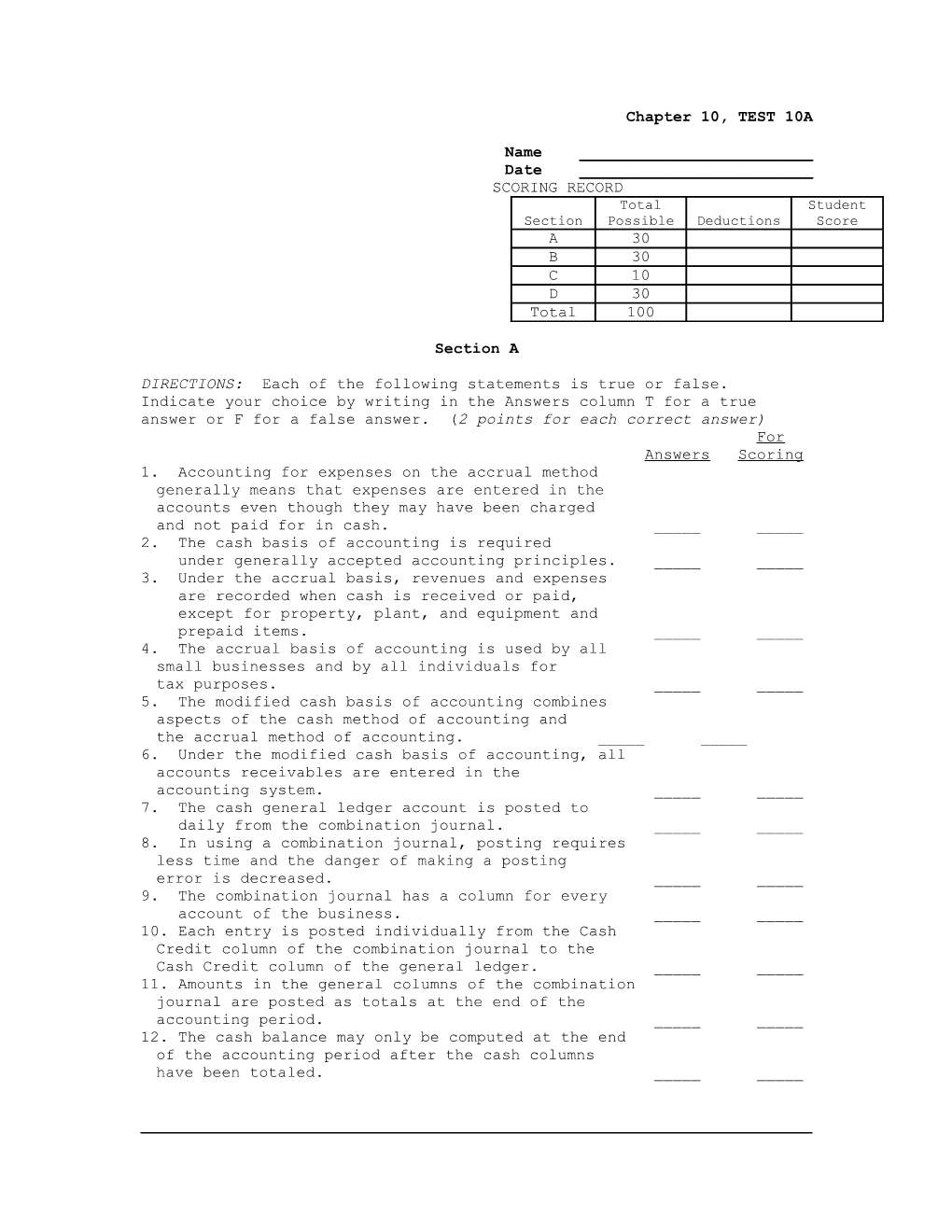

Chapter 10, TEST 10A

Name ______Date ______SCORING RECORD Total Student Section Possible Deductions Score A 30 B 30 C 10 D 30 Total 100

Section A

DIRECTIONS: Each of the following statements is true or false. Indicate your choice by writing in the Answers column T for a true answer or F for a false answer. (2 points for each correct answer) For Answers Scoring 1. Accounting for expenses on the accrual method generally means that expenses are entered in the accounts even though they may have been charged and not paid for in cash. ______2. The cash basis of accounting is required under generally accepted accounting principles. ______3. Under the accrual basis, revenues and expenses are recorded when cash is received or paid, except for property, plant, and equipment and prepaid items. ______4. The accrual basis of accounting is used by all small businesses and by all individuals for tax purposes. ______5. The modified cash basis of accounting combines aspects of the cash method of accounting and the accrual method of accounting. ______6. Under the modified cash basis of accounting, all accounts receivables are entered in the accounting system. ______7. The cash general ledger account is posted to daily from the combination journal. ______8. In using a combination journal, posting requires less time and the danger of making a posting error is decreased. ______9. The combination journal has a column for every account of the business. ______10. Each entry is posted individually from the Cash Credit column of the combination journal to the Cash Credit column of the general ledger. ______11. Amounts in the general columns of the combination journal are posted as totals at the end of the accounting period. ______12. The cash balance may only be computed at the end of the accounting period after the cash columns have been totaled. ______10-2

