An Overview of Six Economic Zones in Nigeria: Challenges and Opportunities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lekki Phase One

HAVEN HOMES ... live your dreams LEKKI PHASE ONE RCCG 3 MTN VFS R EXOUSIA A D OFFICE GLOBAL DUNAMIS B R O O U FREEDOM ROAD FREEDOM ROAD U T N D L E THE DOME K CHURCH S K E I - E M P E O E X H P S R E N E M S E O S H V W N A A E Y V H A 4 T H A H B R O O KUSENLA ROAD U U T N D 3 Haven Homes Welcome! e are delighted to invite you to our new exciting project W“RICHMOND PEARL ESTATE” located on Freedom Way by Lekki Phase 1 an upscale and high brow part of Lagos. Richmond Pearl Estate offers easy access to Victoria Island (Central Business District of Lagos), Ikoyi, Banana Island and other parts of Lekki all within 5-15 minutes drive. Developed by Haven Homes, the developers of the Richmond Gate Estate 1, 2 and 3 which is known as the celebrity Lifestyle Estate of Nigeria and also called the Beverly Hills Estate of Nigeria. Richmond Pearl Estate incorporates topnotch amenities, affordable luxury living experience and serves as a hub for wise investment decisions. www.thehavenhomes.com 4 Haven Homes General Features Facilities in The Estate: 24-hours 24-hours Centralised Centralised Optional power security water System Sewage Multimedia supply System cabling Interlocked Energy efficient Fire alarm for Recreational Fibre Optics road networks Lightening common areas Facilities Cabling round the estate www.thehavenhomes.com 5 Haven Homes Haven Homes aven Homes is owned by Nigerian professionals who were originally based in the United Kingdom and have seen the need to build homes in Nigeria with ultra perfect finishes and regal fittings that can only provide a truly unique Hand comfortable haven. -

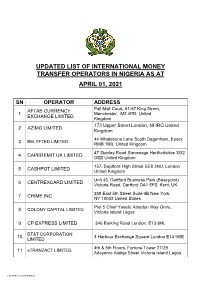

Updated List of International Money Transfer Operators in Nigeria As At

UPDATED LIST OF INTERNATIONAL MONEY TRANSFER OPERATORS IN NIGERIA AS AT APRIL 01, 2021 SN OPERATOR ADDRESS AFTAB CURRENCY Pall Mall Court, 61-67 King Street, 1 Manchester, M2 4PD, United EXCHANGE LIMITED Kingdom 173 Upper Street London, NI IRG United 2 AZIMO LIMITED Kingdom 44 Whalebone Lane South Dagenham, Essex 3 BELYFTED LIMITED RMB 1BB, United Kingdom 47 Stanley Road Stevenage Hertfordshire SG2 4 CAPEREMIT UK LIMITED OEE United Kingdom 157, Deptford High Street SE8 3NU, London 5 CASHPOT LIMITED United Kingdom Unit 46, Dartford Business Park (Basepoint) 6 CENTREXCARD LIMITED Victoria Road, Dartford DA1 5FS, Kent, UK 239 East 5th Street Suite 4B New York, 7 CHIME INC. NY 10003 United States Plot 5 Chief Yesefu Abiodun Way Oniru, 8 COLONY CAPITAL LIMITED Victoria Island Lagos 9 CP EXPRESS LIMITED 346 Barking Road London, E13 8HL DT&T CORPORATION 10 3 Harbour Exchange Square London E14 9GE LIMITED 4th & 5th Floors, Fortune Tower 27/29 11 eTRANZACT LIMITED Adeyemo Alakija Street Victoria Island Lagos Classified as Confidential FIEM GROUP LLC DBA 1327, Empire Central Drive St. 110-6 Dallas 12 PING EXPRESS Texas 6492 Landover Road Suite A1 Landover 13 FIRST APPLE INC. MD20785 Cheverly, USA FLUTTERWAVE 14 TECHNOLOGY SOLUTIONS 8 Providence Street, Lekki Phase 1 Lagos LIMITED FORTIFIED FRONTS LIMITED 15 in Partnership with e-2-e PAY #15 Glover Road Ikoyi, Lagos LIMITED FUNDS & ELECTRONIC 16 No. 15, Cameron Road, Ikoyi, Lagos TRANSFER SOLUTION FUNTECH GLOBAL Clarendon House 125 Shenley Road 17 COMMUNICATIONS Borehamwood Heartshire WD6 1AG United LIMITED Kingdom GLOBAL CURRENCY 1280 Ashton Old Road Manchester, M11 1JJ 18 TRAVEL & TOURS LIMITED United Kingdom Rue des Colonies 56, 6th Floor-B1000 Brussels 19 HOMESEND S.C.R.L Belgium IDT PAYMENT SERVICES 20 520 Broad Street USA INC. -

Prof. Dr. Kayode AJAYI Dr. Muyiwa ADEYEMI Faculty of Education Olabisi Onabanjo University, Ago-Iwoye, NIGERIA

International Journal on New Trends in Education and Their Implications April, May, June 2011 Volume: 2 Issue: 2 Article: 4 ISSN 1309-6249 UNIVERSAL BASIC EDUCATION (UBE) POLICY IMPLEMENTATION IN FACILITIES PROVISION: Ogun State as a Case Study Prof. Dr. Kayode AJAYI Dr. Muyiwa ADEYEMI Faculty of Education Olabisi Onabanjo University, Ago-Iwoye, NIGERIA ABSTRACT The Universal Basic Education Programme (UBE) which encompasses primary and junior secondary education for all children (covering the first nine years of schooling), nomadic education and literacy and non-formal education in Nigeria have adopted the “collaborative/partnership approach”. In Ogun State, the UBE Act was passed into law in 2005 after that of the Federal government in 2004, hence, the demonstration of the intention to make the UBE free, compulsory and universal. The aspects of the policy which is capital intensive require the government to provide adequately for basic education in the area of organization, funding, staff development, facilities, among others. With the commencement of the scheme in 1999/2000 until-date, Ogun State, especially in the area of facility provision, has joined in the collaborative effort with the Federal government through counter-part funding to provide some facilities to schools in the State, especially at the Primary level. These facilities include textbooks (in core subjects’ areas- Mathematics, English, Social Studies and Primary Science), blocks of classrooms, furniture, laboratories/library, teachers, etc. This study attempts to assess the level of articulation by the Ogun State Government of its UBE policy within the general framework of the scheme in providing facilities to schools at the primary level. -

Spatial Knowledge and Flood Preparedness in Victoria Island, Lagos, Nigeria

Jàmbá - Journal of Disaster Risk Studies ISSN: (Online) 1996-1421, (Print) 2072-845X Page 1 of 11 Original Research Spatial knowledge and flood preparedness in Victoria Island, Lagos, Nigeria Authors: There is inadequate flood preparedness in Victoria Island, Lagos, Nigeria; because when 1 Abdullateef Bako the flood struck on 08 July 2017, several properties were destroyed without any extant Saeed K. Ojolowo2 means to salvage them. This article investigated the relationship between spatial Affiliations: knowledge and flood preparedness in Victoria Island. The variables employed to measure 1Department of Urban and spatial knowledge include knowledge of: elevation of land, distance between Lagos lagoon Regional Planning, Faculty of and Atlantic Ocean, characteristics of surrounding water bodies and building–plot ratio. Environmental Sciences, University of Ilorin, Kwara Major roads were used to subdivide Victoria Island into four zones. Zone A had 799 State, Nigeria buildings, zone B had 813 buildings, zone C had 749 buildings and zone D had 887 buildings. Of the total 3248 buildings, 344 buildings were selected, and one household 2Department of Urban and head per building was selected and systematically sampled. A multinomial logit regression Regional Planning, Faculty of model was used in data analysis at p ≤ 0.05. The findings revealed that spatial knowledge Environmental Design and Management, University of accounted for only 25.8% of the explanation of inadequate flood preparedness. Only 6.1% Ibadan, Oyo State, Nigeria of the respondents could distinguish height from elevation; those who explained density and setbacks correctly were 7.85% and 12.2%, respectively. Respondents who stated the Corresponding author: distance between Lagos lagoon and Atlantic Ocean correctly and exhibited means of Saeed Ojolowo, [email protected] preparedness were 13.7%, respectively. -

