Community Banks, Credit Unions Will Have Until 2023

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mcconnell Announces Senate Republican Committee Assignments for the 117Th Congress

For Immediate Release, Wednesday, February 3, 2021 Contacts: David Popp, Doug Andres Robert Steurer, Stephanie Penn McConnell Announces Senate Republican Committee Assignments for the 117th Congress Praises Senators Crapo and Tim Scott for their work on the Committee on Committees WASHINGTON, D.C. – Following the 50-50 power-sharing agreement finalized earlier today, Senate Republican Leader Mitch McConnell (R-KY) announced the Senate Republican Conference Committee Assignments for the 117th Congress. Leader McConnell once again selected Senator Mike Crapo (R-ID) to chair the Senate Republicans’ Committee on Committees, the panel responsible for committee assignments for the 117th Congress. This is the ninth consecutive Congress in which Senate leadership has asked Crapo to lead this important task among Senate Republicans. Senator Tim Scott (R-SC) assisted in the committee selection process as he did in the previous three Congresses. “I want to thank Mike and Tim for their work. They have both earned the trust of our colleagues in the Republican Conference by effectively leading these important negotiations in years past and this year was no different. Their trust and experience was especially important as we enter a power-sharing agreement with Democrats and prepare for equal representation on committees,” McConnell said. “I am very grateful for their work.” “I appreciate Leader McConnell’s continued trust in having me lead the important work of the Committee on Committees,” said Senator Crapo. “Americans elected an evenly-split Senate, and working together to achieve policy solutions will be critical in continuing to advance meaningful legislation impacting all Americans. Before the COVID-19 pandemic hit our nation, our economy was the strongest it has ever been. -

JOIN the Congressional Dietary Supplement Caucus

JOIN the Congressional Dietary Supplement Caucus The 116th Congressional Dietary Supplement Caucus (DSC) is a bipartisan forum for the exchange of ideas and information on dietary supplements in the U.S. House of Representatives and the Senate. Educational briefings are held throughout the year, with nationally recognized authors, speakers and authorities on nutrition, health and wellness brought in to expound on health models and provide tips and insights for better health and wellness, including the use of dietary supplements. With more than 170 million Americans taking dietary supplements annually, these briefings are designed to educate and provide more information to members of Congress and their staff about legislative and regulatory issues associated with dietary supplements. Dietary Supplement Caucus Members U.S. Senate: Rep. Brett Guthrie (KY-02) Sen. Marsha Blackburn, Tennessee Rep. Andy Harris (MD-01) Sen. John Boozman, Arkansas Rep. Bill Huizenga (MI-02) Sen. Tom Cotton, Arkansas Rep. Derek Kilmer (WA-06) Sen. Tammy Duckworth, Illinois Rep. Ron Kind (WI-03) Sen. Martin Heinrich, New Mexico Rep. Adam Kinzinger (IL-16) Sen. Mike Lee, Utah Rep. Raja Krishnamoorthi (IL-08) Sen. Tim Scott, South Carolina Rep. Ann McLane Kuster (NH-02) Sen. Kyrsten Sinema, Arizona Rep. Ted Lieu (CA-33) Rep. Ben Ray Luján (NM-03) U.S. House of Representatives: Rep. John Moolenaar (MI-04) Rep. Mark Amodei (NV-02) Rep. Alex Mooney (WV-02) Rep. Jack Bergman (MI-01) Rep. Ralph Norman (SC-05) Rep. Rob Bishop (UT-01) Rep. Frank Pallone (NJ-06) Rep. Anthony Brindisi (NY-22) Rep. Mike Rogers (AL-03) Rep. Julia Brownley (CA-26) Rep. -

