Credit Unions and Caisses Populaires SECTOR OUTLOOK 1Q16

June 2016

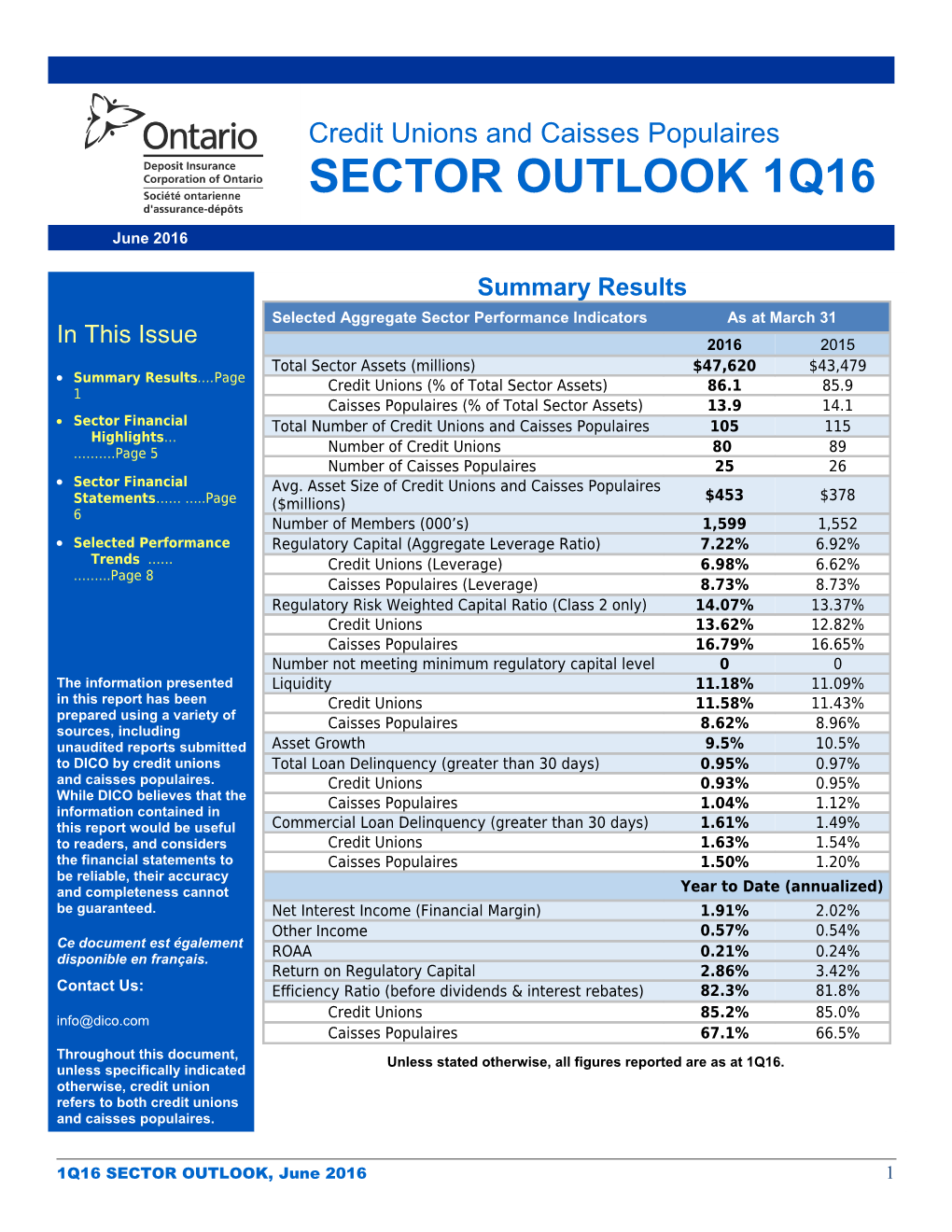

Summary Results Selected Aggregate Sector Performance Indicators As at March 31 In This Issue 2016 2015 Total Sector Assets (millions) $47,620 $43,479 Summary Results….Page Credit Unions (% of Total Sector Assets) 86.1 85.9 1 Caisses Populaires (% of Total Sector Assets) 13.9 14.1 Sector Financial Total Number of Credit Unions and Caisses Populaires 105 115 Highlights… ……….Page 5 Number of Credit Unions 80 89 Number of Caisses Populaires 25 26 Sector Financial Avg. Asset Size of Credit Unions and Caisses Populaires $453 $378 Statements…… …..Page ($millions) 6 Number of Members (000’s) 1,599 1,552 Selected Performance Regulatory Capital (Aggregate Leverage Ratio) 7.22% 6.92% Trends …… Credit Unions (Leverage) 6.98% 6.62% ……...Page 8 Caisses Populaires (Leverage) 8.73% 8.73% Regulatory Risk Weighted Capital Ratio (Class 2 only) 14.07% 13.37% Credit Unions 13.62% 12.82% Caisses Populaires 16.79% 16.65% Number not meeting minimum regulatory capital level 0 0 The information presented Liquidity 11.18% 11.09% in this report has been Credit Unions 11.58% 11.43% prepared using a variety of sources, including Caisses Populaires 8.62% 8.96% unaudited reports submitted Asset Growth 9.5% 10.5% to DICO by credit unions Total Loan Delinquency (greater than 30 days) 0.95% 0.97% and caisses populaires. Credit Unions 0.93% 0.95% While DICO believes that the Caisses Populaires 1.04% 1.12% information contained in this report would be useful Commercial Loan Delinquency (greater than 30 days) 1.61% 1.49% to readers, and considers Credit Unions 1.63% 1.54% the financial statements to Caisses Populaires 1.50% 1.20% be reliable, their accuracy and completeness cannot Year to Date (annualized) be guaranteed. Net Interest Income (Financial Margin) 1.91% 2.02% Other Income 0.57% 0.54% Ce document est également disponible en français. ROAA 0.21% 0.24% Return on Regulatory Capital 2.86% 3.42% Contact Us: Efficiency Ratio (before dividends & interest rebates) 82.3% 81.8% Credit Unions 85.2% 85.0% [email protected] Caisses Populaires 67.1% 66.5% Throughout this document, Unless stated otherwise, all figures reported are as at 1Q16. unless specifically indicated otherwise, credit union refers to both credit unions and caisses populaires.

