RATIO AND BACK SPREADS Essentials

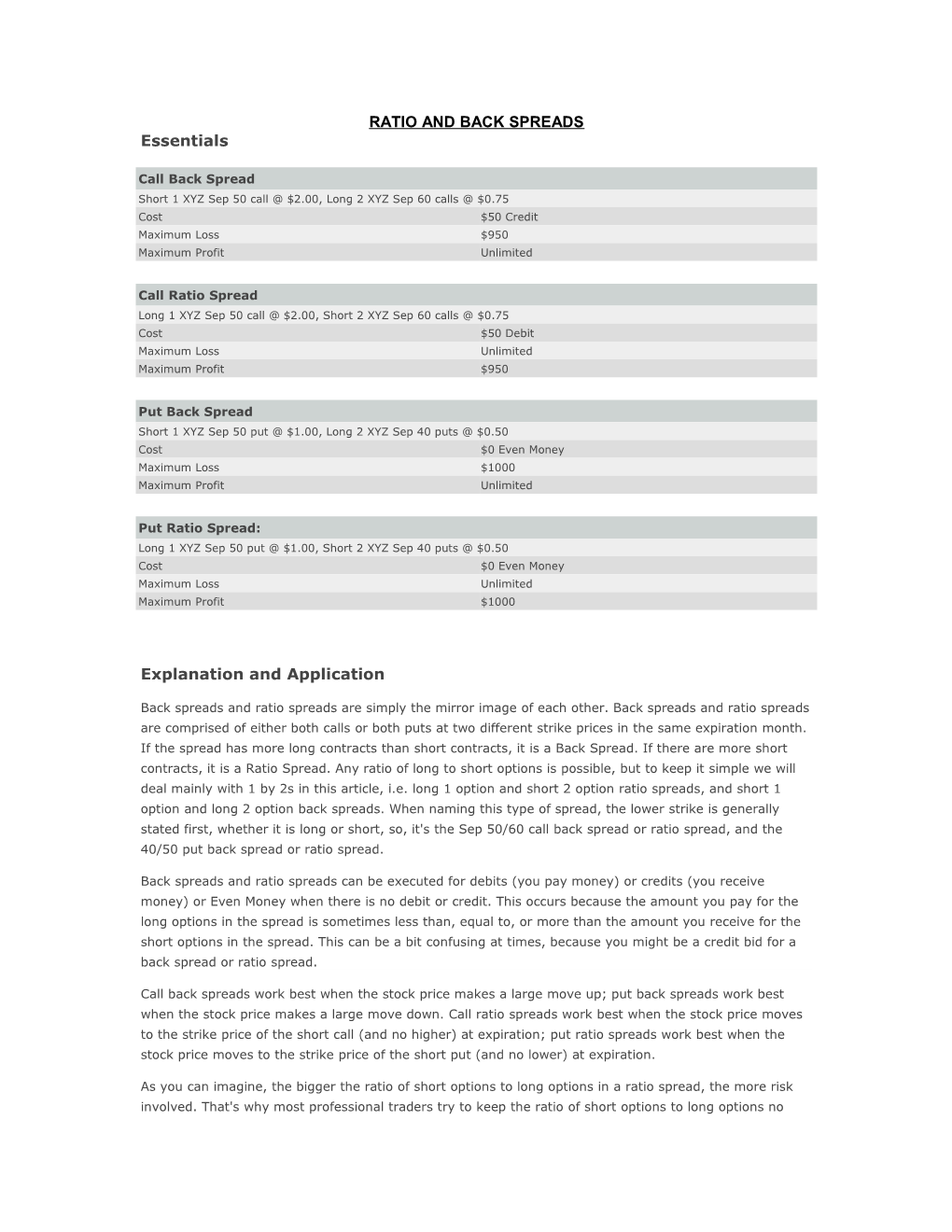

Call Back Spread Short 1 XYZ Sep 50 call @ $2.00, Long 2 XYZ Sep 60 calls @ $0.75 Cost $50 Credit Maximum Loss $950 Maximum Profit Unlimited

Call Ratio Spread Long 1 XYZ Sep 50 call @ $2.00, Short 2 XYZ Sep 60 calls @ $0.75 Cost $50 Debit Maximum Loss Unlimited Maximum Profit $950

Put Back Spread Short 1 XYZ Sep 50 put @ $1.00, Long 2 XYZ Sep 40 puts @ $0.50 Cost $0 Even Money Maximum Loss $1000 Maximum Profit Unlimited

