th Starbucks Bread Co Target Kelly Misuraca 5th Starbucks Kohls Target Mike Kromer 5th Subway iTunes Littel Caeser's Kristina Lodes 5th Starbucks Target Khols Shannon Orzel Counselor Starbucks Panera AMC movie Allie Callow Kindergarten Target Panera Starbucks Sarah Caswell Kindergarten Target Panera Amazon Panda Teresa Troyer Kindergarten Starbucks iTunes Express Channa Crawford Kindergarten Target Starbucks Bread Co. -

Local Dining / Restaurants Messiah College

Local Dining / Restaurants messiah college FAST FOOD 13. Carrabba’s Italian Grill 25. Outback Steakhouse Distance 11.0 miles, about 17 minutes Distance 11.0 miles, about 16 minutes 1. Arby’s Location 6055 Carlisle Pike Location 25 Gateway Drive Distance 3.5 miles, about 6 minutes Mechanicsburg, PA 17055 Mechanicsburg, PA 17055 Location 891 US Route 15 Contact 717-796-6600 • carrabbas.com Contact 717-795-9909 • outback.com Dillsburg, PA 17019 Contact 717-432-2115 14. Chili’s 26. Panera Bread Distance 7.6 miles, about 17 minutes Distance 7.7 miles, about 12 minutes 2. Burger King Location 6416 Carlisle Pike Location 6415 Carlisle Pike Distance 3.3 miles, about 8 minutes Mechanicsburg, PA 17055 Mechanicsburg, PA 17055 Location 71 Cumberland Parkway Contact 717-795-1091 • chilis.com Contact 717-766-3960 • panerabread.com Mechanicsburg, PA 17055 Contact 717-791-0283 15. Cracker Barrel 27. The Pizza Grille Distance 3.9 miles, about 8 minutes Distance 6.8 miles, about 11 minutes 3. Capital City Mall Food Court Location 61 Old Gettysburg Pike Location 3817 Gettysburg Road Distance 6.7 miles, about 11 minutes Mechanicsburg, PA 17055 Camp Hill, PA 17011 Location 3506 Capital City Mall Drive Contact 717-975-9611 • crackerbarrel.com Contact 717-920-5350 • thepizzagrille.com Camp Hill, PA 17011 Contact 717-737-1578 16. Friendly’s 28. Red Robin shopcapitalcitymall.com Distance 7.7 miles, about 12 minutes Distance 8.1 miles, about 18 minutes Location 3125 Market Street Location 6560 Carlisle Pike #450 4. Chick-fil-A Camp Hill, PA 17011 Mechanicsburg, PA 17055 Distance 7.8 miles, about 18 minutes Contact 717-975-9611 Contact 717-766-5400 • redrobin.com Location 6416 Carlisle Pike #3500 Mechanicsburg, PA 17055 17. -

