Last Stuff for AP Macroeconomics

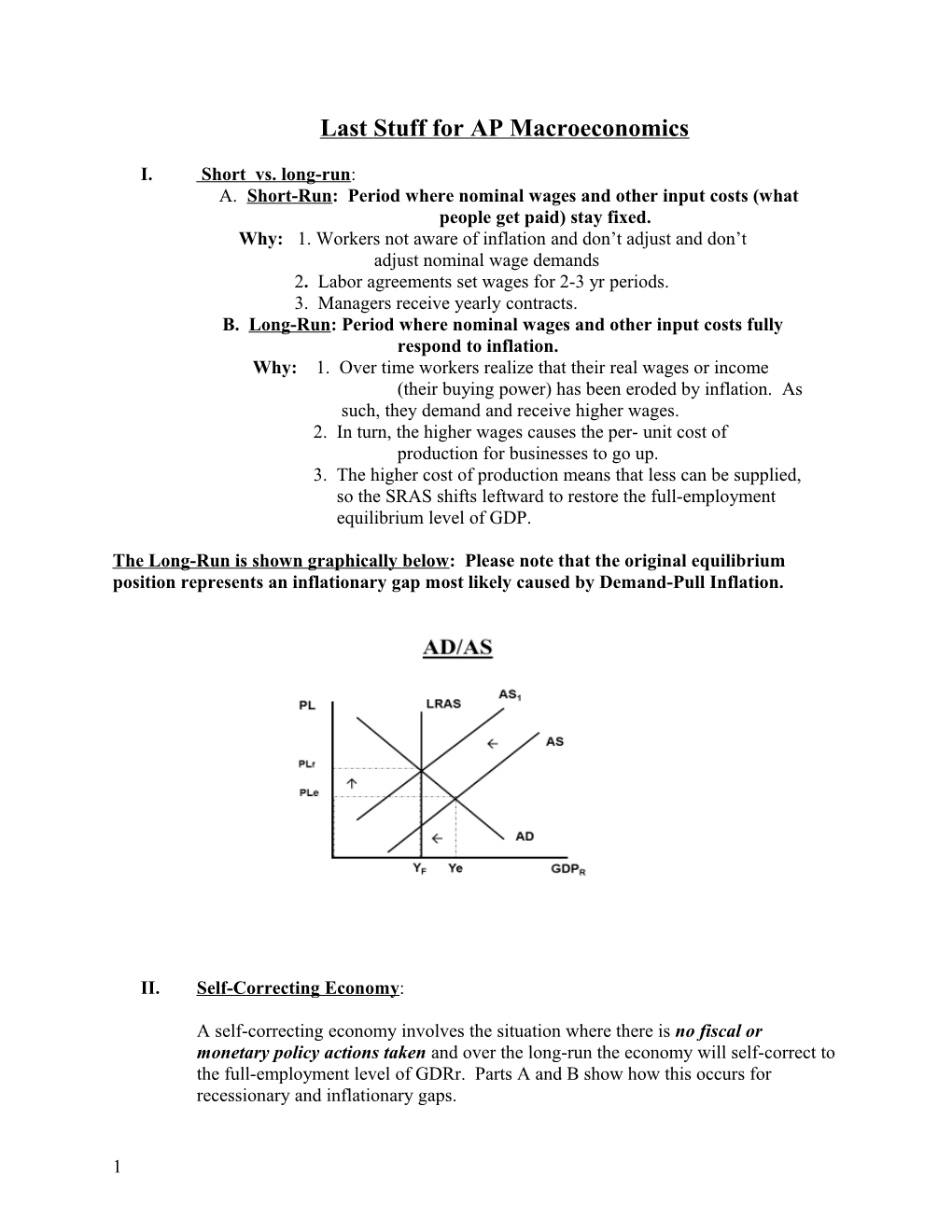

I. Short vs. long-run: A. Short-Run: Period where nominal wages and other input costs (what people get paid) stay fixed. Why: 1. Workers not aware of inflation and don’t adjust and don’t adjust nominal wage demands 2. Labor agreements set wages for 2-3 yr periods. 3. Managers receive yearly contracts. B. Long-Run: Period where nominal wages and other input costs fully respond to inflation. Why: 1. Over time workers realize that their real wages or income (their buying power) has been eroded by inflation. As such, they demand and receive higher wages. 2. In turn, the higher wages causes the per- unit cost of production for businesses to go up. 3. The higher cost of production means that less can be supplied, so the SRAS shifts leftward to restore the full-employment equilibrium level of GDP.

The Long-Run is shown graphically below: Please note that the original equilibrium position represents an inflationary gap most likely caused by Demand-Pull Inflation.

II. Self-Correcting Economy:

A self-correcting economy involves the situation where there is no fiscal or monetary policy actions taken and over the long-run the economy will self-correct to the full-employment level of GDRr. Parts A and B show how this occurs for recessionary and inflationary gaps.

1 A) Recessionary Gap:

With a recessionary gap, in the long-run, wages and other input costs will go down. This will cause the per-unit cost of production to decrease, shifting the AS curve to the right, restoring the economy to the full-employment equilibrium level of GDPr.