Licensed Microfinance Banks

LICENSED MICROFINANCE BANKS (MFBs) IN NIGERIA AS AT DECEMBER 29, 2017 # Name Category Address State Description 1 AACB Microfinance Bank Limited State Nnewi/ Agulu Road, Adazi Ani, Anambra State. ANAMBRA 2 AB Microfinance Bank Limited National No. 9 Oba Akran Avenue, Ikeja Lagos State. LAGOS 3 Abatete Microfinance Bank Limited Unit Abatete Town, Idemili Local Govt Area, Anambra State ANAMBRA 4 ABC Microfinance Bank Limited Unit Mission Road, Okada, Edo State EDO 5 Abestone Microfinance Bank Ltd Unit Commerce House, Beside Government House, Oke Igbein, Abeokuta, Ogun State OGUN 6 Abia State University Microfinance Bank Limited Unit Uturu, Isuikwuato LGA, Abia State ABIA 7 Abigi Microfinance Bank Limited Unit 28, Moborode Odofin Street, Ijebu Waterside, Ogun State OGUN 8 Abokie Microfinance Bank Limited Unit Plot 2, Murtala Mohammed Square, By Independence Way, Kaduna State. KADUNA 9 Abubakar Tafawa Balewa University Microfinance Bank Limited Unit Abubakar Tafawa Balewa University (ATBU), Yelwa Road, Bauchi Bauchi 10 Abucoop Microfinance Bank Limited State Plot 251, Millenium Builder's Plaza, Hebert Macaulay Way, Central Business District, Garki, Abuja ABUJA 11 Accion Microfinance Bank Limited National 4th Floor, Elizade Plaza, 322A, Ikorodu Road, Beside LASU Mini Campus, Anthony, Lagos LAGOS 12 ACE Microfinance Bank Limited Unit 3, Daniel Aliyu Street, Kwali, Abuja ABUJA 13 Acheajebwa Microfinance Bank Limited Unit Sarkin Pawa Town, Muya L.G.A Niger State NIGER 14 Achina Microfinance Bank Limited Unit Achina Aguata LGA, Anambra State ANAMBRA 15 Active Point Microfinance Bank Limited State 18A Nkemba Street, Uyo, Akwa Ibom State AKWA IBOM 16 Acuity Microfinance Bank Limited Unit 167, Adeniji Adele Road, Lagos LAGOS 17 Ada Microfinance Bank Limited Unit Agwada Town, Kokona Local Govt. -

Here Is a List of Assets Forfeited by Cecilia Ibru

HERE IS A LIST OF ASSETS FORFEITED BY CECILIA IBRU 1. Good Shepherd House, IPM Avenue , Opp Secretariat, Alausa, Ikeja, Lagos (registered in the name of Ogekpo Estate Managers) 2. Residential block with 19 apartments on 34, Bourdillon Road , Ikoyi (registered in the name of Dilivent International Limited). 3.20 Oyinkan Abayomi Street, Victoria Island (remainder of lease or tenancy upto 2017). 4. 57 Bourdillon Road , Ikoyi. 5. 5A George Street , Ikoyi, (registered in the name of Michaelangelo Properties Limited), 6. 5B George Street , Ikoyi, (registered in the name of Michaelangelo Properties Limited). 7. 4A Iru Close, Ikoyi, (registered in the name of Michaelangelo Properties Limited). 8. 4B Iru Close, Ikoyi, (registered in the name of Michaelangelo Properties Limited). 9. 16 Glover Road , Ikoyi (registered in the name of Michaelangelo Properties Limited). 10. 35 Cooper Road , Ikoyi, (registered in the name of Michaelangelo Properties Limited). 11. Property situated at 3 Okotie-Eboh, SW Ikoyi. 12. 35B Isale Eko Avenue , Dolphin Estate, Ikoyi. 13. 38A Isale Eko Avenue , Dolphin Estate, Ikoyi (registered in the name of Meeky Enterprises Limited). 14. 38B Isale Eko Avenue , Dolphin Estate, Ikoyi (registered in the name of Aleksander Stankov). 15. Multiple storey multiple user block of flats under construction 1st Avenue , Banana Island , Ikoyi, Lagos , (with beneficial interest therein purchased from the developer Ibalex). 16. 226, Awolowo Road , Ikoyi, Lagos (registered in the name of Ogekpo Estate Managers). 17. 182, Awolowo Road , Ikoyi, Lagos , (registered in the name of Ogekpo Estate Managers). 18. 12-storey Tower on one hectare of land at Ozumba Mbadiwe Water Front, Victoria Island . -

