Attorney for Plaintiff 1

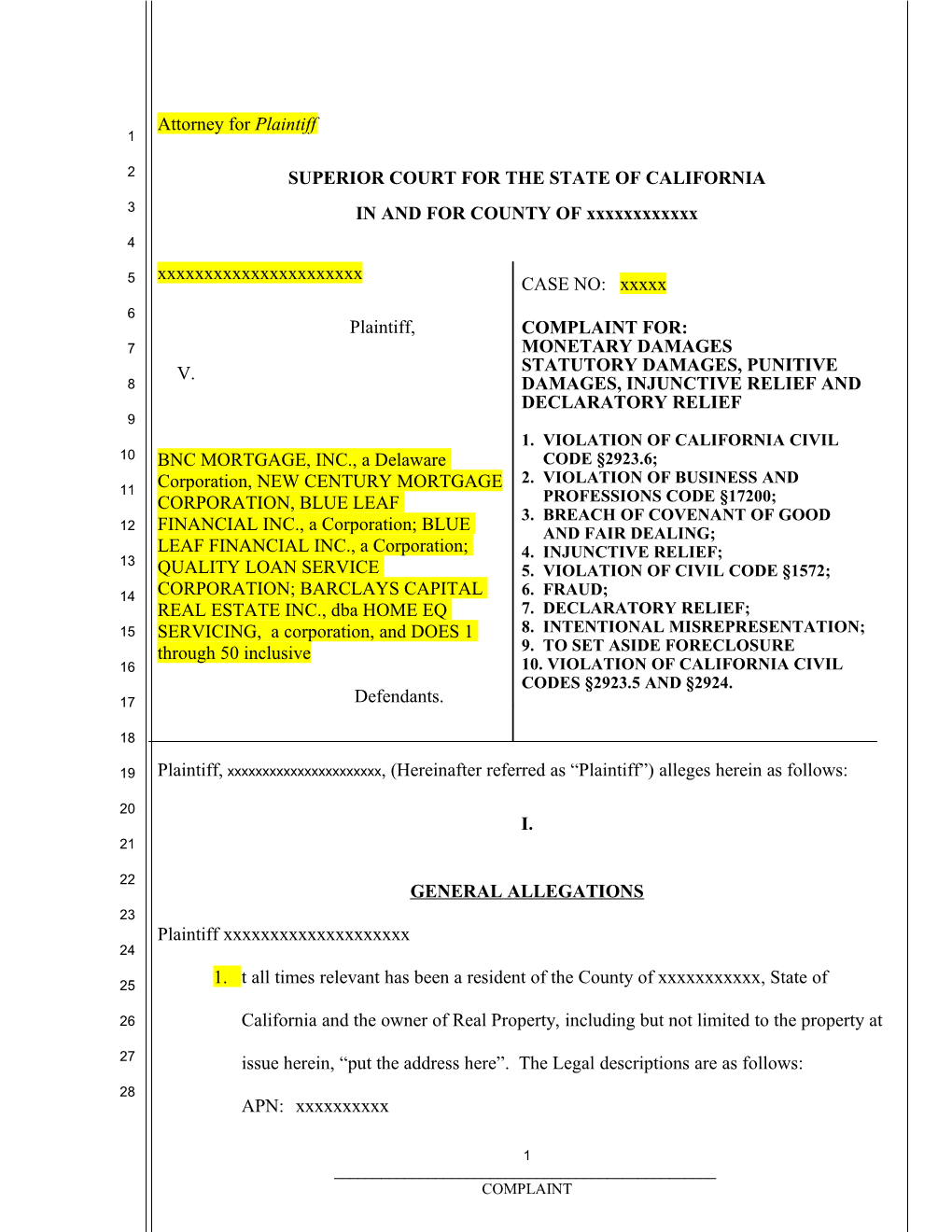

2 SUPERIOR COURT FOR THE STATE OF CALIFORNIA 3 IN AND FOR COUNTY OF xxxxxxxxxxxx 4 xxxxxxxxxxxxxxxxxxxxxx 5 CASE NO: xxxxx 6 Plaintiff, COMPLAINT FOR: 7 MONETARY DAMAGES V. STATUTORY DAMAGES, PUNITIVE 8 DAMAGES, INJUNCTIVE RELIEF AND DECLARATORY RELIEF 9 1. VIOLATION OF CALIFORNIA CIVIL 10 BNC MORTGAGE, INC., a Delaware CODE §2923.6; 2. VIOLATION OF BUSINESS AND 11 Corporation, NEW CENTURY MORTGAGE CORPORATION, BLUE LEAF PROFESSIONS CODE §17200; 3. BREACH OF COVENANT OF GOOD 12 FINANCIAL INC., a Corporation; BLUE AND FAIR DEALING; LEAF FINANCIAL INC., a Corporation; 4. INJUNCTIVE RELIEF; 13 QUALITY LOAN SERVICE 5. VIOLATION OF CIVIL CODE §1572; 14 CORPORATION; BARCLAYS CAPITAL 6. FRAUD; REAL ESTATE INC., dba HOME EQ 7. DECLARATORY RELIEF; 15 SERVICING, a corporation, and DOES 1 8. INTENTIONAL MISREPRESENTATION; through 50 inclusive 9. TO SET ASIDE FORECLOSURE 16 10. VIOLATION OF CALIFORNIA CIVIL CODES §2923.5 AND §2924. 17 Defendants.

18

19 Plaintiff, xxxxxxxxxxxxxxxxxxxxxx, (Hereinafter referred as “Plaintiff”) alleges herein as follows:

20 I. 21

22 GENERAL ALLEGATIONS 23 Plaintiff xxxxxxxxxxxxxxxxxxxx 24

25 1. t all times relevant has been a resident of the County of xxxxxxxxxxx, State of

26 California and the owner of Real Property, including but not limited to the property at

27 issue herein, “put the address here”. The Legal descriptions are as follows: 28 APN: xxxxxxxxxx

1 ______COMPLAINT

1 LOTS xx of Tract No. xxxx, in the City of xxxxxxxx, County of xxxxxxxx, State of 2 California, as per map recorded in Book xx page(2) xx and xx, of maps, in the office of the 3 county recorder of said County, California (hereinafter “Subject Property”) 4

5 2. Defendant BNC MORTGAGE, INC., (hereinafter “BNC”) at all times herein

6 mentioned was doing business in the County of San Bernardino, State of California and

7 was the original Lender for Plaintiff’s Deed of Trust Deed and Note. BNC, formerly a 8 Delaware Corporation and who used to do business in California has surrendered its 9

10 status and their agent for service of process resigned on February 9, 2009. Moreover,

11 Lehman Brothers closed this subprime subsidiary business .

12 3. BLUE LEAF FINANCIAL INC. (hereinafter “BLUE LEAF”) at all times herein 13 mentioned was doing business in Beverly Hills, County of Los Angeles and is 14 registered to with the Secretary of State of California. BLUE LEAF is engaged in the 15

16 business of promoting, marketing, distributing and selling the Arm Loans that are the

17 subject of this Complaint.

18 4. MORTGAGE ELECTRONIC REGISTRATION SERVICES (hereinafter “MERS”) at 19 all times herein mentioned was presumed to being doing business in the County of San 20 Bernardino, State of California and alleged to be the Beneficiary regarding Plaintiff’ 21

22 Real Property as described above and as Situated in San Bernardino County California.

23 5. QUALITY LOAN SERVICE CORPORATION (hereinafter “QUALITY LOAN”) at

24 all times herein mentioned is doing business in the County of San Diego and is 25 handling the Notice of Trustee’s Sale for this property. 26

27

28

2 ______COMPLAINT

6. BARCLAYS CAPIAL REAL ESTATE INC., dba HOMEQ SERVICING at all times 1

2 herein mentioned is doing business in the State of California and is the contact agency

3 of the Notice of Default recorded in San Bernardino County on February 18, 2009.

4 7. Plaintiff is ignorant of the true names and capacities of defendants sued herein as 5 DOES 1 through 50, inclusive, and therefore sues these defendants by such fictitious 6 names and all persons unknown claiming any legal or equitable right, title, estate, lien, 7

8 or interest in the property described in the complaint adverse to plaintiff’s title, or any

9 cloud on Plaintiff’s title thereto. Plaintiff will amend this complaint to allege their true 10 names and capacities when ascertained. 11 8. Plaintiff is informed and believes and thereon alleges that, at all times herein 12

13 mentioned each of the defendants sued herein was the agent and employee of each of

14 the remaining defendants. Plaintiff alleges that each and every defendant alleged herein

15 ratified the conduct of each and every other defendant. Plaintiff further alleges that at 16 all times said defendants were was acting within the purpose and scope of such agency 17 and employment. 18

19 II.

20 HISTORICAL BACKGROUND

21 9. Plaintiff purchased the foregoing Real Property on or about November 15, 2005 when 22 he financed his purchase through BNC by virtue of a Deed of Trust. The loan was in 23 the sum of $256,500.00 by monthly payment commencing thereof. Plaintiff executed 24

25 an “Adjustable Rage Note” promising to pay BNC, at the rate of 6.950% the amount of

26 $1,697.90 commencing January 1, 2006.

