ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends

Consumer Tablet, PC and Ultrabook Demand Trends Samsung Showing Burst of Momentum in Tablets Andy Golub Overview: The tablet market continues to mature, with Apple’s market leading iPad facing increased competition from the likes of Samsung, Google, Microsoft and Amazon.

During May, ChangeWave surveyed 2,588 primarily North American consumers on their tablet buying trends. The survey also focused on PC and Ultrabook demand. ChangeWave Research is a service of 451 Research. Next 90 Days – Tablet Demand

With a handful of key tablet releases slated for summer, ChangeWave's latest survey shows planned buying remains unchanged from February. A total of 6% of respondents say they intend to buy a tablet in the next 90 days.

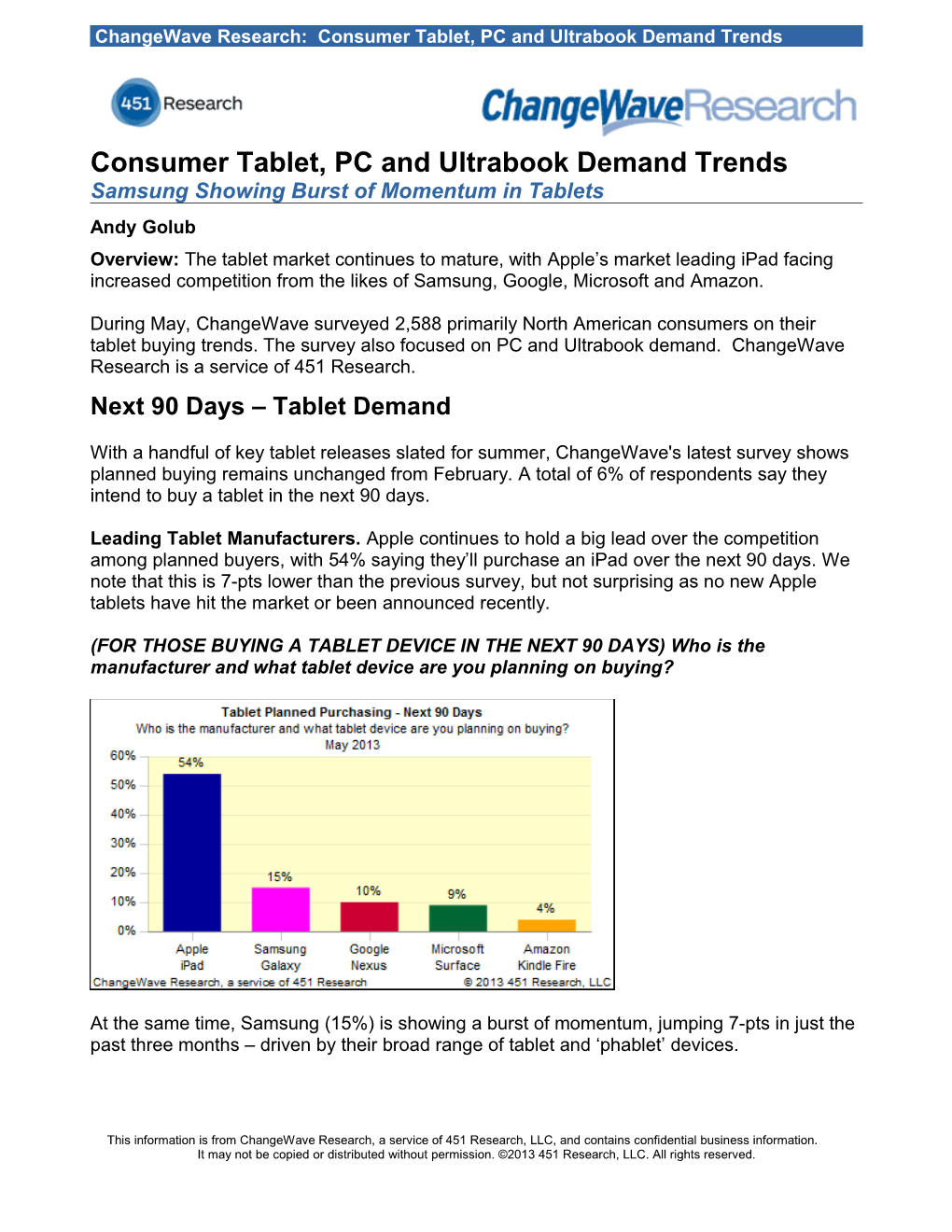

Leading Tablet Manufacturers. Apple continues to hold a big lead over the competition among planned buyers, with 54% saying they’ll purchase an iPad over the next 90 days. We note that this is 7-pts lower than the previous survey, but not surprising as no new Apple tablets have hit the market or been announced recently.

