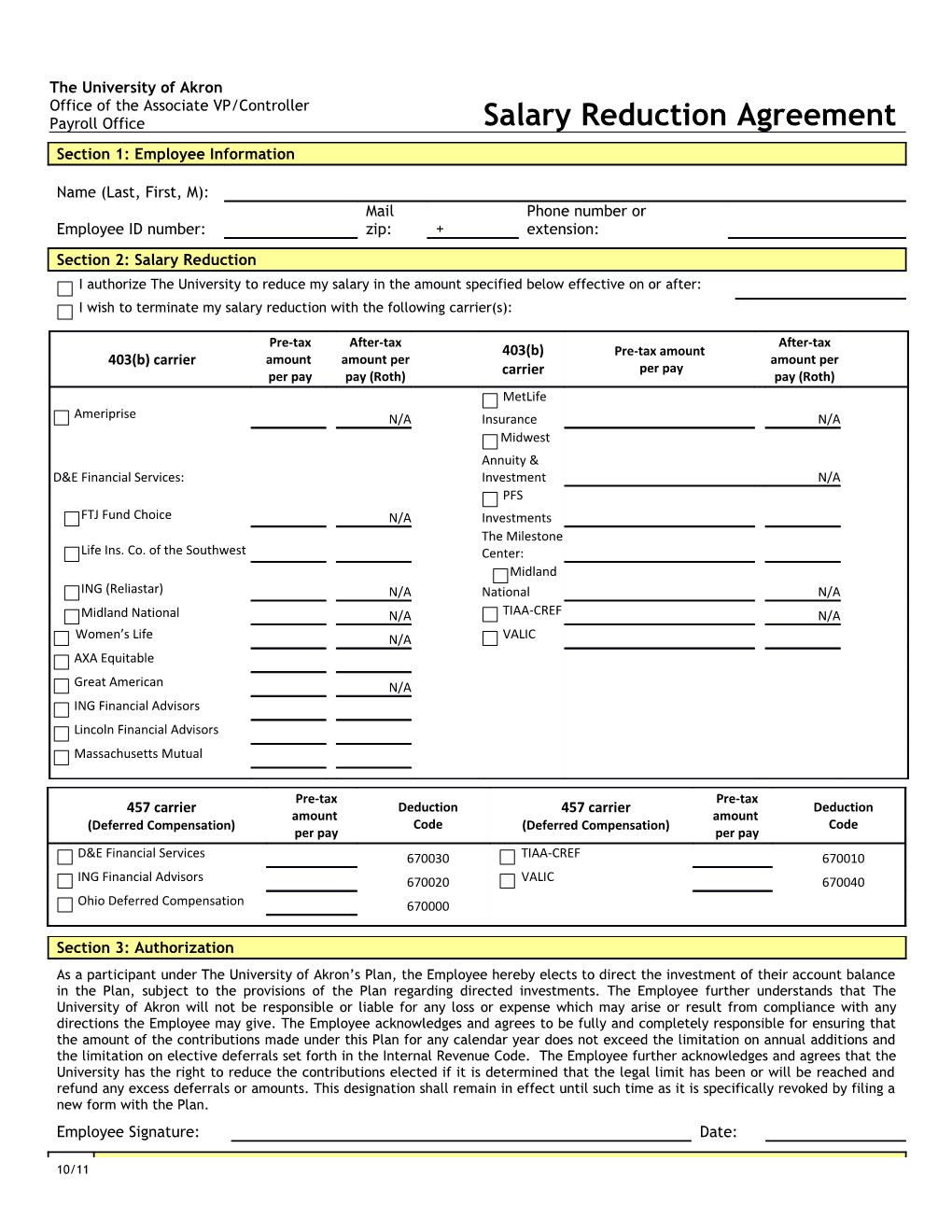

The University of Akron Office of the Associate VP/Controller Payroll Office Salary Reduction Agreement Section 1: Employee Information

Name (Last, First, M): Mail Phone number or Employee ID number: zip: + extension: Section 2: Salary Reduction I authorize The University to reduce my salary in the amount specified below effective on or after: I wish to terminate my salary reduction with the following carrier(s):

Pre-tax After-tax After-tax 403(b) Pre-tax amount 403(b) carrier amount amount per amount per per pay per pay pay (Roth) carrier pay (Roth) MetLife Ameriprise N/A Insurance N/A Midwest Annuity & D&E Financial Services: Investment N/A PFS FTJ Fund Choice N/A Investments The Milestone Life Ins. Co. of the Southwest Center: Midland ING (Reliastar) N/A National N/A Midland National N/A TIAA-CREF N/A Women’s Life N/A VALIC AXA Equitable

Great American N/A ING Financial Advisors Lincoln Financial Advisors Massachusetts Mutual

Pre-tax Pre-tax 457 carrier Deduction 457 carrier Deduction amount amount (Deferred Compensation) Code (Deferred Compensation) Code per pay per pay D&E Financial Services 670030 TIAA-CREF 670010 ING Financial Advisors 670020 VALIC 670040 Ohio Deferred Compensation 670000

Section 3: Authorization As a participant under The University of Akron’s Plan, the Employee hereby elects to direct the investment of their account balance in the Plan, subject to the provisions of the Plan regarding directed investments. The Employee further understands that The University of Akron will not be responsible or liable for any loss or expense which may arise or result from compliance with any directions the Employee may give. The Employee acknowledges and agrees to be fully and completely responsible for ensuring that the amount of the contributions made under this Plan for any calendar year does not exceed the limitation on annual additions and the limitation on elective deferrals set forth in the Internal Revenue Code. The Employee further acknowledges and agrees that the University has the right to reduce the contributions elected if it is determined that the legal limit has been or will be reached and refund any excess deferrals or amounts. This designation shall remain in effect until such time as it is specifically revoked by filing a new form with the Plan. Employee Signature: Date:

10/11 Return completed form to: Payroll Office +6210

Payroll Office Use ONLY Date Entered: Entered by: