Chapter 14

Economic Affairs Division

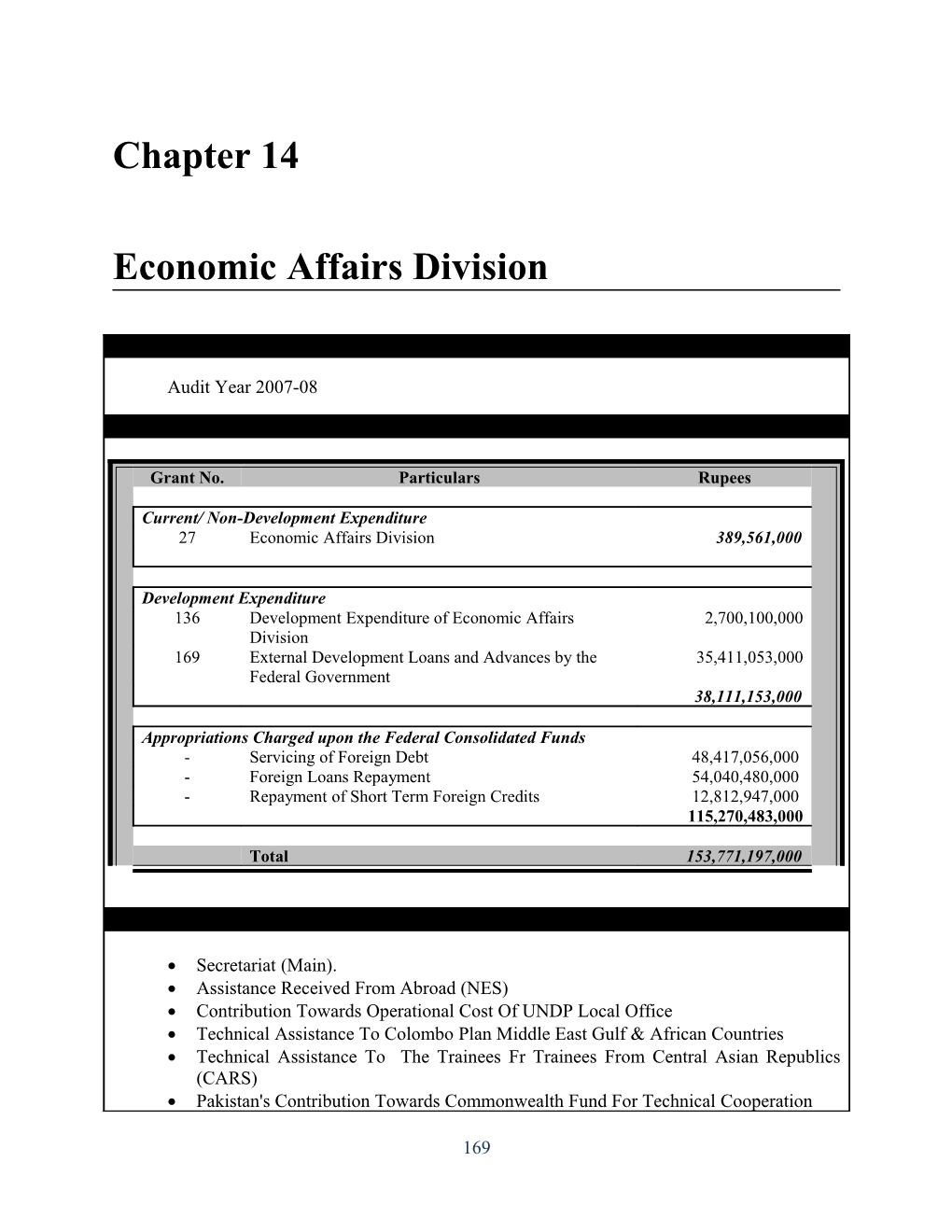

Audit Period

Audit Year 2007-08

Auditable Expenditure

Grant No. Particulars Rupees

Current/ Non-Development Expenditure 27 Economic Affairs Division 389,561,000

Development Expenditure 136 Development Expenditure of Economic Affairs 2,700,100,000 Division 169 External Development Loans and Advances by the 35,411,053,000 Federal Government 38,111,153,000