(FOR THOSE BUYING A TABLET DEVICE IN THE NEXT 90 DAYS) Who is the manufacturer and what tablet device are you planning on buying?

At the same time, Samsung (15%) is showing a burst of momentum, jumping 7-pts in just the past three months – driven by their broad range of tablet and ‘phablet’ devices.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends

The Galaxy Note 10.1 tablet (36%) is most preferred by planned Samsung buyers, followed by the anticipated Note III (12%) ‘phablet.’ Among other manufacturers, Google (10%; up 2-pts) is edging out Microsoft (9%; unchanged) for third place in future tablet demand. At the same time, Amazon (4%) has slipped 3-pts in planned buying since the previous survey. Nonetheless, Kindle Fire owners continue to report they’ll spend more money at Amazon (22%) over the next 90 days than non-Kindle Fire owners (17%) – an encouraging sign. Preferred Tablet Models. Here’s a look at the specific models consumers plan on buying from Apple, Microsoft and Google: Apple. Among planned iPad buyers, 46% say they'll choose the 4th generation iPad with Retina display and 23% the iPad mini. Microsoft. Microsoft demand continues to be dominated by the Surface Pro model (85%). Google. The second generation Nexus 7 – anticipated for July – is preferred by 50% of planned Google tablet buyers. Another 28% say they'll buy the Nexus 10. Tablet Customer Satisfaction. As seen in previous ChangeWave surveys, Apple maintains a big lead in terms of customer satisfaction. A total of 84% of iPad mini owners and 76% of 4th generation iPad owners say they're Very Satisfied.

2 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends In comparison, Google (52%), Samsung (47%), Amazon (43%) and Microsoft (41%) are bunched together within an 11-point range when it comes to their Very Satisfied rating.

Other Tablet Findings Operating Systems. Nearly half of planned buyers (47%) say they prefer their tablet to run on Apple’s iOS, while 19% prefer Android and 13% Windows 8 (12% Pro; 1% RT). Key Factors in Purchase Decision. Long Battery Life (47%) and Price (40%) are the top factors among consumers when deciding which tablet to buy. High Resolution Screen (31%), Operating System (24%) and Compatibility with Other Devices (24%) are also important considerations. Tablet Size Preferences. When planned buyers are asked which tablet size they’re most interested in buying, the most preferred is a 10.0-10.9" device (35%), followed by 7.0-7.9" (22%).

Bottom Line. It's a quieter time in the consumer tablet market in terms of releases, with few major ones in the near term. Apple still has a sizable lead in future demand and customer satisfaction, even as the competition chips away at the iPad's dominance.

Samsung is showing the most tablet momentum in the survey – and is beginning to separate itself from Google, Microsoft and Amazon. With their broad portfolio of devices, Samsung offers a wider variety of options for consumers to choose from.

But the tablet market is fast moving, and a new announcement from any of the big manufacturers could quickly change the playing field. Over the next month, the Apple Worldwide Developers Conference (WWDC) and Samsung Premiere 2013 events will be taking place, which will likely feature new devices and software upgrades.

In the meantime, let's turn to ChangeWave’s survey results on consumer PC and Ultrabook demand trends. Consumer PC Demand – Next 90 Days In terms of overall PC demand, planned laptop buying is up 2-pts after taking a big hit in the previous survey, with 8% of respondents saying they’ll buy a laptop in the next 90 days. At the same time, desktop demand (4%) is down 1-pt.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 3 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends When it comes to operating system preferences, 43% of planned PC buyers say they’ll choose a Windows 8 version (25% Windows 8, 17% Windows 8 Pro, 1% Windows RT).

In comparison, 32% still prefer Windows 7 and another 29% Apple's Mac OS X Mountain Lion.

