International Tropical Schizomeria '' signif.fall Timber Organization

INTERNATIONAL ORGANIZATIONS CENTER,5TH FLOOR, PACIFICO- YOKOHAMA 1-1-1,MINATO-MIRAI, NISHI-KU, YOKOHAMA, 220 JAPAN

F A C S I M I L E ++81-45-223-1121

Tropical Timber Market Report

16 - 31st January 1998

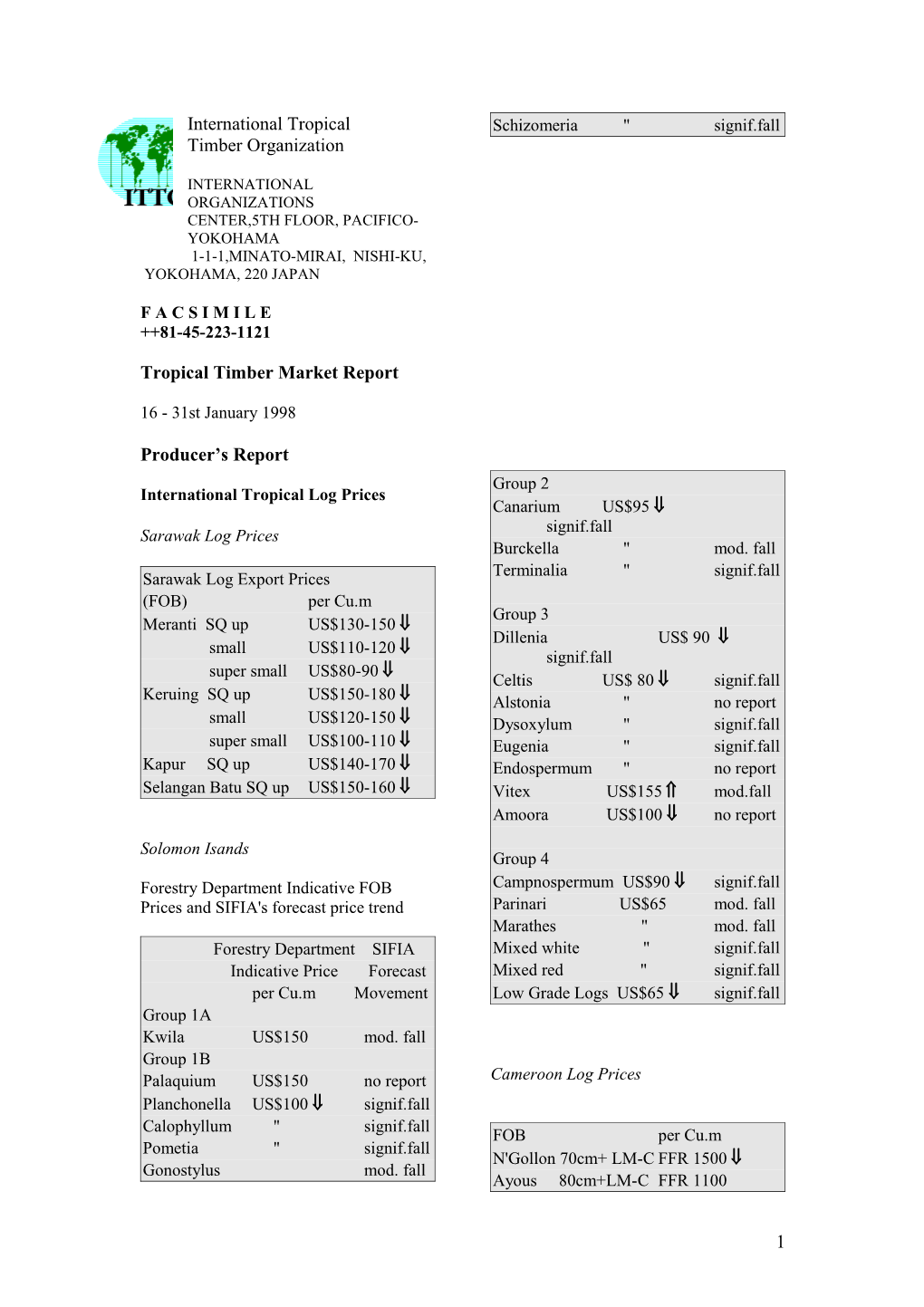

Producer’s Report Group 2 International Tropical Log Prices Canarium US$95 signif.fall Sarawak Log Prices Burckella '' mod. fall Terminalia '' signif.fall Sarawak Log Export Prices (FOB) per Cu.m Group 3 Meranti SQ up US$130-150 Dillenia US$ 90 small US$110-120 signif.fall super small US$80-90 Celtis US$ 80 signif.fall Keruing SQ up US$150-180 Alstonia '' no report small US$120-150 Dysoxylum '' signif.fall super small US$100-110 Eugenia '' signif.fall Kapur SQ up US$140-170 Endospermum '' no report Selangan Batu SQ up US$150-160 Vitex US$155 mod.fall Amoora US$100 no report Solomon Isands Group 4 Forestry Department Indicative FOB Campnospermum US$90 signif.fall Prices and SIFIA's forecast price trend Parinari US$65 mod. fall Marathes '' mod. fall Forestry Department SIFIA Mixed white '' signif.fall Indicative Price Forecast Mixed red '' signif.fall per Cu.m Movement Low Grade Logs US$65 signif.fall Group 1A Kwila US$150 mod. fall Group 1B Palaquium US$150 no report Cameroon Log Prices Planchonella US$100 signif.fall Calophyllum '' signif.fall FOB per Cu.m Pometia '' signif.fall N'Gollon 70cm+ LM-C FFR 1500 Gonostylus mod. fall Ayous 80cm+LM-C FFR 1100

1 Sapele 80cm+LM-C FFR 1750 Gurjan US$234 US$235 Iroko 70cm+LM-C FFR 1650 Thinwin US$646 -

Report from Indonesia Hoppus ton equivalent to 1.8 Cu.m. Teak 3-4th Grade for sliced veneer. Reports from Indonesia are indicating that Teak grade 1-4 for sawmilling. SG Grade the structure of the export levies on logs 3 3ft - 4ft 11" girth, other grades 5ft girth for export will be reduced in March 1998. minimum.

