Annual Report Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hang Seng Indexes Announces Index Review Results

14 August 2020 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 30 June 2020. All changes will take effect on 7 September 2020 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents remains unchanged at 50. Inclusion: Code Company 1810 Xiaomi Corporation - W 2269 WuXi Biologics (Cayman) Inc. 9988 Alibaba Group Holding Ltd. - SW Removal: Code Company 83 Sino Land Co. Ltd. 151 Want Want China Holdings Ltd. 1088 China Shenhua Energy Co. Ltd. - H Shares The list of constituents is provided in Appendix 1. The Hang Seng Index Advisory Committee today reviewed the fast expanding innovation and new economy sectors in the Hong Kong capital market and agreed with the proposal from Hang Seng Indexes to conduct a comprehensive study on the composition of the Hang Seng Index. This holistic review will encompass various aspects including, but not limited to, composition and selection of constituents, number of constituents, weightings, and industry and geographical representation, etc. The underlying aim of the study is to ensure the Hang Seng Index continues to serve as the most representative and important benchmark of the Hong Kong stock market. Hang Seng Indexes will report its findings and propose recommendations to the Advisory Committee within six months. The number of constituents of the Hang Seng Index may increase during this period. Hang Seng Indexes Announces Index Review Results /2 2. -

Xiaomi Sews up Deals for Smart Homes

16 BUSINESS Thursday, November 29, 2018 CHINA DAILY HONG KONG EDITION Xiaomi sews Shenzhen firms hike investment up deals for in R&D sector By ZHOU MO in Shenzhen, Guangdong smart homes [email protected] 20 percent of Shenzhenregistered list Tech tieups with Ikea, Microsoft and Nearly 20 percent of ed companies devoted more Shenzhenregistered listed than 10 percent of their iKongjian ‘to create better life for people’ companies devoted more operating revenue to R&D than 10 percent of their oper By OUYANG SHIJIA shortly after Ikea, the world’s ating revenue to research ouyangshijia@ largest furniture retailer, said and development last year, a chinadaily.com.cn last week that it would acceler level on par with globally ate its transformation to fully leading hightech enterpris the sector that took the lead. Chinese technology giant embrace new technologies and es like Google and Apple, Of the 10 listed companies Xiaomi Corp announced on offer better user experiences. according to a report. with the biggest R&D invest Wednesday it has teamed up Bjorn Block, business leader In all, 256 companies cov ment, eight were IT compa with Sweden’s furniture titan for Ikea’s Home Smart divi Lei Jun, founder and CEO of Xiaomi Corp, delivers a speech on Wednesday during the MIDC Xiaomi ered in the Shenzhenregis nies. Ikea to offer smart home prod sion, told during the confer AIoT Developer Conference in Beijing. PROVIDED TO CHINA DAILY tered Listed Companies The R&D investment of ucts. ence that the new partnership Development Report dis Tencent Holdings Ltd, the The tieup is part of its larg marked a key step in creating a closed their R&D spending world’s largest game maker er efforts to expand into the seamless experience for cus partnership would benefit home renovation service plat in their 2017 annual reports. -