27

28

3 ______COMPLAINT

10. Plaintiff is informed and believe that directly after BNC caused Mortgage Electronic 1

2 Registration Systems (“MERS”) to go on title as the “Nominee Beneficiary” this is

3 routinely done in order to hide the true identity of the successive Beneficiaries when

4 and as the loan was sold. MERS, however, acted as if they were the actual beneficiary 5 although a Nominee is an entity in whose name a security is registered through true 6 ownership is held by another party, in other words MERS is not the Beneficiary but is 7

8 used to hide the true identity of the Beneficiary. Based on this failure to disclose, and

9 the lack of consideration paid by MERS, Plaintiff allege that the Deed of Trust were 10 never perfected and are a nullity as the MERS recording separates the Debt from the 11 Lien, and this is more so especially upon a sale of the Note and Trust Deed. 12

13 11. Plaintiff further alleges that MERS acts as a Nominee for more than one principal, and

14 conceals their identity therefore if a Nominee is the same as an agent MERS cannot act

15 as an agent for multiple Banks, insurance and title companies and Mortgage 16 Companies because of a serious Conflict of interest. In addition Plaintiff allege that a 17 Deed of Trust cannot lawfully be held by a Nominee who has no financial interest in 18

19 the instrument without disclosing the identity of the actual Beneficiary, and that if a

20 party with no interest in the Note records it in their name the recorded deed is Nullity.

21 12. Plaintiff further alleges that MERS failure to transfer beneficial interests as the Note 22 and deed are sold further renders the Deed recording a nullity. 23 13. Plaintiff further alleges that DEFENDANT alleges that Plaintiff became in default of 24

25 his loan and that payments were due to MERS and BNC as Beneficiary. However this

26 default of the loan was occasioned by the high payments, the structure of the loan and

27

28

4 ______COMPLAINT

interest rate and the fact that Plaintiff were not provided full disclosure of the terms of 1

2 their loan.

3

4 III. 5 DEFENDANTS FAILED TO COMPLY WITH CALIFORNIA CIVIL 6 CODES REGARDING FORECLOSURE PROCEDURES 7

8 14. Plaintiff was forced into default of their payments due to non-full disclosure of their

9 loan through BNC. Moreover, the Declaration of Due Diligence attached to the Notice 10 of Default is void because the required “penalty of perjury” and signature of a person 11 with actual knowledge is missing which will be discussed later in the complaint. 12

13 15. Plaintiff alleges that the loan contract was procedurally and substantively

14 unconscionable because at the time, Plaintiff informed DEFENDANT SHAWN

15 RODRIGUEZ, an employee of DEFENDANT BLUE LEAF THAT he was 16 unemployed at the time, whereas, the payment on the loan exceeded the Plaintiff’ 17 entire spendable income, the employees and/or agents of BNC or BLUE LEAF did not 18

19 disclose to Plaintiff the terms and conditions of the repayment, and Plaintiff executed

20 documents without any explanation whatsoever.

21 16. Plaintiff alleges that the employees and/or agents of BLUE LEAF and BNC 22 represented that said employees and/or agents could work-around the fact that 23 Plaintiff’s credit was not in good standing and could get Plaintiff approved for the loan. 24

25 17. Defendants BLUE LEAF or BNC did not disclose at any time to Plaintiff that the

26 initial loan payment would exceed his entire income. Plaintiff alleges that the loan

27

28

5 ______COMPLAINT

contract, deed of trust and accompanying documents were offered to Plaintiff on a take 1

2 it or leave it basis.

3 18. Further, on information and belief, Plaintiff alleges that the Defendants charged and

4 obtained improper fees for the placement of their loan as “sub-prime” when they 5 qualified for a prime rate mortgage which would have generated less in fees and 6 interest. [See Exhibit “1” – Declaration of Timothy Armstrong.] 7

8 19. On information and belief, Plaintiff alleges that the service of the purported note was,

9 without their knowledge, by some means transferred from or by Defendant BNC either 10 completely or by association or other means to MERS who unknown to Plaintiff 11 provided services in various forms to be determined to others which were of such a 12

13 nature to render them a “Servicer.”

14 20. Also on November 15, 2005 Plaintiff executed a “Deed of Trust” which cited the

15 lenders as BNC and stating in the definition section that: 16 (E) “MERS” is a Mortgage Electronic Registration Systems, Inc., MERS is a separate 17 corporation that is acting solely as a nominee for Lender and Lender’s successors and 18

19 assigns. MERS is the beneficiary under this Security Instrument.

20 21. Plaintiff alleges that Defendant BNC and a superior bargaining strength over Plaintiff,

21 and that Plaintiff is relegated only the opportunity to adhere to the contract or reject it, 22 that BNC drafted all of the documents related to the loan, that no negotiations were 23 possible between Plaintiff and BNC, and QUALITY LOAN, BLUELEAF, MERS, and 24

25 that the contract was a contract of adhesion.

26 22. Plaintiff alleges that the loan was unconscionable in that the repayment terms were

27 unfair and unduly oppressive, because the payments exceeded Plaintiff entire combined 28

6 ______COMPLAINT

income and as such, Defendants, and each of them, cannot enforce the terms and 1

2 conditions of the loan against Plaintiff, and any non-judicial foreclosure arising there

3 from is void.

4 23. Plaintiff is informed and believes and thereupon alleges that Defendants, especially 5 SHAWN RODRIGUEZ and BLUE LEAF, and each of them, entered into a fraudulent 6 scheme, the purpose of which was to make a loan to Plaintiff, which Defendants, and 7

8 each of them, were keenly aware that Plaintiff could not afford, at a cost way above the

9 then prevailing market rate, made loans to Plaintiff and falsely represented to Plaintiff 10 that they could not qualify for any other financing, that Plaintiff could not qualify 11 under any reasonably underwriting guidelines, that such scheme was devised to extract 12

13 illegal and undisclosed compensation from Plaintiff by virtue of an undisclosed yield

14 spread premium and which Defendants, and each of them, shared in some presently

15 unknown percentage. 16 24. Plaintiff is informed and believes and therefore alleges that their loans after they were 17 originated and funded were sold on multiple occasions, bundled into a group of Trust 18

19 Deeds and subsequently sold to investors as a Derivative, “Mortgage Backed Security”,

20 and that therefore none of these defendants, and each of them, owned this loan, or Note

21 and cannot be and are not the Beneficiary, or lawfully appointed trustee, and have no 22 right to declare a default, to cause notices of default to issue or to be recorded, or to 23 foreclose on Plaintiff interest in the subject property, Defendants, and each of them, 24

25 were not the note Holder or the Note holder in due course or any Beneficiary at any

26 time in regards to this loan.

27

28

7 ______COMPLAINT

25. That none of these Defendants, and each of them, were ever disclosed as the 1

2 beneficiary in accordance with California Code of Civil Procedure section 2924 et

3 seq.

4 IV. 5 NEW LAW 6 Moreover The California Legislature passed Senate Bill 1137, impacting residential 7

8 mortgage lenders, foreclosure procedures and eviction procedures. The Governor has signed this

9 law into effect and it has taken effect as Urgency Legislation. The law has three pertinent parts. It 10 amends California Code of Civil Procedure Section 1161(b) regarding notice of an eviction. It 11 adds a provision strengthening the right of local governments to adopt “blight” ordinances and 12

13 moreover, it modifies the non-judicial foreclosure procedures set forth in California Civil Code

14 Section 2924. The legislature recognized that the need for such legislation by stating as follows:

15 “…It is essential to the economic health of California for the state to ameliorate the 16 deleterious effects on the state economy and local economies and the California housing market that will result from the continued foreclosures of residential properties in 17 unprecedented numbers by modifying the foreclosures process to require mortgagees, beneficiaries, or authorized agents to contact borrowers and explore options that could 18 avoid foreclosure…” 19

20 This law is effective immediately and extends on to January 1, 2013. This law

21 impacts owner-occupied primary residences only and only loans made on January 1, 2003 22 and December 3, 2007. California Civil Code Section 2924 states in part: 23 Foreclosure: 24

25 The primary purpose for the Statute is foreclosure procedures and imposes an

26 unprecedented duty upon lenders relating to contact with borrowers. The Statute amends

27 provisions of the non-judicial foreclosure procedures found in California Code of Civil 28

8 ______COMPLAINT

Procedure §2924, by adding requirements for meetings, due diligence, and notification of 1

2 counseling. Some of the more important provisions include all of the following:

3 • The lender, beneficiary or authorized agent must wait thirty (30) days after contact is 4

5 made with the borrower, or thirty days (30) after satisfying the due diligence requirements

6 set forth in the Statute, in order to commence the filing of a Notice of Default.

7 • The contact requires that the borrower’s financial situation be assessed and requires that 8 the borrower and lender explore options for the borrower to avoid foreclosure. 9

10 This was not done by defendants or the lender.

11 • The Statute requires the lender or their authorized agent to advise the borrower that the

12 borrower has the right to a subsequent meeting within fourteen (14) days of the initial 13 contact. 14 • The borrower is to be provided a toll free telephone number available at HUD for 15

16 certified housing counseling agencies.

17 • The borrower may designate an authorized agent, such as a counseling service,

18 REALTOR® or attorney, to act as their authorized agent but must expressly approve any 19 workout agreement reached by that agent. 20 • The Notice of Default must include a declaration indicating that the lender has made the 21

22 contact or made a diligent effort to make the contact and will not apply in the event of

23 surrender of the property.

24 • If the Notice of Default was already recorded prior to the date of the Statute, this 25 declaration must be included in Notices of Sale. 26

27 • In the event that the lender is initially unable to contact the borrower, they must attempt

28 telephone contact on three separate occasions at three different times.