13. Financial statements can be prepared directly from the combination journal. ______14. Closing entries are recorded in the combination journal. ______15. Dashes are used in the Posting Reference Column to indicate these totals have not and are not required to be posted. ______

Section B

Directions: Complete each of the following statements by writing in the Answers column the letter of the word or words that correctly completes each statement. (3 points each) For Answers Scoring l. The method of accounting that only recognizes revenue when cash is received for the services performed is called: (A) cash basis; (B) accrual basis; (C) service basis; (D) merchandise basis; (D) commercial basis. ______2. If a business records revenues when earned, regardless of whether cash has been received, and records expenses when they are incurred, the accounting systems is : (A) a cash basis of accounting; (B) an accrual basis of accounting; (C) a modified cash basis of accounting; (D) a revenue and expense basis of accounting; (E) a commercial basis of accounting. ______3. Professional service business enterprises include the following business(es): (A) accounting; (B) law; (C) medical; (D)all of these; (E) none of these. ______4. To record wages earned but not paid under the accrual accounting method: (A) debit Wages Payable and credit Wages Expense; (B) debit Cash and credit Wages Expense; (C) debit Wages Expense and credit Wages Payable: (D) debit Prepaid Wages and credit Wages Payable; (E) no entry is required. ______5. Which of the following (amount) column headings would normally be found in the combination journal? (A) Cash, Debit; (B) Cash, Credit; (C) General, Debit; (D) General, Credit; (E) all of these. ______6. It is necessary to post the total of which columns in the combination journal to the related ledger accounts? (A) the Cash Debit and Credit column totals; (B) the Service Fees credit column total; (C) the General Debit and Credit column totals; (D) A & B; (E) C & D. ______7. When an individual entry is posted from the combination journal to a ledger, what information is entered in the "Post Ref." Column of the ledger? (A)the letters "CJ"; (B) the letters "CJ" and the page number; (C) the letters "CJ" and the invoice number; (D) the letters "CJ" and the year; (E) none of these. ______10-3

8. Which of the following amounts should NOT be posted to any ledger account? (A) the total of the Cash Credit column; (B) the total of the Service Fees column; (C) the total of the General Debit column; (D) the total of the Accounts Receivable column (E) the total of the Cash Debit column. ______9. The totals of the debits and credits to Cash in the combination journal are posted: (A) daily; (B) weekly; (C) after each transactions; (D) when the page is filled; (E) at the end of the accounting period. ______10. The end-of-period work sheet is used to facilitate; (A) making needed adjustments in the accounts; (B) correcting errors; (C) closing the financial statements; (D) entering transactions; (E) all of these. ______

Section C

DIRECTIONS: Indicate which of the three bases of accounting: Cash (C), modified cash (MC), Accrual (A), is used when recording the following revenues and expenses. (2 points each) For Answers Scoring Revenues:

1. Revenues are recorded when earned. ______2. Expenses are recorded when cash is paid rather than incurred. ______3. Revenues are recorded when cash is received. ______4. Expenses are recorded when cash is paid except for property, plant, and equipment and prepaid items. ______5. Expenses are recorded when incurred. ______

Section D

DIRECTIONS: Fran Cook is opening a new law office. Journalize the following transactions in a combination journal. Use the modified cash basis. (Ignore the Posting Reference.) Remember to record only those transactions that would be recorded using the modified cash basis of accounting. Total, rule, and prove the journal. (30 points)

July 1 Invested $30,000 in the practice. 2 Purchased $600 of office supplies for cash. 3 Paid $1,200 for a one-year liability insurance policy. 8 Purchase $2,600 of computer equipment paying $500 cash and the balance on account. 12 Billed clients $1,200. 15 Paid paralegal wages of $800. 30 Received $1,000 from clients previously billed. 31 Paid telephone bill of $250. 31 Paid the electric bill for June, $75. 31 Made payment of $200 on amount due from July 8 transaction.

COMBINATION JOURNAL

SERVICE WAGES CASH POST GENERAL FEES EXPENSE DATE DEBIT CREDIT DESCRIPTION REF. DEBIT CREDIT CREDIT DEBIT 1 2 3 4 5 6 7 8 9 10 11 12

Proof: