Resource Full

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 Festival of the Arts Media

FOR IMMEDIATE RELEASE CONTACT: Michelle Van Swearingen Communications Director (405) 270-4896 [email protected] 53RD ANNUAL FESTIVAL OF THE ARTS April 23-28 • Bicentennial Park The 2019 Festival of the Arts is right around the corner! Here are some fun things to look forward to this year. Featured Artist “Born in a Day” was created by Julie and Kevin Zuckerman to honor the great state of Oklahoma and legacy of the Native American population. The main image was inspired by the Great Eagle Feather and Olive Branch from the state flag. The background color represents the state wildflower, the Indian Blanket. The other vibrant colors honor the pride of the community such as the Oklahoma City Thunder, Oklahoma City Dodgers, Oklahoma City Energy, etc. Finally, the symbolism of the painting is to be bright, be bold, and make a difference in your community. Festival Co-Chairs Susan Whittington and Randy Lewis The 2019 Festival Co-Chairs are available for media interviews upon request. A list of story ideas can be found in the 2019 Festival Media Kit, available by request from Arts Council OKC Communications Director Michelle Van Swearingen (contact info listed above). Artists Square, International Food Row, Performing Arts As always, the Festival of the Arts promises hundreds of talented artists, engaging performances and an abundance of delicious treats and food demonstrations. With new and returning favorites, there is something for everyone to enjoy. The full schedule can be found online: https://www.artscouncilokc.com/festival-of-the-arts/ Opening Ceremonies Continued Oklahoma City Mayor David Holt will help us kick off the Festival in style with live performances and a catered lunch for our Fest-Officios. -

Financial Research & Analysis

Financial Research & Analysis Oil and Gas Accounting Hot Topics 2009 Webcast March 12, 2009 Julie Hilt Hannink [email protected] + 301.354.9919 Today’s Agenda Commodity Price Drives Impairment Charges Borrowing Bases and Covenant Compliance Modernization of SEC Reserve Disclosure LIFO Repeal and Other US Budget Proposals www.riskmetrics.com 2 Commodity Price Plunge Drove Impairments in 4Q08 Relative lack of impairments and price-related impairment charges over the past 6-7 years due to rising oil prices and decent natural gas price trends. Period end pricing most important for Full Cost (FC) companies as ceiling test charges based on those prices. This will change with new SEC rules as it goes to 12-month average. Although 3Q06 and 4Q06 were problematic on the natural gas price front, improved price by report date meant limited impairments in those quarters. Chart 1: Quarterly Closing Oil and Natural Gas Prices 2001-2008 - Price Plunge Expected to Affect Reserve Estimates and Impairments $160 $16 Oil -WTI $140 Natural Gas - HH $14 $120 $12 $100 $10 Natural gas price average $6.13/mcf $80 $8 North Slope $60 US Lower 48 $6 $40 $4 $20 Oil price average $53.26/bbl $2 $0 $0 1Q01 3Q01 1Q02 3Q02 1Q03 3Q03 1Q04 3Q04 1Q05 3Q05 1Q06 3Q06 1Q07 3Q07 1Q08 3Q08 Source: NYMEX, RiskMetrics analysis www.riskmetrics.com 3 Full Cost Ceiling Test Charge Risk Fulfilled Based on high capital spending during the first part of 2009 meant high risk of impairments for companies listed in Chart 2. Significant in the table below are SGY which took $1.3 billion ($850 million AT) impairment charge plus another $466 million in goodwill impairment after spending up for Bois D’Arc and HK which took a $951 million ($600 million AT) impairment charge. -

Thesis Rests with Its Author

University of Bath PHD Sensemaking, metaphor and mission in an Anglican context Roberts, Vaughan S Award date: 1999 Awarding institution: University of Bath Link to publication Alternative formats If you require this document in an alternative format, please contact: [email protected] General rights Copyright and moral rights for the publications made accessible in the public portal are retained by the authors and/or other copyright owners and it is a condition of accessing publications that users recognise and abide by the legal requirements associated with these rights. • Users may download and print one copy of any publication from the public portal for the purpose of private study or research. • You may not further distribute the material or use it for any profit-making activity or commercial gain • You may freely distribute the URL identifying the publication in the public portal ? Take down policy If you believe that this document breaches copyright please contact us providing details, and we will remove access to the work immediately and investigate your claim. Download date: 07. Oct. 2021 Sensemaking, Metaphor and Mission in an Anglican Context Submitted by Vaughan S Roberts for the degree of PhD of the University of Bath 1999 Attention is drawn to the fact that copyright of this thesis rests with its author. This copy of the thesis has been supplied on the condition that anyone who consults it is understood to recognise that its copyright rests with its author and that no quotation from the thesis and no information derived from it may be published without prior written consent of the author. -

