1

NORFOLK STATE UNIVERSITY DIVISION OF ACADEMIC AFFAIRS

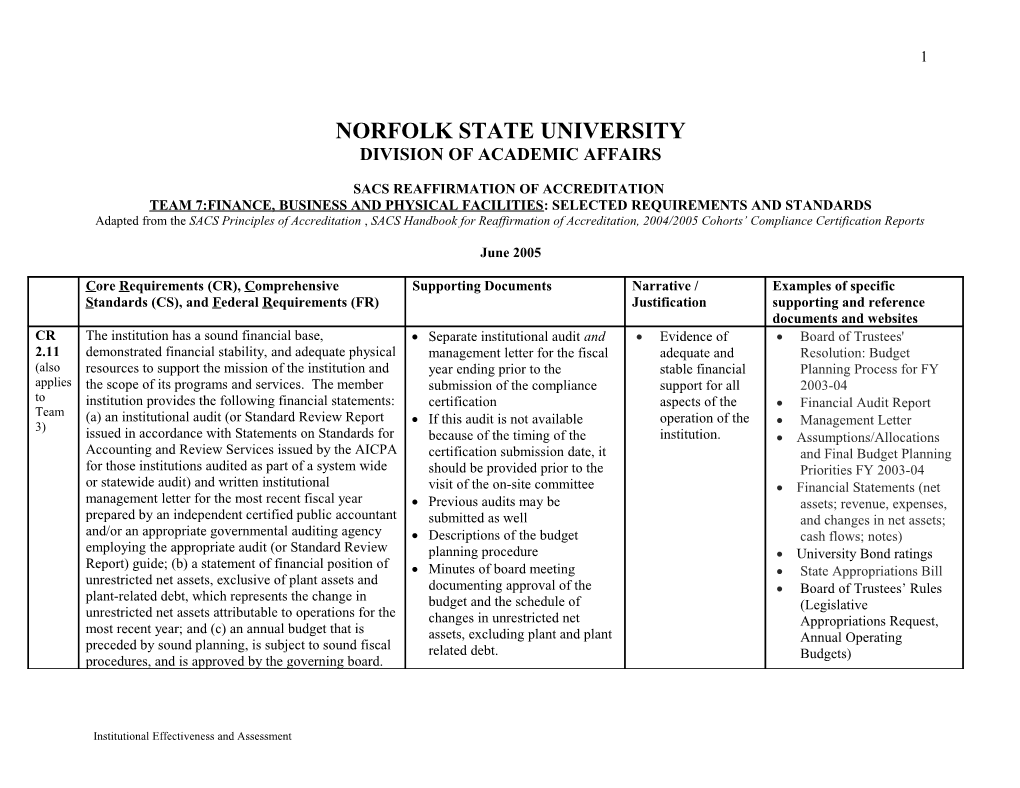

SACS REAFFIRMATION OF ACCREDITATION TEAM 7:FINANCE, BUSINESS AND PHYSICAL FACILITIES: SELECTED REQUIREMENTS AND STANDARDS Adapted from the SACS Principles of Accreditation , SACS Handbook for Reaffirmation of Accreditation, 2004/2005 Cohorts’ Compliance Certification Reports

