Bryce Start-Up Space 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Draper Fisher Jurvetson

TEAM PORTFOLIO NEWS ABOUT DFJ DFJ NETWORK HOME BACK DRAPER FISHER JURVETSON, DFJ FRONTIER, AND ZONE VENTURES AWARD $250,000 TO NEUROVIGIL IN FOURTH ANNUAL DFJ VENTURE CHALLENGE Draper Fisher Jurvetson, DFJ Frontier, and Zone Ventures Award $250,000 to NeuroVigil in Fourth Annual DFJ Venture Challenge By: Press Release May. 28, 2008 UC San Diego Startup Bests 16 Teams from 12 Universities in Competition for Seed Funding MENLO PARK, Calif ‐‐ Leading early‐stage venture capital firms Draper Fisher Jurvetson (DFJ) and its network partners DFJ Frontier and Zone Ventures hosted the fourth annual DFJ Venture Challenge in Menlo Park on Wednesday. With a grand prize of $250,000 in seed stage funding, the competition is believed to be the largest winner‐take‐all business plan competition for university students. During the morning session, 16 teams from 12 universities on the West Coast presented business plans to a panel of 10 judges, comprised of venture capitalists from the DFJ Network. Six teams were selected as finalists and presented extended versions of their business plans and answered further questions from the judges in a second round of competition in the afternoon. Following the final round of judging, NeuroVigil was awarded $250,000 in seed funding. NeuroVigil is poised to revolutionize brain analysis and plans to target the sleep, transportation, and pharmaceutical industries. The company, which comprises several Nobel Laureates and leading business strategists, was founded in 2007 by Dr. Philip Low, who, as a graduate student at the Salk Institute, developed a new way to analyze brain activity using a single non‐invasive probe. -

Philadelphia Investment Trends Report

Venture impact Technology investment in the Greater Philadelphia region Trends and highlights, January 2008 to June 2013 Innovation, investment and opportunity On behalf of EY, Ben Franklin Technology Partners of Southeastern Pennsylvania and the Greater Philadelphia Alliance for Capital and Technologies (PACT), we are pleased to present this review 421 companies of technology investment trends and highlights in the Greater Philadelphia region. $4.1 billion The technology investment community in the Greater Philadelphia region includes a wide variety of funding sources supporting a diverse array of companies and industry sectors. In this report, Total investment since we’ve analyzed more than a thousand investment rounds and January 2008 exits that occurred in the Philadelphia region since 2008 – including investments from venture capital fi rms (VCs), angel investors (Angels), corporate/strategic investors, seed funds, accelerators and other sources of funding. As shown in this report, 2012 reversed a post-recession slowdown in venture funding in Greater Philadelphia, and to date, 2013 has brought a welcome increase in the amount of new funds available at regional investment fi rms. These are positive signs for our region’s technology companies, as are the increasing number of exits via IPO and acquisition, which serve as further validation of the investment opportunities created by our region’s growing technology sector. We encourage you to explore this report, and we hope that it will provide useful insights into the current state of -

Oral History of William H. Draper III

Oral History of William H. Draper III Interviewed by: John Hollar Recorded: April 14, 2011 Mountain View, California CHM Reference number: X6084.2011 © 2011 Computer History Museum Oral History of William H. Draper III Hollar: So Bill, here I think is the challenge. There's been a great oral history done of you at Berkeley; and then you've written your book. So there's a lot of great information about you on the record. So what I thought we would try to— Draper: That's scary. I hope I say it the same way. Hollar: Well, your version of it is on the record, that's for sure. So I wanted to cover about eight areas in the hour and a half that we have. Draper: Okay. Hollar: Which is quite a bit. But I guess that's also a way of saying—we can go into as much or as little detail as you want to. But the eight areas that I was most interested in covering are your early life and your education; your early career—and with that I mean Inland Steel and meeting Pitch Johnson, and Draper, Gaither & Anderson, that section. Draper: Good. Hollar: Then Draper & Johnson—you and Pitch really getting into it together; then, of course, Sutter Hill and that very incredible fifteen-year period. Draper: Yeah, that was a good period. Hollar: A little bit of what you call "the lost decade." Draper: Okay. Hollar: Then what I call the Draper Richards Renaissance. Draper: Good. Hollar: And kind of the second chapter of venture capital for you. -

