Rights Issue Prospectus

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Venture Capital Firms • Institutional Investors • Corporate Investors • Corporations

BBK34133 | Investment Analysis Prepared by Khairul Anuar L2 - Initial Public Offering & Rights Issue 1 Content Content 1. Sources of Funds for Private Companies 2. Initial Public Offering 3. Advantages and Disadvantages of Going Public 4. Appointment of Advisers 5. The IPO Process 6. Pricing of the IPO Shares 7. IPO Puzzles 8. Raising Additional Capital: The Seasoned Equity Offering 9. Rights Issue 10. Dilution of Percentage Ownership 2 Security Markets Are designed to allow corporations and governments to raise new funds and to allow investors to execute their buying and selling orders. Primary and Secondary Security Markets Primary Market Secondary Market Where corporate and Where previously government entities can issued securities are raise capital traded among investors. In short: All securities are first traded in the primary market, and the secondary market provides liquidity for these securities. 1. Sources of Funding for Private Companies -1 A private company can seek funding from several potential sources: • Angel Investors • Venture Capital Firms • Institutional Investors • Corporate Investors • Corporations 5 1. Sources of Funds for Private Companies -2 Angel Investors • Individual investors who buy equity in small private firms. • For many start-ups, the first round of outside private equity financing is often obtained from „angels‟. Institutional Investors • Include superannuation funds, insurance companies, investment companies and charities. • May invest directly in private firms, or may invest indirectly by becoming investors in venture capital firms. 6 1. Sources of Funding for Private Companies -3 Venture Capital Firms • A venture capital firm specialises in raising money to invest in the private equity of young firms. • Typically, institutional investors, such as superannuation funds, are investors in a venture capital firm. -

Orege Launches a €49.2 Million Rights Issue to Strengthen Its Financial Structure and Fund Its Development

This press release is not intended to be published, released or distributed, directly or indirectly, in the United States of America, Canada, Australia or Japan. Orege launches a €49.2 million rights issue to strengthen its financial structure and fund its development ▪ Rights issue for a maximum amount of approximately €49.2 million ▪ Subscription price: €1.24 per new share, i.e. a nominal discount of 14.48% over the last closing price ▪ Subscription ratio: 85 new shares for 40 existing shares ▪ Detachment of preemptive rights on 28 June 2019 and subscription open from 2 July 2019 to 11 July 2019 inclusive ▪ Commitments and guarantee by the majority shareholder, Eren Industries S.A. and commitments by third- party investors to subscribe for 76.46% of the issue Voisins-le-Bretonneux, 26 June 2019, 7:30am – Orege, an innovative company specialized in municipal and industrial sludge conditioning, treatment and recovery solutions, is announcing the launch of a capital increase through issuing new shares (the “New Shares”) with preemptive rights for a maximum gross total of €49.2 million (“the Rights Issue”). With this operation, Orege aims to strengthen its financial position in order to accelerate the commercial and industrial rampup that began in 2018. The Autorité des marchés financiers (AMF, the French financial markets authority) granted visa number 19- 296 on 25 June 2019 for the Prospectus relating to the Rights Issue, comprising the Document de Référence registered on 25 June 2019 under number R. 19 – 023 and the Note d’Opération (including the summary of the Prospectus). The Rights Issue will reconstitute the Company’s net equity by capitalising a substantial proportion of the shareholder current account held by its majority shareholder, Eren Industries S.A. -

Refinitiv Corporate Actions Methodology

REFINITIV EQUITY INDICES Corporate Action Methodology April 2020 Published: April 6, 2020 © 2019 Refinitiv Limited. All Rights Reserved. Refinitiv Limited, by publishing this document, does not guarantee that any information contained herein is or will remain accurate or that use of the information will ensure correct and faultless operation of the relevant service or associated equipment. Neither Refinitiv Limited, nor its agents or employees, shall be held liable to any user or end user for any loss or damage (whether direct or indirect) whatsoever resulting from reliance on the information contained herein. This document may not be reproduced, disclosed, or used in whole or part without the prior written consent of Refinitiv. 1 Sensitivity: Confidential Contents Introduction ......................................................................................................................................... 3 Corporate Actions ............................................................................................................................... 4 1.1 Cash Dividend .......................................................................................................................... 4 1.2 Special Dividend ...................................................................................................................... 5 1.3 Cash Dividend with Stock Alternative ....................................................................................... 5 1.4 Stock Dividend ........................................................................................................................ -