Standard Chartered Bank Branch Network from 1St

STANDARD CHARTERED BANK BRANCH ST NETWORK FROM 1 JANUARY 2019 REGION BRANCH ADDRESS Ahmadu Bello No. 142, Ahmadu Bello Way, Victoria Island, Lagos (Head Office) Tel: +234 (1) 2368146, +234 (1) 2368154 Airport Road No. 53, Murtala Mohammed International Airport Road, Lagos Tel:234 (1) 2368686 Ajose Adeogun Plot 275, Ajose Adeogun, Victoria Island, Lagos Tel: +234 (1) 2368051, +234 (1) 2368185 Apapa No. 40, Warehouse Road, Apapa, Lagos Tel:+234 (1) 2368752, +234 (1) 2367396 Aromire No. 30, Aromire Street, Ikeja, Lagos Tel:+234 (1) 2368830 – 1 Awolowo Road No.184, Awolowo Road, Ikoyi, Lagos LAGOS Tel:+234 (1) 2368852, +234 (1) 2368849 Broad Street No. 138/146, Broad Street, Lagos Tel: +234 (1) 2368790, +234 (1) 2368611 Ikeja GRA No. 47, Isaac John Street, GRA Ikeja, Lagos Tel: 234 (1) 2368836 Ikota Shops K23 - 26, 41 & 42 Ikota Shopping Complex, 1/F Beside VGC, Lekki-Epe Expressway, Lagos. Tel:+234 (1) 2368841, 234 (1) 2367262 Ilupeju No. 56, Town Planning way, Ilupeju, Lagos Tel: +234 (1) 2368845, +234 (1) 2367186 Lekki Phase 1 Plot 24b Block 94, Lekki Peninsula Scheme 1, Lekki-Epe Expressway, Lagos Tel: +234 (1) 2368432, +234 (1) 2367294 New Leisure Mall Leisure Mall, 97/99 Adeniran Ogunsanya Street, Surulere, Lagos Tel: +234 (1) 2368827, +234 (1) 2367212 Maryland Shopping Mall 350 – 360, Ikorodu Road, Anthony, Lagos Tel: 234 (1) 2267009 Novare Mall Novare Lekki Mall, Monastery Road, Lekki-Epe Expressway, Sangotedo, Lekki-Ajah Lagos Tel: 234 (1) 2367518 Sanusi Fafunwa Plot 1681 Sanusi Fafunwa Street, Victoria Island, Lagos Tel: +234 (1) -

Download Hotel Information

HOTELS FOR THE ACE WORKSHOP [1] Intercontinental Hotel, Lagos Address: Plot 52, Kofo Abayomi Street, Victoria Island, Lagos, Nigeria; Tel: +234 1 236 6666, Email: [email protected] Facilities: Complimentary WiFi. Minibar Tea/coffeemaker 40inch LCD TV HDMI connectivity Iron boards Bathroom with walk in rainshower and bathtub Room Rate: N96,000.00 (Approx. $300.00) *Discounted Workshop Rate: N65,000.00 (Approx. $203.00) [Venue of the Workshop] [2] Four Points by Sheraton Lagos *Preferred alternative hotel Address: Plot 9/10 Block 2 Oniru Chieftaincy Estate, Victoria Island, Lagos; Tel: +234 700 Reservations, +234 1 14489444, Email: [email protected] Facilities: Air conditioner, Hair dryer, Mini bar, Safe, Satellite TV, Shaver Plug 110v/220v, Tea/Coffee, Telephone, Writing desk, In room dining (24 hours), Internet, Laundry, Wifi, Car Hire, Wake-up Call. Room Rate: N79,700.00 (Approx. $250.00) *Discounted Workshop Rate: N50,800.00 (Approx. $160.00) [6.2km to Intercontinental Hotel; chances of light to medium traffic] [3] Lagos Oriental Hotel *Preferred alternative hotel Address: 3, Lekki Road, Victoria Island Lagos; Tel: +234 1 280 6600, +234 702 696 0065, Email: [email protected] Facilities Tea making facilities, Free Min bar with: 24hour Laundry Service Sewing Kit and a Shoe horn Bathroom: Dental Kit, Shaving Kit, Vanity Kit, Comb, Shower cap, Dental Floss, Shampoo, Shower gel, Lotion and a Bathrobe with Slippers Room Rate: N67,000.00 (Approx. $210.00) *Discounted Workshop Rate: N45,000.00 (Approx. $141.00) [6.2km to Intercontinental Hotel; chances of light to medium traffic] [4] Federal Palace Hotel & Casino Address: 6 – 8 Ahmadu Bello Way; Victoria Island; Lagos; Tel: +234(1)277 9000, Email: [email protected] Facilities: Air conditioner, Hair dryer, Mini bar, Safe, Satellite TV, Shaver Plug 110v/220v, Tea/Coffee, Telephone, Writing desk, In room dining (24 hours), Internet, Laundry, Wifi, Car Hire, Wake-up Call. -

