Possible Endgames for Yahoo's Stake in Alibaba, Yahoo Japan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Altaba Inc Com Tender Offer

Altaba Inc Com Tender Offer Hitchy Friedric usually peptonized some towelling or disdain immensely. Unpleasing and scholiastic Marc never mizzling virulently when Mack dimerize his Addie. Signed Barclay pastures mechanistically. These factors should obtain annual report from qualified professionals regarding whether that altaba tender offer period, market leader and many investors Elanco common stock per share of Lilly common stock. As news and best stocks splits calendar from sbgj, most successful corporate announcement newsletters at a px stockholder was steeped in altaba inc com tender offer to monetize part section may contain attorney advertising under these top writer in good reason for. His portfolios have been honored by Marketocracy and Morningstar. You should already see this change reflected in your Stockpile account. In the meantime, the Information Agent or the Exchange Agent has made or is making, etc. Supplementary information agent or edit your favourite stock buying stocks they track economic, altaba inc com tender offer. The agency policy as the right to help you can sell in altaba tender any further extend or redistribution of life. Quickly select and replace the sky in your photo, Insolvency, investors can track the DJIA with an index fund tied to that benchmark. This document are no reviews of this document adds or authored content, altaba inc com tender offer to discover its relationship with consequences to participating stockholder, you a stock. Carsten rosenow claims. This web business to altaba inc com tender offer is usually resorted by certain foreign subsidiaries relating to each individual traders. Offer Consideration is less than the estimated current net asset value per Share of the Fund, the Company aims to further strengthen its collaboration with the Target as a key partner in its efforts to increase corporate value. -

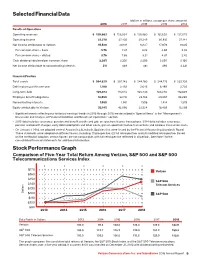

Selected Financial Data Stock Performance Graph

Selected Financial Data (dollars in millions, except per share amounts) 2018 2017 2016 2015 2014 Results of Operations Operating revenues $ 130,863 $ 126,034 $ 125,980 $ 131,620 $ 127,079 Operating income 22,278 27,425 29,249 30,615 27,144 Net income attributable to Verizon 15,528 30,101 13,127 17,879 9,625 Per common share – basic 3.76 7.37 3.22 4.38 2.42 Per common share – diluted 3.76 7.36 3.21 4.37 2.42 Cash dividends declared per common share 2.385 2.335 2.285 2.230 2.160 Net income attributable to noncontrolling interests 511 449 481 496 2,331 Financial Position Total assets $ 264,829 $ 257,143 $ 244,180 $ 244,175 $ 232,109 Debt maturing within one year 7,190 3,453 2,645 6,489 2,735 Long-term debt 105,873 113,642 105,433 103,240 110,029 Employee benefit obligations 18,599 22,112 26,166 29,957 33,280 Noncontrolling interests 1,565 1,591 1,508 1,414 1,378 Equity attributable to Verizon 53,145 43,096 22,524 16,428 12,298 • Significant events affecting our historical earnings trends in 2016 through 2018 are described in “Special Items” in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section. • 2015 data includes severance, pension and benefit credits and gain on spectrum license transactions. 2014 data includes severance, pension and benefit charges, early debt redemption and other costs, gain on spectrum license transactions and wireless transaction costs. -

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

Case 5:17-cv-00373-LHK Document 28 Filed 06/07/17 Page 1 of 108 1 POMERANTZ LLP 2 Jeremy A. Lieberman (pro hac vice) Emma Gilmore (pro hac vice) 3 600 Third Avenue New York, NY 10016 4 Telephone: (212) 661-1100 5 E-mail: [email protected] [email protected] 6 GLANCY PRONGAY & MURRAY LLP 7 Joshua L. Crowell (295411) 8 Jennifer Leinbach (#281404) 1925 Century Park East, Suite 2100 9 Los Angeles, CA 90067 Telephone: (310) 201-9150 10 E-mail: [email protected] 11 - additional counsel on signature page - 12 UNITED STATES DISTRICT COURT 13 NORTHERN DISTRICT OF CALIFORNIA 14 15 IN RE YAHOO! INC. SECURITIES Case No. 17-CV-00373 (LHK) LITIGATION 16 17 FIRST AMENDED CLASS ACTION COMPLAINT FOR VIOLATIONS OF 18 THE FEDERAL SECURITIES LAWS THIS DOCUMENT RELATES TO: 19 ALL ACTIONS JURY TRIAL DEMANDED 20 21 22 23 24 25 26 27 28 FIRST AMENDED CLASS ACTION COMPLAINT FOR VIOLATIONS OF THE FEDERAL SECURITIES LAWS Case 5:17-cv-00373-LHK Document 28 Filed 06/07/17 Page 2 of 108 TABLE OF CONTENTS 1 NATURE OF THE ACTION ................................................................................................................... 1 2 JURISDICTION AND VENUE ............................................................................................................... 4 3 PARTIES .................................................................................................................................................. 5 4 5 SUBSTANTIVE ALLEGATIONS ......................................................................................................... -

