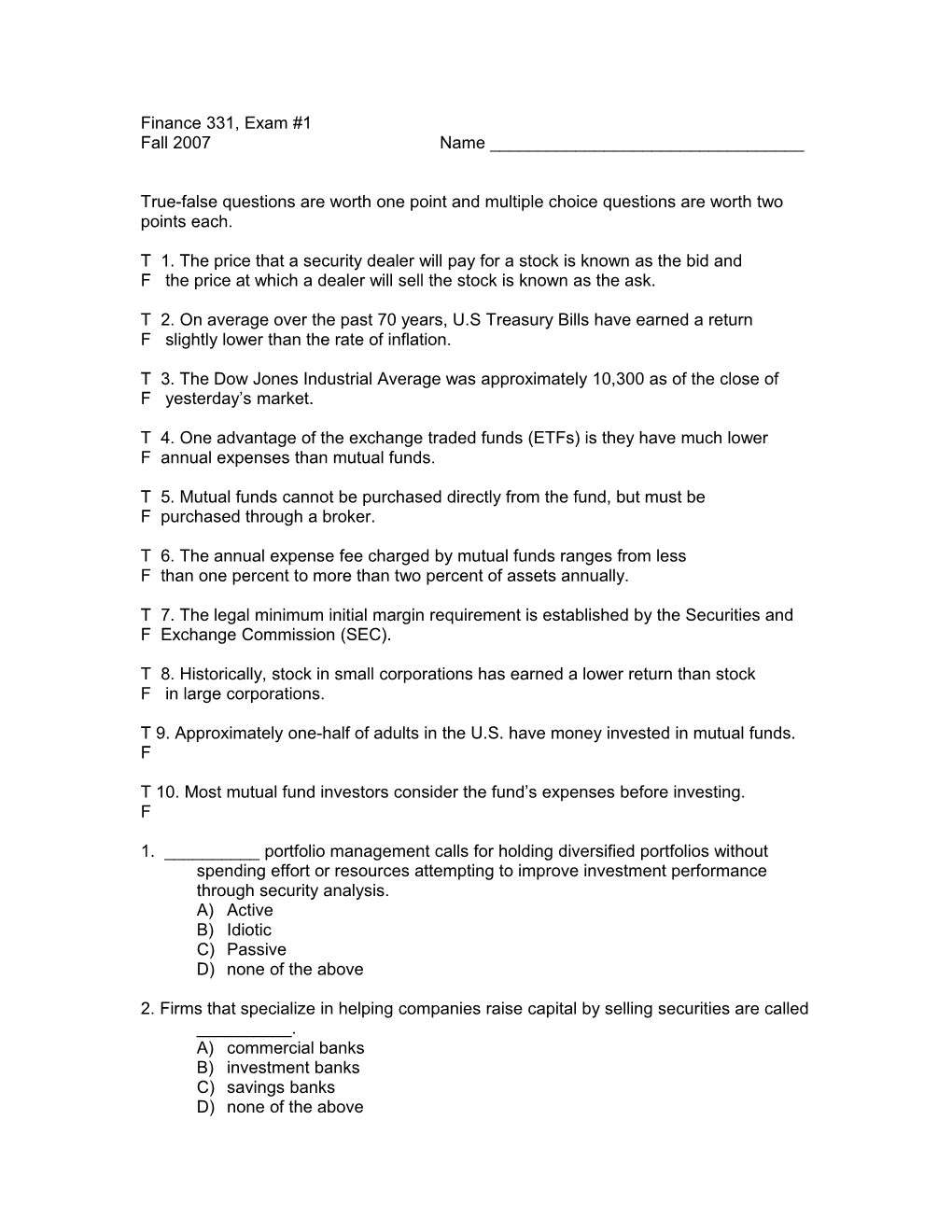

Finance 331, Exam #1 Fall 2007 Name ______

True-false questions are worth one point and multiple choice questions are worth two points each.

T 1. The price that a security dealer will pay for a stock is known as the bid and F the price at which a dealer will sell the stock is known as the ask.

T 2. On average over the past 70 years, U.S Treasury Bills have earned a return F slightly lower than the rate of inflation.

T 3. The Dow Jones Industrial Average was approximately 10,300 as of the close of F yesterday’s market.

T 4. One advantage of the exchange traded funds (ETFs) is they have much lower F annual expenses than mutual funds.

T 5. Mutual funds cannot be purchased directly from the fund, but must be F purchased through a broker.

T 6. The annual expense fee charged by mutual funds ranges from less F than one percent to more than two percent of assets annually.

T 7. The legal minimum initial margin requirement is established by the Securities and F Exchange Commission (SEC).

T 8. Historically, stock in small corporations has earned a lower return than stock F in large corporations.

