1 st Jan 20 10 VAT Changes and Recommendations

In preparation for the increase in the VAT rate on 1st January 2010, the following instructions provide advice in modifying your Esprit & Quantum configurations to deal with this change.

To implement the change for the system to recognise the new rate an alteration to the VAT file record is required. However to ensure accurate reporting in the future and to enable continued use of the old rate for crediting the additional changes are recommended.

We hope this provides a clear instruction of how to deal with this change and demonstrates the simplicity of the changes required but should you have any further questions please do not hesitate to call us on 01925 732 333.

Further information should also be obtained from the government website www.hmrc.gov.uk as clearly we cannot advise on matters affecting your reporting to them

Making the changes

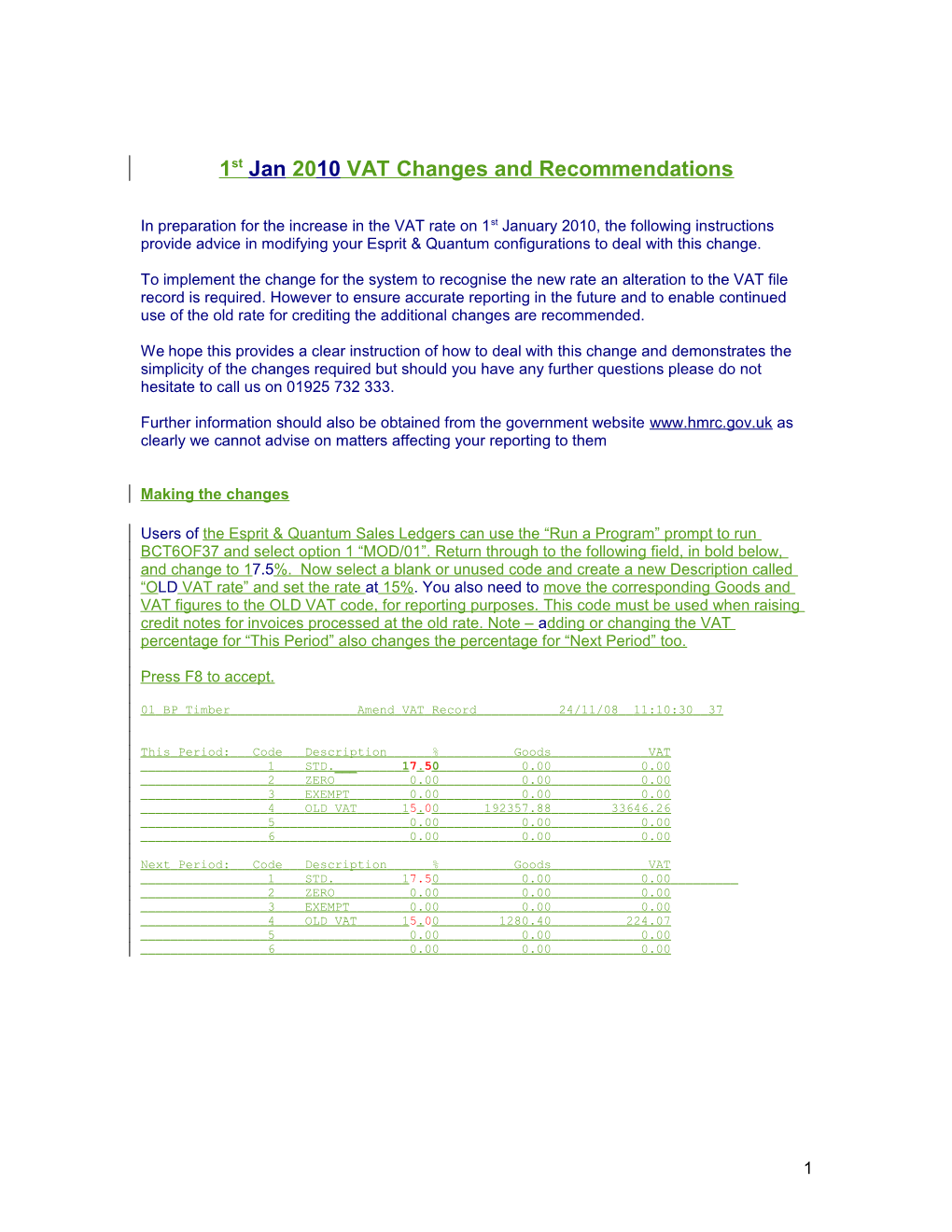

Users of the Esprit & Quantum Sales Ledgers can use the “Run a Program” prompt to run BCT6OF37 and select option 1 “MOD/01”. Return through to the following field, in bold below, and change to 17.5%. Now select a blank or unused code and create a new Description called “OLD VAT rate” and set the rate at 15%. You also need to move the corresponding Goods and VAT figures to the OLD VAT code, for reporting purposes. This code must be used when raising credit notes for invoices processed at the old rate. Note – adding or changing the VAT percentage for “This Period” also changes the percentage for “Next Period” too.