In 1981 Indonesia introduced measures Papua New Guinea which were the precursor of a total log export ban in 1985. In 1990 hefty export There are some 332,600 Cu.m in stock of levies were applied to sawnwood for which only 174,000 or around 52% are export which effectively stopped subject to sales negotiations. Recently sawnwood exports. In 1992 the ban on log 46,600 Cu.m were written off as exports was altered to met international unsaleable representing a loss of over criteria and was replaced by prohibitive US$4.0 mil export levies which had the same effect as the ban. FOB per Cu.m Taun US$90 Reports from Indonesian sources say that Calophyllum US$90 in March this year the levies on logs for export will be drastically reduced to be Group 2 largely in-line with the restructured export Amoora, Hopea US$70-75 duties being introduced for export Group 3 sawnwood which are discussed below. Celtis, Watergum US$70-75 Group 4 Mixed Reds/Whites US$60-70 Myanmar

Prices obtained at monthly auction Logs in stock for more than eight weeks US$60-66 Logs per Hoppus ton FOB Teak Dec 97 Jan 98 3rd Grade - - Gabon Log Prices 4th Grade US$3109 US$3214 SG-1 Grade US$2200 US$2150 Okoume, FOB per Cu.m SG-2 Grade US$1543 US$1518 Grade SG-3 Grade - US$862 LM F.CFA 147000 SG-4 Grade US$990 US$996 QS F.CFA 130000 Teak Flitch US$3017 - CI F.CFA 100000 Padauk CE F.CFA 90000 3rd Grade US$1509 - CS F.CFA 70000 4th Grade US$803 US$800 Assorted - US$510 Ozigo, FOB per Cu.m Grade Pyinado US$258 US$253 LM F.CFA 104000 QS F.CFA 100000 CI F.CFA 80000

2 CE F.CFA 60000

Agba F.CFA 65000 Ghana Niangon F.CFA 78000 More and more millers are making Sapelli F.CFA 85000 arrangements with independant loggers so Faro F.CFA 90000 the availability of "market logs" is Padouk F.CFA 95000 declining, the domestic supply has been affected by the non renewal of licences of the independant loggers.

Domestic Log Prices Logs per Cu.m Report From Brazil Ceiba 90cm plus US$40 Otie/Ilombe 60cm plus US$50 The flow of international investments Emire/Framire 60cm plus US$55 continues. These investments, together with the privatization programme, will Ofram/Frako 55cm plus US$45 make funds available for new investment Ekki/Azobe 70cm plus US$50 in infrastructure. For this reason it is not Kussia/Billina 70cm plus US$50 expected that the Asian crises will have a Guarea 60cm plus US$60 big impact on the Brazilian economy in Chenchen 70cm plus US$45 1998. Cedrella 50cm plus US$45

Logs at mill yard per Cu.m Mahogany Ist Grade US$365 Indonesia Ipe US$65 Jatoba US$48 Guaruba US$40 Domestic log prices per Cu.m Mescla(white virola) US$58 Plywood logs Face Logs US$90-125 Core logs US$70-100 Report from Peru Sawlogs (Merantis') US$90-120 Falkata logs US$60-68 Domestic Log Prices Pucallpa Rubberwood US$30-32 per Cu.m Pine US$55-60 Caoba Mahoni US$350-400 Swietenia macrophylla) US$203 Capirona Report from Malaysia (Calycophylum spruceanum)US$48 Catahua (Hura crepitans) US$14 Cedro (Cedrela odorata) Logs US$150 Domestic (SQ ex-log yard) per Cu.m Estoraque DR Meranti US$115-130 (Miroxilon balsamun) US$57 Balau US$120-140 Huayruro (Ormosia sp ) US$61 Merbau US$120-150 Shihuahuaco (Dipterex sp) US$57 Peeler Core logs US$60-90 Tahuari (Tabebuia sp) US$61 Rubberwood US$22-25 Tornillo (Cedrelinga catenaeformis) US$65 Keruing US$140-190

3 Ghana

International Sawnwood Prices The minimum prices set by the authorities in Ghana have remained largely Report from Indonesia unchanged.

As part of the economic restructuring plan Rough Sawn Prices FOB introduced by the Indonesian Government, per Cu.m major changes have been made which will Mixed Redwoods US$330 affect the timber trade. Some nine (9) low grade Odum (Iroko) US$400 Presidential Decrees have been made regarding deregulation in the timber Wawa US$220 industry. Sources in Indonesia are Wawa fixed dimensions US$260 reporting that, as of the 2nd February Wawa Boules US$219 1998, the export levies on sawnwood will 70cm log dia. 25-75mm. 450cm length be drastically reduced. It is reported that Mahogany per Cu.m the export levy on sawnwood will be set at FAS 100mm plus 1.8m plus US$480 a maximum at 10% of the FOB value of FAS 150mm plus 2.4m plus US$520 the order for all species. This change will Odum FAS 100mm US$700 now make it financially feasible for Wawa FAS 1.8m plus US$400 Indonesian millers to resume sawnwood exports the implications of which are far Anegre reaching. FAS 150mm plus 2.4m plus US$640

Brazil Guarea FAS US$460 Ofram FAS US$270 Sawnwood exports to Asian markets Emire FAS US$460 continue at lower prices. Traditional Ekki FAS US$335 markets for sawntimber continue at the Kussia FAS US$330 same level as in December. Prices of pine clear blocks, blanks and mouldings for US Dahoma FAS US$250 market have continued to drop. Present Cedrella FAS US$410 prices of clear blocks to the US are 20% lower than July 1997. Malaysia Export Sawnwood per Cu.m Mahogany KD FAS FOB Sawn Timber UK market US$990 Export(FOB) per Cu.m Jatoba Green (dressed) US$520 Dark Red Meranti (2.5ins x 6ins & up) Asian Market GMS select & better (KD)US$480-530 Guaruba US$260 Seraya Angelim pedra US$240 Scantlings (75x125 KD)US$530-580 Mandioqueira US$200 Sepetir Boards US$200-220 Pine (AD) US$170 Perupok (25mm&37mm KD) US$780-820 Peru K.Semangkok (25mm&37mmKD) US$680-710 Export Sawnwood FOBCallao/Lima per Cu.m Caoba (Mahogany) US$966 Taiwan Province of China Cumala (Virola) no report