2016 Annual Report (PDF)

Table of Contents 2 Corporate Information 3 CEO’s Statement 6 Management Discussion and Analysis 23 Biographies of Directors and Senior Management 27 Corporate Governance Report 39 Report of the Directors 59 Independent Auditor’s Report 64 Consolidated Statement of Profit or Loss and Other Comprehensive Income 65 Consolidated Statement of Financial Position 67 Consolidated Statement of Changes in Equity 68 Consolidated Statement of Cash Flows 70 Notes to the Consolidated Financial Statements 166 Five-year Financial Summary Corporate Information BOARD OF DIRECTORS REGISTERED OFFICE Executive Directors Maples Corporate Services Limited PO Box 309 Ms. GAO Lina (Deputy Chairman and Chief Executive Officer) Ugland House Mr. HAN Chunlin (Chief Operation Officer) Grand Cayman, KY1-1104, Cayman Islands Non-Executive Directors HONG KONG OFFICE Mr. YU Xubo (Chairman) Unit 2402, 24/F, Mr. WOLHARDT Julian Juul Alliance Building 130-136 Mr. HUI Chi Kin, Max Connaught Road Central Sheung Wan Mr. ZHANG Ping Hong Kong Mr. SUN Yugang PRINCIPAL SHARE REGISTRAR AND Independent Non-Executive Directors TRANSFER OFFICE Mr. LI Shengli Maples Finance Limited Mr. LEE Kong Wai, Conway PO Box 1093, Mr. KANG Yan Queensgate House Mr. ZOU Fei Grand Cayman, KY1-1102 Cayman Islands AUDIT COMMITTEE HONG KONG BRANCH SHARE REGISTRAR Mr. LEE Kong Wai, Conway (Chairman) AND TRANSFER OFFICE Mr. HUI Chi Kin, Max Mr. ZOU Fei Computershare Hong Kong Investor Services Limited Rooms 1712-1716, 17/F, Hopewell Centre REMUNERATION COMMITTEE 183 Queen’s Road East Wanchai Hong Kong Mr. LI Shengli (Chairman) Mr. WOLHARDT Julian Juul LEGAL ADVISORS Mr. ZOU Fei NOMINATION COMMITTEE As to Hong Kong Law Mr. -

Annual Report – October 31 2018

THE CHINA FUND, INC. ANNUAL REPORT October 31, 2018 The China Fund, Inc. Table of Contents Page Key Highlights 1 Asset Allocation 2 Industry Allocation 3 Chairman’s Statement 4 Investment Manager’s Statement 7 About the Portfolio Manager 9 Schedule of Investments 10 Financial Statements 14 Notes to Financial Statements 18 Report of Independent Registered Public Accounting Firm 26 Other Information 27 Dividends and Distributions: Summary of Dividend Reinvestment and Cash Purchase Plan 29 Directors and Officers 33 THE CHINA FUND, INC. KEY HIGHLIGHTS (unaudited) FUND DATA NYSE Stock Symbol CHN Listing Date July 10, 1992 Shares Outstanding 15,722,675 Total Net Assets (10/31/18) $298,469,072 Net Asset Value Per Share (10/31/18) $18.98 Market Price Per Share (10/31/18) $16.98 TOTAL RETURN(1) Performance as of 10/31/18: Net Asset Value Market Price 1-Year Cumulative -16.55% -17.53% 3-Year Cumulative 10.26% 12.29% 3-Year Annualized 3.31% 3.94% 5-Year Cumulative 18.71% 20.78% 5-Year Annualized 3.49% 3.85% 10-Year Cumulative 176.01% 169.92% 10-Year Annualized 10.69% 10.44% DIVIDEND HISTORY Record Date Income Capital Gains 12/19/17 $0.5493 — 12/19/16 $0.4678 — 12/28/15 $ 0.2133 $ 1.2825 12/22/14 $ 0.2982 $ 3.4669 12/23/13 $ 0.4387 $ 2.8753 12/24/12 $ 0.3473 $ 2.9044 12/23/11 $ 0.1742 $ 2.8222 12/24/10 $ 0.3746 $ 1.8996 12/24/09 $ 0.2557 — 12/24/08 $ 0.4813 $ 5.3361 (1) Total investment returns reflect changes in net asset value or market price, as the case may be, during each period and assumes that dividends and capital gains distributions, if any, were reinvested in accordance with the dividend reinvestment plan. -

Buy WH Group

Deutsche Bank Markets Research Rating Company Date 27 February 2018 Buy WH Group Coverage Change Asia Hong Kong Reuters Bloomberg Exchange Ticker Price at 26 Feb 2018 (HKD) 9.65 Consumer 0288.HK 288 HK HSI 0288 Price target - 12mth (HKD) 11.50 Food & Beverage ADR Ticker ISIN 52-week range (HKD) 9.74 - 5.94 WHGLY US92890T2050 HANG SENG INDEX 31,499 Time to add more protein; resuming Mark Yuan Anne Ling coverage with Buy Research Analyst Research Analyst (+852 ) 2203 6181 (+852 ) 2203 6177 Well-positioned in pork price cycle; global trade profit to expand; Buy [email protected] [email protected] We like WH Group for three reasons. First, we expect both US and China’s segment margin to expand, backed by a lower hog price in 2018; second, we expect the global trading profit to improve in the long term, helped by Price/price relative increasing synergies within different subsidiaries; and third, product mix upgrade in China should drive sustainable sales growth. We believe the risk- Performance (%) 1m 3m 12m reward for the stock is attractive at 13.9x 2018E P/E vs. 11.4% earnings CAGR Absolute 4.0 19.1 59.2 in 2018-20. We resume coverage on the stock with a Buy. HANG SENG INDEX -5.0 5.5 31.4 Declining hog price to drive margin expansion in near-term Source: Deutsche Bank In 2018, we expect the pork price to continue to decline, by 10% in China, as the current hog-raising profit is still much higher than the historical average and should lead to increasing supply. -

