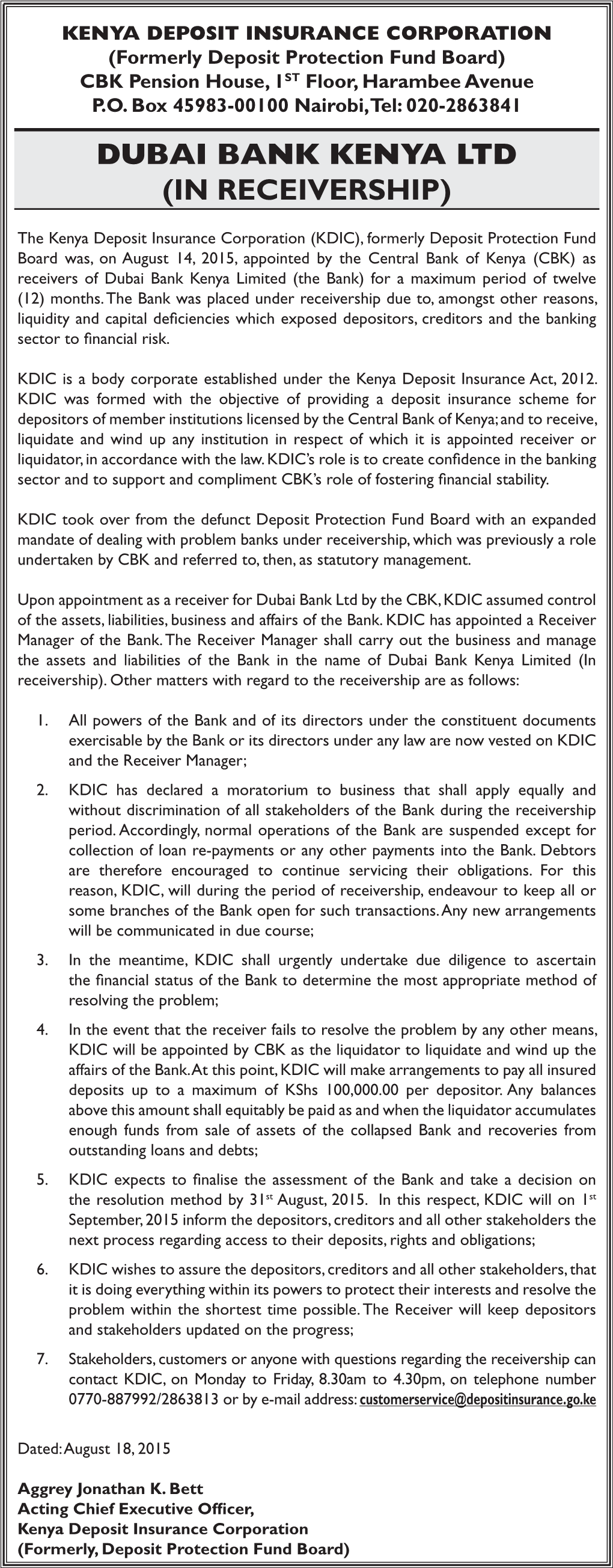

Dubai Bank Kenya Ltd (In Receivership)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Consumer Perceived Risk of Internet Banking in Kenya

CONSUMER PERCEIVED RISK OF INTERNET BANKING IN KENYA: A SURVEY OF THREE SELECTED BANKS IN NAIROBI COUNTY ORUCHO DANIEL OKARI FACULTY OF INFORMATION SCIENCE AND TECHNOLOGY A Research Thesis Submitted to the Graduate School in Partial Fulfillment of the Requirements for the Award of the Degree of Masters in Information Systems KISII UNIVERSITY February, 2017 DECLARATION BY STUDENT Declaration by candidate This is my original work and has not been presented for any degree award in this or any university. Orucho Daniel Okari Signature: …………………..Date: ………………… Registration Number: MIN 14/20189/14 Declaration by the Supervisors This thesis research has been submitted for examination with our approval as university supervisors. Dr. Elisha Ondieki Makori Lecturer, Faculty of Information Science and Technology University of Nairobi Signature: ……………. Date: …………….. Dr. Festus Ngetich Lecturer, Faculty of Information Science and Technology Kabianga University Signature………………. Date: ……………. ii DECLARATION OF NUMBER OF WORDS This form should be signed by the candidate and the candidate‟s supervisor (s) and returned to Director of Postgraduate Studies at the same time as you copies of your thesis/project. Please note at Kisii University Masters and PhD thesis shall comprise a piece of scholarly writing of not less than 20,000 words for the Masters degree and 50 000 words for the PhD degree. In both cases this length includes references, but excludes the bibliography and any appendices. Where a candidate wishes to exceed or reduce the word limit for a thesis specified in the regulations, the candidate must enquire with the Director of Postgraduate about the procedures to be followed. Any such enquiries must be made at least 2 months before the submission of the thesis. -

KDIC Annual Report 2012

Annual Report & Accounts th For Annualthe Year Report ended &3 0Accounts June 20 12 th For the Year ended 30 June 2012 Deposit Protection DepositFund Protection Board i Fund Board i Vision To be a best-practice deposit insurance scheme Mission The Year under Review under Year The Corporate Social Responsibility Social Corporate To promote and contribute to public confidence in the stability of the nation’s 23iii 12 12 financial system by providing a sound safety net for depositors of member institutions. Strategic Objectives • Promote an effective and efficient deposit insurance scheme • Enhance operational efficiency • Promote best practice Strategic Pillars • Strong supervision and regulation • Public confidence • Prompt problem resolutions • Public awareness • Effective coordination Corporate Values • Integrity • Professionalism • Team work • Transparency and accountability • Rule of Law Corporate Information The Year under Review under Year The Corporate Social Responsibility Social Corporate 12iv 23 Deposit Protection Fund Board CBK Pension House Harambee Avenue PO Box 45983 - 00100 Nairobi, Kenya Tel: +254 – 20 - 2861000 , 2863841 Fax: +254 – 20 - 2211122 Email : [email protected] Website: www.centralbank.go.ke Bankers Central Bank of Kenya, Nairobi Haile Selassie Avenue PO Box 60000 - 00200 Nairobi Auditors KPMG Kenya 16th Floor, Lonrho House Standard Street PO Box 40612 - 00100 Nairobi Table of Contents Statement from the Chairman of the Board..................................................................................6 -

Bank Code Finder

No Institution City Heading Branch Name Swift Code 1 AFRICAN BANKING CORPORATION LTD NAIROBI ABCLKENAXXX 2 BANK OF AFRICA KENYA LTD MOMBASA (MOMBASA BRANCH) AFRIKENX002 3 BANK OF AFRICA KENYA LTD NAIROBI AFRIKENXXXX 4 BANK OF BARODA (KENYA) LTD NAIROBI BARBKENAXXX 5 BANK OF INDIA NAIROBI BKIDKENAXXX 6 BARCLAYS BANK OF KENYA, LTD. ELDORET (ELDORET BRANCH) BARCKENXELD 7 BARCLAYS BANK OF KENYA, LTD. MOMBASA (DIGO ROAD MOMBASA) BARCKENXMDR 8 BARCLAYS BANK OF KENYA, LTD. MOMBASA (NKRUMAH ROAD BRANCH) BARCKENXMNR 9 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BACK OFFICE PROCESSING CENTRE, BANK HOUSE) BARCKENXOCB 10 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BARCLAYTRUST) BARCKENXBIS 11 BARCLAYS BANK OF KENYA, LTD. NAIROBI (CARD CENTRE NAIROBI) BARCKENXNCC 12 BARCLAYS BANK OF KENYA, LTD. NAIROBI (DEALERS DEPARTMENT H/O) BARCKENXDLR 13 BARCLAYS BANK OF KENYA, LTD. NAIROBI (NAIROBI DISTRIBUTION CENTRE) BARCKENXNDC 14 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PAYMENTS AND INTERNATIONAL SERVICES) BARCKENXPIS 15 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PLAZA BUSINESS CENTRE) BARCKENXNPB 16 BARCLAYS BANK OF KENYA, LTD. NAIROBI (TRADE PROCESSING CENTRE) BARCKENXTPC 17 BARCLAYS BANK OF KENYA, LTD. NAIROBI (VOUCHER PROCESSING CENTRE) BARCKENXVPC 18 BARCLAYS BANK OF KENYA, LTD. NAIROBI BARCKENXXXX 19 CENTRAL BANK OF KENYA NAIROBI (BANKING DIVISION) CBKEKENXBKG 20 CENTRAL BANK OF KENYA NAIROBI (CURRENCY DIVISION) CBKEKENXCNY 21 CENTRAL BANK OF KENYA NAIROBI (NATIONAL DEBT DIVISION) CBKEKENXNDO 22 CENTRAL BANK OF KENYA NAIROBI CBKEKENXXXX 23 CFC STANBIC BANK LIMITED NAIROBI (STRUCTURED PAYMENTS) SBICKENXSSP 24 CFC STANBIC BANK LIMITED NAIROBI SBICKENXXXX 25 CHARTERHOUSE BANK LIMITED NAIROBI CHBLKENXXXX 26 CHASE BANK (KENYA) LIMITED NAIROBI CKENKENAXXX 27 CITIBANK N.A. NAIROBI NAIROBI (TRADE SERVICES DEPARTMENT) CITIKENATRD 28 CITIBANK N.A. -

Commercial Banks Directory As at 30Th April 2006

DIRECTORY OF COMMERCIAL BANKS AND MORTGAGE FINANCE COMPANIES A: COMMERCIAL BANKS African Banking Corporation Ltd. Postal Address: P.O Box 46452-00100, Nairobi Telephone: +254-20- 4263000, 2223922, 22251540/1, 217856/7/8. Fax: +254-20-2222437 Email: [email protected] Website: http://www.abcthebank.com Physical Address: ABC Bank House, Mezzanine Floor, Koinange Street. Date Licensed: 5/1/1984 Peer Group: Small Branches: 10 Bank of Africa Kenya Ltd. Postal Address: P. O. Box 69562-00400 Nairobi Telephone: +254-20- 3275000, 2211175, 3275200 Fax: +254-20-2211477 Email: [email protected] Website: www.boakenya.com Physical Address: Re-Insurance Plaza, Ground Floor, Taifa Rd. Date Licenced: 1980 Peer Group: Medium Branches: 18 Bank of Baroda (K) Ltd. Postal Address: P. O Box 30033 – 00100 Nairobi Telephone: +254-20-2248402/12, 2226416, 2220575, 2227869 Fax: +254-20-316070 Email: [email protected] Website: www.bankofbarodakenya.com Physical Address: Baroda House, Koinange Street Date Licenced: 7/1/1953 Peer Group: Medium Branches: 11 Bank of India Postal Address: P. O. Box 30246 - 00100 Nairobi Telephone: +254-20-2221414 /5 /6 /7, 0734636737, 0720306707 Fax: +254-20-2221417 Email: [email protected] Website: www.bankofindia.com Physical Address: Bank of India Building, Kenyatta Avenue. Date Licenced: 6/5/1953 Peer Group: Medium Branches: 5 1 Barclays Bank of Kenya Ltd. Postal Address: P. O. Box 30120 – 00100, Nairobi Telephone: +254-20- 3267000, 313365/9, 2241264-9, 313405, Fax: +254-20-2213915 Email: [email protected] Website: www.barclayskenya.co.ke Physical Address: Barclays Plaza, Loita Street. Date Licenced: 6/5/1953 Peer Group: Large Branches: 103 , Sales Centers - 12 CFC Stanbic Bank Ltd. -

Effect of Cash Reserves on Performance of Commercial Banks in Kenya: a Comparative Study Between National Bank and Equity Bank Kenya Limited

