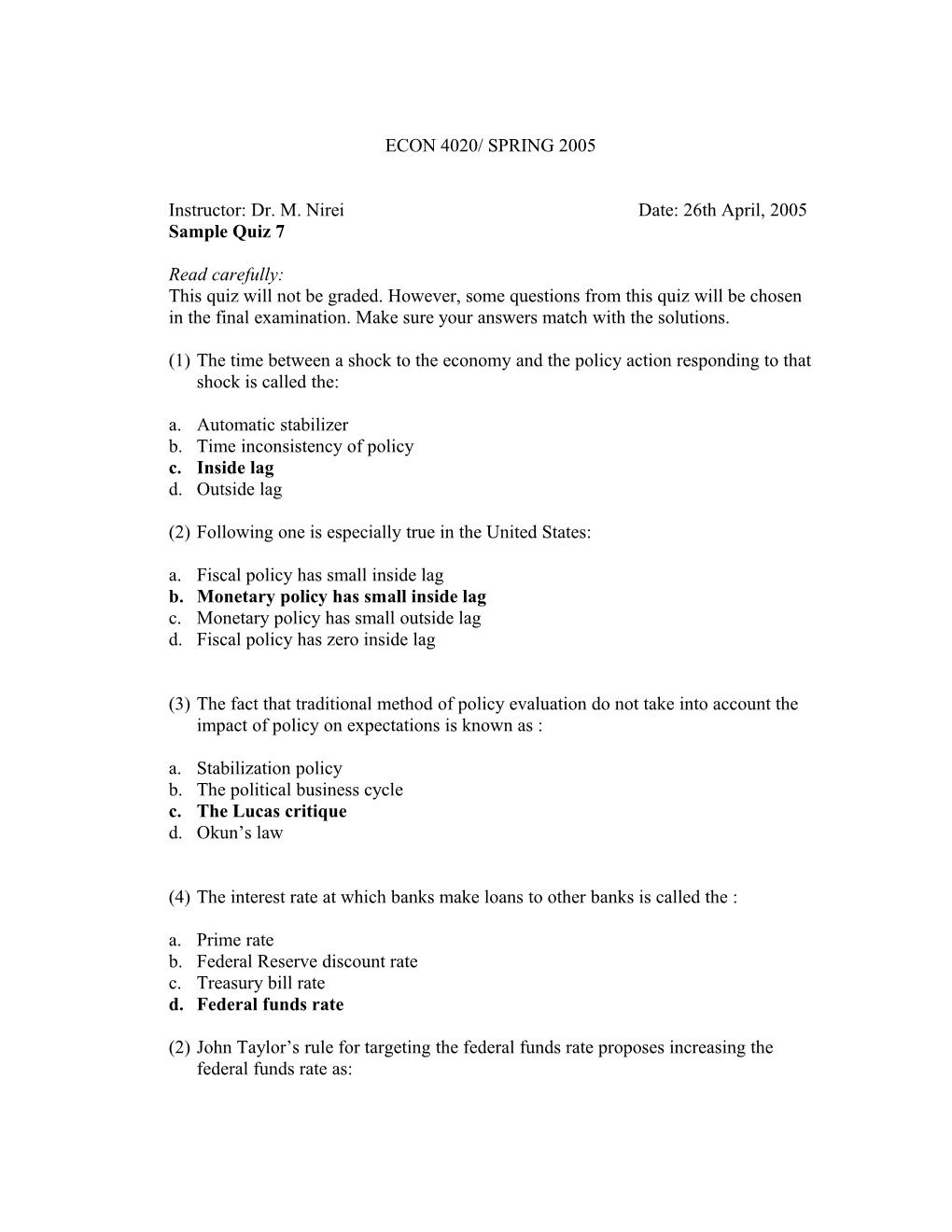

ECON 4020/ SPRING 2005

Instructor: Dr. M. Nirei Date: 26th April, 2005 Sample Quiz 7

Read carefully: This quiz will not be graded. However, some questions from this quiz will be chosen in the final examination. Make sure your answers match with the solutions.

(1) The time between a shock to the economy and the policy action responding to that shock is called the: a. Automatic stabilizer b. Time inconsistency of policy c. Inside lag d. Outside lag

(2) Following one is especially true in the United States: a. Fiscal policy has small inside lag b. Monetary policy has small inside lag c. Monetary policy has small outside lag d. Fiscal policy has zero inside lag

(3) The fact that traditional method of policy evaluation do not take into account the impact of policy on expectations is known as : a. Stabilization policy b. The political business cycle c. The Lucas critique d. Okun’s law

(4) The interest rate at which banks make loans to other banks is called the : a. Prime rate b. Federal Reserve discount rate c. Treasury bill rate d. Federal funds rate

(2) John Taylor’s rule for targeting the federal funds rate proposes increasing the federal funds rate as: a. Inflation decreases, real GDP exceeds the natural level of output b. Inflation decreases, real GDP falls short of the natural level of output c. Inflation increases, real GDP falls short of the natural level of output d. Inflation increases, real GDP exceeds the natural level of output

(3) Monetary policy rules that target nominal variables would target any of the following except the: a. Price level b. Money supply c. Unemployment rate d. Nominal GDP

(4) Suppose, in a given year federal government’s reported budget deficit is $28 billion, inflation is 8.6 percent, and the government debt at the beginning of the year is $495 billion, then the deficit is overstated (approximately) by: a. $ 398 billion b. $ 4229 billion c. $ 34 billion d. $ 43 billion

(5) According to the traditional viewpoint, a tax cut without a cut in government spending would result in: a. Decrease in domestic interest rate and depreciation of domestic currency b. Decrease in domestic interest rate and appreciation of domestic currency c. Increase in domestic interest rate and depreciation of domestic currency d. Increase in domestic interest rate and appreciation of domestic currency

(9) According to the theory of Ricardian equivalence, a tax cut that has no plans to reduce government spending results in: e. Increase in public saving and increase in private saving f. Decrease in public saving and increase in private saving g. Decrease in public saving and decrease in private saving h. Increase in public saving and decrease in private saving

(10) When President George Bush lowered tax withholding in 1992 without lowering the amount of tax owed, surveys showed that: a. Almost everyone spent the higher take-home pay b. Almost everyone saved the higher take-home pay c. A majority of the respondents said they would spend the higher take-home pay, but a significant minority said they would save it d. A majority of the respondents said they would save the higher take-home pay, but a significant minority said they would spend it