Building Excellence

Barratt Developments PLC Building excellence Annual Report and Accounts 2017 Annual Report and Accounts 2017 Inside this report 1 45 113 175 Strategic Report Governance Financial Statements Other Information 1 Key highlights 46 The Board 114 Independent Auditor’s Report 175 KPI definitions and why we measure 2 A snapshot of our business 48 Corporate governance report 119 Consolidated Income Statement 176 Glossary 4 Our performance and financial highlights 60 Nomination Committee report 119 Statement of Comprehensive Income 177 Other Information 6 How we create and preserve value 65 Audit Committee report 120 Statement of Changes in 8 Chairman’s statement 74 Safety, Health and Environment Shareholders’ Equity – Group 10 Key aspects of our market Committee report 121 Statement of Changes in 76 Remuneration report Shareholders’ Equity – Company 12 Chief Executive’s statement Notice regarding limitations on Directors’ liability under 106 Other statutory disclosures 122 Balance Sheets English law 17 Our Strategic priorities Under the Companies Act 2006, a safe harbour limits the 112 Statement of Directors’ 123 Cash Flow Statements liability of Directors in respect of statements in, and omissions from, the Strategic Report contained on pages 1 to 44 and the Our principles Responsibilities 124 Notes to the Financial Statements Directors’ Report contained on pages 45 to 112. Under English Law the Directors would be liable to the Company (but not to 34 Keeping people safe any third party) if the Strategic Report and/or the Directors’ Report contains errors as a result of recklessness or knowing 35 Being a trusted partner misstatement or dishonest concealment of a material fact, 36 Building strong but would not otherwise be liable. -

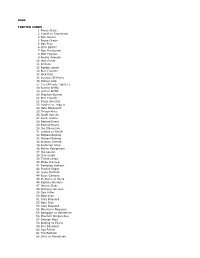

Dr. Larry and Sandra Aaron

Dr. Larry and Sandra Aaron Lois and Christy Adams Gary and Jutta Aaron William and Debora Adams Gary Aaron Jim and Sandra Adams Lucile Aasmundstad Gary Adamson Debra Aasmundstad Donna Adamson John Aasmundstad Kurt and Martha Adamson Stephen and Donna Abb Alfred and Mary Addington James and Wanda Abbott Robert Addis Jeannie Abbott Michael and Sallie Adelman Austin and Erica Abbott Anita and Stephen Adelson Issa and Yusra Abboud Gary and Lois Ades C.L. Abercrombie Fred and Margaret Adkins Nina Abernathy Rodney and Dianna Adkison George and Sharron Abide Bill Adkisson George and Kimberly Abide Richard and Judy Adler Gerald and Judith Abrahamson Louis and Evelyn Adler Jerry and Mary Abram Robert and Julie Aenchbacher Annie Abrams Elaine Agather Harry and Kathleen Aburrow Susan Agee Bill and Bootsie Ackerman George and Katherine Aggus Sandra and Stan Ackerman George and Jody Agnacian Michael and Sharon Ackerson Alex and Sharon Aguila Kay Aclin Guillermo Aguirre and Mariana Puga Glenda Jane Acord Selina Aguirre Carlos and Aileen Acosta Michael and Gayle Ahearn Jan Adair Lindsey Ahlen Rob and Kendra Adair Richard Ahlstrand Ed and Marinell Adair Karen Ahuja Joan Adam Henry Aiken Carol Adam Robert and Rosa Ainley JoAnne Adamek Alan and Jan Ainley Kerrie Adams William and Sandra Ake Linda Adams Brent and LeAnn Akers Sara Adams Stan Akins and Sarah Patrick Gary and Carol Adams Glen and Jannette Akridge Wes and Marci Adams Shamsul and Shamsad Alam Paul and Betty Adams Angel Alamo and Jacqueline Rivera William and Katherine Adams Frank and Carol Albee -

