Farlie Turner & Co. Overview Special Situations Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Public Notices & the Courts

PUBLIC NOTICES B1 DAILY BUSINESS REVIEW TUESDAY, SEPTEMBER 28, 2021 dailybusinessreview.com & THE COURTS BROWARD PUBLIC NOTICES BUSINESS LEADS THE COURTS WEB SEARCH FORECLOSURE NOTICES: Notices of Action, NEW CASES FILED: US District Court, circuit court, EMERGENCY JUDGES: Listing of emergency judges Search our extensive database of public notices for Notices of Sale, Tax Deeds B5 family civil and probate cases B2 on duty at night and on weekends in civil, probate, FREE. Search for past, present and future notices in criminal, juvenile circuit and county courts. Also duty Miami-Dade, Broward and Palm Beach. SALES: Auto, warehouse items and other BUSINESS TAX RECEIPTS (OCCUPATIONAL Magistrate and Federal Court Judges B14 properties for sale B8 LICENSES): Names, addresses, phone numbers Simply visit: CALENDARS: Suspensions in Miami-Dade, Broward, FICTITIOUS NAMES: Notices of intent and type of business of those who have received https://www.law.com/dailybusinessreview/public-notices/ and Palm Beach. Confirmation of judges’ daily motion to register business licenses B3 calendars in Miami-Dade B14 To search foreclosure sales by sale date visit: MARRIAGE LICENSES: Name, date of birth and city FAMILY MATTERS: Marriage dissolutions, adoptions, https://www.law.com/dailybusinessreview/foreclosures/ DIRECTORIES: Addresses, telephone numbers, and termination of parental rights B8 of those issued marriage licenses B3 names, and contact information for circuit and CREDIT INFORMATION: Liens filed against PROBATE NOTICES: Notices to Creditors, county -

Fort Lauderdale

4 WEST LAS OLAS BLVD | FORT LAUDERDALE RETAIL FOR LEASE HIGHLIGHTS • ±4,988 sf of available retail space • Property will soon house the 2nd South Florida locations of Garcia’s Seafood Grille & Fish Market and The Wharf - an outdoor culinary, music and event space currently located in Miami • Located along the Riverwalk at the entrance of Las Olas Boulevard, the major restaurant, café, boutique strip running through the heart of Fort Lauderdale attracting tourists, locals and the 41,096 area employees • Downtown Fort Lauderdale is experiencing steady population growth • Over 4.8 million square feet of office space within the CBD • ½ mile walk to the Brightline Train Station connecting Ft Lauderdale to West Palm Beach, and soon to Miami and Orlando • Huizenga Park, Museum of Discovery and Science and Broward Center for the Performing Arts within walking distance Conceptual rendering 2 3 FLOOR PLAN RIVERWALK LAS OLAS BOULEVARD TARPON RIVER PARKING ±4,988 SF OUTDOOR SEATING SOUTH ANDREWS AVENUE 4 5 N LAS OLAS RIVERFRONT & DOWNTOWN FORT LAUDERDALE CBD Las Olas Boulevard is famous throughout South Florida for it’s beautiful tree-lined charm, incredible dining and shopping, and relaxed ambiance. For decades, locals and tourists alike have flocked to Las Olas as a place for drinking, eating, shopping and entertainment. Restuaurants like American Social, Big City Tavern, Louie Bossi, Rocco’s Tacos and Royal Pig Pub line the streets along with boutique shopping such as Alex & Ani, Hoffman’s Chocolates, Chico’s, Sunglass Hut, Bluemercury and Tommy Bahama. Las Olas is not just a place for dining and shopping, but entertainment as well. -