B) Inflationary Gap:

With an inflationary gap, in the long-run, wages and other input costs will go up. This will cause the per-unit cost of production to increase, shifting the AS curve to the left, restoring the economy to the full-employment equilibrium level of GDPr.

2 III. Economic Theories:

A) Classical Economics:

Classical Economic theory dominated economic thinking from Adam Smith in the 1770’s until the 1930’s with the onset of the Great Depression and the Keynesian influenced deficit spending of Franklin Roosevelt’s New Deal programs. Classical economics was laissez faire, meaning no government intervention in the economy. The economy would always self-correct to full-employment.

B) Keynesian Economics:

Keynesian Economics involve using tax and spending changes to change AD to fight recession. It influenced FDR’s New Deal and was paid for by deficit spending. Keynesian economics dominated U.S. policy from the 1930’s into the 1960’s. It is the biggest influence on fiscal policy today.

C) Monetarism:

Modern Monetarism came from the University of Chicago and Milton Friedman, the nobel prize winner in economics in 1976. It is a neo-classical theory which basically says that monetary and fiscal policy are inept and ineffective. What is needed is a Monetary Rule. That is, increase the rate of growth of the money supply with the project growth of real GDP and the economy will run smoothly.

D) Rational Expectations Theory:

Rational Expectations Theory is similar to Monetarism in that they propose the same Monetary Rule. Their reasoning is not that fiscal and monetary policy changes are inept, but they are rendered ineffective by actions of the public. They believe the public will react rationally and adjust their investment options to counter fiscal policy changes by Congress/President and monetary policy changes by the Fed. This would render those attempts to stabilize the economy ineffective.

E) Supply-Side Economics:

Supply Side emphasizes:

1. Increases in AS to achieve satisfactory levels of output, employment, and inflation. 2. Tax Cuts Provide Incentives: a. To work more and produce more b. To save and invest 3. Laffer Curve – Lower Marginal tax rates will actually increase tax revenue

3 4. Criticism of Laffer Curve: It did not prove valid during the 1980’s under Reagan. a. Incentives of tax cuts caused limited impact. Some people work more, some less b. Inflation. Tax cuts near full-employment levels of output produce demand-pull inflation. Increases in AD overwhelm increases in AS. c. The optimal position on the curve is unknown.

IV. Economic Growth and Productivity:

A) Economic Growth Defined 1) Sustained increase in Real GDP over time. 2) Sustained increase in Real GDP per Capita over time. B) Why Grow? 1. Growth leads to greater prosperity for society. 2. Lessens the burden of scarcity. 3. Increases the general level of well-being. C) Conditions for Growth 1. Rule of Law 2. Sound Legal and Economic Institutions 3. Economic Freedom 4. Respect for Private Property – Political & Economic Stability – Low Inflationary Expectations 5. Willingness to sacrifice current consumption in order to grow 6. Saving 7. Trade D) Physical Capital 1. Tools, machinery, factories, infrastructure 2. Physical Capital is the product of Investment. 3. Investment is sensitive to interest rates and expected rates of return. 4. It takes capital to make capital. 5. Capital must be maintained. E) Technology & Productivity 1. Research and development, innovation and invention yield increases in available technology. 2. More technology in the hands of workers increases productivity.

4 3. Productivity is output per worker. 4. More Productivity = Economic Growth. F) Human Capital 1. People are a country’s most important resource. Therefore human capital must be developed. 2. Education 3. Economic Freedom 4. The right to acquire private property 5. Incentives 6. Clean Water 7. Stable Food Supply 8. Access to technology

G) Hindrances to Growth 1. Economic and Political Instability – High inflationary expectations 2. Absence of the rule of law 3. Diminished Private Property Rights 4. Negative Incentives

5 – the welfare state 5. Lack of Savings 6. Excess current consumption 7. Failure to maintain existing capital 8. Crowding Out of Investment – Government deficits & debt increasing long term interest rates! 9. Increased income inequality Populist policies 10. Restrictions on Free International Trade V. Policy Mix:

Fiscal and Monetary Policy do not exist in a vacuum and operate independent of each other. Ideally, they should work together to solve common problems in the economy. However, because they have opposite effects upon interest rates, these policies will not work perfectly together.

The chart below summarizes the effect of fiscal and monetary policies on interest rates:

Stabilization Policy Expansionary Contractionary

Fiscal Policy Increases the real interest rate Decreases the real interest rate

Monetary Policy Decreases the nominal and Increases the real and nominal real interest rates interest rates.

Policy Mix and Interest Rates:

Policy mix involves using fiscal and monetary policy at the same time. However, each policy has a different effect on interest rates, but the same effect on AD, GDPr, and U%. This results in the following effect for policy mix situations: We will use the AD/AS, Loanable Funds Market & Investment Demand, and Money Market Graphs to demonstrate this situation for all four types of policy mix situations shown below in parts A through D.

A) Combination of expansionary fiscal policy and monetary policy:

6 B) Combination of contractionary fiscal and monetary policy:

C) Combination of expansionary fiscal policy and contractionary monetary policy:

7

D) Combination of contractionary fiscal policy and expansionary monetary policy:

8