Gabriel India CMP:| HOLD of Price Target a at Arrive We 8.0/Share, | of EPS FY21E 15X on P/E at GIN Valuing Stead

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 September 1, 2020 to Whom It May Concern: Keiichi Aida President

Note: This document has been translated from a part of the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. The Company assumes no responsibility for this translation or for direct, indirect, or any other forms of damages arising from the translation. September 1, 2020 To Whom It May Concern: Listed Company’s Name: Keihin Corporation Representative: Keiichi Aida President and CEO (Code: 7251, TSE 1st Section) Contact: Mitsutoshi Sato, General Manager, Accounting Department (Telephone: 03-3345-3411) Notice of Position Statement regarding the Scheduled Commencement of the Tender Offer by Honda Motor Co., Ltd., an Affiliate, for the Management Integration of Hitachi Automotive Systems, Ltd., Keihin Corporation, Showa Corporation (Securities Code: 7274), and Nissin Kogyo Co., Ltd. (Securities Code: 7230) Keihin Corporation (the “Company”) hereby announces that as part of a series of transactions for management integration (the “Integration”; for details, please see the Note below) stated in “Notice of Position Statement regarding the Scheduled Commencement of the Tender Offer by Honda Motor Co., Ltd., an Affiliate, for the Management Integration of Hitachi Automotive Systems, Ltd., Keihin Corporation, Showa Corporation (Securities Code: 7274), and Nissin Kogyo Co., Ltd. (Securities Code: 7230)” dated October 30, 2019 (the “October 30 Press Release”) announced by the Company, regarding a tender offer (the “Tender Offer”) for the shares of the Company’s common stock (the “Shares”) commenced by Honda Motor Co., Ltd. (the “Tender Offeror”) pursuant to the basic contract (the “Basic Contract”) entered into among the Company, Hitachi Automotive Systems, Ltd. -

Defendants and Auto Parts List

Defendants and Parts List PARTS DEFENDANTS 1. Wire Harness American Furukawa, Inc. Asti Corporation Chiyoda Manufacturing Corporation Chiyoda USA Corporation Denso Corporation Denso International America Inc. Fujikura America, Inc. Fujikura Automotive America, LLC Fujikura Ltd. Furukawa Electric Co., Ltd. G.S. Electech, Inc. G.S. Wiring Systems Inc. G.S.W. Manufacturing Inc. K&S Wiring Systems, Inc. Kyungshin-Lear Sales And Engineering LLC Lear Corp. Leoni Wiring Systems, Inc. Leonische Holding, Inc. Mitsubishi Electric Automotive America, Inc. Mitsubishi Electric Corporation Mitsubishi Electric Us Holdings, Inc. Sumitomo Electric Industries, Ltd. Sumitomo Electric Wintec America, Inc. Sumitomo Electric Wiring Systems, Inc. Sumitomo Wiring Systems (U.S.A.) Inc. Sumitomo Wiring Systems, Ltd. S-Y Systems Technologies Europe GmbH Tokai Rika Co., Ltd. Tram, Inc. D/B/A Tokai Rika U.S.A. Inc. Yazaki Corp. Yazaki North America Inc. 2. Instrument Panel Clusters Continental Automotive Electronics LLC Continental Automotive Korea Ltd. Continental Automotive Systems, Inc. Denso Corp. Denso International America, Inc. New Sabina Industries, Inc. Nippon Seiki Co., Ltd. Ns International, Ltd. Yazaki Corporation Yazaki North America, Inc. Defendants and Parts List 3. Fuel Senders Denso Corporation Denso International America, Inc. Yazaki Corporation Yazaki North America, Inc. 4. Heater Control Panels Alps Automotive Inc. Alps Electric (North America), Inc. Alps Electric Co., Ltd Denso Corporation Denso International America, Inc. K&S Wiring Systems, Inc. Sumitomo Electric Industries, Ltd. Sumitomo Electric Wintec America, Inc. Sumitomo Electric Wiring Systems, Inc. Sumitomo Wiring Systems (U.S.A.) Inc. Sumitomo Wiring Systems, Ltd. Tokai Rika Co., Ltd. Tram, Inc. 5. Bearings Ab SKF JTEKT Corporation Koyo Corporation Of U.S.A. -