Individual PC Manufacturers Apple. Demand for Apple computers has remained very steady over the past four ChangeWave surveys. One-third of laptop buyers (32%; unchanged) and 30% of desktop buyers (up 1-pt) say they’ll purchase a Mac in the next 90 days.

Many analysts are expecting Apple to announce a refresh to the Macbook line in June, and the survey results show the Macbook Pro (53%; up 16-pts) with the most momentum of all Mac models.

Hewlett-Packard. Demand for Hewlett-Packard desktops (23%; up 3-pts) and laptops (19%; up 2-pts) has increased for the second consecutive survey – an encouraging sign.

4 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends

* Note that approximately 60% of H-P’s sales come from outside the U.S., whereas ChangeWave surveys focus primarily on the North American market.

Dell. The results for Dell are mixed, with laptop demand (20%) up 1-pt and desktop demand (26%) down 3-pts.

Lenovo. Demand for Lenovo desktops (11%) has grown considerably over the past three years, increasing another point since February to hit an all-time high. Lenovo laptop buying (11%; down 3-pts) is not faring as well, falling for the second consecutive survey.

ASUS. We note that ASUS is currently the biggest momentum winner in both desktop (10%; up 5-pts) and laptop demand (11%; up 3-pts).

Consumer Ultrabooks: Future Demand

Consumers are showing an increased level of interest in Ultrabooks, with 8% of respondents saying they’ll buy one in the future – 3-pts higher than the previous February survey. Among those who know which Ultrabook manufacturer they’ll buy from, Lenovo (20%; up-3- pts) edges out Hewlett-Packard (19%; down 2-pts) for the lead.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 5 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends Who is the manufacturer of the new Ultrabook computer you plan on buying? Current Previous Previous Survey Survey Survey May ‘13 Feb ‘13 Nov ‘12 Lenovo (e.g., Thinkpad X1 Carbon, IdeaPad U410) 20% 17% 17% Hewlett-Packard (e.g., Envy 6-1000sg, Folio 13) 19% 21% 18% Dell (e.g., Inspiron 15z, XPS 14) 17% 15% 22% ASUS (e.g., VivoBook S500CA, Zenbook Prime) 15% 12% 8% Samsung (e.g., Series 9, Series 5) 12% 17% 18% Sony (e.g. VAIO T Series, Duo 11) 5% 7% 6% Toshiba (e.g., Satellite U845W, Portégé Z935) 5% 3% 4% Acer (e.g., Inspire S3, Aspire S5) 4% 4% 5% Other 5% 4% 2% Note that half of planned Ultrabook buyers (52%) still do not know which model they're going to choose. In terms of timing, 26% of planned buyers say they’ll make their purchase within the next 90 days – a big jump compared to the previous survey and another positive finding for the Ultrabook market. Summary of Key Findings

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals in leading companies of select industries—credentialed professionals who spend their everyday lives working on the frontline of technological change. ChangeWave surveys its Alliance members on a range of business and investment research and intelligence topics, collects feedback from them electronically, and converts the information into proprietary quantitative and qualitative reports.

6 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends Table of Contents

Summary of Key Findings...... 6

The Findings 8

Next 90 Days Tablet Demand 8

Consumer PC Demand – Next 90 Days 17

Consumer Ultrabooks: Future Demand 22

ChangeWave Research Methodology...... 23

About ChangeWave Research...... 23

About 451 Research 23

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 7 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends I. The Findings

Introduction: The tablet market continues to mature, with Apple’s market leading iPad facing increased competition from the likes of Samsung, Google, Microsoft and Amazon.

During May, ChangeWave surveyed 2,588 primarily North American consumers on their tablet buying trends. The survey also focused on PC and Ultrabook demand. ChangeWave Research is a service of 451 Research. Next 90 Days – Tablet Demand

With a handful of key tablet releases slated for summer, ChangeWave's latest survey shows planned buying remains unchanged from February. A total of 6% of respondents say they intend to buy a tablet in the next 90 days.

Looking ahead, are you planning on buying a tablet device in the next 90 days?

Current Previous Previous Previous Previous Survey Survey Survey Survey Survey May ‘13 Feb ‘13 Nov ‘12 Aug ‘12 May ‘12 Yes 6% 6% 13% 6% 7%

Leading Tablet Manufacturers. Apple continues to hold a big lead over the competition among planned buyers, with 54% saying they’ll purchase an iPad over the next 90 days. We note that this is 7-pts lower than the previous survey, but not surprising as no new Apple tablets have hit the market or been announced recently.

(FOR THOSE BUYING A TABLET DEVICE IN THE NEXT 90 DAYS) Who is the manufacturer and what tablet device are you planning on buying?

8 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends Here's a look at the current survey results (May '13) vs. the previous results (Feb '13):

At the same time, Samsung (15%) is showing a burst of momentum, jumping 7-pts in just the past three months – driven by their broad range of tablet and ‘phablet’ devices.

The Galaxy Note 10.1 tablet (36%) is most preferred by planned Samsung buyers, followed by the anticipated Note III (12%) ‘phablet.’

*Other = 14%; Don't Know = 22%

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 9 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends Current Survey May ‘13 Samsung Galaxy Note 10.1 Tablet 36% Samsung Galaxy Note III ‘phablet’ (5.9"; expected 2013) 12% Samsung Galaxy Note II ‘phablet’ (5.5") 10% Samsung Galaxy Note 8.0 Tablet 8% Samsung Galaxy Mega ‘phablet’ (5.8" and 6.3" models) 4% Samsung Galaxy Tab 3 4% Samsung Galaxy Tab 2 4% Other 2% Don’t Know 22%

Among other manufacturers, Google (10%; up 2-pts) is edging out Microsoft (9%; unchanged) for third place in future tablet demand. Curren t Previous Previous Previous Survey Survey Survey Survey May Feb ‘13 Nov ‘12 Aug ‘12 ‘13 Apple (e.g., iPad with Retina display, iPad 54% 61% 67% 65% mini, iPad 2) Samsung (e.g., Galaxy Note 8.0, Mega, Tab 15% 8% 6% 9% 3, Note III) Google (e.g., Nexus 10, Nexus 7) 10% 8% 7% 12% Microsoft (e.g., Surface) 9% 9% 8% 7% Amazon (e.g., Kindle Fire HD, Kindle Fire) 4% 7% 11% 3% Asus (e.g., Transformer Pad, Vivo Tab) 2% 1% 1% 2% Lenovo (e.g., IdeaTab, ThinkPad) 1% 2% 0% 1% Acer (e.g., Iconia) 1% 1% 0% 0% Barnes & Noble (e.g., Nook HD+, Nook HD) 1% 1% 1% 0% BlackBerry (e.g., Playbook) 1% 1% 0% 1% H-P (e.g., Slate 7, ElitePad, TouchPad) 1% 0% 0% 0%

At the same time, Amazon (4%) has slipped 3-pts in planned buying since the previous survey. Nonetheless, Kindle Fire owners continue to report they’ll spend more money at Amazon (22%) over the next 90 days than non-Kindle Fire owners (17%) – an encouraging sign.

Please tell us if you will be spending more money at Amazon.com, about the same amount, or less money over the next 90 days compared with the previous 90 days. Non- Kindle Kindle Fire Fire Owners Owners More Money 22% 17% Same Amount of Money 61% 57% Less Money 9% 12% No Money 6% 12%

10 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends NA 3% 2% Preferred Tablet Models. Here’s a look at the specific models consumers plan on buying from Apple, Microsoft and Google: Apple. Among planned iPad buyers, 46% say they'll choose the 4th generation iPad with Retina display and 23% the iPad mini.

Microsoft. Microsoft demand continues to be dominated by the Surface Pro model (85%).