Villagio Di Las Olas

VILLAGIO DI LAS OLAS Offering Memorandum 1103-1111 E Las Olas Blvd Ft Lauderdale FL 33301 Morgan Whitney | Commercial Division 235 Lincoln Rd Suite 307| Miami Beach FL 33139 1110 Brickell Ave Suite 102| Miami FL 33131 T. 305-345-3738 | F. 305-675-0461| Off. 888-335-8585 [email protected] - www.morganwhitney.com VILLAGIO DI LAS OLAS I N V E S T M E N T H I G H LI G H T S Representative Photo LOCATION PROPERTY TENANTS ✓ Prime Location on Las Olas Blvd ✓ Mixed use – Restaurants and office ✓ 3 well known Restaurants current with waterfront Spaces operating ✓ Close proximity to downtown and Ft ✓ Covered parking managed by Asta ✓ 2 Office Spaces Lauderdale Beach Parking ✓ Strategically Located Property, ✓ Attractive Rental Escalations | 4.00% ✓ Long term history of 100% occupancy well Positioned Within A Percent Rental Increases Annually with little turnover Dense Retail Corridor ✓ Stable Tenant Mix ✓ Walking distance to retail and ✓ Well maintained property on high banks visibility road ✓ Strong Traffic Counts | Average ✓ Property Size: 26,780 Sq. Ft. daily traffic count +/- 22,000 cars per day ✓ Close proximity to Ft Lauderdale - Hollywood International Airport and major highways such as I-95, 595 and Florida Turnpike. 1103-1111 E Las Olas Blvd. Ft Lauderdale FL 33301 Financial Analysis ✓ PRICE $7,499,000 ✓ CAP 5.1% ✓ RENT $469,488.00 Property Description Property Villagio Di Las Olas Property Address 1103-1111 E Las Olas Blvd City, State, ZIP Ft Lauderdale FL 33301 Folio 5042 11 07 0970 Building Size (Square Feet) 26,780 Primary Zone Mixed use – store and office or store and residential or residential combination Floors: 2 Units 3 Restaurants, 2 office spaces Parking 27 covered parking Year Built 1968 The Offering Purchase Price $7,499,000.00 CAP Rate 5.1% Annual Rent $469,488.00 Price / SF $280.02 Villagio Di Las Olas Financials Asking Price: $7,499,000.00 principles of Services, Inc. -

A Publication of Riverwalk Fort Lauderdale Vol

A PUBLICATION OF RIVERWALK FORT LAUDERDALE VOL. 9 NO. 6 JULY 2012 July_daouds.indd 2 6/22/12 1:16 PM IN THIS ISSUE Features On The Cover 15 A PUBLICATION OF THE RIVERWALK TRUST VOL. 9 NO. 6 JULY 2012 A Publication of Riverwalk Fort Lauderdale Photography by Jason Leidy Design by Ryan K. Hughes Las Olas Resurgence 18 Go Riverwalk is Fort Lauderdale’s City Kevin Lane Magazine covering arts, entertainment, business and lifestyles. Go Riverwalk is Three Perfect Days on Las Olas a Riverwalk Fort Lauderdale publication and publishes 12 times a year to inform, 22 Kathryn Dressler inspire and connect residents, readers and leaders with the people, places, Quarter Century Club Fire Department Turns 100 happenings and events that make Fort 30 Kevin Lane 36 Michelle Klymko Lauderdale one of the world’s best places to live, work and play. © Copyright 2012, Riverwalk Fort Lauderdale. All rights reserved. No part of Go Riverwalk may be reproduced in any form by any means without prior written Departments consent from Riverwalk Fort Lauderdale and publisher Riverwalk Ad Group, Inc. Riverwalk Fort Lauderdale and publisher 6 Chair Column 44 Dining Destinations Mark Budwig Alexandra Roland accept no liability for the accuracy of statements made by the editors or Riverwalk Roundup Event Connections 8 52 advertisers. The waves device and Go Genia Duncan Ellis Compiled by Alexandra Roland Riverwalk are trademarks of Riverwalk Downtown Lowdown Fort Lauderdale. © Copyright 2012. 10 58 Membership Chris Wren 14 Riverwalk Trust Exclusives 60 Snapped@ JULY 2012 -

4 West Las Olas Blvd | Fort Lauderdale

4 WEST LAS OLAS BLVD | FORT LAUDERDALE RETAIL FOR LEASE Conceptual rendering 2 HIGHLIGHTS • ±4,988 sf of available retail space • Located along the Riverwalk at the entrance of Las Olas Boulevard, the major restaurant, café, boutique strip running through the heart of Fort Lauderdale attracting tourists, locals and the 41,096 area employees • Downtown Fort Lauderdale is experiencing steady population growth • Over 4.8 million square feet of office space within the CBD • ½ mile walk to the Brightline Train Station connecting Ft Lauderdale to West Palm Beach, and soon to Miami and Orlando • Huizenga Park, Museum of Discovery and Science and Broward Center for the Performing Arts within walking distance Conceptual rendering 3 FLOOR PLAN TARPON RIVER RIVERWALK 4 PARKING PARKING LAS OLAS BOULEVARD ±4,988 SF OUTDOOR SEATING SOUTH ANDREWS AVENUE 5 N LAS OLAS RIVERFRONT & DOWNTOWN FORT LAUDERDALE CBD Las Olas Boulevard is famous throughout South Florida for it’s beautiful tree-lined charm, incredible dining and shopping, and relaxed ambiance. For decades, locals and tourists alike have flocked to Las Olas as a place for drinking, eating, shopping and entertainment. Restaurants like American Social, Big City Tavern, Louie Bossi, Rocco’s Tacos and Royal Pig Pub line the streets along with boutique shopping such as Alex & Ani, Hoffman’s Chocolates, Chico’s, Sunglass Hut, Bluemercury and Tommy Bahama. Las Olas is not just a place for dining and shopping, but entertainment as well. The Broward Center for the Performing Arts, The Florida Grand Opera, The Museum of Discovery & Science and the IMAX 3D Theater are all within a few blocks of Las Olas Riverfront project. -

ICSC South Florida

ICSC South Florida The Westin Fort Lauderdale Beach Resort Fort Lauderdale, FL November 15 – 16, 2017 #ICSC Directory ICSC South Florida MODERATOR WEDNESDAY, NOVEMBER 15 Barry Somerstein Registration Shareholder 3:00 – 7:00 pm Greenspoon Marder Fort Lauderdale, FL Atlantic Foyer PANELISTS Aileen Bouclé Welcome Reception Executive Director 5:00 – 7:00 pm Miami-Dade Transportation Sky Terrace Planning Organization Miami, FL Kasra Moshkani THURSDAY, NOVEMBER 16 General Manager Uber Registration Miami, FL 8:00 am – 4:00 pm Las Olas Foyer Joseph Napoli Chief of Staff and Senior Policy Advisor Miami-Dade Aviation Department Networking Lounge Miami, FL 8:00 am – 2:00 pm Atlantic Ballroom Foyer Mike Reininger Executive Director Brightline Continental Breakfast Served Miami, FL 9:00 – 9:30 am (No breakfast served after 9:30 am) General Session II: Las Olas Foyer The Evolution of Retail 11:15 am – 12:15 pm Welcome and Introduction to Las Olas Ballroom the Program Change Is Upon Us 9:30 – 9:45 am This panel explores consumer patterns, retail Las Olas Ballroom insights, and the nuances of our transitioning times. With deep experience in grocery, mass Jamie Levenshon merchandise, and small shop retail, the panelists ICSC 2017 South Florida Idea Exchange will share frank answers to tough questions. Program Planning Committee Chair Business Development MODERATOR Commercial Real Estate Insurance Division Lori Schneider Hays Companies of Florida ICSC Southern Division Ambassador Plantation, FL Senior Managing Director Investments Marcus & Millichap General Session I: Fort Lauderdale, FL Transportation Panel PANELISTS Angel Cicerone 10:00 – 11:00 am President Las Olas Ballroom Tenant Mentorship, LLC Airplanes, Trains, and Automobiles Sanford, FL Transportation has a large impact on how we live, work, and play. -

BI-MONTHLY MONITOR the Florida Region Features a Dynamic Multifamily Landscape and Fast-Moving Economy

CUSHMAN & WAKEFIELD / FLORIDA CAPITAL MARKETS GROUP FLORIDA MARKET INSIGHT NOVEMBER 9, 2019 BI-MONTHLY MONITOR The Florida region features a dynamic multifamily landscape and fast-moving economy. The Cushman & Wakefield Research Team is pleased to curate the most relevant news articles twice a month in order to help our clients keep abreast of key movements in their markets. SOUTH FLORIDA TAMPA • Miami developer planning 250-300 rental units • Hard Rock Hotel & Casino reveals $700M plans • Fort Lauderdale affordable housing snags $27M loan • USF innovation effort pumps $582M/year to economy • Deerfield Beach office buildings sell for $28M • Investcorp purchases 2,876-unit portfolio • SOLD: 318-unit Class A property ($69M) • Industrial land sells for $24M near Opa-locka • Tourism adds $6.6B to Hillsborough Economy • OKO secures $243M loan for Edgewater tower • 55+ housing market confidence at all time high • FCP buys three Palm Beach County apartment deals ORLANDO • Altman closes on Miramar development site ($35M) • SOLD: 278-unit Winter Park community • Developer planning 302 apartments in Dania Beach • SOLD: 50,000 square foot retail center ($20.5M) • SOLD: Tamarac apartment complex ($47M) • SOLD: 208-unit Kissimmee property ($25M) • Brickell office tower sold to Aimco • UniCorp lands $21M loan for retail project • Miami’s 4th tallest tower reaches completion • Luxury community coming to MetroWest • Brightline to open station at PortMiami in 2020 • AdventHealth Kissimmee plans $84M expansion • Phase one of Miami River Walk topped off -

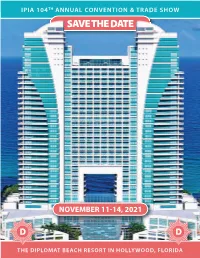

Convention 2021

IPIA 104TH ANNUAL CONVENTION & TRADE SHOW SAVE THE DATE NOVEMBER 11!14, 2021 THE DIPLOMAT BEACH RESORT IN HOLLYWOOD, FLORIDA THE DIPLOMAT BEACH RESORT IN HOLLYWOOD, FLORIDA IPIA 104 TH ANNUAL CONVENTION & TRADE SHOW Please mark your calendar to come and reunite with your IPIA friends and colleagues in 2021 at the Diplomat Beach Resort in Hollywood, Florida. This iconic retreat is a hidden gem tucked between Miami and Fort Lauderdale. Notable facts about the Diplomat Beach Resort…. Voted one of the top 10 resorts in Florida by Condé Nast Traveler Choice Awards 2018. Spacious rooms and suites featuring stunning views of the Atlantic Ocean or Intracoastal Waterway, vintage-inspired art, luxurious amenities, and plush bedding. Oceanfront resort featuring (2) beachside pools and a private beach with water sports options such as jet skiing, kayaking, and paddle boarding. 8 unique culinary experiences onsite led by celebrity chefs Geo$rey Zakarian and Michael Schulson, including Monkitail, voted #1 Best New Restaurant of 2017 by USA Today’s reader’s choice, and Four Diamond AAA-rated Diplomat Prime. Conveniently located near Fort Lauderdale’s Las Olas Boulevard, Miami’s South Beach Art Deco District, and world-class shopping at nearby Aventura Mall and Bal Harbour Shops. Home to the Diplomat Spa + Wellness center that features a host of spa and wellness treatments, concierge sta$ and *tness classes. Mark your calendars for NOVEMBER 11-14, 2021, and come join us on Florida’s Gold Coast! THE DIPLOMAT BEACH RESORT IN HOLLYWOOD, FLORIDA IPIA 104 TH ANNUAL CONVENTION & TRADE SHOW NOVEMBER 11-14, 2021 THE DIPLOMAT BEACH RESORT IN HOLLYWOOD, FLORIDA. -

Technical Specifications

TECHNICAL SPECIFICATIONS AMATURO THEATER Fort Lauderdale, Florida February 2017 TABLE OF CONTENTS GENERAL CONTACT INFORMATION ................................................................................. 2 MAP & DIRECTIONS .................................................................................................................... 3 TRUCK, BUS & VEHICLE PARKING ........................................................................................ 3 SITE PLAN ....................................................................................................................................... 4 LOADING DOCK INFO ............................................................................................................. 6 SEATING CAPACITY ................................................................................................................... 7 SEATING CHART ......................................................................................................................... 8 STAGE SPECIFICATIONS ........................................................................................................... 9 ORCHESTRA PIT / STAGE THRUST INFORMATION ....................................................... 9 STAGE DIMENSIONS & GROUND PLAN ............................................................................. 10 RIGGING SPECIFICATIONS / OBSTACLES .......................................................................... 12 SOFTGOODS INVENTORY ..................................................................................................... -

Prologis Pompano Commerce Center II Prologis Pompano Commerce

Prologis Pompano Commerce Prologis Pompano Commerce Center II Center II Pompano Beach, FL 33069 USA Pompano Beach, FL 33069 USA Property Description: • ±380,000 SF Master planned distribution park on 1 approximately ±26.2 acres PROPOSED 2 • Located in Pompano Beach, Florida in between I-95 and the Florida Turnpike • Excellent access to I-95, Florida Turnpike, Sawgrass 3 Expressway, US-1 and 4 Andrews Avenue 15 Miles • Available space from ±20,000 - 380,000 SF 30 Miles 5 6 • Land opportunities available for build-to-suit, sale, lease or build-to-own 60 Miles • Fully entitled and permitted; all utilities available at site SIGNIFICANT LOCATIONS: • ±Up to ±26.2 acres available for sale, build-to-suit and/or build-to-own • ±20,000 - ±380,000 SF spaces available for lease or purchase 1. Port of Palm Beach 4. Port Everglades 2. Palm Beach International Airport 5. Miami International Airport • Fully entitled and permitted, can be delivered within 9 months 3. Fort Lauderdale - Hollywood International Airport 6. Port Miami CBRE, Inc. Prologis CBRE, Inc. Prologis Tom O’Loughlin, SIOR, CCIM Denver Glazier Tom O’Loughlin, SIOR, CCIM Denver Glazier First Vice President ph +1 305 392 4275 First Vice President ph +1 305 392 4275 ph +1 954 356 0468 8355 NW 12th Street ph +1 954 356 0468 8355 NW 12th Street 200 E. Las Olas Boulevard Doral, FL 33126 USA 200 E. Las Olas Boulevard Doral, FL 33126 USA Suite 1620 Larry W. Genet www.prologis.com Suite 1620 Larry W. Genet www.prologis.com Fort Lauderdale, FL 33301 USA Associate Fort Lauderdale, FL 33301 USA Associate CBRE, Inc. -