Mizuho BK Custody and Proxy Board Lot Size List OCT 27, 2020 21LADY

Mizuho BK Custody and Proxy Board Lot Size List OCT 27, 2020 Board Lot Stock Name (in Alphabetical Order) ISIN Code QUICK Code Size 21LADY CO.,LTD. 100 JP3560550000 3346 3-D MATRIX,LTD. 100 JP3410730000 7777 4CS HOLDINGS CO.,LTD. 100 JP3163300001 3726 A DOT CO.,LTD 100 JP3160590000 7063 A-ONE SEIMITSU INC. 100 JP3160660001 6156 A.D.WORKS GROUP CO.,LTD. 100 JP3160560003 2982 A&A MATERIAL CORPORATION 100 JP3119800005 5391 A&D COMPANY,LIMITED 100 JP3160130005 7745 A&T CORPORATION 100 JP3160680009 6722 ABALANCE CORPORATION 100 JP3969530009 3856 ABC-MART,INC. 100 JP3152740001 2670 ABHOTEL CO.,LTD. 100 JP3160610006 6565 ABIST CO.,LTD. 100 JP3122480001 6087 ACCESS CO.,LTD. 100 JP3108060009 4813 ACCESS GROUP HOLDINGS CO.,LTD. 100 JP3108190004 7042 ACCRETE INC. 100 JP3108180005 4395 ACHILLES CORPORATION 100 JP3108000005 5142 ACMOS INC. 100 JP3108100003 6888 ACOM CO.,LTD. 100 JP3108600002 8572 ACRODEA,INC. 100 JP3108120001 3823 ACTCALL INC. 100 JP3108140009 6064 ACTIVIA PROPERTIES INC. 1 JP3047490002 3279 AD-SOL NISSIN CORPORATION 100 JP3122030004 3837 ADASTRIA CO.,LTD. 100 JP3856000009 2685 ADEKA CORPORATION 100 JP3114800000 4401 ADISH CO.,LTD. 100 JP3121500007 7093 ADJUVANT COSME JAPAN CO.,LTD. 100 JP3119620007 4929 ADTEC PLASMA TECHNOLOGY CO.,LTD. 100 JP3122010006 6668 ADVAN CO.,LTD. 100 JP3121950004 7463 ADVANCE CREATE CO.,LTD. 100 JP3122100005 8798 ADVANCE RESIDENCE INVESTMENT CORPORATION 1 JP3047160001 3269 ADVANCED MEDIA,INC. 100 JP3122150000 3773 ADVANEX INC. 100 JP3213400009 5998 ADVANTAGE RISK MANAGEMENT CO.,LTD. 100 JP3122410008 8769 ADVANTEST CORPORATION 100 JP3122400009 6857 ADVENTURE,INC. 100 JP3122380003 6030 ADWAYS INC. 100 JP3121970002 2489 AEON CO.,LTD. 100 JP3388200002 8267 AEON DELIGHT CO.,LTD. -

Published on 7 October 2016 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 31 October 2016) Published on 7 October 2016 1. Constituents Change Addition( 70 ) Deletion( 60 ) Code Issue Code Issue 1810 MATSUI CONSTRUCTION CO.,LTD. 1868 Mitsui Home Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 2196 ESCRIT INC. 2117 Nissin Sugar Co.,Ltd. 2198 IKK Inc. 2124 JAC Recruitment Co.,Ltd. 2418 TSUKADA GLOBAL HOLDINGS Inc. 2170 Link and Motivation Inc. 3079 DVx Inc. 2337 Ichigo Inc. 3093 Treasure Factory Co.,LTD. 2359 CORE CORPORATION 3194 KIRINDO HOLDINGS CO.,LTD. 2429 WORLD HOLDINGS CO.,LTD. 3205 DAIDOH LIMITED 2462 J-COM Holdings Co.,Ltd. 3667 enish,inc. 2485 TEAR Corporation 3834 ASAHI Net,Inc. 2492 Infomart Corporation 3946 TOMOKU CO.,LTD. 2915 KENKO Mayonnaise Co.,Ltd. 4221 Okura Industrial Co.,Ltd. 3179 Syuppin Co.,Ltd. 4238 Miraial Co.,Ltd. 3193 Torikizoku co.,ltd. 4331 TAKE AND GIVE. NEEDS Co.,Ltd. 3196 HOTLAND Co.,Ltd. 4406 New Japan Chemical Co.,Ltd. 3199 Watahan & Co.,Ltd. 4538 Fuso Pharmaceutical Industries,Ltd. 3244 Samty Co.,Ltd. 4550 Nissui Pharmaceutical Co.,Ltd. 3250 A.D.Works Co.,Ltd. 4636 T&K TOKA CO.,LTD. 3543 KOMEDA Holdings Co.,Ltd. 4651 SANIX INCORPORATED 3636 Mitsubishi Research Institute,Inc. 4809 Paraca Inc. 3654 HITO-Communications,Inc. 5204 ISHIZUKA GLASS CO.,LTD. 3666 TECNOS JAPAN INCORPORATED 5998 Advanex Inc. 3678 MEDIA DO Co.,Ltd. 6203 Howa Machinery,Ltd. 3688 VOYAGE GROUP,INC. 6319 SNT CORPORATION 3694 OPTiM CORPORATION 6362 Ishii Iron Works Co.,Ltd. 3724 VeriServe Corporation 6373 DAIDO KOGYO CO.,LTD. 3765 GungHo Online Entertainment,Inc. -

International Corporate Investment in Ohio Operations June 2020

Research Office A State Affiliate of the U.S. Census Bureau International Corporate Investment in Ohio Operations 20 September 2007 June 20 June 2020 Table of Contents Introduction and Explanations Section 1: Maps Section 2: Alphabetical Listing by Company Name Section 3: Companies Listed by Country of Ultimate Parent Section 4: Companies Listed by County Location International Corporate Investment in Ohio Operations June 2020 THE DIRECTORY OF INTERNATIONAL CORPORATE INVESTMENT IN OHIO OPERATIONS is a listing of international enterprises that have an investment or managerial interest within the State of Ohio. The report contains graphical summaries of international firms in Ohio and alphabetical company listings sorted into three categories: company name, country of ultimate parent, and county location. The enterprises listed in this directory have 5 or more employees at individual locations. This directory was created based on information obtained from Dun & Bradstreet. This information was crosschecked against company Websites and online corporate directories such as ReferenceUSA®. There is no mandatory state filing of international status. When using this directory, it is important to recognize that global trade and commerce are dynamic and in constant flux. The ownership and location of the companies listed is subject to change. Employment counts may differ from totals published by other sources due to aggregation, definition, and time periods. Research Office Ohio Development Services Agency P.O. Box 1001, Columbus, Ohio 43266-1001 Telephone: (614) 466-2116 http://development.ohio.gov/reports/reports_research.htm International Investment in Ohio - This survey identifies 4,303 international establishments employing 269,488 people. - Companies from 50 countries were identified as having investments in Ohio. -