2015 Topps UFC Chronicles Checklist

BASE FIGHTER CARDS 1 Royce Gracie 2 Gracie vs Jimmerson 3 Dan Severn 4 Royce Gracie 5 Don Frye 6 Vitor Belfort 7 Dan Henderson 8 Matt Hughes 9 Andrei Arlovski 10 Jens Pulver 11 BJ Penn 12 Robbie Lawler 13 Rich Franklin 14 Nick Diaz 15 Georges St-Pierre 16 Patrick Côté 17 The Ultimate Fighter 1 18 Forrest Griffin 19 Forrest Griffin 20 Stephan Bonnar 21 Rich Franklin 22 Diego Sanchez 23 Hughes vs Trigg II 24 Nate Marquardt 25 Thiago Alves 26 Chael Sonnen 27 Keith Jardine 28 Rashad Evans 29 Rashad Evans 30 Joe Stevenson 31 Ludwig vs Goulet 32 Michael Bisping 33 Michael Bisping 34 Arianny Celeste 35 Anderson Silva 36 Martin Kampmann 37 Joe Lauzon 38 Clay Guida 39 Thales Leites 40 Mirko Cro Cop 41 Rampage Jackson 42 Frankie Edgar 43 Lyoto Machida 44 Roan Carneiro 45 St-Pierre vs Serra 46 Fabricio Werdum 47 Dennis Siver 48 Anthony Johnson 49 Cole Miller 50 Nate Diaz 51 Gray Maynard 52 Nate Diaz 53 Gray Maynard 54 Minotauro Nogueira 55 Rampage vs Henderson 56 Maurício Shogun Rua 57 Demian Maia 58 Bisping vs Evans 59 Ben Saunders 60 Soa Palelei 61 Tim Boetsch 62 Silva vs Henderson 63 Cain Velasquez 64 Shane Carwin 65 Matt Brown 66 CB Dollaway 67 Amir Sadollah 68 CB Dollaway 69 Dan Miller 70 Fitch vs Larson 71 Jim Miller 72 Baron vs Miller 73 Junior Dos Santos 74 Rafael dos Anjos 75 Ryan Bader 76 Tom Lawlor 77 Efrain Escudero 78 Ryan Bader 79 Mark Muñoz 80 Carlos Condit 81 Brian Stann 82 TJ Grant 83 Ross Pearson 84 Ross Pearson 85 Johny Hendricks 86 Todd Duffee 87 Jake Ellenberger 88 John Howard 89 Nik Lentz 90 Ben Rothwell 91 Alexander Gustafsson -

State of Emergency in Kenya North-Eastern Region. - Regional Elections

Keesing's Record of World Events (formerly Keesing's Contemporary Archives), Volume 10, April, 1964 Kenya, Somalia, Kenya, Page 20034 © 1931-2006 Keesing's Worldwide, LLC - All Rights Reserved. Apr 1964 - Border Incidents. - State of Emergency in Kenya North-Eastern Region. - Regional Elections. The continued unrest in the North-Eastern Region of Kenya and the activities of nomadic Somali bands of armed shiftas caused Mr. Kenyatta to call an urgent Cabinet meeting, also attended by Major-General Ian Freeland (G.O.C., British Land Forces, Kenya) and Mr. Richard Catling (Inspector-General of Police), at Gatundu on Dec. 25, 1963. After the meeting the Government proclaimed a state of emergency throughout the Region and set up a five-mile-deep prohibited zone along the Kenya-Somalia border, excluding the settlements of Mandera and El Wak. Although this was not known at the time of the Cabinet meeting, 50 armed Somali tribesmen had on that date raided the police post at Msabubu, near Galole on the River Tuna, one policeman, a policeman's wife, and a Pokomo tribesman helping the police being killed and four other policemen wounded: a number of Somalis were killed and injured. After this raid a delegation of anti-secessionists asked Mr. Kenyatta to be allowed to take the law into their own hands to deal with the raiding shifta gangs. Mr. T. P. Randle, the Region's Civil Secretary, reported that resentment against the raiders’ terrorism was growing. and that the chairman of the Northern Province People's Progressive Party—the main secessionist party—had withdrawn all support for the shiftas (whose leader was Ma’alim Mohamed Stamboul) and had promised to work for the party's objectives by constitutional means. -

