Warsaw, March 21st 2014

Press release Grupa Azoty Group's 2013 financial results

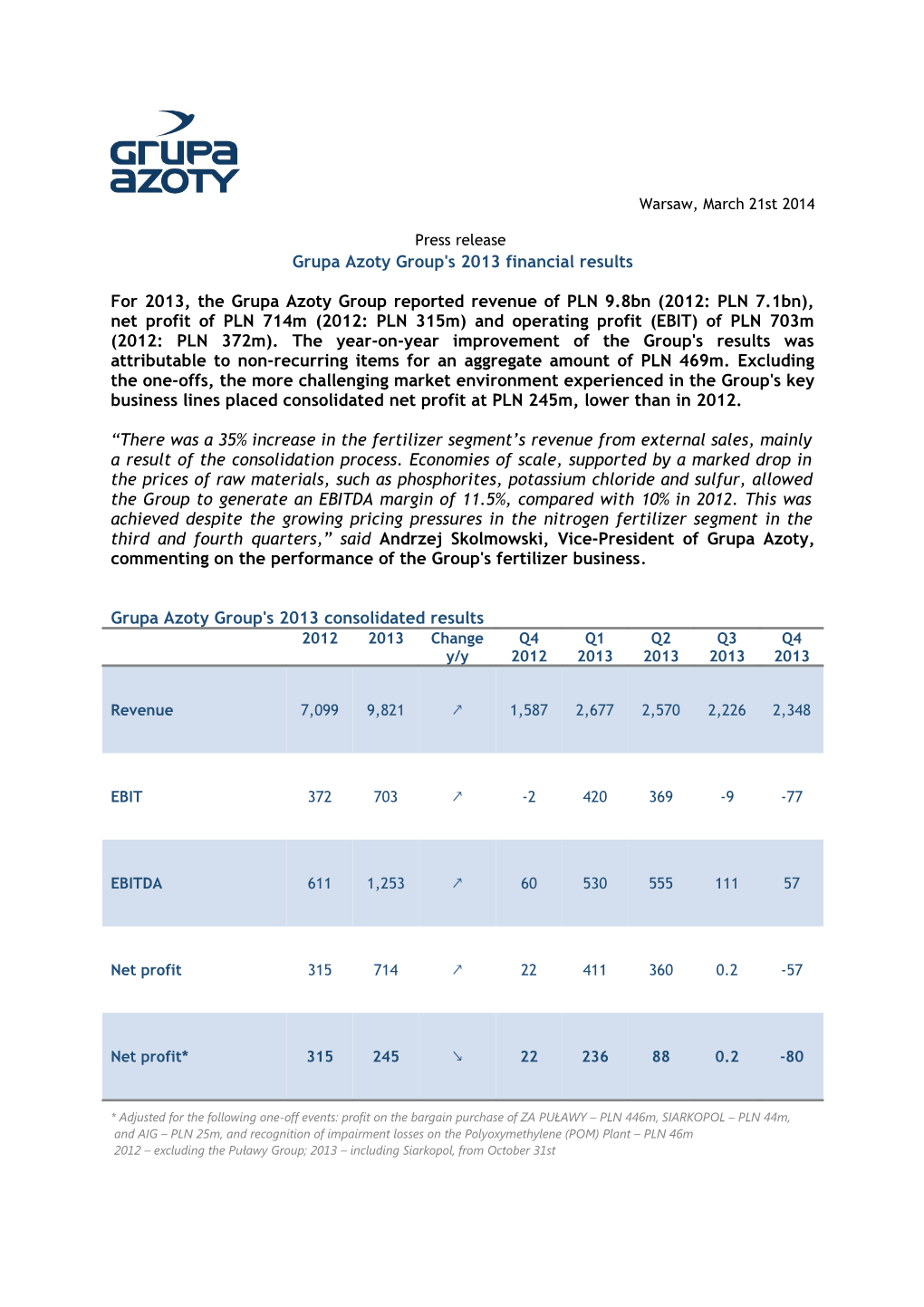

For 2013, the Grupa Azoty Group reported revenue of PLN 9.8bn (2012: PLN 7.1bn), net profit of PLN 714m (2012: PLN 315m) and operating profit (EBIT) of PLN 703m (2012: PLN 372m). The year-on-year improvement of the Group's results was attributable to non-recurring items for an aggregate amount of PLN 469m. Excluding the one-offs, the more challenging market environment experienced in the Group's key business lines placed consolidated net profit at PLN 245m, lower than in 2012.