International Journal of Academic Research in Business and Social Sciences Vol. 8 , No. 9, Sept. 2018, E-ISSN: 2222-6990 © 2018 HRMARS Effect of Cash Reserves on Performance of Commercial Banks in Kenya: A Comparative Study between National Bank and Equity Bank Kenya Limited Aloys Jared Oganda, Vitalis Abuga Mogwambo, Simeyo Otieno To Link this Article: http://dx.doi.org/10.6007/IJARBSS/v8-i9/4648 DOI: 10.6007/IJARBSS/v8-i9/4648 Received: 06 August 2018, Revised: 13 Sept 2018, Accepted: 29 Sept 2018 Published Online: 15 October 2018 In-Text Citation: (Oganda, Mogwambo, & Otieno, 2018) To Cite this Article: Oganda, A. J., Mogwambo, V. A., & Otieno, S. (2018). Effect of Cash Reserves on Performance of Commercial Banks in Kenya: A Comparative Study between National Bank and Equity Bank Kenya Limited. International Journal of Academic Research in Business and Social Sciences, 8(9), 685–704. Copyright: © 2018 The Author(s) Published by Human Resource Management Academic Research Society (www.hrmars.com) This article is published under the Creative Commons Attribution (CC BY 4.0) license. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this license may be seen at: http://creativecommons.org/licences/by/4.0/legalcode Vol. 8, No. 9, September 2018, Pg. 685 - 704 http://hrmars.com/index.php/pages/detail/IJARBSS JOURNAL HOMEPAGE Full Terms & Conditions of access and use can be found at http://hrmars.com/index.php/pages/detail/publication-ethics 685 International Journal of Academic Research in Business and Social Sciences Vol. -

KDIC Annual Report 2018

ANNUAL REPORT 2017 - 2018 ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED JUNE 30, 2018 Prepared in accordance with the Accrual Basis of Accounting Method under the International Financial Reporting Standards (IFRS) CONTENTS Key Entity Information..........................................................................................................1 Directors and statutory information......................................................................................3 Statement from the Board of Directors.................................................................................11 Report of the Chief Executive Officer...................................................................................12 Corporate Governance statement........................................................................................15 Management Discussion and Analysis..................................................................................19 Corporate Social Responsibility...........................................................................................27 Report of the Directors.......................................................................................................29 Statement of Directors' Responsibilities................................................................................30 Independent Auditors' Report.............................................................................................31 Financial Statements: Statement of Profit or Loss and other Comprehensive Income...................................35 -

Challenges Facing the Development of Islamic Banking. Lessons from the Kenyan Experience

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by International Institute for Science, Technology and Education (IISTE): E-Journals European Journal of Business and Management www.iiste.org ISSN 2222-1905 (Paper) ISSN 2222-2839 (Online) Vol.5, No.22, 2013 Challenges Facing the Development of Islamic Banking. Lessons from the Kenyan Experience Shamim Njeri Kinyanjui Jomo Kenyatta University of Agriculture and Technology Abstract The purpose of the study was to investigate the challenges facing the development of Islamic banking in Kenya. The research designed for study was a case study approach focusing on four Islamic compliant banks in Kenya. These are: - First Community Bank; Gulf African Bank; Dubai Bank; Kenya commercial Bank Ltd and Barclays Bank Ltd. The population of the study consisted of 33 customers, who were the holders of accounts in the respective banks and 11 managers. Sample data collected by use of questionnaires administered by the researcher and a research assistant. Data analysis method used is based on the quantitative approach using descriptive statistics: mean, mode, and median. Frequency tabulations and cross tabulations were used to bring out the finding of the study. The study revealed Islamic banking compliant was driven by religious compliance and customers need being met. It also revealed that continuous review and improvement of shariah compliant products together with diversifying market niche will lead to drastic development and marketing of Islamic banking products. From the study the following conclusions were drawn: firstly, the factors that influence development of Islamic banking products in Kenya are purely religious compliance and customers need being met. -