Autodesk W Branży Motoryzacyjnej

Autodesk w Branży Motoryzacyjnej Name Surname Job Title Image courtesy of Local Motors Inc. Idea Koncepcja Wizualizacja Ergonomia Konstrukcja i optymalizacja Symulacja Organizacja procesu produkcyjnego Marketing 14 GENERAL MOTORS CORPORATION EXEDY CORPORATION IMABARI SHIPBUILDING CO.,LTD. WERNER BAIER UND GERHARD MEY TOYOTA MOTOR CORPORATION TSUNEISHI SHIPBUILDING COMPANY CENTRAL JAPAN RAILWAY COMPANY AMSTED INDUSTRIES INCORPORATED HONDA MOTOR CO., LTD. MAZDA MOTOR CORPORATION LINAMAR CORPORATION MITSUBISHI MOTORS AUSTRALIA LIMITED MITSUBISHI HEAVY INDUSTRIES, LTD. GENERAL ELECTRIC COMPANY CHINA SHIPBUILDING INDUSTRY CORPORATION CHINA STATE SHIPBUILDING CORPORATION MICHELIN ET CIE GM DAEWOO AUTO & TECHNOLOGY COMPANY NAMURA SHIPBUILDING CO.,LTD. KEIHIN CORPORATION NORTHROP GRUMMAN CORPORATION SIEMENS AG AUSTAL USA, LLC AKEBONO BRAKE INDUSTRY CO., LTD. FORD MOTOR COMPANY VALEO MAG IAS HOLDINGS, INC. COOPER-STANDARD HOLDINGS, INC. HYUNDAI HEAVY INDUSTRIES CO., LTD. L-3 COMMUNICATIONS HOLDINGS, INC. KOREA DELPHI AUTOMOTIVE SYSTEMS CENTRAL MOTOR CO.,LTD. ROBERT BOSCH GMBH DANA HOLDING CORPORATION STELLA VERM?GENSVERWALTUNGS GMBH L?RSSEN MARITIME BETEILIGUNGEN GMBH. VOLKSWAGEN AG SUZUKI MOTOR CORPORATION REPUBBLICA ITALIANA CHINA COMMUNICATIONS CONSTRUCTION KUBOTA CORPORATION SEMBCORP INDUSTRIES LTD THAI SUMMIT AUTOPARTS INDUSTRY COMPANY PARKER -HANNIFIN CORPORATION FIAT SPA ROLLS-ROYCE GROUP PLC NAVISTAR INTERNATIONAL CORPORATION DCNS MAGNA INTERNATIONAL INC AB VOLVO PRESCO, Y.K. JUNGHEINRICH AG BRIDGESTONE CORPORATION CKD CORPORATION UNITED TECHNOLOGIES CORPORATION MITSUBA CORPORATION CONTINENTAL AG NIENPAL EMPREENDIMENTOS E PARTICIPACOES YAZAKI CORPORATION YOKOHAMA RUBBER COMPANY, LIMITED, THE DAIMLER AG FUJI HEAVY INDUSTRIES LTD. BENTELER AG MUSASHI SEIMITSU INDUSTRY CO., LTD. STX OFFSHORE & SHIPBUILDING CO., LTD. SHANGHAI AUTOMOTIVE INDUSTRY CORP ABEKING & RASMUSSEN SCHIFFS- UND ALLISON TRANSMISSION, INC. NISSAN MOTOR CO., LTD. BROSE FAHRZEUGTEILE GMBH & CO. KG ODIM ASA STICHTING ADMINISTRATIEKANTOOR HUISMAN MITSUBISHI MOTORS CORPORATION HARLEY-DAVIDSON, INC. -