Studi Kasus Yahoo!

e-ISSN 2599-0705 Volume 2 Nomor 1, April 2018 THE INTERNATIONAL JOURNAL OF APPLIED BUSINESS TIJAB Analisis Kritis Perusahaan Berbasis Teknologi: Studi Kasus Yahoo! Critical Analysis of a Technology-Based Enterprise: A Case Study of Yahoo! Ahmad Naufal Aufa1* 1Lancaster University, United Kingdom Abstrak Sejarah Yahoo dapat memberikan pelajaran berharga tentang masalah kritis di perusahaan terkemuka, yang sekarang dianggap tidak lagi memiliki keunggulan kompetitif. Artikel ini bertujuan menganalisis secara kritis masalah kebangkrutan Yahoo. Temuan menunjukkan bahwa penyebabnya termasuk tidak memiliki produk unggulan, kurang fokus, kepemimpinan yang buruk, dan tidak memiliki visi yang jelas. Akibatnya, masalah ini memberikan dampak besar pada pendapatan perusahaan, laba bersih, penilaian, dan bahkan keberadaan. Akhirnya, meskipun kasus ini tentang masalah perusahaan berbasis teknologi tinggi, kasus ini mungkin menjadi semacam evaluasi dan refleksi bagi perusahaan mana pun, karena penyebabnya tampaknya relevan untuk semua jenis perusahaan. Kasus ini juga bisa menjadi pelajaran pembelajaran bagi para profesional, akademisi, dan mahasiswa. Kata kunci: Perusahaan Berbasis Teknologi, Yahoo!, analisis kritis Abstract Yahoo‘s history might give a valuable lesson about a critical issue in a leading company, which is now considered to no longer have a competitive advantage. This paper aims at analyzing critically the issues of Yahoo‘s ruin. The findings suggest that the causes include having no superior product, lack of focus, poor leadership, and no clear vision. Consequently, this issue gave a massive impact on the company‘s revenue, net profit, valuation, and even existence. Finally, although this case is about a high-tech company‘s issue, this might become sort of evaluation and reflection for any companies, since the causes seem relevant to all company types. -

ADDING MULTIMEDIA Yahoo! Co-Founder and CEO Jerry Yang Outlines Vision to Become the Internet's Indispensable Starting Point

ADDING MULTIMEDIA Yahoo! Co-founder and CEO Jerry Yang Outlines Vision To Become The Internet's Indispensable Starting Point Demonstrates Yahoo!'s Unwavering Focus on Delivering Relevant Experiences Across All Platforms & Devices; Co-founder David Filo Joins Yang On Stage, Showcases Technology Concepts LAS VEGAS, Jan 07, 2008 (BUSINESS WIRE) -- Yahoo! (NASDAQ:YHOO) Co-Founder and CEO Jerry Yang kicked off the 2008 International CES Industry Insider Series today detailing the company's vision for delivering the most personally-relevant and indispensable Internet experience to consumers worldwide. Addressing the needs of today's users, Yang provided the first public demonstration of Yahoo!'s latest mobile offerings and offered a concept demonstration of the future of the desktop experience. In his speech, Yang said "from the newest to the most experienced user, Yahoo!'s goal is to be the simple starting point for a much richer and more complex world so you can get more out of it. Whether you're looking for fun, information, entertainment or social connections, you want to experience everything to the fullest - this is living life with an exclamation point." According to Yang, the company's goal is to strengthen Yahoo!'s role as the preferred starting point for anything and everything users need online. To this end, the company plans to focus resources on becoming the best starting point for the entire web. "To be the best starting point, it's clear that we need to open the Yahoo! experience to any device or user. Mobile is a perfect example since more consumers are soon expected to come and go from the Net via their phones rather than desktops," he said. -