4 Rubberwood per Cu.m leaving for China, however, the 25mm boards US$270-290 Government is looking at ways to limit log exports and encourage local processing 50-75mm squares US$300-320 75-100mm squares US$380-400 The most popular and well known species is Umbila, a timber that is very stable with Sepetir good working properties. To conserve the GMS (AD) US$230-250 remaining resources the trade is reporting Ramin less than 2 ft. US$510-550 that the Government may limit the cutting licenses on Umbila, but these rumours are greater than 2 ft. US$600-630 not confirmed. Oak 25mm boards US$800-830 Maple US$1300-1500 Cherry US$1200-1300

Domestic Sawnwood Prices Mozambique Sawnwood Report from Brazil For more than two decades very little timber came out of Mozambique, but this is changing. The infrastructure is being Sawnwood (Green ex-mill) repaired and there is investment in Northern Mills per Cu.m processing mills and the country is looking Mahogany US$795 forward to an improved position in the tropical timber markets Ipe US$430 Jatoba US$314 Eucalyptus AD US$165 FOB Shipping Dry Southern Mills per Cu.m Pine (KD) First Grade US$160 Panga Panga (Millettia stuhlmanii) FAS US$650 - 680 2nd Grade US$600 - 650 Peru Chanfuta (Afzellia quanzensis) per Cu.m FAS US$650 - 680 Caoba 2nd Grade US$600 - 650 (Swietenia macrophylla) US$628 Umbila (Pterocarpus angolensis) Capirona FAS US$ 680 - 710 (Calycophylum spruceanum)US$133 2nd Grade US$650 - 680 Catahua (Hura crepitans) US$58 Messassa (Brachystegia spiciformis) Cedro (Cedrela odorata) FAS US$660 - 690 US$455 2nd Grade US$620 - 660 Estoraque African Mahogany (Khaya nyasica) (Miroxilon balsamun) US$172 FAS US$650 - 680 Huayruro (Ormosia sp) US$141 2nd Grade US$600 - 650 Shihuahuaco (Dipterex sp) US$157 Tahuari (Tabebuia sp) US$172 Demand is developing for flooring strips, a Tornillo traditional export from the country before (Cedrelinga catenaeformis) US$277 the civil war. Currently large quantities of Panga Panga and Umbila logs are Ghana

5 75mm+ US$230-250 There is reportedly a glut of local grade sawnwood in stock as the building sector is very sluggish. International Plywood and Veneers Prices

Dahoma, Chenchen, Antiaris Indonesia per Cu.m Mill Run 50x150mm US$95-125 In regard to the Japanese market the 50x100mm US$72-105 Indonesian Plywood Association at its 50x50mm US$105-150 January 21 meeting agreed to liberalise the 25x300mm US$72-105 export of some grades (reportedly medium thick panels, packing grades, baseboards Mixed Redwood for printing and new products such as 40x300x3.6m US$105-240 printed panels, flooring and particleboard). At present concrete formboards, base boards for flooring and thin boards will still be shipped through NIPPINDO.

Report from Indonesia The president of NIPPINDO in Japan is reported as saying that the plywood cartel in Indonesia will be reformed but that Sawn timber NIPPINDO would remain the main Domestic construction material plywood importer in Japan.

Kampar Plywood (export, FOB) AD 6x12-15x400cm US$250-280 MR, per Cu.m KD US$340-370 Grade BB/CC AD 3x20x400cm US$300-340 2.7mm US$320-380 KD US$410-450 3mm US$290-310 Keruing 6mm and above US$260-290 AD 6x12-15cmx400 US$220-250 AD 2x20cmx400 US$240-280 AD 3x30cmx400 US$260-300 Ghana

Rotary Cut Veneer FOB per Cu.m Malaysian Domestic Sawnwood Prices Face Veneer 1-1.6mm Ceiba US$320 Koto US$500 Sawnwood per Cu.m Otie/Ilomba US$440 Balau(25&50mm,100mm+) Ofram US$440 US$180-230 Kempas50mm by (75,100&125mm) US$120-150 Anegre veneer qualities are reportedly Red Meranti falling and some analysts point to a dismal (22,25&30mm by180+mm) future for Ghana's veneer industry. US$210-240 Sliced Veneer FOB per Sq.m Rubberwood Asanfona Face US$1.20 25mm & 50mm Boards US$140-150 Interior US$1.00 50mm squares US$200-210 Backing US$0.65

6 lower levels. At current prices Brazilian Redwoods (Mahogany, Candollei, plywood producers say they are already Edinam) losing money. Many producers have per Sq.m reduced production and exports. Face US$1.15 Veneer exports to Asia are now very Interior US$0.90 limited. The markets for veneers are Backing US$0.55 almost only concentrated in the Middle East countries and USA (lower priced Thickness 0.55mm, Width 950 - markets). 1250mm, Length 1550, 1850, 2150, 2450 mm. The Government has announced a change in the exchange rate band. Now the US SpeciesGrade DM per Sq m. dollar will be allowed to fluctuate between Angre Interior 3.05 1.14 and 1.22, this is against the 1.06 to Angre Backing 2.28 1.14 band of the last year. This means that Brazilian products should be more Sapele Backing 2.25 competitive in the international market in Makore Backing 2.25 the next months. Khaya, Edinam, Kosipo Backing 2.06 Plywood 1220 x 2440 mm Grade BB/CC, Veneer FOB per Cu.m FOB Ceiba for the UK market White Virola Face per Cu.m 2.5mm US$260-330 WBP MR Pine Veneer (C/D) US$175-195 4mm Stg347 Stg278 Mahogany Veneer per Sq.m 6mm Stg296 Stg249 0.7mm US$2.80 9mm Stg284 Stg248 12mm Stg275 Stg238 18mm Stg270 Stg230 Plywood FOB per Cu.m 25mm Stg282 ------White Virola (US Market) 5.2mm OV2 (MR) US$360 Plywood 1220 x 2440mm Grade c/c WBP 15mm BB/CC (MR) US$290 FOB Ceiba for the German market For Caribbean countries per Cu.m White Virola 4mm US$420 4mm DM735 9mm US$320 6mm DM623 Pine USA market 9mm DM613 9mm C/CC (WBP) US$240 12mm DM600 15mm DM587 15mm C/CC (WBP) US$230 18mm DM573 Malaysian Plywood

