Download Forms

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pension-Fund-Custodians-In

NATIONAL PENSIONS REGULATORY AUTHORITY NPRA PUBLIC NOTICE á LIST OF REGISTERED PENSIONS FUND CUSTODIANS THAT HAVE FULFILLED THE PRESCRIBED REQUIREMENTS OF THE AUTHORITY FOR THE 2019 AUTHORISATION PROCESS. THE LICENCES ARE VALID UNTIL 31ST JULY, 2020 LICENCE / TELEPHONE NO. NAME OF SERVICE PROVIDER REGISTRATION PHYSICAL ADDRESS CONTACT PERSON NUMBERS NO. 1. Agricultural Development FC12005 Accra Financial Elorm Aidam 0244-253181 Bank Centre, 3rd Ambassadorial Development Area, Ridge-Accra 2. First Atlantic Bank Limited FC15001 Atlantic Place No. 1 Yvonne Oppong- 0541-704753 Seventh Avenue, Ayisi Ridge West, Accra 3. Standard Chartered Bank FC12002 Standard Chartered Beverly Frimpong 0202-023933 Ghana Limited Bank Head Office #Independence Avenue 4. Republic Bank Ghana FC12006 No 48A Sixth Audrey Smith 0208-737616 Limited Avenue, North Dadzie Ridge, Accra 5. Fidelity Bank Ghana Limited FC12011 1st Floor, Ridge Rebecca Gyebi 0544-338784 Towers, Accra Elias Augustine 0576-036467 Dey 6. Ecobank Ghana Limited FC12001 Ecobank Ghana Vera-Marie Ayitey- 0244-483036 Head Office, Accra Smith 7. Cal Bank Limited FC12004 No. 23 Nan Opoku (Ms.) 0244-601170 Independence Avenue-Accra Website: www.npra.gov.gh , e-mail: [email protected] “Ensuring Retirement Income Security” NATIONAL PENSIONS REGULATORY AUTHORITY NPRA PUBLIC NOTICE á LICENCE / TELEPHONE NO. NAME OF SERVICE PROVIDER REGISTRATION PHYSICAL ADDRESS CONTACT PERSON NUMBERS NO. 8. Stanbic Bank Ghana Limited FC12003 Stanbic Heights, Eunice Amoo- 0244-333145 Airport City, Accra Mensah 9. Zenith Bank Ghana Limited FC12013 31 Independence Alvin Abbah-Foli 0242-729012 Avenue, Accra 10. Prudential Bank Limited FC12007 8 John Harmond Seth Kyeremeh 0244-762652 Street, Ring Road Central, Accra 11. -