1Q16 SECTOR OUTLOOK, June 2016 1 Economic Overview In Canada, interest rates are expected to remain low for the foreseeable future with the economic recovery progressing at a very slow pace. The new federal government’s first budget contained additional spending promises intended to provide a boost to the flagging economy across the country but at the cost of ELECTRONIC very large deficits for the next few years. While increased government spending PUBLICATION: may help to spur the Canadian economy, the low interest rate environment The Sector Outlook is continues to put pressure on margins. available in PDF format (readable using Adobe Although the Bank of Canada has advised Canadians to take this opportunity to Acrobat Reader) and can be reduce their debt loads, consumers continue to spend on credit with the downloaded from the household debt level hitting a new high at the end of March 2016. Along with Publications section on DICO’s website at higher consumer debt, continued strong demand for residential mortgages is www.dico.com. resulting in increased liquidity demand for some credit unions. Credit unions should ensure their capital and liquidity management stress testing models appropriately reflect any potential decrease in interest rates.

Capital

NOTE : Aggregate regulatory sector capital increased to $3.40 billion from $2.98 billion year over year and as a percentage of assets to 7.22% from 6.92%. The Income Statement results are increase in capital was largely due to eight credit unions issuing investment based on aggregate year to date annualized information share offerings in the latter part of 2015 that raised approximately $300 million for each credit union. (approximately 70% of the increase in capital). All credit unions met minimum Comparative results may not regulatory capital requirements. Retained earnings represented 61.4% ($2.1 B) always agree with previously of regulatory capital, investment and patronage shares accounted for 36.8% reported information for the same period as a result of ($1.25 B) with membership shares making up the remaining 1.8% ($65 million). additional information Retained earnings grew by 6.2% year over year (4.4% as a ratio to total assets) received after the reporting much lower than the 13.6% increase from 1Q 2014 to 1Q 2015. date.