Press F8 to accept.

01 BP Timber Amend VAT Record 24/11/08 11:10:30 37

This Period: Code Description % Goods VAT 1 STD.___ 17.50 0.00 0.00 2 ZERO 0.00 0.00 0.00 3 EXEMPT 0.00 0.00 0.00 4 OLD VAT 15.00 192357.88 33646.26 5 0.00 0.00 0.00 6 0.00 0.00 0.00

Next Period: Code Description % Goods VAT 1 STD. 17.50 0.00 0.00 2 ZERO 0.00 0.00 0.00 3 EXEMPT 0.00 0.00 0.00 4 OLD VAT 15.00 1280.40 224.07 5 0.00 0.00 0.00 6 0.00 0.00 0.00

1 Customers using Esprit Purchase Ledger (Quantum Purchase Ledger customers can ignore this part) can use the “Run a Program” prompt to run BCT5PL12 and select option 2 “Amend VAT record”. Return through to the following field, in bold below, and change to 17.5%. Now select a blank or unused code and create a new Description called “OLD VAT rate” and set the rate at 15%. You also need to move the corresponding Goods and VAT figures to the OLD VAT code, for reporting purposes. This code must be used when raising credit notes to suppliers for invoices processed at the old rate. Note - adding or changing the VAT percentage for “This Period” also changes the percentage for “Next Period” too.

Press F8 to accept.

01 BP Timber Amend Purchase VAT Record 24/11/08 11:10:30 37

This Period: Code Description % Goods VAT 1 STD.___ 17.50 0.00 0.00 2 ZERO 0.00 0.00 0.00 3 EXEMPT 0.00 0.00 0.00 4 OLD VAT 15.00 192357.88 33646.26 5 0.00 0.00 0.00 6 0.00 0.00 0.00

Next Period: Code Description % Goods VAT 1 STD. 17.50 0.00 0.00 2 ZERO 0.00 0.00 0.00 3 EXEMPT 0.00 0.00 0.00 4 OLD VAT 15.00 1280.40 224.07 5 0.00 0.00 0.00 6 0.00 0.00 0.00

Considerations

All Sales Orders raised for December 2009 and before must be processed and invoiced prior to changing the VAT rate to 17.5% on 1 st January 2010.

The advice we have been given is that sales invoices raised at the current vat rate of 15% should be credited at this rate but please verify this with your accountants or revenue and customs office or visit the www.hmrc.gov.uk site for further information

Each line on a credit note raised for sales orders processed at the old VAT rate will need to be amended. At the Accept prompt for each line press F7 to amend the VAT field from “1” Standard VAT rate to the number that corresponds to the OLD VAT rate, i.e. 4 in the example below (bold).

2 01 BP Timber Collection Note Entry 25/11/08 10:39:45 E1

Branch No. [ 1] Margin 24.21- Account No. BQ/0200601 B.Q.V. Ltd T/A Hancock & Hall' Total 24.21- % 100.00 Order 1233620 Nett Sales LN-LN-Product Code-Description------Quantity----Price-----Amount- 1 100 0159DWL0005 32 x 140mm P/PACKED DOOR LINER 0 24.21 24.21- (2'6" / 2'9" HEAD) 28/PK Each

---Product Code--Description- ASH = OFF ------Quantity---Price---Reg.---Disc1-V d032140S9 Disc2 Disc3 0199WDL0005 32 x 140mm P/PACKED DOOR LINER 24.21 0.00 0.00 (2'6" / 2'9" HEAD) 28/PK Each 0.00 0.00 4 Amount 24.21- N 0 Code/Find /Normal line

NB: Some users have enhancement 8PB579 switched on which prevents the VAT rate from being amended. This enhancement will need turning off in the short term.

All Purchase Orders raised and goods received for December 2009 and before must be processed through Purchase Invoice Registration using the OLD VAT rate as detailed above.

All Supplier Returns Notes raised against Purchase Orders where the VAT rate was 15% must also be processed through Purchase Invoice Registration using the OLD VAT rate as detailed above.

Deposits - You should account for VAT on a deposit at the rate in force when you receive it. If you receive a deposit before 1 January 2010 for goods or services that you will supply after the rate change you have the option of applying the 17.5% rate of VAT

3 Q uantum Financials

For manual postings within Quantum Financials, the VAT code will need to be amended. In the short term there may be postings at both 15% and the new VAT rate, therefore both values will need to be maintained.

Click on Key Lists (the red key on the icon bar). This will bring up the maintenance option. Click on VAT and then Details. This will display the VAT rates configured in the system.

4 Click on the standard rate (typically 1) and set the value to be the new rate. Click on the old rate (typically 5) and set the value to be the old rate.

When entering documents using a Multi-Vat rate input form, the user will now have the option of which VAT rate to use.

5