The Kenya Gazette

SPECIAL ISSUE THE KENYA GAZETTE Published by Authority of the Republic of Kenya (Registered as a Newspaperat the G.P.O.) Vol. CXVII—No.85 NAIROBI, 14th August, 2015 Price Sh. 60 GAZETTE NOTICENO. 5968 Corporation, the receiver for Dubai Bank Kenya Limited (in THE KENYA DEPOSIT INSURANCE ACT Receivership) declares that with effect from the 14th August, 2015, and until such time as normal operations of Dubai Bank Kenya (No. 10 of2012) Limited (In Receivership) shall have resumed, a moratorium shall IN THE MATTEROF DUBAI BANK KENYA LIMITED apply equally and without discrimination to the liabilities of the Dubai Bank Kenya Limited. (in Receivership) APPOINTMENT OF RECEIVER Accordingly— IN EXERCISEofthe powers conferred by sections 43 as read with (@) no deposits on any types of accounts operated by Dubai Bank section 53 (1) of the Kenya Deposit Insurance Act, 2012, the Central Kenya Limited (In Receivership) shall be paid nor shall any Bank of Kenya appoints the Kenya Deposit Insurance Corporation as claims by any otherclass of creditors be met; the receiver for Dubai Bank Kenya Limited, for a period of twelve months, with effect from the 14th August, 2015. (6) the maximum rate of interest which shall accrue on deposits Any claims and matters relating to Dubai Bank Kenya Limited (In and other debts payable by Dubai Bank Kenya Limited (In Receivership) shall be directed to the receivers at CBK Pension House, Receivership) during the period of the moratorium shall be 3rd Floor, Harambee Avenue; P.O. Box 45983-00100, Nairobi, Tel. limited to the minimum rate determined by the Central Bank of 020-2863841; E-mail [email protected] Kenya, provided that there shall be no obligation on Dubai Dated the14th August, 2015. -

Financial Innovations and Performance of Commercial Banks in Kenya

International Journal of Economics, Commerce and Management United Kingdom Vol. III, Issue 5, May 2015 http://ijecm.co.uk/ ISSN 2348 0386 FINANCIAL INNOVATIONS AND PERFORMANCE OF COMMERCIAL BANKS IN KENYA Korir Millicent Cherotich School of Business and Economics, University of Nairobi, Nairobi, Kenya [email protected] William Sang School of Business and Economics, University of Nairobi, Nairobi, Kenya [email protected] Adam Shisia School of Business and Economics, Mount Kenya University, Thika, Kenya [email protected] Charles Mutung’u School of Business and Economics, Mount Kenya University, Thika, Kenya [email protected] Abstract Kenya’s banking system has not been exception as far as financial innovations is concerned. The major impetus for financial innovation has been globalization of financial systems, deregulation, and great advances in technologies. The objective of this study was to establish the effect of financial innovations on financial performance of commercial banks in Kenya. This study relied on secondary data. It adopted a census where all the 44 banks were used in the study and there was no sampling since the population size was small. The study found out that there is a strong relationship between financial innovations and financial performance. The study concludes that financial innovations positively affect financial performance. Based on these results, the study recommends that financial innovation information should be available particularly to regulatory and advisory bodies for guidance to the commercial banks on the need Licensed under Creative Common Page 1242 International Journal of Economics, Commerce and Management, United Kingdom to craft and employ sound strategies geared towards continuously embracing innovativeness since innovation leads to improved financial performance. -

The Central Bank of Kenya Act

CAP 491 CENTRAL BANK OF KENYA ACT LAWS OF KENYA The Central Bank of Kenya Act CHAPTER 491 Note This edition incorporates amendments up To 1st January 2014 PRINTED AND PUBLISHED BY CENTRAL BANK OF KENYA FOR INTERNAL USE ONLY THE CENTRAL BANK OF KENYA ACT ARRANGEMENT OF SECTIONS PART 1 – PRELIMINARY Section 1. Short title 2. Interpretation PART II – ESTABLISHMENT, CONSTITUTION AND OBJECTS 3. Establishment of Bank and legal status 4. Principal object of the Bank 4A Other objects of the Bank 4B Monetary Policy Statements 4C Consultations on Monetary policy 4D Monetary Policy Committee 5. Head office and branches 6. Agents 7. Exemption from tax PART III – CAPITAL AND RESERVES 8. Authorized Capital of Bank 9. General Reserve Fund PART IV – MANAGEMENT 10. Board of Directors 11. Constitution of Board 12. Meetings of Board 12A. Delegation by the Board 13. Governor 13A Common Seal and Power of Attorney 13B. Deputy Governor 14. General Disqualifications for all Board Members 15. Special disqualifications for Governor and Deputy Governor 16. Remuneration 17. Preservation of Secrecy 18. Declaration of Interest PART V – CURRENCY 19. Currency of Kenya 20. External Value of the Shilling 21. Use of Kenya shilling 22. Issue of Notes and Coins, Legal Tender and Withdrawal 2 CAP 491 THE CENTRAL BANK OF KENYA ACT 23. (Spent) 24. Exchange of Mutilated Notes and Coins 25. Bills of Exchange, Promissory Notes, Etc PART VI – EXTERNAL RELATIONS 26. Reserve of External Assets 27. Dealings in Gold and Foreign Exchange 28. Institutions with which Bank may Deal in Foreign Exchange 29. Relations with Foreign Central Banks, Foreign Banks and Foreign Financial Institutions 30. -