International Corporate Investments in Ohio Operations

Research Office A State Affiliate of the U.S. Census Bureau International Corporate Investment in Ohio Operations 20 September 2007 June 20 June 2020 Table of Contents Introduction and Explanations Section 1: Maps Section 2: Alphabetical Listing by Company Name Section 3: Companies Listed by Country of Ultimate Parent Section 4: Companies Listed by County Location International Corporate Investment in Ohio Operations June 2020 THE DIRECTORY OF INTERNATIONAL CORPORATE INVESTMENT IN OHIO OPERATIONS is a listing of international enterprises that have an investment or managerial interest within the State of Ohio. The report contains graphical summaries of international firms in Ohio and alphabetical company listings sorted into three categories: company name, country of ultimate parent, and county location. The enterprises listed in this directory have 5 or more employees at individual locations. This directory was created based on information obtained from Dun & Bradstreet. This information was crosschecked against company Websites and online corporate directories such as ReferenceUSA®. There is no mandatory state filing of international status. When using this directory, it is important to recognize that global trade and commerce are dynamic and in constant flux. The ownership and location of the companies listed is subject to change. Employment counts may differ from totals published by other sources due to aggregation, definition, and time periods. Research Office Ohio Development Services Agency P.O. Box 1001, Columbus, Ohio 43266-1001 Telephone: (614) 466-2116 http://development.ohio.gov/reports/reports_research.htm International Investment in Ohio - This survey identifies 4,303 international establishments employing 269,488 people. - Companies from 50 countries were identified as having investments in Ohio. -

Takeshi Nemoto Partner Tokyo

Takeshi Nemoto Partner Tokyo Tel: 03-6250-6345(Direct) Fax: 03-6250-7200 E-mail: [email protected] Takeshi Nemoto has represented clients in various corporate law matters, especially in M&A transactions. In particular, he has extensive knowledge and experience with respect to the business integrations and legal issues regarding companies that are owned by founding family shareholders. In addition, he has advised on corporate governance matters, shareholders meetings, intellectual property matters and disputes between companies. Qualifications . Admitted in Japan (2005) . Admitted in New York (2015) Education . University of Virginia School of Law, LL.M. (2014) . Keio University, LL.B. (2003) Other Professional Experience . Lecturer, Hitotsubashi University School of Law (2020-) . Lecturer, Hitotsubashi University, Graduate School of International Corporate Strategy (ICS) (2016 - 2017) . Debevoise & Plimpton, LLP, New York (2014 - 2015) Work Highlights . Idemitsu Kosan Co., Ltd. - Tender offer to fully acquire TOA Oil Co., Ltd.(2020) . Idemitsu Kosan Co., Ltd. - Transfer of all shares in Shell Lubricants Japan K.K.(2020) . Honda Motor Co., Ltd. - Integration of Hitachi Automotive Systems, Ltd., Keihin Corporation, Showa Corporation and Nissin Kogyo Co., Ltd.(2019) . Idemitsu Kosan Co., Ltd - Business integration with Showa Shell Sekiyu(2018) . Launch of Japan version of Grameen Bank(2018) . FWD Group - Acquisition of AIG Fuji Life Insurance Company, Limited.(2017) . Ci:z Holdings - Capital and business alliance with Johnson & Johnson(2016) . Hitachi Transport System - Strategic alliance with SG Holding(2016) . Business integration between Idemitsu Kosan and Showa Shell Sekiyu (2015 -) . Capital injection in a company listed on JASDAQ by a listed company in Taiwan in exchange for the allocation of new shares (2015) Representative Publications . -