June 2005

Core Requirements (CR), Comprehensive Supporting Documents Narrative / Examples of specific Standards (CS), and Federal Requirements (FR) Justification supporting and reference documents and websites CR The institution has a sound financial base, Separate institutional audit and Evidence of Board of Trustees' 2.11 demonstrated financial stability, and adequate physical management letter for the fiscal adequate and Resolution: Budget (also resources to support the mission of the institution and year ending prior to the stable financial Planning Process for FY applies the scope of its programs and services. The member submission of the compliance support for all 2003-04 to institution provides the following financial statements: certification aspects of the Financial Audit Report Team (a) an institutional audit (or Standard Review Report If this audit is not available operation of the 3) Management Letter issued in accordance with Statements on Standards for because of the timing of the institution. Assumptions/Allocations Accounting and Review Services issued by the AICPA certification submission date, it and Final Budget Planning for those institutions audited as part of a system wide should be provided prior to the Priorities FY 2003-04 or statewide audit) and written institutional visit of the on-site committee Financial Statements (net management letter for the most recent fiscal year Previous audits may be assets; revenue, expenses, prepared by an independent certified public accountant submitted as well and changes in net assets; and/or an appropriate governmental auditing agency Descriptions of the budget cash flows; notes) employing the appropriate audit (or Standard Review planning procedure University Bond ratings Report) guide; (b) a statement of financial position of Minutes of board meeting State Appropriations Bill unrestricted net assets, exclusive of plant assets and documenting approval of the Board of Trustees’ Rules plant-related debt, which represents the change in budget and the schedule of (Legislative unrestricted net assets attributable to operations for the changes in unrestricted net Appropriations Request, most recent year; and (c) an annual budget that is assets, excluding plant and plant Annual Operating preceded by sound planning, is subject to sound fiscal related debt. Budgets) procedures, and is approved by the governing board.

Institutional Effectiveness and Assessment 2

Core Requirements (CR), Comprehensive Supporting Documents Narrative / Examples of specific Standards (CS), and Federal Requirements (FR) Justification supporting and reference documents and websites Audit requirements for applicant institutions may be Board of Trustee’s found in the Commission policy entitled Resolutions (Budget “Accreditation Procedures for Applicant Institutions.” Planning Process; Budget Approval; Tuition and fees, Strategic Plan Strategic Planning process Capital Outlay Plan Budget Guidelines and Allocations Budget Committee minutes University Fact Book CS Copy of position description of Evidence Department of 3.2.11 chief executive office verifying that Intercollegiate Athletics: (also Copy of organization chart practice is Policies and Procedures applies depicting relationship between consistent with Manual The institution’s chief executive officer has ultimate to intercollegiate athletics and written policies Athletic Foundation bylaws Team responsibility for, and exercises appropriate administrative officials NCAA Certification Report 3) administrative and fiscal control over, the institution’s Copy of appropriate policies intercollegiate athletics program. Organizational Chart and procedures manual Athletics Committee Copy of manual for Athletics Recruitment intercollegiate athletics Materials Relevant budget documents CS The institution’s chief executive officer has ultimate Copy of position description of Evidence Board of Trustees' Manual: 3.2.12 control of the institution’s fund-raising activities. chief executive officer verifying that Minimum Standards, (also Copy of appropriate policies practice is Acceptance, and Reporting applies and procedures manual consistent with of Gifts and Use of Gift to Relevant budget documents written policies Revenue Team Board of Trustees' Manual: 3) Authority and Duties of the

Institutional Effectiveness and Assessment 3

Core Requirements (CR), Comprehensive Supporting Documents Narrative / Examples of specific Standards (CS), and Federal Requirements (FR) Justification supporting and reference documents and websites Presidents Organizational Chart CS Any institution-related foundation not controlled by Bylaws of the foundation, Evidence that the Foundation: Bylaws 3.2.13 the institution has a contractual or other formal Appropriate manuals activities of the Foundation: Guidelines for (also agreement that (a) accurately describes the relationship Contracts, and other formal foundation are Operation applies between the institution and the foundation, and (b) agreements. consistent with to describes any liability associated with that mission. Team relationship. In all cases, the institution ensures that 3) the relationship is consistent with its mission. CS The institution’s recent financial history demonstrates Audits and management letters Evidence of Board of Trustees' 3.10.1 financial stability. for three prior years financial stability Resolutions Copies of budgets based on audits Educational and General Summaries of endowment and evidence that Budget all programs and Endowment Funds services are Foundation funds funded adequately Sponsored Research / Grants funds Financial History: Reports University Fact Book CS The institution provides financial statements and Audits Annual Financial Reports 3.10.2 related documents, including multiple measures for Budgets Institutional Financial determining financial health as requested by the Other financial statements and Profile Commission, which accurately and appropriately documents requested by the Monthly Financial Reports represent the total operation of the institution. Commission Sample Report of Daily Activity (E&G funds), Departmental Ledgers Sample Report of Monthly and Year to Date Budgetary Activity (E&G funds), Departmental Ledgers,