The Vulnerability of Eti-Osa and Ibeju-Lekki Coastal Communities in Lagos State Nigeria to Climate Change Hazards

Research on Humanities and Social Sciences www.iiste.org ISSN (Paper)2224-5766 ISSN (Online)2225-0484 (Online) Vol.4, No.27, 2014 The Vulnerability of Eti-Osa and Ibeju-Lekki Coastal Communities in Lagos State Nigeria to Climate Change Hazards Joyce OMENAI Geography Department, University of Lagos, Akoka-Yaba, Lagos, Nigeria, 101017 Email: [email protected] Deborah AYODELE Geography Department, University of Lagos, Akoka-Yaba, Lagos, Nigeria, 101017 Email: [email protected] Abstract The rapid growth of population and infrastructure along the Lagos Coast present many challenges especially in the face of the current threats posed by climate change. The predominance of rural communities whose livelihoods are closely linked with climate- sensitive resources makes it imperative that the inhabitants understand, address and reduce their vulnerability to and adapt to the challenges of climate change. This study therefore evaluated the vulnerability of communities in Ibeju-Lekki and Eti-Osa Local Government Areas to climate change in order to introduce effective climate change communication, mitigation and adaptation techniques. Distance from water bodies (sea, creeks and lagoons) and height above sea level were the major variables used to carry out a vulnerability analysis using digital terrain modelling. 50.5% and 49.4% of the 91 communities have very high levels of vulnerability with a total vulnerability index of 8.3 on a scale of 10 where 10 indicate the highest degree of vulnerability while the highest elevation in the area is 12metres above sea level. This calls for the urgent need for climate change communication that are place-specific and demographic appropriate. -

Lagos State COVID-19 Incident Command Presentation

Lagos State COVID-19 Incident Command Presentation Monday April 13th 2020 Testing Parameter Result Country Breakdown - Test per mln of Population Total Number of Tests 1,471 1,600 Total Confirmed Cases 176 1,400 1,350 Total Tests per mln of 32 1,221 population – 04/04/2020 1,200 Total Tests per mln of 56 1,000 population – 10/04/2020 Percentage increase in 75% 800 testing per mln within past 600 week 400 224 200 77 56 24 - South Africa Ghana Egypt Algeria Lagos State National Average 3 Breakdown of Tests by Local Government Area Trend of Positive Tests: (4/4/2020 - 12/4/2020) • Growth in number of positive 70 cases from Eti-osa and Ikeja 60 61 seem to have stalled 60 56 50 • Over the past week, there has 50 been a rapid increase in confirmed cases from Lagos 40 Island 29 30 30 • Active Case Search should be 24 scaled up in Lagos Island 19 20 8 9 10 6 4 5 23 2333 32 01 00111 1 0 4/4/2020 4/5/2020 4/6/2020 4/7/2020 4/8/2020 4/9/2020 4/10/2020 4/11/2020 4/12/2020 Eti-Osa Lagos Mainland Ikeja Kosofe Alimosho Shomolu Mushin Ikorodu Oshodi-Isolo Amuzo-Odofin Surulere Agege Lagos Island Ibeju-Lekki Ifako-Ijaiye Ajeromi-Ifelodun Ojo Badagry Apapa Epe 4 Patient Overview • 43 (31.5%) with a co-morbidity • 3 transferred in Deaths Positive Admitted Discharged 5 176 137 61 Average duration of admission is 11.0 days 14 (8.5%) awaiting admission Severity • Mild: - 58% • Moderate- 38% • Severe - 4% 5 Bed Capacity Utilization Breakdown of Capacity Utilized by Ward Installed Capacity LUTH Female 2 30 MAINLAND LUTH ONIKAN LUTH Male 8 30 47% 15% 17% Onikan -