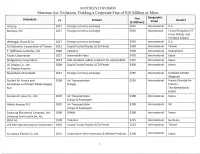

Sherman Act Violations Yielding a Corporate Fine of $10 Million Or More

ANTITRUST DIVISION Sherman Act Violations Yielding a Corporate Fine of $10 Million or More Fine Geographic Defendant FY Product Country ($ Millions S cop e Citicorp 2017 Foreign currency exchange $925 International U.S. Barclays, PLC 2017 Foreign currency exchange $650 International United Kingdom Of Great Britain And Northern Ireland JPMorgan Chase & Co. 2017 Foreign currency exchange $550 International U.S. AU Optronics Corporation of Taiwan 2012 Liquid Crystal Display (LCD) Panels $500 International Taiwan F. Hoffmann-La Roche, Ltd. 1999 Vitamins $500 International Switzerland Yazaki Corporation 2012 Automobile Parts $470 International Japan Bridgestone Corporation 2014 Anti-vibration rubber products for automobiles $425 International Japan LG Display Co., Ltd 2009 Liquid Crystal Display (LCD) Panels $400 International Korea LG Display America Royal Bank of Scotland 2017 Foreign currency exchange $395 International Scotland (United Kingdom) Societe Air France and 2008 Air Transportation $350 International France (Societe-Air Koninklijke Luchtvaart Maatschappij, (Cargo) France) N.V. The Netherlands (KLM) Korean Air Lines Co., Ltd. 2007 Air Transportation $300 International Korea (Cargo & Passenger) British Airways PLC 2007 Air Transportation $300 International UK (Cargo & Passenger) Samsung Electronics Company, Ltd. 2006 DRAM $300 International Korea Samsung Semiconductor, Inc. BASF AG 1999 Vitamins $225 International Germany CHI MEI Optoelectronics Corporation 2010 Liquid Crystal Display (LCD) Panels $220 International Taiwan Furukawa Electric Co. Ltd. 2012 Automotive Wire Harnesses & Related Products $200 International Japan 1 ANTITRUST DIVISION Shetrnan Act Violations Yielding a Corporate Fine of $10 Million or More Fine Geographic Defendant FY Product Country ($ Millions) Scop e Hitachi Automotive Systems, Ltd 2014 Automotive Wire Harnesses & Related Products $195 International Japan Mitsubishi Electric Corporation 2014 Automotive Wire Harnesses and Electronic $190 International Japan Components Hynix Semiconductor Inc. -

September 1, 2020 To: Shareholders of Honda Motor Co., Ltd. From

[Translation] September 1, 2020 To: Shareholders of Honda Motor Co., Ltd. From: Honda Motor Co., Ltd. 1-1, Minami-Aoyama 2-chome, Minato-ku, Tokyo, 107-8556 Takahiro Hachigo President and Representative Director Notice regarding the Commencement of the Tender Offer to Make Showa Corporation (Securities Code: 7274) a Wholly-Owned Subsidiary in connection with the Management Integration of Hitachi Automotive Systems, Ltd., Keihin Corporation (Securities Code: 7251), Showa Corporation, and Nissin Kogyo Co., Ltd. (Securities Code: 7230) As announced by Honda Motor Co., Ltd. (the “Tender Offeror”) in the “Notice regarding the Scheduled Commencement of the Tender Offer to Make Showa Corporation (Securities Code: 7274) a Wholly-Owned Subsidiary in connection with the Management Integration of Hitachi Automotive Systems, Ltd., Keihin Corporation (Securities Code: 7251), Showa Corporation, and Nissin Kogyo Co., Ltd. (Securities Code: 7230)” dated October 30, 2019 (the “October 30 Press Release by the Tender Offeror”) and the “Notice regarding the Management Integration of Hitachi Automotive Systems, Ltd., Keihin Corporation, Showa Corporation, and Nissin Kogyo Co., Ltd.” also dated October 30, 2019 (the “Integration Press Release”), the Tender Offeror, Hitachi Automotive Systems, Ltd. (“Hitachi Automotive Systems”), Keihin Corporation (First Section of the Tokyo Stock Exchange, Inc. (“TSE”) (the “TSE 1st Section”), securities code: 7251,”Keihin”), Showa Corporation (TSE 1st Section, securities code: 7274, “Showa” or the “Target Company”), Nissin -

Constituent Changes TOPIX New Index Series (Effective 31 October 2016)