Institutional Effectiveness and Assessment 4

Core Requirements (CR), Comprehensive Supporting Documents Narrative / Examples of specific Standards (CS), and Federal Requirements (FR) Justification supporting and reference documents and websites Daily Ledger Screen Budgets Strategic Plan CS The institution audits financial aid programs as Financial Aid Audits Report of Federal Awards in 3.10.3 required by federal and state regulations. Accordance with OMB Circular A-133 Schedule of Expenditures of Federal Awards Financial aid audits CS The institution exercises appropriate control over all Documents containing policies Daily Account Screen 3.10.4 its financial and physical resources. relative to control Month-end Reports Property management policies Purchasing policies and procedures Travel policies Spending policies Payroll and tax compliance Accounts payable and receivables Year-end procedures Unit websites with policies and procedures State statues on property supervision and control Internal Audits Plan and Reports Leased property list Human Resources Policies

Institutional Effectiveness and Assessment 5

Core Requirements (CR), Comprehensive Supporting Documents Narrative / Examples of specific Standards (CS), and Federal Requirements (FR) Justification supporting and reference documents and websites and Procedures CS The institution maintains financial control over Documents containing policies Grants policies 3.10.5 externally funded or sponsored research and programs. relative to control over Faculty Handbook: Pre -and externally funded or sponsored Post-Award Policies and research and programs Procedures (e.g., conflict of interest, budget worksheets, approval routes, etc.) Office for Sponsored Programs website with policies and procedures Compliance-oriented training and workshops Office of Contract and Grant Accounting Report on Federal Awards in Accordance with OMB Circular A-133 Organizational Chart CS The institution takes reasonable steps to provide a Documents containing policies Description of Asbestos Analysis Program 3.10.6 healthy, safe, and secure environment for all members relative to safety and security adherence to Biological Safety Program (also of the campus community. on campus various federal Fire Safety Program applies and state safety Food Service Inspections to standards Team Hazardous Material 4) Management Disaster preparedness Radiation safety Lab safety Smoking Drugs

Institutional Effectiveness and Assessment 6

Core Requirements (CR), Comprehensive Supporting Documents Narrative / Examples of specific Standards (CS), and Federal Requirements (FR) Justification supporting and reference documents and websites Sexual Harassment Health Services Recreational Opportunities Immunization Keys ADA Compliance Occupational Safety New Employee Orientations Medical Leave policy Risk Management Facilities Management website Campus Security and Safety Committee Campus Security Report University Police Department website Police Patrol Incident Reporting Counseling Center Relevant federal and state regulations CS The institution operates and maintains physical Description of physical Facilities inventory database 3.10.7 facilities, both on and off campus, that are adequate to facilities Campus Master Plan (also serve the needs of the institution’s educational Facilities Master Plan Capital Outlay Projects applies programs, support services, and other mission-related Maintenance procedures and Deferred Maintenance List to activities. records Teams Assignable square footage 1, 4, 5) by space type Facilities Management

Institutional Effectiveness and Assessment 7

Core Requirements (CR), Comprehensive Supporting Documents Narrative / Examples of specific Standards (CS), and Federal Requirements (FR) Justification supporting and reference documents and websites website Computerized Work Request System Facility Condition Analysis ADA Compliance Renovations and Capital Improvements Routine and non-routing maintenance procedures Academic facilities Residential facilities IT facilities Recreational facilities Food Service facilities Parking Building design and construction standards Facilities/Space Committee (minutes, policies, procedures) Campus beautification Photos of facilities FR The institution is in compliance with its program Document that describes A-133 Audit Reports 4.8 responsibilities under Title IV of the 1998 Higher compliance with Title IV Expenditure of Awards Education Amendments. (In reviewing the institution’s Financial Aid compliance with these program responsibilities, the Organizational Chart Commission relies on documentation forwarded to it Program Participation by the U.S. Secretary of Education.) Agreement Academic Progress Policy

