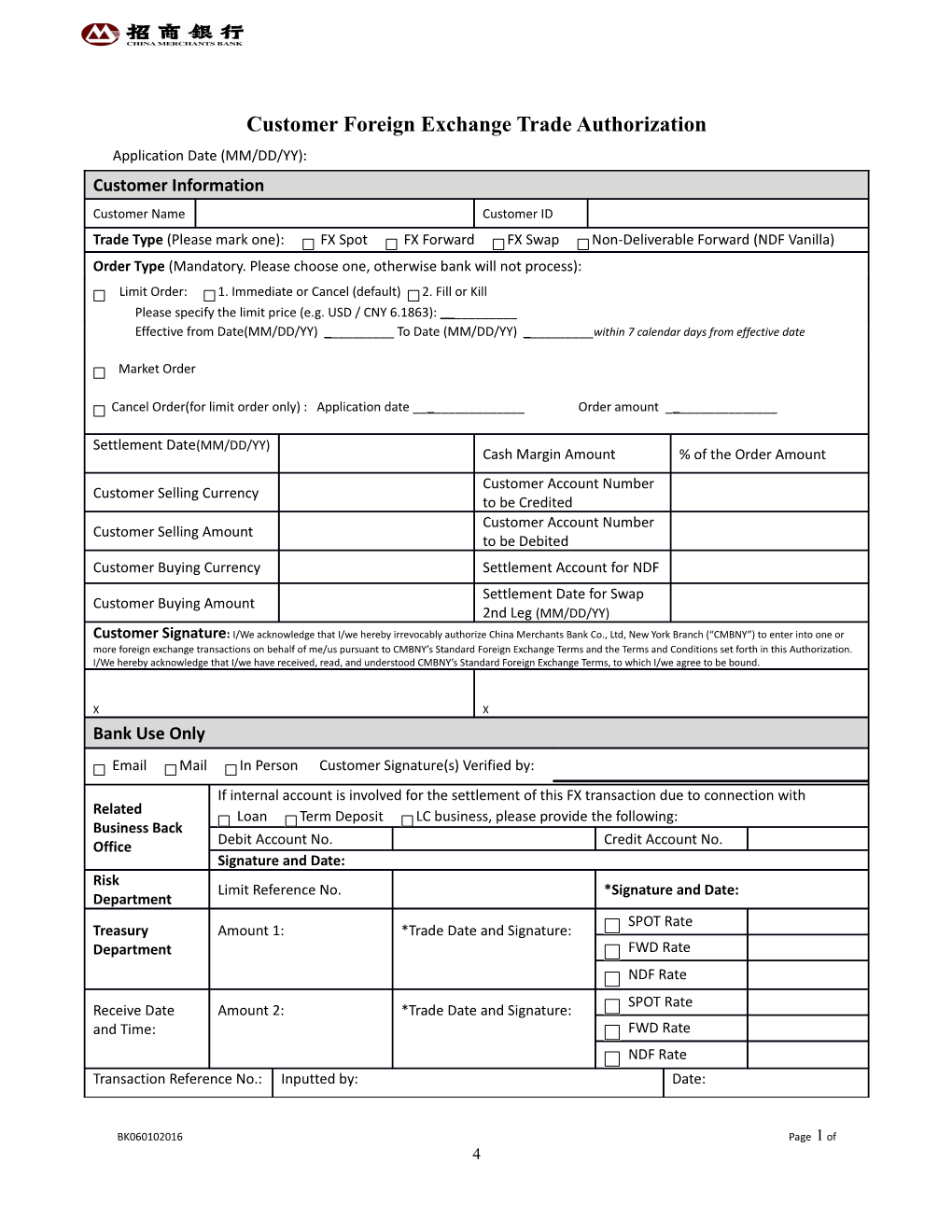

Customer Foreign Exchange Trade Authorization Application Date (MM/DD/YY): Customer Information Customer Name Customer ID Trade Type (Please mark one): FX Spot FX Forward FX Swap Non-Deliverable Forward (NDF Vanilla) Order Type (Mandatory. Please choose one, otherwise bank will not process): Limit Order: 1. Immediate or Cancel (default) 2. Fill or Kill Please specify the limit price (e.g. USD / CNY 6.1863): ______Effective from Date(MM/DD/YY) ______To Date (MM/DD/YY) ______within 7 calendar days from effective date

Market Order

Cancel Order(for limit order only) : Application date ______Order amount ______

Settlement Date(MM/DD/YY) Cash Margin Amount % of the Order Amount Customer Account Number Customer Selling Currency to be Credited Customer Account Number Customer Selling Amount to be Debited Customer Buying Currency Settlement Account for NDF Settlement Date for Swap Customer Buying Amount 2nd Leg (MM/DD/YY) Customer Signature: I/We acknowledge that I/we hereby irrevocably authorize China Merchants Bank Co., Ltd, New York Branch (“CMBNY”) to enter into one or more foreign exchange transactions on behalf of me/us pursuant to CMBNY’s Standard Foreign Exchange Terms and the Terms and Conditions set forth in this Authorization. I/We hereby acknowledge that I/we have received, read, and understood CMBNY’s Standard Foreign Exchange Terms, to which I/we agree to be bound.