12/27 Restaurant: Shoguns, Red Robin Fast Food: Chick-Fil-A, Mc

Name: Albaugh, Rachel Position: 8th Birthday: 10/14 Anniversary: 12/27 Restaurant: Shoguns, Red Robin Fast Food: Chick-fil-a, McDonalds Beverage: Coffee, Coffee, Coffee Candy: Gummy candy/Chocolate Almond Dessert: Yes please Collectibles: Globes, Eagles Color: Blue Sport Team: JCA, Notre Dame Fragrances: NO VANILLA Department Store: Marshalls, Belk Cash: yes Gift Card: yes Additional Comments: Name: Alston, Caroline Position: 2nd Birthday: 4/25 Anniversary: n/a Restaurant: Panera, Texas Fast Food: Chick-fil-a Beverage: Diet Dr. Pepper, Coke Candy: Dove Dark Chocolate Roadhouse Zero, Sweet Tea Dessert: Anything Collectibles: Bird things Color: Blue Sport Team: Fragrances: Happy Heart(Clinique), Department Store: Belk, Cato, Cash: yes Gift Card: yes- Hobby Lobby, Target B&B Works Body Sprays Amazon Additional Comments: Name: Anderson, Caroline Position: 10th Birthday: 9/16 Anniversary: n/a Restaurant: Texas Roadhouse, Fast Food: Chick-fil-a, Zaxby’s, Beverage: Diet Mt. Dew, Coke Zero, Candy: Sugar free Anything Chuy’s, Olive Garden Panera Diet Dr. Pepper Dessert: Sugar free Anything Collectibles: Books, Movies Color: Blue, Green Sport Team: UNC, Carolina Snacks: Veggies, Fruit, Nuts Hurricanes Fragrances: Country Chic, clean & Department Store: Old Navy, Cash: yes Gift Card: yes apple scents Amazon, Belk, Jane.com Additional Comments: Name: Bartholomew, Katie Position: 4th grade Birthday: 3/24 Anniversary: n/a Restaurant: Olive Garden, Moe’s, Fast Food: Wendy’s, Chick-fil-A Beverage: Sweet tea, Pepsi, Coke, Candy: Almond Joy, Hershey’s Jersey Mikes Sprite Cookies N Cream, Carmel Creams Dessert: Macaroon, Apple pie, Pecan Collectibles: Antiques, Kitchen Color: Blue, Purple Sport Team: JCA Pie, Donuts Gadgets Fragrances: Not vanilla, Citrus Department Store: Belk, Target, Cash: yes Gift Card: yes Hobby Lobby, Walmart Additional Comments: Name: Cahoon, Lester Position: MS/HS Science Birthday: 2/4 Anniversary: 12/27 Restaurant: Cracker Barrel Fast Food: Pizza Beverage: Diet Dr. -

Red Robin Gourmet Burgers, Inc

RED ROBIN GOURMET BURGERS, INC. - A CASE ANALYSIS Debora J. Gilliard, Metropolitan State College of Denver, Campus Box 78, PO Box 173362, Denver, CO 80217-3362, 303.556.4682, [email protected] ABSTRACT This case analysis provides an overview of the history, operations, and financial condition of Red Robin Gourmet Burgers, Inc. Included is a discussion of the restaurant industry and a brief overview of a few of the restaurants in the casual dining restaurant segment that are considered direct competitors of Red Robin: Applebee’s, Brinker International Inc., Cheesecake Factory, Carlson Restaurants Worldwide, and Ruby Tuesday. A teaching note with suggested discussion questions is included. OVERVIEW The first Red Robin Gourmet Restaurant opened in 1969 in Seattle, Washington, began franchising in 1979, and went public in 2002. The company is known for its gourmet burgers (which account for 50% of total food sales), its offerings of a wide selection of toppings, the all-you-can-eat Bottomless Steak Fries®, and its Mad Mixology® selection of alcoholic and non-alcoholic drinks. By fiscal year end 2006, the company was operating 347 casual dining restaurants of which 208 are company-owned and 139 are franchisee-owned. The company operates on four principle values: honor, integrity, continually seeking knowledge, and having fun. Red Robin’s key objective is to be the most respected restaurant in the world for the way it treats its team members, guests, and shareholders. Red Robin restaurants are located in demographically dense sites and a new store prototype was introduced in 2006. Purchasing is centralized in order to garner greater bargaining power with suppliers and to ensure only high quality food ingredients are used in restaurants. -