Ghana Fixed Income Market Summary of Status Report

GHANA FIXED INCOME MARKET SUMMARY OF STATUS REPORT JUNE 2019 1 MEMBERSHIP GFIM as at the end of June 2019 has 41 registered members categorized as follows: LICENSED DEALING MEMBERS PRIMARY DEALER BANKS 1. African Alliance Securities Limited 1. Access Bank Ghana Limited 2. Black Star Brokerage Limited 2. ARB Apex Bank 3. Bullion Securities Limited 3. Barclays Bank Ghana Limited 4. Cal Brokers Limited 4. Cal Bank Ghana Limited 5. CDH Securities Limited 5. Consolidated Bank Ghana Limited 6. Databank Brokerage Limited 6. Ecobank Ghana Limited 7. EDC Stockbrokers Limited 7. Fidelity Bank Ghana Limited 8. Gold Coast Brokerage Limited 8. GCB Bank Limited 9. Republic Securities Ghana Limited 9. Guaranty Trust Bank Ghana Limited 10. IC Securities Limited 10. Societe Generale Ghana Limited 11. Liberty Securities Limited 11. Stanbic Bank Limited 12. NTHC Ltd 12. Standard Chartered Bank Limited 13. Prudential Stockbrokers Limited 13. Universal Merchant Bank 14. SBG Securities Ghana Limited 15. SIC Financial Services Limited 16. Strategic African Securities Limited 17. UMB Stock Brokers Ltd NON - PRIMARY DEALER BANKS 1. Agricultural Development Bank 2. Bank of Africa Ghana Ltd 3. First Atlantic Bank Ghana Ltd 4. First National Bank Limited 5. FBN Bank Ghana Ltd 6. National Investment Bank 7. Prudential Bank Limited 8. Republic Bank Ghana Limited 9. Sahel Sahara Bank Ghana Limited 10. UBA Ghana Limited 11. Zenith Bank Ghana Ltd 2 SUMMARY OF SECURITIES Benchmark Securities: 9 3yr Government bond- 1 5yr Government bond- 5 7yr Government bond- 1 10yr Government bond- 1 15yr Government bond- 1 Non-Benchmark Securities: 20 3yr Government bond-10 5yr Government bond- 5 6yr Government bond- 1 7yr Government bond- 3 10yr Government bond-1 Treasury Notes: 34 1yr Government note- 16 2yr Government note- 18 Treasury Bills: 64 364 day bill- 13 182 day bill- 25 91 day bill- 12 Ghana Cocoa Bill- 14 Local US dollar 3-year bond-1 Eurobond-9 Corporate Bonds AFB Ghana Plc 18 Bayport Financial Services (Ghana) 9 Edendale Properties 2 Izwe Loans Ghana 6 PBC Ghana Limited 1 E.S.L.A. -

National Pensions Regulatory Authority

NATIONAL PENSIONS REGULATORY AUTHORITY NPRA PUBLIC NOTICE á LIST OF REGISTERED PENSIONS FUND CUSTODIANS THAT HAVE FULFILLED THE PRESCRIBED REQUIREMENTS OF THE AUTHORITY FOR THE 2020 AUTHORISATION PROCESS. THE LICENCES ARE VALID UNTIL 31ST JULY, 2021 LICENCE / TELEPHONE NO. NAME OF SERVICE PROVIDER REGISTRATION PHYSICAL ADDRESS CONTACT PERSON NUMBERS NO. 1. Prudential Bank Limited FC12007 8 John Hammond Seth Kyeremeh 0244-762652 Street, Ring Road Central, Accra 2. Access Bank Ghana Limited FC20002 Starlets '91 Road Franklin Ayensu- 0244-128163 Opposite Accra Nyarko Sports Stadium, Osu 3. First National Bank Ghana FC20001 6th Floor Accra Hilda Esenam 0242-435156 Limited Financial Centre, Odame-Gyenti 0501-632441 Liberia Road. 4. Agricultural Development FC12005 Accra Financial Elorm Aidam 0244-253181 Bank Centre, 3rd Ambassadorial Development Area, Ridge-Accra 5. GCB Bank Limited FC18002 No. 2 Thorpe Road, John Ekow 0557-410577 Accra Appiah-Sam 6. Ecobank Ghana Limited FC12001 Ecobank Ghana Albert Amekugee 0244-427476 Head Office, Accra 7. Zenith Bank Ghana Limited FC12013 31 Independence Alvin Abbah-Foli 0242-729012 Avenue, Accra Website: www.npra.gov.gh , e-mail: [email protected] “Ensuring Retirement Income Security” NATIONAL PENSIONS REGULATORY AUTHORITY NPRA PUBLIC NOTICE á LICENCE / TELEPHONE NO. NAME OF SERVICE PROVIDER REGISTRATION PHYSICAL ADDRESS CONTACT PERSON NUMBERS NO. 8. Republic Bank Ghana FC12006 No 48A Sixth Audrey Smith 0208-737616 Limited Avenue, North Dadzie Ridge, Accra 9. Fidelity Bank Ghana Limited FC12011 1st Floor, Ridge Rebecca Gyebi 0544-338784 Towers, Accra Elias Augustine 0576-036467 Dey 10. Guaranty Trust Bank FC12008 25A Castle Road Michael Yevu 0504-100158 (Ghana) Limited Ambassadorial Area, Ridge, Accra 11. -