Constituent Changes TOPIX New Index Series (effective 31 October 2016) Published on 7 October 2016 1. Constituents Change (1) TOPIX Core30 Addition( 1 ) Deletion( 1 ) Code Issue Code Issue 6861 KEYENCE CORPORATION 8604 Nomura Holdings, Inc. (2) TOPIX Large70 Addition( 1 ) Deletion( 1 ) Code Issue Code Issue 8604 Nomura Holdings, Inc. 6861 KEYENCE CORPORATION (3) TOPIX Mid400 Addition( 7 ) Deletion( 7 ) Code Issue Code Issue 2201 Morinaga & Co.,Ltd. 1979 Taikisha Ltd. 3938 LINE Corporation 3608 TSI HOLDINGS CO.,LTD. 4043 Tokuyama Corporation 5021 COSMO ENERGY HOLDINGS COMPANY,LIMITED 4095 NIHON PARKERIZING CO.,LTD. 6740 Japan Display Inc. 4587 PeptiDream Inc. 6754 ANRITSU CORPORATION 7458 DAIICHIKOSHO CO.,LTD. 8368 The Hyakugo Bank,Ltd. 8585 Orient Corporation 8544 The Keiyo Bank,Ltd. (4) TOPIX Small Addition(14) Deletion( 7 ) Code Issue Code Issue 1979 Taikisha Ltd. 2201 Morinaga & Co.,Ltd. 3608 TSI HOLDINGS CO.,LTD. 3938 LINE Corporation 5021 COSMO ENERGY HOLDINGS COMPANY,LIMITED 4043 Tokuyama Corporation 6740 Japan Display Inc. 4095 NIHON PARKERIZING CO.,LTD. 6754 ANRITSU CORPORATION 4587 PeptiDream Inc. 8368 The Hyakugo Bank,Ltd. 7458 DAIICHIKOSHO CO.,LTD. 8544 The Keiyo Bank,Ltd. 8585 Orient Corporation * 3221 Yossix Co.,Ltd. * 3445 RS Technologies Co.,Ltd. * 3837 Ad-Sol Nissin Corporation * 3918 PCI Holdings,INC. * 6050 E-Guardian Inc. * 7527 SystemSoft Corporation * 9644 TANABE MANAGEMENT CONSULTING CO.,LTD. * This issue will be newly added to TOPIX new index series after the close of trading on October 28. 2. Number of constituents The Name of TOPIX New Index Current After (As of October 7) (Effective 30 October) TOPIX Core30 30 30 TOPIX Large70 70 70 TOPIX Mid400 400 400 TOPIX Small1 496 500 TOPIX Small2 974 977 Each code means constituents of following index. -

Munjal Showa Rs 273 Signs of Growth Revival BSE Sensex: 33,250 Nifty-50: 10,266

For private circulation only Volume No. IX Issue No. 03 December 8, 2017 Munjal Showa Rs 273 Signs of growth revival BSE Sensex: 33,250 Nifty-50: 10,266 FINANCIALS SALES OPM (%) OP OTHER INC. PBIDT INTEREST PBDT DEP. PBT TOTAL TAX PAT EPS (RS) * 1403 (12) 1598.59 6.6 105.83 5.46 111.29 2.7 108.59 28.41 80.18 10.48 69.7 17.4 1503 (12) 1643.26 7.9 129.71 5.72 135.43 0.45 134.98 28.67 106.31 30.68 75.63 18.9 1603 (12) 1501.84 7.5 111.97 5.3 117.27 0.12 117.15 29.3 87.85 26.7 61.15 15.3 1703 (12) 1459.66 6.5 94.61 16.1 110.71 0.05 110.66 29.06 81.6 25.05 56.55 14.2 1803 (12P) & 1566.61 6.6 103.16 19.8 122.96 0.13 122.83 28.34 94.48 28.93 65.56 16.4 1903 (P) & 1785.93 7.0 125.02 20.19 145.21 0.2 145.01 28.91 116.1 38.31 77.78 19.5 *Annualised on current equity of Rs 7.99: Face value of Rs 2 each. (P) Projections. &: As per new accounting standards. EO: Extraordinary items. EPS is adjusted for EO and relevant tax . Source: Capitaline Databases Established in 1985, in technical and financial collaboration with Showa Corporation of Japan (having 26% stake in the company), the pioneering global leaders in the manufacture of shock absorbers, Munjal Showa is a member of Hero Group (flagship listed company Hero MotoCorp).