Capital International Fund

Capital International Fund Audited Annual Report 2020 For the year ended 31 December 2020 Société d’Investissement à Capital Variable organised under the laws of the Grand Duchy of Luxembourg R.C.S. Luxembourg B 8833 1RVXEVFULSWLRQFDQEHDFFHSWHGRQWKHEDVLVRIWKHÀQDQFLDOUHSRUWV6XEVFULSWLRQVDUHRQO\YDOLGLIWKH\DUHPDGHRQWKHEDVLVRIWKH prospectus accompanied by the latest annual report and the latest semi-annual report, if published thereafter. Capital International Fund Audited Annual Report for the year ended 31 December 2020 Contents Report of the Board of Directors of the Company to the shareholders .............. 2 Summary information ..................................................... 4 Results (unaudited) ....................................................... 17 Historical data ........................................................... 36 Portfolio breakdown ....................................................... 52 Schedule of investments ................................................... 76 Capital Group New Perspective Fund (LUX) ............................. 76 Capital Group Global Equity Fund (LUX) ................................ 88 Capital Group World Growth and Income (LUX) .......................... 94 Capital Group World Dividend Growers (LUX) ........................... 104 Capital Group New Economy Fund (LUX) ............................... 108 Capital Group New World Fund (LUX) .................................. 115 Capital Group Emerging Markets Growth Fund (LUX) ..................... 131 Capital Group Japan Equity Fund -

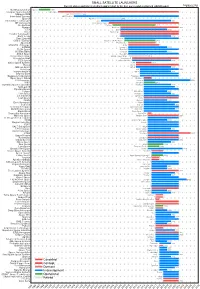

Small Satellite Launchers

SMALL SATELLITE LAUNCHERS NewSpace Index 2020/04/20 Current status and time from development start to the first successful or planned orbital launch NEWSPACE.IM Northrop Grumman Pegasus 1990 Scorpius Space Launch Demi-Sprite ? Makeyev OKB Shtil 1998 Interorbital Systems NEPTUNE N1 ? SpaceX Falcon 1e 2008 Interstellar Technologies Zero 2021 MT Aerospace MTA, WARR, Daneo ? Rocket Lab Electron 2017 Nammo North Star 2020 CTA VLM 2020 Acrux Montenegro ? Frontier Astronautics ? ? Earth to Sky ? 2021 Zero 2 Infinity Bloostar ? CASIC / ExPace Kuaizhou-1A (Fei Tian 1) 2017 SpaceLS Prometheus-1 ? MISHAAL Aerospace M-OV ? CONAE Tronador II 2020 TLON Space Aventura I ? Rocketcrafters Intrepid-1 2020 ARCA Space Haas 2CA ? Aerojet Rocketdyne SPARK / Super Strypi 2015 Generation Orbit GoLauncher 2 ? PLD Space Miura 5 (Arion 2) 2021 Swiss Space Systems SOAR 2018 Heliaq ALV-2 ? Gilmour Space Eris-S 2021 Roketsan UFS 2023 Independence-X DNLV 2021 Beyond Earth ? ? Bagaveev Corporation Bagaveev ? Open Space Orbital Neutrino I ? LIA Aerospace Procyon 2026 JAXA SS-520-4 2017 Swedish Space Corporation Rainbow 2021 SpinLaunch ? 2022 Pipeline2Space ? ? Perigee Blue Whale 2020 Link Space New Line 1 2021 Lin Industrial Taymyr-1A ? Leaf Space Primo ? Firefly 2020 Exos Aerospace Jaguar ? Cubecab Cab-3A 2022 Celestia Aerospace Space Arrow CM ? bluShift Aerospace Red Dwarf 2022 Black Arrow Black Arrow 2 ? Tranquility Aerospace Devon Two ? Masterra Space MINSAT-2000 2021 LEO Launcher & Logistics ? ? ISRO SSLV (PSLV Light) 2020 Wagner Industries Konshu ? VSAT ? ? VALT -

