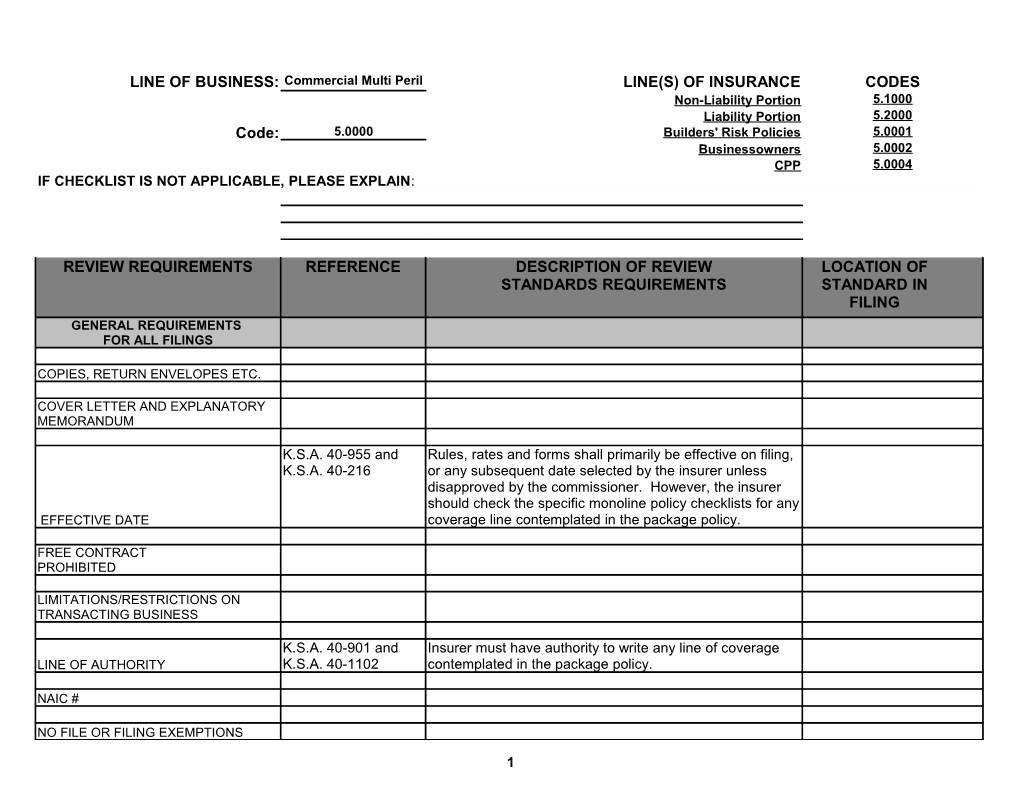

LINE OF BUSINESS: Commercial Multi Peril LINE(S) OF INSURANCE CODES Non-Liability Portion 5.1000 Liability Portion 5.2000 Code: 5.0000 Builders' Risk Policies 5.0001 Businessowners 5.0002 CPP 5.0004 IF CHECKLIST IS NOT APPLICABLE, PLEASE EXPLAIN:

REVIEW REQUIREMENTS REFERENCE DESCRIPTION OF REVIEW LOCATION OF STANDARDS REQUIREMENTS STANDARD IN FILING GENERAL REQUIREMENTS FOR ALL FILINGS

COPIES, RETURN ENVELOPES ETC.

COVER LETTER AND EXPLANATORY MEMORANDUM

K.S.A. 40-955 and Rules, rates and forms shall primarily be effective on filing, K.S.A. 40-216 or any subsequent date selected by the insurer unless disapproved by the commissioner. However, the insurer should check the specific monoline policy checklists for any EFFECTIVE DATE coverage line contemplated in the package policy.

FREE CONTRACT PROHIBITED

LIMITATIONS/RESTRICTIONS ON TRANSACTING BUSINESS

K.S.A. 40-901 and Insurer must have authority to write any line of coverage LINE OF AUTHORITY K.S.A. 40-1102 contemplated in the package policy.

