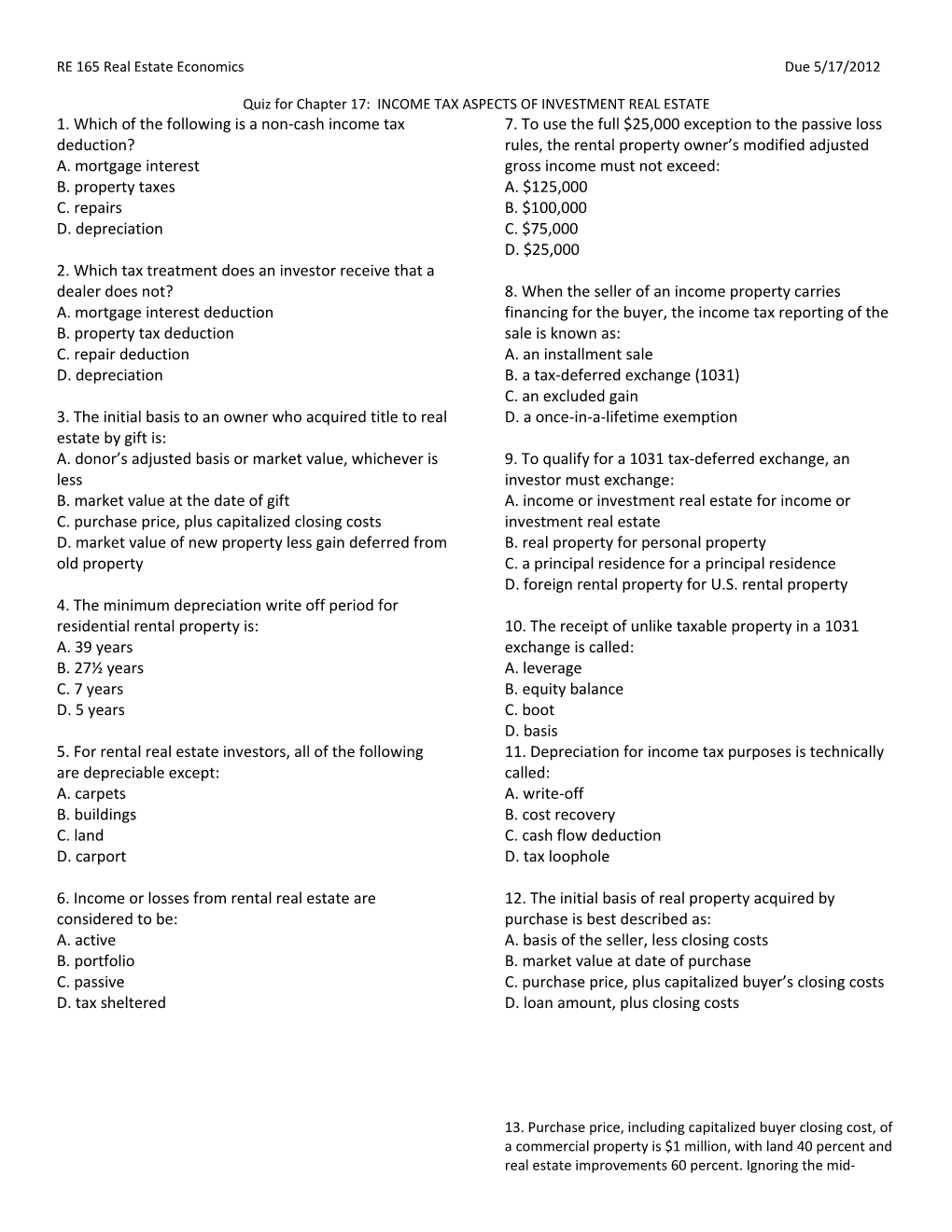

RE 165 Real Estate Economics Due 5/17/2012

Quiz for Chapter 17: INCOME TAX ASPECTS OF INVESTMENT REAL ESTATE 1. Which of the following is a non-cash income tax 7. To use the full $25,000 exception to the passive loss deduction? rules, the rental property owner’s modified adjusted A. mortgage interest gross income must not exceed: B. property taxes A. $125,000 C. repairs B. $100,000 D. depreciation C. $75,000 D. $25,000 2. Which tax treatment does an investor receive that a dealer does not? 8. When the seller of an income property carries A. mortgage interest deduction financing for the buyer, the income tax reporting of the B. property tax deduction sale is known as: C. repair deduction A. an installment sale D. depreciation B. a tax-deferred exchange (1031) C. an excluded gain 3. The initial basis to an owner who acquired title to real D. a once-in-a-lifetime exemption estate by gift is: A. donor’s adjusted basis or market value, whichever is 9. To qualify for a 1031 tax-deferred exchange, an less investor must exchange: B. market value at the date of gift A. income or investment real estate for income or C. purchase price, plus capitalized closing costs investment real estate D. market value of new property less gain deferred from B. real property for personal property old property C. a principal residence for a principal residence D. foreign rental property for U.S. rental property 4. The minimum depreciation write off period for residential rental property is: 10. The receipt of unlike taxable property in a 1031 A. 39 years exchange is called: B. 27½ years A. leverage C. 7 years B. equity balance D. 5 years C. boot D. basis 5. For rental real estate investors, all of the following 11. Depreciation for income tax purposes is technically are depreciable except: called: A. carpets A. write-off B. buildings B. cost recovery C. land C. cash flow deduction D. carport D. tax loophole

6. Income or losses from rental real estate are 12. The initial basis of real property acquired by considered to be: purchase is best described as: A. active A. basis of the seller, less closing costs B. portfolio B. market value at date of purchase C. passive C. purchase price, plus capitalized buyer’s closing costs D. tax sheltered D. loan amount, plus closing costs

13. Purchase price, including capitalized buyer closing cost, of a commercial property is $1 million, with land 40 percent and real estate improvements 60 percent. Ignoring the mid- RE 165 Real Estate Economics Due 5/17/2012