X X Bank Use Only Email Mail In Person Customer Signature(s) Verified by: If internal account is involved for the settlement of this FX transaction due to connection with Related Loan Term Deposit LC business, please provide the following: Business Back Office Debit Account No. Credit Account No. Signature and Date: Risk Limit Reference No. *Signature and Date: Department SPOT Rate Treasury Amount 1: *Trade Date and Signature: Department FWD Rate NDF Rate SPOT Rate Receive Date Amount 2: *Trade Date and Signature: and Time: FWD Rate NDF Rate Transaction Reference No.: Inputted by: Date:

BK060102016 Page 1 of 4 Authorized by: Date: If you choose to send us this application electronically, please always email to [email protected] in PDF version. Terms and Conditions

Definitions: (a) “ I”, “We”, “Us”, “Customer” means the person(s) who has been issued with this Foreign Exchange Trade Authorization, or on whose behalf this Trade Authorization has been issued. All demands and notices made under this Authorization to this person shall be sent to the address specified in the account opening form this person kept with CMBNY. (a) “The Bank” or “CMBNY” represents China Merchants Bank Co., Ltd, New York Branch. All demands and notices made under this Authorization to it shall be sent to 535 Madison Ave, 18th floor, New York, NY 10022. (a) “Trade Date”: The date when an order to purchase, sell or otherwise acquire a FX is performed. Trade Date of the Transaction shall be determined by the Bank at its sole discretion. (b) “Settlement Date”: The date on which the payment of funds is delivered. (c) “Limit Orders”: orders to buy or sell a contract at a specific or better price. Limit Orders may or may not get filled depending upon how the market is moving, but if they do get filled it will always be at the chosen price or at a better price if there is one available. The Customer will specify the duration that the order should remain active. The time period for limit orders specified by the Customer shall not exceed 7 calendar days. An order remains unexecuted after the specified period will automatically expire. Unless otherwise indicated herein, all references to date and time of the day in this Authorization refer to Eastern Standard Time (EST). (d) “Market Orders”: orders to buy or sell a contract at the current price, whatever that price may be. In an active market, market orders will always get filled, but not necessarily at the exact price that the trader intended same price for the entire order. Please note that currency quotes will be provided by the Bank during the Bank’s business hours from 9:00 a.m. to 5:30 p.m. (e) “Immediate or Cancel Order (IOC)”: the order will be filled as much as possible at limit or the best available price, if the entire order cannot be filled at such price, the remainder will be cancelled. (f) “Fill or Kill Order (FOK)”: If the entire order cannot be filled at the limit or best available price, the entire order will be cancelled, hence, partial order is not permitted. If the Customer does not specify the choice between IOC and FOK, IOC will be limit order type by default. (g) “Business Day” means a day (other than a Saturday or Sunday) on which banks are open in New York. (h) “Cash” means the lawful currency of the United States of America. (i) “Exposure” means for any Valuation Date, the amount, if any, that would be payable to CMBNY by the Customer (expressed by a positive number) pursuant to Section 4 - Remedies as if the Transaction was the only FX Transaction being terminated as of the relevant Valuation Time. (j) “Obligations” means all present and future obligations of the Customer owing to CMBNY and/or any affiliate of CMBNY. (k) “Posted Collateral” means all Eligible Collateral and all proceeds thereof that have been Transferred to the Customer Collateral Account hereunder and not Transferred to the Customer or released by CMBNY under Clause (g). Any interest on the Posted Collateral or portion thereof held by CMBNY and not Transferred to Customer will constitute Posted Collateral in the form of cash. (l) “ Transfer” means, with respect to any Eligible Collateral or Posted Collateral, and in accordance with the instructions of the applicable party, payment by delivery by wire transfer into one or more bank accounts specified by the recipient. (m) “Valuation Time” means the close of business on the Business Day immediately preceding the Valuation Date or date of calculation.

Agreement to Conditions: I agree that this Authorization is subject to the terms and conditions set forth herein.