Google. The second generation Nexus 7 – anticipated for July – is preferred by 50% of planned Google tablet buyers. Another 28% say they'll buy the Nexus 10.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 11 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends

Tablet Customer Satisfaction. As seen in previous ChangeWave surveys, Apple maintains a big lead in terms of customer satisfaction. A total of 84% of iPad mini owners and 76% of 4th generation iPad owners say they're Very Satisfied. Overall, how satisfied are you with your tablet device? (Please rate only the tablets you currently own)

In comparison, Google (52%), Samsung (47%), Amazon (43%) and Microsoft (41%) are bunched together within an 11-point range when it comes to their Very Satisfied rating. Very Somewhat Somewhat Very Satisfied Satisfied Unsatisfied Unsatisfied Apple iPad mini 84% 14% 1% 2% Apple 4th Generation iPad with Retina display 76% 22% 1% 0% Google Nexus 52% 40% 2% 7% Samsung 2nd Generation Tablets 47% 40% 7% 6% Amazon 2nd Generation Tablets 43% 47% 6% 5% Microsoft Surface 41% 32% 12% 15%

12 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends Here’s a look at satisfaction ratings with a handful of specific tablet and operating system features: And how satisfied are you with each of the following aspects of your current tablet? Very Satisfied Ratings by Manufacturer (May 2013) Microsof Apple Google Samsung Amazon t Battery Life 51% 43% 40% 25% 30% Screen Size 64% 48% 54% 50% 40% Screen Resolution 68% 62% 71% 50% 45% Processor Speed 48% 41% 34% 28% 23% Quality of Video Streaming 48% 46% 38% 27% 34% Very Satisfied Ratings by Operating System (May 2013) iOS Windows 8 Android (Apple) (Microsoft) (Google) # of Apps Available 78% 57% 48% Compatibility with Other Devices 30% 24% 16% Frequency of OS Updates 42% 21% 25% Security Features 48% 43% 25% Capability to Perform Work Tasks 28% 33% 14% Top Tablet Uses Among Owners. The survey also asked tablet owners how they use their devices, and found Surfing the Web (87%) topping the list, followed by Email (78%) and Getting News/Weather (70%). In which of the following ways do you use your tablet? (Check All That Apply)

Current Previous Previous Previous Survey Survey Survey Survey May ‘13 Feb ‘12 Nov ‘12 Aug ‘12 Surfing the Web 87% 87% 85% 85% Sending/Receiving Email 78% 78% 76% 75% Getting News/Weather 70% 67% 66% 68% Reading eBooks 58% 59% 54% 55% Shopping Online 57% 57% 51% 41% Using Apps 57% 56% 52% 57% Playing Games 51% 50% 49% 51% Social Networking (e.g., Facebook, Twitter) 37% 37% 35% 35% Listening to Music 37% 35% 30% 34% Watching TV Shows/Movies 35% 31% 31% 29% Calendar/Scheduling Features 32% 29% 26% 33% Working Away From the Office 26% 26% 25% 24% Sharing Pictures/Video with Others 24% 21% 22% 21% Taking/Editing Pictures 23% 21% 19% 21% GPS Navigation/Directions 23% 20% 19% 23% Video Conferencing 15% 10% 9% 10% Storing/Managing Files in the Cloud 15% 13% 11% 13% Laptop Replacement 14% 14% 15% 19% Editing Documents/Spreadsheets 12% 10% 10% 10% Digital Assistant/Voice Commands (e.g., Siri, 7% 5% 4% 3% Google Voice) Here's a look at the top uses by tablet manufacturer: This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 13 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends

All Kindle Tablet Apple Samsung Google Fire Owners Surfing the Web 87% 93% 81% 86% 87% Sending/Receiving Email 78% 85% 66% 81% 80% Getting News/Weather 70% 77% 58% 66% 77% Reading eBooks 58% 57% 85% 55% 72% Shopping Online 57% 66% 53% 43% 64% Using Apps 57% 65% 48% 51% 70% Playing Games 51% 56% 54% 47% 52% Social Networking (e.g., Facebook, Twitter) 37% 42% 31% 33% 34% Listening to Music 37% 42% 38% 38% 38% Watching TV Shows/Movies 35% 40% 37% 29% 33% Calendar/Scheduling Features 32% 38% 21% 30% 39% Working Away From the Office 26% 31% 15% 18% 26% Sharing Pictures/Video with Others 24% 29% 14% 22% 20% Taking/Editing Pictures 23% 27% 15% 27% 20% GPS Navigation/Directions 23% 27% 14% 31% 31% Video Conferencing 15% 18% 10% 16% 30% Storing/Managing Files in the Cloud 15% 18% 11% 15% 16% Laptop Replacement 14% 16% 11% 19% 18% Editing Documents/Spreadsheets 12% 13% 5% 16% 21% Digital Assistant/Voice Commands (e.g., Siri, 7% 9% 5% 8% 16% Google Voice)

Other Tablet Findings Operating Systems. Nearly half of planned buyers (47%) say they prefer their tablet to run on Apple’s iOS, while 19% prefer Android and 13% Windows 8 (12% Pro; 1% RT). Which mobile OS (operating system) would you most prefer to have on the Tablet you plan on buying?