EFFECT of ISLAMIC BANKING DEVELOPMENT on ECONOMIC GROWTH –A Case of the Kenyan Economy

International Journal of Scientific Research and Innovative Technology Vol. 7 No. 2; March 2020 EFFECT OF ISLAMIC BANKING DEVELOPMENT ON ECONOMIC GROWTH –A case of the Kenyan Economy Abdullahi Mohamed Hassan School of Economics, University of Nairobi, Kenya Email:[email protected] Benedicto Onkoba Ongeri School of Economics University of Nairobi Email: [email protected]/[email protected] ABSTRACT Islamic banking is growing fast in Kenya and is gradually gaining acceptance both locally and internationally. The inauguration of first fully-fledged Islamic banking in Kenya can be traced back in 2008 when it was initiated. The study investigated the effect of Islamic banking development on economic growth in Kenya using five Islamic banks in Kenya. To serve the purpose of the study, appropriate variables adopted which include Islamic banks’ financing funds given by Islamic banks to private sector through modes of financing as a proxy for the development of Islamic finance system, FDI and Trade as the independent variables while Real Gross Domestic Product (RGDP) was dependent variable measuring economic growth. This study carried out an ECM model for the purpose of analysis to achieving all the stated objectives. A cointegration test proved a cointegration between the dependent and independent variables with a positive and significant link between the Islamic Bank finance and the economic growth in Kenya. There was also a causal relationship between the economic growth and Islamic bank finance in Kenya from the Granger causality test. This study concluded by proposing appropriate policies to be taken to encourage Islamic bank finance because it spurs economic growth. -

DAVID NTONGAI.Pdf

ORGANIZATION CULTURE, STRATEGY OPERATIONALISATION AND PERFORMANCE OF COMMERCIAL BANKS IN KENYA DAVID NTONGAI A THESIS SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENT FOR THE CONFERMENT OF THE DOCTOR OF PHILOSOPHY DEGREE IN BUSINESS ADMINISTRATION AND MANAGEMENT (STRATEGIC MANAGEMENT) OF KENYA METHODIST UNIVERSITY OCTOBER 2020 I DECLARATION This Thesis is my original work and has not been presented for a degree in any other university. Signature………………………… Date …………………………… David Ntongai BUS-4-0188-1-2015 This Thesis has been submitted for examination with our approval as University Supervisors: Signature……………………….… Date……………………… Prof. (Eng.) Thomas A. Senaji (PhD) School of Business and Economics Kenya Methodist University Signature……………………….… Date……………………… Prof. George K. King’oriah, PhD., MBS University of Nairobi ii DEDICATION To my mother for instilling in me virtues of hard work, responsibility, discipline, passion and aspirations for greater things in life and for making me who I am, your prayers and wise counsel will forever be treasured. To my wife, your encouragement and patience during the long and many hours of absence cannot be taken for granted. iii ACKNOWLEDGEMENTS I sincerely salute my University supervisors Prof. (Eng.) Thomas A. Senaji and Prof. George K. King’oriah for their effective guidance and continuous availability for consultation. To all other lecturers in KEMU who guided me throughout my course work, I thank you. Special thanks to all members of my family, whose financial support and moral encouragement made this study possible; thank you for being there for me. All my friends and colleagues I acknowledge you, for the encouragement. I sincerely appreciate and acknowledge all my respondents in this research who took their valuable time to respond.