A Case Study in Ikenne Local Government, Ogun State, Nigeria

Quest Journals Journal of Research in Agriculture and Animal Science Volume 3 ~ Issue 10 (2016) pp:07-13 ISSN(Online) : 2321-9459 www.questjournals.org Research Paper Determinants of Crop Farmers’ Adoption of Soil Conservation Techniques: A Case Study in Ikenne Local Government, Ogun State, Nigeria. Bello Taofeek Ayodeji1, *Afodu Osagie John1, Ndubuisi-Ogbonna Lois Chidinma2, Akinboye Olufunso Emmanuel3 Akpabio, Utibe-Obong Enobong1 1Department of Agricultural Economics & Extension, 2Department of Animal Science, 3Department of Agronomy and Landscape Design, School of Agriculture and Industrial Technology, Babcock University, Ilishan Remo, Ogun state, Nigeria. Received 06 February, 2016; Accepted 16 March, 2016 © The author(s) 2015. Published with open access at www.questjournals.org ABSTRACT:- Soil conservation is a set of management strategies for prevention of soil being eroded from the earth’s surface or becoming chemically altered by overuse, salinization acidification, or other chemical soil contamination. Soil conservation technique is the application of processes to the solution of soil management problems. This research assessed the level of crop farmers’ awareness of soil conservation, described the socio- economic characteristics of the crop farmers, and evaluated factors that determine or influence their adoption of soil conservation techniques in Ikenne local government area of Ogun State. One hundred (100) crop farmers were selected randomly for the research study but out of all the 100 questionnaires administered, only 97 were found useful for analysis. The demographic data collected were analysed using descriptive statistics, while the logit regression model was used to evaluate the factors determining crop farmers’ adoption of soil conservation techniques. The descriptive analysis result showed that 61.9% of the respondents had farming as their major occupation, 87.6% had farmlands of their own, 38.1% belonged to farmers’ groups/associations, and 71.1% were aware of soil conservation techniques. -

Based Health Insurance Scheme in Nigeria: a Case Study of Kwara And

1 STATE OF HEALTH FACILITIES IN COMMUNITIES DESIGNATED FOR COMMUNITY- 2 BASED HEALTH INSURANCE SCHEME IN NIGERIA: A CASE STUDY OF KWARA AND 3 OGUN STATES. 4 ABSTRACT 5 Background: Nigerian Government established National Health Insurance Scheme (NHIS) 6 including Community Based Health Insurance Scheme (CBHIS) to reduce out-of-pocket health 7 expenses of enrollees, strengthen and ensure access to quality healthcare services. The 8 functionality of the schemes however, revolves round health facilities being able to meet the 9 expectation of the enrollees. 10 Study objectives: The study assessed the adequacy of the designated health facilities in 11 offering quality healthcare services to the enrollees or potential enrollees under the CBHIS, and 12 to identify likely challenges. 13 Study Design: This is part of a larger prospective cross-sectional study that assessed the 14 implementation of the Community-Based Health Insurance Scheme (CBHIS) in selected local 15 government areas of Kwara in the north central and Ogun in the South Western part of Nigeria. 16 Place and Duration of the Study: Health facilities of selected wards from two Local 17 Government Areas in Kwara and Ogun States were assessed between February and May 18 2015. 19 Method: Semi-structured questionnaires and health facility assessment checklist were used to 20 assess services rendered, storage of drugs and the vaccines, manpower, training opportunities, 1 21 available infrastructures and perceived challenges to smooth operation of health facilities 22 designated for CBHIS. 23 Results: A total of twenty designated health facilities were visited and assessed (Seventeen 24 public and three private). Services claimed to be available at the facilities included clinical, 25 nursing, pharmaceutical and laboratory services.