Brazilian Plywood and Veneer MR Grade BB/CC FOB Brazilian plywood exporters are facing per Cu.m strong competition from Asian producers. 2.7mm US$320-400 Markets are slow, and offers received by 3mm US$300-320 some producers indicate a price decline of 3.6mm US$280-300 between 10 and 15%. There are 9-18mm US$250-280 indications that the prices might drop to Domestic plywood

7 3.6mm US$300-330 Domestic MR plywood 9-18mm US$290-320 (Jarkarta) per Cu.m 9mm US$300-350 Myanmar 12mm US$290-330 15mm US$270-300 Hardwood plywood, FOB. 18mm US$260-300 1220x2440 per Cu.m 3.6mm MR BB/CC US$300 Ghana 3.6mm MR Utility US$280 3.6mm WBP BB/CC US$325 Decorative Sliced Veneer Surfaced 3.6mm WBP Utility US$305 Plywood 5.5mm WBP BB/CC US$280 5.5mm WBP Utility US$265 Avodire/Walnut/Figured 910-1210x1820-2430 Anegre/Hyedua/Mansonia/Sapele faces 3.6mm MR BB/CC US$290 Cedi per Sheet 3.6mm MR Utility US$270 4mm 20,000 3.6mm WBP BB/CC US$320 6mm 23,000 3.6mm WBP Utility US$300 9mm 25,000 5.5mm WBP BB/CC US$275 12mm 30,000 5.5mm WBP Utility US$260 15mm 33,00 Domestic Plywood Prices 18mm 36,000 Mahogany/Edinam Faces Brazil Cedi per Sheet Domestic market prices are very low at the 4mm 18,000 moment. Demand has dropped due to 6mm 20,700 recent increases in interest rate and also 9mm 22,500 business activity is slow because of the 12mm 27,000 holiday period. Some market movement is expected only in March. Analysts are 15mm 29,700 saying that by March the market will be 18mm 32,000 affected by a reduction in international demand and overall falling prices as a result of Asian crisis. There is a tendancy Other Panel Product Prices to put extra volumes, especially plywood, onto the domestic market. Brazil

Rotary Cut Veneer Export Prices (ex-mill Northern Mill) per Cu.m Blockboard 18mm per Cu.m White Virola Face US$175 White Virola Faced White Virola Core US$120 B/C US$265 Plywood (ex-mill Southern Mill) Domestic Prices Grade MR per Cu.m Ex-mill Southern Region per Cu.m 4mm White Virola US$510 Blockboard 15mm White Virola US$350 15mm White Virola Faced US$480 4mm Mahogany 1 face US$1,150 15mm Mahogany Faced US$850 Indonesia Particleboard

8 15mm US$225 Domestic Prices 3mm thick US$260-300 16-18mm x 4' x 8' US$195-220 Investment in an OSB plant has been announced this month. The plant will be Particleboard per Cu.m installed in Parana State and is said to 12-18mm (4x8) US$170-190 have a production capacity of 360,000 Cu.m per year. The product will be marketed mainly in the domestic market and will take a significant share of the Malaysia market for tropical and pine plywood.

Domestic production of MDF is replacing Particleboard (FOB) imported material. Duratex, the first and per Cu.m only domestic MDF producer started the 6mm & above US$130-150 production in August last year. At present, Domestic production is oriented to the domestic 6mm & above US$140-160 market.

Producers of wood panels are moving towards value added products. Three new MDF (FOB) per Cu.m projects are to be implemented to produce Less than5mm US$190-230 wooden floors based on MDF and Greater than 6mm US$180-190 plywood. The product is expected to replace traditional floor material produced Domestic Price US$200-220 mainly from tropical timbers.

The first edge glued panels based on Eucalyptus wood from plantations is now in production. The mill is located in the Prices of Added Value Products extreme south of Brazil. New markets have to be developed for this product. Indonesia Indonesia Mouldings Other Panels per Cu.m Ramin casings per Cu.m Export Particleboard FOB (for the Italian market) US$830-900 9-18mm US$135-150 Laminated Scantlings US$500-550 Domestic Particleboard Laminated Boards 9mm US$200 Falkata wood US$295-320 12-15mm US$180-190 Red Meranti Mouldings 18mm US$160-180 11x68/92mm x 7ft up Grade A US$700-750 MDF Export (FOB) Grade B US$500-550 12-18mm US$170-200 MDF Domestic 12-18mmUS$200-230 Malaysia

Taiwan Province of China, Imports Mouldings (FOB) per Cu.m MDF per Cu.m Selagan Batu Decking US$540-560 Laminated Scantlings

9 72mmx86mm US$500-550 Red Meranti Mouldings 11x68/92mm x 7ft up Brazil Grade A US$700-750 Edge Glued Pine Panel Grade B US$580 per Cu.m for Korea 1st Grade no business Ghana Last price US$570 US Market US$510 Wawa 10mmx23mmx2.16m - 2.45m per Cu.m Taiwan Province of China some black spots allowed DM 900 Finger jointed mouldings DM 850 With 30% Filled holes DM 550 Furniture 5mmx24mmx2.43m DM1200 Dining suite (FOB) Dahoma Oak Veneered MDF tables and Blanks KD 20% No defects chairs (6 per set) 4ft dia. 25mmx90mmx510, 533, 1000, 1273 US$135-140per set 1800 Stg505 Dining table Cheery veneer Albizzia Blanks Occasional table Cherry veneer 25mmx90mmx510, 533, 1000, 1273 top 2ftx4ft US$25-28ea 1800 Stg505 Odum Blanks KD 14% PAR Consumer's Report 25,28x66, 90x674,728,762 Stg660-780 (for the Irish market) Report From Japan