9 ______COMPLAINT

• The lender must provide the borrower with an (800) number that will be answered by a 1

2 live person during normal business hours and provide certain links to web pages. The web

3 page must be a prominent link and must link to the following information:

4 - Options for borrowers who cannot afford their payments. 5 - A list of financial documents to gather when discussing their options. 6 - A toll-free telephone number available by HUD for certified counseling services. 7

8 - A toll-free telephone number for borrower’s to discuss options to avoid foreclosure with

9 the lender or lender’s representative. 10 Defendants did not fully comply with this code therefore the title is not duly 11 perfected. 12

13 26. Plaintiff further alleges on information and belief that none of these alleged 14 beneficiaries or representatives of the Beneficiary have the original note to prove that 15

16 they are in fact the party authorized to conduct the foreclosure.

17 27. Plaintiff further alleges that the foreclosure sale of the Subject Property was not

18 executed in accordance with the requirements of California Civil Code Sections 19 2923.5, 2932.5 and Commercial Code section 3302 et seq. 20 28. That the notices and foreclosure failed to conform with the provisions of California 21

22 Civil Code Sections 2923.5, 2932.5 et seq., and Commercial Code section 3302

23 et seq. Furthermore, the Notice of Default did not have a penalty of perjury 24 disclosure, nor is the agent of personal knowledge. Therefore, it is not a valid 25 declaration. 26

27 29. Plaintiff further alleges that California Civil Code section 2924 et seq. and its subparts

28 are being applied to Plaintiff in a manner that is unlawful, because at least in part the

10 ______COMPLAINT

party acting as the Trustee proceeded with the foreclosure of Plaintiff Subject Property 1

2 notwithstanding the fact that the Trustee was not in possession of the original Note,

3 that the Note when it was assigned, the assignment by BNC and its assigns, did not

4 covey the power of sale because it violated the terms of California Civil Code section 5 2932.5, that the assignment when it was made, that the Note executed by Plaintiff was 6 no longer a negotiable instrument because the assignment was not physically applied to 7

8 the Note pursuant to the holding of Pribus v. Bush, (1981) 118 Cal.App.3d 1003, 173

9 Cal.Rptr. 747, although there was sufficient room on the back of the Note to complete 10 the assignment, and as such the foreclosure of Plaintiff’s subject property did not 11 conform to the strict mandates of Civil Code section 2924.76. 12

13 30. Plaintiff alleges that the employees and/or agents of BNC represented that said

14 employees and/or agents could work-around the fact that Plaintiff’s credit was not in

15 good standing and could get Plaintiff approved for the loan. Defendants did not 16 disclose at any time to Plaintiff that the initial loan payment would exceed their entire 17 income. 18

19 31. Plaintiff alleges that the loan contract, deed of trust and accompanying documents

20 were offered to Plaintiff on a take it or leave it basis.

21 32. That by virtue of the method and manner of Defendants carrying out Civil Code 22 section 2924 et seq., the foreclosure of the Subject Property is void ab initio as a matter 23 of law. 24

25 33. Plaintiff alleges that Defendants, and each of them, are engaged in and continue to

26 engage in violations of California law including but, not limited to: Civil Code section

27 2924 et seq. and 2932.5 et seq., and unless restrained will continue to engage in such 28

11 ______COMPLAINT

misconduct, and that a public benefit necessitates that Defendants be restrained from 1

2 such conduct in the future.

3 V.

4 CALIFORNIA LEGISLATURE FINDINGS 5

6 34. Recently, the California Legislature found and declared the following in enacting

7 California Civil Code 2923.6 on July 8, 2008:

8

9 (a) California is facing an unprecedented threat to its state economy because 10 of skyrocketing residential property foreclosure rates in California. Residential 11 property foreclosures increased sevenfold from 2008 to 2007, in 2007, more than 12 84,375 properties were lost to foreclosure in California, and 254,824 loans went 13 into default, the first step in the foreclosure process. 14

15 (b) High foreclosure rates have adversely affected property values in 16 California, and will have even greater adverse consequences as foreclosure rates 17 continue to rise. According to statistics released by the HOPE NOW Alliance the 18 number of completed California foreclosure sales in 2007’ increased almost 19 threefold from 2002 in the first quarter to 5574 in the fourth quarter of that year. 20 Those same statistics report that 10,556 foreclosure sales, almost double the 21 number for the prior quarter, were completed just in the month of January 2008. 22 More foreclosures means less money for schools, public safety, and other key 23 services. 24

25 (c) Under specified circumstances, mortgage lenders and servicers are 26 authorized under their pooling and servicing agreements to modify mortgage loans 27 when the modification is in the best interest of investors. Generally, that 28

12 ______COMPLAINT

1 modification may be deemed to be in the best interest of investors when the net

2 present value of the income stream of the modified loan is greater than the amount

3 that would be recovered through the disposition of the real property security

4 through a foreclosure sale.

5

6 (d) It is essential to the economic health of California for the state to

7 ameliorate the deleterious effects on the state economy and local economies and

8 the California housing market that will result from the continued foreclosures of

9 residential properties in unprecedented numbers by modifying the foreclosure

10 process to require mortgagees, beneficiaries, or authorized agents to contact

11 borrowers and explore options that could avoid foreclosure. These Changes in

12 accessing the state's foreclosure process are essential to ensure that the process

13 does not exacerbate the current crisis by adding more foreclosures to the glut of

14 foreclosed properties already on the market when a foreclosure could have been

15 avoided. Those additional foreclosures will further destabilize the housing market

16 with significant, corresponding deleterious effects on the local and state economy.

17 (e) According to a survey released by the Federal Home Loan Mortgage 18 Corporation (Freddie Mac) on January 31, 2008, 57 percent of the nation’s late- 19 paying borrowers do not know their lenders may offer alternative to help them 20 avoid foreclosure. 21

22 (f) As reflected in recent government and industry-led efforts to help troubled 23 borrowers, the mortgage foreclosure crisis impacts borrowers not only in 24 nontraditional loans, but also many borrowers in conventional loans. 25

26 (g) This act is necessary to avoid unnecessary foreclosures of residential 27 properties and thereby provide stability to California's statewide and regional 28

13 ______COMPLAINT

1 economies and housing market by requiring early contact and communications

2 between mortgagees, beneficiaries, or authorized agents and specified borrowers

3 to explore options that could avoid foreclosure and by facilitating the modification

4 or restructuring of loans in appropriate circumstances.

5 35. “Operation Malicious Mortgage’ is a nationwide operation coordinated by the U.S. 6

7 Department of Justice and the FBI to identify, arrest, and prosecute mortgage fraud

8 violators.” San Diego Union Tribune, June 19, 2008. As shown below, Plaintiff were

9 victims of such mortgage fraud. 10 36. "Home ownership is the foundation of the American Dream. Dangerous mortgages 11 have put millions of families in jeopardy of losing their homes.” CNN Money, 12

13 December 24, 2007. The Loan which is the subject of this action to Plaintiff is of such

14 character. 15 37. "Finding ways to avoid preventable foreclosures is a legitimate and important concern 16 of public policy. High rates of delinquency and foreclosure can have substantial 17

18 spillover effects on the housing market, the financial markets and the broader

19 economy. Therefore, doing what we, can to avoid preventable foreclosures is not just

20 in the interest of the lenders and borrowers. It's in everybody's best interest." Ben 21 Bernanke, Federal Reserve Chairman, May 9, 2008. 22 38. Plaintiff alleges that Defendants had the duty to prevent such foreclosure, but failed to 23

24 so act. "Most of these homeowners could avoid foreclosure if present loan holders

25 would modify the existing loans by lowering the interest rate and making it fixed,

26 capitalizing the arrearages, and forgiving a portion of the loan. The result would 27 benefit lenders, homeowners, and their communities.” CNN Money, id. 28

14 ______COMPLAINT

39. On behalf of President Bush, Secretary Paulson has encouraged lenders to voluntarily 1

2 freeze interest rates on adjustable-rate mortgages. Mark Zandl, chief economist for

3 Mood’s commented, “There is no stick in the plan. There are a significant number of

4 investors who would rather see homeowners default and go into foreclosure.” San 5 Diego Union Tribune, id. 6 40. “Fewer than l%· of homeowners have experienced any help "from the Bush-Paulson 7

8 plan.” San Diego Union Tribune, id. Plaintiff' are not of that sliver that have obtained

9 help. 10 41. The Gravamen of Plaintiff's complaint is that Defendants violated State laws which 11 were specifically enacted to protect such abusive, deceptive, and unfair conduct by 12

13 Defendants, and that Defendants cannot legally enforce a non-judicial foreclosure.

14 42. Plaintiff is a "debtor" as defined by the Rosenthal Act, California Civil Code

15 1788.2(h). 16 43. Defendants are engaged in the collection of debts from consumers using the mail and 17 telephone. 18

19 44. Defendants regularly attempt to collect consumer debts alleged to be due to another.

20 45. Defendants are "debt collectors" as defined by the Rosenthal Act, California Civil

21 Code §1788.2(c). 22 46. The purported debt which Defendants attempted to collect from Plaintiff was a 23 "consumer debt" as defined by the Rosenthal Act, California Civil Code §1788.2(f). 24

25

26 Defendants Are Not Holders In Due Course Since Plaintiff Was Duped Into An 27 Improper Loan And There Is No Effective Endorsement: 28

15 ______COMPLAINT

47. Plaintiff incurred a "debt" as that term is defined by California Civil 17 Code 1

2 §1788(d), when he obtained a Loan on their Personal Residence.