*Don't Know/Other = 21%

14 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends

Current Previous Previous Survey Survey Survey May ‘13 Feb ‘13 Nov ‘12 iOS (Apple) 47% 51% 51% Android (Google) 19% 18% 17% Windows 8 Pro (Microsoft) 12% 9% 11% Windows 8 RT (Microsoft) 1% 1% 3% Don't Know 18% 16% 16% Other 3% 4% 2%

Key Factors in Purchase Decision. Long Battery Life (47%) and Price (40%) are the top factors among consumers when deciding which tablet to buy. High Resolution Screen (31%), Operating System (24%) and Compatibility with Other Devices (24%) are also important considerations. Which of the following factors is most important to you when deciding which tablet to purchase? (Choose No More Than Three)

Current Survey May ‘13 Long Battery Life 47% Price 40% High Resolution Screen 31% Operating System 24% Compatibility with My Other Devices 24% Weight/Thickness 19% Large Screen Size 15% 4G/LTE Network Connectivity 14% # of Apps Available 14% Processor Speed 14% Brand Loyalty 8% Available on My Wireless Service Provider 6% Removable Memory/Storage 6% Free Cloud Storage 4% eReading Features 4% Stylus/Handwriting Recognition 2% Other 3%

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 15 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends Tablet Size Preferences. When planned buyers are asked which tablet size they’re most interested in buying, the most preferred is a 10.0-10.9" device (35%), followed by 7.0-7.9" (22%). What screen size tablet are you most interested in buying?

Current Previous Survey Survey May ‘13 Feb ‘13 Less than 7 Inch Screen 5% 5% 7.0-7.9 Inch Screen 22% 25% 8.0-8.9 Inch Screen 14% 9% 9.0-9.9 Inch Screen 15% 16% 10.0-10.9 Inch Screen 35% 35% 11.0-11.9 Inch Screen 4% 4% 12 Inch Screen or Larger 6% 6%

Wireless Providers. A total of 37% of tablet buyers say they’ll purchase Wi-Fi only models, similar to the results of one year ago. Verizon Wireless (21%; down 4-pts) and AT&T (16%; down 1-pt) are the top choices among those using a wireless service.

Which wireless service provider - if any - will you use for your new tablet device?

Current Previous Previous Previous Previous Survey Survey Survey Survey Survey May ‘13 Feb ‘13 Nov ‘12 Aug ‘12 May ‘12 None (Wi-Fi Only) 37% 31% 31% 34% 36% Verizon Wireless 21% 25% 22% 22% 22% AT&T 16% 17% 18% 15% 16% Sprint 2% 2% 5% 3% 3% T-Mobile 1% 2% 2% 1% 2% Don’t Know 14% 14% 14% 16% 14% Other 7% 6% 7% 6% 7%

16 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends The ChangeWave survey also looked at PC and Ultrabook demand trends. Consumer PC Demand – Next 90 Days In terms of overall PC demand, planned laptop buying is up 2-pts after taking a big hit in the previous survey, with 8% of respondents saying they’ll buy a laptop in the next 90 days. At the same time, desktop demand (4%) is down 1-pt. Will you be buying a computer in the next 90 days?

When it comes to operating system preferences, 43% of planned PC buyers say they’ll choose a Windows 8 version (25% Windows 8, 17% Windows 8 Pro, 1% Windows RT).

In comparison, 32% still prefer Windows 7 and another 29% Apple's Mac OS X Mountain Lion.