Buyouts' List of Candidates to Come Back to Market In

32 | BUYOUTS | December 3, 2018 www.buyoutsnews.com COVER STORY Buyouts’ list of candidates to come back to market in 2019 Firm Recent Fund Strategy Vintage Target ($ Amount Raised Year Mln) ($ Mln) Advent International Advent International GPE VII, L.P. Large Buyout 2012 $12,000.00 $13,000.00 Advent International Advent Latin American Private Equity Fund VI, L.P. Mid Buyout 2015 $2,100.00 $2,100.00 American Industrial Partners American Industrial Partners Capital Fund VI LP US MM Buyout 2015 N/A $1,800.00 Apollo Global Management Apollo Investment Fund IX Mega Buyout 2017 $23,500.00 $24,700.00 Aquiline Capital Partners Aquiline Financial Services Fund III Mid Buyout 2015 $1,000.00 $1,100.00 Arlington Capital Partners Arlington Capital Partners IV LP Mid Buyout 2016 $575.00 $700.00 Black Diamond Capital Management BDCM Opportunity Fund IV Turnarounds 2015 $1,500.00 $1,500.00 Blackstone Group Blackstone Real Estate Partners VIII LP Global Real Estate Opp 2015 $4,518.11 $4,518.11 Bunker Hill Capital Bunker Hill Capital II Lower mid market buyout 2011 $250.00 $200.00 CCMP Capital CCMP Capital Investors III, L.P. Buyout/Growth Equity 2014 N/A $1,695.65 Centerbridge Partners Centerbridge Capital Partners III Global Dist Debt Control 2014 $5,750.00 N/A Centerbridge Partners Centerbridge Special Credit Partners III Hedge Fund 2016 $1,500.00 N/A Charlesbank Capital Partners Charlesbank Equity Fund IX, L.P. Mid Buyout 2017 $2,750.00 $2,750.00 Craton Equity Partners Craton Equity Investors II, L.P. -

The Handbook of Financing Growth

ffirs.qxd 2/15/05 12:30 PM Page iii The Handbook of Financing Growth Strategies and Capital Structure KENNETH H. MARKS LARRY E. ROBBINS GONZALO FERNÁNDEZ JOHN P. FUNKHOUSER John Wiley & Sons, Inc. ffirs.qxd 2/15/05 12:30 PM Page b ffirs.qxd 2/15/05 12:30 PM Page a Additional Praise For The Handbook of Financing Growth “The authors have compiled a practical guide addressing capital formation of emerging growth and middle-market companies. This handbook is a valuable resource for bankers, accountants, lawyers, and other advisers serving entrepreneurs.” Alfred R. Berkeley Former President, Nasdaq Stock Market “Not sleeping nights worrying about where the capital needed to finance your ambitious growth opportunities is going to come from? Well, here is your answer. This is an outstanding guide to the essential planning, analy- sis, and execution to get the job done successfully. Marks et al. have cre- ated a valuable addition to the literature by laying out the process and providing practical real-world examples. This book is destined to find its way onto the shelves of many businesspeople and should be a valuable ad- dition for students and faculty within the curricula of MBA programs. Read it! It just might save your company’s life.” Dr. William K. Harper President, Arthur D. Little School of Management (Retired) Director, Harper Brush Works and TxF Products “Full of good, realistic, practical advice on the art of raising money and on the unusual people who inhabit the American financial landscape. It is also full of information, gives appropriate warnings, and arises from a strong ethical sense. -

