Minimizing Asymmetric Information in Online Markets Through Knowledge Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Markets in Higher Education: Can We Still Learn from Economics' Founding Fathers?* Abstract

Research & Occasional Paper Series: CSHE.4.06 UNIVERSITY OF CALIFORNIA, BERKELEY http://cshe.berkeley.edu/ MARKETS IN HIGHER EDUCATION: CAN WE STILL LEARN * FROM ECONOMICS’ FOUNDING FATHERS? March 2006 Pedro Nuno Teixeira Assistant Professor of Economics; Research Associate, CEMPRE and CIPES University of Porto and Visiting Scholar, Center for Studies in Higher Education, UC Berkeley Copyright 2006 Pedro Nuno Teixeira, all rights reserved. ABSTRACT Markets or market-like mechanisms are playing an increasing role in higher education, with visible consequences both for the regulation of higher education systems as a whole, as well as for the governance mechanisms of individual institutions. This article traces the history of economists’ views on the role of education, from Adam Smith, John Stuart Mill, Alfred Marshall, and Milton Friedman, to present-day debates about the relevance of market economies to higher education policy. Recent developments in higher education policy reflect both the rising strength of market mechanisms in higher education worldwide, and a certain ambivalence about these developments. The author argues that despite the peculiarities of the higher education sector, economic theory can be a very useful tool for the analysis of the current state of higher education systems and recent trends in higher education policy. Introduction Markets or market-like mechanisms are playing an increasing role in higher education, with visible consequences both for the regulation of higher education (HE) * The author is Assistant Professor in the Economics Department at the University of Porto and Research Associate of CEMPRE (Centre for Macroeconomics and Forecasting) and CIPES (Portuguese National Research Centre on Higher Education Policy). -

Information Asymmetry and the Protection of Ordinary Investors

William & Mary Law School William & Mary Law School Scholarship Repository Faculty Publications Faculty and Deans 11-2019 Information Asymmetry and the Protection of Ordinary Investors Kevin S. Haeberle William & Mary Law School, [email protected] Follow this and additional works at: https://scholarship.law.wm.edu/facpubs Part of the Securities Law Commons Repository Citation Haeberle, Kevin S., "Information Asymmetry and the Protection of Ordinary Investors" (2019). Faculty Publications. 1954. https://scholarship.law.wm.edu/facpubs/1954 Copyright c 2019 by the authors. This article is brought to you by the William & Mary Law School Scholarship Repository. https://scholarship.law.wm.edu/facpubs Information Asymmetry and the Protection of Ordinary Investors Kevin S. Haeberle* To some, the reductions in information asymmetry provided by the main securities-specific disclosure, fraud, and insider-trading laws help ordinary investors in meaningful ways. To others, whatever their larger social value, such reductions do little, if anything for these investors. For decades, these two sides of this investor-protection divide have mostly talked past each other. This Article builds on economic theory to reveal something striking: The reductions in information asymmetry provided by the core securities laws likely impose a long-overlooked cost on buy-and-hold ordinary investors. More specifically, I explain why there is much reason to believe that the reductions take away investment return from these investors, while providing them with only limited benefits. Thus, the article presents a serious challenge to conventional wisdom on information asymmetry and the protection of ordinary investors, and argues in favor of a shift in investor-protection efforts away from the main securities laws and to areas of regulation that have received relatively little attention to date. -

Asymmetric Information Along the Food Supply Chain: a Review of the Literature

Asymmetric information along the food supply chain: a review of the literature Francesca Minarelli1, Francesco Galioto1, Meri Raggi2, Davide Viaggi1 1Department of Agricultural Sciences, University of Bologna 2Department of Statistical Sciences, University of Bologna Abstract Market failure occurs when the market is not able to reach optimal output. In literature, among the main causes of market failure there is asymmetric information. Asymmetric information occurs when parties involved in a transaction are not equally informed. There has been a considerable increase in attention on asymmetric information in economic literature over the last twenty years in several fields, such as agro-environmental scheme payments, food quality and chain relationships. The literature reveals that the agri-food sector represents a field particularly exposed to the effect of asymmetric information. In particular, issues are related on the lack of information on quality, price and safety that frequently occurs in the transactions along the supply chain until the final consumer. Many actions in terms of regulation and policies have been undertaken in order to control attributes in the food transactions, however there is still need to improve conditions in order to achieve a more efficient and competitive market. The purpose of the paper is to review the literature on asymmetric information issues affecting the agri-food chain, the main solutions proposed and the modeling approaches applied in economic literature to understand asymmetric information along the food supply chain. Keywords: Asymmetric Information, food supply chain, contracts 1. Introduction Asymmetric information occurs when parties involved in an economic transaction are not equally informed and does not allow society from enhance the resource first-best allocation. -