Put Ratio Spread: Long 1 XYZ Sep 50 put @ $1.00, Short 2 XYZ Sep 40 puts @ $0.50 Cost $0 Even Money Maximum Loss Unlimited Maximum Profit $1000

Explanation and Application

Back spreads and ratio spreads are simply the mirror image of each other. Back spreads and ratio spreads are comprised of either both calls or both puts at two different strike prices in the same expiration month. If the spread has more long contracts than short contracts, it is a Back Spread. If there are more short contracts, it is a Ratio Spread. Any ratio of long to short options is possible, but to keep it simple we will deal mainly with 1 by 2s in this article, i.e. long 1 option and short 2 option ratio spreads, and short 1 option and long 2 option back spreads. When naming this type of spread, the lower strike is generally stated first, whether it is long or short, so, it's the Sep 50/60 call back spread or ratio spread, and the 40/50 put back spread or ratio spread.

Back spreads and ratio spreads can be executed for debits (you pay money) or credits (you receive money) or Even Money when there is no debit or credit. This occurs because the amount you pay for the long options in the spread is sometimes less than, equal to, or more than the amount you receive for the short options in the spread. This can be a bit confusing at times, because you might be a credit bid for a back spread or ratio spread.

Call back spreads work best when the stock price makes a large move up; put back spreads work best when the stock price makes a large move down. Call ratio spreads work best when the stock price moves to the strike price of the short call (and no higher) at expiration; put ratio spreads work best when the stock price moves to the strike price of the short put (and no lower) at expiration.

As you can imagine, the bigger the ratio of short options to long options in a ratio spread, the more risk involved. That's why most professional traders try to keep the ratio of short options to long options no greater than 1 by 2. Also, with the ratio at 1 by 2, the position is one long call or put away from a butterfly. This is a good way to reduce the risk of a ratio spread if the stock price starts going against you – in the heat of the moment it might be easier to buy the next higher call (for a call ratio spread) or lower put (for a put ratio spread) to form a limited-risk butterfly rather than trying to exit the ratio spread. You can then take a breather and trade out of the butterfly if you want, after that.

Ratio Spread

Ratio spreads involve buying one option and selling a greater quantity of an option with a more OTM strike. The options are either both calls or both puts. The "ratio" of the spread is the number of short options divided by the number of long options. So, selling 3 XYZ Nov 60 calls and buying 1 XYZ Nov 50 call is a "1 by 3" ratio spread. It's useful to keep the ratio in terms of "1 by X", even if that "X" isn't a whole number. For example, selling 5 XYZ Nov 60 calls and buying 2 XYZ Nov 50 calls is a "1 by 2.5" ratio spread, although some traders will still refer to it as "2 by 5". But if you keep everything in terms of "1", you can tell much more quickly how many more short options the spread has. It's easier to see the "1 by 3" ratio spread has more short options than the "1 by 2.5" (as opposed to "2 by 5") ratio spread.

The most common rationale for a ratio spread is to buy some options on a directional speculation and finance the purchase with the sale of options that are further out-of-the-money. Many investors seek to do a ratio spread for a credit, but to do so might mean in some instances that the ratio has to be quite steep (i.e., many more short options than long options). Since the options that the investor is selling are cheaper than the options he is buying, he has to sell more to recoup most of, all of, or even a greater amount than the purchase cost of the long option. That can lead to an extremely risky position. It is usually unwise to have a ratio spread with a ratio greater than 1 by 2. Never get comfortable or complacent with ratio spreads. Call ratio spreads lose money when the stock price rises sharply; put ratio spreads lose money when the stock price drops sharply. Monitor ratio spreads frequently and have a plan that can be enacted at a moment's notice to neutralize the risk. Be prepared for the worst. It is the spread that finishes careers.

Back Spread

Back spreads involve selling one option and buying a greater quantity of an option with a more OTM strike. The options are either both calls or both puts. Like the ratio spread, the "ratio" of the back spread is the number of long options divided by the number of short options.

The purpose of a back spread is to profit on a quick extended move toward, through and beyond the long strike. The purchase of a quantity of more long options is financed by the sale of fewer short options. The danger is that because the short options are closer to or in the money, they might grow faster than the long out-of-the-money options if the stock price moves more slowly or with less magnitude than expected. This happens even faster as expiration approaches. The long out-of-the-money options may lose value despite a favorable move in the stock price, and that same move in the stock price may increase the value of the short options. This is when the back spread loses value most quickly. This is depicted in the "valley" of the P&L graphs. The current day shows no valley, but over time one forms and gets deeper and deeper, signifying greater and greater losses. The price of the stock at the bottom of the valley, incidentally, is the strike price of the long options.