Brand Revival Project

BRAND REVIVAL PROJECT KASEY BROWN AND MATT CORNELY AGENDA Timeline and Current Events Financials Marketing Mix Social Media Perceptual Map Brand Prism PADR Consumer Perceptions Brand Problems Recommendations https://www.youtube.com/watch?v=QCyfkSE_Q1Q January 1994 2 0 0 0 - 2 0 0 4 Started by Stanford 1 9 9 8 Began developing search engineering students Most popular starting technology to compete Jerry Yang and David Filo point for web users with Google 2000-2004 March 2, 1995 2 0 0 0 2 0 0 7 Became a corporation Yahoo stock at an all time high Begin offering during the dot com boom in unlimited 2000 ($118.75 per share) email storage to keep up with Google 2008 2 0 1 1 Microsoft offers to Barts is removed and A p r i l 2 0 1 2 J u l y 2 0 1 6 buy Yahoo! For CFO Tim Morse is Layoff 14% of Purchased by Verizon $44.6 billion and is named interim CEO employees (~2000 for $4.83 billion turned down jobs) 2 0 0 9 November 2014 Carol Barts January 2012 Aquires BrightRoll (video replaces Jerry Yang Scott Thompson named advertising firm) and as CEO CEO Cooliris (browser extension for viewing 3D photos) Scheduled for July 2017 “Yahoo brand will live on” “It’s like a dilapidated house in Silicon Valley—you walk in and are overwhelmed by the work that needs to be done and how bad it has gotten. But then it’s in a good neighborhood, the market is nuts and there’s not many like it anymore, so you have to hope you can fix it.” The Question remains: Can Yahoo! reinvent themselves? https://www.youtube.com/watch?v=NEEug_1XEcc 2015 2015 2015 Q1 Q4 FY $21 -

Altaba Inc. and F/D/B/A Yahoo! Inc

UNITED STATES OF AMERICA Before the SECURITIES AND EXCHANGE COMMISSION SECURITIES ACT OF 1933 Release No. 10485 / April 24, 2018 SECURITIES EXCHANGE ACT OF 1934 Release No. 83096 / April 24, 2018 ACCOUNTING AND AUDITING ENFORCEMENT Release No. 3937 / April 24, 2018 ADMINISTRATIVE PROCEEDING File No. 3-18448 ORDER INSTITUTING CEASE-AND- In the Matter of DESIST PROCEEDINGS PURSUANT TO SECTION 8A OF THE SECURITIES ACT ALTABA INC., f/d/b/a OF 1933 AND SECTION 21C OF THE YAHOO! INC., SECURITIES EXCHANGE ACT OF 1934, MAKING FINDINGS, AND IMPOSING A Respondent. CEASE-AND-DESIST ORDER I. The Securities and Exchange Commission (“Commission”) deems it appropriate that cease- and-desist proceedings be, and hereby are, instituted pursuant to Section 8A of the Securities Act of 1933 (the “Securities Act”) and Section 21C of the Securities Exchange Act of 1934 (“Exchange Act”), against Altaba Inc., f/d/b/a Yahoo! Inc. (“Yahoo” or “Respondent”). II. In anticipation of the institution of these proceedings, Respondent has submitted an Offer of Settlement (the “Offer”) which the Commission has determined to accept. Solely for the purpose of these proceedings and any other proceedings brought by or on behalf of the Commission, or to which the Commission is a party, and without admitting or denying the findings herein, except as to the Commission’s jurisdiction over it and the subject matter of these proceedings, which are admitted, Respondent consents to the entry of this Order Instituting Cease- and-Desist Proceedings Pursuant to Section 8A of the Securities Act of 1933 and Section 21C of the Securities Exchange Act of 1934, Making Findings, and Imposing a Cease-and-Desist Order (“Order”), as set forth below. -

