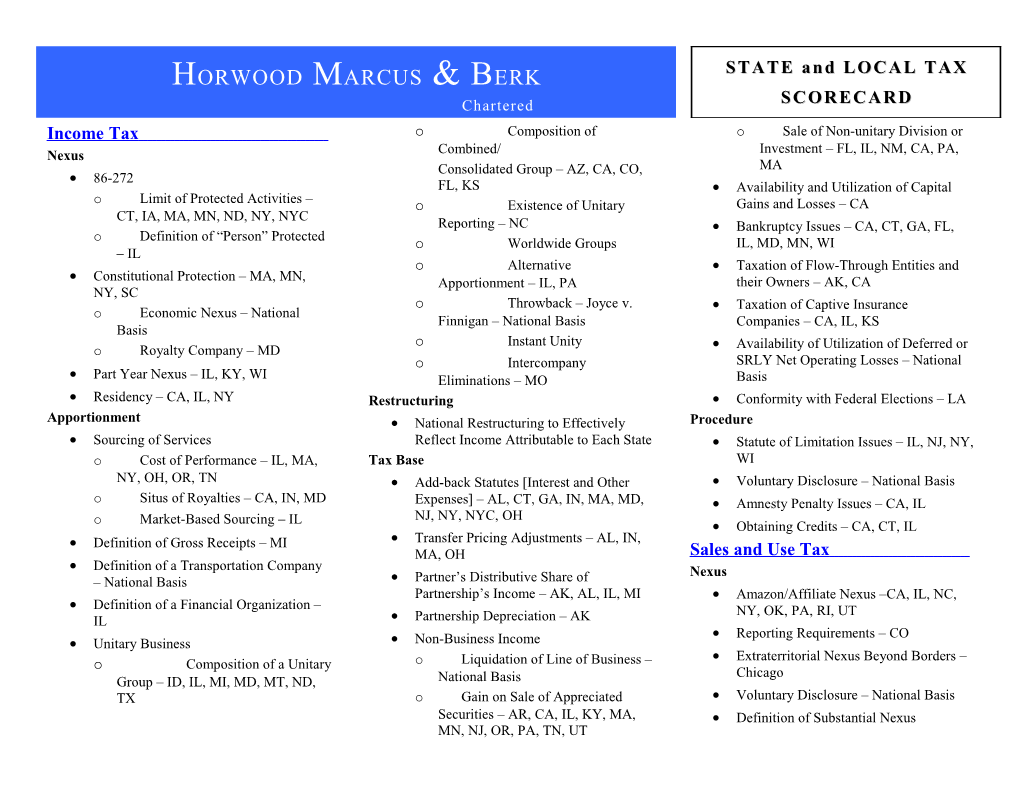

HORWOOD MARCUS & BERK STATE and LOCAL TAX Chartered SCORECARD Income Tax o Composition of o Sale of Non-unitary Division or Investment – FL, IL, NM, CA, PA, Nexus Combined/ Consolidated Group – AZ, CA, CO, MA 86-272 FL, KS Availability and Utilization of Capital Limit of Protected Activities – o o Existence of Unitary Gains and Losses – CA CT, IA, MA, MN, ND, NY, NYC Reporting – NC Bankruptcy Issues – CA, CT, GA, FL, Definition of “Person” Protected o o Worldwide Groups IL, MD, MN, WI – IL o Alternative Taxation of Flow-Through Entities and Constitutional Protection – MA, MN, Apportionment – IL, PA their Owners – AK, CA NY, SC o Throwback – Joyce v. Taxation of Captive Insurance Economic Nexus – National o Finnigan – National Basis Companies – CA, IL, KS Basis o Instant Unity Availability of Utilization of Deferred or o Royalty Company – MD o Intercompany SRLY Net Operating Losses – National Part Year Nexus – IL, KY, WI Eliminations – MO Basis Residency – CA, IL, NY Restructuring Conformity with Federal Elections – LA Apportionment National Restructuring to Effectively Procedure Sourcing of Services Reflect Income Attributable to Each State Statute of Limitation Issues – IL, NJ, NY, o Cost of Performance – IL, MA, Tax Base WI NY, OH, OR, TN Add-back Statutes [Interest and Other Voluntary Disclosure – National Basis o Situs of Royalties – CA, IN, MD Expenses] – AL, CT, GA, IN, MA, MD, Amnesty Penalty Issues – CA, IL Market-Based Sourcing – IL NJ, NY, NYC, OH o Obtaining Credits – CA, CT, IL Definition of Gross Receipts – MI Transfer Pricing Adjustments – AL, IN, MA, OH Sales and Use Tax Definition of a Transportation Company Nexus – National Basis Partner’s Distributive Share of Partnership’s Income – AK, AL, IL, MI Amazon/Affiliate Nexus –CA, IL, NC, Definition of a Financial Organization – NY, OK, PA, RI, UT IL Partnership Depreciation – AK Reporting Requirements – CO Unitary Business Non-Business Income Extraterritorial Nexus Beyond Borders – Composition of a Unitary o Liquidation of Line of Business – o Chicago Group – ID, IL, MI, MD, MT, ND, National Basis TX o Gain on Sale of Appreciated Voluntary Disclosure – National Basis Securities – AR, CA, IL, KY, MA, Definition of Substantial Nexus MN, NJ, OR, PA, TN, UT HORWOOD MARCUS & BERK | STATE and LOCAL TAX | SCORECARD