If you can establish a back spread for a credit, the position can still be profitable if the stock price moves down (for a call back spread) or up (for a put back spread) enough to escape the "valley" of losses. Assessing risk in ratio spreads and back spreads through ratio analysis

Here are a few guidelines for assessing risk that traders may want to use to modify their artistic approach: Use as shallow a ratio as possible. Be sure that a large move in the underlying can be withstood without losing any money. This should be of greater concern than doing the spread for a credit. Stress-test the spread, assuming that a move will occur any moment. When trying to assess how a spread may perform, look at the spreads of deeper in-the-money options for an indication of relative prices. Should a what-if analysis reveal that traders will lose an uncomfortable amount of money, they should either flatten out their ratio, wait for another opportunity in the cycle, or look for a spread in another stock. This must be monitored often, always checking the prices of the relationships a few strikes deeper. The ratio should be adjusted as necessary, always testing for the chosen tolerance level. When steepening the ratio, consider doing it with a vertical instead of with naked options, so that in case of a devastating move, you will not be faced with exponentially increased exposure.

Taking a closer look at several spreads gives the trader a sense of where the market believes that these ratios belong over time and movement in the underlying. The same exercise can be performed with butterflies to start building a mental database of price relationships.

Volatility is not money. There is a different frame of reference for it every day and strikes have many different proximities to the underlying stock price. Spreads, on the other hand, are easier to keep track of; the frame of reference is all of the other spreads. This kind of analysis gives us a different perspective on price relationships and an insight into what the Back Spreaders and Ratio Spreaders do.

Greeks

As with other option spreads, the Greeks of ratio and back spreads depend on where the stock price is relative to the strike prices of the long and short options, the ratio of long options to short options, and how far apart the strikes are from each other. Because of this, the Greeks can change dramatically as the stock price moves and as time passes. It's best to plug a back or ratio spread into the analyzer before doing the trade to see how the spread reacts to changes in the stock price, time, and volatility.

The delta of a back spread or ratio spread is generally dominated by the option with the greater quantity the further it is from expiration. That makes sense, because the more days to expiration, the deltas of options are not as close to 0.0 or 1.00 as they are when there are fewer days to expiration. For example, if XYZ stock is at $100 and with 100 days to expiration, the XYZ Feb 100 calls have a delta of +.57 and the XYZ Feb 105 calls have a delta of +.48, the delta of the XYZ Feb 100/105 call back spread would be +.39 ((2*.48)-.57). The delta of the back spread is dominated by the long options. But with 5 days to expiration, the XYZ Feb 100 calls have a delta of +.52 and the XYZ Feb 105 calls have a delta of +.16, the delta of the XYZ Feb 100/105 call back spread would be - .20 ((2*.16)-.52). Now, the delta of the back spread is dominated by the short option.

This is the reason that call back spreads, for example, are generally always long delta as long as there are enough days to expiration. But with fewer days to expiration, the delta of the call back spread is more sensitive to where the stock price is in relation to the strike prices. Remember that a back spread loses the most money when the stock price is at the long strike price at expiration. Close to expiration, if the stock price is close to the short lower strike, the call back spread can have negative deltas. The intuition behind this is that if the stock price rises, it will go to the long higher strike and drop in value. Once the stock price is at the higher strike, the delta of the back spread tilts positive – the delta of the short lower strike option is approaching (but less negative than) –1.00 and the deltas of the long higher strike options are approximately +.50. If there are two long higher strike options, they will typically generate more positive deltas than the negative delta of the short lower strike option. If the stock price rises past the long higher strike, the delta of the back spread will become increasingly positive, as the long higher strike option's delta approaches +1.00, thus offsetting the negative delta at the short lower strike.

Because a back spread is most profitable when the stock has a large price movement and with a relatively long time to go until expiration of the options, the delta is generally positive for call back spreads and negative for put back spreads. But that can change as time passes. If the stock price is in between the strike prices of the long and short options, the delta changes from positive to negative for call back spreads, and from negative to positive for put back spreads as time passes. This is due to the fact that as time passes, ITM option deltas move towards 1.00, and OTM deltas move towards 0.00. With the stock price in between the strike prices of the back spread, the delta of the short option (which has to be ITM if the stock price is in between the strike prices) dominates the deltas of the long options.

The same ideas can be applied to put back spreads and call and put ratio spreads, with the appropriate terms reversed.