3 48. The loan is memorialized via a Deed of Trust and Promissory Note, each of which

4 contain an attorney fees provision for the lender should they prevail in the enforcement 5 of their contractual rights. 6 49. Plaintiff have no experience beyond basic financial matters. 7

8 50. Plaintiff were never explained the full terms of their loan, including but not limited

9 to the rate of interest how the interest rate would be calculated, what the payment 10 schedule should be, the risks and disadvantages of the loan, the prepay penalties, the 11 maximum amount the loan payment could arise to. 12

13 51. Certain fees in obtaining the loan, were also not explained to the Plaintiff, including

14 but not limited to "underwriting fees," "MERS registration fee," "appraisal fees,"

15 "broker fees”, “loan tie in fees," etc. 16 52. A determination of whether Plaintiff would be able to make the payments as specified 17 in the loan was never truly made. 18

19 53. Plaintiff's income was never truly verified; and DEFENDANTS knew that plaintiff

20 was unemployed.

21 54. Plaintiff could not understand any of the documents and signed them based on 22 representations and the trust and confidence the Plaintiff placed in Defendants’ 23 predecessors. 24

25 55. Plaintiff is informed and believes that Defendants and/or Defendants' predecessors

26 established and implemented the policy of failing to disclose material facts about the

27 Loan, failing to verify Plaintiff's income, falsifying Plaintiff's income, agreeing to 28

16 ______COMPLAINT

accept a Yield Spread Premium, and causing Plaintiff's Loan to include a penalty for 1

2 early payment.

3 56. Plaintiff is informed and believes that Defendants and/or Defendants’ predecessors

4 established such policy so as to profit, knowing that Plaintiff would be unable to 5 perform future terms of the Loan. 6 57. Plaintiff was a victim of Fraud in the Factum since the forgoing misrepresentations 7

8 caused them to obtain the home loan without accurately realizing, the risks, duties, or

9 obligations incurred. 10 58. The Promissory Note contains sufficient space on the note itself for endorsement 11 whereby any assignment by allonge is ineffective pursuant to Pribus v. Bush, 118 Cal. 12

13 App. 3d 1003 (May 12, 1981).

14 59. Defendants are not holders in due course due to Fraud in Factum and ineffective

15 endorsement. 16 Defendants’ Lack Standing To Conduct A Non-Judicial Foreclosure 17 Pursuant To California Civil Code 2932.5 18

19 60. Defendants have no standing to enforce a non-judicial foreclosure. 20

21 61. Defendants are strangers to this transaction, and have no authority to go forward with

22 the foreclosure and Trustee's Sale.

23 62. Plaintiff executed a ADJUSTABLE RATE NOTE (hereinafter the “Note”) and a 24 Deed of Trust to BNC. 25 63. BNC is the Lender and only party entitled to enforce the Note and any security 26

27 interest with it.

28

17 ______COMPLAINT

64. DEFENDANTS QUALITY LOANS, BARCLAYS CAPITAL are not listed 1

2 anywhere in the Deed of Trust or Promissory Note.

3 65. In California, California Civil Code § 2932.5 governs the Power of sale under an

4 assigned mortgage, and provides that the power of sale can only vest in a person 5 entitled to money payments: "Where a power to sell real property is given to a 6 mortgagee, or other encumbrancer, in an instrument intended to secure the payment of 7

8 money, the power is part of the security and vests in any person who by assignment

9 becomes entitled to payment of the money secured by the instrument. The power of 10 sale may be exercised by the assignee if the assignment is duly acknowledged and 11 recorded.” 12

13 66. The San Bernardino County Recorder's Office does not contain any evidence of a

14 recorded assignment from BNC.

15 67. BNC has never assigned their rights under the Note. 16 68. The power of sale may not be exercised by any of the Defendants since there was 17 never an' acknowledged and recorded assignment pursuant to California Civil Code § 18

19 2932.5.

20 69. Since the Defendants did not comply with California Civil Code§2932.5, the Notice

21 of Default provisions of California Civil Code § 2924 were likewise never complied 22 with. 23 70. QUALITY LOANS nor BARCLAYS never complied with the Notice of Default 24

25 provisions of California Civil Code §2924. QUALITY LOANS never complied with

26 the Notice of Default provisions of California Civil Code §2924.

27

28

18 ______COMPLAINT

1 Defendants’ Lack of Standing to Enforce A Non-Judicial Foreclosure Pursuant To

2 California Commercial Code § 3301

3 71. A promissory note is person property and the deed of trust securing a note is a mere 4

5 incident of the debt it secures, with no separable ascertainable market value.

6 California Civil Code §§ 657, 663. Kirby v. Palos Verdes Escrow Co., 183 Cal. App.

7 3d 57, 62. 8 72. Any transfers of the notice and mortgage fundamentally flow back to the note: 9 "The assignment of a mortgage without a transfer of the Indebtedness confers no right, 10

11 since debt and security are inseparable and the mortgage alone is not a subject of

12 transfer, " Hyde v. Mangan (1891) 88 Cal. 319, 26 P 180, 1891 Cal LEXIS 693; 13 Johnson v, Razy (1919)181 Cal 342, 184 P 657; 1919 Cal LEXIS 358; 14 Bowman v. Sears (1923, Cal App) 63 Cal App 235, 218 P 489, 1923 Cal App LEXIS 15

16 199; Treat v. Burns (1932) 216 Cal 216, 13 P2d,724, 1932 Cal LEXIS 554.

17 80. ''A mortgagee's purported assignment of the mortgage without an assignment of the

18 debt which is secured is a legal nullity.” Kelley V. Upshaw (1952) 39 Cal 2d 179, 19 246 P2d 23, 1952 Cal. LEXIS 248. 20 73. ''A trust deed has no assignable quality independent of the debt; it may not be 21

22 assigned or transferred apart from the debt; and an attempt to assign the trust deed

23 without a transfer of the debt is without effect.” Domarad v. Fisher & Burke, Inc.

24 (1969 Cal. App. 1st Dist) 270 Cal. App. 2d 543, 76 Cal. Rptr. 529, 1969 Cal. App. 25 LEXIS 1556. 26 74. The Promissory Note is a negotiable instrument. 27

28

19 ______COMPLAINT

75. Transferring a Deed of Trust by itself does not allow enforcement of the instrument 1

2 unless the Promissory Note is properly negotiated.

3 76. Where an instrument has been transferred, enforceability is determined based upon

4 possession. 5 77. California Commercial Code § 3301 limits a negotiable instrument's enforcement to 6 the following: 7

8 "Person entitled. to enforce" an Instrument means (a) the holder of the instrument,

9 (b) a nonholder in possession of the instrument who has the rights of a holder, or 10 (c) a person not in possession of the instrument who is entitled to enforce the 11 instrument pursuant to 12

13 Section 3309 or subdivision (d) of Section 3418. A person may be a person entitled

14 to enforce the instrument even though the person is not the owner of the instrument

15 or is in wrongful possession of the instrument. 16 78. None of the Defendants are present holders of the instrument. 17 79. None of the Defendants are nonholders in possession of the instrument who has rights 18

19 of the holder.

20 80. None of the Defendants are entitled to enforce the instrument pursuant to section

21 3309 or subdivision (d) of Section 3418. 22 81. Defendants have no enforceable rights under California Commercial Code 3301(a) to 23 enforce the negotiable instrument. 24

25 82. Since there is no right to enforce the negotiable instrument, the Notice of Default

26 provisions of California Civil Code § 2924 and Notice of Sale provisions of California

27

28

20 ______COMPLAINT

Civil Code § 2924(f) were likewise never complied with, and there is no subsequent 1

2 incidental right to enforce any deed of trust and conduct a non-judicial foreclosure.

3 83. That the Trustee and the loan servicer are acting as agents of the Beneficiary and

4 signing documents as the agent of the agent of the agent of the Beneficiary for Plaintiff 5 Notes and the notices therein, notwithstanding the fact that the Notes were not 6 negotiable prior to the sale of the Subject Property. 7

8 84. That by virtue of the method and manner of Defendants carrying out Civil Code

9 section 2924 et seq., the foreclosure of the Subject Property is void ab initio as a matter 10 of law. 11 85. MERS was NOT and never has been a Beneficiary of this loan or any other. MERS 12

13 is solely a registration service for tracking these Trust Deeds and mortgages and also

14 the Notes. MERS records these Trust Deeds in their name as a “nominee”, with NO

15 actual ownership interest in these Loans, the purpose is allegedly to allow the sale and 16 transfer of these instruments without the need for further recordation, however what 17 actually occurs is that the real Beneficiary remains obscured, and unknown. In 18

19 addition MERS is NOT a TRUSTEE and has no right to collect any TD payments on

20 the Note, neither does MERS have any right to enforce the notes or to be a party in

21 any Foreclosure proceedings. Yet MERS has represented itself under oath in this case 22 to be the BENEFICIARY and in that “stated” but “false” capacity has unlawfully 23 nominated a successive trustee. 24

25 86. While MERS remain on title as a “nominee” for the TD and Note both are sold on

26 several occasions afterward and ultimately bundled as a security and sold to a final

27 investor. MERS actually helps to conceal the real beneficiary which is in violation of 28

21 ______COMPLAINT

California statutory law, Cal. Civ. Code Sec. 2924 et. Seq. The Beneficiary is 1

2 completely shielded and not disclosed as required. Also the forms that they used to

3 give Notices are defective.