Market Reaction to Rights Offering Announcements in the Turkish Stock Market

MARKET REACTION TO RIGHTS OFFERING ANNOUNCEMENTS IN THE TURKISH STOCK MARKET A THESIS SUBMITTED TO THE GRADUATE SCHOOL OF APPLIED MATHEMATICS OF MIDDLE EAST TECHNICAL UNIVERSITY BY METE TEPE IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF SCIENCE IN FINANCIAL MATHEMATICS JANUARY 2012 Approval of the thesis: MARKET REACTION TO RIGHTS OFFERING ANNOUNCEMENTS IN THE TURKISH STOCK MARKET submitted by METE TEPE in partial fulfillment of the requirements for the degree of Master of Science in Department of Financial Mathematics , Middle East Technical University by, Prof. Dr. Ersan Akyıldız ____________ Director, Graduate School of Applied Mathematics Assoc. Prof. Dr. Ömür U ğur ____________ Head of Department, Financial Mathematics Assist. Prof. Dr. Seza Danı şoğlu ____________ Supervisor, Department of Business Administration, METU Examining Committee Members: Prof. Dr. Gerhard-Wilhelm Weber ____________ Department of Financial Mathematics, METU Assist. Prof. Dr. Seza Danı şoğlu ____________ Department of Business Administration, METU Prof. Dr. Zehra Nuray Güner ____________ Department of Business Administration, METU Assoc. Prof. Dr. Azize Hayfavi ____________ Department of Financial Mathematics, METU Assoc. Prof. Dr. Zeynep Önder ____________ Department of Management, Bilkent University Date: ____________ I hereby declare that all information in this document has been obtained and presented in accordance with academic rules and ethical conduct. I also declare that, as required by these rules and conduct, I have fully cited and referenced all material and results that are not original to this work. Name, Last Name : METE TEPE Signature : iii ABSTRACT MARKET REACTION TO RIGHTS OFFERING ANNOUNCEMENTS IN THE TURKISH STOCK MARKET Tepe, Mete M.Sc., Department of Financial Mathematics Supervisor : Assist. -

Loan Notes & Rights Issue to Raise $1,958,777

ASX AND MEDIA ANNOUNCEMENT 11 December 2019 LOAN NOTES & RIGHTS ISSUE TO RAISE $1,958,777 MinRex Resources Limited (ASX: MRR) (“MinRex” or “the Company”) is pleased to announce that it has secured $1 million (before costs) through the issue of unsecured Loan Notes (“Loan Notes”) to sophisticated investors. The Loan Notes have a face value of $0.01 each with a coupon rate of 12% per annum and a maturity date of 3 February 2020 (which may be extended by the Company to 1 May 2020) (“Maturity Date”). Subject to Shareholder approval at a General Meeting of Shareholders to be held on 20 January 2020 (“General Meeting”), each Loan Note will convert into one (1) Fully Paid Ordinary Share (“Share”) in the Company at a conversion price of $0.01 per Share at the earlier of Shareholder approval or the Maturity Date. New Shares issued through the conversion of the Loan Notes, will have one (1) free-attaching Unlisted Option (”Option”) for every four (4) Shares, exercisable at $0.04 per Option on or before 30 months from the date of issue and which will be issued upon the conversion of the Loan Notes. The Company is also pleased to announce that it intends to conduct a Non-Renounceable Entitlements Issue (“Rights Issue”) of one (1) Share for every one (1) Share held by the Company’s Shareholders at the record date, to issue up to a maximum of 95,877,727 Shares at an issue price of $0.01 per Share to raise up to $958,777.27 (before costs) with one (1) free-attaching Option for every four (4) Shares issued under the proposed Rights Issue, exercisable at $0.04 per Option on or before 30 months from the date of issue. -