Administration of Donald J. Trump, 2018 Remarks at the Susan B

Administration of Donald J. Trump, 2018 Remarks at the Susan B. Anthony List Campaign for Life Gala May 22, 2018 The President. Thank you. Wow. Thank you very much. Thank you, Marjorie. Thank you, Marjorie, for that wonderful introduction. All my friends are out here. Thank you very much. Thank you. Thank you very much. I appreciate it. So nice. And I'm thrilled to be here tonight at the very first—and as the very first President to address this incredible group of people. I have a lot of friends in the audience. They are incredible people. And I'd also like to thank the Susan B. Anthony List Chairwoman, Jane Abraham, and her husband, the Honorable Spence Abraham, for hosting this beautiful gala. Thank you both. Thank you very much. Thank you very much. Beautiful job. And we're also very glad to be joined by many wonderful Members of Congress, including the legend from Louisiana, a very brave guy, Steve Scalise. Where is Steve? Where is Steve? Hi, Steve. So I was going to ask all Members of Congress to stand, but there's a short list. Should I just—we have to do this, right? [Laughter] They're fighting for you all the time, right? Don't you think? All right. You have Steve. Steve, stand. You have no problem standing. This guy is in better shape than all of us. [Laughter] Kevin Brady. Where is Kevin? What a man he is. How are you? Thank you. Thank you, Kevin. Steve Daines. Steve Daines. Hi, Steve. -

113Th Congressional Committees

House Energy and Commerce Committee House Energy and Commerce Committee Subcommittee on Energy and Power Ratio: 30-24 Ratio: 17-14 Repubicans R State Democrats D State Republicans R-State Democrats D-State Fred Upton (Chairman) MI Henry Waxman (Ranking) CA Ed Whitfield (Chairman) KY Bobby Rush (Ranking) IL Ralph Hall TX John Dingell MI Steve Scalise (Vice Chairman) LA Jerry McNerney CA Joe Barton TX Edward J. Markey MA Ralph Hall TX Paul Tonko NY Ed Whitfield KY Frank Pallone Jr. NJ John Shimkus IL Ed Markey MA John Shimkus IL Bobby L. Rush IL Joseph R. Pitts PA Eliot Engel NY Joseph R. Pitts PA Anna G. Eshoo CA Lee Terry NE Gene Green TX Greg Walden OR Eliot Engel NY Michael C. Burgess TX Lois Capps CA Lee Terry NE Gene Green TX Bob Latta OH Michael F. Doyle PA Mike Rogers MI Diana DeGette CO Bill Cassidy LA John Barrow GA Tim Murphy PA Lois Capps CA Pete Olson TX Doris O. Matsui CA Michael C. Burgess TX Michael F. Doyle PA David McKinley WV Donna Christensen VI Marsha Blackburn (Vice-Chairman) TN Jan Schakowsky IL Cory Gardner CO Kathy Castor FL Phil Gingrey GA Jim Matheson UT Mike Pompeo KS John Dingell (non-voting) MI Steve Scalise LA GK Butterfield CA Adam Kinzinger IL Henry Waxman CA Bob Latta OH John Barrow GA Morgan Griffith VA Cathy McMorris Rodgers WA Doris O. Matsui CA Joe Barton TX Gregg Harper MS Donna Christensen VI Fred Upton MI Leonard Lance NJ Kathy Castor FL Bill Cassidy LA John Sarbanes MD Subcommittee on Environment and Economy Brett Guthrie KY Jerry McNerney CA Ratio: 14-11 Pete Olson TX Bruce Braley IA Republicans R-State Democrats D-State David McKinley WV Peter Welch VT John Shimkus (Chairman) IL Paul Tonko (Ranking) NY Cory Gardner CO Ben Ray Lujan NM Phil Gingrey (Vice Chairman) GA Frank Pallone Jr. -