4 87. Evidence in prior cases has demonstrated that MERS is nothing more than a 5 Registration Service, and does not even service the loan. MERS cannot prove or show 6 ownership in the form of an “original Note” (i) with proper indorsements, to them, or 7

8 that they are actually in the chain of ownership and (ii) to establish the actual

9 relationship of the holder of the Note, as a Holder in Due course, and (iii) with the right 10 to enforce the Note. April Charney, a lawyer at Jacksonville Are Legal Aid in Florida, 11 in 2007 had over 300 foreclosure cases dismissed or postponed due to “MERS” 12

13 attempting to foreclose on those Mortgages.

14

15 VI. 16 FIRST CAUSE OF ACTION VIOLATION OF CALIFORNIA CIVIL CODE §2923.6 17 (As Against All Defendants)

18 88. Plaintiff reallege and incorporate by reference the above paragraphs 1 through 94 as 19

20 though set forth fully herein.

21 89. Defendants’ Pooling and Servicing Agreement (hereinafter “PSA”) contains a duty to

22 maximize net present value to its investors and related parties. 23 90. California Civil Code 2923.6 broadens and extends this PSA duty by requiring 24 servicers to accept loan modifications with borrowers. 25

26 91. Pursuant to California Civil Code 2923.6(a), a servicer acts in the best interest of all

27 parties if it agrees to or implements a loan modification where the (1) loan is in

28

22 ______COMPLAINT

payment default, and (2) anticipated recovery under the loan modification or workout 1

2 plan exceeds the anticipated recovery through foreclosure on a net present value basis.

3 92. California Civil Code 2923.6(b) now provides that the mortgagee, beneficiary, or

4 authorized agent offer the borrower a loan modification or workout plan if such a 5 modification or plan is consistent with its contractual or other authority. 6 93. Plaintiff’s loan is presently in an uncertain state. 7

8 94. Plaintiff is willing, able, and ready to execute a modification of their loan on a

9 reasonable basis 10 (a) New Loan Amount: $150,000.00 11 (b) New Interest Rate: 5% 12 (c) New Loan Length: 30 years 13 (d) New Payment: $ 805.23 14

15 95. The present fair market value of the property is $159500.00. 16 96. The Joint Economic Committee of Congress estimated in June, 2007, that the average 17

18 foreclosure results in $77, 935.00 in costs to the homeowner, lender, local government,

19 and neighbors.

20 97. Of the $77,935.00 in foreclosure costs, the Joint Economic Committee of Congress 21 estimates that the lender will suffer $50,000.00 in costs in conducting a non-judicial 22 foreclosure on the property, maintaining, rehabilitating, insuring, and reselling the 23

24 property to a third party. Freddie Mac places this loss higher at $58,759.00.

25 98. Pursuant to California Civil Code §2823.6, Defendants are now contractually bound

26 to accept the loan modification as provided above and tender is deemed made pursuant 27 to Defendants’ Pooling and Service Agreement, California Civil Code 2923.6(a), and 28

23 ______COMPLAINT

California Civil Code 2923.6(b), taken individually or entirely. Plaintiff invoke the 1

2 remedies embodied in the aforementioned agreement and/or codes with a willingness

3 to execute a modification of their loan.

4 99. Alternatively, Plaintiff alleges that tender, if any, is excused by obstruction or 5 prevention or imposition of unwarranted conditions by the person or corporate entity to 6 whom it was to be made. 7

8 100. Alternatively, Plaintiff alleges that obstruction or imposition of unwarranted

9 conditions by defendants occurred when defendants evaded the Plaintiff’ attempts to 10 provide tender as specified and encouraged by defendants’ pooling agreement, 11 California Civil Code 2923.6(a), and California Civil Code 2923.6(b). [Hudson v. 12

13 Morton, 231 Ala. 392, 165 So. 227 (1936); Loftis v. Alexander, 139 Ga. 346, 77 S.E.

14 169 (1913); Kennedy v. Neil, 333 Ill. 629, 165 N.E. 148 (1929); Borden v. Borden, 5

15 Mass. 67, 1809 WL 989 (1809); Loughney v. Quigley, 279 Pa. 396, 123 A. 84 (1924); 16 Montague Corp. v. E.P. Burton Lumber Co., 136 S.C. 40, 134 S.E. 147 (1926); 17 Stansbury V. Embrey, 128 Tenn. 103, 158 S.W. 991 (1913); Loehr v. Dickson, 141 18

19 Wis. 332, 124 N.W. 293 (1910)]

20 101. Alternatively, Plaintiff further alleges that obstruction or imposition of unwarranted

21 conditions by defendants occurred when defendants manifested to the Plaintiff that 22 tender, if made, will not be accepted, the Plaintiff are excused from making tender as it 23 would be a futile gesture, and the law will not require the doing of a useless act. 24

25 [Simmons v. Swan, 275 U.S. 113, 48 S. Ct. 52, 72 L. Ed. 190 (1927); Lee v. Joseph E.

26 Seagram & Sons, Inc., 552 F.2d 447 (2d Cir. 1977); Buckner v. Tweed, 157 F.2d 211

27 (App. D.C. 1946); Peterson v. Hudson Ins. Co., 41 Ariz. 31, 15 P.2d 249 (1932); 28

24 ______COMPLAINT

Woods-Drury, Inc. v. Superior Court in and for City and County of San Francisco, 18 1

st 2 Cal. App. 2d 340, 63 P.2d 1184 (1 District 1936); Chesapeake Bay Distributing Co. v.

3 Buck Distributing Co., Inc. 60 Md. App. 210, 481 A.2d 1156 (1984); Issacs v.

4 Caterpillar, Inc., 765 F. Supp. 1359 (C.D. Ill. 1991); Platsis v. Diafokeris, 68 Md. App. 5 257, 511 A.2d 535 (1986)] 6 102. Alternatively, Plaintiff further alleges that obstruction or imposition of unwarranted 7

8 conditions by defendants occurred when defendants’ objection for want of actual

9 tender of money is waived by defendants’ refusal to receive the money if produced. 10 [Shaner v West Coast Life Ins. Co, 73F.2d 681 (C.C.A. 10th Cir. 1934); Buell v. White, 11 908 P.2d 1175 (Colo. Ct. App. 1995) (when party, who is willing and able to pay, 12

13 offers to pay another a sum of money and is advised that it will not be accepted, offer

14 amounts to tender even though money is not produced); Hall v. Norwalk Fire Ins. Co.,

15 57 Conn. 105, 17 A. 356 (1888); Lamar v. Sheppard, 84 Ga. 561, 10 S.E. 10984 16 (1890); Ventres v. Cobb, 105 Ill. 33, 1882 WL 10475 (1882); Metropolitan Credit 17 Union v. Matthes, 46 Mass. App. Ct. 326, 706 N.E.2d 296 (1999)]. 18

19

20 SECOND CAUSE OF ACTION 21 (VIOLATION OF BUSINESS AND PROFESSIONS CODE §17200 22 (As Against All Defendants) 23

24 103. Plaintiff realleges and incorporate by reference the allegations of paragraphs 1 25 through 109, inclusive, as though set forth at length herein again. 26

27

28

25 ______COMPLAINT

1 104. Beginning in April 11, 2007 and continuing to the present time, Defendants

2 committed acts of unfair competition as defined by Business and Professions Code § 3 17200, by engaging in the following practices: 4 105. These acts and practices, as described in the previous paragraphs, violate Business 5 and Professions Code § 17200 because their policies and practices described above 6 violate all the statutes as previously listed and California Civil Code § 1709, and 7 consequently, constitute and unlawful business act of practice within the meaning of 8 Business and Professions Code § 17200. 9

10 106. The harm to Plaintiff and to members of the general public outweighs the utility of 11 Defendants’ policy and practices, consequently, constitute an unlawful business act of 12 practice within the meaning of Business and Professions Code §17200. 13

14 107. Further, the foregoing conduct threatens an incipient violation of a consumer law,

15 including, or violates the policy or spirit of such law or otherwise significantly

16 threatens or harms competition. Defendants’ practices described above are likely to 17 mislead the general public, and therefore, constitute a fraudulent business act of 18 practice within the meaning of Business and Professions Code §17200. The 19

20 Defendants’ unfair, unlawful, and fraudulent business practices and false and

21 misleading advertising present a continuing threat to members of public in that other

22 consumers will be defrauded into closing on similar fraudulent loans. Plaintiff and 23 other members of the general public have no other adequate remedy of law. 24 108. As a result of the aforementioned acts, Plaintiff has lost money or property and 25

26 suffered injury in fact. Defendants received and continue to hold Plaintiff’s money and

27 other members of the public who fell victim to Defendants’ scheme.

28

26 ______COMPLAINT

1

2 THIRD CAUSE OF ACTION

3 BREACH OF COVENANT OF GOOD FAITH AND FAIR DEALING

4 (Only Against BLUE LEAF AND BNC)

5 109. Plaintiff repeat and realleges Paragraphs 1 through 115 as though fully set forth 6

7 herein.