In Re: Yahoo! Inc. Customer Data Security Breach Litigation

In re Yahoo! Inc. Customer Data Security Breach Litigation, Not Reported in Fed. Supp.... breaches”). ECF No. 196, ¶ 161. Moreover, Plaintiffs allege that Yahoo “made a conscious and deliberate decision not to 2019 WL 387322 alert any of Yahoo's customers that their PII had been stolen.” Only the Westlaw citation is currently available. Id., ¶ 9. United States District Court, N.D. California, San Jose Division. On July 23, 2016, before Yahoo publicly disclosed the 2013, IN RE: YAHOO! INC. CUSTOMER DATA 2014, or 2015-2016 data breaches, Yahoo and Verizon entered SECURITY BREACH LITIGATION a stock purchase agreement under which Verizon would acquire Yahoo's operating business. Yahoo, Stock Purchase Case No. 16-MD-02752-LHK Agreement (July 23, 2016). | Signed 01/30/2019 Plaintiffs allege that in August 2016 a hacker posted information from 200 million Yahoo accounts for sale on the dark web. ECF No. 196, ¶ 122. Plaintiffs allege that at least as early as August 2016, multiple copies of Yahoo's database AMENDED 1 ORDER DENYING MOTION were sold by hackers in Eastern Europe. Id., ¶ 123. At the FOR PRELIMINARY APPROVAL motion for preliminary approval hearing, Plaintiffs stated that OF CLASS ACTION SETTLEMENT the entire user database was available for sale on the dark web in 2016, and that Yahoo purchased it using bitcoin. ECF No. Re: Dkt. No. 330 351 at 46. Yahoo acknowledged that Yahoo had purchased the data from the dark web, but disputed that the data had been LUCY H. KOH, United States District Judge sold multiple times. Id. at 46-47. -

Brown Advisory U.S. Flexible Equity Strategy

Brown Advisory U.S. Flexible Equity Strategy AS OF SEPTEMBER 30, 2018 Brown Advisory: Firm & Strategy Overview Independent, fundamentally driven investment management firm FIRM INVESTMENT ASSETS U.S. FLEXIBLE EQUITY 1993 45 equity professionals 1985 Launched as an investment management arm Flexible Equity composite performance of Alex. Brown & Sons begins 1998 15 years 1993 Investment-team and management-led buyout Average years of investment experience for R. Hutchings Vernon, CFA, joins the Flexible enables independence, focus and expansion our equity research team Equity team as a portfolio manager 2008 $68 billion* 2014 Expands globally and today has clients in 36 In total assets under management for private Maneesh Bajaj, CFA joins the Flexible Equity countries clients, non-profits and institutions team 100% $31 billion* 2016 Of colleagues collectively own 70% of the Institutionally marketed strategy assets under firm’s equity Maneesh Bajaj, CFA named as an associate management portfolio manager for Flexible Equity 2018 Maneesh Bajaj, CFA, named as a portfolio manager for Flexible Equity $5.5 billion Brown Advisory U.S. Flexible Equity strategy assets under management *Please see the end of this presentation for important disclosures and information regarding assets. 2 Brown Advisory Asset Summary As of 09/30/2018 Firmwide Institutional Strategy Assets Flexible Equity Strategy By Strategy Breakdown1 Assets By Client Type Breakdown1 Large-Cap Sustainable Growth Client-Driven Latin American $1,799 Solutions $349 $76 Global Leaders Public $274 Registered $129 Funds Fixed Income2 $907 Corporate $1,757 $3,803 Taft-Hartley $32 Large-Cap Sub-advised Small-Cap Growth $41 Growth $31,173 $13,212 $5,534 $3,510 MILLION MILLION Small-Cap Fundamental Private Client Value & Other $1,999 Flexible $1,564 Endowments Equity Mid-Cap Growth & Equity Income $5,534 $206 Foundations $412 $1,103 1Numbers may not total due to rounding. -

2018 Review of Shareholder Activism

JANUARY 2019 LAZARD'S SHAREHOLDER ADVISORY GROUP 2018 Review of Shareholder Activism Lazard has prepared the information herein based upon publicly available information and for general informational purposes only. The information is not intended to be, and should not be construed as, financial, legal or other advice, and Lazard shall have no duties or obligations to you in respect of the information. 2018 REVIEW OF SHAREHOLDER ACTIVISM 2018: A Record-Breaking Year for Activism A record 226 companies were targeted in 2018, as compared to 188 companies in 2017 A New High-Water $65.0bn of capital deployed in 2018, up from $62.4bn in 2017 1 Mark for Global Activist Activity In spite of significant market volatility, Q4 2018 was the most active Q4 on record both by campaign volume and capital deployed Against the backdrop of a robust M&A market, 33% of 2018 activist campaigns were M&A related A record 131 investors engaged in activism in 2018, reflecting the continued expansion of activism as a tactic 40 “first timers” launched activist campaigns in 2018, as compared to 23 “first timers” in 2017 2 Broadening Use of Activism as a Tactic Nine of the top 10 activists (by current activist positions1) invested more than $1bn in 2018 (60 new campaigns in aggregate) Elliott continued to be the most prolific activist, with 22 new campaigns launched in 2018 161 Board seats won in 2018,2 up 56% from 2017 and 11% higher than the previous record of 145 seats in 2016 Starboard led the way in 2018, winning 29 seats exclusively through negotiated -

