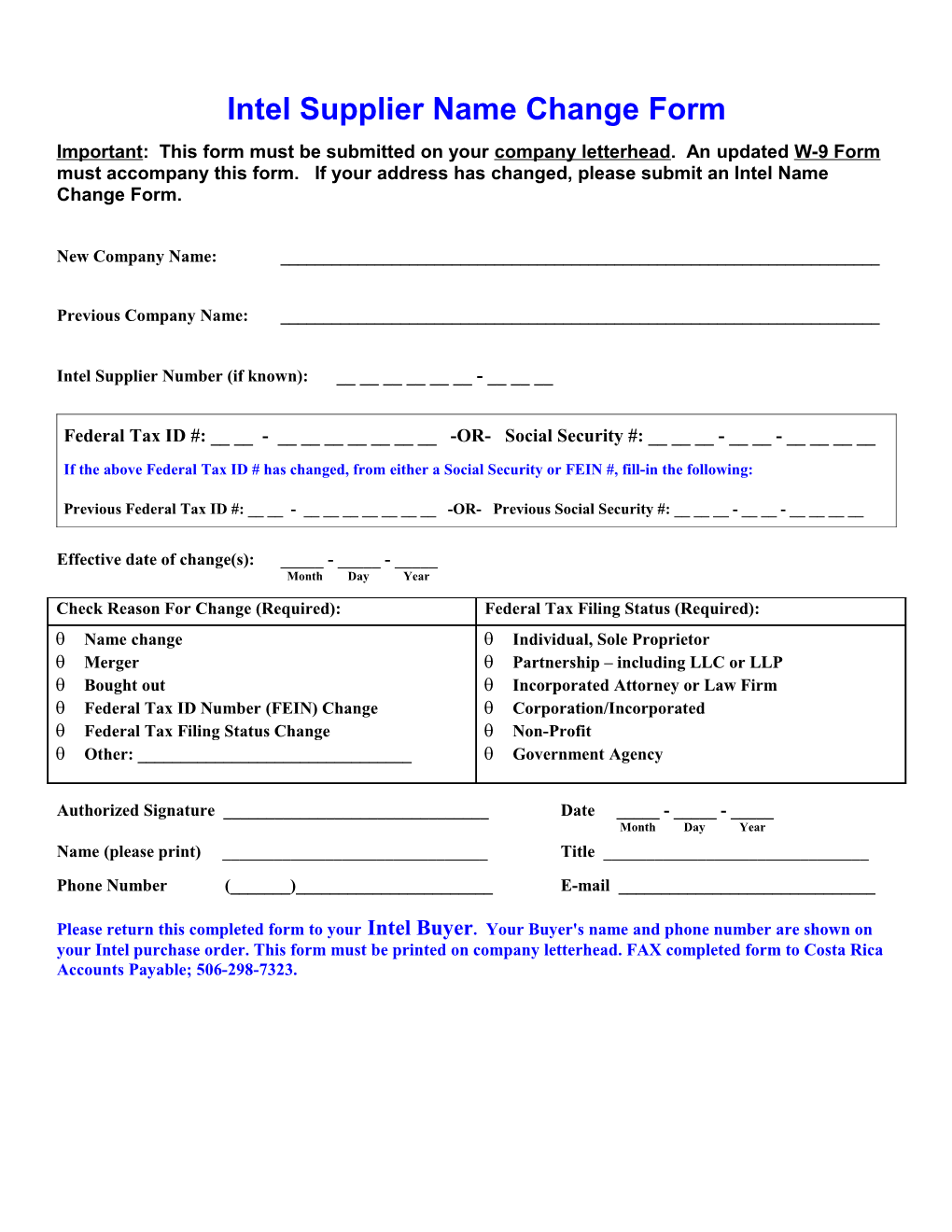

Intel Supplier Name Change Form Important: This form must be submitted on your company letterhead. An updated W-9 Form must accompany this form. If your address has changed, please submit an Intel Name Change Form.

New Company Name: ______

Previous Company Name: ______

Intel Supplier Number (if known): ______- ______

Federal Tax ID #: __ __ - ______-OR- Social Security #: ______- __ __ - ______

If the above Federal Tax ID # has changed, from either a Social Security or FEIN #, fill-in the following:

Previous Federal Tax ID #: __ __ - ______-OR- Previous Social Security #: ______- __ __ - ______

Effective date of change(s): _____ - _____ - _____ Month Day Year

Check Reason For Change (Required): Federal Tax Filing Status (Required): Name change Individual, Sole Proprietor Merger Partnership – including LLC or LLP Bought out Incorporated Attorney or Law Firm Federal Tax ID Number (FEIN) Change Corporation/Incorporated Federal Tax Filing Status Change Non-Profit Other: ______ Government Agency

Authorized Signature ______Date _____ - _____ - _____ Month Day Year Name (please print) ______Title ______Phone Number (______)______E-mail ______

Please return this completed form to your Intel Buyer. Your Buyer's name and phone number are shown on your Intel purchase order. This form must be printed on company letterhead. FAX completed form to Costa Rica Accounts Payable; 506-298-7323.