An Introduction to the Law & Economics of Information

Columbia Law School Scholarship Archive Faculty Scholarship Faculty Publications 2014 An Introduction to the Law & Economics of Information Tim Wu Columbia Law School, [email protected] Follow this and additional works at: https://scholarship.law.columbia.edu/faculty_scholarship Part of the Law Commons Recommended Citation Tim Wu, An Introduction to the Law & Economics of Information, COLUMBIA LAW & ECONOMICS WORKING PAPER NO. 482; COLUMBIA PUBLIC LAW RESEARCH PAPER NO. 14-399 (2014). Available at: https://scholarship.law.columbia.edu/faculty_scholarship/1863 This Working Paper is brought to you for free and open access by the Faculty Publications at Scholarship Archive. It has been accepted for inclusion in Faculty Scholarship by an authorized administrator of Scholarship Archive. For more information, please contact [email protected]. An Introduction to the Law & Economics of Information Tim Wu† Information is an extremely complex phenomenon not fully understood by any branch of learning, yet one of enormous importance to contemporary economics, science, and technology. (Gleick 2012, Pierce 1980). Beginning from the 1970s, economists and legal scholars, relying on a simplified “public good” model of information, have constructed an impressively extensive body of scholarship devoted to the relationship between law and information. The public good model tends to justify law, such as the intellectual property laws or various forms of securities regulation that seek to incentivize the production of information or its broader dissemination. A review of the last several decades of scholarship based on the public choice model suggests the following two trends. First, scholars have extended the public good model of information to an ever-increasing number of fields where law and information intersect. -

Essays on Information Asymmetry in Financial Market

The London School of Economics and Political Science Essays on Information Asymmetry in Financial Market Shiyang Huang A thesis submitted to the Department of Finance of the London School of Economics for the degree of Doctor of Philosophy, London. September 2014 1 Declaration I certify that the thesis I have presented for examination for the MPhil/PhD degree of the London School of Economics and Political Science is solely my own work other than where I have clearly indicated that it is the work of others (in which case the extent of any work carried out jointly by me and any other person is clearly identified in it). The copyright of this thesis rests with the author. Quotation from it is permitted, provided that full acknowledgement is made. This thesis may not be reproduced without the prior written consent of the author. I warrant that this authorization does not, to the best of my belief, infringe the rights of any third party. Statement of Conjoint Work I confirm that Chapter 2 "Investment Waves under Cross Learning" is jointly co-authored with Mr.Yao Zeng from Economic Department at Harvard University, and I contributed 50% of this work. 2 Abstract I study how asymmetric information affects the financial market in three papers. In the first paper, I study the joint determination of optimal contracts and equilibrium asset prices in an economy with multiple principal-agent pairs. Principals design optimal contracts that provide incentives for agents to acquire costly information. With agency problems, the agents' compensation depends on the accuracy of their forecasts for asset prices and payoffs. -

The Role of Information Asymmetry in the Choice of Entrepreneurial Exit Routes

JBV-05646; No of Pages 17 Journal of Business Venturing xxx (2012) xxx–xxx Contents lists available at SciVerse ScienceDirect Journal of Business Venturing The role of information asymmetry in the choice of entrepreneurial exit routes Tobias Dehlen, Thomas Zellweger ⁎, Nadine Kammerlander, Frank Halter Center for Family Business, University of St. Gallen, Dufourstrasse 40a, CH-9000 St. Gallen, Switzerland article info abstract Article history: Our quantitative study investigates the determinants of internal versus external exit routes in Received 21 March 2012 family firms. Building on information asymmetry theory, we examine how an owner's inferior Received in revised form 4 October 2012 knowledge about the abilities of potential external entrants (in contrast to family internal Accepted 4 October 2012 successors) renders a family internal transfer more likely. This information asymmetry, however, Available online xxxx can be mitigated by activities such as owners' screening and transfer candidates' signaling efforts to reveal the candidates' abilities. Our data exhibits a positive effect of signaling and an inverted Field Editor: D. Shepherd U-shaped effect of screening on the probability of external exit routes. Firm age, as a driver of emotional attachment, weakens these effects. Keywords: © 2012 Elsevier Inc. All rights reserved. Entrepreneurial exit Exit routes Succession Information asymmetry Emotional attachment 1. Executive summary The transfer of ownership and management from an incumbent entrepreneur to his or her successor is an important and often studied phenomenon. Prior literature (Wennberg et al., 2011) shows that the choice of exit route is highly influential on the future firm prosperity. Thus far, we still lack a comprehensive understanding and quantitative evidence about what factors determine to whom the entrepreneur transfers the business. -

