Designing a Co-Development Contract in the Pharmaceutical Industry © 2004 by Nicos Savva & Stefan Scholtes (Cambridge)

DESIGNING A CO-DEVELOPMENT CONTRACT IN THE PHARMACEUTICAL INDUSTRY

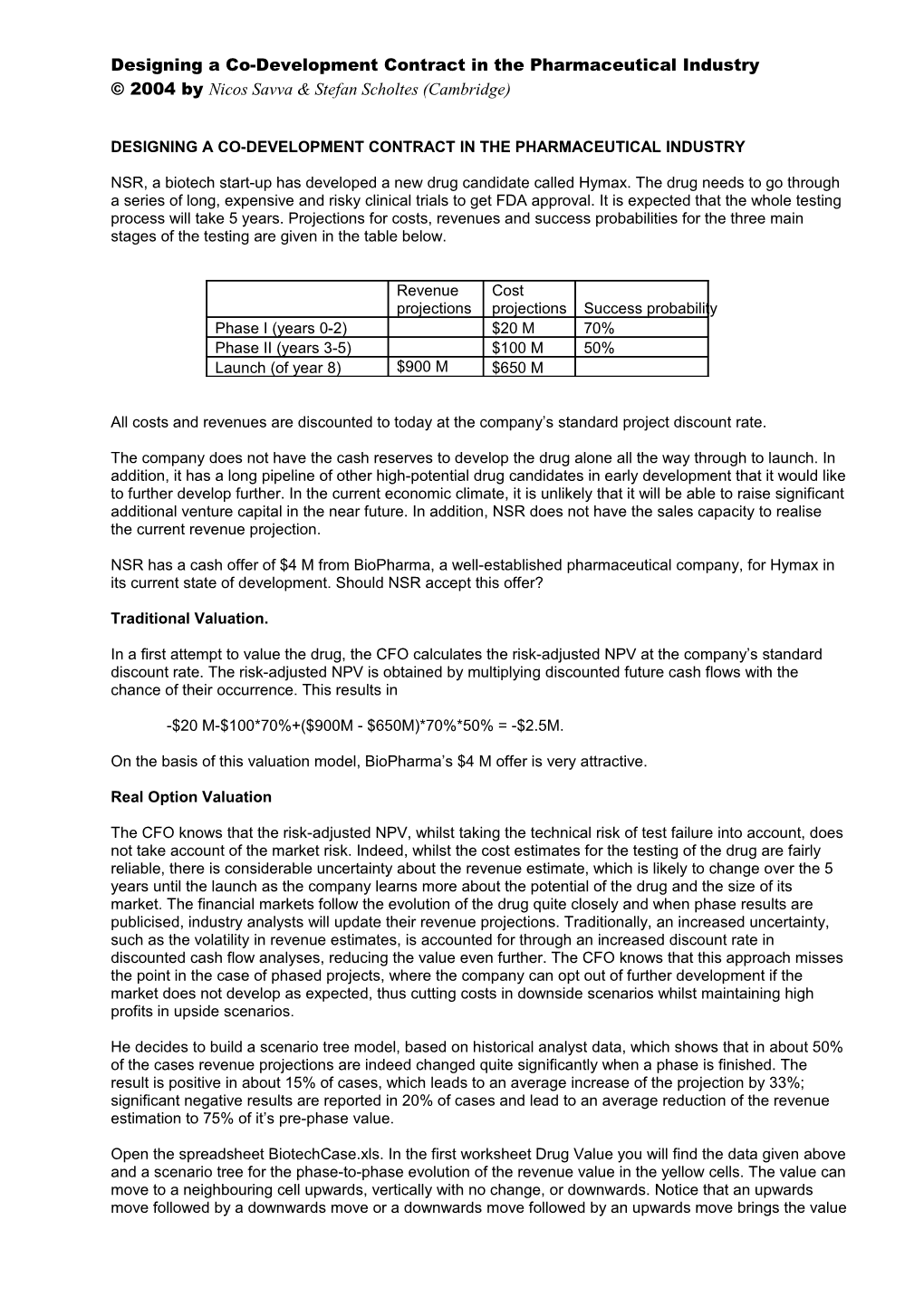

NSR, a biotech start-up has developed a new drug candidate called Hymax. The drug needs to go through a series of long, expensive and risky clinical trials to get FDA approval. It is expected that the whole testing process will take 5 years. Projections for costs, revenues and success probabilities for the three main stages of the testing are given in the table below.

Revenue Cost projections projections Success probability Phase I (years 0-2) $20 M 70% Phase II (years 3-5) $100 M 50% Launch (of year 8) $900 M $650 M

All costs and revenues are discounted to today at the company’s standard project discount rate.

The company does not have the cash reserves to develop the drug alone all the way through to launch. In addition, it has a long pipeline of other high-potential drug candidates in early development that it would like to further develop further. In the current economic climate, it is unlikely that it will be able to raise significant additional venture capital in the near future. In addition, NSR does not have the sales capacity to realise the current revenue projection.

NSR has a cash offer of $4 M from BioPharma, a well-established pharmaceutical company, for Hymax in its current state of development. Should NSR accept this offer?

Traditional Valuation.

In a first attempt to value the drug, the CFO calculates the risk-adjusted NPV at the company’s standard discount rate. The risk-adjusted NPV is obtained by multiplying discounted future cash flows with the chance of their occurrence. This results in

-$20 M-$100*70%+($900M - $650M)*70%*50% = -$2.5M.

On the basis of this valuation model, BioPharma’s $4 M offer is very attractive.

