4 Cost Allocation and Activity-Based Costing

SOLUTIONS TO APPLY WHAT YOU HAVE LEARNED

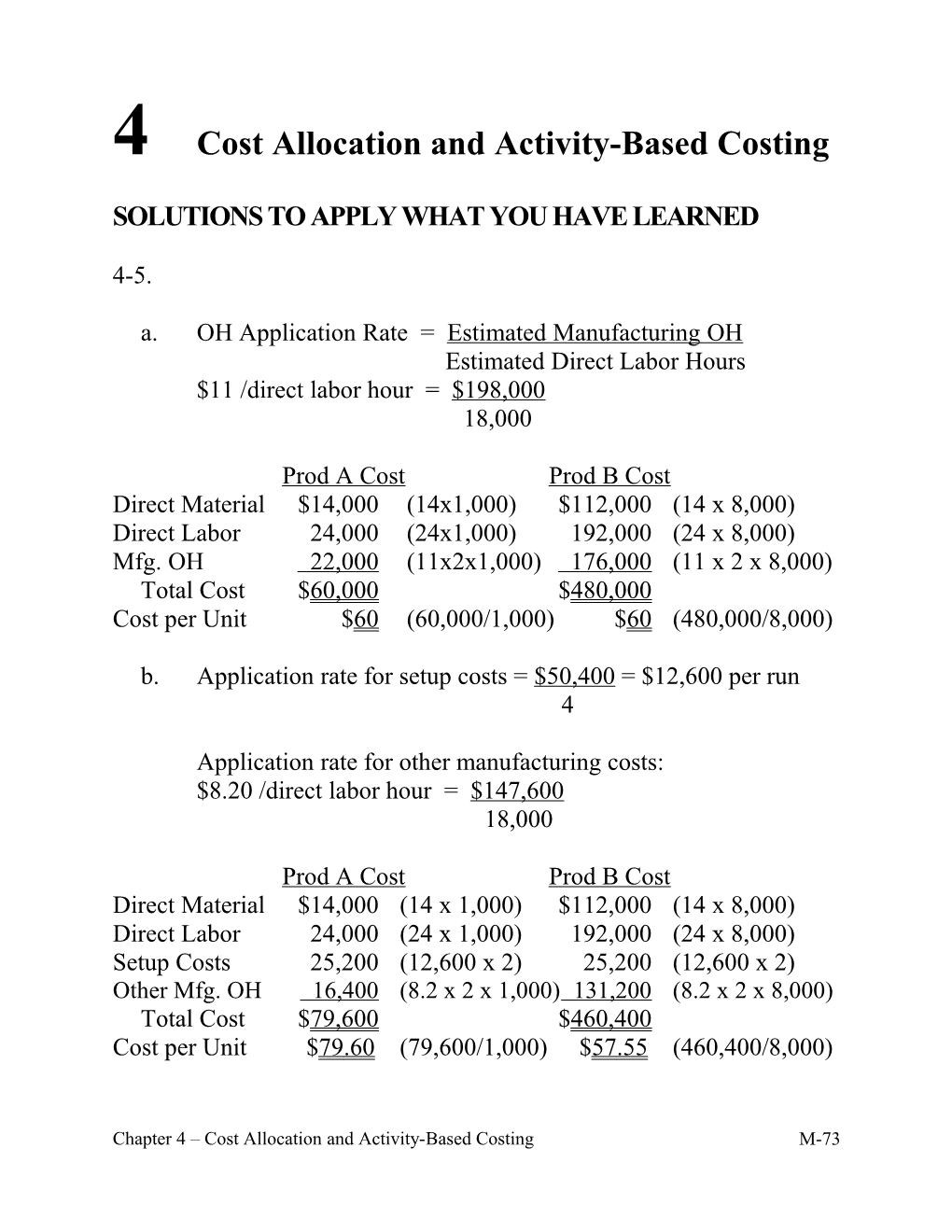

4-5.

a. OH Application Rate = Estimated Manufacturing OH Estimated Direct Labor Hours $11 /direct labor hour = $198,000 18,000