Log Imports

Rubberwood Parts and Furniture Japan's imports of logs have been declining since the second half of 1997 Malaysia and this trend is forecast to continue into the first half of 1998. Total imports of per Cu.m lumber are expected to drop considerably Finger jointed in the first half of 1998 to estimated 4.3 laminated boards US$620-630 million cubic metres (a fall of 31% from imports of 6.22 million cubic metres for top grade US$680-700 the first half of 1997. The downward trend in plywood imports from the second Dining table half of 1997 will continue into the first Solid rubberwood laminated top 3' x 5' half of 1998 and the imports are estimated with extension leaf US$35-38ea to be about 80% of the level last year. Same with African Logs Oak veneered MDF US$50-52ea Windsor Chair US$8.0-9.0ea It is forecast that demand for both African Colonial Chair US$10.0-12.0ea logs for plywood and for lumber will decrease substantially to 115,000 cubic Queen Anne Chair (with soft seat) metres in the first and the second without arm US$14-16ea quartersof 1998. In the supply countries. with arm US$17-20ea The Japanese trade senses that availability

10 seem more of a problem than the reduced Meranti (Hill, Sarawak) demand. STD Mixed 7,000 Meranti (Hill, Sarawak) Plywood Small Lot It is forecast that demand of plywood for (SM60%, SSM40%) 6,400 the first quarter will be down some 28% Taun, Calophyllum (PNG) compared to the same period last year. and others 6,300 However, in the second quareter demand Mix Light Hardwood in Japan is expected to increase and this (PNG G3-G5 grade) 4,800 will drive up production for the second Okume (Gabonese) 8,700 quarter toan estimated 2.26 mil cubic Keruing (Sarawak) metres. Medium MQ & up 8,000 Plywood Markets Remain Weak Kapur (Sarawak) Medium MQ & up 7,500 Although plywood markets seemed to be bottoming out at the end of the last year, Logs For Sawmilling FOB Yen per the market did not rebound and has Koku remained unchanged. Housing starts are Melapi (Sarawak) inactive and distributors are trying to Select 10,500 reduce stocks. Buyers are sticking to Agathis (Sarawak) small lots at a time. Fortunately the heavy supply situation has Select 9,500 begun to be solved. Domestic manufacturers are maintaining the Lumber FOB Price Yen production cut backs. per Cu.m White Seraya (Sabah) Arrivals of plywood from Indonesia in 24x150mm, 4m 1st grade 115,000 November were below 200,000 Cu.m. Mixed Seraya 24x48mm, Those from Malaysia were less than 1.8 - 4m, S2S 47,000 110,000 Cu.m. when the Japanese yen Red Oak 5/4x6 ins and wider weakened to Yen 130 to the dollar, FAS (US East Coast) 125,000 importer business became marginal. Shipment of half-inch plywood, an index item, is inactive as there are possible credit financing problems because of an overall Other News from Japan credit squeeze. January Wholesale Prices At present prices are Yen980-1,000 for Indonesian plywood in eastern Japanese markets. NIPPINDO proposed a price of Yen1,100 which has not been accepted by the markets. For domestic production, Seihoku manufacturing group proposed Yen1,070 and the market recovered to Yen1,050.

Asian Log, Lumber and Panel Prices

Logs For Plywood Manufacturing CIF Price Yen per Koku Meranti (Hill, Sarawak) Medium Mixed 7,200

11 Indonesian Plywood Sheet economic stability by not devaluing the 2.4mm (thin plywood, A board) 920 X 1830 310 3.6mm (midium thickness, OVL) 910 X 1820 440 yuan. 5.2mm (midium thickness, OVL) 910 X 1820 550 8.5mm for sheathing (UTY) 910 X 1820 800 11.5mm for foundation 910 X 1820 900 12mm concrete-form ply (JAS) 900 X 1800 1000 Prices in China 11.5mm flooring board (JAS) 945 X 1840 1730 3.6mm baseboard for overlays (OVL) 1230 X 2440 800 5.2mm for packing 1230 X 2440 900 8.5mm for packing 1230 X 2440 1400 Prices in Hong Kong, September 1997 Malaysian Plywood 2.4mm (thin plywood, A board) 920 X 1830 310 3.6mm (midium thickness, OVL) 910 X 1820 430 HK$ per Cu.ft 5.2mm (midium thickness, OVL) 910 X 1820 550 Sarawak log 54"-71" 26.00 8.5mm for sheathing (UTY) 910 X 1820 790 11.5mm for foundation 910 X 1820 900 72" 27.00 11.5mm concrete-form ply (non-JAS) 900 X 1800 980 Sawnwood 11.5mm flooring board (non-JAS) 945 X 1840 1620 3.6mm baseboard for overlays (OVL) 1230 X 2440 760 Mixed Hardwood (locally sawn) Softwood Plywood 42-43.00 9.5mm foundation of wall (JAS) 1220 X 2440 1300 Imported Kapur 104- 12.5mm Sheathing (T&G JAS) 606 X 2273 1000 15.5mm foundation (T&G JAS) 1220 X 2440 2300 106.00 9.5mmfor packing (non-JAS) 1220 X 2440 1280 Imported Meranti Particleboard 12mm for woodworking 910 X 1820 560 55.00-58.00 15mm for woodworking 910 X 1820 670 Taiwan P.o.C Plywood OSB 11.9mmfoundation of roof (JAS) 910 X 1820 760 2.7mm 2.00 9.5mm foundation for 2 by 4 910 X 2440 920 3.0mm 2.10 6.5mm for packing (non-JAS) 1220 X 2440 680 9.5mm for packing (non-JAS) 1220 X 2440 1020 Plywood from Malaysia 12mm 3.70-4.40 Plywood from Malaysia Report From China 18mm 4.80-5.00 Plywood from Korea China's Export Competition 12mm 3.70-3.90 18mm 4.80-5.00 China's exporters are bracing for double trouble this year as a result of Asia's Plywood from Philippine financial crisis. Southeast Asian countries 12mm 3.80-4.00 will buy fewer Chinese goods and will 18mm 4.70-4.90 also export their products at bargain prices. Key export in China will face intense competition from Southeast Asian Prices for Imported Tropical Wood exporters where prices have fallen with the Products in Shanghai and Eastern sharp depreciation of the currencies. China (Yuan/cubic metre)