GUIDE to the 116Th CONGRESS

th GUIDE TO THE 116 CONGRESS - SECOND SESSION Table of Contents Click on the below links to jump directly to the page • Health Professionals in the 116th Congress……….1 • 2020 Congressional Calendar.……………………..……2 • 2020 OPM Federal Holidays………………………..……3 • U.S. Senate.……….…….…….…………………………..…...3 o Leadership…...……..…………………….………..4 o Committee Leadership….…..……….………..5 o Committee Rosters……….………………..……6 • U.S. House..……….…….…….…………………………...…...8 o Leadership…...……………………….……………..9 o Committee Leadership……………..….…….10 o Committee Rosters…………..…..……..…….11 • Freshman Member Biographies……….…………..…16 o Senate………………………………..…………..….16 o House……………………………..………..………..18 Prepared by Hart Health Strategies Inc. www.hhs.com, updated 7/17/20 Health Professionals Serving in the 116th Congress The number of healthcare professionals serving in Congress increased for the 116th Congress. Below is a list of Members of Congress and their area of health care. Member of Congress Profession UNITED STATES SENATE Sen. John Barrasso, MD (R-WY) Orthopaedic Surgeon Sen. John Boozman, OD (R-AR) Optometrist Sen. Bill Cassidy, MD (R-LA) Gastroenterologist/Heptalogist Sen. Rand Paul, MD (R-KY) Ophthalmologist HOUSE OF REPRESENTATIVES Rep. Ralph Abraham, MD (R-LA-05)† Family Physician/Veterinarian Rep. Brian Babin, DDS (R-TX-36) Dentist Rep. Karen Bass, PA, MSW (D-CA-37) Nurse/Physician Assistant Rep. Ami Bera, MD (D-CA-07) Internal Medicine Physician Rep. Larry Bucshon, MD (R-IN-08) Cardiothoracic Surgeon Rep. Michael Burgess, MD (R-TX-26) Obstetrician Rep. Buddy Carter, BSPharm (R-GA-01) Pharmacist Rep. Scott DesJarlais, MD (R-TN-04) General Medicine Rep. Neal Dunn, MD (R-FL-02) Urologist Rep. Drew Ferguson, IV, DMD, PC (R-GA-03) Dentist Rep. Paul Gosar, DDS (R-AZ-04) Dentist Rep. -

May 2016 Sunday Morning Talk Show Data

May 2016 Sunday Morning Talk Show Data May 1, 2016 25 men and 11 women NBC's Meet the Press with Chuck Todd: 4 men and 2 women Sen. Ted Cruz (M) John Brennan (M) Ron Fournier (M) Tom Friedman (M) Doris Kearns Goodwin (F) Kristen Welker (F) CBS's Face the Nation with John Dickerson: 6 men and 2 women Sen. Ted Cruz (M) Sen. Bernie Sanders (M) Paul Manafort (M) Sen. Lindsey Graham (M) Peggy Noonan (F) Jamelle Bouie (M) Jeffrey Goldberg (M) Molly Ball (F) ABC's This Week with George Stephanopoulos: 6 men and 3 women Fmr. Sec. Defense Robert Gates (M) Gov. Mike Pence (M) Sen. Ted Cruz (M) Sarah Huckabee Sanders (F) Stephanie Schriock (F) Kristen Soltis Anderson (F) E.J. Dionne (M) LZ Granderson (M) Matthew Dowd (M) CNN's State of the Union with Jake Tapper: 4 men and 3 women Fmr. Sec. State Hillary Clinton (F) Sen. Ted Cruz (M) Karen Finney (F) Rick Wiley (M) Jeff Weaver (M) Alice Stewart (F) Trent Duffy (M) Fox News' Fox News Sunday with Chris Wallace: 5 men and 1 woman Donald Trump (M) Sen. Ted Cruz (M) George Will (M) Kimberly Guilfoyle (F) Karl Rove (M) Juan Williams (M) May 8, 2016 20 men and 15 women NBC's Meet the Press with Chuck Todd: 4 men and 2 women Donald Trump (M) Kellyanne Conway (F) Andrea Mitchell (F) Matt Bai (M) Eugene Robinson (M) Sen. Jeff Flake (M) CBS's Face the Nation with John Dickerson: 4 men and 5 women Fmr. -

The Senate Legislative Manual

TENNESSEE SENATE 106TH GENERAL ASSEMBLY LEGISLATIVE MANUAL RON RAMSEY LIEUTENANT GOVERNOR AND SPEAKER OF THE SENATE Published by: The Office of the Chief Clerk Tennessee State Senate Russell Humphrey, Chief Clerk TABLE OF CONTENTS THE LEGISLATIVE BRANCH 3 The Lieutenant Governor ............................................................................... 4 Members of the Senate ................................................................................... 5 General Schedule ...........................................................................................15 Senate District Map .......................................................................................16 Senate Seating Chart......................................................................................17 Officers of the Senate.....................................................................................18 Sergeants-At-Arms........................................................................................19 Members of the House of Representatives.....................................................20 House District Map .......................................................................................24 House Seating Chart......................................................................................26 Senate Standing & Select Committees ..........................................................27 House Standing & Select Committees ..........................................................28 Joint Committees ...........................................................................................30 -