8 110. Plaintiff alleges that at all times there existed an implied covenant of good faith and

9 fair dealing requiring Defendants, and each of them, to safeguard, protect, or otherwise 10 care for the assets and rights of Plaintiff. Said covenant prohibited Defendants from 11 activities interfering with or contrary to the rights of Plaintiff. 12

13 111. Plaintiff alleges that the commencement of foreclosure proceedings upon the

14 property lawfully belonging to Plaintiff without the production of documents 15 demonstrating the lawful rights for the foreclosure constitutes a breach of the covenant. 16 112. Defendants breach the provisions as contained within the “Deed of “Trust” which 17

18 cited the lender as BNC.

19 113. Defendants breached the provisions as contained within the “Adjustable Rate Note”

20 promising to pay BNC a monthly payment. 21 114. Plaintiff paid timely monthly payments in accordance with the “Adjustable Rate 22 Note” to BNC or its agents. 23

24 115. As a consequence and proximate result, Plaintiff has been damaged in a sum to be

25 proven at trial.

26 FOURTH CAUSE OF ACTION 27 INJUNCTIVE RELIEF 28

27 ______COMPLAINT

1 (Against all Defendants)

2 116. Plaintiff repeats and realleges Paragraphs 1 through 122 as though fully set forth 3

4 herein.

5 117. Plaintiff seeks a determination as to the legal status of the parties as to the

6 Adjustable Rate Note and the Deed of Trust. 7 118. The Adjustable Rate Note states that the Lender is BNC. 8 119. It also states, “Lender or anyone who takes this Note by transfer and who is entitled 9

10 to receive payment under this Note is called the “Note Holder.”

11 120. BNC sent to Plaintiff a statement with a coupon asking for payment. 12 121. The Deed of Trust which cited the lender as BNC and stating in the definition 13 section that: 14

15 “ MERS” is Mortgage Electronic Registration Systems, Inc. MERS is a separate

16 corporation that is acting solely as a nominee for Lender and Lender’s successors and

17 assigns; MERS is the beneficiary under this Security Instrument. 18 122. Additionally, based upon information and belief, Mortgage Electronic Registration 19 Systems is not qualified to do business in the state of California and therefore, would not 20

21 have standing to seek non-judicial remedies as well as judicial remedies.

22 123. Defendants should be required to provide the original note with the appropriate

23 endorsements thereon to Plaintiff or this Honorable Court so that it may determine 24 under California law, who owns the right to receive payments and exercises the rights 25 relating to said ownership. 26

27

28

28 ______COMPLAINT

124. Only the Note Holder is authorized to collect payments and, in the event of a 1

2 default, commence foreclosure proceedings, including authorizing the substitution of a

3 Trustee.

4 125. Until Defendants are able to provide Plaintiff and this Honorable Court the 5 aforementioned documents, this Honorable Court should order that Plaintiff are not 6 required to make any further payments on the Adjustable Rate Note and enjoin any 7

8 further collection activity on the Note, including staying the count down towards the

9 date a Notice of Trustee’s sale may be filed and served. 10 FIFTH CAUSE OF ACTION 11 VIOLATION OF CIVIL CODE §1572 12 (As to All Defendants) 13

14 126. Plaintiff realleges and incorporates by reference the above paragraphs 1 through 15 132 as though set forth fully herein. 16 127. The misrepresentations by Defendant BLUE LEAF AND SHAWN RODRIGUEZ 17 and/or Defendants’ predecessors, failures to disclose, and failure to investigate as 18 described above were made with the intent to induce Plaintiff to obligate himself on the

19 Loan in reliance on the integrity of Defendants and/or Defendants’ predecessors.

20 128. Plaintiff is an unsophisticated customer whose reliance upon Defendants and/or Defendants’ predecessors was reasonable and consistent with the Congressional intent 21 and purpose of California Civil Code § 1572 enacted in 1872 and designed to assist 22 and protect consumers similarly situated as Plaintiff in this action. 23 129. As an unsophisticated customer, Plaintiff could not have discovered the true nature 24 of the material facts on their own. 25 130. The accuracy by Defendants and/or Defendants’ predecessors of representation is 26 important in enabling consumers such as Plaintiff to compare market lenders in order 27 to make informed decisions regarding lending transactions such as a loan.

28

29 ______COMPLAINT

131. Plaintiff was ignorant of the facts which Defendants and/or Defendants’ 1 predecessors misrepresented and failed to disclose. 2 132. Plaintiff’s reliance on Defendants and/or Defendants’ predecessors was a 3 substantial factor in causing their harm. 4 133. Had the terms of the Loan been accurately represented and disclosed by Defendants 5 and/or Defendants’ predecessors, Plaintiff would not have accepted the Loan nor been 6 harmed. 7 134. Had Defendants and/or Defendants’ predecessors investigated Plaintiff’s financial

8 capabilities, they would have been forced to deny Plaintiff on this particular loan.

9 135. Defendants and/or Defendants’ predecessors conspired and agreed to commit the

10 above mentioned fraud. 136. As a proximate result of Defendants and or Defendants’ predecessors fraud, 11 Plaintiff has suffered damage in an amount to be determined at trial. 12 137. The conduct of Defendants and/or Defendants’ predecessors as mentioned above 13 was fraudulent within the meaning of California Civil Code § 3294(c)(3), and by virtue 14

15 thereof Plaintiff is entitled to an award of punitive damages in an amount sufficient to

16 punish and make an example of the Defendants.

17 SIXTH CAUSE OF ACTION 18 FOR FRAUD 19 (Against All Defendants) 20 138. Plaintiff repeats and realleges Paragraphs 1 through 144 as though fully set forth 21

22 herein.

23 139. An unknown employee of QUALITY LOANS AND BARCLAYS executed on

24 behalf the alleged Beneficiary a “Notice of Default” which stated that the payments 25 were due to MERS and BNC as Beneficiary. “Notice of Breach and Default and of 26 Election to Cause Sale of Real Property Under Deed of Trust”. 27

28

30 ______COMPLAINT

140. On the Notice of Breach, it stated, in part, that Plaintiff as Trustor, to secure certain 1

2 obligations in favor of Defendants, as beneficiary.

3 141. It further states that:

4 That by reason thereof of the present Beneficiary under such deed of 5 Trust has executed and delivered to said duly appointed Trustee a written Declaration of Default and Demand for Sale and has 6 deposited with said duly appointed Trustee such Deed of Trust and all documents evidencing obligations secured thereby and has 7 declared and does hereby declared all sums secured thereby 8 immediately due and payable and has elected and does hereby elect to cause the trust property to be sold to satisfy the obligations served 9 thereby. 10

11 142. This representation was made by these defendants in order to induce reliance by

12 Plaintiff.

13 143. Plaintiff did rely on these representations and because of their reliance their 14 property will be foreclosed and Plaintiff reliance was justified. 15 144. Plaintiff is informed and believes that the representation as stated on the Notice of 16

17 Default were a false representation in the following particular(s)

18 A. Documents were not provided to the trustee that showed that BNC or MERS was

19 the Beneficiary and entitled to the payments. 20 B. At the time BNC made the representations they knew they were false and were 21 made for the sole purpose of inducing reliance. 22

23 145. Plaintiff alleges that Defendants, and each of them, were engaged in an illegal

24 scheme the purpose of which was to execute loans secured by real property in order to

25 make commissions, kick-backs, illegal undisclosed yield spread premiums, and 26 undisclosed profits by the sale of any instruments arising out of the transaction and to 27

28 make loans to borrowers that they could not afford to repay given their stated financial

31 ______COMPLAINT

situation. Plaintiff allege that Defendants, and each of them, have represented to 1

2 Plaintiff and to third parties that they were the owner of the Trust Deed and Note as

3 either the Trustee or the Beneficiary regarding Plaintiff real property. Based on this

4 representation they caused a Notice of Default to be issued and recorded without 5 disclosing their true role, and thereafter a notice of intent to foreclose and finally they 6 executed a foreclosure, which was completed, permanently affecting Plaintiff right, 7

8 title and interest in the Subject Property. In fact, Plaintiff allege that the promissory

9 notes which was executed by Plaintiff and which initially formed a basis of a security 10 interest in the subject property, was assigned in violation of Civil Code section 2932.5 11 et seq. because the assignment was not recorded, and as such the promissory note was 12

13 rendered as non-negotiable and no power of sale was conveyed with the note at the

14 time of the assignment, and therefore, Defendants, and each of them, had no lawful

15 security interest in the subject property. 16 146. On or about April 11, 2007 representatives, agents and/or employees of Defendants, 17 and each of them, made false representations to Plaintiff in order to fund a loan, in 18

19 which the Plaintiff’ personal residence was to be security therefore. Plaintiff allege that

20 Defendants, and each of them, made certain representations regarding their honesty,

21 that they were experts in obtaining loans which borrower’s could afford and that they 22 would only offer Plaintiff a loan which was in their best interests given their credit 23 history and financial needs and limitations and that Plaintiff could trust the 24

25 representations of Defendants, and each of them. Plaintiff allege that based upon the

26 representations made by Defendants, and each of them, Plaintiff reasonably reposed his

27 trust in Defendants’ representations and disclosed their private financial information to 28

32 ______COMPLAINT

Defendants, in order that Defendants could in keeping with their representations, find a 1

2 loan which was in the best interests of Plaintiff given his financial needs and

3 limitations. More particularly, Defendants, and each of them, represented that they

4 would not make a loan to Plaintiff unless he could afford the loan, and that they would 5 not make the loan unless and until he had passed the underwriting guidelines of the 6 lender, which further assured that the loan being offered to Plaintiff was in fact in the 7

8 Plaintiff’s best interests, and that the loan was within Plaintiff’s financial needs and

9 limitations. 10 147. Plaintiff alleges that the loans provided by Defendants, and each of them, contained 11 a repayment schedule, whereas, exceeded Plaintiff’ total spendable income, and that 12

13 the loan contained excessive financing was approved to allow closing costs to be

14 financed, that Defendants failed to utilize adequate due diligence regarding Plaintiff’s

15 ability to repay the loan, Defendants’ as part of their continuing scheme intentionally 16 placed Plaintiff’s in a sub-prime loan to the benefit of the Defendants with excessively 17 high interest rates, Defendants failed to provide Plaintiff mandated disclosures, and 18

19 Defendants repeatedly employed coercive tactics in order to force Plaintiff to sign the

20 loan documents.