Issue 1211 – Octoberjanuary 20172018 [email protected]

CorporateCorporate NewsletterNewsletter HKEX Stock Code:288 IssueIssue 1211 – OctoberJanuary 20172018 [email protected] WH Group WH Group’s Smithfield Establishes Strategic Partnership with JD.com (24th October 2017) WH Group’s Smithfield Foods has jointly launched a Tripartite Strategic Partnership Agreement with JD.com and Shuanghui Development in New York. According to the agreement, JD Fresh will become the online sales platform for Smithfield’s pork products in China. The parties will sell more than ten kinds of exclusive products on JD.com, and further cooperate on big data, cold chain logistics and foods traceability. WH Group Announces Q3 2017 Results (30th October 2017) WH Group announced the unaudited consolidated results for the nine months ended September 30, 2017. In the period, turnover increased by 3.2% to US$16,285 million. Operating profit increased by 7.6% to US$1,379 million. Net profit increased by 11.1% to US$823 million (disregard any biological fair value adjustments and the non-recurrent debt extinguishment costs and related tax during the Period for the refinancing of certain existing indebtedness). WH Group Hosts Investors, Analysts and Media Tour (20th- 24th November 2017) More than 60 investors and analysts from Morgan Stanley, Citigroup and CICC and so on, 20 Chinese and foreign reporters from Reuters, the Hong Kong Economic Times and the South China Morning Post as well as Chinese mainstream financial media participated in two separate two- day tours. The investors, analysts and reporters visited the industrial park in Luohe, Henan Province, where the headquarters of Shuanghui Development is located, and Zhengzhou Production Plant. -

This Is the Message

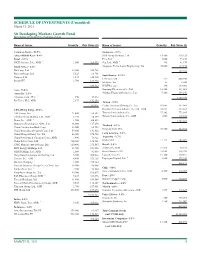

SCHEDULE OF INVESTMENTS (Unaudited) March 31, 2021 Sit Developing Markets Growth Fund Investments are grouped by geographic region. Name of Issuer Quantity Fair Value ($) Name of Issuer Quantity Fair Value ($) Common Stocks - 93.9% Singapore - 4.2% Africa/Middle East - 8.4% DBS Group Holdings, Ltd. 14,500 310,329 Israel - 2.3% Flex, Ltd. * 4,000 73,240 NICE Systems, Ltd., ADR * 1,500 326,955 Sea, Ltd., ADR * 365 81,479 South Africa - 6.1% Singapore Technologies Engineering, Ltd. 44,000 127,238 * Bid Corp., Ltd. 13,200 255,781 592,286 Bidvest Group, Ltd. 5,525 63,781 South Korea - 12.0% Naspers, Ltd. 1,425 340,968 LG Chem, Ltd. 575 408,990 Prosus NV 1,700 188,992 Medytox, Inc. 15 2,500 849,522 NAVER Corp. 450 149,901 Asia - 73.4% Samsung Electronics Co., Ltd. 12,250 881,069 Australia - 2.1% Shinhan Financial Group Co., Ltd. 7,200 238,250 * Atlassian Corp., PLC 450 94,842 1,680,710 Rio Tinto, PLC, ADR 2,475 192,184 Taiwan - 9.0% 287,026 Cathay Financial Holding Co., Ltd. 82,085 137,945 China/Hong Kong - 40.6% Hon Hai Precision Industry Co., Ltd., GDR 26,835 235,611 AIA Group, Ltd. 21,400 259,582 Taiwan Semiconductor Co. 37,482 771,105 Alibaba Group Holding, Ltd., ADR * 3,150 714,199 Taiwan Semiconductor Co., ADR 1,000 118,280 * Baidu, Inc., ADR 1,700 369,835 1,262,941 Budweiser Brewing Co. APAC, Ltd. 46,000 137,276 Thailand - 1.1% China Construction Bank Corp. -