Rights Issue Fees Inquiry Report

Rights Issue Fees Inquiry December 2010 In association with: RIGHTS ISSUE FEES INQUIRY Contents Foreword 3 Executive Summary 5 1. Background 9 1.1 Rights issue 9 1.2 Discount 9 1.3 Underwriting 10 1.4 Underwriting risks 10 1.4.1 Pre-marketing 11 1.4.2 Offer period 11 1.4.3 Discount 11 1.5 Professional Advisers 11 1.5.1 Corporate Broker 11 1.5.2 Sponsor 12 1.5.3 Independent Financial Adviser 12 1.5.4 Legal Counsel and Reporting Accountants 12 2. How practice has developed over time 14 2.1 Volumes 14 2.2 Fees and Discounts 15 2.2.1 Pre MMC Report 15 2.2.2 MMC Report to financial crisis 15 2.2.3 Post 2007 16 2.3 The changing roles of the participants 17 2.3.1 Broker 17 2.3.2 Shareholder 18 2.3.3 Primary underwriter 19 2.3.4 Sub-underwriter 19 3. Issues identified by the Inquiry 20 3.1 Context 20 3.2 Level of underwriting fees 20 1 RIGHTS ISSUE FEES INQUIRY 3.2.1 Position of issuers 21 3.2.2 Issuers’ views on fee levels 21 3.2.3 Views of institutional investors 22 3.2.4 Conclusions of the Inquiry 22 3.3 Competition 23 3.3.1 Tendering by prospective lead underwriters 23 3.3.2 Competition in sub-underwriting 23 3.3.3 Tendering for sub-underwriting 23 3.3.4 Sub-underwriting offset 24 3.4 Transparency 24 3.4.1 Fees 24 3.4.2 Bundling of underwriting and advice fees 24 3.4.3 Transparency of sub-underwriting fees 26 3.4.4 Publication of fees 26 3.5 Other issues 26 3.5.1 Proliferation of advisers 26 3.5.2 Leaks 27 3.5.3 Index funds 27 3.5.4 Regulation 27 3.5.5 Standardisation of documentation 27 3.5.6 Shareholder registers 28 3.5.7 Logistical issues 28 4. -

The Guide to Securities Lending

3&"$)#&:0/%&91&$5"5*0/4 An Introduction to Securities Lending First Canadian Edition An Introduction to $IPPTFTFDVSJUJFTMFOEJOHTFSWJDFTXJUIBO Securities Lending JOUFSOBUJPOBMSFBDIBOEBEFUBJMFEGPDVT Mark C. Faulkner, Managing Director, Spitalfields Advisors Spitalfields Managing Director, Mark C. Faulkner, First Canadian Edition 5SVTUFECZNPSFUIBOCPSSPXFSTXPSMEXJEFJOHMPCBMNBSLFUT QMVTUIF64 BOE$BOBEB $*#$.FMMPOJTDPNNJUUFEUPQSPWJEJOHVOSJWBMMFETFDVSJUJFTMFOEJOH TFSWJDFTUP$BOBEJBOJOTUJUVUJPOBMJOWFTUPST8FMFWFSBHFOFBSMZZFBSTPG EFBMFSBOEUSBEJOHFYQFSJFODFUPIFMQDMJFOUTBDIJFWFIJHIFSSFUVSOTXJUIPVU Mark C. Faulkner, Managing Director DPNQSPNJTJOHBTTFUTFDVSJUZ 0VSTUSBUFHZJTUPNBYJNJ[FSFUVSOTBOEDPOUSPMSJTLCZGPDVTJOHJOUFOUMZPOUIF Spitalfields Advisors TUSVDUVSFBOEEFUBJMTPGFBDIMPBO5IBUJTXIZXFPGGFSBMFOEJOHQSPHSBNUIBUJT USBOTQBSFOU SJTLDPOUSPMMFEBOEEPFTOPUJNQFEFZPVSGVOETUSBEJOHBOEWBMVBUJPO QSPDFTT4PZPVDBOFYDFFEFYQFDUBUJPOT ■ (MPCBM$VTUPEZ ■ 4FDVSJUJFT-FOEJOH ■ 0VUTPVSDJOH ■ 8PSLCFODI ■ #FOFmU1BZNFOUT ■ 'PSFJHO&YDIBOHF &OBCMJOH:PVUP 'PDVTPO:PVS8PSME XXXDJCDNFMMPODPN XXXXPSLCFODIDJCDNFMMPODPN $*#$.FMMPO(MPCBM4FDVSJUJFT4FSWJDFT$PNQBOZJTBMJDFOTFEVTFSPGUIF$*#$BOE.FMMPOUSBEFNBSLT ______________________________ An Introduction to Securities Lending First Canadian Edition Mark C. Faulkner Spitalfields Advisors Limited 155 Commercial Street London E1 6BJ United Kingdom Published in Canada First published, 2006 © Mark C. Faulkner, 2006 First Edition, 2006 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, -