Institutional Effectiveness and Assessment 8

Core Requirements (CR), Comprehensive Supporting Documents Narrative / Examples of specific Standards (CS), and Federal Requirements (FR) Justification supporting and reference documents and websites Student Financial Aid Website

Compliance Certification Examples

University of Alabama o http://sacs.ua.edu/ccoutput.cfm University of South Florida o http://usfweb2.usf.edu/accreditation/reaffirmation/CoreReqs/ Virginia Commonwealth University o http://www.vcu.edu/quality/sacs/pdf/Compliance%20Certification.pdf Louisiana State University – Shreveport o http://www.lsus.edu/sacs/compliance_certification_report.asp Louisiana State University – Alexandria o http://sacs.lsua.edu/default.aspx North Carolina State University o http://www2.acs.ncsu.edu/UPA/auth/compliance/standards/reports.htm Florida State University o http://sacs.fsu.edu/fsu_sacs/index.html University of Memphis o http://www.memphis.edu/sacscompliance/index.htm Texas A&M International University o http://www.tamiu.edu/sacs/auditindex.html Austin Peay State University o http://www.apsu.edu/sacs/compliance/sacs_menu.asp University of West Florida o http://nautical.uwf.edu/accreditation/sacsccsubmission/main.htm University of Alabama – Birmingham o http://sacs.ad.uab.edu/default.asp?main=DocumentLists.htm

Institutional Effectiveness and Assessment 9

Southeastern Louisiana University o http://www.selu.edu/sacs/report/report_index.htm Texas Tech o http://www.irim.ttu.edu/SACS/CCC/Contents.htm

SACS 2004, 2005 Cohorts Off-Site Reviewers’ Comments (from Focused Reports discussing non-compliance items)

Core Requirement 2.11

The institution has not yet furnished the committee ed financial statements or a statement of financial position of unrestricted net assets, exclusive of plant assets and plant-related debt. The institution has noted that this information will not be supplied until late fall of this year or early spring of 2005. The institution did supply information supporting that an annual budget is prepared that is preceded by sound financial planning, approved by the governing board and subject to sound fiscal procedures. However, since the institution did not submit a standard review report or ed financial report, it needs to provide such a report or financial report for FY 2004, to demonstrate financial stability. Insufficient documentation provided. The institution does not have the institutional audit and management letter for the most recent fiscal year. The On-Site Review Committee should review the most recent audit and management letter to determine whether the institution has a sound financial base and financial stability. The institution has not yet furnished the committee audited financial statements or a statement of financial position of unrestricted net assets, exclusive of plant assets and plant-related debt. The institution did supply information supporting that an annual budget is prepared that is preceded by sound financial planning, approved by the governing board and subject to sound fiscal procedures. The institution needs to provide the audited report for fiscal year 03-04. Based on the institution's audited and un-audited financial statements, the college appears to have a sound financial base and has demonstrated financial stability despite fluctuations in state funding levels. 2.11(a) Non Compliance – The college self disclosed non compliance with the audit requirement and identified an action plan to resolve the issue. Southwest Tennessee Community College is audited by the state's Comptroller of the Treasury, Division of State Audit. The audit is performed biannually. The last audit performed was for the fiscal year ending June 30, 2001. The college has requested a special audit be conducted to comply with the SACS core requirement. Evidence was provided from the state documenting that the Division of State Audits anticipates completing the audit of fiscal years ending June 30, 2002 and 2003 by July 31, 2004. The institution should provide evidence that a current audit has been completed and provide a supplemental stated position of unrestricted net assets of closure of plant assets and plant related debt. 2.11(c) Not able to