Prod A Cost Prod B Cost Direct Material $14,000 (14x1,000) $112,000 (14 x 8,000) Direct Labor 24,000 (24x1,000) 192,000 (24 x 8,000) Mfg. OH 22,000 (11x2x1,000) 176,000 (11 x 2 x 8,000) Total Cost $60,000 $480,000 Cost per Unit $60 (60,000/1,000) $60 (480,000/8,000)

b. Application rate for setup costs = $50,400 = $12,600 per run 4

Application rate for other manufacturing costs: $8.20 /direct labor hour = $147,600 18,000

Prod A Cost Prod B Cost Direct Material $14,000 (14 x 1,000) $112,000 (14 x 8,000) Direct Labor 24,000 (24 x 1,000) 192,000 (24 x 8,000) Setup Costs 25,200 (12,600 x 2) 25,200 (12,600 x 2) Other Mfg. OH 16,400 (8.2 x 2 x 1,000) 131,200 (8.2 x 2 x 8,000) Total Cost $79,600 $460,400 Cost per Unit $ 79 .60 (79,600/1,000) $ 57 .55 (460,400/8,000)

Chapter 4 – Cost Allocation and Activity-Based Costing M-73 4-5. (Continued) c. Activity-based costing would benefit Simple Products. The use of different application bases for setup costs and other manufacturing overhead costs produces more accurate product costs than would an allocation of all manufacturing overhead costs using a single allocation base. 4-6. a. OH Application Rate = Estimated Manufacturing OH Estimated Direct Labor Hours $25 /direct labor hour = $175,000 7,000 Prod A Cost Prod B Cost Direct Material $ 24,000 (24 x 1,000) $ 24,000 (24 x 1,000) Direct Labor 36,000 (36 x 1,000) 48,000 (48 x 1,000) Mfg. OH 75,000 (3 x 25 x 1,000) 100,000 (4 x 25 x 1,000) Total Cost $135,000 $172,000 Cost per Unit $135 (135,000/1,000) $172 (172,000/1,000) b. Application rate for setup costs = $52,000 = $13,000 per run 4 Application rate for engineering change costs: $3,250 / per change = $26,000 8 Application rate for other manufacturing costs: $13.8571 / direct labor hour = $97,000 7,000 Prod A Cost Prod B Cost Direct Material $ 24,000 (24 x 1,000) $ 24,000 (24 x 1,000) Direct Labor 36,000 (36 x 1,000) 48,000 (48 x 1,000) Setup Costs 26,000 (13,000 x 2) 26,000 (13,000 x 2) Engineering 19,500 (3,250 x 6) 6,500 (3,250 x 2) Other Mfg. OH 41,571 (13.8571 x 3 x 1,000) 55,428 (13.8571 x 4 x 1,000) Total Cost $147,071 $159,928 Cost per Unit $ 147 .07 (147,071/1,000) $159.93 (159,928/1,000)

M-74 Chapter 4 – Cost Allocation and Activity-Based Costing 4-6. (Continued)

c. Activity-based costing would benefit Complex Products. The use of different application bases for various types of manufacturing overhead costs produces more accurate product costs than would an allocation of all manufacturing overhead costs using a single allocation base.

4-7.

a. OH Application Rate = Estimated Manufacturing OH Estimated Direct Labor Hours $46.40 /direct labor hour = $1,160,000 25,000

FP111 Cost FP222 Cost Direct Material $ 60,000 $ 6,000 Direct Labor 14,400 1,440 Mfg. OH 37,120 (800 x 46.40) 3,712 (80 x 46.40) Total Cost $111,520 $11,152 Cost per Unit $22 .304 (111,520/5,000) $22 .304 (11,152/500)

b. Appl. rate for mat. handling = $50,000 = $0.25 / movement 200,000 Appl. rate for prod. engineering = $110,000 = $25 / hour 4,400 Application rate for setup cost = $200,000 = $2,000 / setup 100 Appl. rate for machine deprec. = $450,000 = $25 / machine hour 18,000 Appl. rate for quality testing = $100,000 = $0.80 / test 125,000 Appl. rate for other manuf. = $250,000 = $10 / direct labor hour 25,000

