Using The VSA Methodology To Analyse Key World Markets

Instrument Date(s) Resolution Volume Dow Jones 22nd of September 1997 Daily Real

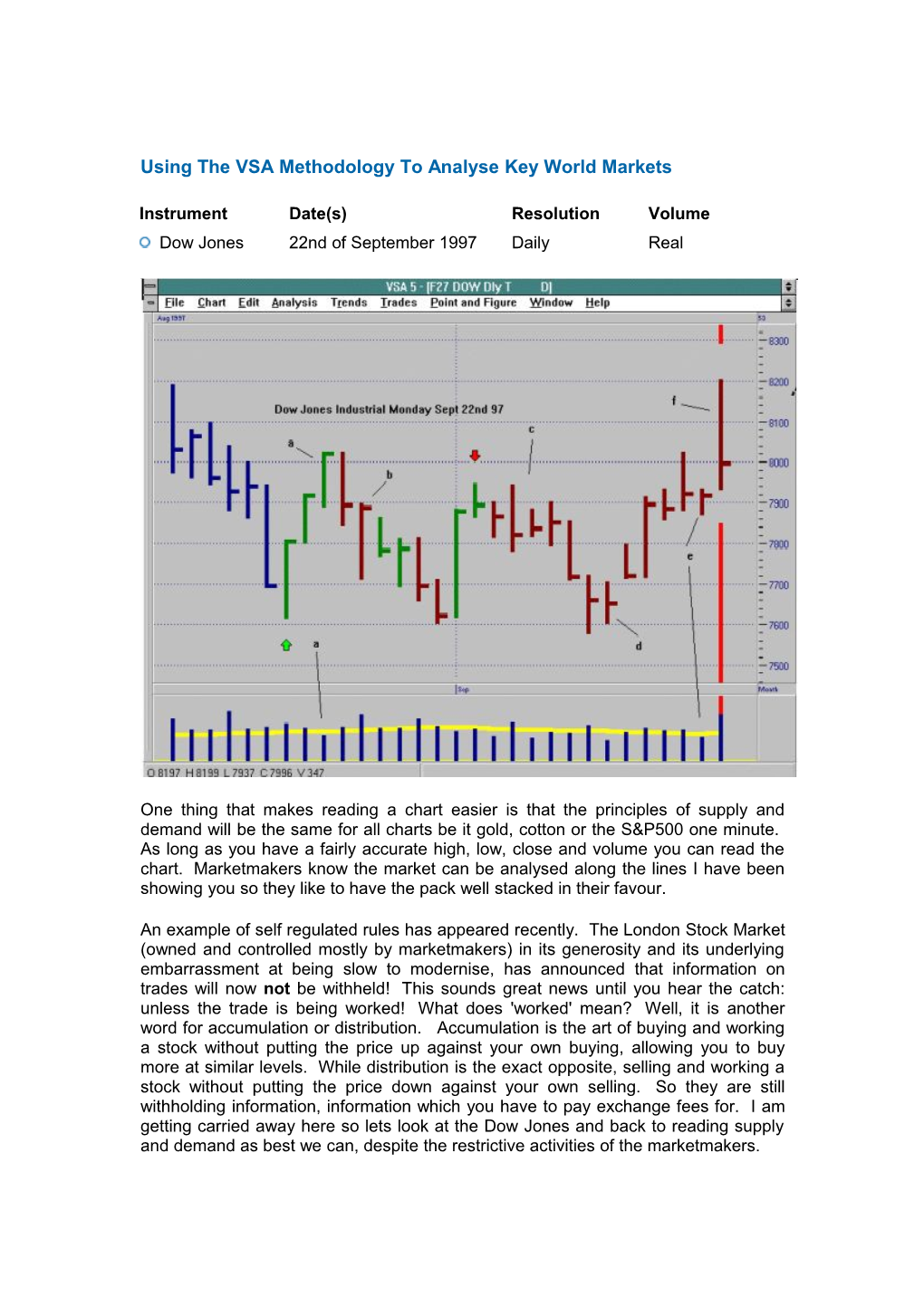

One thing that makes reading a chart easier is that the principles of supply and demand will be the same for all charts be it gold, cotton or the S&P500 one minute. As long as you have a fairly accurate high, low, close and volume you can read the chart. Marketmakers know the market can be analysed along the lines I have been showing you so they like to have the pack well stacked in their favour.