2018-Summer.Pdf

EFFECT OF BOOT WEIGHT For performance unmatched AND SOLE by any other waterproof, Read the NIOSH boot study FLEXIBILITY breathable barrier globeturnoutgear.com/supraflex Gait and Physiological Responses of Firefighters in Stepping Over Obstacles SUPRAFLEX™ PERFORMS LIKE A BOOT. FEELS LIKE A SNEAKER. Introducing SUPRAFLEX™, our state-of-the-science boots with segmented flex panels. Because scientific studies have proven that lighter weight and more flexible footwear isn’t just about comfort – it’s about safety. Designed to meet the new challenges you face every day to help keep you safe and healthy throughout your career and beyond. Also available with Vibram® Arctic Grip Pro soles for unprecedented grip on wet ice. globeturnoutgear.com ATHLETIC GEAR FOR FIREFIGHTERS.TM GLOBE, SUPRAFLEX, and designs are trademarks or registered trademarks of Globe Holding Company, LLC. GORE, CROSSTECH, and designs are trademarks of W.L. Gore & Associates, Inc. VIBRAM and designs are registered trademarks of Vibram S.p.A. Summer 2018 Fire Fighter Quarterly vol. 101 no.3 20 34 44 Cover Features Departments 12 IAFF 54th Convention 18 Disaster in the Carolinas n 5 From the General President Celebrating our union’s IAFF provides disaster relief after centennial and setting Hurricane Florence n 7 From the General the stage for the next Secretary-Treasurer 100 years 20 California Wildfires n Letters IAFF members on the fire line of worst 9 PHOTOS BY JOCELYN AUGUSTINO fire season in state’s history n 11 Noteworthy News 22 Violence Threatens EMS Personnel n 28 Across the IAFF Targeted attacks on the rise during EMS response n 46 Retirees 24 Rebuilding Lives n 56 Never Forget IAFF Center of Excellence alumni share n 58 Last Alarm their stories of recovery and hope Download the IAFF Frontline App The IAFF app is available for Apple, Android Connect with and Blackberry devices. -

© 2012 Bad Boy Brands. Todos Os Direitos Reservados. Agradecimentos Fotógrafos:Marcelo Kura, Pedro Collon, André Schiliró, Haroldo Nogueira, Tsuno

© 2012 Bad Boy Brands. Todos os direitos reservados. Agradecimentos Fotógrafos:Marcelo Kura, Pedro Collon, André Schiliró, Haroldo Nogueira, Tsuno. Revista Gracie e Revista Tatame. Jornalista responsável: Anna Carolina Cortez Diagramação e tratamento: Fábio Vantini Direção de Arte - Big Blue Licenses - Monica Arruda e Carlos Ameni Impressão:Type Brasil INTRODUÇÃO Bad Boy, a primeira em lutas! A Bad Boy chegou ao Brasil em 1992 através de Marco Antônio Merhej e Nair Afonso, um casal de surfistas que possuía uma marca de surf, a ST COMP. A Bad Boy se tornou referência nacional. Patrocinou atletas e eventos, formou campeões e apoiou as lutas até mesmo quando os olhos da população estavam voltados para outras modalidades de esporte. E, no momento em que os holofotes se voltam para os ringues e mostram ao mundo um pouco mais sobre as artes marciais, a Bad Boy mostra que sempre esteve presente nos tatames, nos ringues e na vida dos atletas. Nas páginas a seguir apresentamos um pouco do que fez a Bad Boy se tornar a “Imagem da Vitória, a Marca do Guerreiro”. 1982 O INÍCIO A Bad Boy surgiu no início dos anos 80, em San Diego, Califórnia como uma marca local de surf, skate e motorsports, patrocinando atletas com personalidade forte e de atitude como o Havaiano Johnny Boy Gomes. Dez anos depois da criação da Bad Boy, dois novos personagens entraram em cena: Marco Antônio Merhej e Nair Afonso. Para promover a ST Comp, loja de surf da qual eram donos, eles realizavam campeonatos de surf no Brasil e viajavam para todos os cantos do mundo para fazer pesquisas de mercado. -