21 148. Plaintiff is informed and believe and thereupon allege that defendants BNC, and 22 MERS, engaged in some degree in making the loan to Plaintiff including, but not 23 limited to: made the loan to Plaintiff by "marketing and extending adjustable-rate 24

25 mortgage ("ARM") products to Plaintiff in an unsafe and unsound manner that greatly

26 increases the risk that Plaintiff would default on the loan, because the initial payments

27 on the loan exceeded Plaintiff’s established retirement income, and the loan terms 28

33 ______COMPLAINT

offered to Plaintiff included ARM products with one or more of the following 1

2 characteristics: without to utilize an adequate analysis of the Plaintiff ability to repay

3 the debt at the fully-indexed rate; approving Plaintiff without considering appropriate

4 documentation and/or verification of their income; including substantial prepayment 5 penalties and/or prepayment penalties that extend beyond the initial interest rate 6 adjustment period; providing Plaintiff with inadequate and/or confusing information 7

8 relative to product choices, material loan terms and product risks, prepayment

9 penalties, and the Plaintiff’s obligations for property taxes and insurance; approving 10 Plaintiff for a loan with inadequate debt-to-income analyses 11 that did not properly consider the Plaintiff’s ability to meet his overall level 12

13 indebtedness and common housing expenses; and/or approving Plaintiff for loan

14 arrangements with loan-to-value ratios approaching or exceeding 100 percent of the

15 value of the collateral;" and making Plaintiff a mortgage loan without adequately 16 considering the Plaintiff’s ability to repay the mortgage according to its terms. 17 149. Plaintiff alleges that based upon the foregoing representations of Defendants, and 18

19 each of them, Plaintiff did in fact repose their trust in the representations of

20 Defendants, and each of them, and that such trust was reasonable.

21 150. Plaintiff alleges that Defendants, and each of them, presented a loan to Plaintiff 22 whereby Defendants represented that they did qualify for ordinary underwriting, and 23 that the loan was within Plaintiff’ personal financial needs and limitations given the 24

25 confidential financial information that Plaintiff shared with Defendants, however, the

26 true is that the loan payments exceeded Plaintiff’ established retirement income.

27 151. Plaintiff alleges that Defendants, and each of them, had a duty to disclose the true 28

34 ______COMPLAINT

cost of the loan which was made to Plaintiff, and the fact that Plaintiff could not afford 1

2 the loan in the first instance. Defendants, and each of them, provided Plaintiff a loan

3 through Defendant BNC, and Defendants, and each of them, were secretly

4 compensated, however, they did not disclose for this loan that they were by being paid 5 for its services, and in a spread of the yield of an amount which has not yet been fully 6 ascertained as a Yield Spread Premium paid-outside and after the close of escrow. 7

8 152. Plaintiff is informed and believes and thereupon allege that after the close of escrow

9 Defendant BNC paid the other Defendants herein fees above and beyond the value of 10 the services actually performed and an illegal kickback and added that additional 11 amount to the total amount being financed, however such amount was never disclosed 12

13 to Plaintiff.

14 153. Plaintiff acquired the foregoing property by virtue of the said funding through BNC

15 based on the representations of Defendants, and each of them, that the loan was the 16 best they could obtain for him, and that the loan was well within Plaintiff’s financial 17 needs and limitations. 18

19 154. Plaintiff is informed and believe and thereupon alleges that Defendants, and each of

20 them, represented to Plaintiff that Defendants, and each of them, were working for the

21 benefit of Plaintiff and in their particular best interest to obtain for him the best loan 22 and at the best rates available. 23 155. That at the time Defendants, and each of them, made the foregoing false 24

25 representations to Plaintiff they knew that they were untrue and that these

26 representations were material representations, and that no basis in fact existed to

27 support such fraudulent representations. 28

35 ______COMPLAINT

156. That the foregoing representations were made in order to induce Plaintiff to act on 1

2 and take the said loan(s) in order for both defendants to make a substantial amount of

3 money thereby and there from.

4 157. Plaintiff is in fact induced to and did take these loans based on the said fraudulent 5 representations. 6 158. That Plaintiff was induced to rely and did rely on the representations of these 7

8 defendants through deception and their reliance was justified as they believed that

9 Defendants, and each of them, were working for their and in his best interests. 10 159. That by virtue of Plaintiff’s reasonable reliance and the increased interest they were 11 made to pay, they have been damaged in the loss of their good credit and a higher 12

13 payment and are now being involved in litigation that they did not bargain for, all to

14 their damage and injury.

15 160. Plaintiff has relied on the representations of Defendant, and each of them, and 16 because of this reliance have made various moves to avoid foreclosure all to no avail, 17 while defendants knew all the time that they were deceiving Plaintiff. 18

19 161. Plaintiff’s reliance was justified based upon the false representations of Defendants,

20 and each of them, and had no reason to believe that a party representing a bank would

21 go to such lengths to deceive and to convert Plaintiff’s property by utilizing such a 22 fraud and artifice. 23 162. Plaintiff is informed and believe that Defendants, and each of them, at the time of 24

25 execution of the Deed of Trust and Note maintained an interest in the Subject Property,

26 however at the time the Note and Deed of Trust were assigned to Defendant BNC, the

27 Note was no longer negotiable and the power of sale was not conveyed during the 28

36 ______COMPLAINT

assignment, notwithstanding the foregoing, Defendants, and each of them, foreclosed 1

2 on Plaintiff’s Trust Deed, in concert with their scheme to defraud Plaintiff out of their

3 property.

4 163. Plaintiff has recently learned that Defendants, and each of them, are not the legal 5 owners of the Note and TRUST DEED and will not be at the time they will issue the 6 notices and commenced the foreclosure process, notwithstanding the fact that the note 7

8 was not negotiable and did not contain a valid power of sale.

9 164. Plaintiff alleges that Defendants, and each of them, knew at the time they made 10 these representations to Plaintiff that they were untrue, and defendants know at the 11 time that they were attempting to foreclose on Plaintiff’ Trust Deeds and notes that 12

13 they had no right to do so.

14 165. Plaintiff alleges Defendants, and each of them, intentionally and fraudulently

15 converted Plaintiff’ right, title and interest to his property, and any equity therein. 16 166. Plaintiff alleges that due to their reliance on Defendants representations he has been 17 damaged in an amount that currently exceeds $25,000.00 and additionally costs of 18

19 moving out of Plaintiff’s property and the costs to relocate back to the subject

20 Property.

21 167. Defendants’ conduct as set forth above was intentional, oppressive fraudulent and 22 malicious so as to justify an award of punitive damages in an amount sufficient that 23 such conduct will not be repeated. 24

25 168. Plaintiff will be damaged in having their home wrongfully foreclosed and a slander

26 of their title, and being required to become involved in this litigation all to their

27 damages and injuries the amount of which is subject to proof at the time of trial. 28

37 ______COMPLAINT

169. The actions of Defendants and each of them were fraudulent oppressive and 1

2 malicious so as to warrant the imposition of exemplary damages, and that by virtue of

3 Defendants conduct as set forth herein Plaintiff is entitled to exemplary damages.

4

5 SEVENTH CAUSE OF ACTION 6 FOR DECLARATORY RELIEF 7 (Against all Defendants) 8 170. Plaintiff repeats and realleges Paragraphs 1 through 169 as though fully set forth 9 herein. 10

11 171. A dispute has arisen between and among Plaintiff and Defendants and each of them

12 as to the duties and obligations of the respective parties with regard to the loan or the 13 foreclosure. 14 172. These disputes concern but are not limited to the ownership rights and the validity of 15

16 the commencement of the foreclosure process.

17 173. As to these issues, Plaintiff is required to seek this relief.

18 174. Plaintiff further alleges that a declaration of rights and duties of the parties herein are 19 essential to determine the actual status and validity of the loan, deed of trust, 20 nominated beneficiaries, actual beneficiaries, loan servicers, trustees instituting 21

22 foreclosure proceedings and related matter.

23

24 EIGHTH CAUSE OF ACTION 25 FOR INTENTIONAL MISREPRESENTATION 26 (Against all Defendants)

27 175. Plaintiff repeats and realleges Paragraphs 1 through 175 as though fully set forth 28 herein.