An example of self regulated rules has appeared recently. The London Stock Market (owned and controlled mostly by marketmakers) in its generosity and its underlying embarrassment at being slow to modernise, has announced that information on trades will now not be withheld! This sounds great news until you hear the catch: unless the trade is being worked! What does 'worked' mean? Well, it is another word for accumulation or distribution. Accumulation is the art of buying and working a stock without putting the price up against your own buying, allowing you to buy more at similar levels. While distribution is the exact opposite, selling and working a stock without putting the price down against your own selling. So they are still withholding information, information which you have to pay exchange fees for. I am getting carried away here so lets look at the Dow Jones and back to reading supply and demand as best we can, despite the restrictive activities of the marketmakers. At point (a) we have a wide spread up closing on the highs, the news will be good, producing a rapid recovery after sharp falls. Do you rush in to buy before missing out? If you can read a chart you do not. Why? Because there is no demand from the marketmakers, which can be seen in the low volume up bar. The next bar is sharply down, creating a top reversal and confirming a sign of weakness.

At point (b) we have substantial test like action which, standing alone, is a sign of strength. However, the volume is too high - there is too much supply around. For a test to be successful you need to see low volume not high. Also we have seen weakness in the immediate background, with no demand and a top reversal. Markets do not change suddenly - if there is no demand in the near background there will be a reason for this; reasons which we are not privileged to know about. We also know that even if the market rallied at this point you would expect a re-test of the area because markets do not like high volume (supply present).

At point (c) the market has rallied, but look at the volume on all the up bars - it is low. Again we have ‘no demand’, the market is unlikely to go up very far with multiple up bars on reduced volume. Knowing this principle will prevent you from going into the market at the wrong time.

At point (d) we have two down bars, both at a similar price level. The first bar has a low that would have caught many stops. The volume is high on this bar and on this volume the market closed in the middle. We must assume that demand has entered the market. If the high volume had represented selling then we would have surely closed on the lows: demand must have arrived. This demand is confirmed on the second bar, which is a down bar, also closing in the middle - and look at the volume! We have a low volume down bar immediately after a high volume down bar. There is no supply left in the market. If there is no supply then the market is going to go up. The next bar is gapped up also confirming the strength in the market.

Point (e): At first there is a hesitation in the rally. This is because we have an old top immediately to the left. It appears to be a minor top so we do not expect a great deal of resistance. However, they still like to test, as seen at point (e). The volume is low. Again this is telling you that there is no selling, and therefore no supply. If there is no supply then the market is going to go up.

At point (f) we have what appears to be a sign of weakness and you would certainly not be buying at times like this. The market basically looks strong: we have multiple signs of strength in the background, with several major shake-outs followed by tests, showing little or no supply. We have gapping up and wide spreads up as the marketmakers attempt to lock traders out of the market.

So why the up-thrust? I have shown you this chart because the data is incorrect and has a spike. In reality the high is on the close, there is no up-thrust. Even the volume is incorrect and is not nearly so high as it appears on the chart. Whether this is done deliberately or is a true accident or failure in the communication system is hard to say. But these things do happen often and appear at the most inconvenient times in the market. The last bar on the chart , even with the high corrected, still looks like supply. Any further testing, especially on low volume (must be a down bar) would indicate higher prices.

Market Commentary

Using The VSA Methodology To Analyse Key World Markets

Instrument Date(s) Resolution Volume 18th / 19th of December Dow Jones 5 minute Tick 2001

It's a good idea to have two charts running on the same contract or instrument for better analysis; one chart using tick volume, the other using real time volume (if available). Tick volume is difficult for anyone at the Exchanges to ‘knobble’, whereas real-time volume is open to all sorts of trickery.