If Customer requests a withdrawal and/or transfer from its account with CMBNY after CMBNY executes the Transaction on the Trade Date, and there are insufficient funds in the Customer’s account available to pay due amounts on the Settlement Date to CMBNY as a result of such request or other action taken by Customer, Customer understands and agrees that such authorization may not be processed for the full withdrawal and/or transfer amount requested, and CMBNY is authorized to withhold any fees due from amount withdrawn.

General Terms: This Authorization shall also be governed by the CMBNY’s Standard Foreign Exchange Terms which have been provided to and agreed with the Customer, and this Transaction constitutes an FX Transaction as defined in the Standard Foreign Exchange Terms. The Customer will receive a notice of revisions to the Bank’s Standard Foreign Exchange Terms whenever changes are made.

Provision of Rates: The Bank may provide the Customer with rates for transactions based on the order type the Customer chooses in this Authorization.

Credit Support Terms:

(a) Security Interest. The Customer hereby pledges to CMBNY as security for all Obligations and grants to CMBNY a first priority continuing security interest in lien on and right of set-off against: (i) all Posted Collateral, whether now owned or hereafter acquired, existing or arising, credited to the account that the Customer has with CMBNY (the “Customer Collateral Account”); (ii) all right, title and interest in the Customer Collateral Account; and (iii) all rights, cash and proceeds which may from time to time be derived from, accrue on or be offered in respect of any Posted BK060102016 Page 2 of 4 Collateral.

(b) Credit Support Obligations.

(i) Delivery Amount. Upon a demand made by CMBNY on or promptly following a Valuation Date, if the Delivery Amount for that Valuation Date equals or exceeds the Minimum Transfer Amount, then the Customer will Transfer to CMBNY Eligible Collateral in an amount equal to the applicable Delivery Amount (rounded up to the nearest USD 10,000), where for purposes of this Authorization: (A) the “Delivery Amount” applicable to the Customer for any Valuation Date will equal the amount by which the Credit Support Amount exceeds the value as of that Valuation Date of all Posted Collateral; (B) the “Minimum Transfer Amount” as of any date shall mean an amount equal to 50% of the Independent Amount; (C) “Eligible Collateral” shall be Cash; (D) “Credit Support Amount” means for any Valuation Date (i) CMBNY’s Exposure for that Valuation Date plus (ii) the Independent Amount; (E) “Independent Amount” means certain percentage of cash margin as specified in the Customer Foreign Exchange Authorization that the Customer is required to initially post; In the event that the Customer already has one or more existing accounts with CMBNY, the Customer hereby authorizes CMBNY to credit the Independent Amount from the existing accounts to meet the requirement. Otherwise, if the Customer does not have existing accounts with CMBNY, CMBNY will give the Customer payment directions in order for the Customer to remit the Independent Amount to the designated Customer Collateral Account; and (F) “Valuation Date” means each Business Day.

(c) Transfer Timing. If a demand for the Transfer is made by the Notification Time, then the relevant Transfer will be made not later than the close of business on the next Business Day; if a demand is made after the Notification Time, then the relevant Transfer will be made not later than the close of business on the second business Day thereafter. “Notification Time” means 1:00pm, New York time, on a Business Day.

(d) Calculations. All calculations of value and Exposure for purpose of this Transaction will be made by CMBNY as of the Valuation Time. CMBNY will notify the Customer of its calculation no later than the Notification Time on the Business Day following the applicable Valuation Date.

(e) Holding and Using Posted Collateral.

(i) Use of Posted Collateral. CMBNY will, notwithstanding Section 9-207 of the New York Uniform Commercial Code, have the right to pledge, rehypothecate, assign, invest, use, commingle or otherwise dispose of, or otherwise use in its business any Posted Collateral, free from any claim or right of any nature whatsoever of the Customer. For purposes of the obligation to Transfer Eligible Collateral or any rights or remedies authorized hereunder, CMBNY will be deemed to have a continuing security interest over all Posted Collateral, regardless of whether CMBNY has exercised any rights with respect to any Posted Collateral pursuant to the preceding sentence. (ii) Final Returns. When no amount are or thereafter may become payable by the Customer with respect to any obligations under or in respect of this Transaction, CMBNY will Transfer to one or more accounts specified by the Customer all Posted Collateral, if any. Until CMBNY Transfers the Posted Collateral to the Customer pursuant to this Clause (e)(ii), notwithstanding any other agreement to the contrary, the Customer shall waive its right to make any withdrawals from the Customer Collateral Account without CMBNY’s consent. Upon CMBNY’s Transfer of Posted Collateral to such account(s) specified by the Customer, the security interest and lien granted hereunder on that Posted Collateral will be released immediately and, to the extent possible, without any further action by either party.