NAIC #

NO FILE OR FILING EXEMPTIONS

1 REVIEW REQUIREMENTS REFERENCE DESCRIPTION OF REVIEW LOCATION OF STANDARDS REQUIREMENTS STANDARD IN FILING

SIDE BY SIDE COMPARISON

GENERAL REQUIREMENTS FOR ALL FILINGS

THIRD PARTY FILERS AUTHORITY

TRANSACTING OTHER BUSINESS

FORMSPOLICY PROVISIONS

ACCESS TO COURTS

AGGREGATE LIMITS

K.S.A. 40-2404(1a) This statute provision prohibits policy provisions that misrepresent the benefits, advantages, conditions or terms AMBIGUOUS & MISLEADING of any insurance policy.

APPLICATIONS K.A.R. 40-3-23 Insurers have to file applications only if they bind coverage.

Bulletin 2004-1 and This Bulletin establishes the conditions for any Bulletin 1998-3 appraisal/arbitration. One of the key points of the Bulletin is that this condition must be very clear that an appraisal or arbitration can only occur after a dispute has arisen and APPRAISALS must be mutually agreeable between both parties.

Bulletin 2004-1 and This Bulletin establishes the conditions for any Bulletin 1998-3 appraisal/arbitration. One of the key points of the Bulletin is that this condition must be very clear that an appraisal or arbitration can only occur after a dispute has arisen and ARBITRATION must be mutually agreeable between both parties.

2 REVIEW REQUIREMENTS REFERENCE DESCRIPTION OF REVIEW LOCATION OF STANDARDS REQUIREMENTS STANDARD IN FILING ASSESSIBLE POLICIES

BANKRUPTCY PROVISIONS

Bulletin 1998-13 Blank or change endorsements do not have to be filed with our office. Insurers must comply with K.A.R. 40-1-32 and BLANK ENDORSEMENTS 40-1-39.

CANCELLATION & NON-RENEWAL Calculation of Unearned/Return Premium Conditional Renewal Minimum Retained Premium K.S.A. 40-2,122 and Written explanation and notice, and establishes the time Notice of Cancellation K.A.R. 40-3-15 limit notification to the policyholder. FORMSPOLICY PROVISIONS K.S.A. 40-2,121 and Written explanation and notice. Notice of Non-renewal K.S.A. 40-2,122 Permissible Reasons for Cancellation K.S.A. 40-2,120 This statute establishes the grounds for cancellation. K.S.A. 40-2,121 and These statutes establish the grounds for non-renewal and Permissible Reasons for Non-renewal K.S.A. 40-2,122 the time limit notification to the policyholder. Required Policy Period K.A.R. 40-1-17 Request of the return of unearned premium by the insured Return Premium shall not be required. Suspension Bulletin 2010-2 Insurance agents may not issue certificates of insurance CERTIFICATION -Certificates of that are not filed and approved by the Kansas Insurance Insurance Department or which violate K.S.A. 40-955b.

CLAIMS MADE

CONINSURANCE

CONSUMER INFORMATION Privacy Notice Credit Scoring Notice VSI Warning

3 REVIEW REQUIREMENTS REFERENCE DESCRIPTION OF REVIEW LOCATION OF STANDARDS REQUIREMENTS STANDARD IN FILING Notification Form

K.S.A. 40-216 Requires that all contracts of insurance or indemnity be filed with the Commissioner of Insurance

K.A.R. 40-3-32 Exceptions to the above

K.A.R. 40-1-15 This regulations provides that a policy form shall not contain the name of an insurance company that is “unauthorized” to transact business in Kansas. May use an endorsement to “delete” an unauthorized company. It has been interpreted that “unauthorized” means not licensed or has not filed program in question.

Addresses combination policies CONTENT OF POLICIES K.A.R. 40-1-19

COUNTERSIGNATURES

K.A.R. 40-3-5 This regulation requires the filing of declaration pages, unless the company is a member of a rating organization and the rating organization has the authority to file on its DECLARATIONS PAGE behalf.