Strategic Investment and Rights Issue, Bank Support Confirmed and Deferred Savor Group Consideration Agreed

7 April 2020 STRATEGIC INVESTMENT AND RIGHTS ISSUE, BANK SUPPORT CONFIRMED AND DEFERRED SAVOR GROUP CONSIDERATION AGREED. Moa Group Limited (NZX:MOA) today announces: • a capital raising of up to $5.5 million at an issue price of 14 cents per share, comprising: o strategic placement of $2.5m to a new cornerstone investor, and o 1 for 5 rights issue to raise up to approximately $3m. • as previously announced the Group continues to have the support of their banking partner. This support gives the Group confidence in trading through the next financial year. • an agreement has been reached with vendors of Savor Group to defer the $3.2 million additional cash payment until 1 April 2021. The new funds are being pre-emptively raised to provide the Group with additional Balance Sheet strength given the ongoing uncertainty facing the Hospitality business due to COVID-19, in connection with an agreement reached with the Savor Group vendors regarding the additional cash payment which is due to them and to provide additional flexibility for future acquisitions. Strategic Investment: New Cornerstone Investor After close of trading yesterday Moa agreed the terms of a strategic investment in the Group by a prominent New Zealand businessperson. The total amount of the investment is up to $4m, and has been agreed on the following terms: • $2.5m placement of 17,857,143 new shares at an issue price of 14 cents per share. • Approximately $480,000 via subscription for full entitlement under subsequent rights issue. • Moa has undertaken to place shortfall shares not taken up by existing shareholders under the rights issue to increase the total investment to $4 million (to the extent there are shortfall shares available to do so). -

Rights Issue Circular

THIS DOCUMENT AND THE ACCOMPANYING DOCUMENTS ARE IMPORTANT AND REQUIRE YOUR IMMEDIATE ATTENTION. If you are in any doubt as to what action you should take, you are recommended to seek immediately your own financial advice from your stockbroker, bank manager, solicitor, accountant, fund manager or other appropriate independent financial adviser, who is authorised under the Financial Services and Markets Act 2000 (‘‘FSMA’’) if you are resident in the United Kingdom or, if not, from another appropriately authorised independent financial adviser. Subject to the restrictions set out below, if you sell or have sold or otherwise transferred all of your Existing Ordinary Shares please send this document, together with the Proxy Form at once to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for delivery to the purchaser or transferee except that such documents should not be distributed, forwarded to or transmitted in or into any jurisdiction where to do so might breach local securities laws or regulations. If you sell or have sold or otherwise transferred only part of your holding of Existing Ordinary Shares please retain this document and the accompanying Proxy Form and contact immediately the bank, stockbroker or other agent through whom the sale or transfer was effected. This document does not constitute or form part of any offer or invitation to sell, dispose of or issue, or any solicitation of any offer to acquire Nil Paid Rights, Fully Paid Rights or New Ordinary Shares or to take up any entitlements to Nil Paid Rights. -