FY 2021 Senate NIH DCL Signatories FINAL.Xlsx

FY 2021 Senate NIH Dear Colleague Letter (64 Total Signatories, D‐42, R‐20, I‐2) Updated March 16, 2020 Senator Party State FY20 FY21 Dan Sullivan R AK Yes yes Doug Jones D AL Yes yes Krysten Sinema D AZ Yes yes Martha McSally R AZ Yes yes Dianne Feinstein D CA Yes yes Kamala Harris D CA Yes yes Michael Bennet D CO Yes yes Cory Gardner R CO Yes yes Chris Murphy D CT Yes yes Richard Blumenthal DCTYes yes Chris Coons D DE Yes yes Tom Carper D DE Yes yes David Perdue R GA Yes yes Kelly Loeffler R GA no yes Brian Schatz D HI Yes yes Mazie Hirono D HI Yes yes Jim Risch R ID Yes yes Michael Crapo R ID Yes yes Richard Durbin D IL Yes yes Tammy Duckworth D IL Yes yes Todd Young R IN Yes yes Ed Markey D MA Yes yes Elizabeth Warren D MA Yes yes Ben Cardin D MD Yes yes Chris Van Hollen D MD Yes yes Angus King I ME Yes yes Susan Collins R ME Yes yes Debbie Stabenow D MI Yes yes Gary Peters D MI Yes yes Amy Klobuchar D MN Yes yes Tina Smith D MN Yes yes Tom Udall D MN no yes Roger Wicker R MS Yes yes Jon Tester D MT Yes yes Steve Daines R MT Yes yes Richard Burr R NC Yes yes Thom Tillis R NC Yes yes John Hoeven R ND Yes yes Kevin Cramer R ND Yes yes Deb Fischer R NE Yes yes Jeanne Shaheen D NH Yes yes Maggie Hassan D NH Yes yes Cory Booker DNJYes yes Robert Menendez D NJ Yes yes Martin Heinrich D NM Yes yes Catherine Cortez Masto D NV Yes yes Jacky Rosen D NV Yes yes Kirsten Gillibrand D NY Yes yes Sherrod Brown D OH Yes yes James Inhofe R OK Yes yes Jeff Merkley D OR Yes yes Ron Wyden D OR Yes yes Robert Casey D PA Yes yes Jack Reed D RI Yes yes Sheldon Whitehouse D RI Yes yes Mike Rounds R SD Yes yes Marsha Blackburn R TN Yes yes John Cornyn R TX Yes yes Mark Warner D VA Yes yes Tim Kaine D VA Yes yes Bernie Sanders I VT Yes yes Maria Cantwell D WA Yes yes Tammy Baldwin D WI Yes yes Joe Manchin D WV Yes yes Johnny Isakson R GA Yes no. -

August 19, 2021 the Honorable Merrick Garland Attorney General

August 19, 2021 The Honorable Merrick Garland Attorney General Department of Justice 950 Pennsylvania Avenue, NW Washington, DC 20530-0001 Dear Attorney General Garland: We write to request an update on the status of Special Counsel John Durham’s inquiry into the Crossfire Hurricane Investigation. Two years ago, your predecessor appointed United States Attorney John Durham to conduct a review of the origins of the FBI’s investigation into Russian collusion in the 2016 United States presidential election. Mr. Durham was later elevated to special counsel in October 2020 so he could continue his work with greater investigatory authority and independence. The Special Counsel’s ongoing work is important to many Americans who were disturbed that government agents subverted lawful process to conduct inappropriate surveillance for political purposes. The truth pursued by this investigation is necessary to ensure transparency in our intelligence agencies and restore faith in our civil liberties. Thus, it is essential that the Special Counsel’s ongoing review should be allowed to continue unimpeded and without undue limitations. To that end, we ask that you provide an update on the status of Special Counsel Durham’s inquiry and that the investigation’s report be made available to the public upon completion. Thank you for your attention to this matter. Sincerely, Marsha Blackburn Mitch McConnell United States Senator United States Senator Pat Toomey Rick Scott United States Senator United States Senator Bill Hagerty Rand Paul United States Senator -