Appropriations Charged upon the Federal Consolidated Funds - Servicing of Foreign Debt 48,417,056,000 - Foreign Loans Repayment 54,040,480,000 - Repayment of Short Term Foreign Credits 12,812,947,000 115,270,483,000

Total 153,771,197,000

Audit Formations

Secretariat (Main). Assistance Received From Abroad (NES) Contribution Towards Operational Cost Of UNDP Local Office Technical Assistance To Colombo Plan Middle East Gulf & African Countries Technical Assistance To The Trainees Fr Trainees From Central Asian Republics (CARS) Pakistan's Contribution Towards Commonwealth Fund For Technical Cooperation

169 DG Audit – Federal Government Audit Plan 2007 - 08

(CFTC) ASPL -II Allocation NWFP (Loans) ASPL -II Allocation Punjab (Loans) ASPL -II Allocation Sindh (Loans) ASPL -II Allocation Balochistan (Loans)

Audit Team

S.No. Name Designation Role 1. Dr. Akmal Minallah Director Finalization of Audit report, Holding DAC meetings 2. Nazar Rauf Rathore Dy. Director Supervision of audit activities, Planning of audit, Review of audit findings, Review of draft audit report 3. Saqib Latif Sheikh Audit Expert Technical support in planning, execution & reporting 4. Khalid Umar Rajooka Audit Officer Audit execution, Preparation of AIRs & draft audit report Update audit permanent file 5. Fayaz Hussian Naqvi Senior Audit Audit execution, Officer Prepare audit working papers

Time Schedule

From 22 October 2007 to 18 December 2007 (For details refer page 189)

170 Chapter 14: Economic Affair Division

I. AUDIT OBJECTIVE & SCOPE

A. AUDIT OBJECTIVE

The overall objective of audit of the Economic Affairs Division is to review the management, financial and operating controls and to appraise their adequacy and soundness. As we are specifically focusing upon the current and development expenditure being incurred from the grants received, it is necessary to evaluate the internal controls over expenditures and assets purchased. This includes the following specific objectives:

Provide reasonable assurance regarding the achievement of objectives in the following categories:

o Effectiveness and efficiency of operations o Reliability of financial reporting o Compliance with applicable laws and regulations

To determine the existence, accuracy and completeness of the current and development expenditure. To ensure the compliance of applicable rules, regulations and policies regarding the incurrence of such expenditure. To ensure proper classification with respect to account head, function and cost centre. To determine that payroll record is complete and accurate. To ensure that it is being updated and complies with all prescribed rates of Federal Govt. To determine if internal controls for recording and safeguarding of assets are adequate To perform the performance audit and review of regulatory authorities, statutory authorities and attached departments that would be centered on financial performance, technical measures and compliance with applicable laws. Providing recommendations to improve operating efficiency and internal controls.

B. AUDIT SCOPE

The Auditor General is appointed under section 168 of the constitution of the Islamic republic of Pakistan, 1973 and section 169 defines the functions and powers of the Auditor General as;

The Auditor General shall, in relation to- o The accounts of the federation and of the provinces; o The accounts of any authority or body established by the federation or a province; and

171 DG Audit – Federal Government Audit Plan 2007 - 08

o Perform such functions and exercise such powers as may be determined by the parliament or by order of President.

Further the scope of the auditor general of Pakistan is defined in Section 8 of the Auditor General’s Ordinance, 2001 which, empowers the Auditor General of Pakistan to audit:

All expenditure from the Consolidated Funds of the Federation and of each Province; All transactions of the Federation and of the Provinces relating to Public Account; All trading, manufacturing, profit & loss accounts, balance sheets and other subsidiary accounts kept by order of the President or of the Governor of the province in any Federal or Provincial Department; and The accounts of any authority or body established by the Federation or a province, and in each case report on the expenditure, transactions or accounts so audited by him.