Quiz for Chapter 17: INCOME TAX ASPECTS OF INVESTMENT REAL ESTATE month convention, what will be the total depreciation for 12 A. $8,000 loss months? B. $100,000 gain A. $15,385 C. $85,000 gain B. $36,364 D. $60,000 gain C. $21,819 D. $25,641 21. To qualify as an installment sale, the seller must carry back a junior lien or second, not a first, deed of trust. 14. Which of the following is considered passive income? A. true A. wages B. false B. profits from an owner-managed business C. dividends from stocks 22. For the seller who carries a loan, one disadvantage of an D. rents from investor-owned real estate installment sale is that: A. it could lower tax on gain in year of payoff 15. The general passive loss rule states that passive losses can B. in the event of default, seller may need to foreclose only offset: C. if inflation continues, the seller will pay the tax using A. passive income cheaper dollar B. active income D. the seller will earn interest on gain and tax not yet C. portfolio income reported D. all of the above 23. 1031 real estate exchanges cannot be used by: 16. To use the $25,000 exception to the general passive loss A. homeowners rule, an investor must own at least what percent of the B. investors who own land property? C. investors who own commercial property A. 1 percent D. investors who own farms B. 5 percent C. 10 percent 24. Foreign properties can be exchanged 1031 tax deferred D. 20 percent for U.S. properties. A. true 17. Real estate passive losses that cannot be used in the B. false current year: A. are lost forever 25. For a married couple to exclude up to $500,000 in gain B. can be carried forward to be used in future years upon the sale of their owner-occupied principal residence, C. can always be used when the investor’s income drops they must: below $25,000 A. both be on title D. are carried back to offset income earned the previous year B. earn no more than $100,000 per year C. occupy the home for a minimum of one year 18. Qualified real estate professionals are exempt from the D. file a joint income tax return for two years passive loss rules on their rental properties. A. true B. false

19. Purchase price of income property is $300,000; buyer’s capitalized closing cost, $3,000; capital improvements added, $15,000; and depreciation accumulated during term of ownership, $20,000. Based only on this information, what is the adjusted cost basis? A. $338,000 B. $318,000 C. $298,000 D. $262,000

20. The property in Question 19 is resold for $400,000, seller’s closing costs come to 8 percent, and carry forward passive losses are $10,000. What is the gain or loss on the sale?