Growth Sector consolidation continued over the last twelve months with the number of credit unions decreasing by ten to 105, increasing the average size to approximately $454 million. The number of credit unions declined by nine to 80 resulting in an average asset size of $513 million while the number of caisses Results are based on the populaires decreased by one to 25 with an average asset size of $264 million. latest available Total assets grew by 9.5% to $47.6 billion, largely due to growth in commercial information as at April loans (10.9%), residential mortgage loans (10.8%) and agricultural loans (8.3%). 26, 2016. The proportion of personal loans has decreased from 11.0% to 6.7% of total loans over the past five years while residential mortgages have increased from 56.3% to 59.7% and commercial loans from 28.2% to 29.2%.

1Q16 SECTOR OUTLOOK, June 2016 2 1Q 2016 1Q 2015 1Q 2011 $ Billions Percent of $ Billions Percent of $ Billions Percent of Total Loans Total Loans Total Loans Residential Mortgage Loans $ 24.50 59.7% $ 22.07 58.9% $ 14.77 56.3% Commercial Loans $ 12.00 29.2% $ 10.86 29.0% $ 7.40 28.2% Agricultural Loans $ 1.67 4.1% $ 1.54 4.1% $ 1.10 4.2% Personal Loans $ 2.74 6.7% $ 2.88 7.7% $ 2.88 11.0% Other Loans $ 0.12 0.3% $ 0.10 0.3% $ 0.10 0.4% $ 41.03 100.0% $ 37.45 100.0% $ 26.25 100.0%

Credit unions should continue to adhere to prudent underwriting practices when pricing loans, including stress testing the impact of interest rate increases on the borrower’s ability to pay. This is particularly important with the economists’ growing concerns over a potential real estate correction combined with the high level of consumer debt. Total deposits grew by 7.3%, the highest first quarter year over year growth rate in the last 6 years and higher than the five-year average deposit growth trend of 6.4%. This compares favourably against the average five-year growth rate for the entire Canadian credit union sector of 4.3%. Demand deposit growth lead the way with an increase to 16.0% from 8.6% last year while the term deposit decreased by 0.4% year over year (7.4% increase in the previous year). This deposit behaviour continues a trend away from longer term deposits due to low investment returns. The funding gap, the difference between total loans and total deposits, continues to grow and has increased from 4.5% in 1Q15 to 6.5% in 1Q16 due in part to the fact that credit unions are aggressively growing their loan portfolios in order to increase revenue. Insured deposits were estimated at $26.6 billion or 69.4% of total deposits in contrast to the banking sector with insured deposits of 31% (source: CDIC). The level of insured deposits at credit unions has decreased steadily at an average of 1% per year over the last decade from 82% in 2005. The proposed change in deposit insurance limits to $250,000 will result in an increase in insured deposits to an estimated 80% of total deposits.

Efficiency Ratio Credit Caisse Populaires Banks Unions 82.3% 67.1% 64% The overall efficiency ratio (before dividends and interest rebates) weakened marginally to 82.3% from 81.8% in 1Q15 and remains significantly higher than the large Canadian banks (fiscal 2015). As a group, caisses populaires at 67.1% continue to report efficiency ratios that are closer to the big banks than credit unions at 85.2%. Caisse populaires realize increased economies of scale from their credit union counterparts through their integrated model, where all back office functions (including credit underwriting and adjudication) and systems are shared.

1Q16 SECTOR OUTLOOK, June 2016 3 Profitability: Decreasing Over Time Return on average assets (ROAA) declined to 21 bps in 1Q16 from 24 bps in 1Q15. The following table provides the income and expenses breakdown by credit unions and caisses populaires over the last 5 years.