International standards of auditing define scope as the audit procedures that are necessary in the circumstances to achieve the objectives of the audit. These audit procedures should be determined in accordance with the applicable laws and regulations which includes the compliance of applicable financial reporting framework, that is;

Financial reporting manual of New Accounting Model (NAM) International Public Sector Accounting Standard; and Other applicable laws and regulations which includes;

o Rules of business o Establishment codes o PEPRA rules o Account code o Audit codes o PC-1 o General financial rules

The scope of audit would include verification and analysis of current and development expenditure on test check basis and also includes performance audits as when required. Compliance testing and substantive tests have to be performed as appropriate, but due to the extensive volume of transactions, more emphasis is laid on compliance testing. Brief descriptions of areas to be covered but not limited to are as follows:-

Current expenditure has to be verified on sampling basis to ensure the completeness, accuracy, relevance, genuineness and proper classification as well as compliance of grant formalities in respect thereof.

Development expenditure has to be checked and verified on a test check basis keeping in view the procedures for the purchases, the necessary formalities that are

172 Chapter 14: Economic Affair Division

required to be fulfilled for the expenditure incurred and the related documentation maintained in support of the expenditure incurred.

II. UNDERSTANDING THE ENTITY

A. BACKGROUND OF THE DIVISION

Economic Affairs Division is responsible for assessment of requirements, programming and negotiations of external economic assistance related to the Government of Pakistan and its constituent units from foreign Governments and multilateral agencies. The issues regarding external debt management and matters relating to technical assistance to foreign countries, credit to friendly countries on lending/re-lending of foreign loans and monitoring of aid utilization are being handled by this division. The functions and responsibilities of the Economic Affairs Division as listed in Schedule II of Rules of Business 1973 which are as under;

Assessment of requirements, programming and negotiations for external economic assistance from foreign governments and organizations. Matters relating to IBRD, IDA, IFC, ADB and IFAD. Economic matters pertaining to Economic and Social Council of the United Nations, Governing Council of UNDP, ESCAP, (Economic and Social Commission for Asia and Pacific) Colombo Plan and OECD (DAC) Negotiations and coordination activities etc., pertaining to economic cooperation with other countries (excluding RCD and IPECC) Assessment of requirements, programming and negotiation for securing technical assistance to Pakistan from foreign governments and organizations including nominations for EDI courses. Matters relating to technical assistance to foreign countries. External debt management, including authorization of remittances for all external debt service, compilation, accounting and analysis of economic assistance from foreign governments and organizations. Review and appraisal of international and regional economic trends and their impact on the national economy. Proposals concerning change in international economic order. Matters relating to transfer of technology under UNDP assistance. Matters relating to Islamic Development Bank.

B. SWOT ANALYSIS

Strengths Headed by the Federal Minister Goals and targets set by the Prime Minister of Pakistan Direct coordination with the President and Prime Minister Full financial support from Federal Government

Weaknesses

173 DG Audit – Federal Government Audit Plan 2007 - 08

Undue influence from politicians Incorrect decision making due to political pressure and availability of incorrect information Weak coordination with regulatory and statutory bodies and attached departments. Weak monitoring by the Secretary of the activities of the divisions attached with them and lack of coordination with them.

Opportunities No such opportunities

Threats Meagre performance by different sections resulting in an inadequate performance of activities and functions that they have been assigned. Change of political setup and political instability Mismanagement of funds Qualified and experienced staff leaves the organization Change of government may suspend important projects undertaken by the present government for sale. Sale of projects at an inadequate price. Funds might not be utilized for the purposes to achieve the targets.

C. INTERGOVERNMENTAL RELATIONSHIP

The Division is responsible for matters concerning assessment of requirements, programming and negotiations of external economic assistance related to the Government of Pakistan and its constituent units from foreign Governments and multilateral agencies.

D. ACCOUNTING SYSTEM OF THE MINISTRY

Economic Affair Division is a centralized accounting entity, where, controller general of accounts is responsible for processing of its accounting transactions and maintaining the accounts. The sub offices of the controller general of accounts at province and districts maintain the respective accounts.