The gamma of back spreads and ratio spreads reacts very much like delta to the amount of time to expiration and where the price of the stock is in relation to the strike prices. With many days to go to expiration, back spreads generally have positive gamma, indicating that each wants the stock price to move, and that favorable deltas will be manufactured when the stock price does move.

But close to expiration, if the stock price is at the short strike of a back spread the gamma is negative. If the stock price moves, unfavorable deltas will be manufactured. Remember that a back spread is at its minimum value when the stock price is at the long strike at expiration. The short gamma indicates that negative deltas will be manufactured if the stock price rises, and positive deltas if the stock price falls.

If you understand the gamma of a back spread, you already understand theta. Any time gamma is positive, theta is negative. Far from expiration, the theta of a call back spread is negative; the call back spread needs the stock price to make a big move up, and the passage of time decreases the probability of that happening. That's bad for a call back spread, so time passing reduces a back spread's value. Close to expiration, if the stock price is near the strike price of the long options in the back spread, theta becomes increasingly negative. Remember, a back spread loses most money at expiration when the stock price is at the strike price of the long options.

Vega in a back spread is generally dominated by the long options the more time there is to expiration and the closer the stock price is to the strike price of the long options. The more time there is to expiration, generally the more positive vega the back spread. The reason for this is that far from expiration, the difference between the vega of one strike and the next is relatively small. But as the time to expiration falls, the vega is generally much less positive, and can be negative, depending on whether the stock price is closer to the strike with the short options or the strike with the long options. If the stock price is closer to the strike with the short options, the vega at that strike can be sufficiently negative to offset the positive vega from the options at the long strike.

Structure

One of the easiest ways to think about a ratio spread or back spread is as a vertical with some extra short (in the case of a ratio spread) or long (in the case of a back spread) options. A call back spread is a bear vertical (typically a short call vertical) plus extra long call options at the higher of the two strikes. A put back spread is a bull vertical (typically a short put vertical) plus extra long put options at the lower of the two strikes. A call ratio spread is a bull vertical (typically a long call vertical) plus extra short call options at the higher of the two strikes. A put ratio spread is a bear vertical (typically a long put vertical) plus extra short put options at the lower of the two strikes.

If you look at a back spread or ratio spread, it's one option away from being a butterfly. Let's look at an XYZ Dec 50/55 call ratio spread, which is long 1 XYZ Dec 50 call and short 2 XYZ Dec 55 calls. If you were to buy 1 XYZ Dec 60 call, you would have transformed the XYZ Dec 50/55 call ratio spread into a long XYZ Dec 50/55/60 call butterfly.

As another example, consider an XYZ Dec 40/50 put back spread, which is long 2 XYZ Dec 40 puts and short 1 XYZ Dec 50 put. If you were to sell 1 XYZ Dec 30 put, you would have transformed the XYZ Dec 40/50 put back spread into a short XYZ Dec 30/40/50 put butterfly.

Understanding how ratio and back spreads can be transformed into butterflies or verticals is a very useful technique to get out of trouble. Keep it in mind when trading these spreads.

Pricing

One of the trickiest things to figure out about back spreads and ratio spreads is how they can be established for credits or debits. It all depends on the relative prices of the two different options. If the total money received from the short options is greater than the money paid for the long options, the back spread or ratio spread will be a credit. If the total money received from the short options is less than the money paid for the long options, the back spread or ratio spread will be a debit.

The main factor in the relative costs of the long versus short options is how far apart their strike prices are. For example, if the XYZ Dec 100 calls are $5.25, and the XYZ Dec 105 calls are $3.25, and the XYZ Dec 110 calls are $1.875, the XYZ Dec 100/105 call back spread would cost a $1.25 debit, while the XYZ Dec 100/110 call back spread would receive a $1.50 credit. If a back spread is established for a credit, the position will make money if the stock price moves big enough either up or down (keep all the 'credit' premium if both options go out worthless). If a back spread is established for a debit, the position will make money only if the stock price moves big enough in the direction of the long options (lose all the 'debit' premium if both options go out worthless).

If you look at back spreads that are the same width in strikes, say 1 strike apart and all other things being equal, their price declines, from ITM back spreads (the most expensive) to OTM back spreads (the least expensive). The reason for this is quite simple. ITM options are more expensive, and if you think of what a back spread is (a vertical plus an extra long option) the ITM options will add more value to the back spread than the OTM options will.

An increase in volatility or more days to expiration will make the prices of back spreads more equal, as well as more expensive. That is, all back spreads will be more expensive, and ITM back spreads will be more expensive than OTM back spreads, but the difference will be smaller.