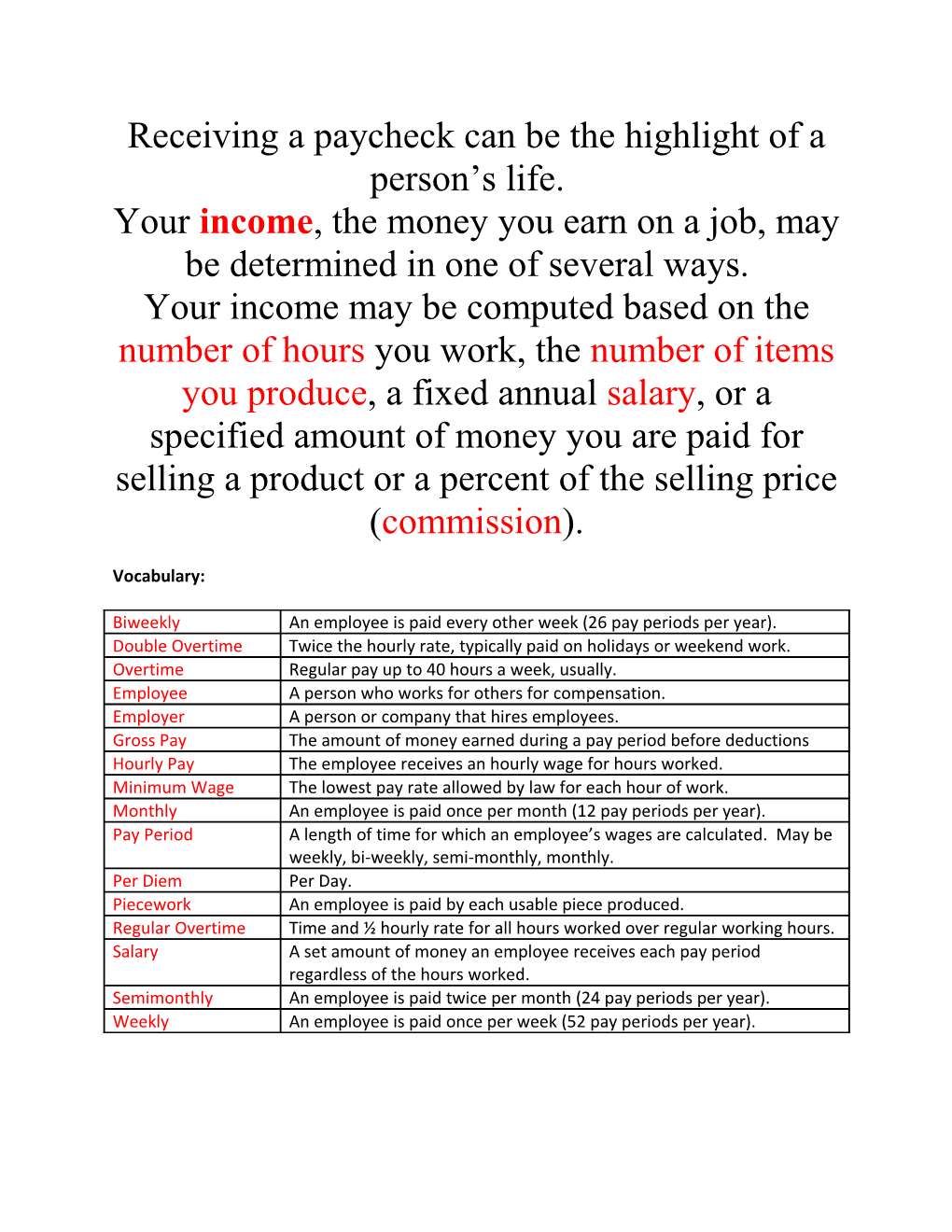

Receiving a paycheck can be the highlight of a person’s life. Your income, the money you earn on a job, may be determined in one of several ways. Your income may be computed based on the number of hours you work, the number of items you produce, a fixed annual salary, or a specified amount of money you are paid for selling a product or a percent of the selling price (commission).

Vocabulary:

Biweekly An employee is paid every other week (26 pay periods per year). Double Overtime Twice the hourly rate, typically paid on holidays or weekend work. Overtime Regular pay up to 40 hours a week, usually. Employee A person who works for others for compensation. Employer A person or company that hires employees. Gross Pay The amount of money earned during a pay period before deductions Hourly Pay The employee receives an hourly wage for hours worked. Minimum Wage The lowest pay rate allowed by law for each hour of work. Monthly An employee is paid once per month (12 pay periods per year). Pay Period A length of time for which an employee’s wages are calculated. May be weekly, bi-weekly, semi-monthly, monthly. Per Diem Per Day. Piecework An employee is paid by each usable piece produced. Regular Overtime Time and ½ hourly rate for all hours worked over regular working hours. Salary A set amount of money an employee receives each pay period regardless of the hours worked. Semimonthly An employee is paid twice per month (24 pay periods per year). Weekly An employee is paid once per week (52 pay periods per year). Calculating Employee Total Earnings Using Hourly Pay and Overtime Pay

Regular Hours (# of hours worked, excluding overtime) X Regular Rate = Regular Earnings

Sally worked 36 hours this week. Her regular rate of pay is $8/hour.

Regular Hours X Hourly Rate = Regular Earnings 36 X $8 = $288

Calculating Overtime Rate of Pay

Sally receives time and ½ for her regular overtime rate of pay.

Hourly Rate X Regular Overtime = Overtime Rate $8 X 1.5 = $12

This week Sally worked 10 hours of overtime. Calculate her overtime pay.

Overtime Hours X Overtime Rate = Overtime Pay 10 X $12 = $120

Calculating Total Pay

40 Hours is considered full time. Last week Sally worked 43 hours. Calculate her total pay for this pay period.

Regular Hours X Regular Rate = Regular Earnings 40 X $8 = $320

Overtime Hours X Overtime Rate = Overtime Pay 3 X $12 = $36

Regular Earnings + 0vertime Pay = Total Earnings $320 + $36 = $356