Various development projects are undertaken by each line department. For the purpose of the accounting classification each division and line departments are classified under cost centers, (the functions) and cost element (the objects).

The major cost centers as per New Accounting Model are;

Account Code Cost Centres 012 Foreign Economic Aid 041 General Economic, Commercial & Labour Affairs

174 Chapter 14: Economic Affair Division

Each cost centre is further divided into cost elements, the major classification of which is detailed below;

Account Code Cost Elements A01 Employee related expenses A03 Operating expenses A05 Grants subsidies and write off loans A06 Transfers A09 Physical assets A13 Repair and maintenance

E. Organizational Chart

The organizational chart is annexed as Annexure A to the chapter

III. RISK ASSESSMENT

A. GENERAL RISK ASSESSMENT PROCEDURES

Our risk based approach during the audit would be to plan and document our risk assessment procedures performed so as to obtain an understanding of the entity and its environment. Our risk assessment procedures may include inquiries, observations and inspections, and analytical procedures. The major risk factors that would commonly be addressed to assess the risk of the entity are;

The adequacy of internal controls and the control consciousness environment is in place; Discussions with the management regarding any internal control weakness, frauds and irregularities identified earlier. Are changes in the design of internal controls documented and review by a competent authority; There is a clearly defined organization structure and the operating functions are performed independently so as to create segregation of duties; The role and authority of the internal audit function (if any), and review of internal auditor’s assessment of the corrective actions taken, and to consider the impact on the nature, extent and timing of our audit tests and procedures; The nature of transactions (for example, the number and Rupee volumes and the complexity involved); Assessment of non-routine transactions and its adequacy of its documentation and approvals; Understanding of the financial reporting process; The age of the system or applications used; The physical and logical security of information, equipment, and premises; Susceptibility of assets to theft and misappropriation;

175 DG Audit – Federal Government Audit Plan 2007 - 08

The adequacy of operating management oversight and monitoring; Previous regulatory and audit results and management’s responsiveness in addressing the issues raised; Human resources, including the experience of management and staff, turnover, technical competence, management’s succession plan, and the degree of delegation; and Senior management oversight.

B. INHERENT RISK FACTORS

1) Inherent risk factors associated with activities /programs

Complexity of programs; Complex, unusual or high value transactions; Activities involving the handling of large amounts of cash or high value attractive goods - embezzlement or theft; Activities of a nature traditionally considered to be particularly prone to fraud or corruption (e.g. public works and technical contracts, contracts for the delivery goods); Urgent operations (e.g. emergency aid) and operations not fully subject to the usual controls; Historical evidence of a high incidence of intentional irregularities; Eligibility criteria inconsistent with objectives (too wide, too restrictive, not relevant); Activities that are uninsurable and/or are subject to risks arising from political, financial, ecological (etc) instability;

2) Inherent risk factors associated with the operating structure

Management approach to taking, managing and mitigating business risk; Geographically dispersed organization, or organization operating in areas where communications are difficult; Unclear division of responsibilities within the Division/Department; Activities or projects involving numerous partners (coordination problems, weaknesses in management and communications structures); Particular points mentioned in internal and external audit reports, and in press reports etc.

3) Inherent risk factors associated with the beneficiaries

Operations where the conduct of beneficiaries is difficult to check, or where the ultimate beneficiaries may be different from the apparent recipient; Beneficiaries highly dependant on public funds; Activities which imply several levels of subcontracting, making the

176 Chapter 14: Economic Affair Division

identification of eligible beneficiaries difficult; Historical evidence of a high incidence of intentional irregularities; Political or administrative pressure exerted by beneficiaries or participants in the activity; Imposition of unwanted responsibilities upon organizations, administrations or beneficiaries;

4) Inherent risk factors associated with the economic or technical circumstances

Abnormal trends and ratios; Results intangible or difficult to evaluate; Activities that are starting up or coming to an end, or are subject to rapid technological change; Unstable sources of supply and variable prices of inputs (raw materials, etc); Over-dependence on one supplier (e.g. supplier of equipment has exclusive maintenance contract, is sole supplier of parts and materials, software, etc);