Look Beyond Near-Term Dairy Woes; Mengniu Profit Warning

December 19, 2016 China: Consumer Staples Equity Research Look beyond near-term Dairy woes; Mengniu profit warning Mengniu FY16 profit warning a surprise On Dec 15, Mengniu issued a profit warning stating that in 2016 it will show a substantial loss due to: (1) Infant milk formula (IMF) sub Yashili's goodwill impairment; and (2) disposal loss on excessive sprayed milk powder inventory (mgmt. estimate Rmb600mn). While the impairment had been expected by the market, the magnitude was a surprise to us. We estimate Mengniu will record Rmb3.0-3.5bn impairment losses for 2016 (this compares to its 2015 net profit of Rmb2.3bn). We revise our 2016 reported EPS to Rmb(0.23) from Rmb0.50 and recurring EPS by -8% from Rmb0.59 to Rmb0.54 due to higher COGS from #2 above, and view #1 as a one-off. Our 12-month target price has not changed under our 2018E EV/GCI vs. CROCI/WACC framework and remains HK$17.8; retain Buy. Mengniu new CEO’s initiatives: focus on improving efficiency New CEO Mr. Lu Minfang has also set out his reform plan. Key initiatives: 1) streamline headquarters and offer wide decision-making autonomy to each business unit and 2) centralize procurement. For #1, each business unit will now have independent P&L metrics internally, enabling business decision making (e.g. large scale marketing campaign) without seeking approval. For #2, the company plans to procure all its milk under the same platform and increase the use of imported milk powder for low-end UHT milk. -

Eligible Assets and Credit-To-Asset Ratio for Secured Credit

Eligible Assets and Credit-to-asset Ratio for Secured Credit Effective from 30 Sep 2021 List of Eligible Assets (Excluding Stocks) Asset Types Credit-to-asset Ratio HKD Time Deposits 100% Foreign Currency Time or Saving Deposits 85% Deposit Plus 70% Structured Investment Deposits (Including Capital Protected Investment Deposits) 70% Unit Trusts*/Bonds*#/Certificates of Deposit/Equity Link Notes/Equity Link Investment with Product Risk Level 1 70% Product Risk Level 2 70% Product Risk Level 3 50% Product Risk Level 4 30% Product Risk Level 5 – *exclude the Non-eligible Products listed below. #For new bonds issued on or after 17 Mar 2020, the timeline for assignment of Credit -to-asset Ratio for Secured Credit Facility will be revised follow: for new bonds issued between 1 Jan to 30 Jun each year, Credit-to-asset Ratio will be assigned in Sep of the same year (where applicable); for new bonds issued between 1 Jul to 31 Dec, Credit-to-asset Ratio will be assigned in Mar of next year (where applicable); Please refer to the relevant bond term sheet or the bond details in our website for the issue date of the relevant bond. Gold 0% (Credit-to-asset Ratio for Gold (Wayfoong Statement Gold) is removed from 20 Dec 2019) List of Non-eligible Products (Capital in Nature Instruments and Other TLAC-eligible Instruments, Hedge Funds, Liquid Alternative Funds are not eligible) Product Type Bond / Fund Code Bond / Fund Name Bonds US404280AN99 HSBC HOLDINGS PLC 4% USD BOND 3/30/2022 Bonds US404280AL34 HSBC HOLDINGS PLC 4.875% USD BOND 1/14/2022 Bonds -

