October 11, 2004

Research Digest Ian Madsen, MBA, CFA, Editor TEL: 312-630-9880 x. 417 [email protected]

www.zackspro.com 155 North Wacker Drive Chicago, IL 60606

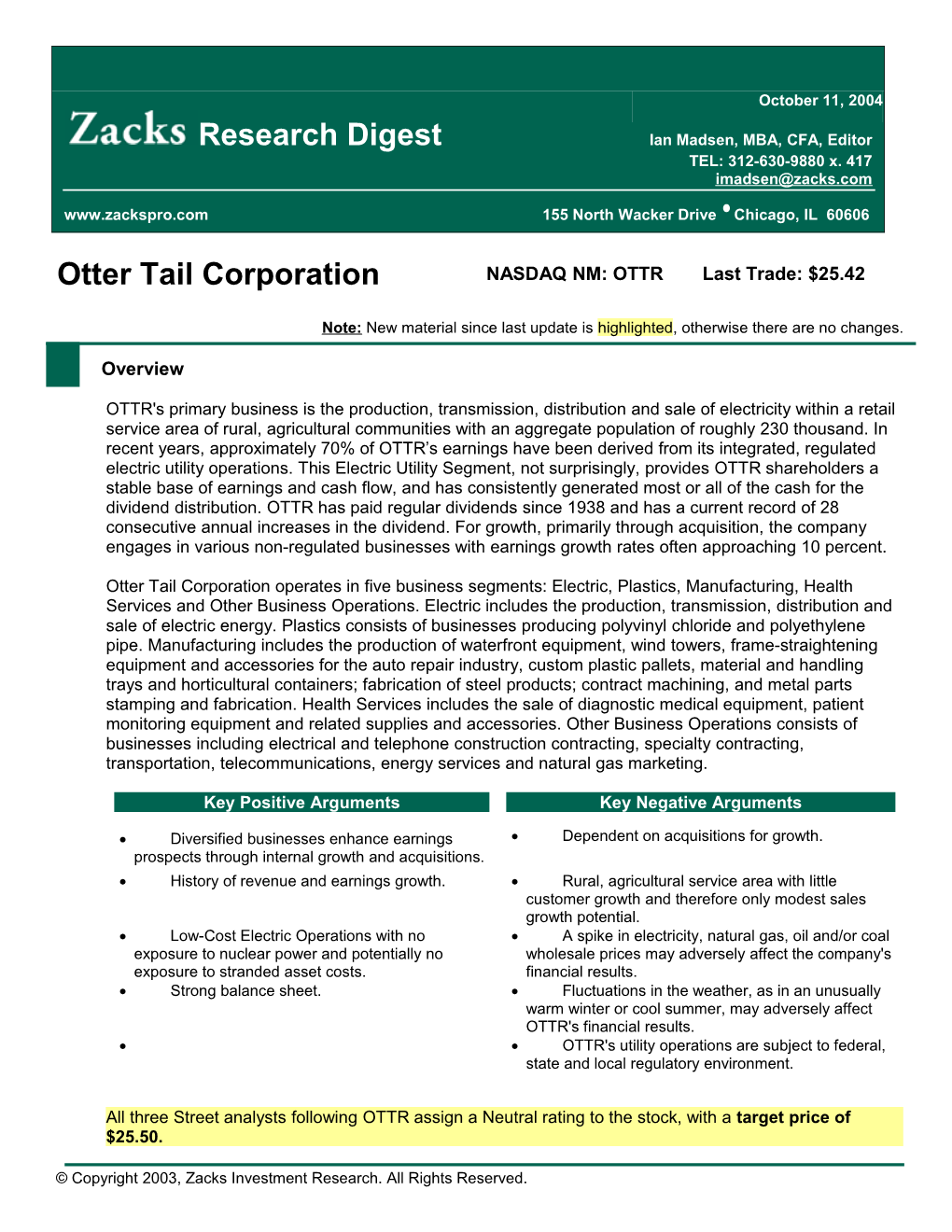

Otter Tail Corporation NASDAQ NM: OTTR Last Trade: $25.42

Note: New material since last update is highlighted, otherwise there are no changes.

Overview

OTTR's primary business is the production, transmission, distribution and sale of electricity within a retail service area of rural, agricultural communities with an aggregate population of roughly 230 thousand. In recent years, approximately 70% of OTTR’s earnings have been derived from its integrated, regulated electric utility operations. This Electric Utility Segment, not surprisingly, provides OTTR shareholders a stable base of earnings and cash flow, and has consistently generated most or all of the cash for the dividend distribution. OTTR has paid regular dividends since 1938 and has a current record of 28 consecutive annual increases in the dividend. For growth, primarily through acquisition, the company engages in various non-regulated businesses with earnings growth rates often approaching 10 percent.

Otter Tail Corporation operates in five business segments: Electric, Plastics, Manufacturing, Health Services and Other Business Operations. Electric includes the production, transmission, distribution and sale of electric energy. Plastics consists of businesses producing polyvinyl chloride and polyethylene pipe. Manufacturing includes the production of waterfront equipment, wind towers, frame-straightening equipment and accessories for the auto repair industry, custom plastic pallets, material and handling trays and horticultural containers; fabrication of steel products; contract machining, and metal parts stamping and fabrication. Health Services includes the sale of diagnostic medical equipment, patient monitoring equipment and related supplies and accessories. Other Business Operations consists of businesses including electrical and telephone construction contracting, specialty contracting, transportation, telecommunications, energy services and natural gas marketing.

