ACC7500 – Bond Refinancing Example

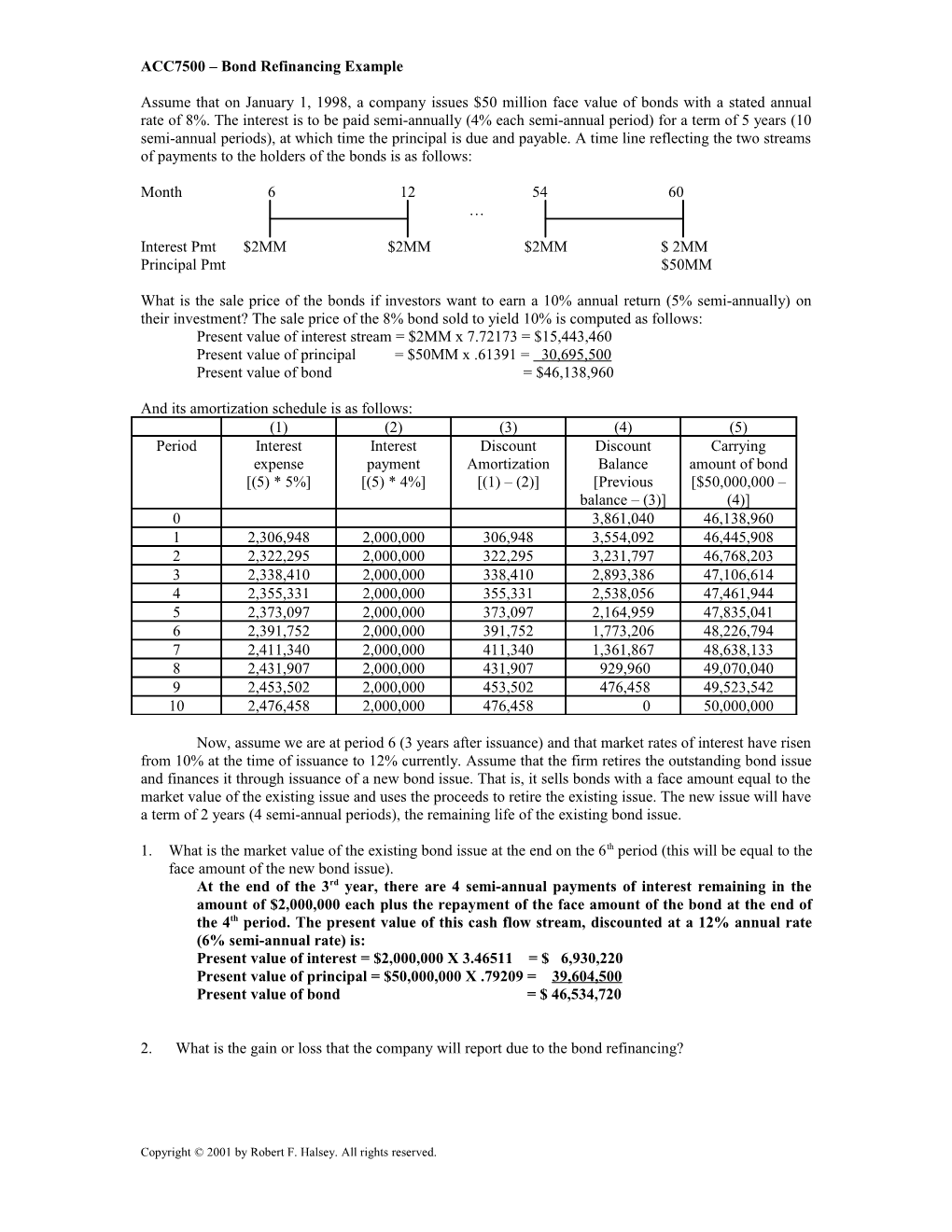

Assume that on January 1, 1998, a company issues $50 million face value of bonds with a stated annual rate of 8%. The interest is to be paid semi-annually (4% each semi-annual period) for a term of 5 years (10 semi-annual periods), at which time the principal is due and payable. A time line reflecting the two streams of payments to the holders of the bonds is as follows:

Month 6 12 54 60 …

Interest Pmt $2MM $2MM $2MM $ 2MM Principal Pmt $50MM

What is the sale price of the bonds if investors want to earn a 10% annual return (5% semi-annually) on their investment? The sale price of the 8% bond sold to yield 10% is computed as follows: Present value of interest stream = $2MM x 7.72173 = $15,443,460 Present value of principal = $50MM x .61391 = 30,695,500 Present value of bond = $46,138,960

And its amortization schedule is as follows: (1) (2) (3) (4) (5) Period Interest Interest Discount Discount Carrying expense payment Amortization Balance amount of bond [(5) * 5%] [(5) * 4%] [(1) – (2)] [Previous [$50,000,000 – balance – (3)] (4)] 0 3,861,040 46,138,960 1 2,306,948 2,000,000 306,948 3,554,092 46,445,908 2 2,322,295 2,000,000 322,295 3,231,797 46,768,203 3 2,338,410 2,000,000 338,410 2,893,386 47,106,614 4 2,355,331 2,000,000 355,331 2,538,056 47,461,944 5 2,373,097 2,000,000 373,097 2,164,959 47,835,041 6 2,391,752 2,000,000 391,752 1,773,206 48,226,794 7 2,411,340 2,000,000 411,340 1,361,867 48,638,133 8 2,431,907 2,000,000 431,907 929,960 49,070,040 9 2,453,502 2,000,000 453,502 476,458 49,523,542 10 2,476,458 2,000,000 476,458 0 50,000,000

Now, assume we are at period 6 (3 years after issuance) and that market rates of interest have risen from 10% at the time of issuance to 12% currently. Assume that the firm retires the outstanding bond issue and finances it through issuance of a new bond issue. That is, it sells bonds with a face amount equal to the market value of the existing issue and uses the proceeds to retire the existing issue. The new issue will have a term of 2 years (4 semi-annual periods), the remaining life of the existing bond issue.