Summary of Status Report February 2020

SUMMARY OF STATUS REPORT FEBRUARY 2020 1 MEMBERSHIP GFIM as at the end of February 2020 has 38 registered members categorized as follows: LICENSED DEALING MEMBERS PRIMARY DEALER BANKS 1. African Alliance Securities Limited 1. Access Bank Ghana Limited 2. Black Star Brokerage Limited 2. ARB Apex Bank 3. Bullion Securities Limited 3. ABSA Bank Ghana Limited 4. Databank Brokerage Limited 4. Cal Bank Ghana Limited 5. EDC Stockbrokers Limited 5. Consolidated Bank Ghana Limited 6. Teak Tree Brokerage Limited 6. Ecobank Ghana Limited 7. Republic Securities Ghana Limited 7. Fidelity Bank Ghana Limited 8. IC Securities Limited 8. GCB Bank Limited 9. NTHC Securities Ltd 9. Guaranty Trust Bank Ghana Limited 10. Prudential Stockbrokers Limited 10. Societe Generale Ghana Limited 11. SBG Securities Ghana Limited 11. Stanbic Bank Limited 12. SIC Brokerage Limited 12. Standard Chartered Bank Limited 13. Strategic African Securities Limited 13. Universal Merchant Bank 14. UMB Stock Brokers Ltd NON - PRIMARY DEALER BANKS 1. Agricultural Development Bank 2. Bank of Africa Ghana Ltd 3. First Atlantic Bank Ghana Ltd 4. First National Bank Limited 5. FBN Bank Ghana Ltd 6. National Investment Bank 7. Prudential Bank Limited 8. Republic Bank Ghana Limited 9. Sahel Sahara Bank Ghana Limited 10. UBA Ghana Limited 11. Zenith Bank Ghana Ltd 2 SUMMARY OF SECURITIES • Benchmark Securities: 8 5yr Government bond- 5 7yr Government bond- 1 10yr Government bond- 1 15yr Government bond- 1 • Non-Benchmark Securities: 28 3yr Government bond-14 5yr Government bond- 6 6yr Government bond- 1 7yr Government bond- 3 10yr Government bond-2 15yr Government bond-1 20yr Government bond-1 • Treasury Notes: 14 1yr Government note- 1 2yr Government note- 13 • Treasury Bills:80 364 day bill- 28 182 day bill- 26 91 day bill- 13 182-day Cocoa Bill- 13 ❖ Local US dollar 3-year bond-1 ❖ Eurobond-9 ❖ Corporate Bonds AFB Ghana Plc 18 Bayport Financial Services (Ghana) 9 Edendale Properties 2 Izwe Loans Ghana 6 E.S.L.A. -

The Effects of Ponzi Schemes and Revocation of Licences of Some

The current issue and full text archive of this journal is available on Emerald Insight at: https://www.emerald.com/insight/1359-0790.htm ff Financial The e ects of Ponzi schemes and threat in revocation of licences of some Ghana financial institutions on financial threat in Ghana Edmond Ofori Department of Accounting, West End University College, Accra, Ghana Abstract Purpose – The purpose of this study was to assess the effects of the Ponzi schemes and revocation of licences of some financial institutions in Ghana on financial threat. Design/methodology/approach – The study adopted a quantitative research approach. Convenient sampling method was used to select 435 individuals from three regions in Ghana. Standardize questionnaire developed by the researcher was used as the main data collection instrument. The binary logistic regression was used to test the relationship between the dependent variable and the independent variables. Findings – The results of the study showed a positive relationship between financial threat and job loss, general health, information search and loss of investment. However, negative relationship was identified between financial threat and total debt, stress, economic hardship and anxiety. Findings from this study imply that job loss, general health, information search and loss of investment are major factors that determined financial threat in Ghana. Practical implications – This indicates that individuals in Ghana have become uncertain regarding the use of current and future financial services in Ghana because most individuals have lost their jobs in the financial institutions, cannot get access to safe drinking water and education, need to gather more information before investing in financial institutions in Ghana and losing of funds invested. -