Pure and Hybrid Crowds in Crowdfunding Markets

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Chen, Liang; Huang, Zihong; Liu, De Article Pure and hybrid crowds in crowdfunding markets Financial Innovation Provided in Cooperation with: SpringerOpen Suggested Citation: Chen, Liang; Huang, Zihong; Liu, De (2016) : Pure and hybrid crowds in crowdfunding markets, Financial Innovation, ISSN 2199-4730, Springer, Heidelberg, Vol. 2, Iss. 19, pp. 1-18, http://dx.doi.org/10.1186/s40854-016-0038-5 This Version is available at: http://hdl.handle.net/10419/176430 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten -

1 the Symmetry Assumption in Transaction Costs Approach And

The Symmetry Assumption in Transaction Costs Approach And Symmetry Breaking in Evolutionary Thermodynamics of Division of Labor Ping Chen China Center for Economic Research at Peking University in Beijing, China [email protected] http://pchen.ccer.edu.cn/ And Center for Political Economy at Fudan University in Shanghai, China Draft: June 30, 2007 Abstract Coase raised fundamental questions on the firm nature and market solution for social conflicts. However, confusion was around the symmetric intonation of transaction costs, the ill-formulated Coase Theorem, and the false analogy in physics. Fundamental issues in the transaction costs approach can be elaborated by the symmetry assumption in equilibrium economics and symmetry breaking in evolutionary dynamics. The Coasian belief of decreasing transaction costs by market competition is against historical experiences of the division of labor and basic law in thermodynamics. The creative nature of the firm and selective role of institution can be understood by Maxwell’s demon of living boundaries and increasing complexity in industrial economy. Key Words: transaction costs, Coase Theorem, symmetry principle, symmetry breaking, evolutionary thermodynamics I. Introduction: Inspiration and confusion surround the concept of transaction costs. Under the term “Coase theorem” in the Palgrave Dictionary of Economics and Law, the article began with a startling question (De Meza 1998): “Is this statement (Coase Theorem) profound, trivial, a tautology, false, revolutionary, wicked? Each of these has been claimed.” There are three sources of confusion concerning the Coase theory. First, Coase himself never gave a clear definition of transaction costs and a rigorous statement of the Coase theorem. Therefore, different interpretations generated conflicting implications. -

A New Logistic Model of Market Information Asymmetry Reduction in Poland

logistics Article A New Logistic Model of Market Information Asymmetry Reduction in Poland Elzbieta˙ Gołembska Department Finance and Banking, WSB University of Poznanul, Powstancow Wielkopolskich 5, 61-895 Poznan, Poland; [email protected] Abstract: The article presents the first theoretical and empirical estimation of the role of logistics in mitigating the effects of market information asymmetry in Poland. Following a review of international (Akerlof, Spencer, Stiglitz) and Polish literature (Gołembska, Gruszecki, Stradomski), a new logistic model of information asymmetry (LMAI) is presented. The article attempts an empirical verification of this model using the results of studies conducted in Polish firms in the period 2000–2018. The studies examined the efficiency and effectiveness of logistics management, with a particular focus on logistics infrastructure expenditure, balance-sheet inventories, and logistics costs. The computation of the LMAI indicator, based on averaged data provided by manufacturers, distributors and service firms, enabled the estimation of the impact of logistics management on reducing the effects of information asymmetry, and showed the differences of this impact in individual industries including the pharmaceutical, tourist, transport and food distribution industry. Keywords: logistic model of information asymmetry; sources of information asymmetry; transaction costs; logistics infrastructure; logistics costs; logistification; strategic alliances; internationalization; transnational corporations 1. Introduction Citation: Gołembska, E. A New The importance of logistics in international business derives not only from its in- Logistic Model of Market Information terdisciplinary nature, but also from the fact that it has the potential to contribute to a Asymmetry Reduction in Poland. company’s success. What is more, a new concept known as “logistification” (Fabbe-Costes Logistics 2021, 5, 5. -

Information Asymmetry and Technical Efficiency: Case of a Panel of Tunisian Insurance Companies