Chapter 4 – Cost Allocation and Activity-Based Costing M-75 4-7. (Continued)

FP111 Cost FP222 Cost Direct Material $60,000 $ 6,000 Direct Labor 14,400 1,440 Mat. Handling 2,500 (10,000 x .25) 250 (1,000 x .25) Engineering 2,500 (100 x 25) 2,500 (100 x 25) Machine Setup 2,000 (2,000 x 1) 2,000 (2,000 x 1) Depreciation 5,000 (200 x 25) 500 (20 x 25) Quality Testing 1,000 (1,250 x .8) 100 (125 x .8) Mfg. OH 8,000 (800 x 10) 800 (80 x 10) Total Cost $95,400 $13,590 Cost per Unit $ 19 .08 (95,400/5,000) $ 27 .18 (13,590/500)

c. The table below summarizes the profit per unit under the traditional method and the activity-based costing method. The activity-based costing method more accurately allocates overhead costs to production and shows clearly that a decision to emphasize the low volume product would be a mistake.

FP111 Cost FP222 Cost Traditional Method: High Volume Low Volume Unit Selling Price $23.00 $26.00 Unit Cost 22 .30 22 .30 Gross Profit Per Unit $ 0 .70 $ 3 .70

Activity-Based Costing: High Volume Low Volume Unit Selling Price $23.00 $26.00 Unit Cost 19 .08 27 .18 Gross Profit Per Unit $ 3 .92 $( 1 .18)

M-76 Chapter 4 – Cost Allocation and Activity-Based Costing 4-8.

a. OH Application Rate = Estimated Manufacturing OH Estimated Direct Labor Hours $30.625 /direct labor hour = $490,000 16,000

AA1 Cost BB2 Cost Direct Material $ 5,000 $ 250 Direct Labor 6,400 320 Mfg. OH 12,250 (400 x 30.625) 613 (20 x 30.625) Total Cost $23,650 $1,183 Cost per Unit $ 2 .365 (23,650/10,000) $ 2 .366 (1,183/500)

b. Application rate for setup cost = $75,000 = $750 / setup 100 Appl. rate for machine deprec. = $240,000 = $75 / machine hour 3,200 Appl. rate for quality testing = $25,000 = $0.50 / test 50,000 Appl. rate for other manuf. = $150,000 = $9.375 / direct labor hr. 16,000

AA1 Cost BB2 Cost Direct Material $ 5,000 $ 250 Direct Labor 6,400 320 Machine Setup 750 (1 x 750) 750 (1 x 750) Depreciation 7,500 (100 x 75) 375 (5 x 75) Quality Testing 50 (100 x .50) 25 (50 x .50) Other Mfg. OH 3,750 (400 x 9.375) 188 (20 x 9.375) Total Cost $23,450 $1,908 Cost per Unit $ 2 .35 (23,450/10,000) $ 3 .82 (1,908/500)

Chapter 4 – Cost Allocation and Activity-Based Costing M-77 4-8. (Continued)

c. The table below summarizes the profit per unit under the traditional method and the activity-based costing method. The activity-based costing method more accurately allocates overhead costs to production and shows clearly that a decision to emphasize the low volume product would be a result in marketing emphasis on a product that is incurring a loss.

AA1 Cost BB2 Cost Traditional Method: High Volume Low Volume Unit Selling Price $2.40 $ 3.25 Unit Cost 2 .37 2 .37 Gross Profit Per Unit $ 0 .03 $ 0 .88

Activity-Based Costing: High Volume Low Volume Unit Selling Price $2.40 $ 3.25 Unit Cost 2 .35 3 .82 Gross Profit Per Unit $ 0 .05 $( 0 .57)

4-9.

a. OH Application Rate = Estimated Manufacturing OH Estimated Direct Labor Hours $50 /direct labor hour = $1,000,000 20,000

Job 303 Job 304 Direct Material $ 2,000 $ 2,000 Direct Labor 3,120 6,240 Mfg. OH 13,000 (260 x 50) 26,000 (520 x 50) Total Cost $18,120 $34,240