Institutional Effectiveness and Assessment 10

determine compliance The institution provided copies of both its proposed and revised FY 2003-2004 budget. The college's SACS Web pages also provided links to budget related state rules, College policies, reports, as well as its on line planning system. The Tennessee Board of Regents is responsible, as the college’s governing board, for approving the budget. There was no evidence, however that the 2003-04 budget been approved. The institution should provide evidence that the 2003-04 budget was approved by the governing board. The Off-site Review Committee noted that the official audit report for 2002-03 was not submitted with Compliance Certification and that it should be provided when available. In addition, the Off-site Review Committee wanted to know about how the reductions in funds have been accomplished without compromising services. It was not clear to the Committee from the budget update (May 2003) as to how the reductions had been accommodated and how additional reductions will be reflected in University operations as well as how the reduced budget will support the University’s mission and goals. The Off-site Review Committee requested VCU to demonstrate that the current budget supports the mission of the University, identify where cutbacks were made and how they impact programs and services, and discuss the rationale used for any phase-outs and reductions. The institution does not have the institutional audit and management letter for the most recent fiscal year. The On-Site Review Committee should review the most recent audit and management letter to determine whether the institution has a sound financial base and financial stability. The FY03 audit was not available for review by the offsite team. Based on the institution’s prior year audited financial statements, the college appears to have a sound financial base and has demonstrated financial stability despite fluctuations in state funding levels. Student fee increases have offset state funding reductions. The Employee Handbook, however, describes the college’s budget process and reports that over 90 percent of the college’s funding is consumed by “staffing and employment” priorities. Allocating such a high percentage of the college’s budget for personnel leaves very little budget flexibility should the college experience a dramatic reduction in revenues. The institution should provide evidence of its financial planning to overcome a major change in its financial position. The college did not provide audited financial statements for fiscal year 2003. The new GASB format for the statement of net assets is inclusive of all college funds. The college will need to prepare a supplemental schedule to separately report unrestricted net assets to comply with this core requirement. The institution should provide more detailed information regarding its general operating budget to include sources and amounts of revenues and allocation of these funds by function and expenditure categories. The institution provided annual audit reports, Statement of Net Assets, and annual budgets that were approved by the governing board. The committee did not find evidence that the institution has responded to issues in the management letter for the last three years. This matter should be addressed by the College. 2004 audit needs to be submitted and reviewed A benchmark assessment of the institution’s financial status and stability with other peer institutions within the state would be helpful. We may define peer institutions. There is a need to provide clear evidence that the annual budgeting process is preceded by sound planning. In addition to a listing of resources, some assessment of the adequacy and condition of the physical resources must be provided. Be prepared for a campus tour.

Institutional Effectiveness and Assessment 11

Because the SACS compliance report was submitted in August 2003, GC&SU could not provide an institutional audit and management letter for FY 2003, which ended June 30, 2003. The off-site reviewers found GC&SU in non-compliance, but a more accurate finding would have been “not able to determine compliance. The On-site team should assess whether the University has a sound financial base and demonstrated financial stability. Based on the FY 02-03 operating deficit the University should demonstrate that it is not continuing to deteriorate.

Comprehensive Standard 3.2.12

Foundation seems to be the primary fundraising vehicle, though Charter and Bylaws were not included in referenced documents. Funds raised by the University of Memphis Foundation on behalf of the institution are ultimately controlled by the foundation’s independent board

Comprehensive Standard 3.2.13

No supporting documents provided. The institution has provided information showing a relationship between the college and the college foundation. This foundation is not controlled by the college, and the relationship between these entities is consistent with the mission of the college. However, there was no information provided by the institution that showed that there is a formal agreement between the institution and the college foundation setting out that relationship. The college foundation has its own Board of Directors which does not report to the college administration; however, there was no formal document furnished indicating a relationship between the foundation and the college. The institution should accurately describe the relationship between the institution and the foundation, describe any liability associated with the relationship, and ensure that the relationship is consistent with the mission.