Theoretical and Applied Economics F Volume XXIII (2016), No. 4(609), Winter, pp. 299-314 Information asymmetry and technical efficiency: Case of a panel of Tunisian insurance companies Chiraz FEKI University of Sfax, Tunisia [email protected] Abstract. The problem of the information asymmetry affects all the insurance sectors namely the one that exists in Tunisia. This problem of asymmetry entails essentially two major problems, such as the adverse selection and the moral hazard. These problems of adverse selection and moral hazard cause perverse effects on the productivity of the insurance companies and consequently on their productive efficiency. The objective of this research work is, on the one hand, to theoretically analyze the effects of the information asymmetry on the insurance functioning and, on the other hand, to estimate the technical efficiency of the Tunisian companies while taking account this problem which remains up to now unsolved. Keywords: information asymmetric, technical efficiency, insurance companies, parametric approach. JEL Classification: D82, D24, G22, C14. 300 Chiraz Feki 1. Introduction Several research studies analyzed the performance of financial institutions and mainly that of the assurance companies, because of their importance in the economy. In fact, the insurance sector is one of the driving forces of development and takes part directly or indirectly in the economic, social and financial development. The insurance transaction involves two operators: the insurer and the insured. On concluding a contract, the insured must pay a premium, which is the price of the risk that the insurer assumes when purchasing an insurance policy. Therefore, in case of a disaster, the insurer grants a compensation to the affected policyholders. -

Information Asymmetry and the Problem of Transfers in Trade Negotiations and International Agencies

ECONOMIC GROWTH CENTER YALE UNIVERSITY P.O. Box 208629 New Haven, CT 06520-8269 http://www.econ.yale.edu/~egcenter/ CENTER DISCUSSION PAPER NO. 910 Information Asymmetry and the Problem of Transfers in Trade Negotiations and International Agencies Koichi Hamada Yale University and Shyam Sunder Yale University May 2005 Notes: Center Discussion Papers are preliminary materials circulated to stimulate discussions and critical comments. This paper can be downloaded without charge from the Social Science Research Network electronic library at: http://ssrn.com/abstract=722628 An index to papers in the Economic Growth Center Discussion Paper Series is located at: http://www.econ.yale.edu/~egcenter/research.htm Abstract This paper studies the role of transfers among groups within a country as well as among countries in a two level game of international trade negotiations. We show that in order to realize the intended transfer in the presence of asymmetric information on the states of recipients (and donors), a transfer process uses up additional resources. The difficulty of making transfers renders it less likely that a nation would find it individually rational to participate as a member of an international institution. Costly transfers render the internal and international adjustment difficult, and serve as a barrier to trade liberalization. Costly international transfers harden the resistance against trade liberalization in the (potentially) recipient country and soften it in the (potentially) donor country. JEL Codes: O82, F13, H21, H71, H77 Keywords: International trade, tariff negotiation, asymmetric information, transfer, WTO, common agency, two-level game Information Asymmetry and the Problem of Transfers in Trade Negotiations and International Agencies Koichi Hamada and Shyam Sunder Yale University∗ May 6, 2005 Abstract This paper studies the role of transfers among groups within a country as well as among countries in a two level game of international trade negotiations. -

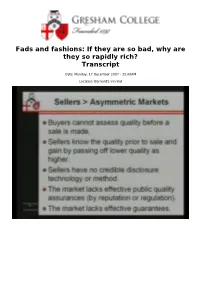

Fads and Fashions: If They Are So Bad, Why Are They So Rapidly Rich? Transcript

Fads and fashions: If they are so bad, why are they so rapidly rich? Transcript Date: Monday, 17 December 2007 - 12:00AM Location: Barnard's Inn Hall FADS AND FASHIONS: IF THEY ARE SO BAD, WHY ARE THEY SO RAPIDLY RICH? Professor Michael Mainelli Good evening Ladies and Gentlemen. I’m pleased to find so many of you gave up an evening’s Christmas shopping for this year’s Annual Gresham College Buzz Lightyear Lecture. But we’ll come to fads in a moment. As you know, it wouldn’t be a Commerce lecture without a commercial. So I’m glad to announce that the next Commerce lecture will continue our theme of better choice next month. That talk is “Perfectly Unpredictable: Why Forecasting Produces Useful Rubbish”, here at Barnard’s Inn Hall at 18:00 on Monday, 28 January. An aside to Securities and Investment Institute, Association of Chartered Certified Accountants and other Continuing Professional Development attendees, please be sure to see Geoff or Dawn at the end of the lecture to record your CPD points or obtain a Certificate of Attendance from Gresham College. Well, as we say in Commerce – “To Business”. We all know that celebrities, sports stars, estate agents, bankers, lawyers and accountants, along with CEO fat cats, are overpaid. But can we explain why? One of the great things about fads, fashions and excessive pay is that it gives us an excuse tonight to explore two key points in commerce, namely information asymmetry and positional goods. Information Asymmetry [SLIDE: TRUST IN RATIONALITY] Before we start with information asymmetry, I’d like to share a little puzzle about trust, deterrence and rationality to warm you up.