Capital Flows to Education Innovation 1 (312) 397-0070 [email protected]

July 2012 Fall of the Wall Deborah H. Quazzo Managing Partner Capital Flows to Education Innovation 1 (312) 397-0070 [email protected] Michael Cohn Vice President 1 (312) 397-1971 [email protected] Jason Horne Associate 1 (312) 397-0072 [email protected] Michael Moe Special Advisor 1 (650) 294-4780 [email protected] Global Silicon Valley Advisors gsvadvisors.com Table of Contents 1) Executive Summary 3 2) Education’s Emergence, Decline and Re-Emergence as an Investment Category 11 3) Disequilibrium Remains 21 4) Summary Survey Results 27 5) Interview Summaries 39 6) Unique Elements of 2011 and Beyond 51 7) Summary Conclusions 74 8) The GSV Education Innovators: 2011 GSV/ASU Education Innovation Summit Participants 91 2 1. EXECUTIVE SUMMARY American Revolution 2.0 Fall of the Wall: Capital Flows to Education Innovation Executive Summary § Approximately a year ago, GSV Advisors set out to analyze whether there is adequate innovation and entrepreneurialism in the education sector and, if not, whether a lack of capital was constraining education innovation § Our observations from research, interviews, and collective experience indicate that there is great energy and enthusiasm around the PreK-12, Post Secondary and Adult (“PreK to Gray”) education markets as they relate to innovation and the opportunity to invest in emerging companies at all stages § Investment volume in 2011 exceeded peak 1999 – 2000 levels, but is differentiated from this earlier period by entrepreneurial leaders with a breadth of experience including education, social media and technology; companies with vastly lower cost structures; improved education market receptivity to innovation, and elevated investor sophistication. -

1Q 2019 Relationship Management Purpose-Built for Finance Learn More at Affinity.Co

Co-sponsored by Global League Tables 1Q 2019 Relationship Management Purpose-Built for Finance Learn more at affinity.co IMPROVE ELIMINATE SUPPORT DISCOVER PROPIERTARY CROSSING YOUR NEW EXECUTIVE DEAL FLOW WIRES PORTFOLIO CONNECTIONS Learn why 500+ firms use Affinity's patented technology to leverage their network and increase deal flow “Within weeks of moving “The biggest problems Affinity “Let’s be honest, no one wants to Affinity, we were able to helps me solve are how to to use Salesforce reporting. easily discover and manage track all of my activity and how Affinity isn’t just better for most the 1,000s of entrepreneur to prioritize my time. It makes teams, it’ll make the difference and venture community me a better investor. All of the between managing your relationships already latent things I need to do on a day-to- pipeline to success, versus not within our team." day basis I now do in Affinity.” tracking it at all.” ERIC EMMONS KYLE LUI KEVIN ZHANG Managing Director Partner Principal MassMutual Ventures DCM Ventures Bain Capital Ventures [email protected]@affinity.co AffinityAffinity is a relationship is a relationship intelligence intelligence platform platform built to builtexpand to expandand evolve and theevolve traditional the traditional CRM. AffinityCRM. Affinityinstantly instantly surfaces surfaces all all www.affinity.cowww.affinity.co of yourof team’s your team’sdata to data show to you show who you is bestwho issuited best tosuited make to the make crucial the crucialintroductions introductions you need you to need close to your close next your big next deal. big deal. -

Technology Transfer and Commercialization in Greater Philadelphia

TECHNOLOGY TRANSFER AND COMMERCIALIZATION IN GREATER PHILADELPHIA PREPARED BY: CEO Council for Growth| Technology Transfer and Commercialization in Greater Philadelphia i TABLE OF CONTENTS EXECUTIVE SUMMARY ................................................................................................................... iv 1.0 INTRODUCTION ..................................................................................................................... 1 1.1 The Importance of Technology Transfer and Commercialization to a Region’s Vitality .................................................................................................................................... 1 1.2 Technology Transfer and Commercialization in the Greater Philadelphia region, Circa 2007 ................................................................................................................ 1 1.3 An Updated Look at the Technology Transfer and Commercialization Landscape in the Greater Philadelphia region ............................................................... 2 1.4 Overview of Report and of Methodological Approach ....................................... 5 1.5 About Econsult Solutions ............................................................................................ 6 1.6 About the CEO Council for Growth ......................................................................... 7 2.0 TECHNOLOGY TRANSFER AND COMMERCIALIZATION .................................................... 8 2.1 Overview .................................................................................................................... -