Banking-Sector-Report-July-2019-1

OF G K HA N N A A B E 7 S T. 1 9 5 9 201 BANK OF GHANA Banking Sector Report uly J P a g e | 2 CONTENTS 1. PREFACE .................................................................................................................................................. 3 2. SUMMARY ................................................................................................................................................. 4 3. BANKING SECTOR DEVELOPMENTS ......................................................................................................... 5 3.1 BANKS’ BALANCE SHEET ................................................................................................................................... 5 3.1.1 Asset and Liability Structure ............................................................................................................. 7 3.1.2 Share of Banks’ Investments ............................................................................................................. 7 3.2 CREDIT RISK ................................................................................................................................................... 7 3.2.1 Credit Portfolio Analysis ........................................................................................................................ 7 3.2.2 Off-Balance Sheet Activities .............................................................................................................. 8 3.2.3 Asset Quality .................................................................................................................................... -

ANNUAL REPORT 2019 of the Insurance Industry, Ghana

NATIONAL INSURANCE COMMISSION INSURANCE NATIONAL 2019 ANNUAL REPORT 2019 ANNUAL ANNUAL REPORT 2019 of the Insurance Industry, Ghana www.nicgh.org National Insurance Commission ANNUAL REPORT 2019 of the Insurance Industry, Ghana NATIONAL INSURANCE COMMISSION TABLE OF CONTENTS 4 Welcome 5 Foreword 7 Chairman’s Report 10 Key Facts The National Insurance Commission 12 Corporate Information Ghana Insurance Market Report 25 Economic Review 28 Ghana Insurance Market Report (2015 – 2019) 60 Anti-Money Laundering and Combating the Financing of Terrorism Activities 62 Research at a Glance 63 Financial & Ratio Analysis Appendices 94 2019 Financial Reports 96 National Insurance Commission 130 Fire Maintenance Fund 137 List of Registered Insurance Companies 145 List of Registered Reinsurance Companies 146 List of Registered Broking Companies NATIONAL INSURANCE COMMISSION Welcome We welcome you to the 2019 Annual Report of the It is important to note that the following Companies Insurance Industry in Ghana. The purpose of the report did not submit their audited annual reports within the is to provide an overview of the Insurance Industry as statutory time-frame and as of the time this report was well as the activities of its Regulator. compiled. Their information and data as contained in this report are, therefore, based on their fourth quarter Unless otherwise stated, all the information in this report unaudited financial statements. The appropriate are based on the audited financial statements of the regulatory sanctions have been applied to these firms National Insurance Commission (NIC), the (Re)Insurance accordingly. Companies and the (Re)Insurance Intermediaries as at the end of 2019. Table 1: Firms whose information are based on unaudited financial statements Non-Life Insurers Life Insurers Insurance Brokers Heritage Insurance Company Limited Allianz Life Company Limited Ideal Insurance Brokers Multi Insurance Company Limited Vanguard Life Assurance Company Glow Insurance Brokers Limited Vanguard Assurance Company SIC Life Insurance Company Ltd. -