DEFENSE WITHIN LIMITS

DISCLOSURES

DEFINITIONS

DISCRIMINATION

DUTY TO DEFEND

FORMSPOLICY PROVISIONS

4 REVIEW REQUIREMENTS REFERENCE DESCRIPTION OF REVIEW LOCATION OF STANDARDS REQUIREMENTS STANDARD IN FILING EMPLOYERS LIABILITY

EXCESS COVERAGE

EXCLUSIONS & LIMITATIONS Asbestos Lead Mold Terrorism Windstorm

K.A.R. 40-3-6 This regulation prohibits offering a preferred rate, FICTITIOUS GROUPS coverage, or premium based on any fictitious group.

FORMS MISCELLANEOUS

K.S.A. 40-2,118 This statute provides a definition of a fraudulent insurance act and the only condition under which an insurance company may void a policy. As such, we will not approve or allow a fraud condition that is broader than the definition FRAUD WARNING in this statute.

GROUP POLICIES Extra-Territorial Approval Authority

GUEST PASSENGER LIABILITY

INSURANCE TO VALUE

LIBERALIZATION CLAUSE

LIMITS

LOSS PAYEE

LOSS SETTLEMENTS

5 REVIEW REQUIREMENTS REFERENCE DESCRIPTION OF REVIEW LOCATION OF STANDARDS REQUIREMENTS STANDARD IN FILING Bulletin 2004-1 and This Bulletin establishes the conditions for any Bulletin 1998-3 appraisal/arbitration. One of the key points of the Bulletin is that this condition must be very clear that an appraisal or arbitration can only occur after a dispute has arisen and Appraisal must be mutually agreeable between both parties. K.S.A. 60-511 This statute provides that any legal action against the Action Against Company company shall be brought within 5 years. FORMSPOLICY PROVISIONS After Market Parts Bulletin 2004-1 and This Bulletin establishes the conditions for any Bulletin 1998-3 appraisal/arbitration. One of the key points of the Bulletin is that this condition must be very clear that an appraisal or arbitration can only occur after a dispute has arisen and Arbitration must be mutually agreeable between both parties. Deductibles Defense Costs Loss Valuation

NOTICE REQUIREMENTS Payment of Loss Time Period Bulletin 2004-1 and This Bulletin establishes the conditions for any Bulletin 1998-3 appraisal/arbitration. One of the key points of the Bulletin is that this condition must be very clear that an appraisal or arbitration can only occur after a dispute has arisen and Appraisal must be mutually agreeable between both parties.

MEDICAL PAYMENTS

MINIMUM STANDARDS FOR CONTENT (POLICIES AND STANDARD FORMS)

MORTGAGEE/LIENHOLDER

ORDINANCE/LAW PROVISIONS

6 REVIEW REQUIREMENTS REFERENCE DESCRIPTION OF REVIEW LOCATION OF STANDARDS REQUIREMENTS STANDARD IN FILING K.A.R. 40-3-6, 40-3-7, These regulations place restrictions on participating PARTICIPATING POLICIES 40-3-8 and 40-3-9 policies or the payment of dividends.

PERMISSIBLE DRIVER

PERSONAL INJURY PROTECTION

PREMIUM AUDIT

PRIMARY/ UNDERLYING COVERAGE

PRIOR APPROVAL K.S.A. 40-2,115 Punitive or Exemplary Damages are prohibited except for PUNITIVE DAMAGES insured being vicariously liable.

READABILITY

FORMSPOLICY PROVISIONS

REBATES K.S.A. 40-966 Rebates and inducements are prohibited under this statute.

SERVICE CONTRACTS VEHICLE & OTHER THAN VEHICLE

STANDARD FIRE POLICY

SUBROGATION K.A.R. 40-1-20 Subrogation clause prohibited for certain coverages Suit

TIMELINESS

UNINSURED/UNDERINSURED MOTORISTS

USE & FILE

7 REVIEW REQUIREMENTS REFERENCE DESCRIPTION OF REVIEW LOCATION OF STANDARDS REQUIREMENTS STANDARD IN FILING

WATER/SEWER BACK-UP

VALUED POLICIES

K.S.A. 40-2,115 Punitive or Exemplary Damages are prohibited except for VICARIOUS LIABILITY insured being vicariously liable.

VOIDANCE

K.A.R. 40-3-16 Insurers cannot require insureds to make expressed or implied warranties of any fact or allegation in an application WARRANTIES or policy.