Asx Settlement Procedure Guidelines

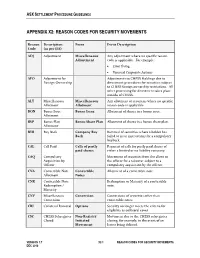

ASX SETTLEMENT PROCEDURE GUIDELINES APPENDIX X2: REASON CODES FOR SECURITY MOVEMENTS Reason Description Event Event Description Code (as per EIS) ADJ Adjustment Miscellaneous Any adjustment where no specific reason Adjustment code is applicable. For example: • Error fixing • Unusual Corporate Actions AFO Adjustment for Adjustments to CHESS Holdings due to Foreign Ownership divestment procedures for securities subject to CHESS foreign ownership restrictions. All other processing for divestment takes place outside of CHESS. ALT Miscellaneous Miscellaneous Any allotment of securities where no specific Allotment Allotment reason code is applicable. BON Bonus Issue Bonus Issue Allotment of shares in a bonus issue. Allotment BSP Bonus Plan Bonus Share Plan Allotment of shares in a bonus share plan. Allotment BYB Buy Back Company Buy Removal of securities where a holder has Back failed to issue instructions for a compulsory buyback. CAL Call Paid Calls of partly Payment of calls for partly paid shares of paid shares either a limited or no liability company. CAQ Compulsory Movement of securities from the client to Acquisition by the offeror for a takeover subject to a Offeror compulsory acquisition by the offeror. CNA Convertible Note Convertible Allotment of a convertible note. Allotment Notes CNR Convertible Note Redemption or Maturity of a convertible Redemption / note. Maturity CNV Miscellaneous Conversion Conversions of securities other than Conversion convertible notes. CRI Collateral Removal Options Security no longer meets the criteria for eligibility as collateral cover. CSC CHESS Subregister Non-Registry Movement due to the CHESS subregister Closed Initiated closing, for example, in the event of an Movement Issuer being delisted. VERSION 1.7 X2-1 REASON CODES FOR SECURITY MOVEMENTS DEC 2010 ASX SETTLEMENT PROCEDURE GUIDELINES Reason Description Event Event Description Code (as per EIS) DIS Distribution in Distribution in Allotment of securities as a result of a Specie Specie distribution in specie. -

Frequently Asked Questions Rights Issue of Units

FREQUENTLY ASKED QUESTIONS RIGHTS ISSUE OF UNITS BY INDIA GRID TRUST Set out below are the frequently asked questions (“FAQs”) to guide investors in gaining familiarity with the application process for subscribing to the rights issue of fully paid Units (“Issue” or “Rights Issue”) by INDIA GRID TRUST (“Trust”) in terms of the letter of offer dated Tuesday, March 23, 2021 (“Letter of Offer”), filed with the Securities and Exchange Board of India, BSE Limited, and National Stock Exchange of India Limited. These FAQs are not exhaustive, nor do they purport to contain a summary of all the disclosures in the Letter of Offer or the entire application process in the Issue or all details relevant to prospective investors (“Investors”). Further, these FAQs should be read in conjunction with, and are qualified in their entirety by, more detailed information appearing in the Letter of Offer, including the sections “Notice to Investors”, “Risk Factors”, “Selling Restrictions”, “Restrictions on Purchases and Sales” and “Issue Information” on pages 8, 56, 294, 297 and 273 respectively, of the Letter of Offer. Readers are advised to refer to the Letter of Offer which is available on the website of the Registrar (www.kfintech.com), Trust (www.indigrid.co.in), Lead Manager, Axis Capital Limited (www.axiscapital.co.in) and Stock Exchanges (www.nseindia.com & www.bseindia.com). Unless otherwise defined herein, all capitalised terms shall have such meaning as ascribed to them in the Letter of Offer. • What are the details of the Issue? Rights units being offered by the Issue of 116,695,404 Units (“Units”) Trust Issue Size Aggregate Amount of ₹ 12,836.49Million* Rights Entitlements Ratio of one lot for every five lots held on the Record Date (each lot comprising of 1701 units) Record Date Tuesday, March 30, 2021 Issue Price ₹110 per Unit * The size of the Issue shall be subject to finalisation of Allotment in the Issue. -

What Is the Point of the Equity Market?

Marketing material for professional investors and advisers only What is the point of the equity market? April 2018 Stock markets were traditionally a venue for companies to raise money to Duncan Lamont Head of Research finance growth. But the number of listed companies has collapsed in many and Analytics parts of the western world, suggesting that markets perform this function less and less. Easier access to alternative sources of financing alongside the increased cost and hassle of a public listing are all partly to blame. Savers and policymakers should all be concerned about the implications. All is not lost, however. Equity markets are thriving in some parts of the world and even where they appear not to be, they continue to serve an economic purpose, albeit one that is different to the original blueprints. We have come a long way since the first financial exchange with wider social and economic benefits. Regulators are not was established in Antwerp, Belgium, in 1531, although rather blind to these features. The UK Financial Conduct Authority than shares, this was a venue where promissory notes, bonds (FCA) has singled out primary markets as playing a “crucial and commodities changed hands. It wasn’t until early the role in supporting prosperity and providing investment next century, when the Dutch East India Company made the opportunities”1. Regulators around the world, including innovation of issuing its backers with paper shares, which in the US, UK and EU, have all conducted studies aimed at investors in turn could trade between each other, that we saw identifying the barriers to effective primary markets.