Breakdown of Income and Expenses for Sector 1Q 2012 1Q 2013 1Q 2014 1Q 2015 1Q 2016 As a percentage of Avg. Assets Interest and Investment Income 3.98% 3.80% 3.71% 3.62% 3.38% Other Income 0.64% 0.58% 0.59% 0.54% 0.57% Total Income 4.62% 4.38% 4.30% 4.16% 3.95% Interest Expense 1.47% 1.34% 1.26% 1.24% 1.09% Dividend Expense 0.18% 0.18% 0.28% 0.36% 0.38% Loan Costs 0.09% 0.05% 0.04% 0.07% 0.07% Total Expenses 4.25% 3.95% 3.94% 3.92% 3.74% Net Income 0.37% 0.43% 0.36% 0.24% 0.21%

There has been a 60 bps decrease in interest and investment income (15% decrease) over the last five years as a result of the low interest rates driving down as the rates charged on loans continues to decrease. “Other income” has decreased by 7 bps (or 11%) over the past 5 years as credit unions continue to be motivated to seek ways to increase income from non-interest related sources in the current low interest rate environment. Total expenses have decreased by 51 bps over the past five years (12.0% decrease) led by lower interest expenses, down 38 bps (or 25.8%) and non- interest expenses, down 31 bps (or 12.3%). All categories of non-interest expenses decreased over the last five years led by salaries and benefits that reduced by 15 bps over this time period.

While credit unions have done a good job of lowering their expenses, it was not enough to overcome the 67 bps reduction in gross income resulting in a decrease in net income of 16 bps (or 43%). Credit unions are exploring new avenues to improve economies of scale through pooling resources to provide shared services and growing assets. Credit Risk Gross loan delinquency greater than 30 days was 0.95% of total loans, down 2 bps from 0.97% in 1Q15. This was due mainly to lower delinquencies in residential mortgages loans (0.59% vs. 0.66%) and largely offset by an increase in commercial loans (1.61% vs. 1.58% in 4Q 2015 and 1.49% in 1Q 2015). The reported total amount of impaired commercial loans increased to $186.2 million from $181.4 million in 1Q 2016 while the percentage of impaired loans has decreased to 1.55% from 1.67%. The following chart shows fluctuations in delinquencies greater than 30 days over the past five years for different loan types. There is considerably more volatility in commercial and agricultural loans than personal and mortgage loans due to external factors. Factors include variation in crop and livestock production (i.e. good year vs. bad year) and downturn in socio-economic conditions affecting certain industry sectors. That being said, total loan costs have remained fairly stable at around 8 to 10 bps over the last 5 years.

1Q16 SECTOR OUTLOOK, June 2016 4 3.00%

2.50%

2.00%

1.50%

1.00%

0.50%

0.00% Q1 11 Q3 11 Q1 12 Q3 12 Q1 13 Q3 13 Q1 14 Q3 14 Q1 15 Q3 15 Q1 16 Personal Mortgages Commercial Agriculture Total

Loan Mix and Yields While total loans grew by 9.5% reflecting growth in almost all other loan categories, personal loans decreased by $138 million (4.8%) year over year to $2.74 billion and continue to represent a declining portion of the total loan portfolio mix at 6.7% from 7.7% in 2015. The following chart illustrates the current loan portfolio mix and yields versus the values from 1Q15 and their impacts on gross interest revenues. The decrease in interest revenues from lower loan yields in the past year is estimated at $41.3 million, due to lower yields in all loan categories, while the notional impact of the change in portfolio mix on interest revenues is estimated to be a decrease of $5.8 million.

Product % of portfolio Change % Change Yield Yield Notional impact (in Millions) on gross ($M) 1Q 2016 1Q 2015 interest revenues due to change in 2016 2015 portfolio mix interest rates Personal Loans 6.7% 7.7% $ (138) -4.8% 6.14% 5.90% (22.7) 5.9 Mortgage Loans 59.6% 58.9% $ 2,379 10.8% 3.80% 3.90% 10.5 (21.9) Commercial Loans 29.3% 29.0% $ 1,181 10.9% 4.62% 4.77% 6.8 (16.2) Agricultural Loans 4.4% 4.4% $ 146 9.5% 3.53% 4.10% (0.4) (9.1) Total 100% 100% (5.8) (41.3)

Competition in the residential mortgage market and low yields in the bond markets have resulted in floating and fixed rates that are near historical lows, leading to continued strong demand for new mortgages. While there have been a number of reports predicting a potential housing bubble collapse in Canadian real estate, strong demand continues to push house prices up and has strained affordability even further. The average house price as measured by the Aggregate Composite MLS® Housing Price Index rose by 9.1 percent on a year- over-year basis in March 2016, the biggest gain since June 2010.