School Management System

University of Ghana http://ugspace.ug.edu.gh UNIVERSITY OF GHANA BUSINESS SCHOOL SCHOOL MANAGEMENT SYSTEM THE EFFECT OF BANKING CRISES ON EMPLOYEES IN GHANA: THE CASE OF CONSOLIDATED BANK GHANA BY MR. STEVE HANSFORD QUANSAH (10702450) A PROJECT WORK SUBMITTED TO THE DEPARTMENT OF FINANCE, UNIVERSITY OF GHANA BUSINESS SCHOOL, UNIVERSITY OF GHANA, LEGON, IN PARTIAL FULFILLMENT OF THE REQUIREMENT FOR THE AWARD OF A DEGREE IN MSC DEVELOPMENT FINANCE JULY 2019 1 University of Ghana http://ugspace.ug.edu.gh DECLARATION I hereby declare that the thesis entitled “The Effect Of Banking Crises On Employees In Ghana: The Case Of Consolidated Bank Ghana” is the result of my original work under the research supervision of Prof. Godfred A. Bokpin, Department of Finance, University of Ghana Business School, and has not been presented in any other university or college or institution for examination or academic purposes, and that all works cited herein have been duly acknowledged. I am solely responsible for any shortcomings this research work may have. ……………………………...................... …………………………… MR. STEVE HANSFORD QUANSAH DATE i University of Ghana http://ugspace.ug.edu.gh CERTIFICATION I hereby certify that this study was supervised in accordance with procedures established by the University. This project work has been submitted for examination with my consent. …………………………… …………………………… PROF. GODFRED A. BOKPIN DATE SUPERVISOR ii University of Ghana http://ugspace.ug.edu.gh DEDICATION I dedicate this thesis to my family for their prayers, love, relentless support, patience, encouragement and understanding throughout this programme. iii University of Ghana http://ugspace.ug.edu.gh ACKNOWLEDGEMENTS My deepest appreciation goes to the Lord Almighty for the strength and wisdom to complete this study. -

Report to the Audit Committee

Report on inventory of assets and property Sovereign Bank Limited (in receivership) August 2018 © 2018 All rights reserved. Office of the Receiver. 1 Table of contents Page Executive summary — Key messages 4 — Matters not considered in this report 5 — Financial position as at 01 August 2018 6 — Summary of inventory of assets and property as at 01 August 2018 7 — Summary of liabilities as at 01 August 2018 9 Notes to the inventory of assets and property — Basis of preparation and compilation 11 — Cash and cash equivalents 11 — Government and other securities 13 — Loans and advances to customers 14 — Property and equipment 16 — Intangible assets 17 — Other assets 18 Appendices 19 © 2018 All rights reserved. Office of the Receiver. 3 Executive summary Key messages The Bank’s asset position as at 01 August 2018 Composition of assets Type Amount Percentage GH¢’000 Composition Liquidation values Composition of assets Quality of assets of Quality Credit Credit Administration Cash and cash 23,496 12% equivalents Composition of assets •Total assets stood at GH¢191 million. Government 40,117 21% and other •Loans and advances and Government and other securities constituted 73% of total securities assets of the Bank Loans and 98,370 52% Quality of assets advances •Top 50 loans amounted to GH¢129 million and constituted 96% of total loans •26% of top 50 loans were classified as non-performing based on BoG’s prudential Property and 12,787 7% guidelines equipment •94% of collaterals provided for top 50 loans had not been perfected Intangible 5,688 3% •Investments amounting to GH¢200 million held with other financial institutions that assets matured have not yet been paid back to the Bank. -