OP#254-New Text

JUNE 2020 Strengthening the C4ISR Capabilities of India’s Armed Forces: The Role of Small Satellites KARTIK BOMMAKANTI Strengthening the C4ISR Capabilities of India's Armed Forces: The Role of Small Satellites KARTIK BOMMAKANTI ABOUT THE AUTHOR Kartik Bommakanti is an Associate Fellow at ORF. ISBN: 978-93-90159-24-6 © 2020 Observer Research Foundation. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without permission in writing from ORF. Strengthening the C4ISR Capabilities of India’s Armed Forces: The Role of Small Satellites ABSTRACT Small satellites have gained considerable importance in recent years. Although small spacecraft have existed for decades, their military applications have recently gained prominence owing to technological advances in their development and integration into the armed services of the major spacefaring countries across the world. This paper analyses the significance of small satellites in the C4ISR capabilities of the three service branches of the Indian military. Small satellites are not a panacea for the C4ISR needs of the Indian Army, Navy and Air Force, but will help partially address their sensor-related requirements. They also contribute to a multi-layered and distributed capability for the Indian armed services. Investment in Small Satellites should assume greater salience in Indian defence planning in the coming years. Attribution: Kartik Bommakanti, “Strengthening the C4ISR Capabilities of India’s Armed Forces: The Role of Small Satellites,” -

Ushering the New Era for Indian Space Sector’ 15-17 September 2020 I Over Digital Platform (Exhibition for Over 25 Day Till 10 October 2020)

International Space Conference ‘Ushering the New Era for Indian Space Sector’ 15-17 September 2020 I Over Digital platform (Exhibition for Over 25 Day till 10 October 2020) PROGRAM DAY 1 - 15 September 2020 1000 Hrs Virtual Platform Opens 1400 - 1530 Hrs Inaugural Session 1545 - 1715 Hrs Reforms in the Indian Space Sector and the Opportunities Therein DAY 2 - 16 September 2020 1400 - 1515 Hrs Opportunities for Space Applications: Enhancing the Role of Tech-Entrepreneurs 1515 - 1645 Hrs Indian Space Start-Ups: Revolutionizing Space Industry 1700 - 1815 Hrs Emerging Trends in Satcom: An India Specific Perspective DAY 3 - 17 September 2020 1400 - 1515 Hrs National Space Programs: Country Strategy and Models for Vibrant Eco-System 1530 - 1645 Hrs Highlight Talk: Human Space flight 1700 - 1815 Hrs Indian Space Industry at an Inflection point International Space Conference ‘Ushering the New Era for Indian Space Sector’ 15-17 September 2020 I Over Digital platform (Exhibition for Over 25 Day till 10 October 2020) DAY 2 - 16 September 2020 [Session – 1] Opportunities for Space Applications: Enhancing the Role of Tech 1400 - 1515 Hrs Entrepreneurs Chairman Nilesh M Desai Associate Director Space Applications Centre (SAC) Panelists P.V.N. Rao (Dr.) OS & Dy. Director, RSAA National Remote Sensing Centre (NRSC) V.V. Srinivasan (Dr.) Director ISRO Telemetry Tracking and Command Network (ISTRAC) Mansoor Ahmad Executive Director Airports Authority of India (AAI) Jason Held (Dr.) CEO Saber Astronautics Australia Zaffar Mohamad-Ghouse (Dr.) Executive