Liquidity and Borrowings Year over year borrowings increased 30.3% due largely to the securitization of residential mortgages in order to make up the funding gap between the growth in assets and deposits. Securitization programs have increased by 35.7% to $4.26 billion from $3.14 billion in 1Q15 while all other borrowings increased

1Q16 SECTOR OUTLOOK, June 2016 5 12.3% to $1.07 billion from $949 million. There are currently 17 credit unions involved in securitization programs. Liquid asset holdings increased by $442 million to $4.85 billion improving the liquidity ratio to 11.18% from 11.09% in 1Q15, largely attributable to increases in deposits at the leagues/centrals held for liquidity ($402 million) and deposits at other Canadian financial institutions held for liquidity ($68 million). Liquidity at caisses populaires, (8.62%) remains much lower than at credit unions (11.58%). This lower level of liquidity is due in large part to the ability of some caisses to access the Caisse Centrale for funding needs should a liquidity event occur. The liquidity level for 1Q16 was the highest quarterly value since 2Q13. In comparison, liquidity of Canada’s banks was approximately 11%. The following chart provides a breakdown of liquidity sources. The largest source of liquidity is “Deposits in a League or Central” (74.3%), followed by “Deposits in deposit taking institutions” (10.5%), “Cash held for liquidity” (4.8%) and “Securities secured by mortgages and guaranteed by CMHC” (4.2%).

1Q 2014 1Q 2015 1Q 2016 Sources of Liquidity % of Total % of Total % of Total $ millions $ millions $ millions Liquidity Liquidity Liquidity Deposits in a League or Central $ 3,181.7 80.7% $ 3,201.0 72.6% $ 3,602.0 74.3% Deposits in a deposit taking institution in $ 257.6 6.5% $ 442.3 10.0% $ 511.3 10.5% Canada Securities secured by mortgages and $ - 0.0% $ 230.6 5.2% $ 201.8 4.2% guaranteed by CMHC held for liquidity Commercial paper, banker's acceptances $ 154.2 3.9% $ 183.2 4.2% $ 190.3 3.9% and similar instruments Cash held for liquidity $ 202.7 5.1% $ 228.9 5.2% $ 232.0 4.8% Other Sources of Liquidity $ 146.2 3.7% $ 120.8 2.7% $ 111.4 2.3% Total Sources of Liquidity $ 3,942.4 100.0% $ 4,406.8 100.0% $ 4,848.8 100.0%

Effect of Change in Deposit Insurance Limit to $250,000 on DIRF and Premiums Preliminary analysis of the proposed change in deposit insurance coverage to $250,000 (for both registered and non-registered accounts) based on information collected to date indicates that insured deposits would increase from approximately $26.4 billion to approximately $30.2 billion. The increased level of insured deposits is expected to result in aggregate deposit insurance premiums increasing by approximately $3.0 million annually. Based on the current estimated level of insured deposits of $30.2 billion, and the current DIRF size of $212 million, the DIRF would be 71 bps of insured deposits (down from the current 78 bps of insured deposits of $100,000). Further analysis is required to determine the long term effects on the growth of the DIRF and the goal of reaching 100 bps of insured deposits in 2020.

1Q16 SECTOR OUTLOOK, June 2016 6 Sector Financial Highlights 1Q 2016

Selected Bank Information ONTARIO SECTOR % average assets*, Year to date at . . .

1Q 2016 1Q 2015 4Q 2015 PROFITABILITY Net Interest and Investment Income 1.91% 2.02% 1.60% Loan Costs 0.07% 0.07% 0.12% Other (non-interest) Income 0.57% 0.54% 1.37% Total Income 2.41% 2.49% 2.85% Total Non-Interest Expenses (Operating Expenses) 2.12% 2.18% 1.79% Net Income/(Loss) before Taxes and 0.29% 0.31% 1.00% Non-recurring & Extraordinary items Efficiency Ratio (% Operating Expenses to Total Income) 87.94% 87.53% 79.20% Efficiency Ratio (% Operating Expenses, before dividends & interest rebates to Total Income) 82.29% 81.82% 63.60% Return on Average Assets (ROA) before dividends etc. 0.37% 0.41% Return on Average Assets (ROA) 0.21% 0.24% 0.85% Return on Regulatory Capital before dividends etc. 5.13% 5.87% 13.60% Return on Regulatory Capital 2.86% 3.42% 7.26%

CREDIT RISK, as at the quarter-end Gross Delinquency greater than 30 days (% of total loans) 0.95% 0.97% Gross Delinquency greater than 90 days (% of total loans) 0.53% 0.48%

OFF BALANCE SHEET ACTIVITY Off balance Sheet Assets ($millions) 8,485 7,761 (Includes mutual fund sales and administered loans etc.) Income on Off Balance Sheet Activity ( % Other Income) 23.25% 19.54%

OTHER INDICATORS, as at the quarter-end

Total Number of Credit Unions 105 115

Total Assets ($ millions) 47,620 43,479 4,700,259 Average Assets per Credit Union ($ millions) 453.5 378.1

Median Assets ($ millions) 132.9 111.6 Regulatory Capital 7.24% 6.93% (as a percentage of net assets) Number of Credit Unions below Regulatory Minimum 0 0 Liquidity 11.18% 11.09%

* Year to date annualized unless otherwise stated. Totals may not agree due to rounding

1Q16 SECTOR OUTLOOK, June 2016 7 Sector Financial Statements 1Q 2016 Balance Sheet

ONTARIO SECTOR

1Q 2016 1Q 2015 1Q 2016 1Q 2015 ($000) ($000) (Percentage of Total Assets) ASSETS Cash and Investments 5,869,049 5,342,796 12.3% 12.3% Personal Loans 2,744,242 2,882,397 5.8% 6.6% Residential Mortgage Loans 24,453,802 22,074,673 51.4% 50.8% Commercial Loans 12,040,967 10,859,718 25.3% 25.0% Institutional Loans 68,045 60,003 0.1% 0.1% Unincorporated Association Loans 53,003 43,165 0.1% 0.1% Agricultural Loans 1,665,624 1,537,484 3.5% 3.5% Total Loans 41,025,683 37,457,440 86.2% 86.2% Total Loan Allowances 134,340 132,548 0.3% 0.3% Capital (Fixed) Assets 474,053 433,812 1.0% 1.0% Intangible & Other Assets 386,025 377,620 0.8% 0.9% Total Assets 47,620,470 43,479,121 100.0% 100.0%

LIABILITIES Demand Deposits 15,636,902 13,499,179 32.8% 31.0% Term Deposits 12,404,295 12,455,285 26.0% 28.6% Registered Deposits 10,084,059 9,574,443 21.2% 22.0% Other Deposits 228,662 237,643 0.5% 0.5% Total Deposits 38,353,919 35,766,550 80.5% 82.3% Borrowings 754,595 832,800 1.6% 1.9% Securitization 4,261,725 3,139,840 8.9% 7.2% Other Liabilities 846,550 764,837 1.8% 1.8% Total Liabilities 44,216,790 40,504,027 92.9% 93.2%

MEMBERS' EQUITY & CAPITAL Membership Shares 65,092 72,721 0.1% 0.2% Retained Earnings 2,091,418 1,968,431 4.4% 4.5% Other Tier 1 & 2 Capital 1,251,291 938,880 2.6% 2.2% Accumulated Other Comprehensive Income (4,121) (4,939) 0.0% 0.0% Total Members' Equity & Capital 3,403,680 2,975,093 7.1% 6.8%

Total Liabilities, & Members' Equity & 47,620,470 43,479,121 100.0% 100.0% Capital Totals may not agree due to rounding

1Q16 SECTOR OUTLOOK, June 2016 8 Sector Financial Statements 1Q 2016 Income Statement Canadian ONTARIO SECTOR Chartered Banks ** Percentage of Average Assets *

