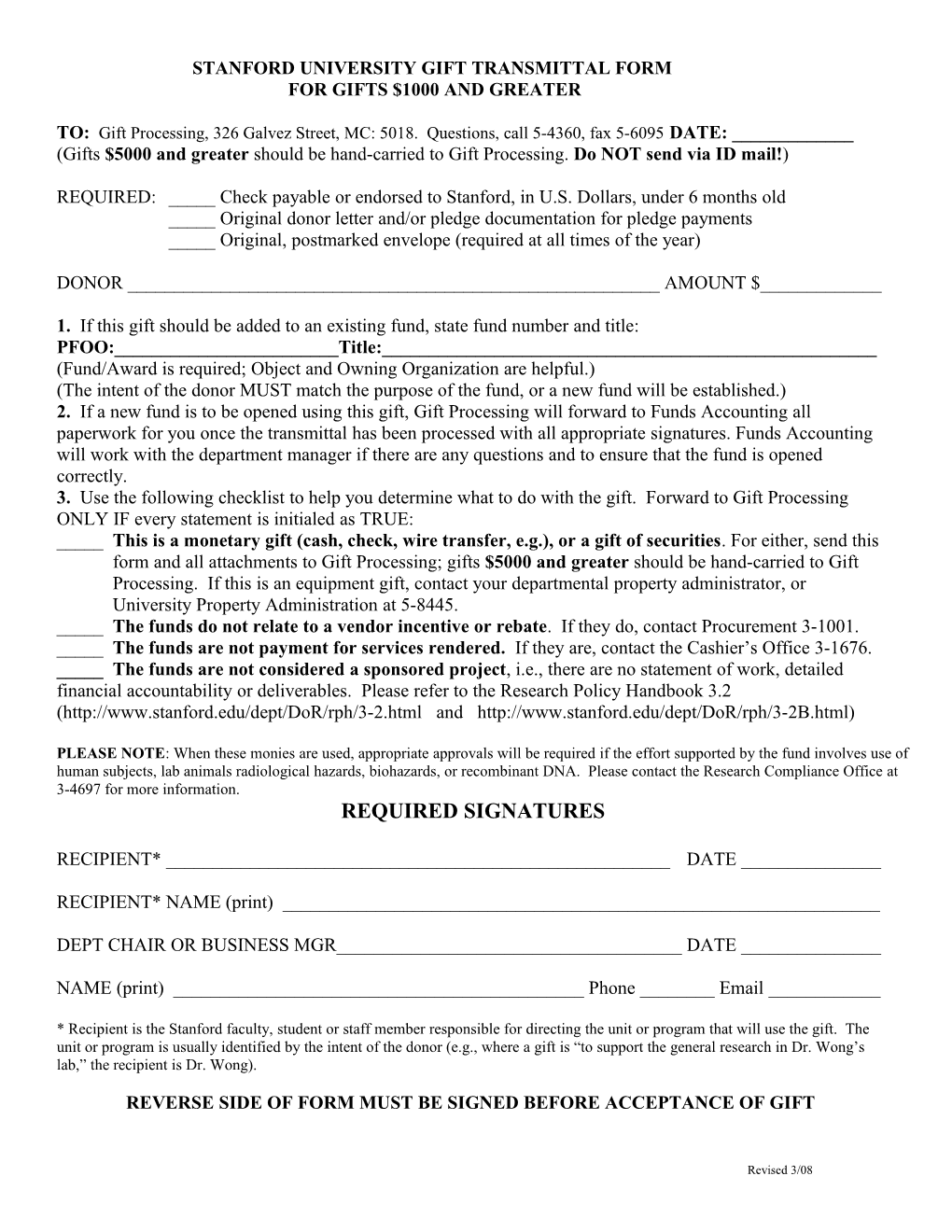

STANFORD UNIVERSITY GIFT TRANSMITTAL FORM FOR GIFTS $1000 AND GREATER

TO: Gift Processing, 326 Galvez Street, MC: 5018. Questions, call 5-4360, fax 5-6095 DATE: ______(Gifts $5000 and greater should be hand-carried to Gift Processing. Do NOT send via ID mail!)