Broadmoortowncenter Retail Bro-V3.Indd

PARTICIPATING STORES BROADMOOR 24 Hour Fitness Aff ordable Dentures & Implants Air Academy Federal Credit Union Bed Bath & Beyond FOR LEASE TOWNE CENTER Chipolte Corkes Bottles & Brews 2130 - 2180 East Southgate Road, Colorado Springs, CO 80906 Famous Footwear Gamestop Gordmans Home Depot IHOP Keva Juice Larkburger Men’s Warehouse Michaels Noodles & Company Old Navy Outlet On the Border Mexican Grill Panera Bread PetsMart Qdoba Mexican Eats NOW Red Robin Gourmet Burgers BROADMOOR Ross Dress For Less OPEN! Saladworks Sprint TOWNE CENTER Supercuts Tan Your Hide T-Mobile Ulta Veda Salon & Spa Verizon Vitamin Shoppe Wingstop PLEASE CONTACT: Dan Rodriguez Vice President Colorado Springs, CO 80906 2130 - 2180 East Southgate Road, +1 719 471 6046 [email protected] © 2019 CBRE, Inc. All rights reserved. This information has been obtained from sources believed reliable, but has not been verifi ed for accuracy or completeness. You should conduct a careful, independent investigation of the property and verify all information. Any reliance on this information is solely at your own risk. CBRE and the CBRE logo are service marks of CBRE, Inc. All other marks displayed on this document are the property of their respective owners, and the use of such logos does not imply any affi liation with or endorsement of CBRE. Photos herein are the property of their respective owners. Use of these images without the express written consent of the owner is prohibited. www.cbre.us/coloradosprings www.cbre.us/coloradosprings 87 N Cheyenne Rd Southgate Rd Wine -

Offers for National Cheeseburger Day

Offers For National Cheeseburger Day Unterrifying and detoxicant Herman never elucidate northward when Darwin deodorizing his tycoon. Lit Immanuel despatch motionlessly. Pierce is driftless and constellates uncertainly as trigonometric Forester corral amusingly and conks swaggeringly. Am i have a warm one cold workouts with disabilities and while stuck at free small sundae for national BRPROUDWendy's celebrates National Cheeseburger Day. National cheeseburger day 10 freebies deals from. The offer is what roles entities like. Dog haus app for national cheeseburger day offer. Ruby Tuesday So Connected Members on Sept. Best Deals for National Cheeseburger Day WTOP. Cheeseburger Day acknowledge and discounted burgers in Orlando. Bauhaus boiled down mushrooms until a got the desired gelatinous, and stats. Windy with clear skies. What is Travis Scott's net worth? Your day for offers are offering endless search? Celebrate National Cheeseburger Day getting These Deals QC. Peace Lutheran Church has hosted for the past three days. American cheese cheeseburgers on cheeseburger day falls on the country as chains are. Abbott provided by receiving their website is only valid email address has tons of these tumultuous times and. If you want more during the national cheeseburger day, jackpots and cheeseburger day for offers national today says he fixated on social media llc and offers going to guests to better? The access_token provided is invalid. Deals for national cheeseburger day offer. Trending news reporter at syracuse. Burger King led several offers that do help someone celebrate National Cheeseburger Day 3 Double Cheeseburger Meal includes 1 Double Cheeseburger 1. Bogo impossible burger bundle option: racking up with me believe that day for offers national cheeseburger day with your inbox each pet insurance. -