On the demand side, deminished demand Yuan per Cu.m for imports in Southeast Asia has hit Keruing Log Chinese firms, with a slump in the region's Length: 6-20m 1880-2400 once-booming construction sector bringing Malaysian Lauan Log a wave of cement factory bankruptcies in various sizes 2500-2600 eastern Shandong province. Analysts say Beijing monetary officials could face Malaysian Lauan with hollow heart pressure from manufacturers and exporters various sizes 1200-1400 to devalue the yuan if Southeast Asian Teak log Myanmar competitors elbow China out of major 2.6m 40 cm dia 2400 markets in Japan, the US and Europe. This week Central-Bank Govnor, Dai Lauan lumber Xianglong, reiterated a pledge to aid Asian Thickness:5-6cm Length: 3-4m 2850-3450

12 to continue its expansion abroad. By the Luan/Malas tongued, grooved flooring year 2000 new showrooms will be opened strip in emerging markets of Eastern Europe 18x70mm x2.2-4.1m 110-125 and Latin America. Among the scheduled openings are Moscow, St. Petersburg, Balian Flooring Top Grade Myanmar Prague, Mexico City, Lima. The Italian 18x50-70x2400mm 300-350 company, which in 1996 posted a turnover Plywood from Indonesia of L 140 billion, is also evaluating the 3mm 1220x2240 4407 possibility of acquisitions.

US Lumber Manufacturer's Prices Oak, Maple, Cherry 7000-14000 T&G Cherry Flooring Manufacturer prices of some furniture 18x50-70mm x 2-4m 120-140 have incresaed significantly since the last report on Italy.

From Europe An Update on Italy Wooden Windows Prices for Italian furniture have recorded moderate growth rates since 1996. Upper Price, However the successful economic policy, Douglas Fir, 150x120cm Lira 824,700 with the stabilisation of the lira exchange Medium Price rate within the EU and the launching of Douglas Fir, 150x120cm Lira 654,200 the single currency in 1999, require an Lowest Price even more rigorous control of cost and Pine, 150x120cm Lira 471,300 price dynamics. In 1997 companies had Medium Price to offset the impact of increased costs of labour by policies to reduce profit margins Mahogany, 150x120cm Lira 567,000 in order not to lose their competitive edge Lowest Price in a less dynamic international market. In Mahogany, 150x120cm Lira 385,500 the first 7 months of 1997 the average unit value of Italian exports recorded a slight drop. In 1998 it will be easier to Solid Wooden Doors moderate price increases, mostly because higher volume production could mean Upper Price, reduced unit labour costs. Mahogany Lira 1,100,000 Oak/Elm Lira 894,600 According to Federlegno-Arredo, the Italian wooden furniture manufacturers' Medium Price, TanganikaLira 576,200 association, in 1997 the Italian furniture Mahogany Lira 742,000 sector turnover increased by 2% to L. Lowest Price, Tanganika Lira 329,700 62,228 billion. The growth was due to the Mahogany Lira 270,000 good performance of exports, which witnessed a 6% increase to around 19,000 billion and contributed to a L 12,000 Furniture and Components billion trade balance surplus (+5.4% compared to 1996). Domestic demand was Kitchen Chairs nearly stable at L 50,000 billion (+1.2%), Medium Price, Beech Lira 172,000 mainly due to the car replacement plan Lowest Price, Pine Lira 43,000 promoted in 1997 by the Italian Government. Dining Chair Upper Price, Walnut Lira 675,000 Cassina, the Italian company which is part Medium Price, Walnut Lira 448,050 of the French Strafor-Facom group, plans Lowest Price, Beech Lira 170,000

13 In the third quarter of 1997 the UK Kitchen Table production of sawmilling and milling Upper Price, Walnut edge glued companies decreased by 5.6% compared 80x160cm Lira 3,242,000 to the same period of 1996. Medium Price, Walnut edge glued Sales of builders' carpentry and joinery 80x160cm Lira 2,969,000 decreased by 11.2%. In the same period, Lowest Price, Oak/Walnut the output of furniture (other than for 80x120cm Lira 320,000 kitchen use) registered a light increase Lowest Price, Pine (+1.9%). 80x140cm Lira 299,000 The Russian furniture distributor Konstantin (Noginsk) has started Dining Table producing modern office furniture. Upper Price, Walnut edge glued Russian furniture companies are now competing with foreign manufacturers to 90x180cm Lira 4,163,640 gain a share in the domestic market for Medium Price, Walnut edge glued office furniture, which is estimated to be 90x160cm Lira 2,976,700 worth US$ 50 million and for which an Lowest Price, Beech Cherry Walnut average annual growth of 5% in the next 90x180cm Lira 1,100,000 decade is predicted.