38 ______COMPLAINT

176. Plaintiff is informed and believe that the representation as stated on the Notice of 1

2 Default and each of them were a false representation in the following particulars(s):

3 [A] Documents were not provided to the trustee that showed that any of the

4 Defendants was the Beneficiary and entitled to the payments. 5 [B] At the time Defendants made the representations they knew they were false and 6 were made for the sole purpose of inducing reliance and confusing Plaintiff. 7

8

9 NINTH CAUSE OF ACTION 10 TO SET ASIDE A DEFECTIVE AND WRONGFUL FORECLOSURE 11 (Against all Defendants) 12 177. Plaintiff repeats and reallege Paragraphs 1 through 176 as though fully set forth 13 herein. 14

15 Recording of an Assignment Prior to Foreclosure

16 178. Cal. Civ. Code section 2932.5 provides a condition precedent for an assignee of a

17 Deed of Trust prior to commencing a foreclosure: 18 Where a power to sell real property is given to a mortgagee, or other 19 encumbrancer, in an instrument intended to secure the payment of money, the 20

21 power is part of the security and vests in any person who by assignment becomes

22 entitled to payment of the money secured by the instrument. The power of sale

23 may be exercised by the assignee if the assignment is duly acknowledged and 24 recorded. (Emphasis added) 25 179. Defendants drafted the Deed of Trust, Plaintiff had no opportunity to negotiate 26

27 the terms of the instrument.

28 180. Defendants BNC, QUALITY LOAN, BARCLAYS and MERS, failed to

39 ______COMPLAINT

record the assignment prior to commencing the foreclosure as such the Foreclosure was not 1

2 conducted in accordance with Cal Civ. Code Sec 2924 and 2932.5.

3 Invalid Notice of Default

4 181. There is in existence a certain written instrument which purports to be a Notice of 5 Default that is in the possession of Defendants, and each of them. (See Exhibit “B”) 6 182. The written instrument alleged in Paragraph "180" was procured as follows: 7

8 Defendants cannot prove that the nonjudicial foreclosure which occurred, strictly complied

9 with the tenets of California Civil Code Sections 2923.5 and 2924 in order to maintain an 10 action for possession pursuant to California Code of Civil Procedure section 1161. As of 11 September 6, 2008, California Civil Code Section 2923.5 applies to loans made from 12

13 January 1, 2003, to December 31, 2007, and loans secured by residential real property that

14 are for owner-occupied residences. For purposes of Section 2923.5, “owner-occupied”

15 means that the residence is the principal residence of the borrower. Prior to filing a Notice 16 of Default, Section 2923.5 of the California Civil Code provides in pertinent part: 17 (1) A trustee may not file a notice of default pursuant to Section 2924 until 30 days after 18

19 contact is made as required by paragraph (2) or 30 days after satisfying the due

20 diligence requirements as described in subdivision (g).

21 (2) An authorized agent shall contact the borrower in person or by telephone in order to 22 assess the borrower’s financial situation and explore options for the borrower to 23 avoid foreclosure. During the initial contact, the mortgagee, beneficiary, or authorized 24

25 agent shall advise the borrower that he or she has the right to request a subsequent

26 meeting and, if requested, the mortgagee, beneficiary, or authorized agent shall

27 schedule the meeting to occur within 14 days. 28

40 ______COMPLAINT

(3) A notice of default filed pursuant to Section 2924 shall include a declaration from 1

2 the mortgagee, beneficiary, or authorized agent that it has contacted the borrower,

3 tried with due diligence to contact the borrower as required by this section, or the

4 borrower has surrendered the property to the mortgagee, trustee, beneficiary, or 5 authorized agent. 6 Invalid Declaration on Notice of Default and/or Notice of Trustee’s Sale 7

8 183. The purpose of permitting a declaration under penalty of perjury, in lieu of a sworn

9 statement, is to help ensure that declarations contain a truthful factual representation 10 and are made in good faith. (In re Marriage of Reese & Guy, 73 Cal. App. 4th 1214, 87 11 Cal. Rptr. 2d 339 (4th Dist. 1999). 12

13 183. In addition to California Civil Code §2923.5, California Code of Civil Procedure

14 §2015.5 states:

15 Whenever, under any law of this state or under any rule, regulation, order or 16 requirement made pursuant to the law of this state, any matter is required or permitted 17 to be supported, evidenced, established, or proved by the sworn statement, 18

19 declaration, verification, certificate, oath, or affidavit, in writing of the person making

20 the same, such matter may with like force and effect be supported, evidenced,

21 established or proved by the unsworn statement, declaration, verification, or 22 certificate, in writing of such person which recites that is certified or declared by him 23 or her to be true under penalty of perjury, is subscribed by him or her, and (1), if 24

25 executed within this state, states the date and place of execution; (2) if executed at any

26 place, within or without this state, states the date of execution and that is so certified or

27

28

41 ______COMPLAINT

declared under the laws of the State of California. The certification or declaration must 1

2 be in substantially the following form:

3 (a) If executed within this state:

4 “I certify (or declare) under penalty of perjury that the foregoing is true and correct”: 5 ______6 (Date and Place) (Signature)

7

8 For our purposes we need not look any farther than the Notice of Default to find the

9 declaration is not signed under penalty of perjury; as mandated by new Civil Code 10 §2923.5(c). (Blum v. Superior Court (Copley Press Inc.) (2006) 141 Cal App 4th 418, 45 11 Cal. Reptr. 3d 902 ). The Declaration is merely a form declaration with a check box. 12

13

14 No Personal Knowledge of Declarant

15 According to Giles v. Friendly Finance Co. of Biloxi, Inc., 199 So. 2nd 265 (Miss. 16 1967), “an affidavit on behalf of a corporation must show that it was made by an 17 authorized officer or agent, and the officer him or herself must swear to the facts.” 18

19 Furthermore, in Giles v. County Dep’t of Public Welfare of Marion County (Ind.App. 1

20 Dist.1991) 579 N.E.2d 653, 654-655 states in pertinent part, “a person who verified a

21 pleading to have personal knowledge or reasonable cause to believe the existence of the 22 facts stated therein.” Here, the Declaration for the Notice of Default by the agent does not 23 state if the agent has personal knowledge and how he obtained this knowledge. 24

25 The proper function of an affidavit is to state facts, not conclusions, ¹ and affidavits that

26 merely state conclusions rather than facts are insufficient. ² An affidavit must set forth facts

27 and show affirmatively how the affiant obtained personal knowledge of those facts. ³ 28

42 ______COMPLAINT

Here, The Notice of Default does not have the required agent’s personal knowledge 1

2 of facts and if the Plaintiff borrower was affirmatively contacted in person or by telephone

3 to assess the Plaintiff’s financial situation and explore options for the Plaintiff to avoid

4 foreclosure. A simple check box next to the “facts” does not suffice. 5 Furthermore, “it has been said that personal knowledge of facts asserted in an 6 affidavit is not presumed from the mere positive averment of facts, but rather, a court 7

8 should be shown how the affiant knew or could have known such facts, and, if there is no

9 evidence from which the inference of personal knowledge can be drawn, then it is 10 ______11 ¹ Lindley v. Midwest Pulmonary Consultants, P.C., 55 S.W.3d 906 (Mo. Ct. App. W.D. 2001). 12 ² Jaime v. St. Joseph Hosp. Foundation, 853 S.W.2d 604 (Tex. App. Houston 1st Dist. 1993). 13 ³ M.G.M. Grand Hotel, Inc. v. Castro, 8 S.W.3d 403 (Tex. App. Corpus Chrisit 1999).

14 presumed that from which the inference of personal knowledge can be drawn, then it is

15 presumed that such does not exist.” ¹ The declaration signed by agent does not state 16 anywhere how he knew or could have known if Plaintiff was contacted in person or by 17 telephone to explore different financial options. It is vague and ambiguous if he himself 18

19 called plaintiff.

20 This defendant did not adhere to the mandates laid out by congress before a foreclosure

21 can be considered duly perfected. The Notice of Default states, “That by reason thereof, 22 the present beneficiary under such deed of trust, has executed and delivered to said agent, 23 a written Declaration of Default and Demand for same, and has deposited with said 24

25 agent such Deed of Trust and all documents evidencing obligations secured thereby, and

26 has declared and does hereby declare all sums secured thereby immediately due and

27 payable and has elected and does hereby elect to cause the trust property to be sold to 28

43 ______COMPLAINT

satisfy the obligations secured thereby.” However, Defendants do not have the Deed of 1

2 Trust, nor do they provide any documents evidencing obligations secured thereby. For the

3 aforementioned reasons, the Notice of Default will be void as a matter of law.

4

5 Recording a False Document 6 184. Furthermore, according to California Penal Code § 115 in pertinent part: 7

8 (a) Every person who knowingly procures or offers any false or forged instrument

9 to be filed, registered, or recorded in any public office within this state, which 10 instrument, if genuine, might be filed, registered, or recorded under any law of this 11 state or of the United States, is guilty of a felony. 12

13 (b) Each instrument which is procured or offered to be filed, registered, or recorded

14 in violation of subdivision (a) shall constitute a separate violation of this section.

15 In addition, California Evidence Code § 669 states in pertinent part: 16 (a) The failure of a person to exercise due care is presumed if: 17 (1) He violated a statute, ordinance, or regulation of a public entity; 18

19

20 ______

21 ¹ Bova v. Vinciguerra, 139 A.D.2d 797, 526 N.Y. S.2d 671 (3d Dep’t 1988). 22

23 Here, as stated above the Declaration of Due Diligence as required by Section 2923.5 of 24

25 the California Civil Code is missing and/or improper for the Notice of Default. Therefore,

26 Defendants are guilty of a felony for recording the Notice of Default with a false

27

28

44 ______COMPLAINT

instrument according to California Penal Code §115. Since Defendants have violated a 1

2 statute, the failure of them to exercise due care will be presumed.