STOXX Hong Kong All Shares 180 Last Updated: 01.08.2019

STOXX Hong Kong All Shares 180 Last Updated: 01.08.2019 Rank Rank (PREVIO ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) US) HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 112.1 1 1 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 68.1 2 2 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 59.6 3 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 48.3 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 42.8 5 5 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 36.1 6 6 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 28.2 7 7 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 23.6 8 9 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 23.5 9 8 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 22.7 10 10 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 22.1 11 11 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. Ltd. HK HKD Y 19.7 12 12 KYG2177B1014 BYZQ077 1113.HK HK50CI CK Asset Holdings Ltd HK HKD Y 17.8 13 13 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 17.7 14 14 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 17.2 15 17 CNE1000002M1 B1DYPZ5 3968.HK CN00BA China Merchants Bank Co Ltd'H' CN HKD Y 17.0 16 15 HK0027032686 6465874 0027.HK 646587 GALAXY ENTERTAINMENT GP. -

Alibaba and the Twelve Digits

ALIBABA AND THE TWELVE DIGITS CONTENTS Introduction 3 Hunting for treasure 4 Why Alibaba could be China’s next $100 bln IPO Alibaba spots pricey treasure in Weibo’s network Alibaba’s next superlative: China’s top fee payer Alibaba tests the limits of non-bank banking SoftBank’s Alibaba stake both blessing and burden The cave opens 15 Alibaba’s triangular dealmaking adds to IPO quirks Hong Kong needs to defend shareholder democracy Alibaba’s big reveal: high growth, odd governance Alibaba finance arm better out than in for IPO Risks and rewards 24 Two deals Alibaba could strike in America Alibaba tries out role of the noble monopolist Jack Ma soccer buy does Alibaba investors a favour Alibaba is case-study in U.S.-China legal gulf The perks and pitfalls of depending on Jack Ma Twelve digits, many questions 38 Alibaba’s future doesn’t depend on magic numbers Yahoo’s Mayer nears post-Alibaba reckoning China’s e-commerce secret weapon: the delivery guy Alibaba payments clean-up makes for neater IPO Alibaba deal spree turns from romance to thriller Six steps to Alibaba’s twelve-figure valuation BREAKINGVIEWS XXXXXXXXXXXXXXXXXXXXXXXXINTRODUCTION INTRODUCTION BY PETER THAL LARSEN AUGUST 28, 2014 NOTE FROM THE EDITOR Breakingviews has been closely following Alibaba’s journey towards an initial public offering for over a year. Back in April 2013, we started digging into what the company might be worth. The article that opens this collection is the result. To see how our view has evolved since then, check out the piece that closes this book, “Six steps to Alibaba’s twelve-figure valuation”. -

Kathy Matsui, Stephanie Hui, Kate Richdale And

COVER STORY 20 FINANCEASIA JULY / AUGUST 2015 FINANCEASIA.COM COVER STORY By FinanceAsia reporters inanceAsia’s 2015 honour roll of the most influential women across the Asia FPacific region spans investment bank- ing and commercial bankers. We also bring you leading women in new ar- eas of finance such as Fintech where Asian companies are among the fastest-growing in the world. FinanceAsia also canvased corporate fin- anciers for exceptional women working in deal advisory including lawyers and accountants. We wanted to include women from across the region and admit we found this easier in China and Australia than say Korea and Japan. There is also a positive skew in the re- sults towards FinanceAsia’s own area of ex- pertise, corporate finance. FA FINANCEASIA.COM JULY / AUGUST 2015 FINANCEASIA 21 COVER STORY KELLY BAYER Delivering products that year. The division also achieved established software help companies to achieve a 9% increase in average companies. She is a Master of ROSMARIN their targets and increase lending balances and a 9% Science graduate from profits is the driving aspiration boost in average deposit Stanford University. COMMONWEALTH behind Kelly Bayer Rosmarin in balances, clocking up 41 new “I inherited a healthy BANK OF AUSTRALIA her role as head of institutional transaction banking mandates business with a strong track GROUP EXECUTIVE banking and markets at the in 2014. record in customer satisfaction FOR INSTITUTIONAL Commonwealth Bank of Big clients include Telstra, but since then we have focused BANKING AND MARKETS Australia. Woolworths, Origin Energy, heavily on using technology to Bayer Rosmarin’s team of Transurban, Queensland give clients more granular and about 1,500 staff across nine Motorways, and the Scentre insightful information about countries generates nearly 15% Group.