WORKERS' COMPENSATION EXCESS

OTHER

RATE, RULE, RATING PLAN, K.S.A. 40-955 For any coverage line contemplated in your package policy CLASSIFICATION, AND TERRITORY refer to the specify monoline policy checklists. FILING REQUIREMENTS

K.S.A. 40-954 and This statute and regulation provide the procedure for rates INDIVIDUAL RISK RATING K.A.R. 40-3-26 that are modified for individual risks.

ACTUARIAL CERTIFICATIONS FOR RATES

ADOPTIONS OF RATE SERVICE ORGANIZATIONS (RSO) FILINGS K.A.R. 40-3-47 This regulation establishes requirements and definitions for Loss Costs prospective loss costs.

K.S.A. 40-954, K.A.R. This statute and regulations provide the procedure for rates CONSENT-TO-RATE 40-3-25 and 40-3-26 in excess of filed rates.

8 REVIEW REQUIREMENTS REFERENCE DESCRIPTION OF REVIEW LOCATION OF STANDARDS REQUIREMENTS STANDARD IN FILING CREDIT SCORING AND REPORTS

CATASTROPHE HAZARDS

CREDIBILITY

DEFENSE COSTS

DISCOUNTS

EXPIRATION DATE(S) FOR APPROVED RATES

GROUP POLICIES Extra-Territorial Approval Authority

LOSS RATIO STANDARDS

MID TERM CHANGES

K.A.R. 40-3-47 This regulation provides the procedures for the filing of loss LOSS COST MULTIPLIERS cost multipliers.

RATE, RULE, RATING PLAN, CLASSIFICATION, AND TERRITORY FILING REQUIREMENTS

K.A.R. 40-1-17 This regulation states that a company can’t require an PREMIUM REFUND OR RETENTION insured to request the return of premium.

PRICING Charges Minimum Premium Rules Bulletin 1993-27 Tiered rating plan must include rules to specify how the rating plan is to be applied. Rules must be specific to Multi-tier assure a risk cannot qualify for more than one rate level. Payment Plans K.A.R. 40-1-10 This regulation addresses the filing of payment plans.

9 REVIEW REQUIREMENTS REFERENCE DESCRIPTION OF REVIEW LOCATION OF STANDARDS REQUIREMENTS STANDARD IN FILING Premiums Service Charges K.A.R. 40-1-9 This regulation defines service charges as premium. Surcharges Other Fees

K.S.A. 40-953 Range of Rates is not permitted in Kansas unless it can be K.S.A. 40-954 determined that the rates are not unfairly discriminatory in RATE RANGES K.S.A. 40-955 accordance with K.S.A. 40-953.

RATING PLAN REQUIREMENTS K.A.R. 40-3-12 If expense modification is used, the expense modification Expense Modification Plan plan must be filed in accordance with K.A.R. 40-3-12. K.A.R. 40-3-12 Experience modification plans must be filed in accordance Experience Rating with K.A.R. 40-3-12. IRPM Large Deductible Retrospective Rating Schedule Rating K.S.A. 40-955b Schedule rating of up to 40% is not required to be filed Small Deductible Wrap-up Rating

K.S.A. 40-954 The insurance company must provide premium, loss and expense data. If losses or premiums are adjusted, the company must submit exhibits supporting the adjustments. This requirement applies to rates, loss cost multipliers, loss RATE/LOSS COST SUPPORTING cost modification factors, changes to the classification INFORMATION plans, increased limit factors and territory revisions. Competition Expenses Experience Judgment Credibility and Other Factors Profit Loading RATE, RULE, RATING PLAN, CLASSIFICATION, AND TERRITORY FILING REQUIREMENTS

10 REVIEW REQUIREMENTS REFERENCE DESCRIPTION OF REVIEW LOCATION OF STANDARDS REQUIREMENTS STANDARD IN FILING RETURN ON EQUITY/ INVESTMENT K.A.R. 40-3-45 This regulation requires that investment income be factored into INCOME the rates.

RISK CLASSIFICATION

SUPPORTING DATA

TRENDING

OTHER Bulletins 1979-11 and These bulletins provide material for reference filing of rules, Reference Filing 1979-20 rates and forms.

11