“There was a 35% increase in the fertilizer segment’s revenue from external sales, mainly a result of the consolidation process. Economies of scale, supported by a marked drop in the prices of raw materials, such as phosphorites, potassium chloride and sulfur, allowed the Group to generate an EBITDA margin of 11.5%, compared with 10% in 2012. This was achieved despite the growing pricing pressures in the nitrogen fertilizer segment in the third and fourth quarters,” said Andrzej Skolmowski, Vice-President of Grupa Azoty, commenting on the performance of the Group's fertilizer business.

Grupa Azoty Group's 2013 consolidated results 2012 2013 Change Q4 Q1 Q2 Q3 Q4 y/y 2012 2013 2013 2013 2013

Revenue 7,099 9,821 ↗ 1,587 2,677 2,570 2,226 2,348

EBIT 372 703 ↗ -2 420 369 -9 -77

EBITDA 611 1,253 ↗ 60 530 555 111 57

Net profit 315 714 ↗ 22 411 360 0.2 -57

Net profit* 315 245 ↘ 22 236 88 0.2 -80

* Adjusted for the following one-off events: profit on the bargain purchase of ZA PUŁAWY – PLN 446m, SIARKOPOL – PLN 44m, and AIG – PLN 25m, and recognition of impairment losses on the Polyoxymethylene (POM) Plant – PLN 46m 2012 – excluding the Puławy Group; 2013 – including Siarkopol, from October 31st Structure of the Group's 2013 consolidated revenue

In 2013, the Chemicals Segment generated revenue from external sales of nearly PLN 2.4bn, up 60% on the previous year. Despite the revenue increase, the EBITDA margin fell from 7% in 2012 to 3% last year, chiefly on declining prices of OXO alcohols, pigments and plasticizers. In its melamine sales, however, the Group benefited from a positive pricing trend in the chemicals market. With the melamine supply being suppressed by plant failures suffered by other manufacturers, the Group was able to charge nearly 23% higher prices, especially in the first half of the year. Margins in the Chemicals Segment were also supported by the falling raw material prices for ilmenite and titanium slag, which are used to manufacture titanium white.

In the Plastics Segment, a difficult market environment prevailed throughout the year, with caprolactam being particularly affected. Stronger pricing pressures caused by the ongoing changes on the market, including China's rise to dominance in caprolactam production, led to oversupply and a consequent nearly 9% drop in prices of caprolactam (Puławy) and polyamides (Tarnów). The situation was further aggravated by the continuing high prices of such raw materials as benzene and phenol. In addition, rallying methanol prices and strong market competition in polyoxymethylene products (Tarnoform) both contributed to the emergence of impairment indicators, and subsequent recognition of a PLN 46m impairment loss on the POM Plant’s assets.

Capital expenditure

In 2013, the Group spent close to PLN 670m of its capex budget of more than PLN 900m.

Budget Capex incurred in Fertilizers Segment PLNm 2013 Liquid and solid fertilizers based on UREA and AS – Puławy Ammonia − a new ammonia storage facility (Puławy) and 370 243 upgrading of reactors (Tarnów, Police) Plastics Segment

Sulfuric acid – upgrade 85 80 C-none – capacity increase and cost reduction – Tarnów

Chemicals Segment

OXO products – terephthalate (Kędzierzyn) and fat processing 68 66 plant (Chorzów) Other Activities Energy – flue gas desulfurisation unit – Puławy 414 277 flue gas purification node - Police Grupa Azoty S.A.'s separate results

On a separate basis, factoring in the effect of impairment losses, in 2013 the Company posted a net profit of PLN 44m (2012: PLN 251m) on PLN 1.8bn revenue (2012: PLN 2bn).