Press Release

PRESS RELEASE GOVERNMENT ESTABLISHES NEW INDIGENOUS BANK; BANK OF GHANA REVOKES LICENCES OF FIVE BANKS AND APPOINTS RECEIVER IN RESPECT OF THEIR ASSETS AND LIABILITIES The Bank of Ghana today has granted a universal banking licence to Consolidated Bank Ghana Limited established by the Government. The Bank of Ghana has also today revoked the licences of uniBank Ghana Limited, The Royal Bank Limited, Beige Bank Limited, Sovereign Bank Limited, and Construction Bank Limited and has appointed Mr. Nii Amanor Dodoo of KPMG as the Receiver for the five banks. All deposits of the five banks are safe and have been transferred to the Consolidated Bank. Customers can carry out their business as usual at their respective banks which will now become branches of the Consolidated Bank. All staff of these banks will become staff of the Consolidated Bank. Boards of Directors and shareholders of these banks no longer have any roles. Ghana needs a strong and stable banking sector to drive the process of economic transformation. A weak banking sector means that access to credit will be limited while lending rates will continue to be high. The Bank of Ghana is mandated by law to promote the safety, soundness, and stability of the financial system and to protect the interests of depositors. In this context, the Bank has over the last year rolled out measures to strengthen the financial system to protect the interests of depositors however, a number of legacy problems have plagued the banking sector including macroeconomic factors, poor corporate governance and risk management practices, related party transactions that were not above board, regulatory non-compliance, and poor supervision, (questionable licensing processes and weak enforcement) leading to a significant build-up of vulnerabilities in the sector. -

Sort Code Bank Name Branch Name

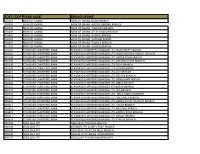

SORT CODE BANK NAME BRANCH NAME 010101 BANK OF GHANA BANK OF GHANA ACCRA BRANCH 010303 BANK OF GHANA BANK OF GHANA -AGONA SWEDRU BRANCH 010401 BANK OF GHANA BANK OF GHANA -TAKORADI BRANCH 010402 BANK OF GHANA BANK OF GHANA -SEFWI BOAKO BRANCH 010601 BANK OF GHANA BANK OF GHANA -KUMASI BRANCH 010701 BANK OF GHANA BANK OF GHANA -SUNYANI BRANCH 010801 BANK OF GHANA BANK OF GHANA -TAMALE BRANCH 011101 BANK OF GHANA BANK OF GHANA - HOHOE BRANCH 020101 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-HIGH STREET BRANCH 020102 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- INDEPENDENCE AVENUE BRANCH 020104 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-LIBERIA ROAD BRANCH 020105 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-OPEIBEA HOUSE BRANCH 020106 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-TEMA BRANCH 020108 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-LEGON BRANCH 020112 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-OSU BRANCH 020118 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-SPINTEX BRANCH 020121 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-DANSOMAN BRANCH 020126 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-ABEKA BRANCH 020127 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH)-ACHIMOTA BRANCH 020129 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- NIA BRANCH 020132 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- TEMA HABOUR BRANCH 020133 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- WESTHILLS BRANCH 020436 -

Ghana-Banking-Survey-2019.Pdf

Banking reforms so far: topmost issues on the minds of bank CEOs August 2019 www.pwc.com/gh Table of contents CSP’s message 2 GAB CEO’s message 4 Tax Leader’s message 5 1 Economy of Ghana 7 2 Survey analysis 12 3 Banking industry overview 35 4 Total operating assets 39 5 Market share analysis 44 6 Profitability and efficiency 56 7 Return to shareholders 64 8 Liquidity 69 9 Asset quality 79 Appendices 84 PwC 2019 Ghana Banking Survey 1 CSP’s message their banks thus far, as well as the those related to the new minimum challenges and opportunities that capital requirement: they foresee. Heritage Bank Limited (HBL) and Highlights of the Premium Bank Ghana Limited (PBG) had their licences revoked. banking sector The reasons provided by BoG for the revocation of their licences reforms were insolvency in the case of Perhaps, one of the most significant Premium bank and questionable components of the banking sector source of capital for Heritage reforms is the new minimum capital bank. directive issued on 11 September Bank of Baroda (BoB) “closed 2017. The directive required shop” and exited the market on universal banks operating in Ghana their own volition also for reasons Vish Ashiagbor to increase their minimum stated related to the new minimum capital to GHS400 million by the capital requirement. Country Senior Partner end of 2018. BoG approved three mergers Following the deadline for involving six banks, effectively Background to this compliance, the changes in the accounting for three more exits. year’s survey banking sector have largely gone in The approved mergers are: 1.