REQUIRED: _____ Check payable or endorsed to Stanford, in U.S. Dollars, under 6 months old _____ Original donor letter and/or pledge documentation for pledge payments _____ Original, postmarked envelope (required at all times of the year)

DONOR ______AMOUNT $______

1. If this gift should be added to an existing fund, state fund number and title: PFOO:______Title:______(Fund/Award is required; Object and Owning Organization are helpful.) (The intent of the donor MUST match the purpose of the fund, or a new fund will be established.) 2. If a new fund is to be opened using this gift, Gift Processing will forward to Funds Accounting all paperwork for you once the transmittal has been processed with all appropriate signatures. Funds Accounting will work with the department manager if there are any questions and to ensure that the fund is opened correctly. 3. Use the following checklist to help you determine what to do with the gift. Forward to Gift Processing ONLY IF every statement is initialed as TRUE: _____ This is a monetary gift (cash, check, wire transfer, e.g.), or a gift of securities. For either, send this form and all attachments to Gift Processing; gifts $5000 and greater should be hand-carried to Gift Processing. If this is an equipment gift, contact your departmental property administrator, or University Property Administration at 5-8445. _____ The funds do not relate to a vendor incentive or rebate. If they do, contact Procurement 3-1001. _____ The funds are not payment for services rendered. If they are, contact the Cashier’s Office 3-1676. _____ The funds are not considered a sponsored project, i.e., there are no statement of work, detailed financial accountability or deliverables. Please refer to the Research Policy Handbook 3.2 (http://www.stanford.edu/dept/DoR/rph/3-2.html and http://www.stanford.edu/dept/DoR/rph/3-2B.html)

PLEASE NOTE: When these monies are used, appropriate approvals will be required if the effort supported by the fund involves use of human subjects, lab animals radiological hazards, biohazards, or recombinant DNA. Please contact the Research Compliance Office at 3-4697 for more information. REQUIRED SIGNATURES

RECIPIENT* ______DATE ______

RECIPIENT* NAME (print) ______

DEPT CHAIR OR BUSINESS MGR______DATE ______

NAME (print) ______Phone ______Email ______

* Recipient is the Stanford faculty, student or staff member responsible for directing the unit or program that will use the gift. The unit or program is usually identified by the intent of the donor (e.g., where a gift is “to support the general research in Dr. Wong’s lab,” the recipient is Dr. Wong).

REVERSE SIDE OF FORM MUST BE SIGNED BEFORE ACCEPTANCE OF GIFT

Revised 3/08 CONFLICT OF INTEREST CERTIFICATION The following section must be completed prior to acceptance of gifts which directly support the teaching, research, or scholarship program of a faculty member or individual. Please indicate true with a T or false with a F for the questions below:

1. I* have a “significant financial interest” ** in the Donor. 2. I* have a consulting arrangement or board appointment with the Donor.

3. I* am employed by the Donor. 4. I* have sponsored project support from the Donor.

5. I* am the Donor. 6. I have disclosed a relationship with the Donor on my annual Conflict of Interest Statement.

* I includes “myself, and members of my immediate family (includes spouse, dependent children, and/or domestic partner)”. ** For this purpose, "significant financial interests" means:

any current or pending ownership interests (including shares, partnership stake, or derivative interests such as stock options) in a privately-held entity (e.g., in a "start up" company); any current or pending ownership interests (including shares, partnership stake, or derivative interests such as stock options) in a publicly-traded entity, amounting to at least one-half percent (0.5%) of that entity's equity or at least $10,000 in ownership interests (except when the ownership interest is managed by a third party such as a mutual fund); or any income amounting to at least $10,000 per year (other than from employment, consulting, or ownership interests as covered above) -- including for example honoraria, licensing or royalty income. If any of the above are true, please disclose your relationship with the donor to your school dean or vice president and obtain an approval signature from him or her to accept the gift. Only the faculty academic deans, vice presidents or vice provosts, university librarian, or equivalent may sign here.

RECIPIENT'S SIGNATURE______DATE______IF NECESSARY, APPROVED BY SCHOOL DEAN/VP______DATE______

If you have any questions, consult the Policy on Conflict of Commitment and Interest (for faculty see Research Policy Handbook 4.1; for students see Research Policy Handbook 2.21; for academic staff see RPH 4.4; and for staff see Administrative Guide 15.2; or call the Assistant Dean of Research at 3-9721.

IF $20,000 OR GREATER: Attachment A (Determination Process Checklist) of the RPH, Chapter 3.2 is required. Attachment B (Gift or Sponsored Project Indicators) is recommended. Please refer to the Research Policy Handbook, Chapter 3.2 (http://www.stanford.edu/dept/DoR/rph/3-2.html) I have reviewed this form and supporting documentation and attest that all statements are true; this is a gift.

APPROVED BY______DATE ______(Associate Dean for Finance/Administration or equivalent, or his/her designee)

Comments: ______Revised 3/08