(f) Event of Default. For purposes of the Transaction, an Event of Default under the Standard Foreign Exchange Terms will exist with respect to the Customer if:

(i) the Customer fails to make, when due, any Transfer of Eligible Collateral required to be made by it and that failure continues for five (5) Business Days after notice of that failure is given to the Customer.

(ii) The Delivery Amount for a Valuation Date exceeds an amount equal to 80% of the Independent Amount.

(g) Rights and Remedies.

(i) If at any time an Event of Default has occurred and is continuing CMBNY may exercise one or more of the following rights and remedies: (A) CMBNY may exercise rights and remedies as set forth in Section 4 – Remedies of the Standard Foreign Exchange Terms; provided that for purposes of this Clause (g)(i)(A), Section 4 – Remedies is amended by inserting the words “any Posted Collateral and” after the words “set off against” and before “any payment due Customer hereunder” in the third to last sentence of the section. (B) CMBNY may terminate the Transaction and effect termination and close-out of the Termination as set

BK060102016 Page 3 of 4 forth in Section 4 – Remedies of the Standard Foreign Exchange Terms as if the Transaction was the only outstanding FX Transaction with the Customer. (C) CMBNY may exercise all rights and remedies available to CMBNY under applicable law with respect to Posted Collateral and the Customer Collateral Account.

(h) Representations. The Customer represents to CMBNY (which representations will be deemed to be repeated as of each date on which the Customer Transfers Eligible Collateral) that:

(i) it has the power to grant a security interest in and lien on any Eligible Collateral it Transfers and has taken all necessary actions to authorize the granting of that security interest and lien;

(ii) it is the sole owner of or otherwise has the right to Transfer all Eligible Collateral it Transfers to CMB hereunder, free and clear of any security interest, lien, encumbrance or other restrictions other than the security interest and lien granted in Clause (a);

(iii) upon the Transfer of any Eligible Collateral to CMB under the terms of this Authorization, CMB will have a valid and perfected first priority security interest therein (assuming that any central clearing corporation or any third-party financial intermediary or other entity not within the control of the Customer involved in the Transfer of that Eligible Collateral gives the notices and takes the action required of it under applicable law for perfection of that interest); and

(iv) the performance by it of its obligations under this Authorization will not result in the creation of any security interest, lien or other encumbrance on any Posted Collateral other than the security interest and lien granted under Clause (a).

(i) Miscellaneous.

(i) Further Protection. The Customer will promptly give notice to CMBNY of, and defend against, any suit, action, proceeding or lien that involves Posted Collateral Transferred by the Customer or that could adversely affect the security interest and lien granted by it under Clause (a). (ii) Good Faith and Commercially Reasonable Manner. Performance of all obligations under this Authorization, including, but not limited to, all calculations, valuations and determinations made by either party, will be made in good faith and in a commercially reasonable manner.

General Risks and Customer Responsibility for Investment Decisions: The Customer understands and acknowledges that buying and selling the foreign exchange products is inherently risky and requires substantial knowledge and expertise. The Customer enters into the above described Transaction independently and represents that he / she is aware of and understands the risks involved and the Customer has sufficient financial resources to bear such risks. The Customer further acknowledges that CMBNY representatives are not authorized to provide investment, trading or tax advice and therefore will not provide advice or guidance on trading or hedging strategies. The Customer must evaluate carefully whether any particular transaction is appropriate for him / her in light of his / her investment experience, financial resources, financial objectives and needs, and other relevant circumstances and whether he / she has the operational resources in places to monitor the associated risks and contractual obligations over the term of the transaction. The Customer understands and agrees that this Authorization shall be irrevocable once this Authorization is received by CMBNY. The Customer may not unwind the Transaction contemplated by this Authorization and shall strictly fulfill all obligations under the terms and conditions stipulated in this Authorizations and CMBNY’s Standard Foreign Exchange Terms.

Cut-off Time for FX Orders: The Bank has established that 3:00 p.m. EST is the cut-off time for processing orders. Orders received after 3:00 p.m. EST may be deemed as next-business-day orders.

Remedies: Customer hereby agrees to indemnify the bank for any and all losses, claims for damages (including without limitation attorneys’ fees, expenses of legal counsel and disbursements) suffered or sustained by the bank in connection with acting as an agent hereunder for purposes of effecting the Transaction.

Governing Law: This authorization and the rights and obligations hereunder shall be governed by and construed in accordance with, the laws of the State of New York, without regard to conflicts of laws principles except Section 5-1401 and 5-1402 of the New York General Obligations Law.

BK060102016 Page 4 of 4