1. What is the market value of the existing bond issue at the end on the 6th period (this will be equal to the face amount of the new bond issue). At the end of the 3rd year, there are 4 semi-annual payments of interest remaining in the amount of $2,000,000 each plus the repayment of the face amount of the bond at the end of the 4th period. The present value of this cash flow stream, discounted at a 12% annual rate (6% semi-annual rate) is: Present value of interest = $2,000,000 X 3.46511 = $ 6,930,220 Present value of principal = $50,000,000 X .79209 = 39,604,500 Present value of bond = $ 46,534,720

2. What is the gain or loss that the company will report due to the bond refinancing?

Copyright © 2001 by Robert F. Halsey. All rights reserved. The company will pay $46,534,720 to redeem a bond that is on its books at a carrying amount of $48,226,794. The difference of $1,692,074 is reported as a gain on redemption, an extraordinary item (net of tax).

3. Although our firm reports an accounting gain on the redemption of bonds, has the company actually realized a true economic gain? In this case, the firm will issue bonds with a coupon rate of 12% (6% semi-annually) in the amount of $46,534,720. Since we assume that the bonds are sold with a coupon rate equal to the market rate, they will sell at par (no discount or premium). The interest expense per six- month period, therefore, will be equal to the interest paid in the amount of $2,792,083 ($46,534,720 * 6%). Total expense for the 4 period life of the bond will be $2,792,083 X 4 = $11,168,333. That amount, plus the $46,534,720 face amount of the bonds the firm will repay at maturity, results in total bond payments of $57,703,053. Had the firm not redeemed the bonds, it would have paid 4 additional interest payments of $2,000,000 each plus retirement of the face amount of $50,000,000 at maturity, for total bond payments of $58,00,000. On the surface, then, it appears that the firm is able to save $296,947 by redeeming the bonds and has realized a true economic gain.1 This is, however, misleading. The firm’s “gain” consists of two parts. First, its interest payments increase by $792,083 per year ($2,792,083 - $2,000,000). And second, the face amount of the bond that must be repaid in 4 years decreases by $3,465,280 ($50,000,000 - $46,534,720). In order to evaluate whether a true gain has been realized, we must consider the present value of these cash outflows and savings.

The present value of the increased interest outflow, a 4 period annuity of $792,083 discounted at 6% per period, is, Present value cost of increased interest outflow = $792,083 * 3.46511 = $2,744,655

The present value of the reduced face amount the firm must repay at maturity, $3,465,280 4 periods hence, is Present value benefit of decreased bond repayment = $3,465,280 * .79209 = $2,744,814

So, has the firm realized a true economic gain? The answer is no. The present value of the increased interest payments offsets the present value of the decreased amount that must be paid at maturity and the present value of the net savings is zero.2 Why, then, does application of current accounting principles result in the recognition of a gain? The answer lies in our use of historical costing. Bonds are reported at amortized cost, that is, the face amount less any applicable discount or plus any outstanding premium. These amounts are a function of the selling price of the bond, its market value at the time of sale, and are fixed for the duration of the bond. Market prices for bonds, however, vary continuously with changes in market rates of interest. Firms do not adjust the carrying amount of their bond liabilities for these changes in market value. As a result, when bonds are redeemed, their carrying amount will differ from their market value and GAAP requires the recognition of a gain or loss equal to this difference to be recorded upon redemption of the bonds. Although marketable securities accounted for as “trading” or “available-for-sale” are reported on the balance sheet at current market values, the same is not true for bonds and other long-term liabilities. This information might be relevant, however, for investors and creditors in their analysis of the firm as it would provide an indication of unrealized gains and losses similar to that reported for marketable securities. Fortunately, GAAP does require companies to provide information about the current market values of their long- term liabilities in footnote disclosures.3 Remember, however, that these current market values are not reported on the balance sheet and changes in these market values are not reflected in net profit. Analysts must make their own adjustments to the balance sheet and income statement based information contained in the notes. 1 Notice, also, that the total interest expense on the new issue will be $3,168,333 ($11,168,333 - $8,000,000) more than it would have recorded under the old bond issue. So, it is recording a present gain but will also incur future higher interest costs. 2 The two amounts differ by $158, which is due to rounding errors in the use of 5 significant digits. 3 SFAS No. 107, “Disclosures About Fair Values of Financial Instruments,” Norwalk, CT: FASB, 1991. Copyright © 2001 by Robert F. Halsey. All rights reserved. Copyright © 2001 by Robert F. Halsey. All rights reserved.