Corporate Governance Failings and Performance Enhancing Drugs

A tale of two football codes: Corporate governance failings and performance enhancing drugs Abstract In 2013, two well-known Australian sporting clubs – the Essendon Football Club (AFL) and the Cronulla Sharks Rugby League Club (NRL), were both investigated for performance enhancing drugs in their elite sports science programs. News of the initial investigations was met with disbelief by supporters, players, club administrators and the respective governing bodies – the AFL and the NRL. What followed was a period of intense and rigorous independent investigation by Australian Sports Anti-Doping Authority (ASADA) and the AFL and the NRL. In August and December 2013 respectively, severe sanctions were handed down to the Essendon Football Club and the Cronulla Sharks. This paper provides an overview of the background to the saga in each of the respective clubs. It provides a time-line of the events before, during and after the initial investigation by the independent bodies. The paper concludes by linking the events at the respective clubs, to short-comings in a number of important corporate governance practices. Keywords: accountability, corporate governance, international sports associations, crisis, performance enhancing drugs, National Rugby League (NRL), Australian Football League (AFL) 1 A tale of two football codes: Corporate governance failings and performance enhancing drugs 1. Introduction Financial stakes involved in professional sport can create powerful incentives for the use of performance enhancing substances (Rapp 2009). Much empirical evidence supports a strong link between on-field results and club revenues (e.g. Morrow 1999; Barajas, Fernandez- Jardon et al. 2005; Pinnuck and Potter 2006; Bernile and Lyandres 2011; Bell, Brooks et al. -

Applications and Decisions

THE TRAFFIC COMMISSIONER FOR THE SCOTTISH TRAFFIC AREA APPLICATIONS AND DECISIONS PUBLICATION NUMBER: 1880 PUBLICATION DATE: 25 March 2013 OBJECTION DEADLINE DATE: 15 April 2013 Correspondence should be addressed to: Scottish Traffic Area Office Hillcrest House 386 Harehills Lane Leeds LS9 6NF Telephone: 0300 123 9000 Fax: 0113 248 8521 Website: www.gov.uk The public counter at the above office is open from 9.30am to 4pm Monday to Friday The next edition of Applications and Decisions will be published on: 08/04/2013 Publication Price 60 pence (post free) This publication can be viewed by visiting our website at the above address. It is also available, free of charge, via e-mail. To use this service please send an e-mail with your details to: [email protected] APPLICATIONS AND DECISIONS Important Information All correspondence relating to public inquiries should be sent to: Office of the Traffic Commissioner Scottish Traffic Area Level 6 The Stamp Office 10 Waterloo Place Edinburgh EH1 3EG The public counter in Edinburgh is open for the receipt of documents between 9.30am and 4pm Monday to Friday. Please note that no payments relating to goods vehicles can be made at this counter. General Notes Layout and presentation – Entries in each section (other than in section 5) are listed in alphabetical order. Each entry is prefaced by a reference number, which should be quoted in all correspondence or enquiries. Further notes precede each section, where appropriate. Accuracy of publication – Details published of applications reflect information provided by applicants. The Traffic Commissioner cannot be held responsible for applications that contain incorrect information. -

Larry Nichols Served As Devon’S CEO Since 1980 and Assumed the Company’S Chairmanship in 2000

Larry Nichols Served as Devon’s CEO since 1980 and assumed the company’s chairmanship in 2000. Chapter 1 – 1:24 Introduction Announcer: Devon Energy is a leading independent energy company engaged primarily in the exploration, development and production of natural gas and oil. The company’s operations are concentrated in various North American onshore areas that extend from the Canadian Arctic to the Gulf Coast in the United States. But let’s go back to the beginning. John Nichols, the father of Larry Nichols, went to work as a public accountant in Oklahoma City in 1936. The tax knowledge he gained while working for several oil and gas companies helped him create the world’s first oil and gas drilling fund registered with the Securities and Exchange Commission. It changed the way drilling programs were funded in this country until Congress restructured tax laws in 1986. In 1971, father and son co-founded Devon Energy and Larry Nichols assumed the company’s chairmanship in 2000. Prior to Devon Energy, Larry served as a law clerk to both Associate Justice Tom Clark and Chief Justice Earl Warren of the Unites States Supreme Court. Devon is the only U.S. energy company to be listed among the Fortune 500, the Fortune World’s Most Admired Companies and the Fortune 100 Best Companies to work for. And it all started with four and a half employees and a shared receptionist. Larry Nichols tells the story for Voices of Oklahoma made possible by those who believe in preserving Oklahoma’s legacy one voice at a time on VoicesofOklahoma.com.