These violent rapid moves on these charts occur because they have contracts out on them! An instrument with no contract will move gently and non-violently. Rapid moves trigger stops, panic many into selling a perfectly good position, even encouraging traders to trade in the wrong direction. It has to be this way to make any market tradable - you have to have a large number of losers and a small number of winners. A pyramid letter, for example, has a few winners at first and then the whole lot collapses because there are no losers.

Point (a): a sharp down bar closing in the middle on very high volume. This has to be a form of shake-out and a strong buy signal.

If you ever saw this action on a daily chart you would have to jump in and buy immediately for a bull rally. VSA doesn't differentiate between a one-minute chart and a daily one as far as the signals are concerned. There is no need to because supply and demand, the driving force behind the markets, acts exactly the same way in any time frame and can be interpreted in the same way as well. NOTE: At point (a), market sentiment would be low and there would probably be some sort of ‘bad news’.

I never allow news releases or newspaper articles to influence me, because I know the truth has to be shown on the chart.

At this point, traders panic, many selling their long holdings, some even shorting. Marketmakers seeing professional traders buying into this selling would also start to buy and also cover any short positions they may have.

How do we know this?

Because on these violent down moves into fresh new low ground, traders panic. We know that many will sell. We also know that professional traders looking for bargains will step into the market and buy into the panic selling. If professional traders had refused to buy because market conditions were not right for them, there is no way the market could have closed in the middle (or high), rather, the market would have closed on the lows.

Point (b): a confirmation of strength. Any down bar closing in the middle on a narrow spread and low volume must be looked upon as strength. The volume is very low, showing that there is no selling on this bar. Expect immediate higher prices.

Why do we look at this bar with so much importance?

Because you have this massive looking shake-out right behind you! Although each bar is of vital importance, it only slots into the ongoing picture. Keep in mind that markets generally do not like very high volume, especially on up bars, because on an up bar supply can easily be swamping demand. Conversely, very high volume on down bars tends to show demand from professional players overcoming the supply.

Because markets are governed by the forces of supply and demand, areas of high volume are usually tested at some time in the future, so be vigilant of this possibility.

Points (c&d) are also giving you the same picture - there is strength in the market.

Point (e): In hindsight you can see that this is a top reversal and a sign of weakness. Any up bar on a wide spread, closing on the highs, after there has already been an up move, looks bullish. However, if the next bar is down, also on a wide spread, closing on the lows, this action forms a top reversal and must be looked upon as potential weakness.

If, over the next few bars, one is up on volume less than the two previous bars, you should short, because this is ‘no demand’ after weakness - a very powerful indication of lower prices.

The market plummets down on ultra-high volume, on wide spreads to point (f). The volume on these two down bars is ultra high. If this is professional traders buying into the market then expect higher prices. However, before we go long we need conformation that supply has disappeared. One way to see this is to wait for the next down bar. At point (g) we see such confirmation. A low volume down bar, followed by a rapid reversal, gives a strong indication of higher prices to come. Why? Because a low volume down bar within the same area of a recent, very high volume down bar, on low volume, must show that there is no longer professional selling on the down side. This confirms that the ultra-high volume areas must have been professional buyers. If this is so expect higher prices.

What helps your analyses of these markets is that the same principles of supply and demand keep on repeating themselves over and over. However, different signs may arrive in varying intensities and disguises, due to human intervention as the market is traded, but the principles involved will be the same.

At point (h) we see a repeat sign of strength. The strength is on the bar, but it's highlighted in your analysis because of the background action at points (f & g) .

Point (i). Here you would keep your long position because again the volume is low on a down bar. Although there are a couple of weak-looking bars, note that you have little or no volume on the down-side and you are loaded with strength, not weakness, in the background.

Point (j): again the same principles are at work in slightly different disguises. Both are down bars, but look at the volume. There is no professional interest in the downside - expect higher prices.

An up bar on a wide to ultra-wide spread, closing on the highs as it approaches an old resistance area, is bullish. The old resistance area might be an upper trend line, but here we have a top to push through at point (e). The volume is usually high, but not excessive either way, like low volume ('no demand'), or very high to ultra high volume (supply swamping demand).