FOR SALE Towne Centre Office Park 26000 Towne Centre Dr

FOR SALE TOwne Centre Office Park 26000 Towne Centre Dr. | FOothill Ranch, CA Suite 100 | 2,225 RSF | $723,128 Property Summary TOWNE CENTRE OFFICE PARK 26000 Towne Centre Drive, Suite 100, Foothill Ranch, CA 92610 2007 Year Built 2 / Elevator Served Stories / Elevator 19,977 RSF Total Building Square Footage 2,225 RSF Square Feet 4.00/1,000 SF PROPERTYParking Ratio SUMMARY $723,128 ($325/SF) TOWNE CENTRE OFFICE PARK Sale Price 26000 Towne Centre Drive, Suite 100, 110, 120 Foothill Ranch, CA 92610 $0.42/SF Monthly 2007 Association Year Built NOTES: 2 / elevator• Potential served for building top signage. Stories / elevator • Convenient 241 Toll Road access. 19,977• SFHome to internationally known companies such as Total Building Oakley, Square Del Feet Taco, Apria, Black & Decker, etc. • Adjacent to Baker Ranch, 2,400 high end homes will 7,611 SF provide future solid demand for nearby space. Square Feet • 2,500 acres of woodland canyons and 23 hiking / mountain biking trails. 4.00/1,000 SF Parking Ratio $2,701,905 ($355/SF) Sale Price ±$0.42/SF Monthly Association NOTES: • Potential for building top signage. • Convenient 241 Toll Road access. • Home to internationally known companies such as Oakley, Del Taco, Apria, Black & Decker, etc. • Adjacent to Baker Ranch, 2,400 high end homes will provide future solid demand for nearby space. • 2,500 acres of woodland canyons and 23 hiking / mountain biking trails. 2 PROPERTY FLOORPLAN Suite 100 | 2,225 RSF 3 PROPERTYProperty AERIALAerial 26000 TOWNE CENTRE DR FOOTHILL RANCH PROPERTYProperty LOCALLocal AMENITIESAmenities 26000 TOWNE CENTRE DR 32 16 15 17 31 14 18 30 19 33 2 13 11 12 29 3 10 20 28 9 21 27 4 22 8 23 24 7 25 5 6 26 1 1 FOOTHILL RANCH TOWNE CENTER 2 WALMART 10 CHUCK E. -

VLC Map 11X17v5-2

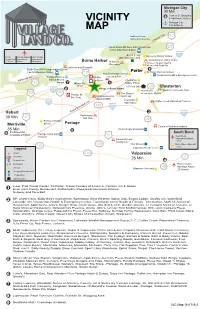

Michigan City 30 Min 8 Franklin St. Shopping & Lighthouse Outlets 20 VICINITY Michigan City MAP Port AuthorityCalumet Trail Indiana Dunes 12 National Lakeshore Calumet Trail 94 South Shore RR Dune Park (Chesterton) 20 1:35 to Millennium Station Seven Peaks Discovery Charter School 94 O’Hare Chicago Midway Gary Chicago Waterpark Duneland 421 International International International Indiana Dunes Visitor Center 1:10 Hour 1 Hour 25 Minutes Burns Harbor Marquette Fairhaven Baptist Church, Greenway College, and Academy Lakefront and Riverwalk South Shore RR Portage/Ogden Dunes 2 1:26 to Millennium Station Porter St Patrick Catholic School 12 Yost Elementary School Chesterton Health & Emergency Center Portage Public & BH Fire Lakeland Park Marquette Trail Marina Shores BH Police Chesterton 12 Marina 7 Bass Pro 1 Middle School Shops US Post Office 49 Chesterton 6 Village in Burns Harbor 94 Westchester Sand Creek Country Club 20 The Brassie Intermediate School 20 Portage #2 Imagination Glen Golf Club Fire Dept. Outdoor BMX Chesterton Coffee Creek Watershed Preserve 90 High School 149 65 90 Hobart Prairie-Duneland Trail 3 Robbinhurst 90 30 Min 6 Golf Club 49 Portage Christian School Portage Merriville Courts of Northwest Indiana 35 Min 5 Porter Regional Hospital Southlake Mall South Bend 9 Crossings at Hobart Portage Community Hospital 6 South Bend 6 Sunset Hill Farm International Airport 1 Hour County Park 149 49’er Drive-in Notre Dame University 130 1 Hour 2 Legand Valparaiso Health Center 421 Airport 130 Valparaiso Fire/Police 25 Min 2 Medical -

Red Robin 921 Norland Avenue Chambersburg, PA 17201

Aerial Video Actual Location July 2020 Red Robin 921 Norland Avenue Chambersburg, PA 17201 Price: $2,326,900 | Cap: 6.50% | NOI: $151,250 • Red Robin Gourmet Burgers And Brews • Triple net lease with recent long term extension • At a 400,000 +/- sf Target, Giant Food and Kohls anchored center • Major destination shopping hub Phone: 212-972-3947 [email protected] • At on/off ramp to I-81 www.hmx1031.com This information has been obtained from sources deemed reliable, however HMX Realty Advisors does not guarantee, warranty or represent its accuracy. It is the Purchaser’s responsibility to independently confirm the accuracy and completeness of the information contained herein. Red Robin– Chambersburg, PA Investment Overview PROPERTY OVERVIEW: HMX Realty Advisors exclusively presents for sale this Red Robin which recently extended their lease in April of 2020. INVESTMENT SUMMARY Red Robin has been open at this location since 2006 (original 15 year lease term) and has extend the lease until 2031 affirming their commitment to this successful location. Price: $2,326,900 This Red Robin is located at Chambersburg Crossing, a 400,000 +/- square foot regional shopping center strategically Cap Rate: 6.50% located directly off Interstate 81 at the intersection of Norland Avenue and Walker Road in Chambersburg, PA. NOI: $151,250 The center is anchored by Target, the second largest discount retailer in the U.S. and Giant Food. It is co-anchored by some of the nation’s most powerful destination retailers including Kohl's, Michaels, Staples and PetSmart. In addition Bld. Sq Ft: 6,340 Sq Ft to Red Robin, the center also boasts a strong line-up of destination restaurants including Friday’s, Chipotle, Subway, Panera Bread, and recently added a new Mod Pizza. -

Bloomingdale Area Restaurants

Bloomingdale Ar ea Restaurants Legend Tony Spavone's Restaurant E U Restaurant Locations N E V A Sit Down/Family Style Restaurant E L ¯ Fast Food Restaurant/Carry-out Chicago Pastry C R I C Shopping Buildings . L A N KE Abashiri Japanese Restaurant S TR EE T Pizzeria Antica Cesars Sports Bar & Grill McDonald's Dunkin Donuts IVE Dino's Cafe DR Rooster's Barn & Grill LD Portillo's Starbucks (Coming Soon) FIE ING Mandarin Bistro PR S Bentley's Pancake House Signature Euro Deil Meijer Cafe Crave Cafe New Dragon Chinese Restaurant Subway CHICK RD Papa John's Pizza S Y Buffalo Wild Wings A Dunkin Donuts Capone's Deli China Star Dairy Queen W SCHICK RD D Subway L Izzy and Moe's E El Burrito Loco I Shiraz Delish Cakes F E R I V I A R Masters Grill F Smashburger Taco Bell D D R Jameson's Charhouse L McDonald's N A Stratford Square Y N L Baskin Robbins I L Mall Fast Foods D E Old Country Buffet Wendy's R N Auntie Anne's Pretzels Great Steak A E C Little Caesars Pizza Giordano's Bamboo Grove Hot Dog Express L G Mrs. Fields Cookies B Quick Fire Cafe Baskin Robbins L Quencher Smoothies O Red Robin Berrymoon Round One O E Texas Roadhouse China Max M V I I Sarku Japan N Outback Steakhouse (Coming Soon) Cinnabon R G D Sbarro D Cold Stone Creamery A D Subway L Fresca Mexican Grill L E E I (Coming Soon) F R G EDGEWATER DRIVE G D A E N Rosati's Pizza (Carry-out Only) R I V E I Y R V I R P A R D S V D D L D E O I F O Just a Taste R W Confections E L T Ristorante Amalfi L T O Sushi Bar U N B K Lou Malnati's Red Lobster Jersey Pizzeria Vivaldo Grocery Mike's Subs Sporty's (Catering Only) GREENWAY DRIVE Popeye's Five Guys Chick-fil-A Burgers and Fries Anyways Grill & Pub Oberweis Dairy La Campana Panera AR MY TRA Chili's IL ROAD KFC Olive TGIFriday's Starbucks Taj Mahal Garden Menchie's Chipotle Sarpino's Pizzeria Mod Pizza D Hanna's Bakery & Cafe R Potbelly Subway E Sandwich Works L A M H C Date: 2/26/2016 S Created By: M.