T 9. Approximately one-half of adults in the U.S. have money invested in mutual funds. F

T 10. Most mutual fund investors consider the fund’s expenses before investing. F

1. ______portfolio management calls for holding diversified portfolios without spending effort or resources attempting to improve investment performance through security analysis. A) Active B) Idiotic C) Passive D) none of the above

2. Firms that specialize in helping companies raise capital by selling securities are called ______. A) commercial banks B) investment banks C) savings banks D) none of the above 3. According to your textbook, initial public offerings tend to exhibit ______performance initially, and ______performance over the long term. A) bad; good B) bad; bad C) good; good D) good; bad

4. Which of the following is true about selling stock short? a. selling short involves the sale of stock you do not own b. an investor might sell a stock short if he believes the stock’s price will drop c. selling stock short is riskier than buying stock d. to close a short position, you must buy the stock e. all of the above are true

5. Which type of stock market order is most common? a. limit order b. stop loss order c. market order d. short sale

6. According to the text, investment decision making consists of two types of decisions: a. buying and selling b. security analysis and portfolio management c. economic analysis and industry analysis d. asset allocation and security selection

7. Which of the following represents the compound annual rate of return on a security over a number of years? a. arithmetic mean of the annual returns b. geometric mean of the annual returns c. standard deviation of the annual returns d. holding period total return

8. Most investors are risk averse, which means a. they will assume more risk only if they are compensated by higher expected return b. they will always invest in the securities that have the least risk c. they will actively seek to minimize their risk d. they avoid the stock market due to its high risk 9. A municipal bond that is not backed by the full faith and credit of the issuing government authority is known as a. an industrial development bond b. a general obligation bond c. a revenue bond d. a tax-free bond

10. A(n) ______investment company has a fixed number of shares that trade on an exchange like any other stock. a. open-end b. closed-end c. institutional d. REIT

11. Which of the following is true of NYSE specialists? a. they can act as brokers, but not as dealers b. they can act as dealers, but not as brokers c. they are required to maintain an orderly market d. they own more than half of the seats on the NYSE

Problems

1. (6 points) You own 100 shares of Acme, Inc. stock that you purchased for $50 per share. The market price of the stock is now about $90. For each of the following situations, indicate the type of order (market, limit, or stop) you would give your broker, and the price. a. You would like to sell the stock at a price of $100, if it is available, but no less than $100. ______b. You would like to keep the stock if the price continues to rise, but if the price drops to $70, you want to sell the stock before the price drops any further. ______

2. (5 points) An investor has a combined Federal and state income tax rate of 25%. He can purchase municipal bonds that earn 4% or corporate bonds that earn 6%. Which should he buy? (Clearly state what your decision is based on and show any necessary calculations.) 3. (5 points) A mutual fund has a 5% front-end load and annual expenses of 1%. An alternative investment is to put the money in a CD that earns an annual rate of 5%. You plan to invest for two years. How much must the mutual fund earn for you to be better off placing your money in the mutual fund?

4. (6 points) A mutual fund has a Net Asset Value (NAV) of $20 and a front-end load of 8%. You invest $1,000 in the fund. How many shares do you purchase, and what is your cost per share?

5. (15 points) On September 1, 2006 Jane Doe opened a margin account with her broker (Chuck Squab) and deposited $5,000 in cash. The initial margin requirement is 50 percent, and the broker charges 8 percent annual interest on margin credit. Jane plans to buy stock in Delta Mfg., which is selling for $50 per share. (Ignore commissions) a. Jane bought 200 shares of stock in Delta on September 1. Squab has a maintenance margin requirement of 30 percent. On September 10, 2006, Delta stock is selling for $38. Calculate Jane’s margin on September 10, in dollars and in percent.

b. Will Jane face a margin call? c. One year after purchase, on September 1, 2007, Delta stock is selling from $60. Jane sells the stock at that price. During the year that she owned it, it paid dividends of $2 per share. Calculate Jane’s dollar gain or loss, and her percentage return.

6. (9 points) Jane’s friend Fred does not trust her investment judgment. Every time she buys a stock, Fred sells it short. He sold 100 shares of Delta short on September 1, 2006, when the stock price was $50 and closed his position on Sept. 1, 2007 when the stock price was $60. During the year the stock paid dividends of $2 per share. (Ignore commissions) a. How much margin was Fred required to post to sell the stock short?

b. Calculate Fred’s dollar gain or loss on the transaction, and his percentage gain or loss. 7. (12 points) Stock X has provided returns as shown below:

Year return

2001 16.9%

2002 31.3

2003 -3.2

2004 30.7

2005 7.7 a. Calculate the arithmetic mean of the annual percentage returns.

b. Calculate the geometric mean of the annual percentage returns.

c. Calculate the standard deviation of the annual percentage returns.

d. If you invested $10,000 at the beginning of 2001, what would the value of your investment be at the end of 2005? Discussion Question.

1. (10 points) According to the book Irrational Exuberance by Robert Shiller, what does the term “speculative bubble” mean? Does Prof. Shiller believe that the increase in stock prices during the late 1990s was a speculative bubble? What evidence does he offer to support his view? Do events in the stock market since the beginning of 2000 support his view?