Comprehensive Standard 3.10.1

Although there is a statement that there were no weaknesses noted in fiscal management for FY2002 and 2003, there are no copies of the financial audits provided for those years. The institution notes that it is in partial compliance and will be in compliance when “Presentation of the audit report and management letters bring the university into compliance with Comprehensive Standard 3.10.1.” Recent financial history of the institution in prior years indicates financial stability. However, compliance cannot be determined without access to the audited financial statements for the most recent fiscal year end. VCU was found not in compliance with this standard as the 2002-03 audit was not submitted. Do not have audit.

Institutional Effectiveness and Assessment 12

The net assets for the foundation are negative for liability exceeding assets for 01-02. these are the results of accounting changes and the reallocation of non-foundational accounts for funds for other organizations. Provide more detailed explanation. The off-site review team was unable to see the 2003 audits and fiscal year 2004 budget since they were not available in August 2003. The committee asked for further information concerning the financial history and stability of the institution

Comprehensive Standard 3.10.2

The institution does prepare financial statements prepared using generally accepted accounting principles. However, the institution has indicated that financial statements for the most current fiscal year end will not be available until late fall or early spring. Additionally, financial report supplied for FY 02-03 was labeled as uned. No financial audit reports have been provided. The institution notes that it is in partial compliance and will be in compliance when “Presentation of the audit report and management letters brings the university into compliance with Comprehensive Standard 3.10.1.” The Off-site Review Committee inquired about the full implication of funding the President’s initiatives, especially in light of budget cutbacks. The Committee was interested in seeing the budgetary numbers that support growth and development of the self-sufficiency initiatives’ six points, specifically with more detail on sponsored research and implications for instruction. As stated previously, the college did not provide a current audited financial statement. Past audited financial statements have been unqualified and report financial health. No other means of measuring or determining financial health was provided. The institution should provide evidence of current audited financial statements as well as other internal reports and analyses that measure financial health. There is a need to provide a more detailed budget to adequately represent the University’s operations. For example, the documents viewed did not provide details for athletics. This is true for several areas. (Provide more of an explanation of the detailed budget rather than the monthly “Blue Book” summary) The off-site review team was unable to see the documents that would provide evidence of GC&SU’s financial health since some were not available in August 2003, when the compliance audit was submitted, and others are too cumbersome to be viewed off-site.

Comprehensive Standard 3.10.3

The institution does not anticipate furnishing an A-133 audit report for its financial aid to the committee until late fall or early spring for the most current fiscal year end. The On-Site Review Committee should review this documentation to confirm that the institution audits its financial aid programs as required by federal and state regulations. Absent the completion of the 2003 audit, the college’s financial aid programs have been audited. The institution should provide evidence of a current audit of its financial aid programs.

Institutional Effectiveness and Assessment 13

The off-site review team did not have the most recent Hope Audit information, nor did they have the State Auditor’s Report for FY 2003 because GC&SU had not yet received them in August when the compliance audit was due.

Comprehensive Standard 3.10.4

Insufficient information and documentation provided. The institution provided numerous policies dealing with control over physical resources. However, no documentation providing evidence they are being followed was provided Documentation in Compliance Certification does not cover the full range of potential liability and does not comply with VCCS Policy 2A27G4. Want onsite review of adequate physical facilities. Provide the updated operational policies and procedures that demonstrate appropriate controls for financial and physical resources. Several manuals are out-of-date. The off-site review team was not provided with the Business Procedures Manual because of the size of the document. The 2003 State Audit was not available for the August submission due date.