M-78 Chapter 4 – Cost Allocation and Activity-Based Costing 4-9. (Continued)

b. Appl. rate for dep. mac. A = $100,000 = $100 / machine A hr. 1,000 Appl. rate for dep. mac. B = $500,000 = $500 / machine B hr. 1,000 Appl. rate for setup cost = $50,000 = $625 / setup 80 Appl. rate for engin. changes = $200,000 = $250 / change 800 Appl. rate for other manuf. = $150,000 = $7.50 / direct labor hr. 20,000

Job 303 Job 304 Direct Material $ 2,000 $ 2,000 Direct Labor 3,120 6,240 Depreciation A 500 (5 x 100) 3,000 (30 x 100) Depreciation B 10,000 (20 x 500) 0 Setup 1,250 (2 x 625) 625 (1 x 625) Engineering 5,500 (22 x 250) 2,250 (9 x 250) Other Mfg. OH 1,950 (260 x 7.50) 3,900 (520 x 7.50) Total Cost $24,320 $18,015

4-10.

a. OH Application Rate = Estimated Manufacturing OH Estimated Direct Labor Hours $60.50 /direct labor hour = $605,000 10,000

Job 500 Job 600 Direct Material $ 1,000 $ 1,000 Direct Labor 1,800 3,000 Mfg. OH 7,260 (120 x 60.50) 12,100 (200 x 60.50) Total Cost $10,060 $16,100

Chapter 4 – Cost Allocation and Activity-Based Costing M-79 4-10. ( Continued)

b. Appl. rate for dep. mac. A = $50,000 = $100 / machine A hr. 500 Appl. rate for dep. mac. B = $300,000 = $600 / machine B hr. 500 Appl. rate for setup cost = $75,000 = $1,000 / setup 75 Appl. rate for mat. handling = $100,000 = $20 / movement 5,000 Appl. rate for other manuf. = $80,000 = $8.00 / direct labor hr. 10,000

Job 500 Job 600 Direct Material $ 1,000 $ 1,000 Direct Labor 1,800 3,000 Depreciation A 1,000 (10 x 100) 5,000 (50 x 100) Depreciation B 30,000 (50 x 600) 0 Setup 2,000 (2 x 1,000) 1,000 (1 x 1,000) Mat. Handling 4,000 (200 x 20) 1,500 (75 x 20) Other Mfg. OH 960 (120 x 8) 1,600 (200 x 8) Total Cost $40,760 $13,100

4-11.

a. OH Application Rate = Estimated Manufacturing OH Estimated Direct Labor Hours $125.50 /direct labor hour = $1,255,000 10,000

Job 901 Job 922 Direct Material $ 3,000 $ 3,000 Direct Labor 1,800 3,000 Mfg. OH 31,375 (250 x 125.50) 12,550 (100 x 125.50) Total Cost $36,175 $18,550

M-80 Chapter 4 – Cost Allocation and Activity-Based Costing 4-11. (Continued)

b. Appl. rate for dep. mac. A = $150,000 = $214.286 / mach. A hr. 700 Appl. rate for dep. mac. B = $600,000 = $857.143 / mach. B hr. 700 Appl. rate for setup cost = $175,000 = $1,750 / setup 100 Appl. rate for mat. handling = $150,000 = $30 / movement 5,000 Appl. rate for other manuf. = $180,000 = $18.00 / direct labor hr. 10,000

Job 901 Job 902 Direct Material $ 3,000 $ 3,000 Direct Labor 1,800 3,000 Depreciation A 4,286 (20 x 214.286) 2,571 (12 x 214.286) Depreciation B 0 6,857 (8 x 857.142) Setup 1,750 (1 x 1,750) 3,500 (2 x 1,750) Mater. Handling 2,700 (90 x 30) 9,000 (300 x 30) Other Mfg. OH 4,500 (250 x 18) 1,800 (100 x 18) Total Cost $18,036 $29,728

Chapter 4 – Cost Allocation and Activity-Based Costing M-81