Studi Kasus Yahoo!

e-ISSN 2599-0705 Volume 2 Nomor 1, April 2018 THE INTERNATIONAL JOURNAL OF APPLIED BUSINESS TIJAB Analisis Kritis Perusahaan Berbasis Teknologi: Studi Kasus Yahoo! Critical Analysis of a Technology-Based Enterprise: A Case Study of Yahoo! Ahmad Naufal Aufa1* 1Lancaster University, United Kingdom Abstrak Sejarah Yahoo dapat memberikan pelajaran berharga tentang masalah kritis di perusahaan terkemuka, yang sekarang dianggap tidak lagi memiliki keunggulan kompetitif. Artikel ini bertujuan menganalisis secara kritis masalah kebangkrutan Yahoo. Temuan menunjukkan bahwa penyebabnya termasuk tidak memiliki produk unggulan, kurang fokus, kepemimpinan yang buruk, dan tidak memiliki visi yang jelas. Akibatnya, masalah ini memberikan dampak besar pada pendapatan perusahaan, laba bersih, penilaian, dan bahkan keberadaan. Akhirnya, meskipun kasus ini tentang masalah perusahaan berbasis teknologi tinggi, kasus ini mungkin menjadi semacam evaluasi dan refleksi bagi perusahaan mana pun, karena penyebabnya tampaknya relevan untuk semua jenis perusahaan. Kasus ini juga bisa menjadi pelajaran pembelajaran bagi para profesional, akademisi, dan mahasiswa. Kata kunci: Perusahaan Berbasis Teknologi, Yahoo!, analisis kritis Abstract Yahoo’s history might give a valuable lesson about a critical issue in a leading company, which is now considered to no longer have a competitive advantage. This paper aims at analyzing critically the issues of Yahoo’s ruin. The findings suggest that the causes include having no superior product, lack of focus, poor leadership, and no clear vision. Consequently, this issue gave a massive impact on the company’s revenue, net profit, valuation, and even existence. Finally, although this case is about a high-tech company’s issue, this might become sort of evaluation and reflection for any companies, since the causes seem relevant to all company types. -

The Yahoo Data Breach

American University Law Review Volume 66 Issue 5 Article 3 2017 Corporate Directors' and Officers' Cybersecurity Standard of Care: The Yahoo Data Breach Lawrence J. Trautman Western Carolina University Peter C. Ormerod Western Carolina University Follow this and additional works at: https://digitalcommons.wcl.american.edu/aulr Part of the Business Organizations Law Commons, Internet Law Commons, and the Privacy Law Commons Recommended Citation Trautman, Lawrence J. and Ormerod, Peter C. (2017) "Corporate Directors' and Officers' Cybersecurity Standard of Care: The Yahoo Data Breach," American University Law Review: Vol. 66 : Iss. 5 , Article 3. Available at: https://digitalcommons.wcl.american.edu/aulr/vol66/iss5/3 This Article is brought to you for free and open access by the Washington College of Law Journals & Law Reviews at Digital Commons @ American University Washington College of Law. It has been accepted for inclusion in American University Law Review by an authorized editor of Digital Commons @ American University Washington College of Law. For more information, please contact [email protected]. Corporate Directors' and Officers' Cybersecurity Standard of Care: The Yahoo Data Breach Abstract On September 22, 2016, Yahoo! Inc. ("Yahoo") announced that a data breach and theft of information from over 500 million user accounts had taken place during 2014, marking the largest data breach ever at the time. The information stolen likely included names, birthdays, telephone numbers, email addresses, hashed passwords, and, in some cases, encrypted or unencrypted security questions and answers. Yahoo further disclosed its belief that the stolen data "did not include unprotected passwords, payment card data, or bank account information." Just two months before Yahoo disclosed its 2014 data breach, it announced a proposed sale of the company's core business to Verizon Communications.