America's Leading, Largest and Most Admired Automotive Retailer

ANNUAL REPORT 2002 America’s leading, largest and most admired automotive retailer We are AutoNation. 2002 was a year of significant accomplishments for AutoNation. From coast to coast, across 374 dealership franchises and 17 states, we provided unparalleled buying experiences for customers, exceptional career opportunities for associates, and delivered impressive financial performance for shareholders. In fact, we established ourselves once again as America's best run and most profitable retailer of new and used vehicles and achieved the following milestones: • Full-year net income of $382 million for a record $1.19 per share. • Four consecutive quarters of record earnings per share. • A second straight year as Fortune magazine's “Most Admired” automotive retailer. Once again, through the dedication and drive of our 28,500 associates, we earned our status as a Fortune 100 company. It is because of their passion and perseverance that we are able again to state proudly that at AutoNation . We are Driven To Be The Best. Financial Highlights Total Revenue Income from Diluted Earnings Per Share Continuing Operations from Continuing Operations in Billions in Millions $20.6 $1.19 $20 $20.0 $19.5 $400 $382 $328 $0.91 300 $0.73 15 $245 200 100 10 0 2000 2001 2002 2000 2001 2002 2000 2001 2002 Company Record Consolidated Balance Sheet Highlights AS OF THE YEAR ENDED DECEMBER 31, ............................. ............................ ........................ ........................ Business Description AutoNation, Inc. (NYSE: AN) is America's largest retailer of both new and used vehicles. As of March 17, 2003, we owned and operated 374 new vehicle franchises from 287 dealerships located in major U.S. -

Matthew G. Mcallister Director 225 NE Mizner Boulevard, Suite 300 | Boca Raton, Florida 33432 515 E

Matthew G. McAllister Director 225 NE Mizner Boulevard, Suite 300 | Boca Raton, Florida 33432 515 E. Las Olas Boulevard, Suite 860 | Fort Lauderdale, Florida 33301 Direct +1 561 227 2018 [email protected] | cushwakesouthfl.com Professional Expertise Matthew G. McAllister joined Cushman & Wakefield in 2014 as a member of the South Florida Industrial Team of Chris Metzger, Rick Etner, Christopher Thomson, Merritt Etner, and Alex VanDresser. Matthew was previously with NAI/Merin Hunter Codman since 2009. While at NAI, Matthew specialized in distressed asset evaluation, investments sales, tenant and landlord representation and corporate service work in industrial, office and retail space. Mr. McAllister specializes in the sale and leasing of industrial properties in the South Florida Market, representing both tenants and landlords. Clients Served Bristol Group, Cabot, C-III Asset Management, CW Capital, DCT, EastGroup, Exeter Properties, First Industrial, Hudson Advisors, Prologis, and Stateside Capital, while also representing many of the active local owners and developers in the South Florida market. His tenant representation clients include BF Aerospace, Empire Carpet, General Insulation, Grafton Cosmetics, Guardian Alarm of Florida, The Singing Machine, Sun-Sentinal, and VTC Corporation. Professional Recognition • C&W Top Industrial Team- South Florida: 2015, 2016, 2017, 2018 • C&W Top Producing Team in Broward & Palm Beach Counties: 2015, 2016, 2017, 2018 • NAIOP Industrial Lease of the Year Finalist: 2016 • NAIOP Industrial Sale of the Year Finalist: 2018 • NAIOP Industrial Brokerage Team of the Year: 2017, 2018 Community Leadership • President of 2011 Leadership Boca Raton • Boca Raton Chamber of Commerce Member • CCA – Coastal Conservation Association Member • George Snow Scholarship Foundation – Selection Committee Education • North Carolina State University in Raleigh – Bachelor of Arts degree in Business Management .