FA.4/2/1999.RB

GUIDE TO CASH FLOW FORECASTS/STATEMENTS

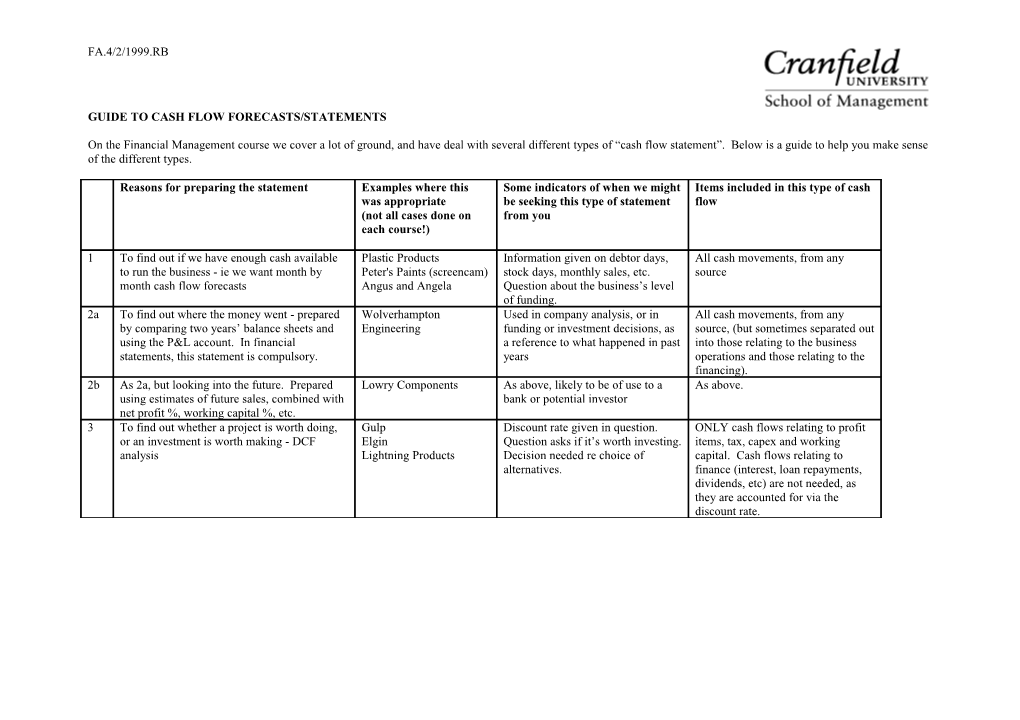

On the Financial Management course we cover a lot of ground, and have deal with several different types of “cash flow statement”. Below is a guide to help you make sense of the different types.

Reasons for preparing the statement Examples where this Some indicators of when we might Items included in this type of cash was appropriate be seeking this type of statement flow (not all cases done on from you each course!)

1 To find out if we have enough cash available Plastic Products Information given on debtor days, All cash movements, from any to run the business - ie we want month by Peter's Paints (screencam) stock days, monthly sales, etc. source month cash flow forecasts Angus and Angela Question about the business’s level of funding. 2a To find out where the money went - prepared Wolverhampton Used in company analysis, or in All cash movements, from any by comparing two years’ balance sheets and Engineering funding or investment decisions, as source, (but sometimes separated out using the P&L account. In financial a reference to what happened in past into those relating to the business statements, this statement is compulsory. years operations and those relating to the financing). 2b As 2a, but looking into the future. Prepared Lowry Components As above, likely to be of use to a As above. using estimates of future sales, combined with bank or potential investor net profit %, working capital %, etc. 3 To find out whether a project is worth doing, Gulp Discount rate given in question. ONLY cash flows relating to profit or an investment is worth making - DCF Elgin Question asks if it’s worth investing. items, tax, capex and working analysis Lightning Products Decision needed re choice of capital. Cash flows relating to alternatives. finance (interest, loan repayments, dividends, etc) are not needed, as they are accounted for via the discount rate.