Comprehensive Standard 3.10.5

Insufficient documentation related to review of compliance with policies and procedures. The college provided evidence of policies and procedures designed to maintain financial control over externally funded programs. However, in the state audit for the period ending June 30, 2001, the auditors disclosed an internal control weakness related to restricted fund accounts, i.e. externally funded programs, and that this audit finding was repeated from the prior audit. College management concurred with the finding and committed to resolving the problem. Absent an audit for the successive period (see CR 2. 11(a) and CS 3.10.3), I am not able to determine if this audit issue has been resolved. The institution should provide evidence that the internal control weakness related to restricted accounts has been resolved

Comprehensive Standard 3.10.6 The institution provided numerous policies concerning the health, safety, and security and provided Safety Manuals. However, no documentation providing evidence they are being followed was supplied The institution has provided documentation of numerous policies addressing health and safety issues and emergency operations plans for each of its sites. The compliance report also lists as documentation the TSTC West Texas Safety/Risk Management Plan 2004 that may be

Institutional Effectiveness and Assessment 14

found in the office of the Director of Physical Plant. The On-Site Committee should examine this plan and any related safety committee minutes or other documentation to ensure the plan and related policies are adequate, evaluated regularly and updated as necessary.

Comprehensive Standard 3.10.7

There are a large number of buildings referenced in Facilities Building Inventory (www.irim.ttu.edu/SAC/BuildingInventory.pdf) that have a CND code of less than satisfactory. The On-Site committee will want to examine this issue. The college appears to have processes in place to operate and maintain physical facilities that serve the mission of the college. Like most states, Tennessee's appropriations for capital outlay and maintenance projects fall significantly short of required funding. The college has been able to set aside operating dollars to supplement funds provided by the state for maintenance and has used these funds to address unfunded needs. The college's physical facilities inventory report indicates that five of its permanent buildings are late 1960's vintage structures and 17 were constructed in the 1970's. There is no indication, however, of the current condition of these buildings. Given the age of these facilities, they should have undergone some major renovations and remodeling to maintain their usefulness. The college indicated that it has a standing committee, the Facilities Committee, which has responsibility for reviewing and commenting on whether or not the college's physical facilities are used and maintained efficiently and well. The committee also recommends ways of improving the appearance of all campus facilities and grounds. Minutes of this committee's meetings or its recommendations were not included in the links to the college's SACS Web pages. The institution should provide evidence of its facilities evaluation process by providing copies of minutes of the Facilities Committee. In addition, a facilities condition report should be prepared for all buildings particularly those 30 and 40 year old structures that have not undergone major renovations or remodeling. The institution provided numerous policies and procedures manuals concerning the operation and maintenance of the physical facilities. A Master Plan was also provided. However, no documentation providing evidence they are being followed was supplied. There is no description of the adequacy and maintenance of facilities. Physical Facilities: Describe the adequacy of facilities in more detail. Be prepared for a campus tour of facilities.

Federal Requirement 4.8

The institution, in its compliance certification report states that, “There have been no significant audit findings for the Financial Aid Office at Southwest." This statement is accurate. However, there was a repeat audit finding in the college's last audit (for the fiscal year ending June 30, 2001) that categorized Southwest's restricted fund accounting “ . . . staff as ineffective in administering internal controls over restricted fund accounts." The specific referenced problem area dealt with Title IV Financial Aid Pell accounts. Under the program participation agreement with the Department of Education, the college is responsible for establishing and maintaining administrative processes and records to ensure the proper and efficient administration of funds received from the Secretary or from students under the

Institutional Effectiveness and Assessment 15

Title IV HEA programs. The audit finding would suggest that Southwest did not fully comply with the provisions of 34CFR Part 668. College management concurred with the finding and committed to resolving the problem. Absent an audit for the successive period (see CR 2.11(a) and CS 3.10.3), I am not able to determine if this audit issue has been resolved. The college has requested a specific audit be conducted to comply with the SACS comprehensive standard. Evidence was provided from the state documenting that the Division of State Audits anticipates completing the audit of fiscal years ending June 30, 2002 and 2003 by July 31, 2004. The institution should provide evidence that a current year audit has been completed and that the internal control weakness has been resolved.

Institutional Effectiveness and Assessment