Real Option Valuation

The CFO knows that the risk-adjusted NPV, whilst taking the technical risk of test failure into account, does not take account of the market risk. Indeed, whilst the cost estimates for the testing of the drug are fairly reliable, there is considerable uncertainty about the revenue estimate, which is likely to change over the 5 years until the launch as the company learns more about the potential of the drug and the size of its market. The financial markets follow the evolution of the drug quite closely and when phase results are publicised, industry analysts will update their revenue projections. Traditionally, an increased uncertainty, such as the volatility in revenue estimates, is accounted for through an increased discount rate in discounted cash flow analyses, reducing the value even further. The CFO knows that this approach misses the point in the case of phased projects, where the company can opt out of further development if the market does not develop as expected, thus cutting costs in downside scenarios whilst maintaining high profits in upside scenarios.

He decides to build a scenario tree model, based on historical analyst data, which shows that in about 50% of the cases revenue projections are indeed changed quite significantly when a phase is finished. The result is positive in about 15% of cases, which leads to an average increase of the projection by 33%; significant negative results are reported in 20% of cases and lead to an average reduction of the revenue estimation to 75% of it’s pre-phase value.

Open the spreadsheet BiotechCase.xls. In the first worksheet Drug Value you will find the data given above and a scenario tree for the phase-to-phase evolution of the revenue value in the yellow cells. The value can move to a neighbouring cell upwards, vertically with no change, or downwards. Notice that an upwards move followed by a downwards move or a downwards move followed by an upwards move brings the value

Designing a Co-Development Contract in the Pharmaceutical Industry © 2004 by Nicos Savva & Stefan Scholtes (Cambridge) back to its original value since 1.33*0.75=4/3*3/4=1. Notice also that the revenue projection model is “expectation consistent”, i.e. the revenue estimate at every node in the lattice equals the expected revenue estimate in the next state, following on from this node.

The blue scenario tree contains the future expected risk-adjusted NPV values, given the project is entering the respective phase and the revenue estimate is at the corresponding node in the revenue scenario tree. The scenario tree values take into account the option to abandon the project after a phase if the revenue estimate is so low that the expected risk-adjusted NPV becomes negative; in this case the value is set to zero because the project is abandoned and therefore has zero future value. The tree is evaluated backwards in time. The corresponding real options value of the drug is about $9.6 M.

Tasks:

- Repeat the setting up of the scenario tree for the risk-adjusted NPV values with decisions in the red cells. Begin at the end of the tree and work towards the root. In each cell look at the corresponding cell in the revenue projection tree (yellow cells) and calculate the risk-adjusted NPV for the future based on this revenue projection. If this value is positive, it will give you the value of the project at this time and state of revenue projection. If the value is negative, you will abandon the project and its value is set to zero. First, set up the value tree without the decisions, just input the risk-adjusted NPV in each cell, depending on the revenue estimate. If you do this, you will recover the original risk-adjusted NPV of - $2.5M as the value of the drug. Then add the downstream decisions, i.e., replace the formula in each cell by max(formula,0), which will set the value to zero where it was below zero before.

- If you vary the purple cell, you will change the variability in the scenario tree of the revenue projection. If you set the purple cell to zero, then there is no variability in the revenue estimates - you will obtain the original risk-adjusted NPV of –$2.5M. By increasing the number in the purple cell, you can see how the value of the drug changes with increasing volatility in the revenue scenarios1. Can you explain intuitively, why the value of the drug increases with increasing volatility?

A contract valuation

At a recent board meeting, another possibility was discussed: Sell the drug to BioPharma for 80% upfront cash, but retain the option to buy back 10% of the drug if the drug is launched. The CFO believes that it will be fairly easy to raise the necessary capital if the drug passes the tests successfully and NSR gets a significant share in production and sales. He will suggest that BioPharma pays 80% of their offer but gives NSR the option to co-market the drug after launch with a 10% participation in revenues and costs. If NSR exercises the option, they will also pay for 10% of the development costs incurred in phases I and II.

Is this a good idea?

BioPharma comes back with a counteroffer: They are prepared to give NSR a 5% buy-back option but would like them to pay more than just 5% of the incurred costs during phases I and II if they exercise the option. They feel that a retrospective 5% share of the cost would not pay them for the risk they take. They suggest that NSR should pay 15% of the cost of phases I and II because there is only about 1/3 chance that the two phases are successful and the risk of failure is entirely with BioPharma.

Open the worksheet Contract Design. You will see a simultaneous real options valuation for NSR (blue cells) and BioPharma (green cells). Make yourself familiar with the backwards valuation of the scenario trees. Notice that the values for both companies add up to the value of the drug.

Evaluate the NSR proposal and BioPharma’s counteroffer and discuss. Suppose both partners agree that they bring equal strengths to the table, NSR the IP on the candidate drug and BioPharma the experience of downstream development, production, marketing and sales. Can you come up with a sensible contract design if the parties agree to split the value 50/50?

1 The purple cell and its its neighbour (“chance of up”) are the only free parameters in the lattice. The downwards growth factor is set = 1/upwards-factor to ensure that the lattice “recombines”, i.e. an upwards move followed by a downwards move results in the same as a downwards move followed by an upwards move or no moves at all. This helps to keep the size of the lattice manageable as the number of periods (phases) increases. The only remaining parameter is the probability of moving downwards, which is fixed by the condition that the lattice is “expectation consistent”, i.e., the value at a node equals the expected value at the beginning of the next phase.

Designing a Co-Development Contract in the Pharmaceutical Industry © 2004 by Nicos Savva & Stefan Scholtes (Cambridge)