2012 2013 Change Q4 Q1 Q2 Q3 Q4 y/y 2012 2013 2013 2013 2013

Revenue 1,996 1,846 ↘ 470 547 420 448 431

EBIT 134 -79 ↘ 11 31 -13 -18 -79

EBITDA 208 10 ↘ 31 53 9 3 -55

Net profit 251 44 ↘ 25 55 80 -19 -72

Net profit* 251 90 ↘ 25 55 80 -19 -26

*Adjusted for non-recurring items: PLN 46m impairment loss on the Polyoxymethylene (POM) Plant

Grupa Azoty Puławy Group's consolidated results

In 2013, the Grupa Azoty Puławy Group earned net profit of PLN 305m (2012: PLN 487m), on revenue of nearly PLN 3.8bn (2012: nearly 4bn).

Change 2012 2013 Q2 12/13 Q3 12/13 Q4 12/13 Q1 13/14 Q2 13/14 y/y Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013

Revenue 3,982 3,798 ↘ 973 1,105 930 840 923

EBIT 505 340 ↘ 91 190 110 19 21

EBITDA 621 478 ↘ 121 224 142 55 57 Net profit 487 305 ↘ 87 163 105 18 19

Grupa Azoty Police Group's consolidated results

In 2013, the Grupa Azoty Police Group earned a net profit of PLN 50m (2012: PLN 102m), on revenue of nearly PLN 2.5bn (2012: nearly 3bn).

Following the end of the financial year, on March 13th 2014 the Management Board recommended that PLN 23.25m be distributed as dividend for 2013. This recommendation was approved by the Supervisory Board and will be included in the agenda of the Company's Annual General Meeting.

Change Q4 Q1 Q2 Q3 Q4 2012 2013 y/y 2012 2013 2013 2013 2013

Revenue 2,981 2,464 ↘ 572 725 728 510 500

EBIT 128 56 ↘ -2 40 32 5 -21

EBITDA 211 142 ↘ 20 61 53 24 4

Net profit 102 50 ↘ -1 32 23 7 -13

Grupa Azoty Zakłady Azotowe Kędzierzyn's separate results

On a separate basis, Grupa Azoty Zakłady Azotowe Kędzierzyn earned net profit of PLN 85m (2012: PLN 116m), on revenue of nearly PLN 2.1bn (2012: nearly PLN 2.2bn).

Change Q4 Q1 Q2 Q3 Q4 2012 2013 y/y 2012 2013 2013 2013 2013

Revenue 2,165 2,076 ↘ 566 545 530 474 527

EBIT 140 98 ↘ 28 52 44 2 0 EBITDA 221 174 ↘ 47 70 63 21 20

Net profit 116 85 ↘ 25 45 39 5 -4

*** The Grupa Azoty Group, whose parent is Grupa Azoty S.A. of Tarnów, is one of the leading players on the European fertilizer and chemical markets. The Group is the second largest EU-based manufacturer of nitrogen and compound fertilizers, and its other products (including melamine, caprolactam, polyamide, oxo alcohols and titanium white) enjoy strong position in the chemical sector, with a wide range of applications in various industries. The Group has been formed through successive acquisitions of Polish chemical companies, and now comprises a number of entities, including: Grupa Azoty S.A. (Parent), Grupa Azoty Zakłady Azotowe Puławy S.A, Grupa Azoty Zakłady Chemiczne Police S.A., and Grupa Azoty Zakłady Azotowe Kędzierzyn S.A.

For additional information, please contact:

Grzegorz Kulik Grupa Azoty Group Press Officer mobile: +48 785 780 005 email: [email protected]