Five Charts: Macro Drivers for Maine’s Forest Based Industries

Assembled by Lloyd C. Irland, The Irland Group

To summarise the macroeconmic economic conditions in Maine’s lumber and paper industries, these charts are offered.

1. Industrial Production Trends

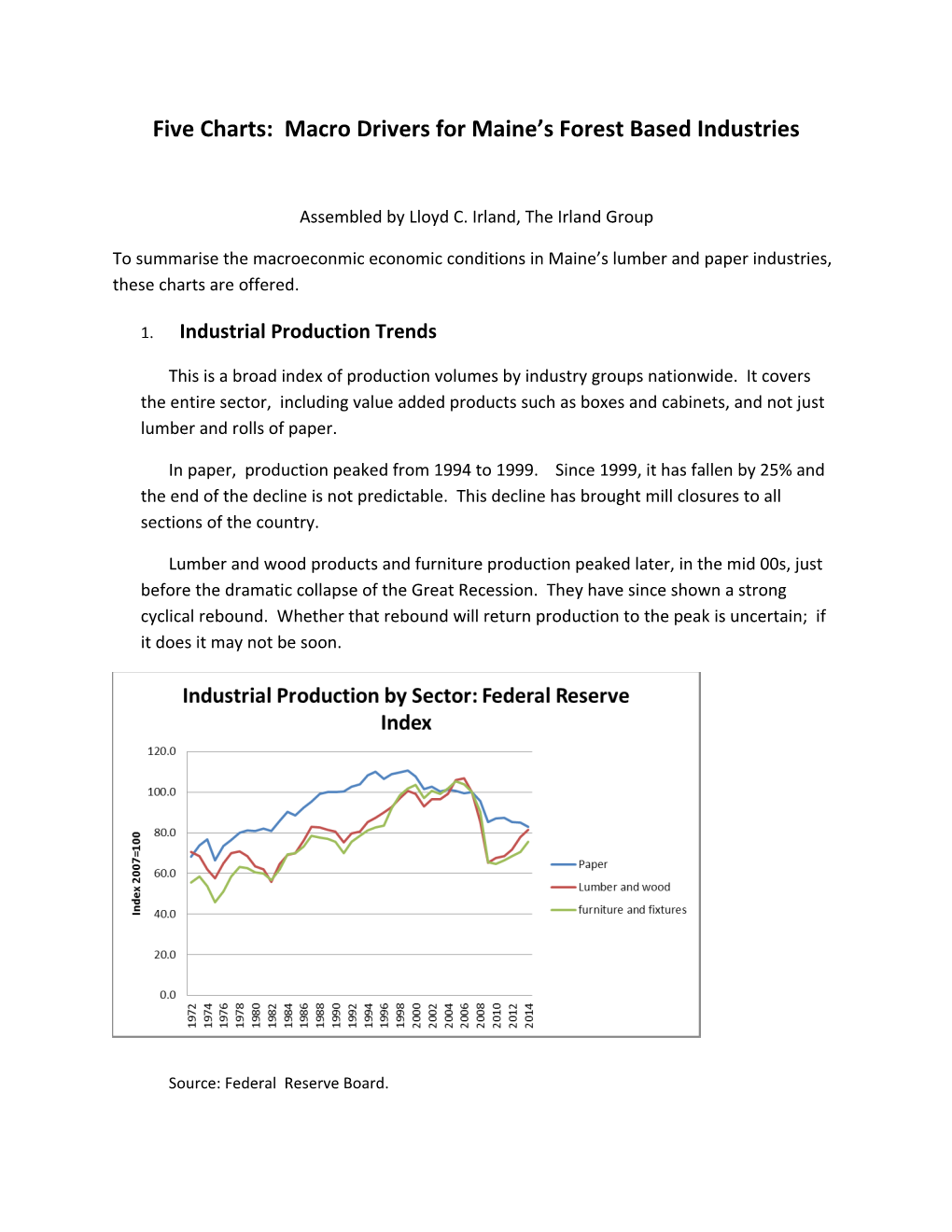

This is a broad index of production volumes by industry groups nationwide. It covers the entire sector, including value added products such as boxes and cabinets, and not just lumber and rolls of paper.

In paper, production peaked from 1994 to 1999. Since 1999, it has fallen by 25% and the end of the decline is not predictable. This decline has brought mill closures to all sections of the country.

Lumber and wood products and furniture production peaked later, in the mid 00s, just before the dramatic collapse of the Great Recession. They have since shown a strong cyclical rebound. Whether that rebound will return production to the peak is uncertain; if it does it may not be soon.

Source: Federal Reserve Board. 2. Housing Starts

Underlying the trend for lumber and furniture is the volatile housing market. Even the overheated boom of the mid 00s did not exceed the early 70’s housing peak. But its collapse brought mill closures and unemployment across North America.

A return to the mid 00s level of starts is probably not achievable in the near term, and would probably require a return to unsound and unsustainable financial practices.

Source: Federal Reserve Board 3. Newspaper Trends

Newspaper circulation has been declining since 1990. The number of newspapers has declined only slightly, but from 2000 to 2014 alone, circulation fell by 28%. The reduction in paper usage was even greater as the average size of each issue fell significantly.

Nobody expects print newspapers to disappear entirely but the bottoming out of this trend is unpredictable.

Source: Newspaper Association of America 4. Imports: China

The China factor and “The China Price” have been major factors in the US furniture market. Despite the Recession, furniture imports from China more than doubled from 2005 to 2014. Paper imports increased as well, but from a low base.

This has caused the closure of considerable Maine capacity in both furniture plants and suppliers of parts and dimension.

Chinese exports have also squeezed formerly leading suppliers out of the US market as well.

Source: US Dept of Commerce 5. Imports from Canada

Paper imports from Canada show clearly the effect of declining demand for newsprint and printing and writing papers.

Declines in furniture reflect Chinese competition, so that Canadian producers received little benefit from the US market recovery.

Recovery in lumber imports, however, reflects the traditionally strong position of Canada as a slumber supplier, together with production volumes boosted by high volumes being salvaged in the wake of an epic beetle outbreak in the West. Source: US Dept of Commerce