Thulema, an Estonian-Danish joint Wardrobe Doors furniture company, will sell its products in Upper Price, Walnut edge glued St. Petersburg: the company has recently opened a new furniture store in co- 250x45cm Lira 1,018,000 operation with ComMark. Medium price, Walnut edge glued 250x45 cm Lira 699,000 Starting from Spring 1998 Villeroy & Lowest Price, Pine Boch, the German sanitary ware and tiles 201x40cm Lira 380,000 company based in Mettlach, will launch a furniture collection. Villeroy & Boch turnover registered a fall in 1996 but good Drawer Fronts ( Office Furniture ) results were achieved in the first nine Upper Price, Birch multilayer months of 1997, when adjusted turnover in the main company has increased by 4.3% 100x10cm Lira 2,150 to DM 1.1 billion. Medium Price, Birch multilayer 100x10cm Lira 1,800 The Spanish conglomerate Mondragon Lowest Price, Birch multilayer Corporacion Cooperative (Basque 100x10cm Lira 1,500 country) will invest Pta 4,500 million in 4 different projects to expand facilities and increase production capacity. In particular, Wooden Shelving MCC will invest Pta 850 mil. to expand Upper Price, Walnut edge glued Danona, its furniture plant in Azpeitia. 100x24cm Lira 365,000 Medium Price, Walnut edge glued 100x24cm Lira 230,000 Lowest Price, Walnut 100x24cm Lira 100,000 Sawnwood in the UK

Other News from Europe FOB plus Commission per Cu.m Teak 1st Quality 1"x8"x8' Stg2655

14 The original forests of the US covered Brazilian Mahogany roughly 1 billion square acres of land FAS 25mm Stg680 (including Alaska). As the New World grew more populated, man's impact on the Tulipwood FAS 25mm Stg205 forest increased tremendously. Colonists Cedro FAS 25mm Stg440 viewed the forest as an "inexhaustible" resource, supporting a fast growing and DR Meranti Sel/Btr 25mm Stg260 lucrative lumber industry. The Keruing Std/Btr 25mm Stg2185 government saw transfer of public land to private ownership as the means to utilise the continent's vast resources. Thanks in Sapele FAS 25mm Stg309 part to increased demand from expanded Iroko FAS 25mm Stg330 railroad construction, in 60 years lumber Khaya FAS 25mm Stg310 production in the US expanded from 5.4 Utile FAS 25mm Stg370 billion board feet in 1850 to 44.5 billion Wawa No1. C&S 25mm Stg185 board feet in 1910. Until the mid-forties, loggers commonly Plywood and MDF in the UK removed only the most valuable trees from harvest areas, leaving behind snags and culls. The large amount of logging debris CIF per Cu.m was often burned in uncontrolled slash Brazilian WBP BB/CC 6mm US$450 burns which, when they got out of hand, " Mahogany 6mm US$1290 destroyed huge tracts of uncut forest.

Indonesian WBP BB/B 6mm US$450 At this time, forests represented an obstacle to agriculture and large areas Eire, MDF BS1142 per 10 Sq.m were cleared for that purpose. During the late years of the 19th century, farmers cut 12mm Stg32.80 forest land at a rate of 13.5 square miles per day and the forest cover east of the Mississippi has fell from 70% at the Manufactured Items beginning of the century to about 20%. CIF Wholesale Little thought was given to conservation or Carolina Door US$25.50 Stg34.00 reforestation in the early days. The health Directors Chair US$9.00 Stg9.00 of woodlands deteriorated at a fast pace 8" Wood and by the turn of the century, the overall Salad bowl Stg2.00 Stg5.00 state of the US forests fell to its lowest point in history.

US Report Forest Conservation By the mid-1800s a few forward-thinking Changes in US Forests and Forest people became concerned about the effects Management of excessive forest utilisation and various conservation groups were formed. Efforts The US timber trade has witnessed got underway to successfully set land significant changes in the last two to three aside in small protected areas. decades in the ways it has to manage its resource base. The following is an During the last decade of the 19th industrialists view on the historical centrury, the federal government felt that development of forest management and is was important to retain some public some of the issues attracting debate. domain lands, a move which signaled a Forest Exploitation in the Past shift away from private ownership. The result was a federal forest reserve mandate

15 (via the 1897 Organic Act) to "preserve management practices. Such laws and and protect the forests to secure favorable guidelines are, today, universally accepted conditions of water flows… [and] furnish and followed, ensuring a commitment to a continuous supply of timber for the use maintaining forests forever. As a result, and necessity of the citizens of the United the amount of forest land in the US has States." Ultimately the federal forest essentially stabilised at 737 million acres, reserves became what is now known as the or about two-thirds of what existed prior to US National Forest System. European settlement.

Additional impetus for these moves came The technology and the volume of work in from the timber industry itself. Some forest nurseries has changed dramatically, entrepreneurs recognised the potential but the purpose - to provide a stable and future value of previously harvested land. adequate supply of tree seedlings to They purchased parcels and rehabilitated replenish harvested and otherwise depleted them back into productive timber lands. forest lands - has not changed. Today, In the South, where cotton had been king some 1.7 billion trees are planted each for over a century, defunct cotton year. Between 1910 and the end of 1997, plantations were acquired and restored to this added up to nearly 100 billion trees southern pine plantations. The resulting planted on commercial forest lands in the timber resurgence has made the southern US. region responsible for nearly half of the country's timber output today. Ecology and Environmental Protection

In 1939, the Northwestern corner of Due to the pressure of conservation Oregon experienced its third massive groups, the federal government started to wildfire of that decade. In typical fashion preserve special places as early as the mid of the day, the various owners deemed the 1800s. In 1872 the National Park System acreage a total loss and walked away, was born with the dedication of leaving it for the counties in lieu of Yellowstone National Park. In later years, property taxes. However, the counties several other areas were preserved and affected embarked on one of the earliest protected as national parks. large-scale reforestation efforts. Some 50 years later, the effort has paid off During the 20th century, values other than producing billions of dollars worth of timber production started to dominate standing timber. forest policy. Various environmental organizations called for additional The Oregon fire and other large scale ecological measures. The issues of habitat burns provided the "spark" to make fire preservation and species protection came protection of forests a national priority. A to a head in the late 1980s with the well- tremendous effort on the part of public worn debates over Old Growth Forests and agencies and private landowners resulted the Northern Spotted Owl. This resulted in a reduction in the acres burned by 90%. in major changes in the relationship The more than 50 million acres destroyed between people and the forests. Public by fire each year during the 1930s were lands are more and more seen in a broad reduced to around 3 to 5 million acres by ecological context and less and less as a the 1960s, where it has stabilised to the source of natural resource production. present time. The year 1964 set an important milestone While reforestation was practiced on a in American forest policy. The first of a small scale for some time, it became a series of Congressional actions was passed central theme of forest policy early in the to designate federal wilderness areas. 1990s. In 1910, the US Forest Service Today, the National Wilderness System established the first forest nursery. Later, encompasses some 250 million acres of reforestation became the cornerstone of national parks and wilderness areas. In state forest practices, laws and best addition to the direct enhancement of the