1Q 2016 1Q 2015 4Q 2015 Interest and Investment Income Loan Interest Income 3.21% 3.37% 2.04% Investment Income 0.17% 0.25% 0.35% 3.38% 3.62% 2.39% Interest Expense Interest Expense on Deposits 1.10% 1.24% 0.56% Interest Rebates & Dividends on Share Capital 0.00% 0.00% Dividends on Investment Capital & Other Capital 0.16% 0.17% Other Interest Expense 0.21% 0.19% Total Rebates, Dividends & Other Interest Expense 0.38% 0.36% 0.23% 1.47% 1.60% 0.79%

Net Interest & Investment Income 1.91% 2.02% 1.60%

Loan Costs 0.07% 0.07% 0.12% Net Interest & Investment Income after Loan Costs 1.84% 1.95% 1.48% Other (non-interest) Income 0.57% 0.54% 1.37% Net Interest, Investment & Other Income 2.41% 2.49% 2.85%

Non-interest Expenses Salaries and Benefits 1.17% 1.17% 1.00% Occupancy 0.21% 0.21% 0.14% Computer, office & other equipment 0.20% 0.21% 0.15% Advertising & Communications 0.14% 0.15% 0.08% Member Security 0.08% 0.09% Administration 0.19% 0.20% Other 0.13% 0.15% 0.42% 2.12% 2.18% 1.79% Net Income/(Loss) Before Taxes and Non- 0.29% 0.31% 1.06% recurring & Extraordinary items Non-recurring & Extraordinary gains/(losses) 0.00% 0.00% 0.00% Taxes 0.08% 0.08% 0.21% Minority Interests 0.00% 0.00% 0.00% Net Income/(Loss) 0.21% 0.24% 0.85% Average Assets ($000) 46,980,257 42,738,151 4,700,259,021

* Year to date annualized ** Source: Canadian Bankers Association, Detailed Financial Statistics. Totals may not agree due to rounding.

1Q16 SECTOR OUTLOOK, June 2016 9 Selected Financial Trends

Selected Growth Trends Selected Performance Trends 12.00% 4.00% 0.80% 3.75% 0.70% 10.00% 3.50% 0.60% 8.00% 3.25% 0.50%

6.00% 3.00% 0.40% 2.75% 0.30% 4.00% 2.50% 0.20% 2.00% 2.25% 0.10% 2.00% 0.00% 0.00% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Financial Margin (L) Gross Margin (L) Assets Loans Deposits Operating Expenses (L) ROA (R)

Loan Growth Loan Yields 10.00% 20.0% 9.00% 15.0% 8.00% 10.0% 7.00% 5.0% 6.00%

0.0% 5.00%

-5.0% 4.00%

-10.0% 3.00% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Personal Mortgages Commercial Total Personal Mortgages Commerical Total

Loan Delinquencies - Greater than 30 Days Liquidity, Total Borrowings and Securitization 3.50% $6,000 16.00%

3.00% $5,000 14.00%

2.50% $4,000 12.00%

2.00% $3,000 10.00% 1.50% $2,000 8.00% 1.00% $1,000 6.00% 0.50% $- 4.00% 0.00% 3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 2010 2011 2011 2012 2012 2013 2013 2014 2014 2015 2015 2016 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Total Borrowings in $millions (L) Securitizations in $millions (L) Personal Mortgages Commercial Total Liquidity Ratio (R)

Loan Cost and Return on Assets Deposit Growth 0.30% 0.70% 18.0% 16.0% 0.25% 0.60% 14.0% 12.0% 0.20% 0.50% 10.0% 8.0% 0.15% 0.40% 6.0% 4.0% 0.10% 0.30% 2.0% 0.05% 0.20% 0.0% -2.0% 3Q 2011 1Q 2012 3Q 2012 1Q 2013 3Q 2013 1Q 2014 3Q 2014 1Q 2015 3Q 2015 1Q 2016 0.00% 0.10% Demand Deposits - Yearly Growth Term Deposits - Yearly Growth 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Registered Deposits - Yearly Growth Total Deposits - Yearly Growth Loan Costs (L) ROA (R) Average Total Deposit Growth Rate

NOTE: L refers to the Left Axis and R refers to the Right Axis 1Q16 SECTOR OUTLOOK, June 2016 10