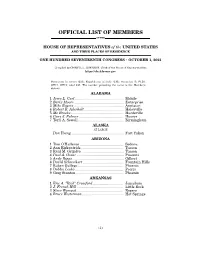

Official List of Members by State

OFFICIAL LIST OF MEMBERS OF THE HOUSE OF REPRESENTATIVES of the UNITED STATES AND THEIR PLACES OF RESIDENCE ONE HUNDRED SEVENTEENTH CONGRESS • OCTOBER 1, 2021 Compiled by CHERYL L. JOHNSON, Clerk of the House of Representatives https://clerk.house.gov Democrats in roman (220); Republicans in italic (212); vacancies (3) FL20, OH11, OH15; total 435. The number preceding the name is the Member's district. ALABAMA 1 Jerry L. Carl ................................................ Mobile 2 Barry Moore ................................................. Enterprise 3 Mike Rogers ................................................. Anniston 4 Robert B. Aderholt ....................................... Haleyville 5 Mo Brooks .................................................... Huntsville 6 Gary J. Palmer ............................................ Hoover 7 Terri A. Sewell ............................................. Birmingham ALASKA AT LARGE Don Young .................................................... Fort Yukon ARIZONA 1 Tom O'Halleran ........................................... Sedona 2 Ann Kirkpatrick .......................................... Tucson 3 Raúl M. Grijalva .......................................... Tucson 4 Paul A. Gosar ............................................... Prescott 5 Andy Biggs ................................................... Gilbert 6 David Schweikert ........................................ Fountain Hills 7 Ruben Gallego ............................................. Phoenix 8 Debbie Lesko ............................................... -

Protect the Right to Life

Bill Hagerty’s Blueprint To Protect The teamhagerty.com Right To Life My Fellow Tennesseans, As a fourth-generation Tennessean, I am proud of the Christian, conservative values that my parents instilled in me that I continue to hold dear. These precious values guide Chrissy and me as we raise our four children. Our aim is to pass these core values onto them. One of those fundamental values is the right to life. Tennesseans value life; we believe that all people— including the unborn — are valued. Our God-given rights to liberty and the pursuit of happiness are meaningless without the right to life. It is the first in our Constitution and the most valuable. Sadly, this right has become increasingly threatened by the liberals in Washington. It is deeply troubling to hear them argue that abortion is a human right. Abortion is not a human right; it takes a human life. I believe that you can judge a nation by how it treats its most vulnerable people—“even as you have done to the least of these” is a creed I live my life by. I support life and in the U.S. Senate, I will be a voice for the voiceless, and am not ashamed to say that I believe every person—born and unborn—has a right to life. 1 I am proud to have the complete and total endorsement of President Donald Trump, the first sitting president to speak at March for Life, the largest annual gathering of pro-life supporters. President Trump understands that every life has immeasurable worth and potential, and he is leading our fight for the right to life. -

Support County Priorities in a Surface Transportation Reauthorization Bill

SUPPORT COUNTY PRIORITIES IN A SURFACE TRANSPORTATION REAUTHORIZATION BILL ACTION NEEDED: • Owning more roads (46 Urge your Members of Congress to support county priorities as Congress works to percent) and bridges (38 reauthorize the Fixing America’s Surface Transportation Act (FAST Act). percent) than any other government entity, BACKGROUND: counties play a critical role in our nation’s Counties play a critical role in the nation’s surface transportation system, owning 46 transportation system. percent of all public roads (compared to the 32 percent of public roads owned by cities and townships, 19 percent by states, and 3 percent by the federal government) and 38 • Counties are directly percent of the National Bridge Inventory. Counties also operate and maintain 78 percent involved in the operation of the nation’s transit systems and a third of public airports that connect residents, of 78 percent of the nation’s public transit communities and our national economy. systems. Following a series of stopgap extensions and the expiration of MAP-21 (P.L. 112-141), • Counties rely on a strong President Obama signed the bipartisan FAST Act (P.L. 114–94) in December 2015, federal-state-local representing the first long-term commitment to investing in our nation’s surface partnership to operate transportation infrastructure in over a decade. Administered by the U.S. Federal and maintain the Highway Administration, the FAST Act included $305 billion over fiscal years 2016 infrastructure that keeps through 2020 for highway development and maintenance, highway and motor vehicle Americans moving. safety, public transportation, motor carrier safety, hazardous materials safety, rail and • Funding for highway and research, technology and statistics programs.