Which operating system would you like to have preinstalled on the computer(s) you plan on buying in the next 90 days? (Check All That Apply)

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 17 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends

Current Previous Previous Survey Survey Survey May ‘13 Feb ‘13 Nov ‘12 Windows 8 25% 25% 29%

Windows 8 Pro 17% 20% 18%

Windows 8 RT 1% 1% 2%

Windows 7 32% 28% 22%

Other Windows 2% 2% 1%

Mac OS X Mountain Lion 29% 28% 28%

Linux 4% 4% 1%

Chrome OS 3% 4% 4%

Don't Know 7% 6% 10%

Other 2% 1% 1%

Individual PC Manufacturers

Apple. Demand for Apple computers has remained very steady over the past four ChangeWave surveys. One-third of laptop buyers (32%; unchanged) and 30% of desktop buyers (up 1-pt) say they’ll purchase a Mac in the next 90 days.

18 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends

Many analysts are expecting Apple to announce a refresh to the Macbook line in June, and the survey results show the Macbook Pro (53%; up 16-pts) with the most momentum of all Mac models.

Hewlett-Packard. Demand for Hewlett-Packard desktops (23%; up 3-pts) and laptops (19%; up 2-pts) has increased for the second consecutive survey – an encouraging sign.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 19 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends *We note that approximately 60% of H-P’s sales come from outside the U.S., whereas ChangeWave surveys focus primarily on the North American market. Dell. The results for Dell are mixed, with laptop demand (20%) up 1-pt and desktop demand (26%) down 3-pts.

*Note that 20% of Dell’s PC business comes from consumer sales, while 80% is corporate. Lenovo. Demand for Lenovo desktops (11%) has grown considerably over the past three years, increasing another point since February to hit an all-time high. Lenovo laptop buying (11%; down 3-pts) is not faring as well, falling for the second consecutive survey.

ASUS. We note that ASUS is currently the biggest momentum winner in both desktop (10%; up 5-pts) and laptop demand (11%; up 3-pts).

20 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends

Here’s a look at the complete PC buying results: (FOR THOSE BUYING A COMPUTER IN NEXT 90 DAYS) Who is the manufacturer and what computer type are you planning on buying? (Check All That Apply) Desktops Current Previous Survey Survey May ‘13 Feb ‘13 Apple - Desktop Computer 30% 29% Dell - Desktop Computer 26% 29% Hewlett-Packard (including Compaq) - Desktop Computer 23% 20% Lenovo - Desktop Computer 11% 10% ASUS - Desktop Computer 10% 5% Acer (including Gateway & eMachines) - Desktop Computer 5% 6% Other - Desktop Computer 6% 12% Don't Know 25% 22% Laptops Current Previous Survey Survey May ‘13 Feb ‘13 Apple - Laptop Computer 32% 32% Dell - Laptop Computer 20% 19% Hewlett-Packard (including Compaq) - Laptop Computer 19% 17% Lenovo - Laptop Computer 11% 14% ASUS - Laptop Computer 11% 8% Toshiba - Laptop Computer 9% 8% Samsung - Laptop Computer 7% 9% Acer (including Gateway & eMachines) - Laptop Computer 5% 7% Sony - Laptop Computer 3% 5% Vizio - Laptop Computer 1% 1% Other - Laptop Computer 3% 3% Don't Know 16% 26%

Importance of Touch Screen. Planned laptop buyers were asked how important it was for their laptop to have a touch screen, and 10% said Very Important and 21% Somewhat Important. This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 21 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends

How important is it to you that your next laptop computer have a touch-screen?

Planned Laptop Buyers May ‘13 Very Important 10% Somewhat Important 21% Not Very Important 38% Not At All Important 28% Don’t Know/NA 3%

The ability to convert a laptop to a tablet (i.e., have a removable screen or screen that flips over) is slightly less important to laptop buyers, with 7% saying it is Very Important and 22% Somewhat Important.

And how important is it to you that your next laptop computer be able to convert to a tablet (i.e., have a removable screen or screen that flips over)?

Planned Laptop Buyers May ‘13 Very Important 7% Somewhat Important 22% Not Very Important 34% Not At All Important 36% Don’t Know/NA 1% Consumer Ultrabooks: Future Demand

Consumers are showing an increased level of interest in Ultrabooks, with 8% of respondents saying they’ll buy one in the future – 3-pts higher than the previous February survey.

Are you planning to buy an Ultrabook computer in the future? Current Previous Previous Previous Previous Survey Survey Survey Survey Survey May ‘13 Feb ‘13 Nov ‘12 Aug ‘12 May ‘12 Yes 8% 5% 7% 6% 7% No 78% 81% 75% 78% 76% Don't Know 15% 14% 18% 16% 14%

Among those who know which Ultrabook manufacturer they’ll buy from, Lenovo (20%; up-3- pts) edges out Hewlett-Packard (19%; down 2-pts) for the lead.

Who is the manufacturer of the new Ultrabook computer you plan on buying? Current Previous Previous Survey Survey Survey May ‘13 Feb ‘13 Nov ‘12 Lenovo (e.g., Thinkpad X1 Carbon, IdeaPad U410) 20% 17% 17%

22 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends Hewlett-Packard (e.g., Envy 6-1000sg, Folio 13) 19% 21% 18% Dell (e.g., Inspiron 15z, XPS 14) 17% 15% 22% ASUS (e.g., VivoBook S500CA, Zenbook Prime) 15% 12% 8% Samsung (e.g., Series 9, Series 5) 12% 17% 18% Sony (e.g. VAIO T Series, Duo 11) 5% 7% 6% Toshiba (e.g., Satellite U845W, Portégé Z935) 5% 3% 4% Acer (e.g., Inspire S3, Aspire S5) 4% 4% 5% Vizio (e.g., Thin + Light) 0% 0% 1% Other 5% 4% 1%

Note that half of planned Ultrabook buyers (52%) still do not know which model they're going to choose.

In terms of timing, 26% of planned buyers say they’ll make their purchase within the next 90 days – a big jump compared to the previous survey and another positive finding for the Ultrabook market.

When do you think you'll purchase your new Ultrabook computer? Current Previous Previous Previous Previous Survey Survey Survey Survey Survey May ‘13 Feb ‘13 Nov ‘12 Aug ‘12 May ‘12 Within the Next 30 Days 9% 3% 3% 5% 2% 30-60 Days 5% 3% 11% 8% 4% 60-90 Days 12% 8% 14% 8% 8% 3-6 Months 12% 25% 24% 23% 16% 6-12 Months 30% 31% 24% 22% 32% More Than 12 Months 23% 18% 13% 24% 32% Don't Know 9% 10% 11% 9% 8% ChangeWave Research Methodology

This report presents the findings of an April 30 – May 16, 2013 ChangeWave survey on consumer demand for Tablets, PCs and Ultrabooks. A total of 2,588 consumers participated. ChangeWave's proprietary research and business intelligence gathering system is based upon the systematic gathering of valuable business and investment information directly over the Internet from accredited members of its research network. The business and investment intelligence provided by ChangeWave provides a real-time view of companies, technologies, and consumer and business trends in key market sectors, along with an in-depth perspective of the macro economy – well in advance of other available sources.

About ChangeWave Research

ChangeWave Research, a service of 451 Research, is a survey research firm that identifies and quantifies change in corporate buying & business trends, telecom trends, and consumer spending & electronics trends.

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals – as well as early adopter consumers – who work in leading companies of select industries. ChangeWave surveys its Network members weekly on a range of business and consumer topics, and converts the information into a series of proprietary quantitative and qualitative reports.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. ©2013 451 Research, LLC. All rights reserved. 23 ChangeWave Research: Consumer Tablet, PC and Ultrabook Demand Trends ChangeWave delivers its products and services on the Web at www.ChangeWaveResearch.com.

451 Research, LLC, including its ChangeWave Research service, does not make any warranties, express or implied, as to results to be obtained from using the information in this report. Investors should obtain individual financial advice based on their own particular circumstances before making any investment decisions based upon information in this report.

About 451 Research

451 Research, a division of The 451 Group, is a leading global analyst and data company focused on the business of enterprise IT innovation. Clients of 451 Research – at end-user, service-provider, vendor, and investor organizations – rely on 451 Research’s insight through a range of syndicated research and advisory services to support both strategic and tactical decision-making. For additional information on 451 Research, go to: 451research.com. For More Information: ChangeWave Research Telephone: 301-250-2363 7101 Wisconsin Ave. Fax: 240-200-3988 Suite 1301 www.ChangeWaveResearch.com Bethesda, MD 20814 [email protected]

24