Tax Base Officer Liability – IL, MI Apportionment Hot Topics Any Way You Slice It, Its Theirs Situs of Services – IL, NY Qui Tam Nexus and Taxation of Alternative Apportionment Becoming a Taxation of Information Services – CT, Shipping and Handling Charges – IL Mainstream Option MD, NY, PA, TX Unclaimed Property Sham Transactions & Other Alternatives for Receipts for Telecom Tax – Chicago Defend National Audits Disregarding the Effect of Corporate Composition and Definition of Business-to-Business Exemption Transactions Information Services – NY Statute of Limitations Situs of the Transaction for Sales Tax Local Tax Sourcing – IL Breaking the Rules: Strategies for Addressing Notice to “Owners” Sale of Tickets – NY Administrative Guidance Voluntary Disclosures The Ins and Outs of Cost of Performance and Resale Exemption – IL Issues in Sampling Market Based Sales Factors Trade-in Credits – IL ERISA and Constitutional Issues How to Deal with Non-Traditional Information Intermediary Hotel Lessors –FL, NY, TX Requests by the States Definition of Escheatable Property Manufacturing Exemption – IL Today in Ethics Daily Deal Issues Top 10 Relationship Killers with Auditors Retailer Bad Debt Reduction – IL Structure National Gift Card Programs Taxation of Foreign Source Income Definition of Licensed Software – IL Draft Unclaimed Property Policies State Tax Issue in Mergers, Acquisitions or Re- Taxation of a Contractor – WI Franchise Tax organizations Taxability of Services – TX National Registration and De-registration State Taxation of Service Providers State Taxation of Catalogs and Printing Programs – National Basis Taxation of Retailers and Wholesaler State Services – CT, MA Rectify Past Reporting Issues from Mergers, Re- Taxation of the Cloud Qui Tam Class Actions and Other Alternative Motor Fuel Issues organizations, Re-capitalizations and Purchases – IL Forms of Tax Litigation o Licensing Restructuring to Minimize Franchise Tax – IL Articles: o Specialty Fuels Unemployment Insurance – IL, NY, IN Mind the Gap: The Current Debate Between Taxation of Medical Equipment and Speeches: States & Municipalities and Online Travel Medicines – AZ, IL, IN, LA, MN, NC, Companies Over the Taxability of the OH Introduction to State Taxation Remittance Gap Taxation of Carbon Dioxide – SST States What May a State's Tax Base Encompass Angel Investment Tax Credits: A Win-Win-Win Complex Issues Faced in Implementing Hotel Occupancy Taxes – Nationwide for Taxpayers, New Ventures, and the States Consolidated and Combined Reporting Substance Over Form The Complexities in Sourcing Receipts from the Nexus/Electronic Commerce State Tax Issues Sale of Other Than Tangible Personal Travel Services – FL Ethics and the Corporate Tax Practitioner Property Sale/Leaseback Transactions – IL Business/Non-business Income Issues: a Procedural Multistate Survey 1161974-v4 HORWOOD MARCUS & BERK | STATE and LOCAL TAX | SCORECARD

Is Taxing Services Too Taxing? A primer on Complexity Created by State's Efforts to Expand Their Sales Tax Bases IL Supreme Court: Internet Shipping Charges are Subject to Sales Tax Non-litigated Resolutions of Multistate Tax Disputes No Uniformity Shouldn’t Be Enough: How the MTC Has Failed Chapter on Franchise Tax – IICLE Chapter on Unclaimed Property – IICLE Chapter on Filing Methods – IPT Income Tax Handbook Chapter on Drop Shipments – IPT Sales Tax Handbook Chapter on IL Protest Monies Act – IICLE

1161974-v4