Key Positive Arguments Key Negative Arguments

Diversified businesses enhance earnings Dependent on acquisitions for growth. prospects through internal growth and acquisitions. History of revenue and earnings growth. Rural, agricultural service area with little customer growth and therefore only modest sales growth potential. Low-Cost Electric Operations with no A spike in electricity, natural gas, oil and/or coal exposure to nuclear power and potentially no wholesale prices may adversely affect the company's exposure to stranded asset costs. financial results. Strong balance sheet. Fluctuations in the weather, as in an unusually warm winter or cool summer, may adversely affect OTTR's financial results. OTTR's utility operations are subject to federal, state and local regulatory environment.

All three Street analysts following OTTR assign a Neutral rating to the stock, with a target price of $25.50.

© Copyright 2003, Zacks Investment Research. All Rights Reserved.

Sales

Fiscal Year ends 1Q04A 2Q04A 3Q04E 4Q04E FY04E FY06E 12/31 in $ in millions Digest High $206.6 $211.2 $265.0 $229.4 $871.4 $940.4 Digest Low 206.6 211.2 224.2 191.0 824.0 876.0 Digest Average 206.6 211.2 244.6 210.2 854.5 913.9 Zacks Consensus 206.6 211.2 245.0 210.0 870.0 933.0

OTTR generates revenue through five primary business segments: Electric Utility, Plastics, Health Services, Manufacturing, and Other Business.

The OTTR Street consensus model of 3 analysts’ individual models predicts total revenues of $854.5 million in FY’04 and $913.9 million in FY’05. This represents a 10.1% compound annual growth rate from realized FY’03 revenues. The consensus sales estimate also represents yr/yr sales growth of +13.4% in FY’04 and +7% in FY’05. ($ in millions) FY'03A FY'04E FY'05E Est. CAGR Sales Est. Total Revenue $753 $854 $914 YoY Growth 13.4% 7.0% 10.1%

For more color on OTTR’s revenue by segment, refer the ‘Consensus Model’ tab of the OTTR spreadsheet.

Margin

Operating Margin Net Income Margin Consensus FY’04 9.4% 4.8% Consensus FY’05 9.5% 5.0%

One of the analysts (Baird) believes the sluggish economic activity, coupled with the delay in extending tax credits associated with wind generation, continues to pressure the company’s non-regulated margin. However, in the long run, the company is well positioned to benefit from sustained economic recovery.

Another analyst (Davidson) is of the view that the acquisition of Idaho Pacific will have little impact on the current year’s (2004) earnings due to business combination accounting principles, which require Otter Tail to mark up Idaho Pacific’s inventory. Because Otter Tail is increasing the value of the inventory to reflect an estimated selling price less the costs of disposal and a reasonable profit allowance, gross margins in Otter Tail’s “Other Business Operations” will be lower than normal.

For more color on OTTR’s operating and performance margins, refer the ‘Consensus Model’ tab of the OTTR spreadsheet.

Zacks Investment Research Page 2 www.zacks.com Earnings per Share

Fiscal Year ends 1Q04A 2Q04A 3Q04E 4Q04E FY04E FY05E 12/31, in $. Digest High $0.31 $0.30 $0.53 $0.44 $1.55 $1.80 Digest Low 0.31 0.30 0.48 0.39 1.50 1.65 Digest Average 0.31 0.30 0.50 0.41 1.52 1.73 Zacks Consensus 0.31 0.30 0.50 0.42 1.52 1.73

In the 2nd quarter 2004, earnings per share were $0.30. Management revised FY’04 guidance to $1.45- $1.60 from previous guidance of $1.55-$1.60.

One of the analysts (AG Edwards) feels the company’s goal of achieving 5-6% EPS growth annually is plausible, but adds that it will depend primarily on the growth of non-utility segments. For color on EPS forecasts by individual brokerage analysts, refer the ‘Consensus Model’ tab of the OTTR spreadsheet.

Target Price/Valuation

All three Street analysts following OTTR assign a Neutral rating to the stock, with a target price of $25.50. Rating Distribution Positive 0% Ratings Neutral 100% & Negative 0% TP Avg. Target Price $25.50

Low TP $25.00 High TP $26.00

For more color on valuation criteria by individual brokerage analysts, refer the ‘Valuation’ tab of the OTTR spreadsheet.

Long-Term Growth

As a diversified utility company, OTTR has a proven track record of positive diversification results that provide above-average EPS growth.

Management maintains a goal of growing EPS by 5% to 6% annually. The analyst consensus model indicates that the three analysts following OTTR project an average long-term CAGR forecast of 3.7%, as compared to an estimate of 5.3% for the electric utilities industry.

The (AG Edwards) analyst also believes 5% annual growth will be dependent primarily on growth from the non-utility segments. Although they expect EPS to be flat in FY’04, they see potential for growth to resume in FY’05 and beyond due to non-utility internal and acquisition related growth.

Zacks Investment Research Page 3 www.zacks.com Individual Analyst Opinions POSITIVE RATINGS (0%)

None. NEUTRAL RATINGS (100%)

Robert W. Baird – Neutral / Average Risk ($26): The analyst maintains Neutral rating for the stock and believes the sluggish economic activity, coupled with the delay in extending tax credits associated with wind generation, continues to pressure the company’s margin. However, in the long run, the company is well positioned to benefit from sustained economic recovery.

D.A. Davidson & Co. – Neutral ($25): Analyst reiterates Neutral rating for the stock, following the completion of the acquisition of Idaho Pacific Holding, Inc. by the company. The analyst also raised its estimate on account of the acquisition.

A.G. Edwards – Hold/Conservative: Analyst reiterates Hold rating with the company working to enhance earnings growth through acquisition, long-term ownership and decentralized operation of diverse businesses.

NEGATIVE RATINGS (0%)

None.

Zacks Investment Research Page 4 www.zacks.com