5) Inherent risk factors associated with the audited entity

Lack of turnover of personnel and/or personnel not taking holidays in a sensitive department/area; Activities with which the audited entity has no or limited experience; Activities that are highly dependant upon a small number of key personnel; Insufficient staff, or staff and management under-qualified, inexperienced or poorly motivated; Peaks and troughs in work patterns and information flows; Utilization of obsolete information technology systems;

6) Inherent risk factors associated with the audited entity’s management policies and practices

Badly defined or unrealistic objectives; Strong pressure upon management to produce results, achieve objectives, meet unrealistic deadlines, achieve high rates of budgetary utilization at the year-end; Short-term budgetary pressures (e.g. delay in undertaking necessary maintenance imposes greater costs later); Management, supervision and control functions poorly suited to the activity; Lack of management information system and/or cost accounting system; Unclear division of responsibilities within and between the various departments;

C. SPECIFIC AUDIT RISK

177 DG Audit – Federal Government Audit Plan 2007 - 08

Proper utilization of development budget Violation of PPRA rules, 2004. Illegitimate payments Compliance with clauses of grant agreements Proper authorization and classification of expenses Incorrect mode of payment Incomplete record Misuse and mismanagement of funds Inadequate control over cash payments and bank payments

IV. AUDIT APPROACH

The audit approach would include a combination of financial audit and compliance audit. At the preliminary stage, the assessment of internal control system would be performed to identify the weaknesses that would lead to the assessment of audit risk. Materiality level is basically determined at 2 percent of the budgeted amount, but nature of expenditure is also considered. The departments, offices and projects are selected on the basis of;

the high budget appropriation grants subsidies and write offs involved criticality of audit issues and sensitivity of core operations

The selection of each DDO of each division for current expenditure and development expenditure is made on the basis of the level of materiality that is established by determining its nature and its amount. The DDOs selected have been mentioned individually and the areas to be focused upon are also mentioned.

The audit approach for efficient and effective would encompass around understanding of the financial reporting and internal control system, checking compliance with applicable laws and regulations and performing compliance testing (test of control) and substantive testing as appropriate. The audit procedures may include any of the following, but are not exhaustive of the all the procedures as some of the procedures may be identified at the time of execution of the audit. Understanding the client internal control system and identifying internal control weaknesses and audit risks. Issues highlighted in the previous audit reports that are still unresolved. Compliance testing to ensure that applicable policies, rules and regulations and complied with. Compliance with grant agreement. Use of sampling to select items for compliance testing and substantive testing.

178 Chapter 14: Economic Affair Division

Vouching payments on a test basis and check the payments for accuracy, completeness, valuation and ownership. Compliance of PC-1 document. Checking compliance with PPRA rules for the procurements made during the year. Comparison of actual expenditure with budgeted expenditure Prepare analytical procedures and Investigate where actual are more than budget appropriation. Investigate transfer payments to sub-offices and there utilizations. Performance audit procedures, if performance audit needs to be performed: o Identification of cost savings o Identification of services that can be reduced or eliminated Identification of programs or services that can be transferred to the private sector o Analysis of gaps or overlaps in programs or services and recommendations to correct gaps or overlaps o Feasibility of pooling information technology systems within the Department o Analysis of the roles and functions of the department, and recommendations to change or eliminate departmental roles or functions o Recommendations for statutory or regulatory changes that may be necessary for the department to properly carry out its functions o Analysis of departmental performance data and performance measures o Financial, economic and technical appraisal of projects o Identification of best practices.

The understanding of the accounting and internal control system will enable the auditor to 1) identify types of potential material misstatements, 2) considers factors that affect the risk of material misstatements, and 3) design appropriate audit procedures. Therefore, the auditor should obtain an understanding of the accounting and internal control system to identify and understand:

Major classes of transactions How such transactions are initiated Significant accounting records and supporting documents Accounting and financial reporting process, from the initiation of significant transactions and other events to their inclusion in the financial statements.

The audit procedures would include a combination of compliance testing (tests of controls) and substantive procedures (test of detail). The objective of test of controls is to evaluate whether a control operates effectively, whereas the objective of tests of detail is to detect material misstatements.

The auditor is required to perform tests of control when the auditor’s risk assessment includes an expectation of the operating effectiveness of controls or when substantive procedure do not provide sufficient appropriate audit evidence. The auditor selects

179 DG Audit – Federal Government Audit Plan 2007 - 08

procedures to obtain sufficient appropriate evidence that the controls operated effectively throughout the period of reliance. The more the auditor relies on the operating effectiveness of controls in the assessment of risk, the greater is the risk of the auditor’s test of controls. In addition, as the rate of expected deviation from a control increases, the auditor increases the extent of testing of the control. The matters that may be considered in determining the extent of the auditor’s test of controls include the following:

The frequency of performance of control by the entity during the period. The length of time during the audit period that the auditor is relying on the operating effectiveness of the control. The relevance and reliability of the audit evidence to be obtained in supporting that the control prevents, or detects and correct, material misstatements at the assertion level. The extent to which audit evidence is obtained from tests of other controls. The extent to which the auditor plans to rely on the operating effectiveness of the control in the assessment of risk. The expected deviation from the control.

The following are the types of controls to test: Financial reporting controls (including certain safeguarding and budget controls) for each significant assertion in each significant cycle/accounting application; Compliance controls for each significant provision of laws and regulations, including budget controls for each relevant budget restriction; and Operations controls for each operations control (1) relied on in performing financial audit procedures or (2) selected for testing by the audit team.

Substantive procedures are performed in order to detect material misstatements and include tests of detail of transactions, account balances, and disclosures and substantive analytical procedures. Substantive procedures are generally applicable to large volume of transactions that tend to be predictable over time, which includes a combination of tests of detail and analytical procedures. The auditor designs tests of details responsive to the assessed risks with the objective of obtaining sufficient appropriate audit evidence to achieve the planned level of assurance. In designing the tests of details, the extent of testing is ordinarily thought of in terms of the sample size, which is affected by the risk of material misstatement. However, the auditor may consider the use of selective sampling such as selecting large or unusual items from a population.

In addition to the above mentioned audit procedures, analytical procedures may also be performed that would include analysis of significant ratios and trend, consideration of relationships among elements of financial information and considering the relationship between financial information and non-financial information. The auditor will need to

180 Chapter 14: Economic Affair Division

consider the testing of controls, over preparation of information used in applying analytical procedures, accuracy and reliability of information available.

Types of audits to be performed: Financial audit Compliance audit Performance audit (if required)

System documentation: Cash/bank payment and receipts system Procurement of assets and other items Payroll Grant receipt and related expenditure Transfers Delegation of powers V. BUDGET ALLOCATION

A. CURRENT EXPENDITURE

The total federal budget for current expenditure amounts to R389,561,000. The grant wise detail is as follows: Budget allocation for Grant No. Particulars current expenditure (Rs.) 27 Economic Affairs Division 389,561,000 Total 389,561,000

Function wise and object wise classification of expenditure under each grant is as follows; Grant No. 27: Economic Affairs Division (Rs. 389,561,000)

2006-2007 Account Particulars Revised Codes Estimates Rupees Functional Classification 012 Foreign Economic Aid 74,200,000 General Economic, Commercial & Labour 041 Affairs 115,361,000 389,561,000 Object Classification A01 Employee related expenses 64,060,000 A03 Operating expenses 239,778,000

181 DG Audit – Federal Government Audit Plan 2007 - 08

A04 Employee's Retirement Benefits 1,000 A05 Grants subsidies and write off loans 400,000 A06 Transfers 82,622,000 A09 Physical assets 1,500,000 A13 Repair and maintenance 1,200,000 389,561,000

The current expenditure considered for the purposes of the audit are;