16 forests and its wildlife habitat, the forest Today, most trees harvested are second or policy has also expanded to include third growth. watershed and soil protection and a wide variety of other, non-product-related forest Trees grown on managed forest stands are issues. smaller and thinner than the "old-growth" trees of earlier days. This has necessitated The responsibility for forest management the development of new structural has shifted significantly to privately- engineered products. Glue laminated owned forest lands. The large forest beams are now serving the functions products companies have taken a long- previously capable of heavy solid timbers term approach to this responsibility. and wide boards. While the primary purpose is to grow the maximum amount of wood per acre each Industry has been very successful in its year, major corporate landowners employ application of technology to improve wildlife biologists, hydrologists, soil wood utilisation. The wood products scientists and other experts to ensure their industry has advanced to the point where forest practices are compatible with better than 95% of each log removed from ancillary forest values. Across the board, the forest is used in the manufacture of management plans call for sustainable wood or paper products. New products harvest levels designed to maintain the allow wood resources to be used more long-term ecological health of the forests. efficiently and effectively. Innovative thinking has spawned such ideas as Challenges and Opportunities plywood, particleboard, MDF, OSB, and other composite wood products. Environmental pressure has led, at times, Furthermore, preservative treatments and to the withdrawal of huge wooded areas other methods were developed to extend which are no longer available for wood's service life. Virtually all the commercial logging. As a result, large residual material is burned to generate numbers of wood products companies, that power, offsetting energy consumed in the previously depended on public land for manufacturing process. their raw materials, have gone out of business. Since 1987, some 350 such The exclusion of fire from the forest lumber mills in the western US have ecosystem has a negative component. As permanently closed operation. a consequence of "too few fires", a tremendous amount of forest is now in Modern forest management practices are unnatural and unhealthy conditions. In not without controversy and several recent years, this has resulted in huge conflicting approaches are promulgated. areas suffering the ravage of insect One school of thought pronounces that infestation and, ultimately, catastrophic some forested areas should be intensively wildfire. The biggest current threat facing managed and others should be left forests may well be poor forest health. untouched. This model, however, is Decades of fire exclusion, combined with being challenged by some forest ecologists a number of other contributing factors, favoring a "landscape approach" to have brought extremely unhealthy resource management. conditions across much of the Western United States. Decades in the making, The days of unlimited forest resources are these conditions will take years to reverse. long gone. The reduced availability of In the meanwhile, immense areas are primary wood resources forced industry to threatened with fires the likes of which enhance wood lot yields. With the help of havenot been seen since the early 1900s. biological engineering and silvicultural techniques trees on well managed woodlots are growing much faster than trees in a non-influenced environment.

17 World Value of the US Dollar 23rd January 1998

Aust ralia Dollar 1.5134 Indonesia Rupiah 14750 Aust ria Schilling 12.6275 Ireland P unt 0.716 Belgium Franc 37.031 Italy Lira 1768.425 Bolivia Boliviano 5.38 Japan Yen 126.335 Brazil Real 1.121 Korea, Rep. of W on 1746 Cambodia Riel 3402 Liberia Dollar 1 Cameroon C.F.A.Franc 601.04 Malaysia Ringgit 4.5303 Canada Dollar 1.4518 Myanmar Kyat 6.4098 Central African Republic C.F.A.Franc 601.04 Nepal Rupee 61.05 China Yuan 8.2782 Netherlands Guilder 2.0224 Colombia P eso 1334.75 New Zealand NZ Dollar 1.7258 Congo D.R New Zaire 122500 Norway Krone 7.4332 Congo, P eople's Rep. C.F.A.Franc 601.04 P anama Balboa 1 Cote d'Ivoire C.F.A.Franc 601.04 P apua New Guinea Kina 1.7575 Denmark Krone 6.8377 P eru New Sol 2.7535 Ecuador Sucre 4493.5 P hilippines P eso 43.825 Egypt P ound 3.415 P ortugal Escudo 183.66 Fiji Dollar 1.9275 Russian Fed. Ruble 6.02 Finland Markka 5.431 Spain P esata 152.175 France Franc 6.0104 Sweden Krona 7.9334 Gabon C.F.A.Franc 601.04 Switzerland Franc 1.4655 Germany Mark 1.7945 T hailand Baht 54.55 Ghana Cedi 2325 T ogo, Rep. C.F.A.Franc 601.04 Greece Drachma 284.57 T rinadad and T obago Dollar 6.22 Guyana Dollar 143.3 United Kingdom P ound 0.605 Honduras, Rep. Lempira 13.2 Venezuala Bolivar 508.9 India Rupee 38.705 EU Ecu 1.1086

Abbreviations

LM Loyale Merchant, a grade of log parcel Cu.m Cubic Metre FOB Free-on-Board SQ Sawmill Quality SSQ Select Sawmill Quality KD Kiln Dry AD Air Dry FAS Sawnwood Grade First and Boule A Log Sawn Through and Through Second the boards from one log are bundled WBP Water and Boil Proof together MR Moisture Resistant BB/CC Grade B faced and Grade C backed pc per piece Plywood ea each MBF 1000 Board Feet BF Board Foot

18 Sq.Ft Square Foot MDF Medium Density Fibreboard FFR French Franc F.CFA CFA Franc Koku 0.278 Cu.m or 120BF Price has moved up or down Stg Pound Sterling Rp Rupiah RM Ringgit

19