Budget DDO Name of the offices/project appropriation in Code FY 2006-07 Rupees ID1847 Secretariat (Main). 114,701,000 ID1860 Assistance received from abroad (NES) 180,000,000 Contribution towards operational cost Of UNDP ID1854 local office 13,193,000 Technical assistance to Colombo Plan Middle ID1826 East Gulf & African Countries 9,000,000 Technical assistance to the trainees for trainees ID2608 from Central Asian Republics (CARS) 15,361,000 Pakistan's contribution towards Commonwealth ID3010 Fund for Technical Cooperation (CFTC) 18,000,000 ID1859 Pakistan's voluntary contribution to the UNDP 26,840,000 TOTAL 377,095,000

The major areas that are considered material and need to be focused upon during the course of audit include;

Employee related expenses Operating expenses Transfers

B. DEVELOPMENT EXPENDITURE

On revenue account The development budget on revenue accounts for the year 2006-07 is Rs. 2,700,100,000

Budget allocation for Grant No. Particulars development expenditure (Rs.)

182 Chapter 14: Economic Affair Division

136 Development Expenditure of Economic Affairs Division 2,700,100,000 Total 2,700,100,000

Function wise and object wise classification of expenditure under each grant is as follows;

Grant No. 136: Development Expenditure of Economic Affairs Division (Rs. 2,700,100,000)

Account 2006-2007 Revised Particulars Codes Estimates Rupees Functional Classification 014 Transfers 2,700,100,000 2,700,100,000 Object Classification A08 Loans and advances 2,700,100,000 2,700,100,000

The development projects selected for audit during year under review includes:

Budget appropriation DDO Name of the project FY 2006-07 Code (Rupees in Thousands) ID2556 ASPL -II Allocation NWFP (Loans) 455,114 ID2554 ASPL -II Allocation Punjab (Loans) 1,347,076 ID2555 ASPL -II Allocation Sindh (Loans) 556,888 ID2557 ASPL -II Allocation Balochistan (Loans) 250,522 TOTAL 2,609,600 On Capital account The development budget on capital accounts for the year 2006-07 is Rs. 35,411,053,000 Budget allocation for Grant No. Particulars development expenditure (Rs.) 169 External Development Loans and Advances by the Federal Government 35,411,053,000 Total 35,411,053,000 Function wise and object wise classification of expenditure under each grant is as follows;

183 DG Audit – Federal Government Audit Plan 2007 - 08

Grant No. 169: External Development Loans and Advances by the Federal Government (Rs. 34,411,053,000)

Account 2006-2007 Revised Particulars Codes Estimates

Rupees Functional Classification 014 Transfers 35,411,053,000 35,411,053,000 Object Classification A08 Loans and advances 35,411,053,000 35,411,053,000

The development projects selected for audit during year under review includes:

Budget appropriation DDO Name of the project FY 2006-07 Code (Rupees in Thousands) ID1845 N.W.F.P. 3,039,912 ID1844 Punjab 5,527,549 ID1843 Sind 3,838,826 ID1822 WAPDA: Water Wing 2,146,212 ID1823 WAPDA: Power Wing 6,257,322 ID1835 National Highway Authority 7,211,562 ID1832 Pakistan Railways: Capital Account. 2,571,601 TOTAL 30,592,984

C. APPROPRIATIONS CHARGED UPON THE FEDERAL CONSOLIDATED FUNDS

Budget allocation for Particulars Appropriation (Rs.) Servicing of Foreign Debt 48,417,056,000 Foreign Loans Repayment 54,040,480,000 Repayment of Short Term Foreign Credits 12,812,947,000 Total 115,270,483,000

Function wise and object wise classification of appropriations upon federal consolidation fund is as follows; Appropriation: Servicing of Foreign Debt (Rs. 48,417,056,000)

184 Chapter 14: Economic Affair Division

Account 2006-2007 Revised Particulars Codes Estimates (Rupees)

Functional Classification 011 Executive and Legislative Organs, Financial and Fiscal Affairs, External Affairs 48,417,056,000 48,417,056,000 Object Classification A07 Interest Payment 48,417,056,000 48,417,056,000 The projects selected for audit during year under review includes:

DDO Budget appropriation in Name of the offices/project Code FY 2006-07 Rupees ID2851 IBRD LOANS 5,445,065,000 ID2852 ASIAN DEVELOPMENT BANK LOANS 5,879,668,000 ID2853 IDA LOANS 3,613,527,000 ID2855 GERMAN CAPITAL AID LOANS 1,936,601,000 ID2856 JAPANESE CREDITS 5,635,502,000 ID2859 FRENCH CREDITS 5,381,160,000 ID2865 CCC LOANS (USA) 1,118,950,000 ID2872 US AID PROJECT LOANS 1,832,392,000 ID2885 KOREA 2,612,357,000 ID2887 SHORT TERM BORROWING 1,601,077,000 ID2888 EURO BONDS 8,821,257,000 TOTAL 43,877,556,000

Appropriation: Foreign Loans Repayment (Rs. 54,040,480,000)

Account 2006-2007 Revised Particulars Codes Estimates (Rupees) Functional Classification Executive and Legislative Organs, Financial and Fiscal 011 Affairs, External Affairs 54,040,480,000 54,040,480,000 Object Classification A10 Principal repayment of loans 54,040,480,000 54,040,480,000

The projects selected for audit during year under review includes:

185 DG Audit – Federal Government Audit Plan 2007 - 08

Budget DDO Name of the offices/project appropriation in FY Code 2006-07 Rupees ID2890 IBRD LOANS. 14,304,792,000 ID2891 ASIAN DEVELOPMENT BANK LOANS. 14,843,353,000 ID2892 IDA LOANS. 7,826,647,000 ID2895 JAPANESE LOANS. 3,276,885,000 ID2907 $ DENOMINATION BONDS 1,332,807,000 ID2912 FRANCE 1,787,840,000 ID2914 KOREA 3,428,250,000 TOTAL 46,800,574,000 Appropriation: Repayment of Short Term Foreign Credits (Rs. 12,812,947,000)

Account 2006-2007 Revised Particulars Codes Estimates

Rupees Functional Classification Executive and Legislative Organs, Financial and 011 Fiscal Affairs, External Affairs 12,812,947,000 12,812,947,000 Object Classification A10 Principal repayment of loans 12,812,947,000 12,812,947,000

VI. ISSUES HIGHLIGHTED IN PREVIOUS YEARS

Expenditure on printing without open tender

Irregular expenditure and non production of record

Non recovery of outstanding loans

Negative balance of “reserve fund for exchange risk on foreign loans”

Parallel accounting systems and difference in outstanding liabilities

Outdated Policies and procedure manual

Internal audit department

Non-payment of the amount of export credits (Principle and interest)

186 Chapter 14: Economic Affair Division

Difference in grant recorded

VII. Time Schedule

Planning 10 days Execution – Fieldwork 10 days Reporting 2 days Holding DAC Meeting 28 days Total 50 days

Particulars Duration Start Date Finish Date 50 days 22-Oct-07 18-Dec-07 Permanent File 5 days 22-Oct-07 26-Oct-07 Planning File 5 days 27-Oct-07 1-Nov-07 Execution 10 days 2-Nov-07 13-Nov-07 Main Ministry 10 days 2-Nov-07 13-Nov-07 Reporting 2 days 14-Nov-07 15-Nov-07 Prepare AIR 1 day 14-Nov-07 14-Nov-07 Send AIR to PAO 1 day 15-Nov-07 15-Nov-07 DAC 28 days 16-Nov-07 18-Dec-07 Hold DAC meeting 21 days 16-Nov-07 10-Dec-07 Sign Minutes of meeting 1 day 11-Dec-07 11-Dec-07 Complete Working Papers 2 days 12-Dec-07 13-Dec-07 Scan WP Evidence 2 days 14-Dec-07 15-Dec-07 Finalize Audit Report 2 days 17-Dec-07 18-Dec-07

187 DG Audit – Federal Government Audit Plan 2007 - 08

Annexure – A

ORGANIZATIONAL STRUCTURE

Economic Affairs Division

188